- Retail sales data suggests a slowing consumer;

- Are consumers tapped out… drawing on credit; and

- Market still at odds with the Fed… who will be right?

This week I’ve been watching the market slowly drift higher.

My thinking (last week) was we could see the S&P 500 drift as far as 4100 – however I suspect that’s where it would meet with stiff resistance.

You can read more about that here…

I will update the chart at the end of the week – however it appears the S&P 500 rallied to 4015 – before reversing sharply.

So what caused the bulls to sell?

Well I suspect a little profit taking after a nice ‘double-digit’ run from the October lows (what I think is a bear market rally)

It might have also been more hawkish Fed speak – with Fed President James Bullard calling for rates to go beyond 5.50%

Let’s hope they do…

Or it could have been the dismal retail data over the holiday season:

Take your pick… I suspect all three are part of the mix.

Is Bad News Finally Bad News?

If the three factors suggested – from mine – the latter is probably the concern.

My thesis coming into 2023 was it’s going to be far less about the Fed (and inflation) this year – but more about growth, earnings and the economy.

The retail sales print was far worse than forecast.

And it suggests the consumer is close to tapping out.

If that’s correct, it’s a negative sign for economic growth – where 70% of US GDP is consumption based.

Here’s CNBC:

Sales during November and December grew 5.3% year over year to $936.3 billion, below the major trade group’s prediction for growth of between 6% and 8% over the year prior. In early November, NRF had projected spending of between $942.6 billion and $960.4 billion.

But here’s your kicker:

The 5.3% “growth” includes the impact of inflation, which drives up total sales.

Put another way, take out inflation and you are down year on year.

What’s more, if you also consider the inflation represented the top-line growth numbers for most retailers last year – once inflation comes down – watch out for the impact on margins.

My bet is we going to see enormous pressure on retail margins as they:

(a) continue to use discounting to clear inventory and attract consumers; and

(b) report much weaker top-line growth as inflation effects fall.

CNBC add:

“It just signals that consumers continue to be cost-conscious. They’re feeling it. They’re aware of the pressures of managing their daily, weekly, monthly expenses.”

