- 303K jobs added not as strong as the headline suggests

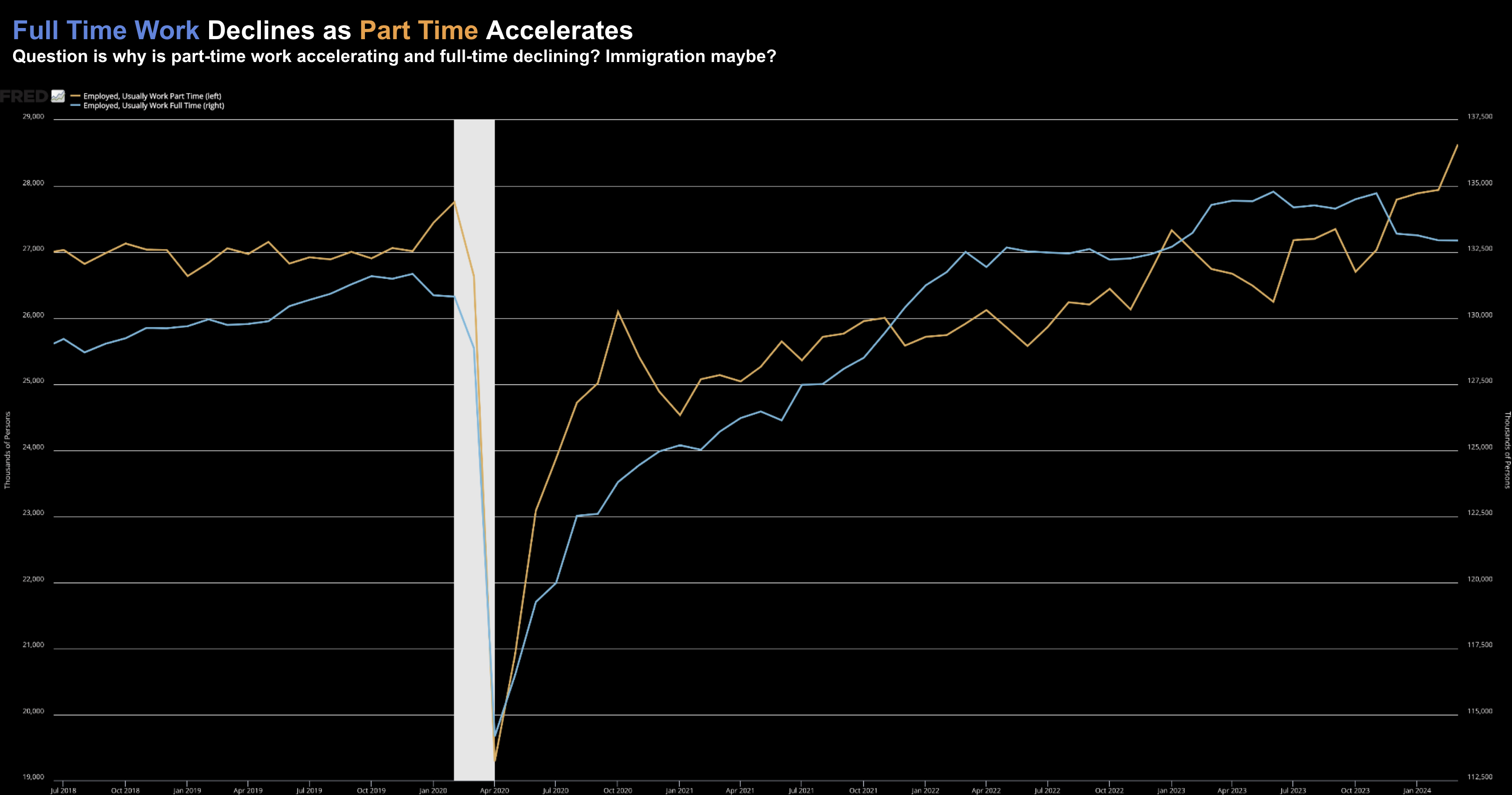

- Full time jobs were down 6,000 (as part-time work surges)

- 10-Year yield expects rates to be higher for longer

With any headline number – it pays to look under the hood.

Rarely does the headline tell you what’s going on.

Take today’s “strong” employment number…

The headlines will read “jobs zoomed last month” – adding 303,000 jobs – a “strong” result

Equities cheered – recovering much of their previous day’s losses.

However, bonds and gold saw things differently.

Gold surged to a new record high and bond yields continued to rise.

Gold typically surges when there are signs of trouble – not when things are going well? And why are bond yields rising if the market expects three rate cuts this year?

Interesting don’t you think?

But let’s look further into the 303K job additions… is all what it seems?

Jobs Up 300K / Full-Time Jobs Down 6K

‘With a headline reading 303K jobs added (subject to revisions) – many might assume these are largely full-time jobs.

Reality is the opposite.

Yes “jobs” were added (which is good news) – but it begs the question around what is a job?

If you worked less than 35 hours last week – you have a job.

And if you worked say two jobs for 10 hours each (e.g. a total of 20 hours) – you will count as two jobs (which I think is a flawed system)

Or maybe you needed to work three jobs for say 8 hours each per week each – well that counts as three jobs etc.

I digress – but this is the trend we see.

Part-time employment (defined as anything less than 35 hours per week) was up 691,000 jobs

However, the number of full time jobs fell by 6,000

One trend is marching higher – the other lower.

