- Why I believe the 10-year yield will be lower in 6-9 months

- Yield curve continues to un-invert – strengthening the recession case

- Do you buy gold at $2,000 given the geopolitical uncertainty?

The S&P 500 is now trading close to the same level it was at the end of January.

8 months of gains gone!

The world’s largest index is up ~10% year to date… losing 2.4% this week.

Now when you consider the S&P 500 lost ~19% last year…. it has not been a good two years.

What if I also told you the S&P 500 has not made any ground since May 2021.

That’s almost 30 months of no gains.

So why the renewed nervousness?

A few things come to mind (not limited to):

- Higher real yields and rates;

- Sustained higher oil prices (e.g. above $80/b)

- Slower economic growth (as a function of higher debts and deficits);

- Waning consumer confidence given the cost of living; and possibly

- Heightened geopolitical tensions

Markets don’t see this is as a risk.

Heated debate over spending bills (and government shut downs) are not unusual…. we’ve seen ~20 since 1995

Markets realize it’s largely theatre… as they know the government will continue to borrow and spend money it doesn’t have.

What’s perhaps more troubling is the government tends to believe that model is the only answer (a panacea if you will) to any problem (home or abroad).

Bond markets are reminding them of a very different reality…

Do you think anyone in DC has noticed?

In terms of what matters – we saw it show up in a number of key charts (not equities):

- US 10-year yield briefly touched 5.00%

- The ‘bear steepening’ of the inverted 10-2 yield curve

- The VIX moving back above 20; and

- Gold touching $2,000 (despite a stronger US dollar)

Let’s try to make some sense of this complex puzzle with some charts and logic.

Things continue to trade ‘per the script’ (at least from my lens)

#1. 10-Year Yield Touches 5.00%

For example, yesterday’s post talked about how higher yields (across the curve) effectively handicap equity prices.

Why?

For starters, future cash flows are discounted. This means valuations are reduced.

But more importantly, the risk premium for owning equities is not there (not with forward PE of 18.5x)

18.5x multiple equates to an earnings yield of 5.4% (e.g., 1/18.5)

Now, if you can lock in a risk free (contractual) 12-month return at 5.50% – why take the risk?

It’s a good question.

“TINA” – There Is No Alternative – has now become “TIA”

But the sheer acceleration we’ve seen in bond yields – particularly at the long-end (which is where all the action is) – has been astonishing.

We haven’t seen anything like it in four decades.

It arguably caused three banks to collapse…

What’s more, the devastation in bond markets now exceeds the pain equities endured through 2001 and 2008.

That’s extreme.

My guess is we’re close to capitulation in bonds – where some institutions are being forced to reduce positions due to risk management (or simply can no longer tolerate the pain)

October 20 2023

I say this because of the torrent of new government debt to hit the market. Janet Yellen will shed more light on this at the end of the month.

For example, the ask of another $100B to help fight two wars only adds to the growing supply. There’s just one problem — there are very few buyers.

That said, I expect resistance in the 5.00% to 5.25% zone for the 10-year.

Let me offer three reasons why:

That means substantial capital appreciation for bond investors (in addition to attractive yields).

And if we see the 10-year trading above 5.50% in 6-9 months – don’t hesitate to email me and say “Adrian – you were flat out wrong mate” (it won’t be the first time!)

