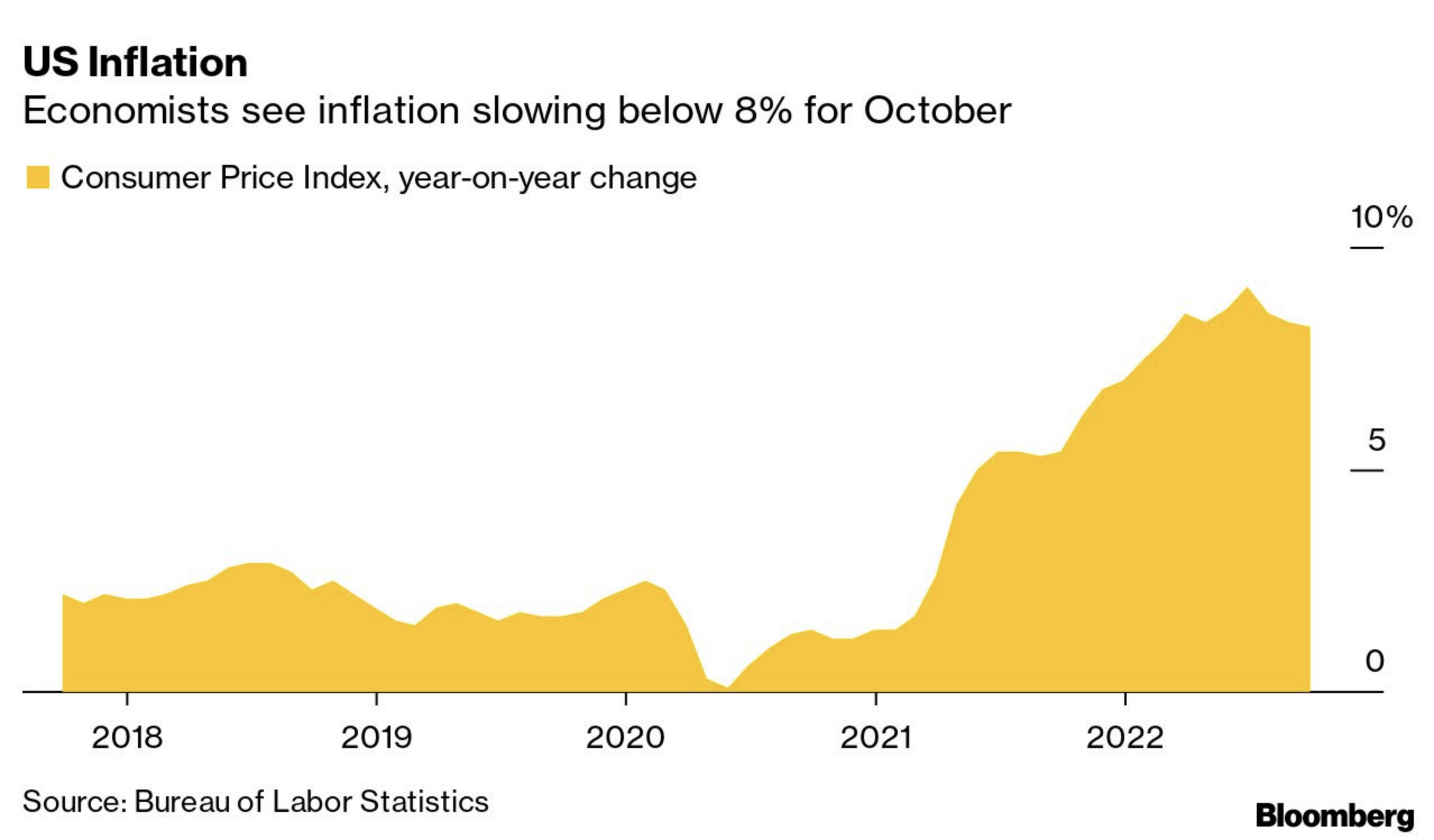

- October CPI – markets expect 7.9%

- Market will cheer (likely) “gridlock” in Congress

- However, it’s the Fed’s actions that matter more (not DC)

I bring good news and bad news.

First the bad news…

CPI for October is going to come in hot.

What’s more, core monthly increase is projected 0.5%, far above the Fed’s level of tolerance.

Now the good news…

With any luck it will be cooler than the month prior. And a long way below the 9.1% CPI high water mark in June.

Fed Needs to Crush Inflation

As at the time of writing, fed funds futures are pricing in a December rate hike of 75 basis points (bps).

As a minimum we will get 50 bps given the strength of the latest job additions.

