The Intelligent Investor

Part 18: 8 Case Studies: Compare & Contrast

Words: 2,093 Time: 10 Minutes

“What has happened before will happen again. What has been done before will be done again. There is nothing new under the sun, only forgotten truths waiting to be rediscovered.” – Anon.

💥 Why This Matters

- Fundamentals always prevail in the long-run: Hype cycles tend to lead investors to ignore financial fundamentals, often resulting in poor long-term returns.

- Market is a weighing machine: In the short-term, the market is a “voting machine” in a popularity contest. Ultimately it’s a “weighing machine”. Companies become overvalued due to popularity – but only those with real value will sustain.

- Short-term sacrifice for long-term gain: Speculative bubbles will always exist – our job is to avoid them. This can mean being comfortable with appearing ‘wrong’ in the near-term (up to 1-2 years). The ‘strategy’ of investing is an intertemporal mindset – short-term sacrifices for longer-term gains.

📝 Introduction

Chapter 18 dives deeper into Graham’s method of security analysis by examining eight pairs of companies listed closely together on the stock exchange.

By comparing and contrasting their financial structures, performance, and market valuations, Graham reveals valuable insights into the diverse nature of corporate enterprises and the often-irrational behavior of investors.

Note – the summary is a little longer – as we take the necessary time to explain how investors can identify if there is intrinsic value and/or red flags and irrationality.

#1. Stability vs. Speculation

This first contrasting pair exemplifies the prudent, long-term investing against reckless speculation.

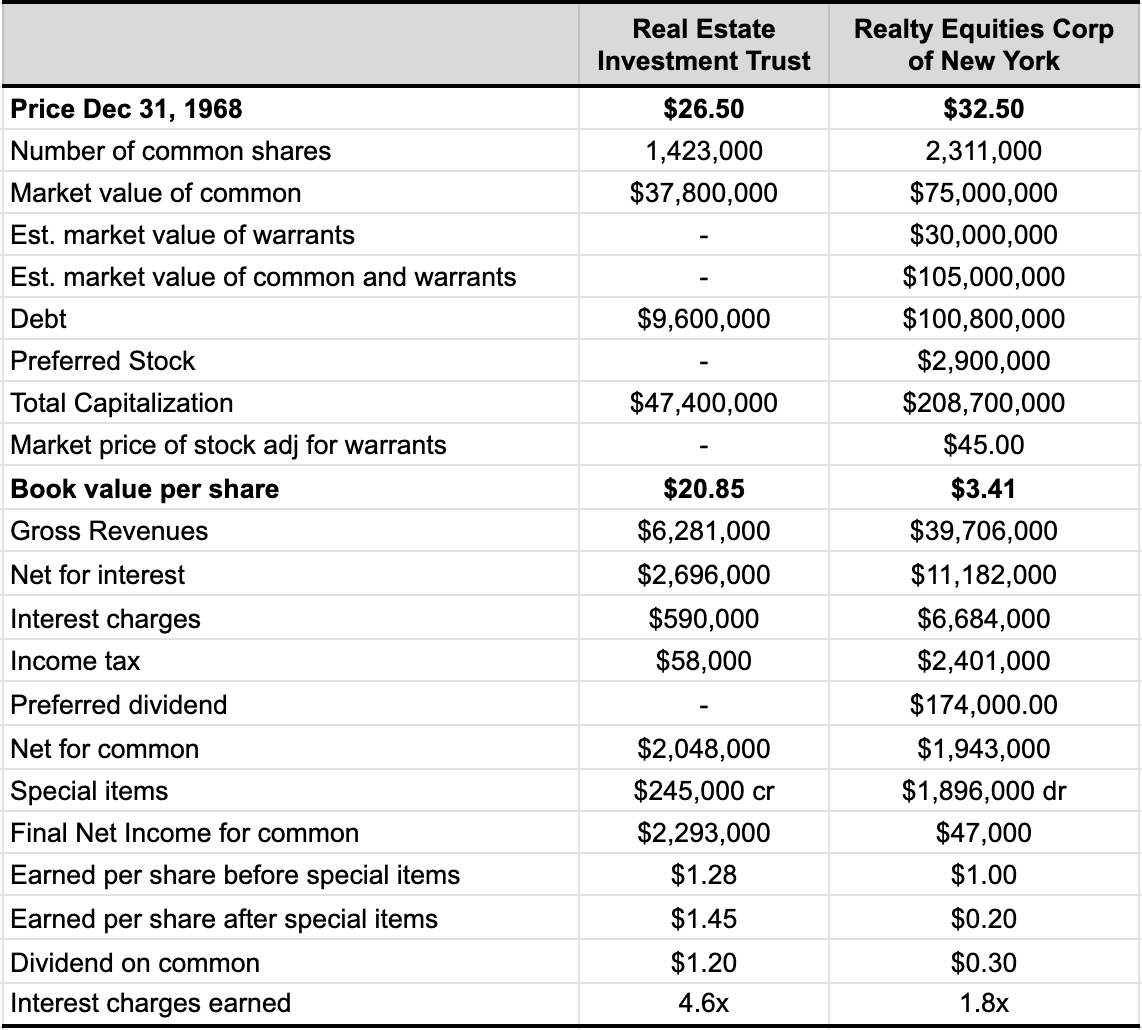

Real Estate Investment (REI) Trust (left hand column below), a century-old trust with a history of stable dividends, represents conservative financial management (e.g., low debt to assets ratio, no issue of warrants, no preferred stock).

