The Intelligent Investor

Part 13: A Practical Look at Security Analysis

Words: 1,699 Time: 7 Minutes

“Under conditions of complexity, not only are checklists a help, they are required for success. They help us avoid blind spots and ensure we don’t miss the crucial steps that keep things from going wrong.”

—The Checklist Manifesto by Atul Gawande

💥 Why This Matters

- Growth vs. Value: High valuations entail greater risk. Conservative investors might find more value in modestly priced companies – which offer a greater margin of safety and strong underlying fundamentals

- Importance of Due Diligence: Don’t solely rely on market sentiment or past performance. Conduct thorough research, analyze financial statements, and consider industry dynamics and future prospects before making investment decisions

- Alignment with Investor Philosophy: The choice between growth and value stocks should align with your individual investment philosophy and risk tolerance. Understand your own preferences and prioritize investments that match your long-term goals and comfort level with risk.

📝 Introduction

Chapter 13 provides a practical demonstration of security analysis by examining four companies listed on the New York Stock Exchange in 1970.

By comparing their performance, financial condition, and market valuations, Graham demonstrates what valuable insights can be gleaned into the process of security analysis and the factors that influence investment decisions.

Updated activity on the four companies studied:

- ELTRA Corp was ultimately acquired by Honeywell (HON);

- Emerson Electric (EMR) delivered a CAGR of 9.1% for ~50 years (exc. dividends)

- Emery Air Freight was ultimately acquired by UPS (UPS); and

- Emhart Corp was acquired by Stanley Black & Decker (SKW)

