Words: 1,968 Time: 8 Minutes

- Persistent Inflation in Services

- Fed Rate Cut Uncertainty

- Optimism Amid Extremely High Valuations

And perhaps not since the dot.com bubble of 1999 – have investors been so sure of the future. For example, reasons for optimism include:

- Trump’s pro-business growth agenda

- The prospect of sweeping deregulation and tax cuts

- Fed expected to continue its easing cycle

- Inflation coming down; and

- Consumers showing no signs of easing spending.

What’s not to like?

Well I can think of one thing….

Valuations.

If buying stocks today – you’re paying through the nose.

I think they’re far too expensive – where I am happy sitting in ~35% in cash or equivalents – with a rolling 2-month protective put strategy in place.

This means I will underperform the market this year – but that’s fine with me.

Benjamin Graham wrote:

“The defensive investor should be satisfied with the gains shown on half his portfolio in a rising market, while in a severe decline he may derive much solace from reflecting how much better off he is than many of his more venturesome friends”

But first we begin with the latest consumer and producer price inflation reports.

Both came in warmer than expected… where parts of inflation are proving to be sticky.

The question is what challenge(s) that may represent for the Fed – especially given Trump’s growth agenda.

Sticky Services

Inflation is trading largely per the script…

That is, the low-hanging fruit is well and truly behind us (where CPI plunged from 9% down to ~4%)

However, the much harder work will be getting it down from the mid 3% range (core inflation) to the Fed’s target of 2.0%.

That will take time.

Let’s summarize the CPI numbers from last month:

- The consumer price index (CPI) showed a 12-month inflation rate of 2.7% after increasing 0.3% on the month.

- Excluding food and energy costs, the core CPI was at 3.3% on an annual basis and 0.3% monthly.

Traders raised the odds of a Dec 25 bps rate cut to 99% according to the CME Group’s FedWatch measure.

The bulls will see Core at 3.3% (the Fed’s preferred measurs) as being “not too far” from their targeted range of 2% (suggesting core inflation only slightly increased month-over-month)

The bears however will be quick to remind folks this reflects persistent price rises in certain sectors of the economy, notably in services.