In contrast, Realty Equities Corp (REC). engaged in rapid expansion, accumulating a diverse portfolio of businesses and a complex web of debt obligations (right hand column).

Three key observations:

- Market Reaction: Wall Street irrationally favored Realty Equities (Equities) over the Real Estate Investment Trust (Trust) – with Equities’ stock soaring to unsustainable highs despite weak fundamentals. By contrast, Trust shares showed steady but modest growth aligned with their strong book value (e.g., $20.85 book value per share vs trading price of $26.50)

- Collapse of Realty Equities: By 1970, Equities faced massive financial losses, eroding shareholder equity, and an auditor’s refusal to certify its statements. This led to trading suspension and a price drop below $2, highlighting speculative excess and poor management (Note: we saw something similar in 2024 with SuperMicro Computer (SMCI) – where their auditor Ernst & Young – refused to certify)

- Trust’s Stability: The Trust maintained its integrity, offering reasonable earnings and trading near book value, reflecting a sound, well-managed investment compared to Equities’ speculative failure

#2. Quality vs. Quantity

This pair illustrates the market’s preference for quality over quantity – even when it means paying a premium.

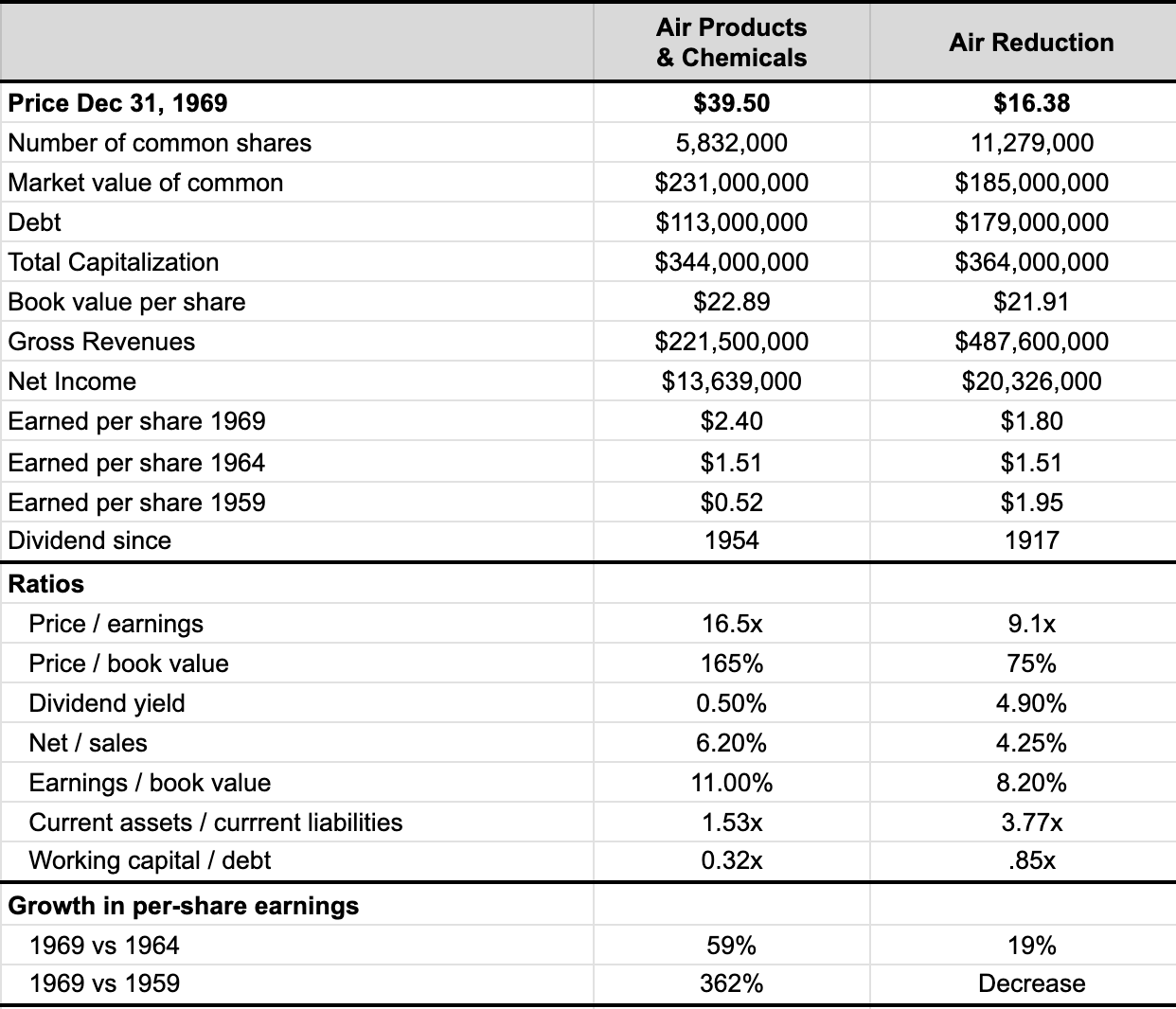

Air Products (left-hand side), despite having smaller sales and earnings than Air Reduction, commanded a higher market valuation due to its superior profitability and growth prospects.