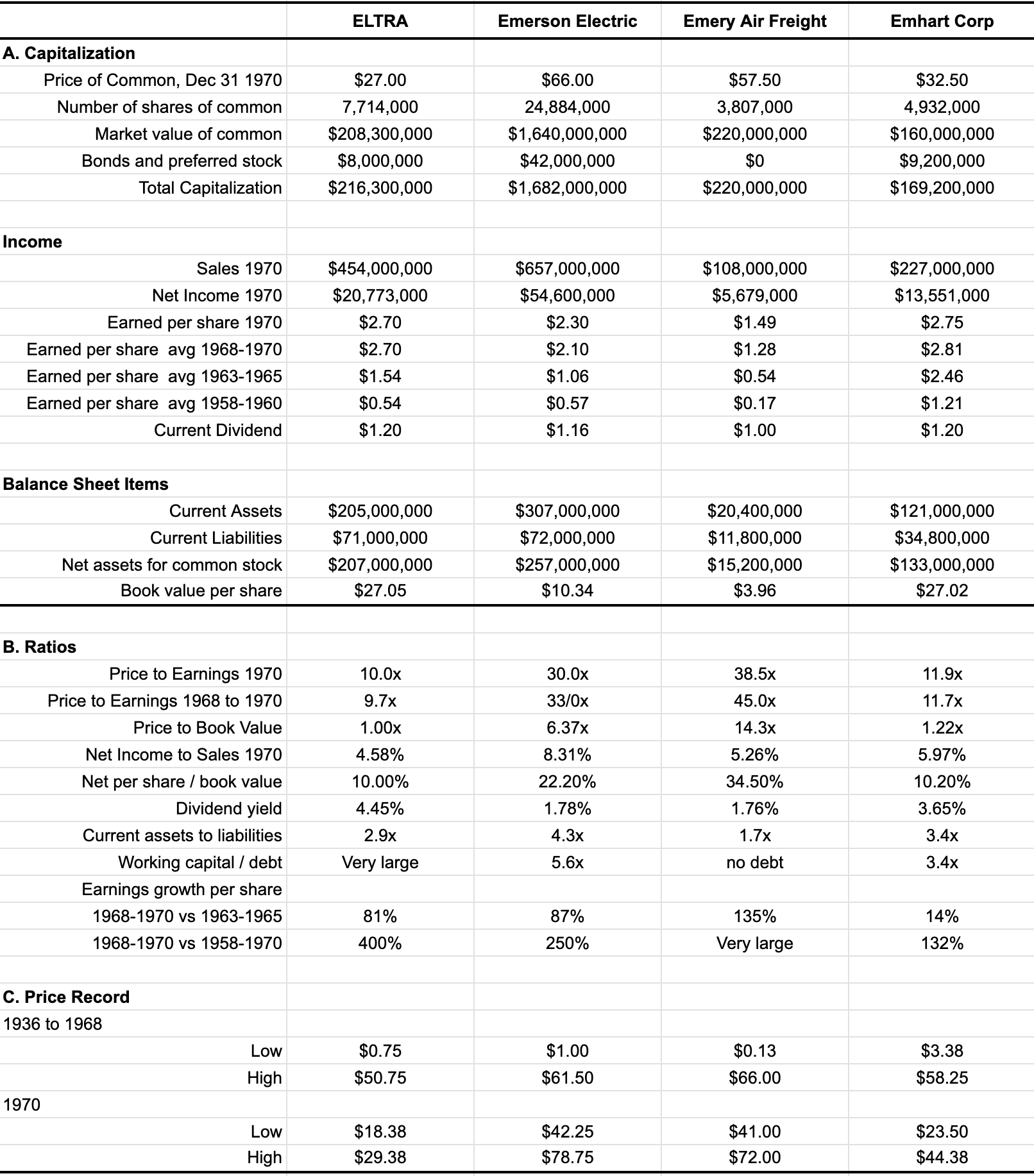

📋 Key Valuation Metrics

📈 Analyzing Performance and Valuation

As a preface, from this point on, we now get into the practical examples of security analysis.

It’s intended you will be able to use these (and other) examples for any company you analyze today – as the same lessons apply.

To begin, Graham says the most striking fact about the four companies is that the current price/earnings ratios vary much more widely than their operating performance or financial condition.

Two of the enterprises—ELTRA and Emhart—were modestly priced at only 9.7x and 12x the average earnings for 1968–1970, as against a similar figure of 15.5x for the Index (Dow Jones).

The other two—Emerson and Emery—showed very high multiples of 33 and 45x such earnings.

Let’s summarize the key findings.

1. Profitability (Net p/share to book value): All companies exhibit satisfactory returns on invested capital, with Emerson (22.2%) and Emery (34.5%) showing particularly strong profitability. Note – a high rate of return on invested capital often goes along with a high annual growth rate in earnings per share.

2. Stability: Emerson and Emery demonstrate exceptional earnings stability, while ELTRA and Emhart show moderate fluctuations

4. Financial Position: All companies maintain healthy financial positions with low debt levels and adequate liquidity.

6. Price History All four companies have experienced significant price appreciation over the long term, highlighting the potential for substantial gains in the stock market

☯️ Contrasting Valuations

As stated above, despite broadly similar performance characteristics, the companies exhibit vastly different price-to-earnings (P/E) ratios.

ELTRA (10.0x) and Emhart (11.9x) trade at modest multiples, while Emerson (30.0x) and Emery (38.5x) command significantly higher (riskier) valuations.

This disparity highlights the influence of growth expectations on market valuations.

Put another way, when a company shows a high forward PE ratio (e.g., above 20x) – it suggests investors are willing to pay a premium for companies with strong growth prospects, even if their current performance is not significantly different from their lower-valued peers.

I think it’s worth noting that whilst paying 30x for Emerson in 1970 – investors still realized a CAGR of 9.1% plus dividends (~2.0%) for around 50 years.

As such, the point is if the company continues to maintain a strong growth profile – paying an above average multiples can be justified over the long-run.

However, your margin of safety is reduced should the company fail to deliver on its growth. In other words, it’s simply a higher risk/reward bet.

🔮 Evaluating Future Prospects

This is essentially what we are tasked with as investors.

Whilst past performance may help us evaluate the reliability of the company and its current state of health – we are always buying future projections.

What matters above everything else is how well the company will do in the next ‘3 to 10+’ years.

Why say ‘3 years’ vs ’12 months’?

My view is you need to allow at least 3-years for the business cycle to work.