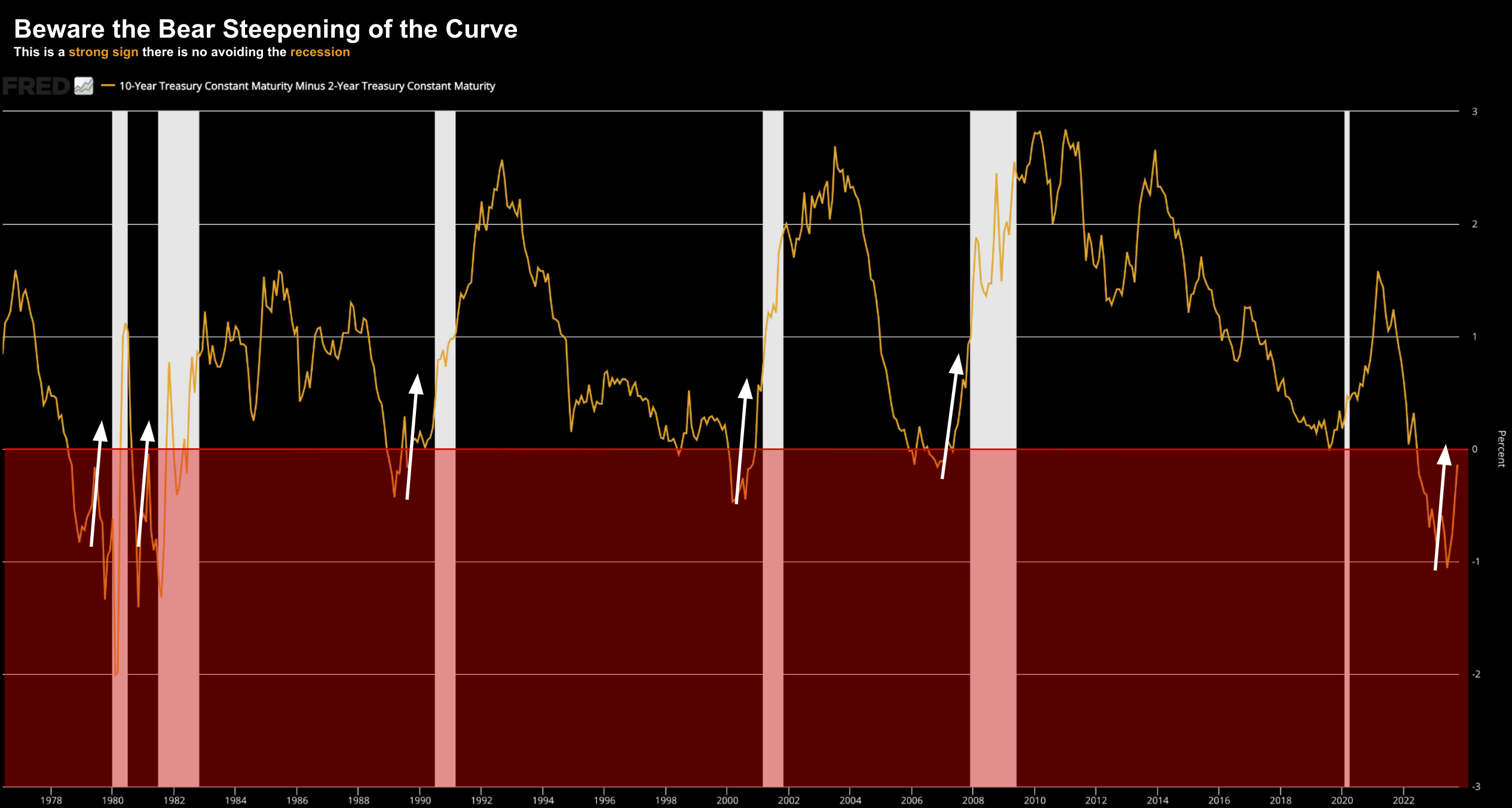

#2. Beware the Bear Steeping

Here I’m talking about the un-inversion of the all important 10-2 yield curve.

To refresh your memory (and for those who might be new) – I refer to this post from August: “Beware the Bear Steepening of the Curve”

Repeating a small portion:

Typically the 10-year trades higher than the 2-year – compensating investors for duration risk.

It’s not often we trade below zero.

However, the curve has been inverted since July 2022 – making it one the longest and deepest inversions of the past forty years.

Now markets will often rally during inversion (and we’ve seen that)

But when the curve un-inverts (i.e., where the 10-year yield accelerates) — that’s a sure sign we’re headed for slowdown.

It’s also worth highlighting that recessions only occur after the curve has worked its way out of inversion (white arrows).

This happens every time without exception.

Again, it’s not the inversion that is cause for alarm (which mainstream tends to fuss over) — it’s the process of un-inversion.

At the time of writing, we are just 14 basis points away. Not long ago, we were over 100 basis points inverted.

Whilst we should not expect any immediate impact on equities – I expect an economic slowdown within the next 6-9 months.

But that’s not what’s priced in.

For example, a 10-year yield trading at 5.00% is not reflective of growth slowing down.

