- Core CPI 0.2% MoM and 4.0% YoY

- Probabilities for Dec rate hike drop below 10%

- Equities best day since April on the back of lower yields

Today we received another important print on inflation.

The good news – it was softer than expected and it continues to trend in the right direction.

However, I think we still need at least another three or four similar prints to declare victory.

If experience has taught me anything… one hot night doesn’t make a summer.

But today – stocks had already made up their mind.

From their lens, the war on inflation is ‘officially won’ and the Fed is finished.

The nail is in the (rate hike) coffin according to Fed funds futures.

And that may be true.

Let’s look at the October inflation print in more detail… the devil is always in the detail.

Inflation Continues to Cool

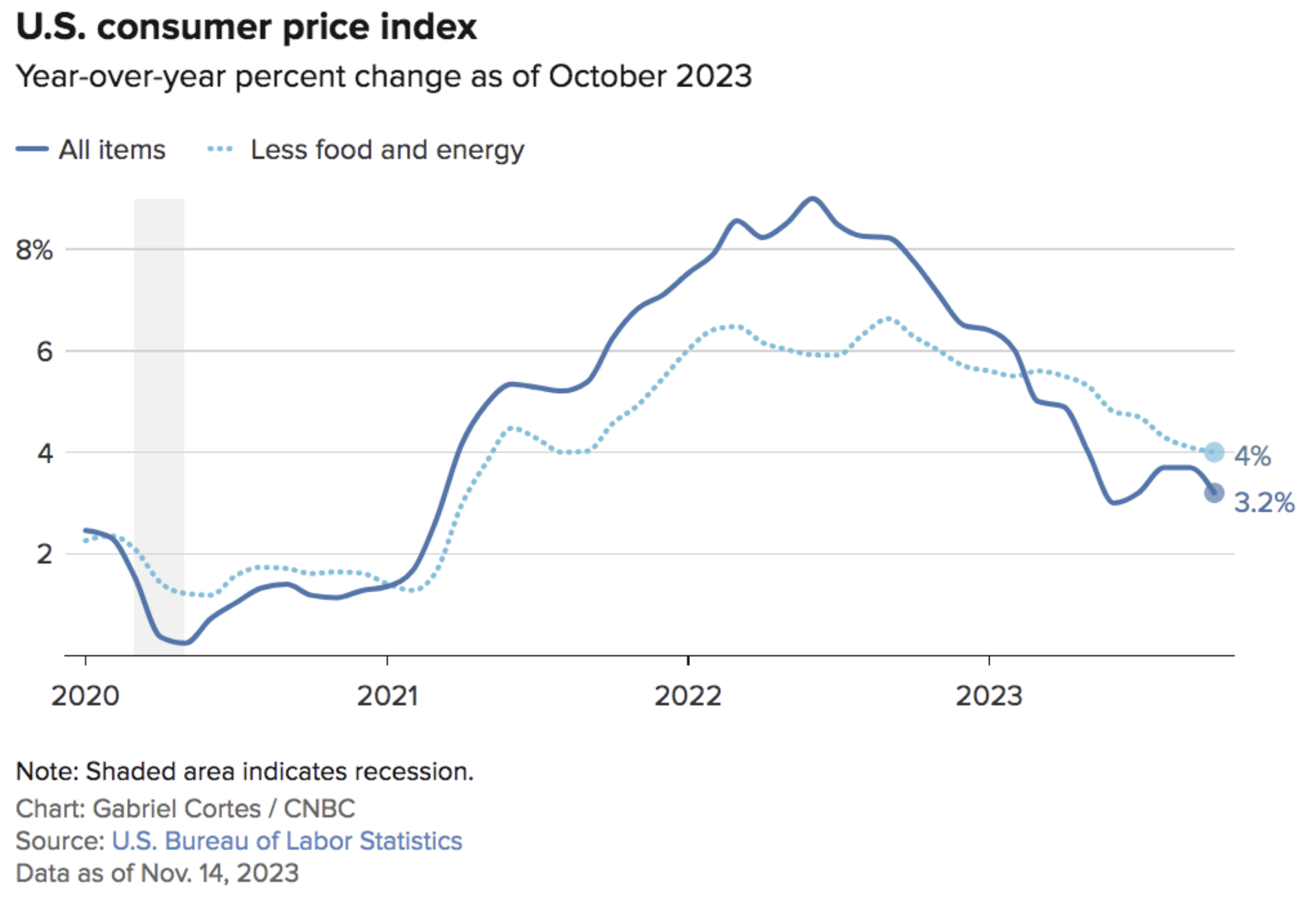

Further to my preface, inflation is trending in the right direction.

That’s great news… but it’s happening at a very slow speed.

