The Intelligent Investor

Part 10: Intricacies of Investment Advice

Words: 1,029 Time: 5 Minutes

💥 Why This Matters

- The Importance of Independent Judgment: Investors should not blindly rely on advice, even from reputable sources. It’s crucial to cultivate your own understanding of investing principles, critically evaluate recommendations, and align investment decisions with your personal goals and risk tolerance

- The Role of Professional Advisors: Investment counselors offer valuable services for those seeking a conservative approach focused on capital preservation. However, investors should have realistic expectations and understand that consistent outperformance is not guaranteed.

- Navigating the Brokerage Industry: While brokerage firms are essential for executing trades, investors need to be aware of potential conflicts of interest. Customers’ brokers are incentivized to encourage (high frequency) trading via commissions.

📝 Introduction

While the self-reliant investor can thrive, many benefit from the guidance of a financial advisor.

Recognizing the signs that you might need professional help is the first step towards achieving your financial goals.

💁 Signs You Might Need Help

1. Significant Investment Losses: If your portfolio suffered disproportionately during market downturns; or has consistently failed to match market-based returns over the long-term – it indicates a need for improved investment strategies and risk management.

2. Budgeting Difficulties: Constantly struggling with finances, overspending, and difficulty saving are signs that a comprehensive financial plan is necessary.

3. Poorly Diversified Portfolio: Holding investments that are heavily concentrated in either a single sector and/or asset class (e.g., stocks vs bonds vs cash) increases risk. For example, I see a lot of investors highly invested in the tech sector today (not unlike 1999) – given the growth rates and margins. However, that carries a very high degree of concentration risk. An advisor can help create a truly diversified portfolio that aligns with your risk tolerance.

4. Major Life Changes: Life events like self-employment, caring for aging parents, or planning for children’s education often require complex financial planning that an advisor can assist with.

👔 2. Finding a Trustworthy Advisor

Finding the right advisor requires careful consideration and due diligence.

1. Seek Referrals: Start with trusted friends or family members who can recommend advisors they have had positive experiences with over a long period (ideally 10+ years)

2. Conduct Background Checks: Research the advisor and their firm online, looking for any red flags like customer complaints, disciplinary actions, or lawsuits.

3. Verify Credentials: Check with regulatory bodies (e.g. in the US – the SEC), state securities regulators, and professional organizations to ensure the advisor is properly licensed and has a clean record

4 Review Form ADV: A Form ADV is a required document that investment advisers in the U.S. must file with the Securities and Exchange Commission (SEC) or state regulators. It provides detailed information about the adviser’s business practices, fees, conflicts of interest, disciplinary history, and key personnel. Carefully examine the advisor’s Form ADV, paying close attention to any disclosures about disciplinary actions or conflicts of interest

📋 3. Interviewing Potential Advisors

Financial advisors is an extremely competitive industry.

Last year, there were around 16,000 registered financial advisors in the US (a record high).

Most financial advisor firms are small businesses, with 91.7% of private companies employing fewer than 100 people.