In addition, equities trading at a forward multiple of 18.5x is also not indicative of slower earnings growth / profitability

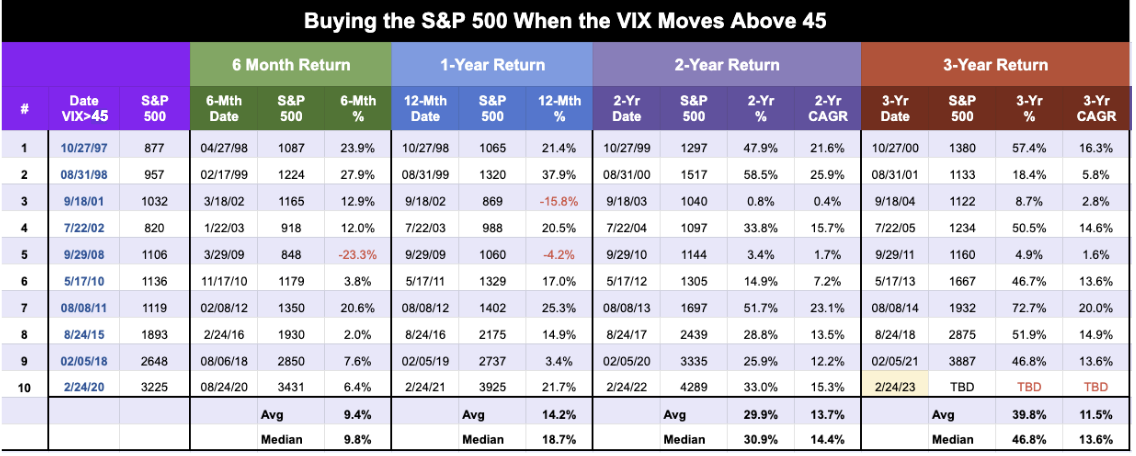

#3. VIX Waking Up – No Panic Yet

After a few months of investor complacency (where the VIX was well below 15) – the “fear index” is waking up.

I say “waking up” because there’s room for more.

For example, as the long-term chart shows – the VIX is not yet elevated.

October 21 2023

That’s what we’ve seen lately…

Now you will notice two horizontal lines – where the VIX has traded at 35 and 45

Since 1998, we’ve seen this rise above 35 twenty times (almost once per year); and only about ten times above 45.

45 is extreme fear.

As Warren Buffet would say, when there is ‘blood on the streets‘ (even if it’s your own) – it spells opportunity (and no different to what we see in bonds today)

Now last year I calculated the average returns over 3 years if buying when the VIX hits 35 (far-right column).

The average was ~8.2% CAGR exclusive of dividends (i.e. ~10% total return annualized)

What’s my point?

If you can stomach volatility in the near-term – buying peak fear can be very profitable if held for 3+ years.

Now in terms numbers – I think the S&P 500 around 3800 could result in the VIX testing 35.

I would consider adding to quality names in that zone.

However, if we are fortunate to see panic down to 3600 or below – that represents a compelling long-term risk/reward entry

See below for the monthly chart for the S&P 500 (and trend channel)