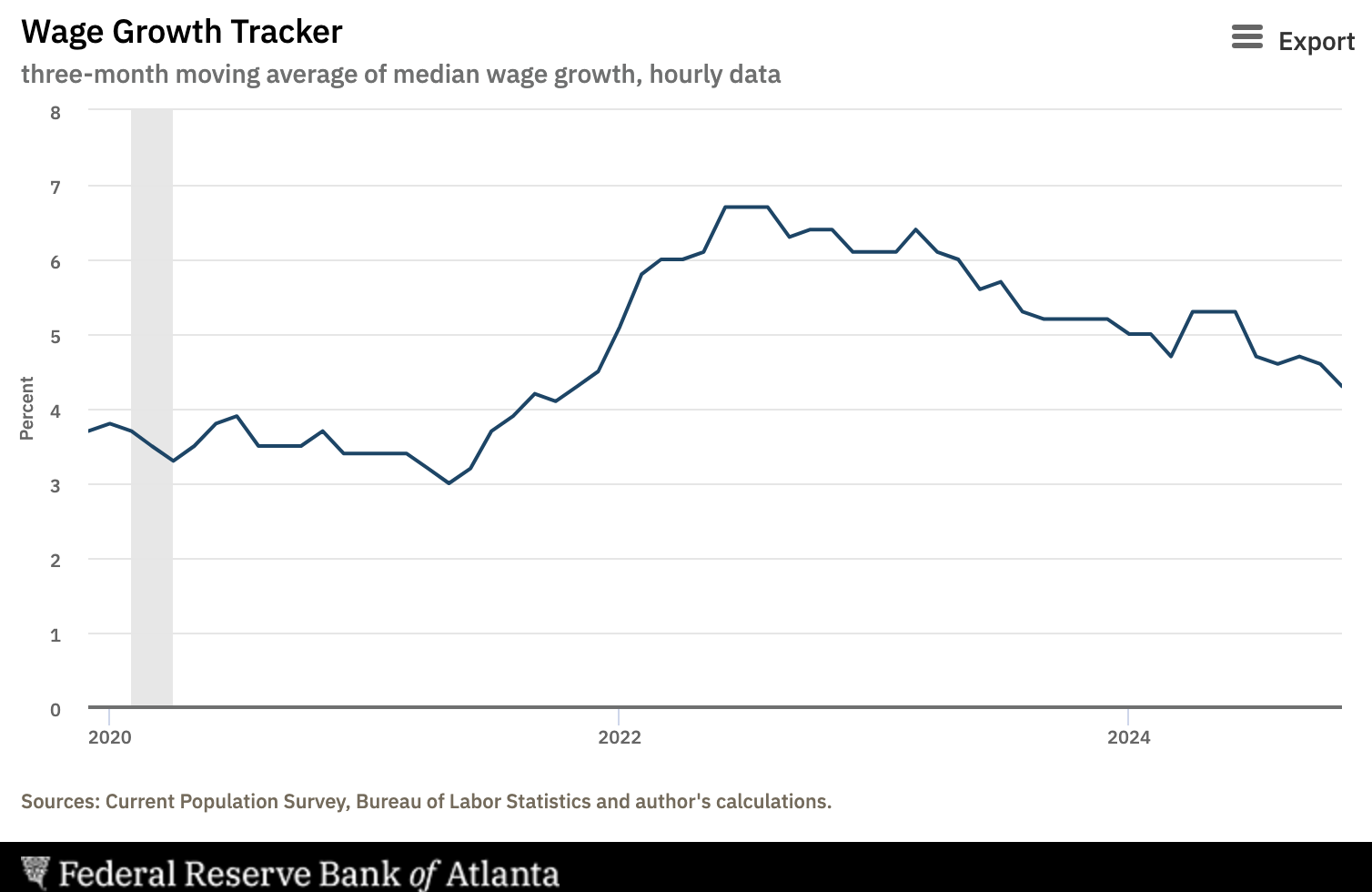

Services are more sticky due to their high wage component – where wages continue to rise at 4.3% annualized.

That said, the trend appears to be lower (good news)