For example, we are assuming you’re buying the stock when it’s either (a) out-of-favor; (b) navigating a change in strategy; and/or (c) a negative in broader economic conditions / investor sentiment.

Back to our case study, Emerson and Emery, with their high valuations, carry greater risk if their growth falters and/or if industry conditions deteriorate.

As an aside, with industries that exhibit very high growth rates, they are also ‘honey pots’. Generally if a company is experiencing rapid growth – you can expect strong competition – which can impact the future earnings potential of the company.

As demonstrated, through 2024, Emerson has delivered exceptional returns for investors (vastly exceeding the returns of the S&P 500)

But let’s fast forward beyond 1970 – and consider what we saw in the lead up to the year 2000…

EMC Corp., a data storage company, experienced meteoric stock price growth during the 1990s.

However, a closer look reveals that its true growth rate was slowing, and its high valuation was based on overly optimistic projections.

We saw the same with Cisco Systems (CSCO)

It too was delivering unparalleled growth rates with a price to sales ratio in the realm of 45x (similar to Nvidia today – which trades ~40x sales revenue).

However, analysis would reveal its growth was not only slowing – it was not sustainable.

This illustrates the dangers of extrapolating past growth rates into the future; and assuming that high-growth companies can sustain their momentum indefinitely.

Rarely does that come to fruition.

ELTRA and Emhart, with their lower valuations, offer a greater margin of safety and may be more attractive to conservative investors.

🤔 The Role of Investor Philosophy

The choice between value and growth-oriented investments depends largely on the individual investor’s philosophy and risk tolerance.