Three key observations:

- Comparison of Key Ratios: Air Products had a stronger growth record and higher profitability than Air Reduction, which allowed its equity issues to sell at a 25% premium. Air Products traded at 16.5x its earnings and well above its asset backing, while Air Reduction traded at a much lower 9.1x earnings and at only 75% of its book value

- Market Preference for “Quality” Over “Quantity”: Despite Air Reduction’s cheaper valuation and stronger working capital position, Wall Street tended to favor the “better” but more expensive Air Products due to its perceived higher quality and growth potential.

- Performance During the Market Downturn: During the 1970 market decline, Air Products fared better with a smaller loss of 16% compared to Air Reduction’s 24% decline. However, Air Reduction rebounded more strongly in early 1971, rising 50% above its 1969 close versus a 30% recovery for Air Products, suggesting that the low-multiplier stock had the advantage in this instance

#3. Health Industry’s High Flyers

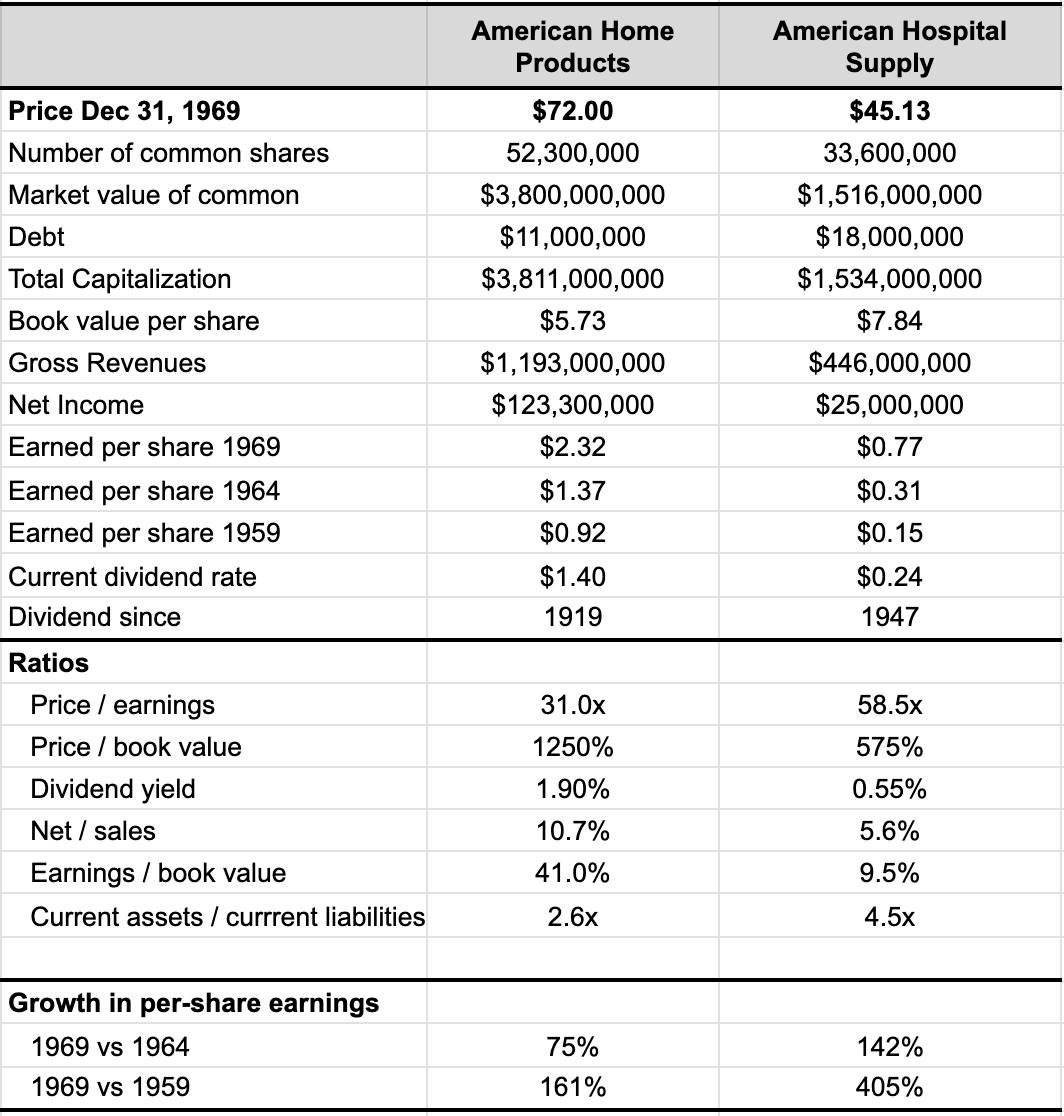

This comparison examines two giants in the healthcare industry, both enjoying excellent growth and strong financial positions.

However, Graham cautions against their high valuations, which reflect significant “goodwill” components. Therefore, he questions how many years of future earnings would be needed to justify the inflated prices?

This case highlights the importance of considering valuation even when investing in promising (growth) industries and companies with strong track records.

Three key observations:

- Growth and Stability: Both Home and Hospital showed strong earnings growth with 100% stability since 1958, reflecting their solid positions in the booming health industry. However, Hospital had a higher growth rate, while Home excelled in profitability on sales and capital.

- Profitability and Risk: Home achieved a high return on capital, indicating strength but also vulnerability to earnings changes. Hospital’s lower net income (5.6% or $25M/$446M) in 1969 raised questions about its profitability despite impressive growth.