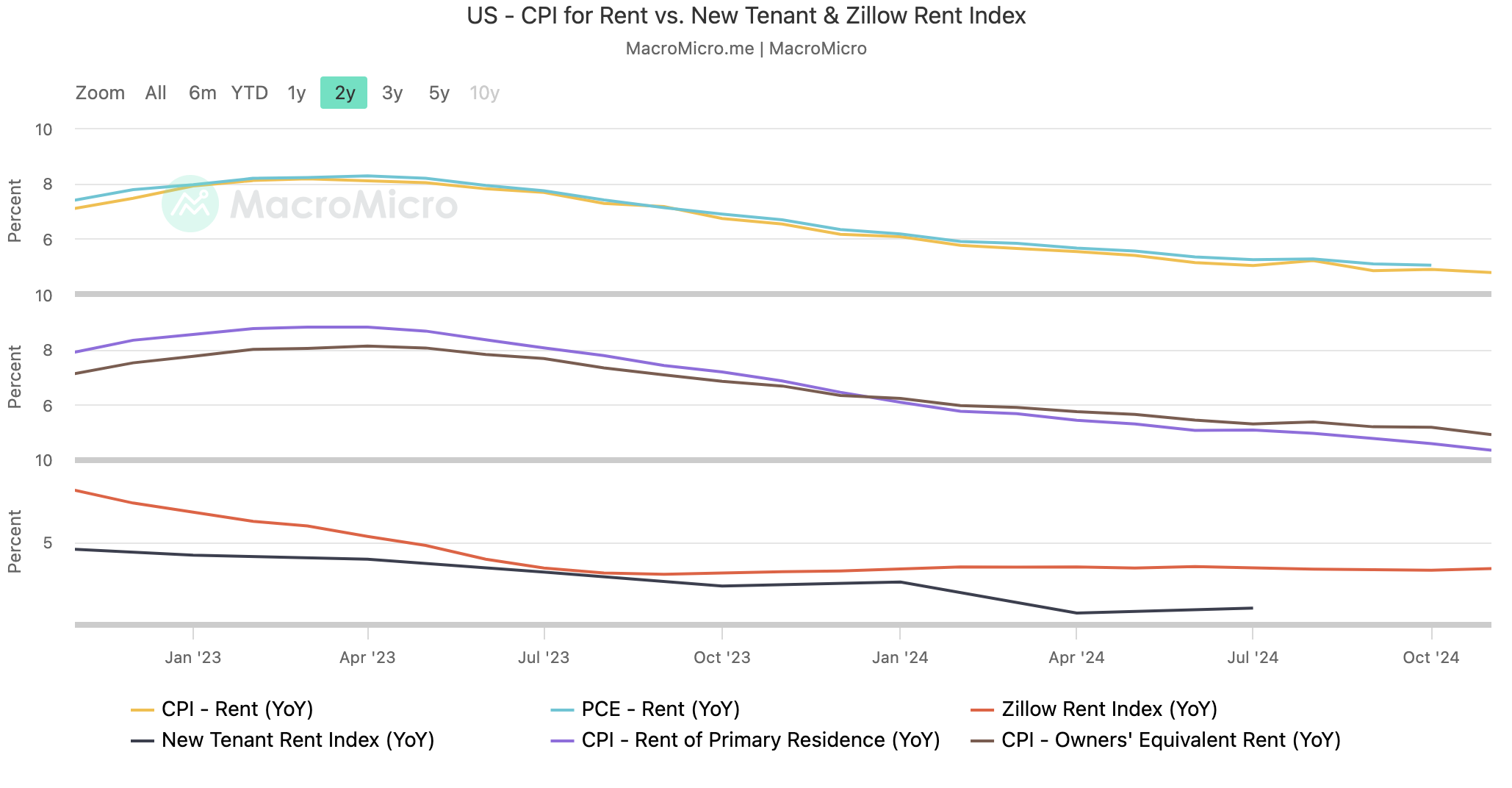

Looking further into the data – shelter costs are still up ~5% year-on-year, making them a contributing factor to the inflationary trend.

However, as regular readers will know, the way the Fed measures shelter lags the market.

For example, the Bureau of Labor Statistics (BLS) uses a lagged approach to rent inflation, which causes the official data to underestimate the actual changes in rent prices.

That said, a comparison of BLS data to private sector indexes, such as Zillow’s rent index, shows that rental inflation has stopped falling since July (red-line below) — a factor that may continue to contribute to inflation.

Overall, the general picture suggests that inflation is still above the Fed’s comfort zone, particularly due to sticky prices in key areas like housing and services.

But it’s rising labor costs which will have the Fed’s eye…

Wage growth as a key determinant of future inflation.

And whilst the Atlanta Fed chart suggests it has slowed to the lowest level in three years (again, that’s very good news) – wage growth is still well above the Fed’s unofficial objective of ~3.0%.

That will need to come down.

Fed Rate Cut “Certainty”

As soon as the CPI hit the tape – markets raised the probability of a Dec 25 bps rate cut to 99% according to the CME Group’s FedWatch measure.

However it raises a question….

Given the relative stickiness of inflation – why should the Fed be convinced they see inflation getting back to 2.0% next year?

Therefore, why keep aggressively cutting rates? And what’s certain beyond December?

Nothing.

Now futures markets were previously anticipating further rate cuts as early as January 2025.

But that’s changed…

The last few inflation prints have seen these expectations get pushed out.

As an aside, some readers may recall that I felt markets were well “over their skis” thinking they would see 200+ bps of cuts next year. The data simply didn’t support it…

For example, consumers were spending (with quarterly change in real PCE remaining above 2.0% YoY); wages were still growing to the tune of at least 4% YoY; unemployment was near record lows (around 4.0%); and corporate profits were very strong.

Therefore, why cut rates at the risk of sparking inflation?

And whilst markets ultimately see the Fed getting the fund rate down to ~3.75% – they have pushed those timeliness well into 2026.

But here’s where our 2025 plot thickens…

Six months ago Trump was not certain to win the election… maybe slightly ahead of Biden (pending which poll you read).

With the election behind us and Trump’s growth agenda very clear – this complicates the rate cut picture.

Further tax cuts and tariffs are likely to be inflationary (not deflationary)

(As an aside, I plan to write a post on the price protection measures (tariffs) and why they serve very little long-term benefit)

Tax cuts will put more money into people’s pockets (not less).

