The Intelligent Investor

Part 2: Protecting Against Inflation

Words: 770 Time: 4 Minutes

“Inflation is a hidden tax. It takes away your purchasing power, even if your nominal income stays the same.” – Warren Buffett

💥 Why This Matters

- Inflation no Longer a Relic: Between 1997 and 2021, inflation was very low, leading some to believe it’s no longer a concern. Post COVID we were given a stark reminder of why inflation matters and how it impacts your purchasing power and investments.

- Inflation Hedge: Certain high-yielding stocks, commodities, property and REITs; and Treasury Inflation Protected Securities (TIPS) tend to do well during times of high inflation – protecting an investor’s wealth.

- The Money Illusion: We tend to focus on nominal (dollar amount) changes in our income and investments, not real (inflation-adjusted) changes. This matters. Always measure returns and economic data series in real terms.

😈 Insidious Inflation

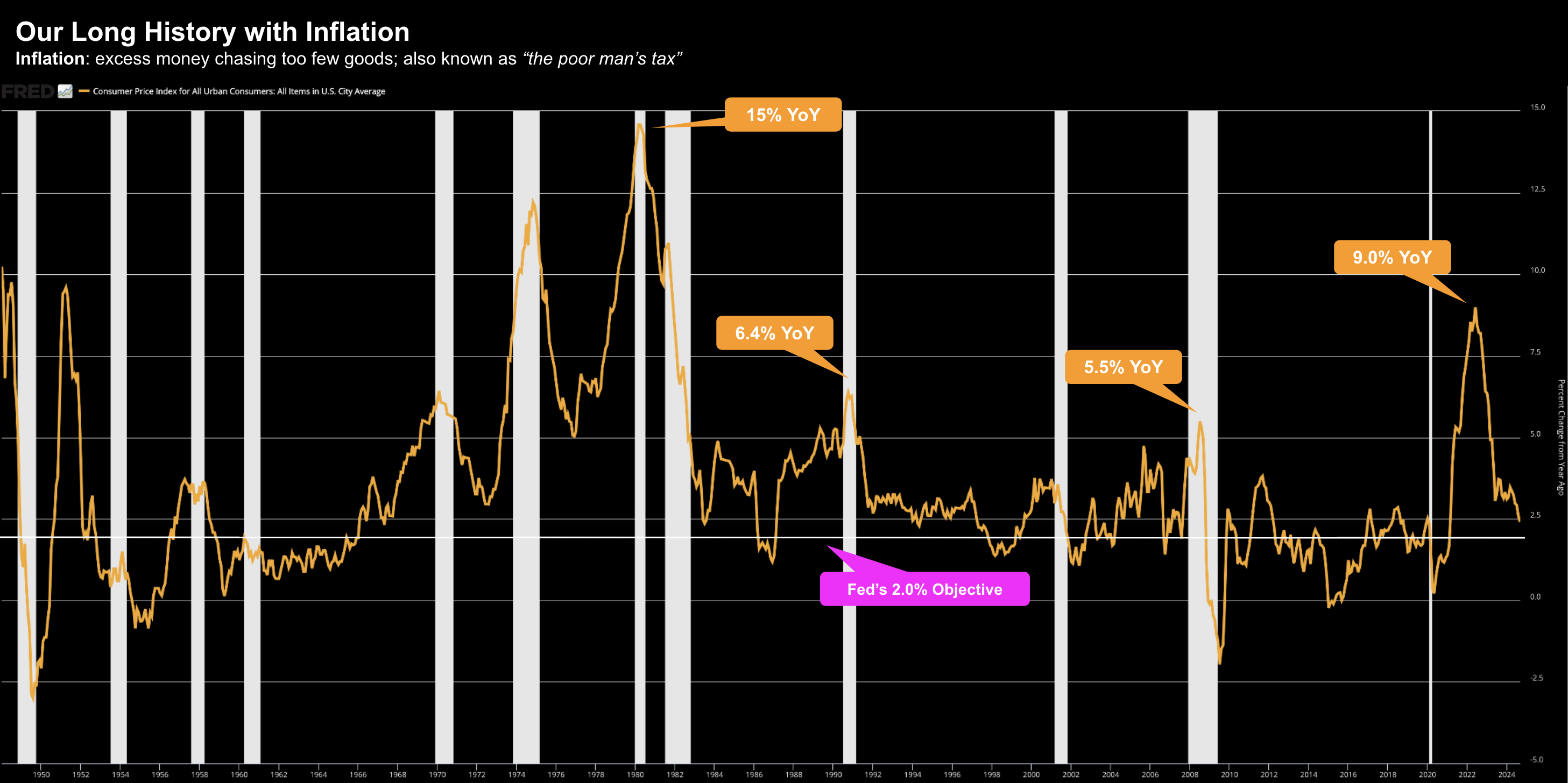

Inflation, the insidious rise in the cost of goods and services, has been a persistent concern for investors throughout our history.

We received a stark reminder of inflation’s bite shortly after the COVID pandemic – surging to levels not seen since the early 1980s – hitting ~9.0% YoY

Prior to 2021 – many felt inflation was a relic – including the Fed.

This proved to be a costly mistake.