- Valuation Comparison: Home offered better value based on earnings and dividends, while Hospital’s higher valuation (almost 6x book value) suggested increased risk for investors

#4. Meteoric Rise vs. Steady Growth

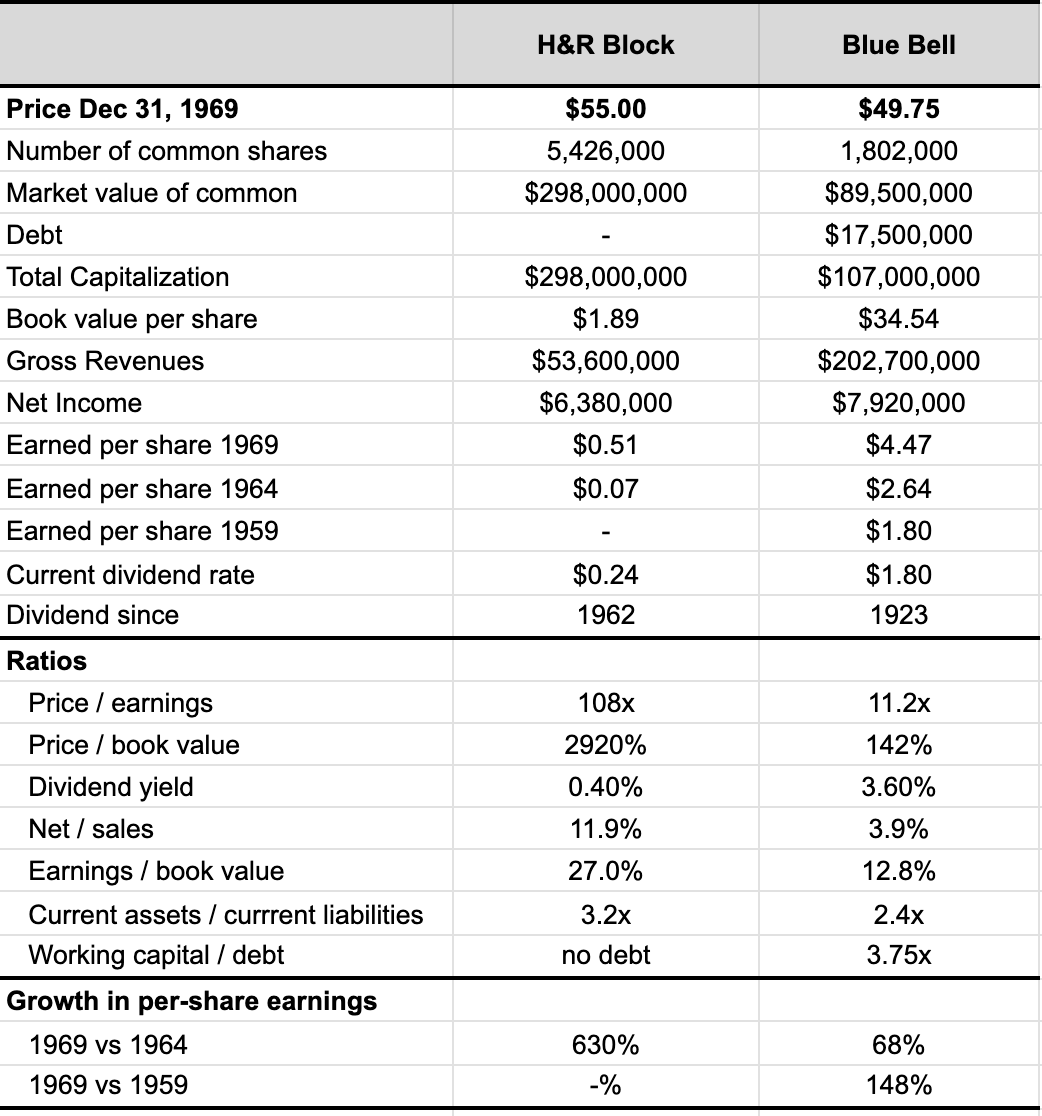

In the fourth case study – Graham contrasts the market’s reaction to a rapidly growing newcomer (H&R Block) versus a well-established company with a long history of steady growth (Blue Bell).

Despite significantly smaller sales and earnings, H&R Block commanded an astronomical valuation, driven by its meteoric rise and the market’s enthusiasm for its (new) business model.

In contrast, Blue Bell, with its strong fundamentals and conservative valuation, appeared undervalued.

This comparison demonstrates how market sentiment can significantly influence stock prices, sometimes leading to irrational valuations (e.g., trading 108x its forward earnings; and 30x its tangible book value)

Three key observations:

- Growth vs. Valuation Disparity: Blue Bell, a stable, established company since 1916, was undervalued in 1969 with a P/E ratio of 11x, despite strong earnings growth. In contrast, H&R Block experienced meteoric growth, with its stock trading at an astonishing 108x earnings and 30x times tangible assets.