And tariffs will drive up the prices of goods (not down).

What’s more, it’s possible we could see fewer goods produced (not more).

Inflation is simply a monetary phenomenon — where excess money is chasing less goods.

If Trump’s growth policies are to play out as expected – this will make the Fed’s task of bringing inflation down to 2% far more difficult.

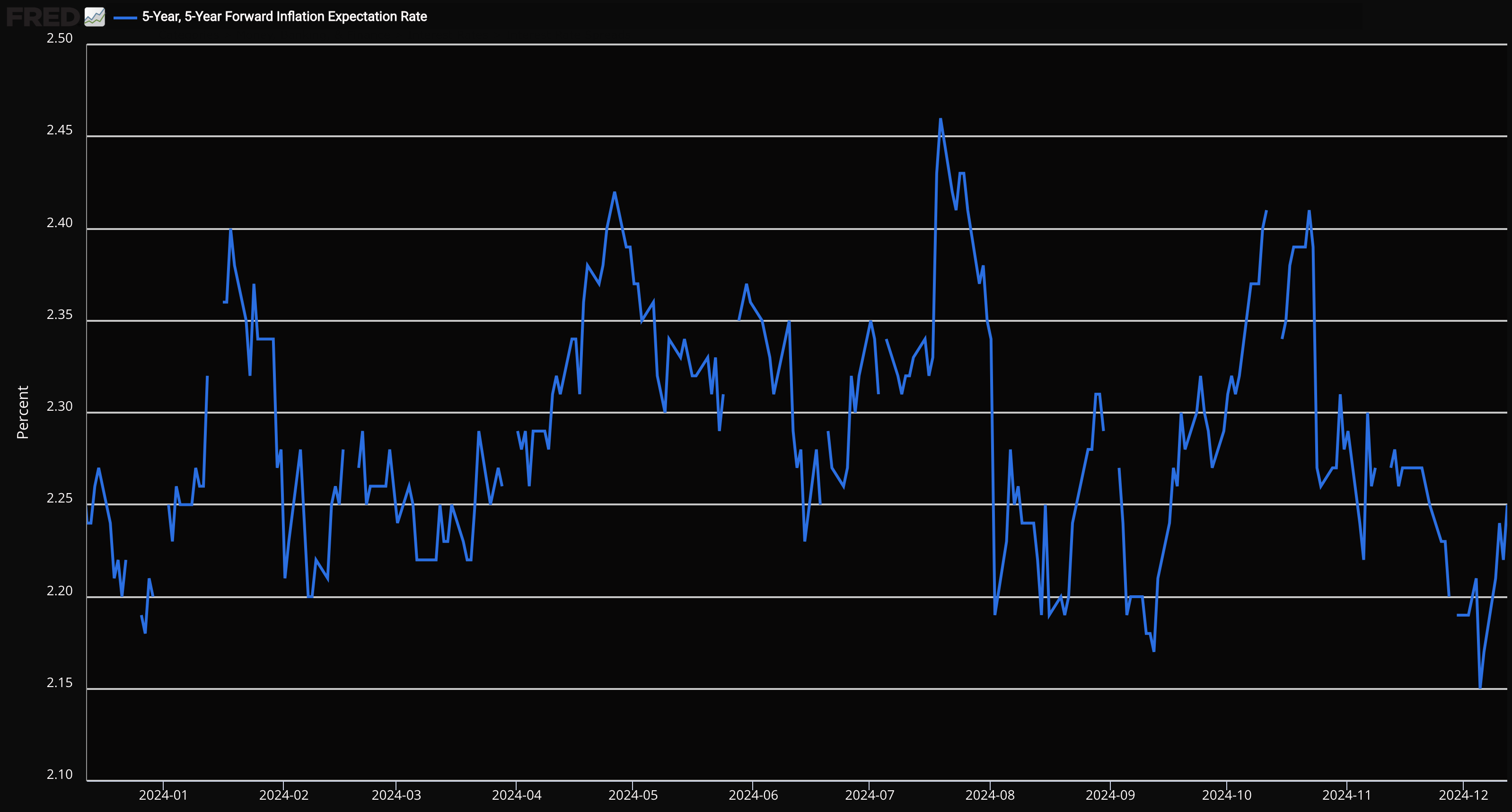

By way of example, inflation expectations in the bond market have risen since Trump’s (growth) policies became clear.