Makes sense…

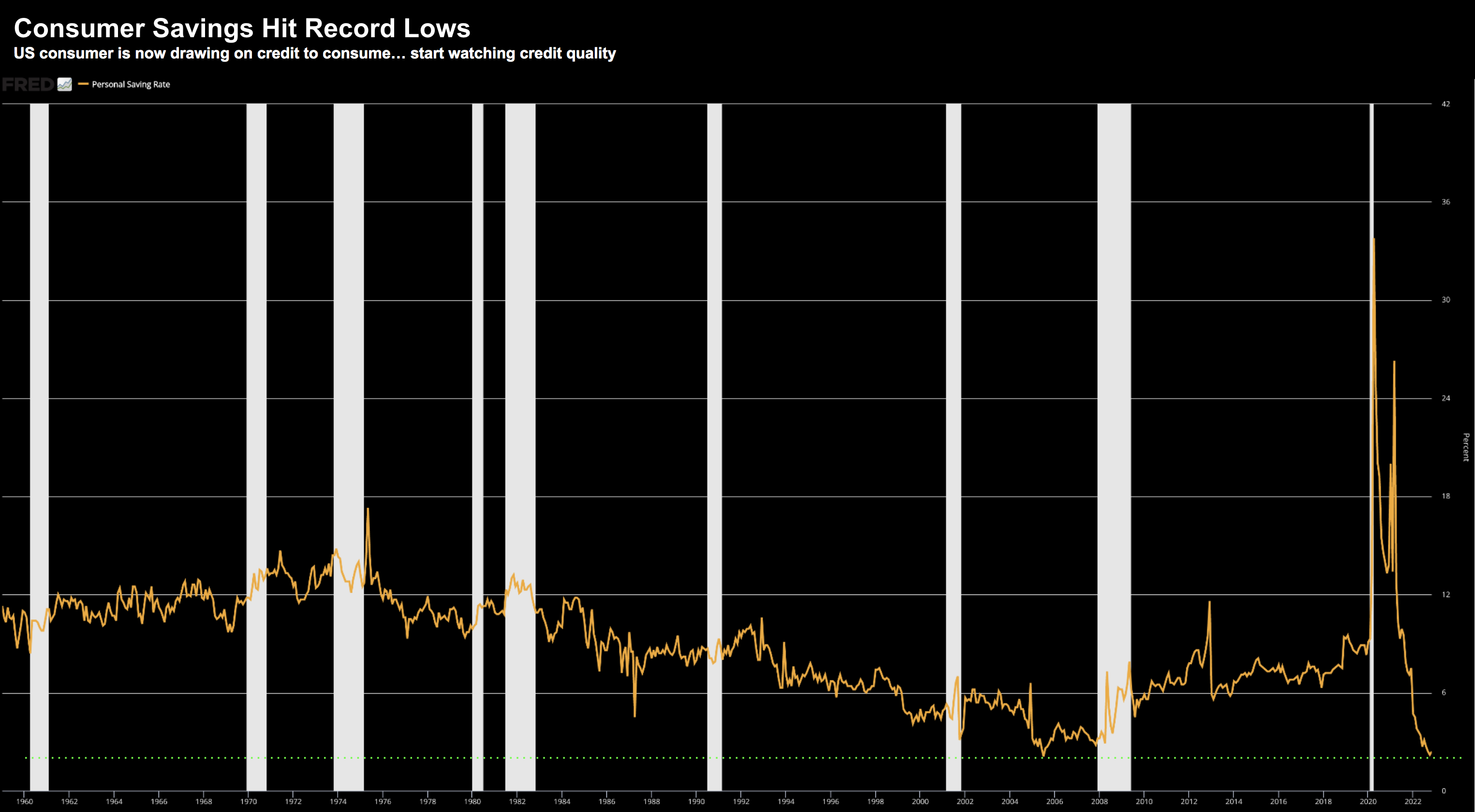

As an aside, take a look at consumer savings rates…. they have hit record lows:

This suggests consumers have now ripped through what’s left of their COVID savings (dare I say handouts) — they are turning to credit.

So where does that leave retailers?

I’ll take a guess…

It will be much harder for discretionary retailers (e.g. apparel, jewelry, accessories etc) versus non-discretionary (e.g., food and staples).

The other question worth asking is what trends do we see with consumer credit quality (with savings now depleted)?

Just on this, today we received a snippet from Discover Financial – who provide credit cards to “lower credit quality” consumers:

It was a terrible result – with the stock falling 6% – where they reported:

Provision for credit losses of $883 million increased $620 million from the prior year driven by a $313 million reserve build in the current quarter compared to a $39 million reserve release in the prior year quarter and a $268 million increase in net-charge offs.

Ouch!!

And increase of $620M in credit losses over the prior period and more to come.

They said expect a much weaker consumer looking ahead.

What does this tell you?

Soft Landing? We’ll See

It’s funny…

There’s a lot of talk in the market about the probabilities of a “soft landing” (whatever that means) increasing.

My read on that is the Fed will need to “thread the needle”… with everything coming up roses.

Sure… it’s possible.

But probable?

I don’t think so.