- Business Scale and Financials: Blue Bell had 4x the revenue, 2.5x the earnings, and significantly more tangible assets than H&R Block, yet its market valuation was less than one-third of Block’s (given Bell’s more modest (yet sustainable) growth profile). Additionally, Blue Bell offered a 9x higher dividend yield

- Investment Perspective: While H&R Block showed strong momentum, its valuation raised concerns about overpricing and competition risks. Blue Bell, on the other hand, appeared to be a solid, conservatively priced investment opportunity (i.e. adequate and sustainable returns for the conservative investor)

#5. Profitability and Growth

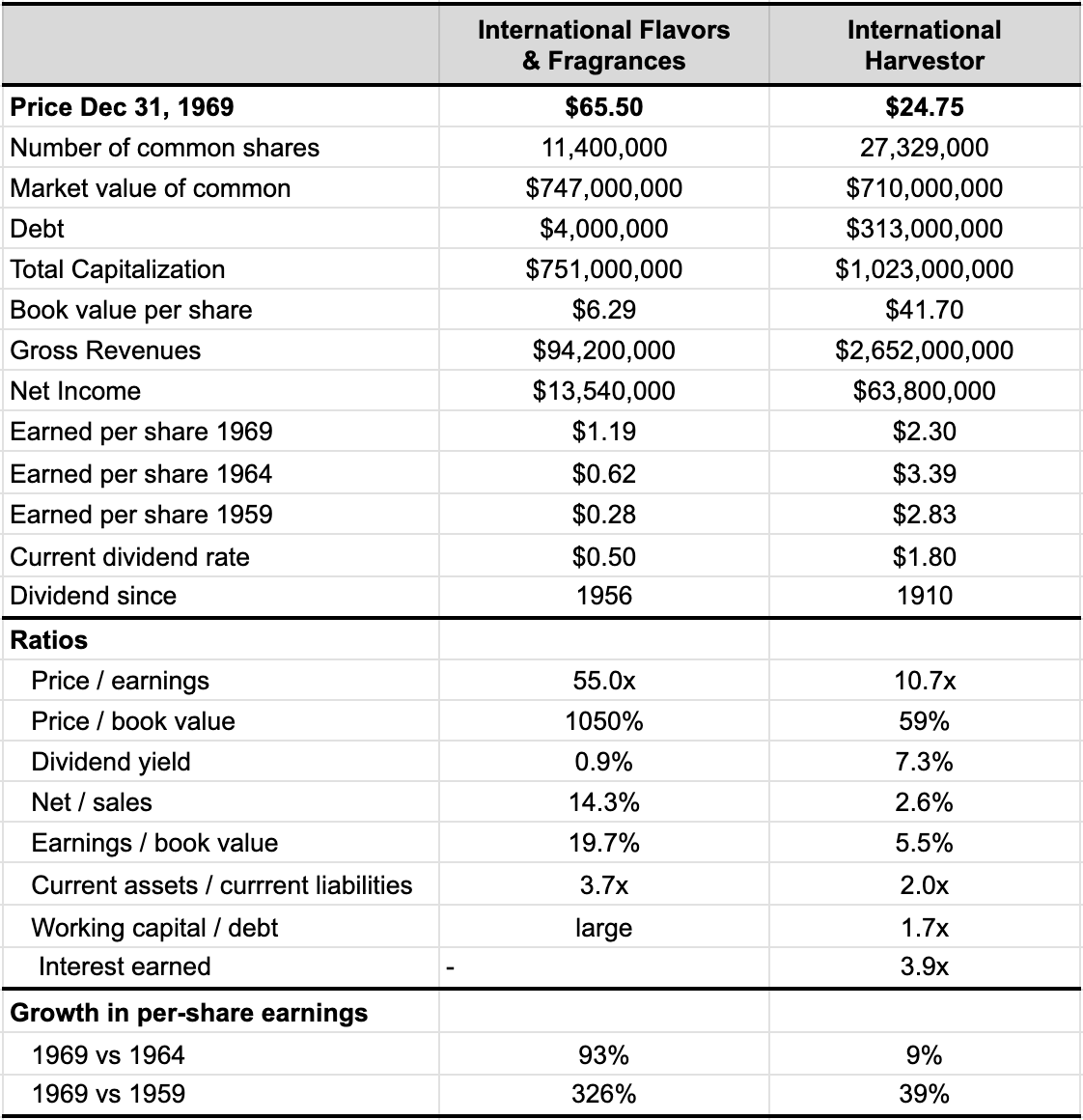

This surprising pair reveals how a relatively unknown company (International Flavors & Fragrances) can surpass a well-known giant (International Harvester) in market valuation due to its superior profitability and growth.

While Harvester struggled with low profitability despite its massive size, Flavors focused on its core business and achieved impressive financial performance – however it was expensive.

This case highlights the importance of profitability and growth in driving shareholder value, regardless of a company’s size or industry prominence. However, it was difficult to make a case to buy either stock (for different reasons)

Three key observations:

- Profitability and Growth Drive Valuation: In 1969, International Flavors & Fragrances (IFF) surpassed International Harvester in market value ($747M vs. $710M) despite having just 1/17th of Harvester’s stock capital and 1/27th of its sales. IFF’s exceptional profitability (14.3% of sales vs. Harvester’s 2.6%) and growth nearly doubled its earnings over five years, while Harvester’s stagnated

- Stock Market Disparity Flavors traded at 55x earnings and 10.4x book value, reflecting its strong performance. In contrast, Harvester sold at just 10.7x earnings and a 41% discount to book value, highlighting its inefficiency

- Investment Suitability: Neither stock was ideal for sound investment. Flavors was overvalued despite its brilliance; while Harvester’s mediocrity made it unattractive even at a steep (41%) discount to tangible book.