What’s more, we have seen the US 10-year yield move up sharply (more on this shortly).

Below are the 5-year, 5-year forward inflation expectations – up sharply the past ~4 weeks:

December 12 2024

Why does this matter?

Inflation expectations affect real interest rates.

This has the impact of reducing real rates (i.e., fed funds rate less inflation) – which then gives the Fed more room to pause rate hikes.

And whilst some areas of inflation are easing (not services) – Jay Powell & Co. may need to accept that inflation will remain well above its 2% target next year.

For example, if the 5-year, 5-year inflation expectation of 2.25% to 2.50% is accurate – this will most likely require the Fed to maintain a higher interest rate than what most were pricing in.

This is what I’ve been saying all year… however markets are slowly coming to terms with it.

Put another way – this is more likely to be higher for longer.

Relentless Optimism Despite the Unknowns

If you were to ask me what this game is all about… it’s managing risk.

For me specifically, it’s avoiding large costly mistakes.

For example, when I make decisions, the first question I ask is what’s the potential downside risk? What do I potentially stand to lose if things don’t work out.

But your approach might be different to mine

For example, the majority of investors are easily lured by the prospect of quick and easy gains — falling victim to self-defeating behaviors (e.g., greed or the fear of missing out)

How many are potentially making this mistake today with markets trading at 22x forward earnings?

From mine, I see far more invesgtors “losing their way” along the difficult road to investment success than reach their destination. It is easy to stray when markets are uber-bullish – and it takes effort to remain disciplined.

But avoiding where others go wrong is an important step in achieving long-term investment success. In fact, it almost ensures it. Here’s Charlie Munger:

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

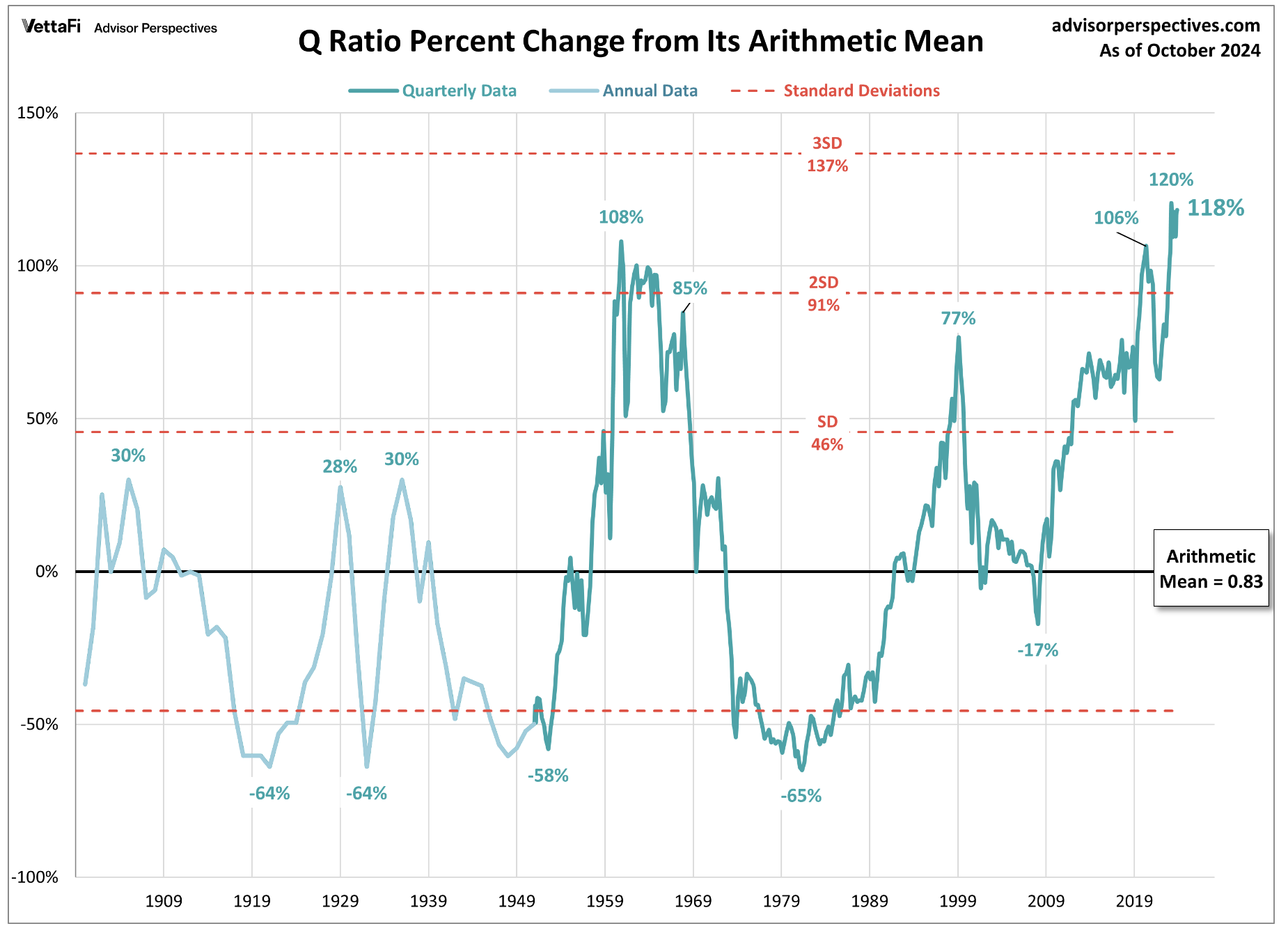

Again, the last time we experience this level of overconfidence (or certainty of investor conviction) was 1999.

Fast forward ~25 years and the Nasdaq 100 (the poster child of 1999) hit all-time highs this week – driven by the so-called “Magnificent Seven”.

As an aside, four of the Magnificent Seven died.

Perhaps lured by the promise of imminent rate cuts — investors are betting that a lower cost of borrowing will support higher corporate earnings and stock prices. In theory, that holds water.

But that view is not without risks.

Again, consider what you are paying.

At the risk of sounding like a broken record – stock prices today (especially tech) – are extremely high by historical standards. The other week, I shared Tobin’s Q-Ratio as one example. It now exceeds that of the dot.com bubble.

What’s more, the price-to-sales ratio for the S&P 500’s information technology sector also exceeds the dot.com bubble.

Yes, the current market valuation may be justified if these companies continue to generate and sustain substantial profits.

And they could…

But what if they don’t?

The other concern I raise is what we see with the yield on the 10-year US Treasury bond. At the time of writing – this is back above 4.30%

December 12 2024

This is also very important…..

With a 10-year yield well above 4.0% (and perhaps likely to go higher on inflationary risks) – this makes it more difficult for stocks to maintain their outperformance relative to bonds.

For example, if bond yields fall, stocks could continue to benefit.

However, if bond yields rise or remain elevated, stocks could face pressure, given their excessive valuations.

Why?

Investors are receiving zero risk premium for betting on stocks.

And whilst this is not a useful timing tool – over the long run – this alone has been a very good indicator of secular highs in the market.