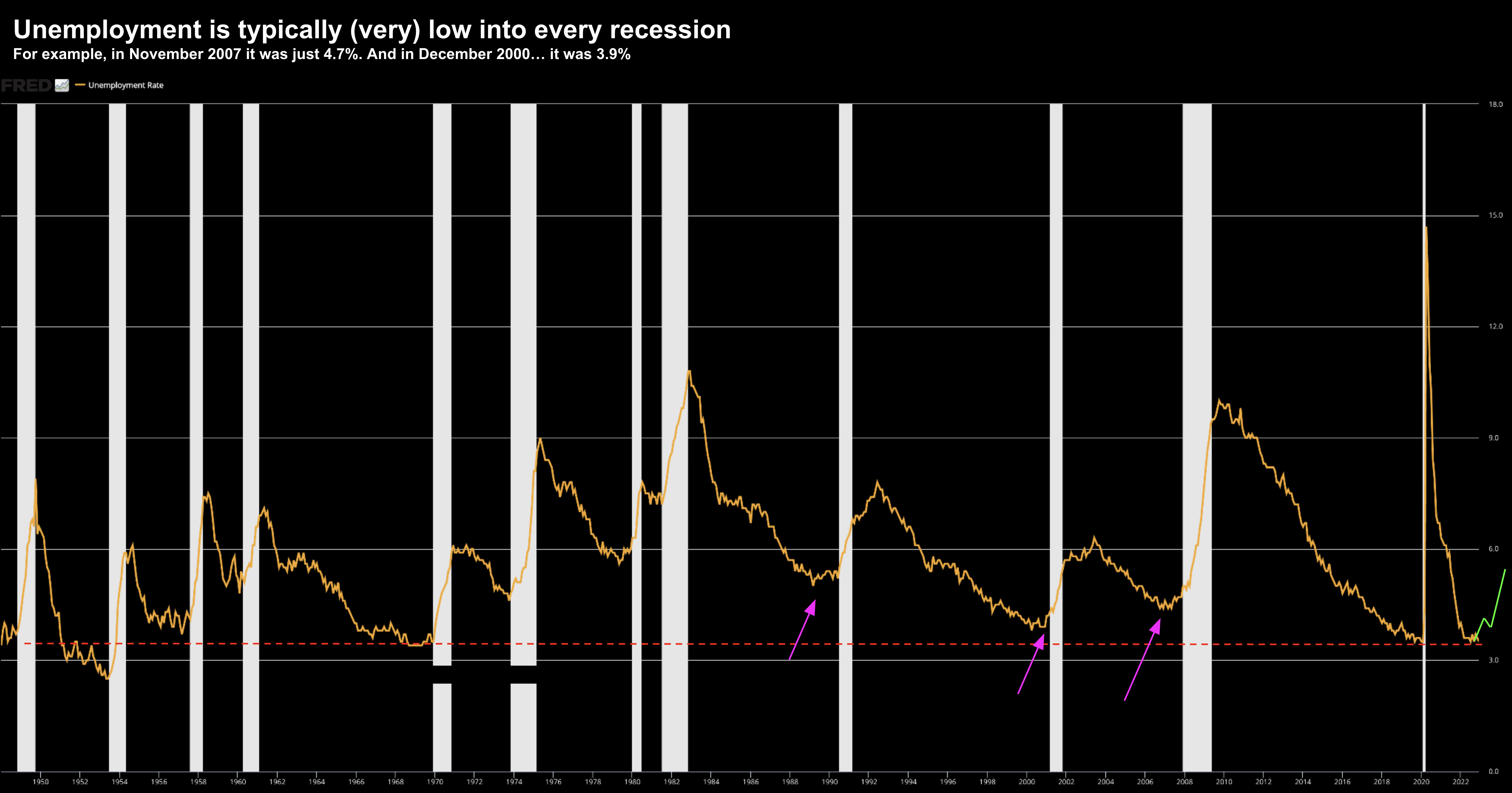

People who subscribe to the ‘soft landing’ thesis will be quick to cite the labor market… with unemployment at 3.5%

And that’s fair… employment levels are strong (for now).

But take a look where employment was prior to every other (recent) recession:

In short, employment is always quite strong going into a recession.

That’s normal.

Therefore, to claim any recession is likely to be “soft” opposite today’s employment level is not overly insightful and/or helpful.

Unemployment levels are set to increase…. as we’ve seen from the likes of (not limited to) Goldman Sachs, Salesforce, Meta, Microsoft and Amazon.

Again, this is the very start.