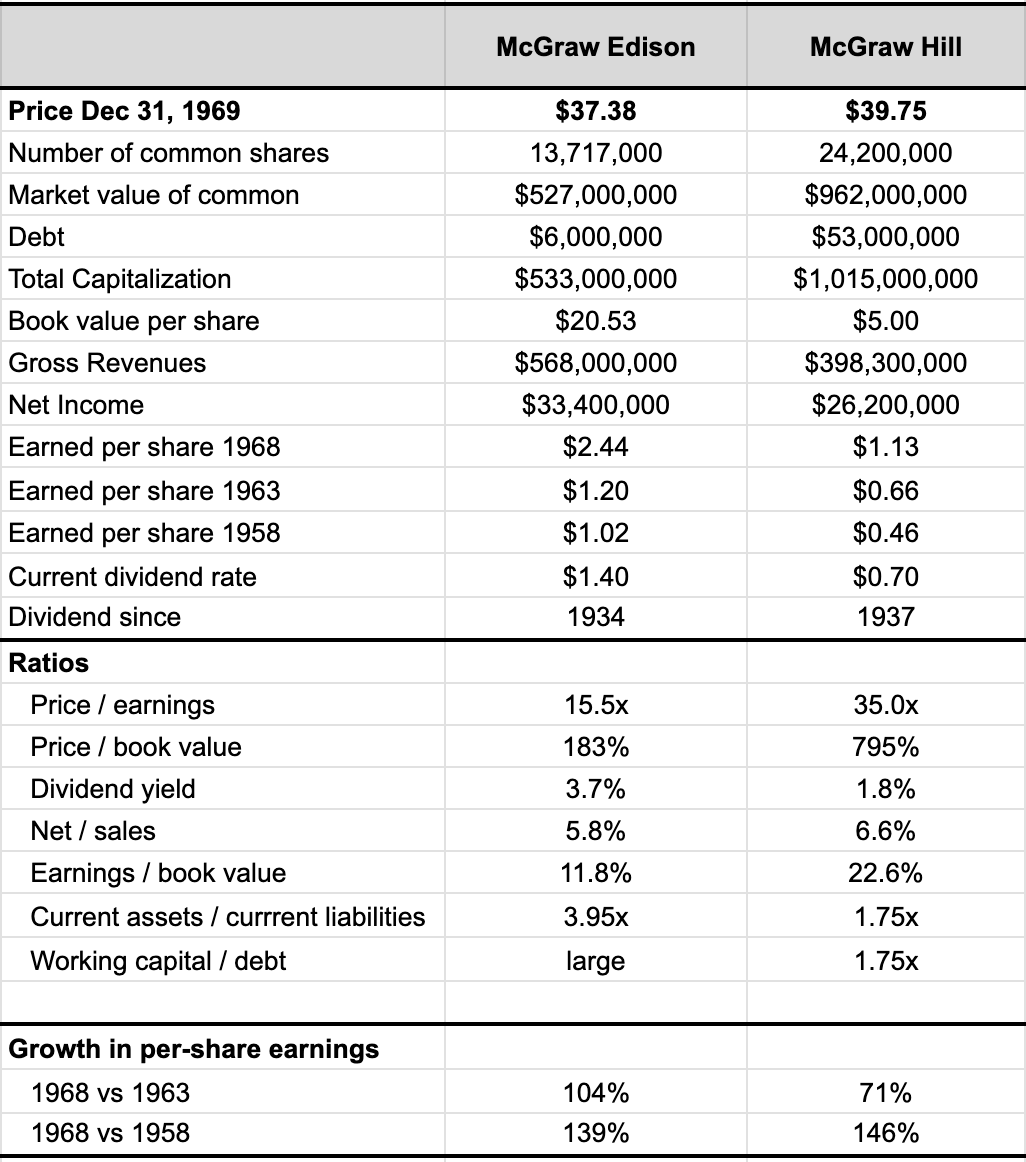

#6. Market Enthusiasm and Disappointment

This comparison examines how market sentiment can shift dramatically, leading to significant price fluctuations.

McGraw-Hill, initially favored by the market due to its presence in the publishing industry, experienced a sharp decline in valuation as its earnings faltered.

In contrast, McGraw Edison, with its more stable performance and reasonable valuation, weathered the market downturn better.

This case underscores the risks of investing in companies driven by market enthusiasm rather than solid fundamentals.

Three key observations:

- Valuation Discrepancy: Despite McGraw Edison’s higher sales (50%) and earnings (25%) in 1968, McGraw-Hill’s market value was double due to its larger capitalization and inflated price/earnings ratio (35x vs. Edison’s 15.5x). This reflected Wall Street’s enthusiasm for book-publishing stocks, even amid declining profits

- Speculative Hazards: McGraw-Hill’s inflated valuation, based on optimistic market sentiment, proved unsustainable as its earnings declined for two consecutive years (1969–70). Its stock price plummeted by over 80% during the May 1970 market downturn, underscoring the risks of overvaluation

- Edison’s Stability: McGraw Edison, with a reasonable valuation and steady performance, weathered the market downturn better, fully recovering by 1971, unlike McGraw-Hill

