The Intelligent Investor

Part 15: The Art of Stock Picking

Words: 1,026 Time: 5 Minutes

“It is easy in the world to live after the world’s opinion; it is easy in solitude to live after our own; but the great man is he who in the midst of the crowd keeps with perfect sweetness the independence of solitude“

—Ralph Waldo Emerson

💥 Why This Matters

- Active Investing Requires Effort and Discipline: While achieving above-average returns is theoretically possible, it’s a challenging endeavor that demands significant effort, discipline, and a contrarian mindset. Investors must be willing to go against the grain and seek out undervalued opportunities neglected by the market.

- Focus on Undervalued Companies: Rather than chasing high-growth narratives, enterprising investors should focus on identifying undervalued companies with solid fundamentals.

- Combine Quantitative and Qualitative Analysis: Utilize quantitative criteria (such as those outlined in prior chapters) to screen for potential investments and identify companies with strong financial positions and reasonable valuations. Combine this with qualitative analysis, considering factors like management quality and industry trends, to gain a comprehensive understanding of the investment opportunity

📝 Introduction

When surrounded by others, it’s often easier to conform to society’s expectations, values, and norms rather than to act independently.

Many people choose this path because it generally garners approval. However, it’s not what will make you successful with investing.

In solitude, without external influences, you will be truer to your beliefs, values, and conviction.

As Emerson said, greatness comes from the ability to maintain one’s individuality, values, and integrity (“the independence of solitude“).

Think of those who have achieved greatness – and these qualities will ring true.

What’s more, true greatness is achieved with grace, humility, and inner strength.

For me, Buffett showed his incredible humility by crediting Charlie Munger as the “architect” of Berkshire’s success and himself as merely the day-to-day “contractor”.

Chapter 15 explores the challenges and potential approaches for investors aiming to achieve superior returns, emphasizing the importance of independent thinking and avoiding group-think.

📈 The Challenge of Outperformance

Achieving above-average returns in the stock market (“alpha”) is a challenging endeavor, even for professional investors.

According to this research – fewer than 11% of active fund managers have beaten Index based returns over 10 years – despite access to extensive resources and expertise.

This suggests that market prices generally reflect available information and future expectations, making it difficult to predict future price movements with certainty.

👨🎓 The Graham-Newman Approach

Traditional Wall Street analysis often focuses on identifying high-growth industries and companies, leading to a tendency to overpay.

However, the reality is that few companies sustain high growth rates indefinitely, and market sentiment can shift dramatically, leaving investors vulnerable to significant losses.

We provided examples in the previous chapters of what we saw with both EMC Corp. and Cisco during the dot.com bust of 2000. And my best is we’re likely to see similar (horror) stories after 2024 as a result of the inevitable “AI bust”

The investment firm Graham-Newman Corp. achieved successful results by focusing on specific, often overlooked, areas of the market.

- Annual returns: In the 10 years before 1946, the average annual return was 17.6%, which was higher than the Dow Industrials’ average return of 10%

- Total return: The average annual total return over the company’s 20-year existence was ~20%

The firm’s investment philosophy concentrated on three overlooked areas:

- Arbitrages and Liquidations: Capitalizing on special situations like mergers, reorganizations, and liquidations where a calculated profit opportunity existed.

- Related Hedges: Simultaneously buying convertible securities and selling the underlying common stock to exploit price discrepancies and profit from market volatility.

- Net-Current-Asset (Bargain) Issues: Investing in companies trading below their net-current-asset value, essentially buying a dollar’s worth of assets for less than a dollar.

These specialized strategies require in-depth analysis and a contrarian mindset, often venturing into areas neglected by mainstream investors.

👀 Identifying Undervalued Opportunities

Growth investors can potentially find undervalued opportunities in various ways:

- Focusing on Secondary Companies: Look for well-established companies with solid track records that are overlooked or undervalued by the market due to a lack of “glamor” or short-term concerns.

- Utilizing Online Financial Resources: Employ a systematic approach to screen for potentially undervalued stocks using resources like (not limited to) Yahoo!Finance, Google Finance, Morningstar, or Bloomberg Terminal – then applying quantitative criteria to narrow down the universe of potential investments

- Seeking Bargain Issues: Identify companies trading below their net-current-asset value, recognizing that these “bargains” may require patience as their value may not be immediately recognized by the market. Note: this is why I give my investment a typical time horizon of at least 3-4 years… where I expect the stock to drift lower in the near-term.

- Analyzing Special Situations: Explore opportunities in mergers, acquisitions, and liquidations, but exercise caution and conduct thorough due diligence as these situations can be complex and unpredictable.

🧠 The Importance of Independent Thinking

Investors seeking ‘alpha’ must cultivate independent thinking and avoid blindly following market trends or conventional wisdom.

Put another way, you cannot achieve outperformance if you’re simply doing what everybody else is doing.

By developing a contrarian mindset and seeking out undervalued opportunities neglected by others, they can potentially achieve superior returns over the long term.