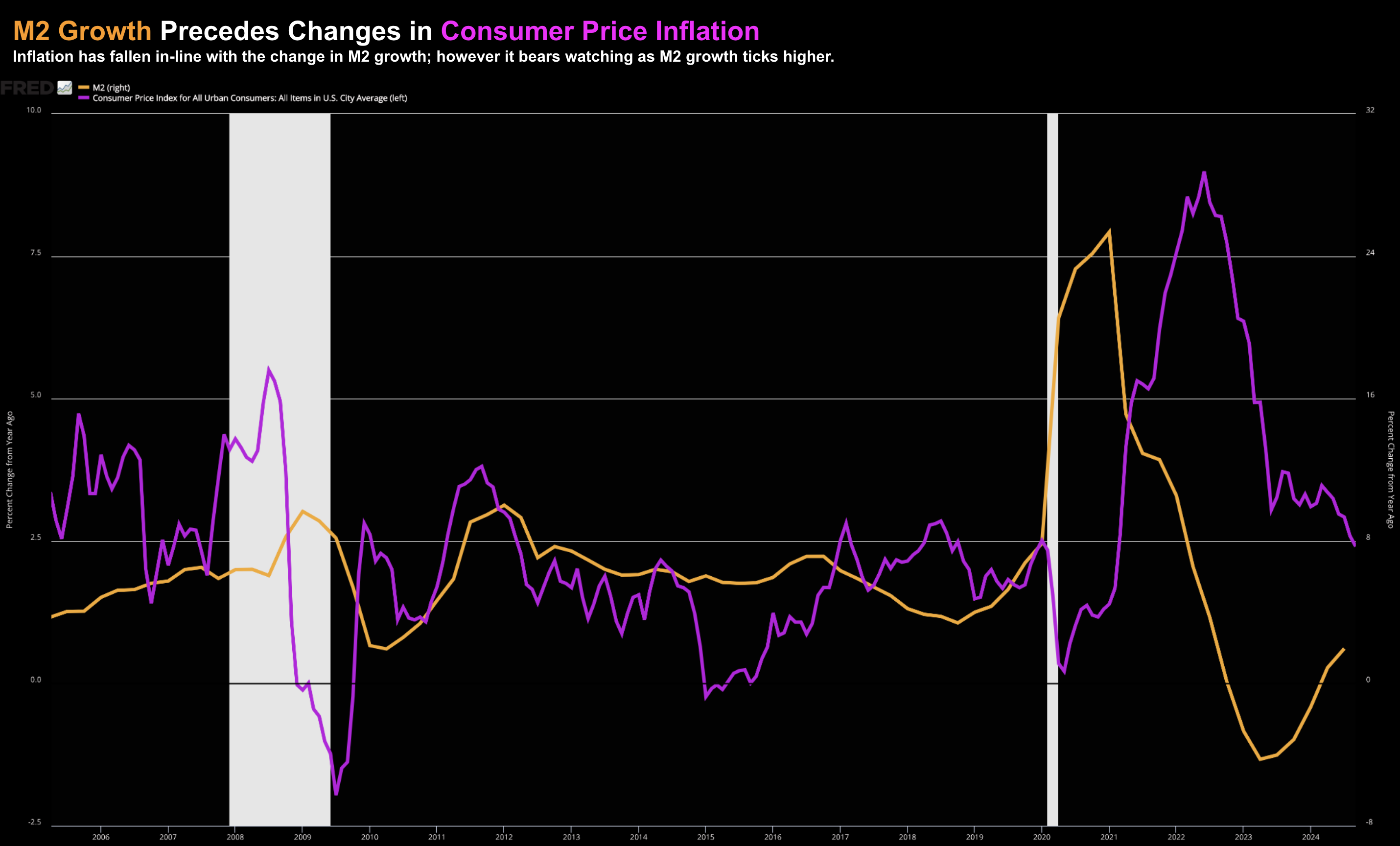

Due to unprecedented levels of government borrowing (and spending) – excess money was chasing too few goods.

For example, below we see the explosion in M2 money supply (cash and equivalents) – which always precedes a spike in inflation.

The surge in prices caused the Federal Reserve to hike rates over 500 basis points in rapid succession – sending stock sharply lower over 2022 – fearing recession.

And whilst recent events were considered extreme (for some) – inflation is a recurring phenomenon – where its effects can be devastating.

Graham reminds us that periods of high inflation will erode the purchasing power of savings, leading to significant financial losses for those who are unprepared.

Chapter 2 details the complexities of inflation; the relative impact on investments; and outlines specific strategies to protect your wealth.

⚡ Inflation’s Impact on Investments

While stocks are often seen as a hedge against inflation, the relationship is not always straightforward.

During periods of high inflation, the stock market can experience volatility as companies struggle to pass on increased costs to consumers.

Moreover, the purchasing power of dividends and capital gains can be eroded by inflation.

Graham suggests to safeguard your investments from inflation, it’s essential to diversify your portfolio and consider assets that are less susceptible to its effects.

He offers the following strategies:

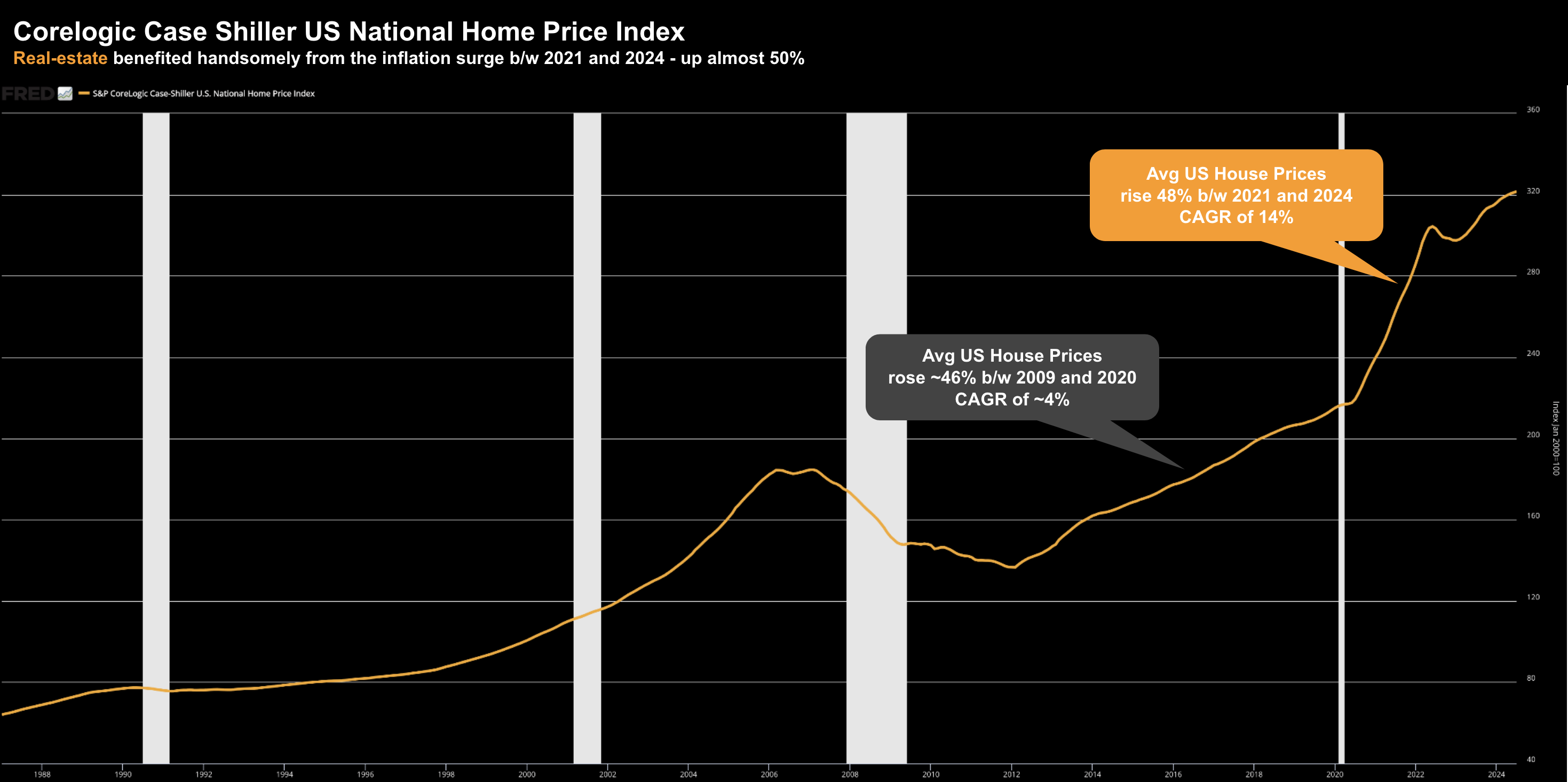

- Real Estate: Historically, real estate has been a good inflation hedge. As prices rise, the value of your property tends to appreciate as well. However, real estate investments can be illiquid and carry additional risks.

- By way of example, U.S. house prices surged at a compound rate of ~14% per annum post COVID – benefiting from the massive injection of liquidity into the economy with limited supply. To put this surge into perspective – for 11 years before COVID (2009 to 2020) – the average annual growth rate for U.S. housing (nationally) was ~4-5% per annum (with inflation around ~2.0%)

- If choosing not to own physical real estate – REITs (Real Estate Investment Trusts – pronounced “reets”) – also do a good job of combating inflation. From mine, the best choice is low-cost Vanguard REIT Index Fund.

- Commodities: Gold, silver, oil, and agricultural products can provide a hedge against inflation. For example, over the past few years, we’ve seen food prices rise ~30% and have not retreated. However, commodity prices are volatile, and investing directly in commodities can be risky.

- TIPS (Treasury Inflation-Protected Securities): These bonds are designed to adjust their principal value to match the rate of inflation, providing a hedge against rising prices

- International Investments: Diversifying your portfolio with investments in foreign markets can help to mitigate the impact of domestic (US based) inflation

5 Key Takeaways

5 Key Takeaways

- Inflation is underestimated: Inflation is insidious – it will erode your purchasing power. Exposure to certain risk assets can provide some defense.

- Historical precedent: What we experienced post 2020 will not be the last episode of unwanted inflation. The more the government continues to borrow and spend beyond its means – we expect further inflation. Monitoring changes in the M2 money supply growth helps us understand where inflation could be headed.

- Government incentives: Governments are motivated to generate inflation of between 2% to 3% per year to help reduce excessive debt burdens. However, this is at the cost of its citizens in terms of eroding purchasing power.

- Stocks and inflation: Not all stocks are always a reliable hedge against inflation, as they can perform poorly during periods of high inflation.

- Diversification is key: To adequately protect against inflation, investors should diversify their portfolios with assets like real estate (which may include REITs), commodities, TIPS, and dividend-paying stocks.