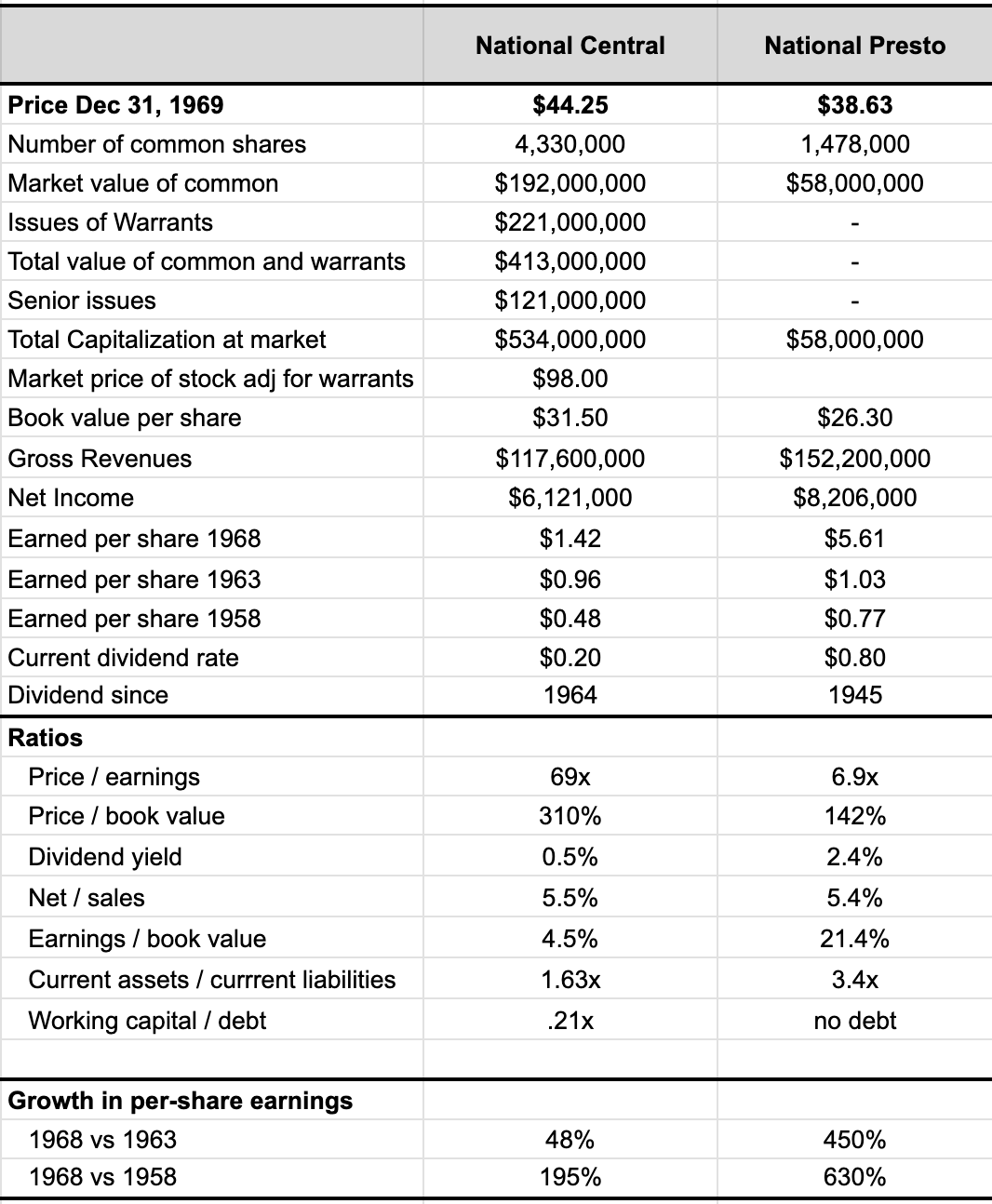

#7. Conglomerate Complexity vs. Focused Simplicity

This pair contrasts the complexities of a conglomerate (National General) with the focused approach of a company specializing in a specific niche (National Presto).

While General pursued a diversification strategy through acquisitions and a complex capital structure, Presto maintained a simpler business model and a strong financial position.

This comparison highlights the potential pitfalls of excessive diversification and financial engineering, emphasizing the value of focused businesses with strong fundamentals

Three key observations:

- Valuation Contrast: National Presto, with a simple capital structure and solid financial performance, was valued at only 6.9x earnings in 1968. In stark contrast, National General, a conglomerate with a complex structure, was effectively valued at 69x earnings when including its warrants and other factors, reflecting inflated market enthusiasm

- Speculative Risks of Conglomerates: National General epitomized the late-1960s ‘conglomerate craze’ – with high market valuation unsupported by tangible assets. Its speculative ventures, like the Minnie Pearl Chicken investment, led to massive write-offs, significant losses in 1969, and a subsequent collapse in stock price to as low as 15% of its 1968 high

- Presto’s Stability and Value: Despite benefiting from war-related contracts, Presto maintained steady earnings growth through 1970 and was undervalued, trading below its net current assets (note: it traded at 1.4x book value at the time of the analysis – not expensive) and at a low price-to-earnings ratio. It exemplified a sound investment opportunity, especially for a diversified portfolio