However, it’s crucial to remain disciplined and avoid overpaying for growth, even when enthusiasm for a particular company or industry is high.

By combining thorough analysis with a value-oriented approach, enterprising investors can increase their chances of success in the quest for outperformance.

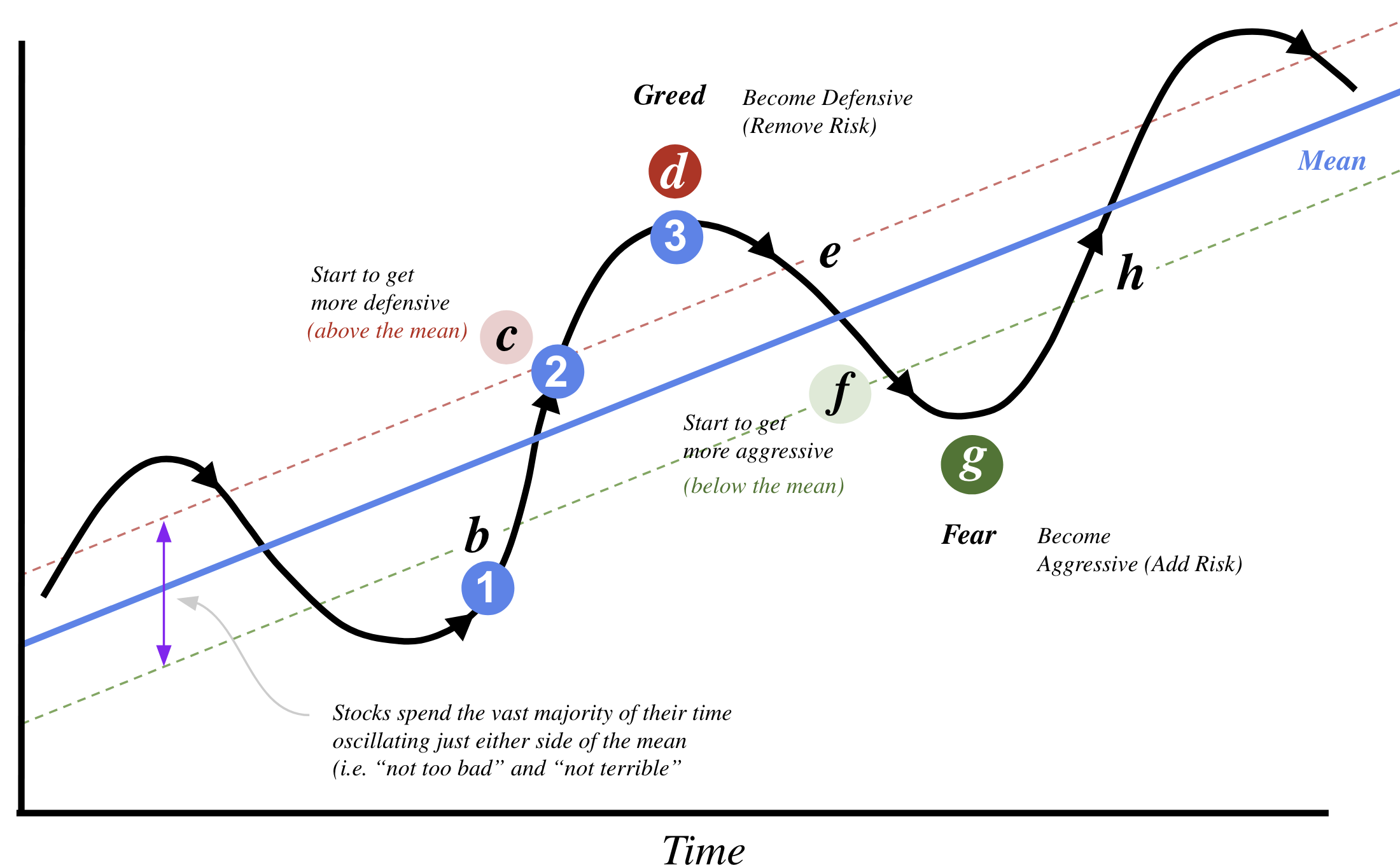

Again, we keep reverting to an annotated version of Howard Marks’ market cycle to help aid investors when identifying these situations (see Part 3):

📚 Learning from Others

To help your journey into value investors – start by learning from professionals.

Professional money managers like (not limited to) Howard Marks, Bill Ackman, Seth Klarman, Warren Buffett and Stanley Druckenmiller all own the same stocks as you.

My recommendation is to study their portfolios (download their quarterly 13F filings) and investment philosophies.

This can provide valuable learning opportunities and help you refine your own stock picking approach.

Regardless of the specific techniques used, successful stock pickers share common traits: discipline, consistency, and a focus on business fundamentals rather than market noise.

By cultivating these qualities and practicing their craft, the investor who seek outperformance can increase their chances of being successful over the long-term