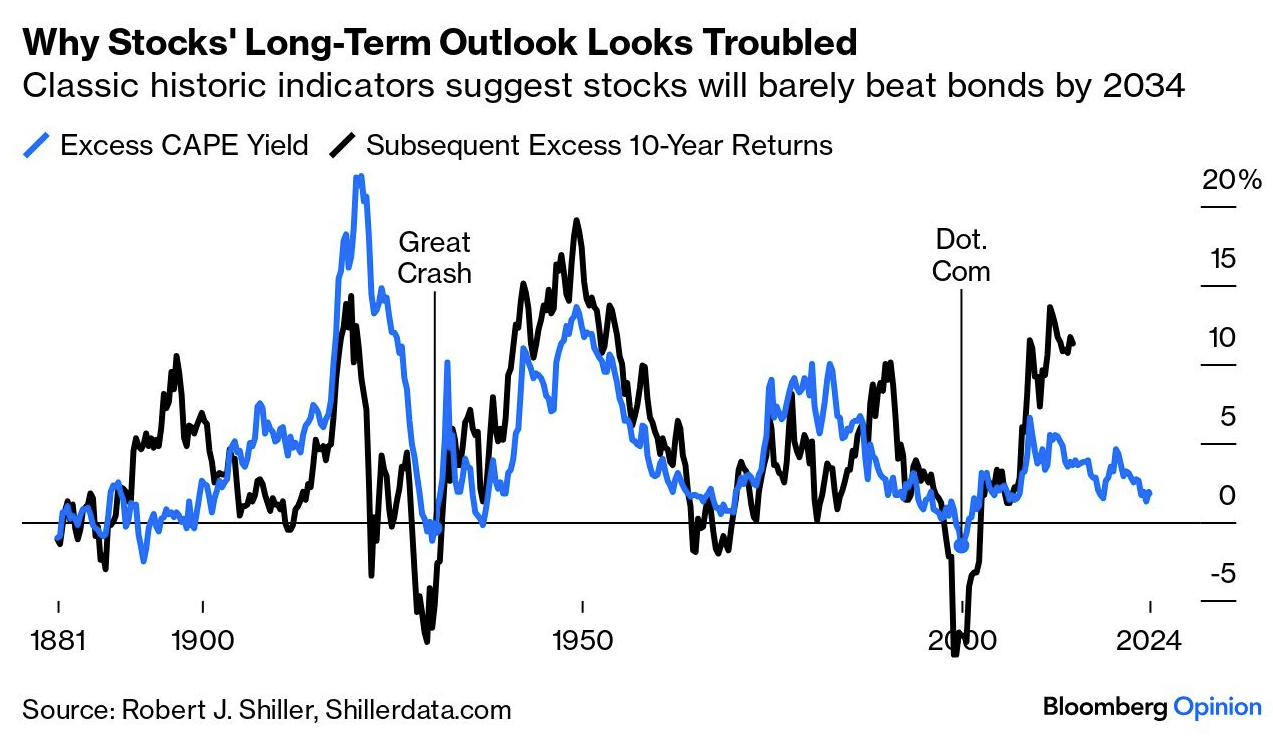

Below is a Bloomberg chart I shared a few weeks ago. However, since that time, stocks have risen which elevates the risks…

Keep a close eye on this chart over the coming weeks (or months) should bond yields continue to rise.

Putting it All Together

In his classic book “Margin of Safety” (no longer in print) – Seth Klarman offered this:

Like most eighth-grade algebra students, some investors memorize a few formulas or rules and superficially appear competent but do not really understand what they are doing.

To achieve long-term success over many financial markets and economic cycles, observing a few rules is not enough. Too many things change too quickly in the investment world for that approach to succeed.

It is necessary instead to understand the rationale behind the rules in order to appreciate why they work when they do and don’t when they don’t.

Amen.

From mine, the herd-like bullish bias in the market today is not driven by fundamentals. It’s more the fear of missing out… willing to pay ‘any price’ for growth.

But here’s a question – how reliable (or certain) are projecting cash flows for 5 or 10 years (which is how many analysts arrive at their targets). It’s guess work at best.

For example, we consider highly uncertain variables such as:

- What if inflation proves more persistent than expected – leading the Fed to maintain higher interest rates for longer? What’s that do to your valuation models (e.g. weighted average cost of capital)?

- What if the Magnificent Seven fail to deliver the growth and profits which are expected?

- What if long-term bond yields continue their ascent higher (perhaps testing 5.0%)?

This list is not intended to be exhaustive – but gives you a flavor of what could happen.

And whilst the outlook for US inflation has improved in some areas, there are significant challenges which remain.

From my lens, services inflation, wage growth and rents appear to be stubborn.

Therefore, would it not pay to be prudent and consider the possibility the Fed may need to keep interest rates higher than expected to prevent inflation from escalating?

Optimism is great but it can be premature.

If nothing else, the exceptionally high valuation of tech stocks suggests that investors are betting on continued strong profits in a very uncertain economic environment.

For me, I’m happy to patiently wait for more attractive multiples. And if that means potentially missing out on short-term gains for maybe up to ’12 months’ (or more) – totally fine by me.