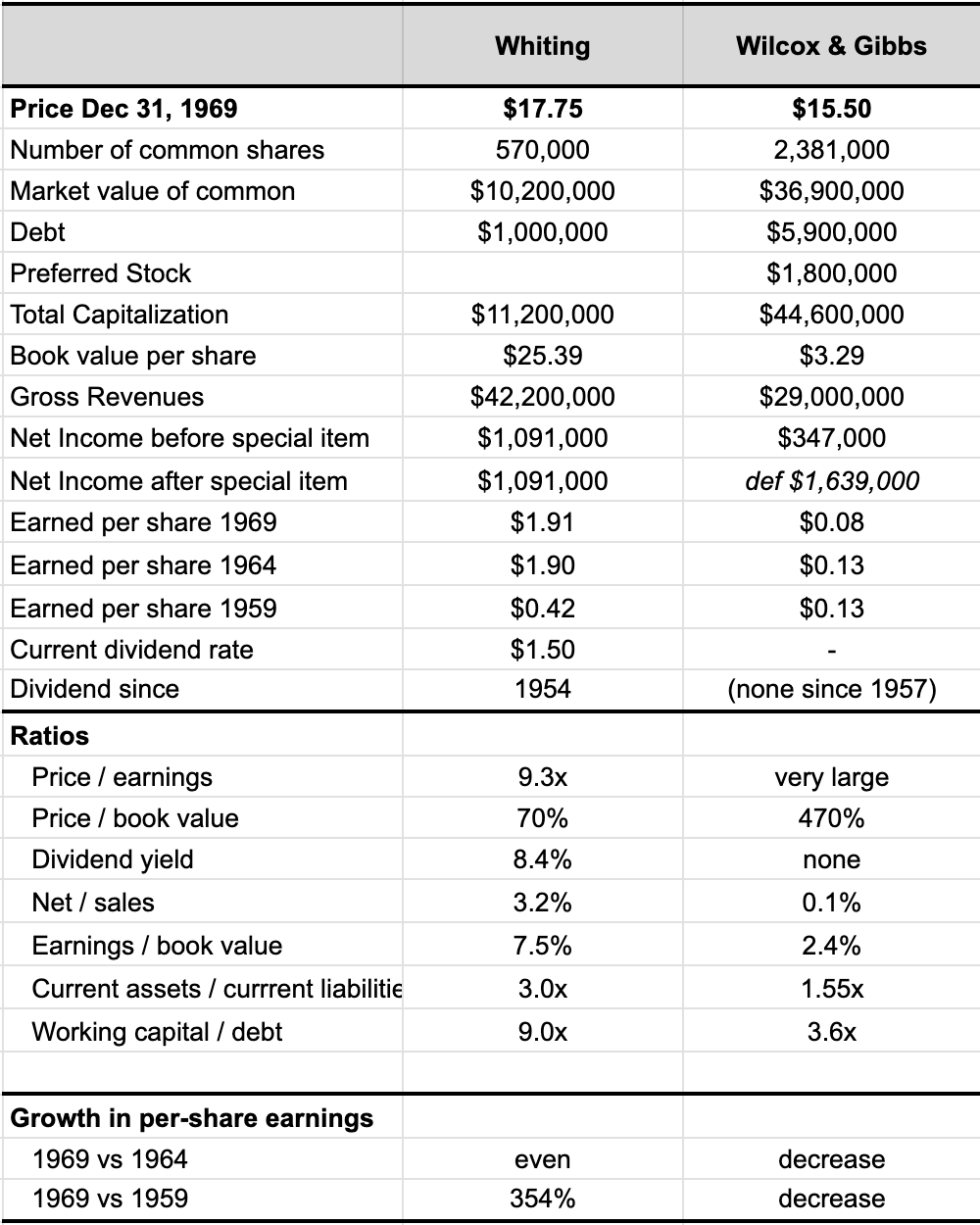

#8. Value vs. Speculation

This final pair showcases the stark difference between a company with a long history of stable earnings and dividends (Whiting Corp.) and a company pursuing a speculative diversification strategy (Willcox & Gibbs).

Despite its superior financial performance and attractive dividend yield, Whiting was significantly undervalued compared to Willcox & Gibbs, which had a history of losses and no dividend payments.

This case demonstrates how market sentiment can lead to irrational valuations, favoring speculative ventures over companies with proven track records.

Three key observations:

- Valuation Disparity: Whiting, with strong earnings, consistent dividends since 1936, and a high dividend yield, was undervalued compared to Willcox & Gibbs, which had smaller earnings, no dividends for 13 years, and a history of losses. Despite its underperformance, Willcox & Gibbs traded at 4x Whiting’s aggregate market value, showcasing Wall Street’s irrationality

- Business Stability vs. Conglomerate Experimentation: Whiting maintained steady growth in its core materials-handling business, while Willcox & Gibbs pursued diversification into numerous small subsidiaries, resulting in a lack of focus and underwhelming financial results

- Investment Potential: Whiting represented a sound secondary-issue investment for ‘growth’ investors, particularly when its stock traded at close to just 1.0x book value. Meanwhile, Willcox & Gibbs lacked statistical justification for its valuation, making it speculative and risky

5 Key Takeaways

5 Key Takeaways

By studying these contrasting pairs and their diverse experiences, investors can gain valuable insights into the complexities of the stock market and develop a more discerning approach to security analysis.

Graham’s emphasis on fundamental analysis, value investing, and skepticism provides a timeless framework for navigating the ever-changing financial landscape and making informed investment decisions. Below are 4 key takeaways from the chapter:

- Fundamental Analysis: A careful examination of financial statements and key ratios is the only way an investor can determine if there is intrinsic value.

- Market Volatility: Regardless of whether the company trades at a discount to its intrinsic value or is built on hype and speculation – the studies highlight the inherent volatility with stock market investing.

- Value Approach: By focusing on identifying undervalued companies with strong fundamentals is a better approach rather than chasing high-growth, high-momentum (popular) stocks over the long run.

- Exercise patience and discipline: The market can be irrational in the short term, but value and sound fundamentals will ultimately prevail.