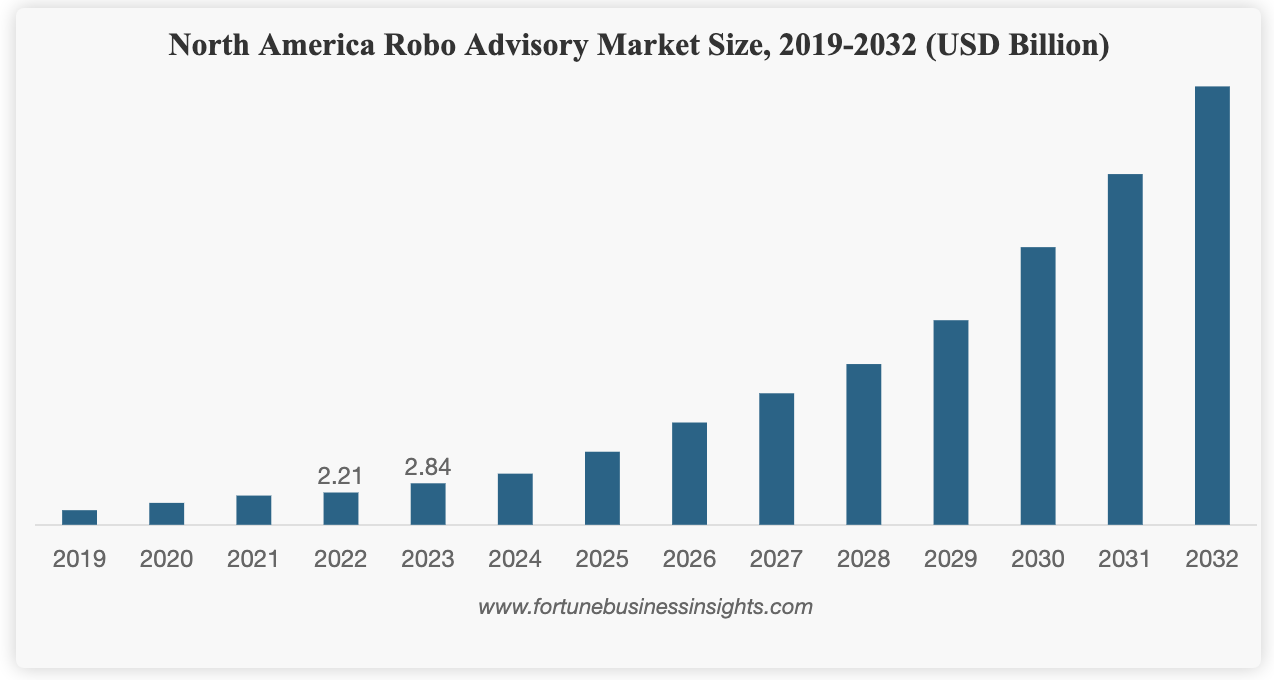

However, in recent years there has been a strong rise in the from robo-advisors (go deeper), which are online platforms that use algorithms to build investment portfolios.

For example, the global robo advisory market size was valued at USD $6.50 billion in 2023 and is projected to grow from USD $8.39 billion in 2024 to USD $69.32 billion by 2032, exhibiting a CAGR of 30.2%

Whether you choose to go with a robo advisory firm or more traditional pathways – the same amount of careful consideration and due diligence applies.

The quality of questions you ask will be critical.

1: Understand Their Philosophy : Inquire about their investment approach, including their views on market timing and technical analysis. For example, many advisors are now leveraging Generative AI to construct portfolios. For example, in May 2023, JPMorgan Chase introduced a software service similar to ChatGPT that provides investment advice using a disruptive form of artificial intelligence.

4. Ask for References: Request a resume, Form ADV (or equivalent if outside the US) and contact information for current clients to get firsthand feedback.

🙋♀️ 4. Be Prepared to Answer Questions

The best advisors will also interview you to ensure a good fit:

3. Share Your Investment Philosophy: Express your views on risk, return expectations, and your emotional response to market fluctuations. Remember: the goal is always adequate and sustainable long-term returns.

💪 5. Establishing a Strong Foundation

Before making any investment decisions, ensure you and your advisor have established a solid foundation:

1. Comprehensive Financial Plan: Develop a plan that outlines your overall financial goals and strategies for achieving them (e.g., follow the key lessons outlined in the first few chapters of Graham’s book)

3. Asset Allocation Plan : Determine the appropriate mix of different asset classes in your portfolio (stocks, bonds, cash etc)

5 Key Takeaways

5 Key Takeaways

- Investing in risk assets (such as stocks and bonds) is unique because it often relies heavily on external advice.

- This creates a peculiar dynamic where individuals seek guidance on how to make money, a task usually considered the investor’s own responsibility.

- This reliance on external expertise necessitates a careful examination of the nature of investment advice, its sources, and the expectations investors should have.

- By taking the measured steps in this chapter – you can find a trustworthy advisor who will help you navigate the complexities of investing and achieve your financial goals while protecting you from your own behavioral biases.