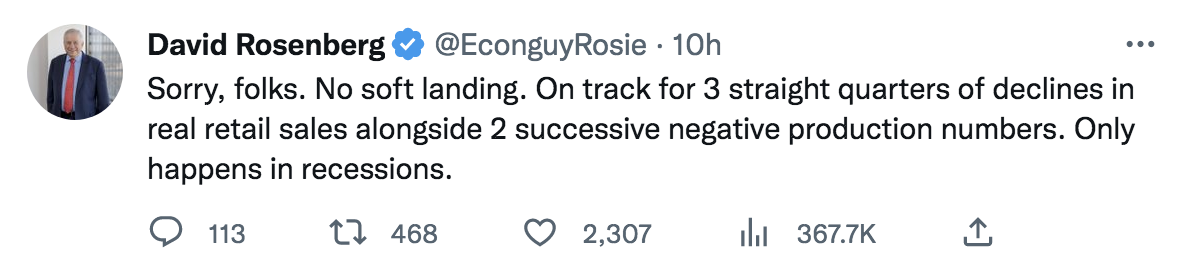

Now following this morning’s weak retail sales report – economist David Rosenberg tweeted:

He cites the three straight quarters of decline in real retail sales (i.e. adjusted for inflation).

What’s more, we have two successive declines in production numbers.

My thesis is that almost every (leading) financial indicator points to a recession… and it’s been that way for several months.

What’s more, the Fed will not mind.

In fact, if the cost is a recession to kill unwanted (core) inflation… that’s a ‘small cost’ to pay versus the potential longer-term trade off (i.e. where 4%+ wage inflation is entrenched).

So let’s bring that back to a (complacent) market…

The 10%+ rally off the October lows has been on the basis of three primary things:

- Inflation coming down (across commodities, goods and services)

- A far more dovish Fed (e.g. potential for two rate cuts as early as this year); and

- A likely “soft” economic landing (e.g., minimum impact to earnings and growth)

But I’m not buying the bull’s (optimistic) logic…

For me, the risk / reward simply isn’t there… certainly not at current levels around 4,000 on the S&P 500.

And we will learn more over the coming weeks with Q4 earnings.

What Will Q4 Earnings Offer?

When you see the likes of ultra-strong companies like Microsoft laying off 10,000 folks… or ~5% of their workforce… you know things are not great.

This is a signal that they need to get their costs under control as revenue is falling (and fast).

For example, Salesforce has talked to the elongated sales cycle they see… and Microsoft warning of just 2% total revenue growth.

And they won’t be alone.

Now if revenue is falling… the one way to (try) and meet earning forecasts is cut costs.

They are seeing the headwinds to growth in terms of both:

(a) the rate environment (where capital actually now has a cost); and

(b) with a far weaker consumer.

At the time of writing, the S&P 500 is trading ~3928

That’s in the realm of ~17.5x forward earnings – where the “E” in PE is arguably 10-15% too high

The question is whether the market has sufficiently priced in the downside risks?

I don’t think so.

My view is earnings expectations will come down in February… and this will set the bar a lot lower.

And potentially a lot lower.

For now, I’m sticking to my (foolish) thesis (from the start of the year) that we will re-test the October lows (and likely make lower lows at some point this year)

However, that will be a generational long-term buying opportunity.

Putting it All Together

Feb 1st we hear from the Fed.

At the time of writing – the market refuses to believe we will see rates “higher for longer”

Question is – who do you believe?

Now if we had a situation where core (services) inflation was not a risk…. I would favor the market.

In that scenario – the Fed would have the option to cut rates on economic weakness (as we have seen every time the past 30 years)

However, with core inflation almost triple the Fed’s 2.0% target, that option isn’t available.

As I explained here (“Peeling the Inflation Onion“) – until we see core inflation trending meaningfully lower (which needs unemployment closer to 5%) – the Fed has its hands tied.

In summary, when “bad news becomes bad news“, that’s a good thing.

Employment, earnings and growth will be the focus for 2023 (not the Fed).

- Earnings are coming down (and will contract on 2022);

- Employment will start to materially weaken in the second quarter (where the Fed will be targeting 5.0%+ unemployment levels – needed to reduce wage inflation); and

- Economic growth will slow.

However, with the S&P 500 trading just below 4,000, it’s not of that view

Let’s see how we go.