However, a core inflation monthly print of 0.50% or higher will likely seal the deal on 75 bps.

But as I’ve stressed several times – whether it’s 50 or 75 for Dec doesn’t matter.

We are going to 4.75% and possibly 5.00% in 2023.

That’s what the 2-year yield is telling us (and what the Fed will be watching)

75 bps in December only gets us to 4.50%.

Now as Powell reminded us the other week – the longer inflation remains well above 2% target – the greater the risk of it being entrenched.

And that’s a concern.

It simply means higher rates for a lot longer.

And some are warning there are signs of this already happening. Some bullet points from Citi:

- Many firms have moved from annual price increases to more-frequent price hikes that they characterize as being more ‘agile’

- In addition, labor markets could move toward greater indexation of wage contracts

- Consumer spending patterns could also adjust to the pressures

“While we are hesitant at this stage to conclude that the current episode is shifting the dynamics of inflation in a sustained and appreciable way, such risks clearly look to be in play,” Citigroup’s Nathan Sheets wrote.

The Hope that is “Gridlock”

As I do each week, I will update the weekly chart for the S&P 500 after Friday’s close.

However, heading into inflation print tomorrow, the price action in markets is not what I would consider encouraging.

That said, I do offer some hope…

Below we can see how the market rallied into what I felt would be a “zone of resistance” before reversing

Nov 09 2022

Whilst technically we remain in a strong bearish trend – the market continues to trade above 3600

I do think that will be tested again soon but there’s a possibility it catches another bid.

For example, seasonally November and December are strong months.

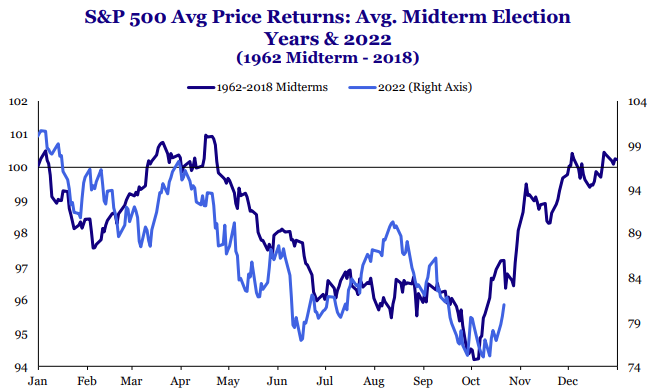

What’s more, mid-terms tend to bode well for equities (especially if we see gridlock in Washington – which now looks very likely with Republicans winning back the House)

Take a look at this chart from Strategas Research:

But the caveat to the midterm results is the impact on inflation…

That’s what matters most (and how it determines interest rates).

For example, if Democrats maintain control of the House and Senate – they will continue to advance their agenda of excess spending — and that will be highly inflationary.

The only stocks to win here will be those who benefit from the Government boondoggles (and sadly there are many!)

But if the Republicans win the House – “gridlock” will limit significant wasteful spending and inflation will have chance of falling.

That’s a win for markets (bonds and equities).

To that end, I think a large part of the sell off today was the fact Democrats did better in both the House and Senate than most expected.

They didn’t do well enough to retain the House… but it was enough to spook equities.

Here’s Mike Wilson from Morgan Stanley:

The midterms could have lasting implications if it’s a decisive victory for the Republicans because as I have said before we think that the majority of the inflation spike was a result of the excessive fiscal spending and that of course will be curtailed even if the Republicans just win one chamber … Ultimately this should be good for bonds.

And part of my long-bet on TLT the other week was on the basis that Republicans would at least win the House (minimum) which will see lower spending; reduce inflation; and send bond yields lower.

What’s more, bond markets prefer gridlock.

For the simple reason that government can do less damage!

Gridlock means far less excessive (wasteful) spending.

Bloomberg reported that data going back to 1951 shows that a Democratic president with a Republican or split congress (the likely outcome as of now) posted an average S&P 500 return of over 17%

What’s more, a split congress and a Republican president saw returns just as strong.

Putting it All Together

In closing, whilst we can hope for gridlock in DC, ultimately this all depends on the Fed.

That’s your bottom line.

For example, the issue I take with Wilson’s comment is inflation is not entirely fiscal (it’s a big part of it).

The enabler of money creation is the central bank.

They created inflation via M2 and now they are trying to reverse their mistake.

If only it worked that way.

And to that end, whether Republicans or Democrats control Congress – the US economy will be held ‘hostage’ to the actions of the Fed’s blunt tools to tame inflation.

The only good news is a split Congress is far less likely to continue pouring more fuel on what is a raging fire.