S&P 500 Monthly Chart: October 21 2023

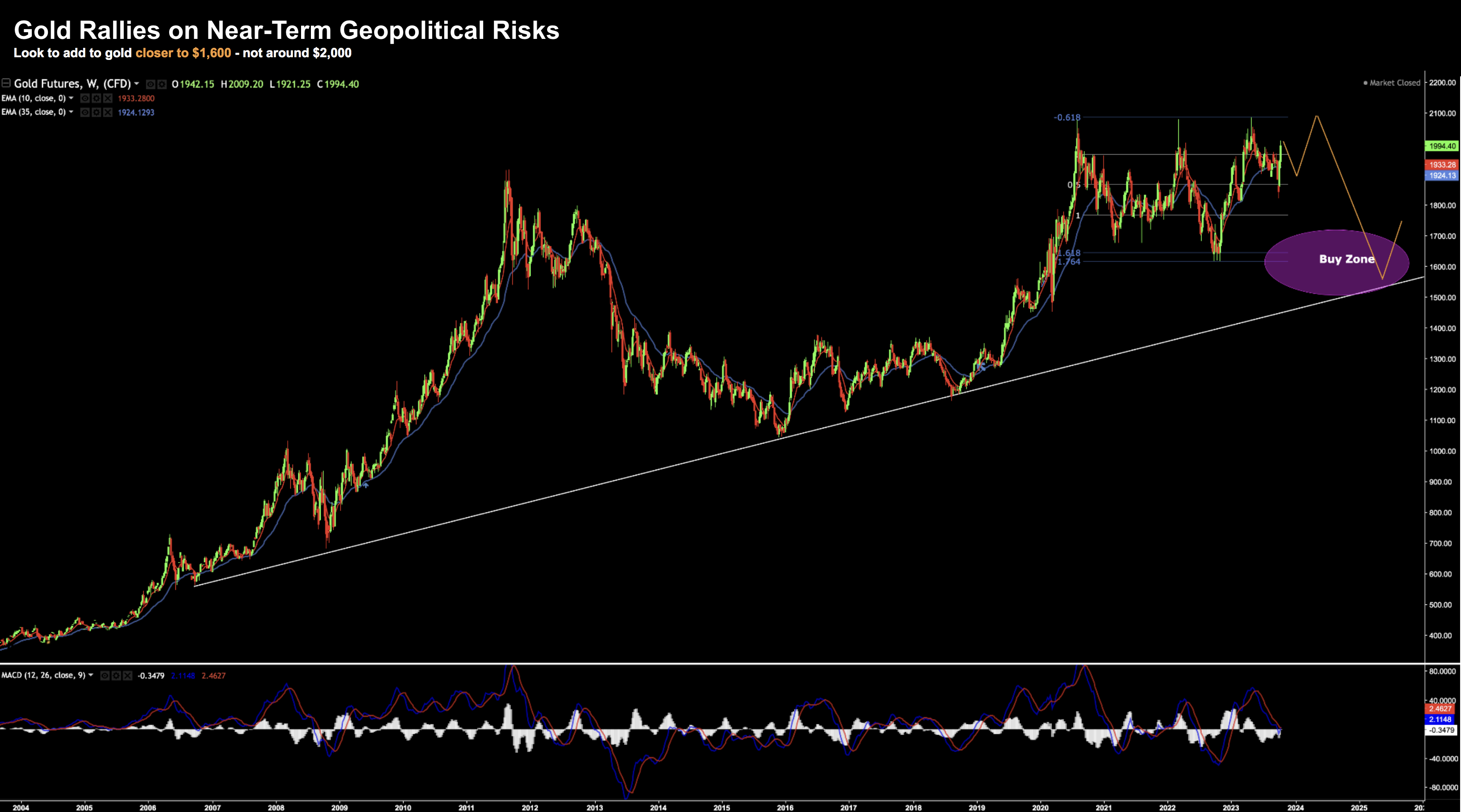

#4. Do You Buy Gold at $2,000?

For the past three years – gold has been caught in a range between $1,600 and $2,000

Now given the inflation and geopolitical risks – why has it struggled to produce outsized returns?

In short, gold will underperform stocks if the conditions for risk assets are more favourable.

For example, take a look at the past 12 years vs the S&P 500:

October 21 2023

Some might say ‘well it’s just timing…that’s all’

Here’s the thing:

Timing is everything in this game.

But I hate to cherry-pick dates – let’s go back to 1975 – maybe we see a better performance from gold?

October 21 2023

I offer these time horizon’s as an important perspective…

If you’re increasing your exposure to gold (e.g. due to geopolitical risks or expected higher inflation) – your timing needs to be very good.

For example, if you tried owning gold at any time over the past decade, it’s unlikely you have done well (vs equities)

But first, a closer look at the weekly chart for gold:

October 21 2023

No.

From a technical perspective – I think it falls back to the long-running trend line in white.

That feels like a zone of around $1600.

Obviously we won’t see $1,600 in a straight line – but I think we could make our way down there.

In the near-term, $1800 is feasible. Expect it to catch a bid there.

But I want to spend a moment on why I think gold is potentially over-valued at $2,000

Surprise, surprise… it all comes back to real interest rates.

Below is a chart that I have not updated in a while – but it warrants a discussion when talking about the gold price.

October 21 2023

As an aside, I used to generate this chart using the St. Louis Feds charting tools – however they removed the ability to chart gold?

Therefore, I downloaded the respective historical data and generated it within Google Sheets.

But let’s explain what’s happening here…

Up until around April/May 2022 – 5-Year TIPS and gold tended to move together.

Note: I’ve inverted the 5-year TIPS (right-hand axis) to make the correlation easier to visualize.

We’ve seen this relationship hold true for almost 20 years.