Below is what we heard from the Bureau of Labor Statistics for October:

- October increased 3.2% on an annual basis – down from 3.7% in September;

- Gasoline prices were a big driver of the reduction; and

- Housing inflation also continued to cool.

“Inflation is slowly but steadily moderating, and all the trend lines look good. It feels like by this time next year inflation will be very close to the [Federal Reserve’s] 2.0% target, and something the American consumer will feel comfortable with.”

And I agree with that…

However, getting inflation from “4% to 2%” is also the most challenging.

You might say we’ve enjoyed the low hanging fruit.

For example, consider core inflation.

Core inflation (which excludes food and energy) came in at 0.2% MoM (0.1% below expectations) and 4.0% YoY (0.1% below expectations)

Here’s the thing:

We have not been under 4.0% YoY Core since May 2021.

It’s sticky…

One of the bright spots with the inflation report was housing.

Housing inflation declined in October to 6.7% YoY and has fallen from a peak over 8% in March 2023.

And based on Zillow’s real-time data – it’s expected this will continue to ease over the coming months.

Zandi adds “[housing inflation] still has a long way to go to get back to something I think we’d feel comfortable with – but we’re heading in that direction.”

TL;DR

There were encouraging signs with the October inflation print.

What’s more, the pathway is lower (as the chart above suggests).

The market interpreted this as the Fed being less likely to hike rates in December (with probabilities dropping well below 10%)

That said, Core CPI YoY is still 4.0% – double the Fed’s objective.

And if we remove energy from the report (the largest contributor to the downside), the print was largely benign.

For example, if we look at food and rent, they increased.

In fact, rent of primary residence, the cost that best equates to the rent people pay, jumped 0.5%

That said, it’s also important to understand the way BLS reports rent is lagging.

It’s likely this will also come down next year (based on more real-time indicators and trends)

Bond Yields Plummet

From mine, the market reaction was a little surprising.

Yes, there were encouraging signs but I didn’t think it warranted the market’s best day since April.

Maybe we saw a few shorts being covered… who knows?

During the regular session, the S&P 500 climbed 1.9%, while the tech-heavy Nasdaq added 2.4%

And interest rate sensitive stocks (e.g., small caps, real-estate and banks) saw 5.0%+ gains.

From mine, equities were taking their cues from bond yields and rate expectations.

Fed fund futures had the chances of a Dec rate hike around 30% into the print.

As I say, they are now below 10%.

Yields dropped along the curve – sending the price of bonds higher.

Below is the weekly chart for the 10-year yield – moving back below 4.50%

Nov 14 2023

If you have exposure to bonds (short or long-term)… you had a very good day!

With respect to the closely watched 10-year – it’s possible we test the 35-week EMA or ~4.20%

However, I also think we find strong support in this zone given the massive (govt debt) supply coming down the pike.

It doesn’t mean they can’t press lower – they might – however investors will demand a premium for buying longer-dated US debt.

Now if I zoom out a further 12 months – it’s quite possible these yields fall below 4.0%.

However, that view is predicated on three things (all of which are highly uncertain):

- Core inflation continuing to fall;

- Fed cutting rates towards the second half; and

- Much slower economic growth.

Putting it All Together

One of my key investment themes for next year is fixed income exposure.

If you don’t have any exposure to bonds – it would be a good time to consider adding some.

Here are four different ways available to you (each with varying degree of risk). Note – my list is not intended to be exhaustive.

As readers know, I’ve been slowly adding to my bond portfolio the past month or so.

For example, I felt the 10-year looked attractive around 5.0%

My exposure includes short and long-term treasuries; investment grade corporate debt; and high-yield debt.

Each of these have performed well as yields fall.

The opposite holds true.

For clarity, I’m not advocating going “all-in” on bonds (just like I would never go “all-in” on any sector or stock)

For example, large-cap tech constitutes ~20% of my total portfolio (which is ~5% under market weight).

That 20% is across names like Apple, Microsoft, Google and Amazon.

I’m of the view these are all quality names (and core holdings) – but with valuations stretched (where forward multiples exceed 25x) – I don’t feel comfortable at full market weight (e.g. 25%).

By comparison, my bond exposure is now ~15%… where I would consider a full position closer to 20-25%.

A few months ago my bond exposure was zero.

Yields were on the rise which meant bond prices were headed down.

But echoing recent missives – I think the total bond return (i.e., guaranteed fixed income plus potential for capital appreciation) looks attractive heading into 2024.

You might argue it has not looked this attractive in over 20 years.

My thesis is straight forward:

Should inflation continue to ease and economic growth slows (as consumer demand wanes) – this will likely auger well for fixed income.

On the contrary, should economic growth accelerate and the Fed continues to hike – yields will rise and bond prices will fall.

And if this happens (which is possible) – I will likely lose money on my bond portfolio.