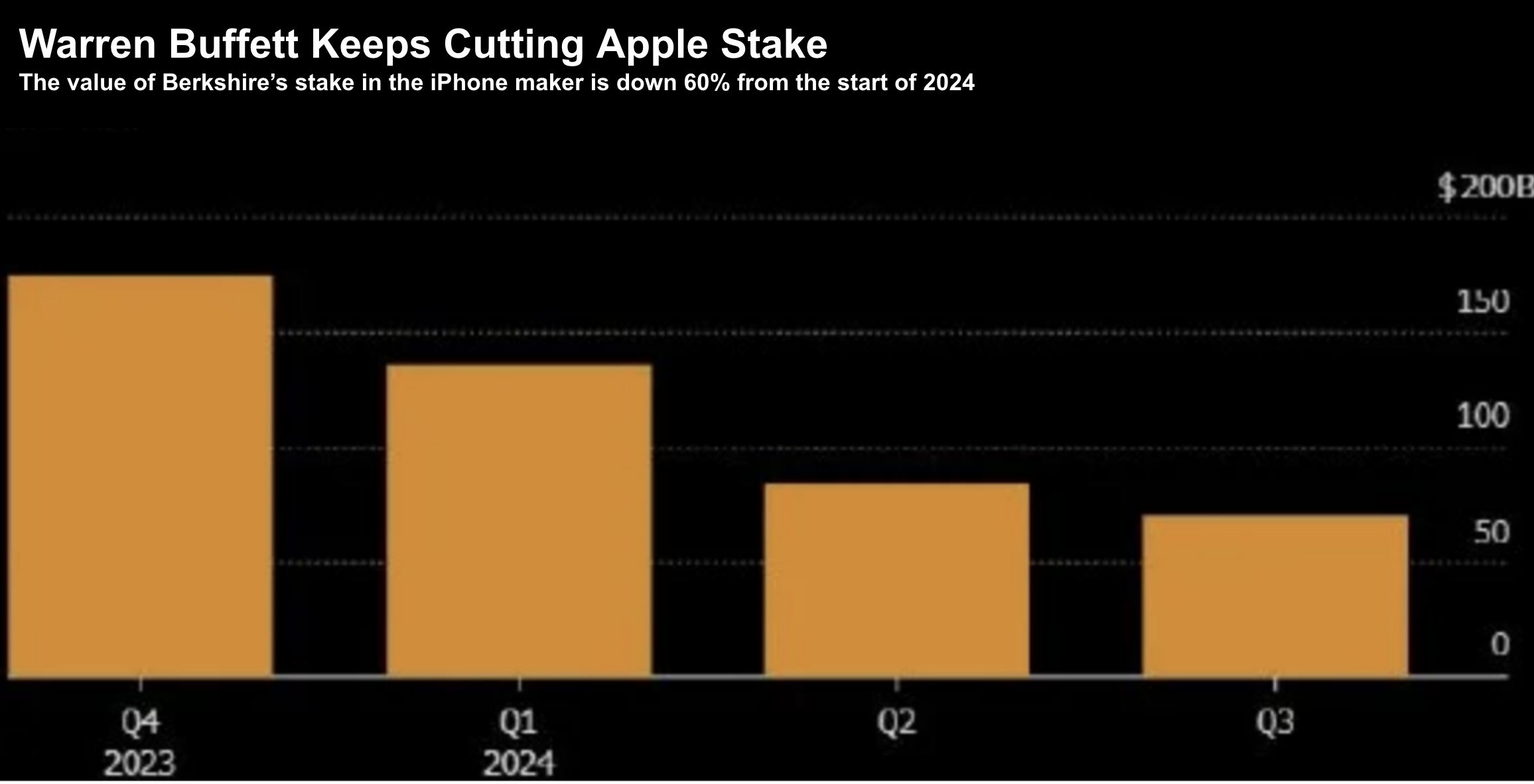

For example, Warren Buffett’s investment philosophy is a great example.

He is known for not investing in high multiple stocks.

For example, when he purchased Apple in 2016 – he paid less than 12x its forward earnings (despite being a ‘tech stock’). This year – 2024 – Buffett liquidated ~2/3rds of his holding (~600M shares) after 8 years of ownership.

He bought the company at 12x forward earnings and sold at 32x.

Here’s another way to frame it:

If we invert the equation — it’s most unlikely Buffett would consider buying Apple at 32x forward earnings (especially with the company only growing sales at very low single digits)

The point is while growth stocks may offer the potential for higher returns – they carry greater risk.

Value stocks, on the other hand, may provide a greater margin of safety and be more suitable for investors seeking capital preservation and steady, albeit potentially slower, growth.

🔬 Identifying Value Investments

Coming back to our four 1970 examples – ELTRA and Emhart – with their modest valuations and strong financial positions, exhibit characteristics of value investments.

This could help explain why they were ultimately acquired by Honeywell (HON) and Stanley Black & Decker (SKW) in subsequent years (both of which have delivered very strong returns for shareholders).

They meet several criteria for inclusion in a defensive investor’s portfolio, including:

- Adequate size

- Strong financial condition

- Consistent dividend history

- No recent earnings deficits

- Solid earnings growth

- Reasonable price relative to assets and earnings

While no guarantees can be made about their future performance, these companies offer a reasonable margin of safety and align with the principles of conservative investing.

Remember, the number one rule for investors is capital preservation. The second most important rule is don’t forget rule number one.

In my experience, if held over an average of three to four years, I expect up to ~20% of my investments to deliver inadequate returns.

However, up to ~80% will generally exceed the returns of the S&P 500. And in some cases, by several hundred percent.

For example, I’ve seen this with my investments in Amazon, Microsoft, Google and Apple from ~2011 (when I was recommending these stocks).

However, similar to Buffett, this year I’ve meaningfully reduced my exposure in each of these names.

By conducting thorough security analysis and considering both quantitative and qualitative factors (such as long-term management quality) – investors can identify undervalued companies with the potential for long-term growth and minimize the risk of overpaying for an uncertain future.

Key Takeaways

Key Takeaways

- Performing due diligence will help you differentiate between companies which are built on strong fundamentals vs those built on hype and speculation (which we saw in 2000/01).

- Paying a fair multiple for quality growth companies will help build in a greater margin of safety for when (not if) things turn for the worse.

- By resisting the temptation to overpay for growth – and adhering to these principles – investors can better navigate market extremes and achieve long-term success