For example, as 5-Year TIPS yields fell – gold rallied (and vice versa)

However, over the past ~18 months, this relationship diverged. You might say it has effectively de-coupled.

5-Year TIPS yields shot sharply higher – now at 2.5% – however gold has remained elevated.

It’s my opinion that over the long-run – real yields tend to be a leading indicator of gold prices.

Not the reverse.

But I stress – this ‘de-coupling’ happens from time to time (e.g., as we saw in 2008). That’s fine…

Now with real yields soaring the question for me is: (a) will gold pull back; or (b) will real yields fall?

My guess is we see both (overlapping with my thesis that yields fall next year).

For example, I think that TIPS are now fundamentally good value.

The high level of real yields is largely being driven by restrictive Fed policy (e.g. the inversion of the yield curve).

That’s the (bond) market’s way of saying the Fed is tight.

Why is the Fed choosing a restrictive stance?

Because they believe that inflation is still too high (as Powell said this week)

The single issue is shelter (which will come down over time)

Remember – the way the government measures shelter is very much in arrears.

For now, the Fed is arguably leaning too much on the ‘backward looking view’ versus looking forward.

However, I believe that inflation will be tamed (e.g., where core is back to near 2.0% by the end of 2025).

If I’m correct – that will prompt the Fed to ease (perhaps as early as H2 2024) – causing real yields to fall – boosting bond prices.

In addition, I also think gold remains vulnerable to various downside risks (e.g. a lower inflationary environment and/or easing of geopolitical risks)

Bond prices (and TIPS) have upside price potential when (not if) the Fed eases.

However, what’s more I think their downside risk is limited by how much the Fed can tighten. For example, I think it’s unlikely the Fed can raise much more than 50 basis points given what the slowdown we are seeing (and what we find with tightening in credit conditions)

Today these yields are ~2.5% incremental to inflation… which is very compelling (and highly unusual)

History also tells when we see a delta of this magnitude – the economy is close to going into recession (i.e., prompting the Fed to ease).

In conclusion – I’m wary of buying gold at $2,000 – and would rather add exposure to short and long-term bonds (as yields fall over the next 6-9 months).

S&P 500 – Trading Per the Script

What’s funny is I don’t need to change any annotations (or my headline) from last week!

The only annotation is the spike in the VIX (shaded grey area)

October 21 2023

After we cleared 4200 (my initial target from 3600) – I was looking for an upside move to the zone of ~4500 – where I thought we would find resistance.

We spent about 4 weeks between 4500 and 4600 before moving back to find support at the old level of resistance (4200)

For those who are new – previous resistance levels often become new support.

I thought we might catch a bid in this zone (we did) – before finding resistance again.

That’s what we saw this week… right at the 10-week EMA (in red)

I think the bulls will put up a fight around the 4200 level given how long it was resistance.

But if that should break – look out below.

I’ve maintained my 65% long exposure through this move down – not adding to positions.

This has resulted in some 3-4% downside moves this week in banks and tech stocks I own.

For example, my positions in Bank of America, Tesla, Amazon and Apple all saw downside (there were others as well)

Not much fun!

In addition, I’m slightly underwater with the long-end of my bond positions.

However, I see this as a 12+ month play – as I don’t expect to be able to predict the top in yields.

I feel we are getting closer – but I’m not ruling at 5.25% in the 10-year (where I will add to the position)

Year-to-date I’m still mostly in lock-step with the S&P 500 (just 0.80% below) – which I will happily take

Something tells me I am not going to outperform the market by ~19% this time around.

Putting it All Together

In my 25+ years doing this (which isn’t long) – this has been one of the more challenging.

However, I’m thoroughly enjoying it.

I’m excited about what the next 10-years will bring opposite meaningfully higher yields.

I think it will significantly advantage the skilled stock picker.

Valuations will matter.

Put another way, beta won’t work as well as it did the past two decades.

Investors will need to achieve alpha if they’re to generate double digit type returns.

Profits will be lower; margins will be squeezed; economic growth will be weaker (due to higher debts and deficits); and overall conditions will be tougher.

The rules have changed for investors. That’s what higher yields do.

Howard Marks reminded us of what I think will be a ‘tectonic’ shift with his latest memo. You would be well served to read it.

For investors, it means it’s going to take a lot more work… but that also makes me excited.