Here are the key numbers:

Payrolls vs Employment Gains over the past 12 Months

- Nonfarm Payrolls: 2,927,000

- Employment Level: +642,000

- Full Time Employment: -1,347,000

And here are the same Payrolls vs Employment Gains since May 2022

- Nonfarm Payrolls: 6,205,000

- Employment Level: +3,152,000

- Full Time Employment:+264,000

The question to ask is why are payrolls up by 6.2 million jobs since May of 2022 – however full time employment is only up 264 thousand?

- Record amounts of immigration (legal and illegal);

- People are working multiple part time jobs; and/or

- Semi-retired boomers are working part time.

The reason I call out illegal immigrants is they will show up in the job numbers.

Being illegal in the US does not mean you cannot work.

Now as of Sept 2023 – this government white paper reported the following:

- The current surge of illegal immigration is unprecedented.

- Some 2.6 million inadmissible aliens have been released into the country by the administration since January 2021.

- There have also been 1.5 million “got-aways” — individuals observed entering illegally but not stopped.

- Visa overstays also seem to have hit a record in FY 2022

- We preliminarily estimate that the illegal immigrant population grew to 12.6 million by May of this year, up 2.4 million since January 2021.

- Perhaps 9 million are now in the labor force. However, additional research is necessary to confirm these estimates.

From mine, illegal immigrants are clearly having a material bearing on what we see with the jobs report.

What’s more, it also explains why part-time work is surging.

But where is that in the headline?

You won’t see it.

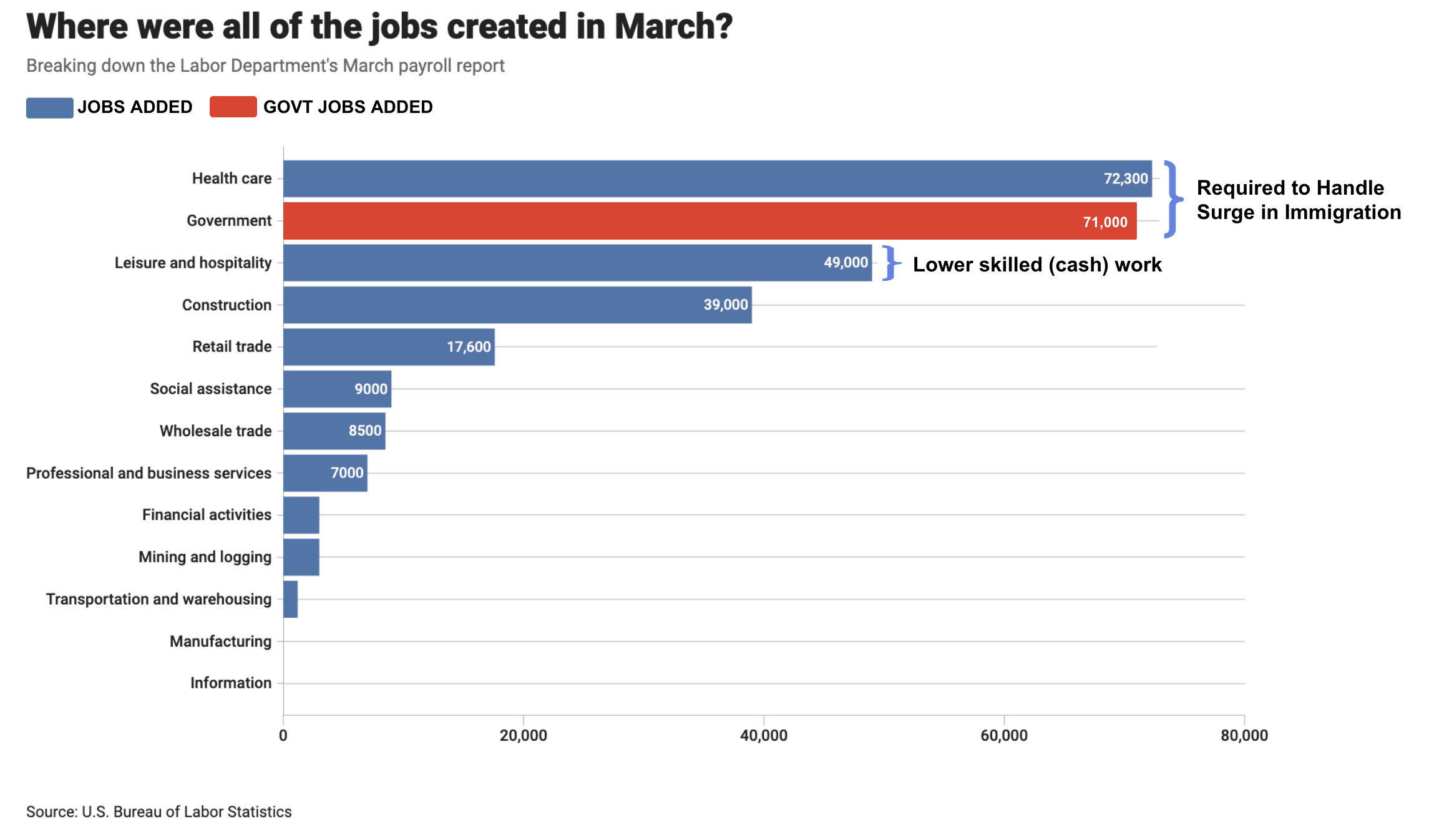

Where are the Jobs Being Added?

The other thing to look at is where jobs are being added.

For example, are they income (and tax) producing private sector jobs?

Or are the tax consuming public sector jobs (requiring the government to borrow further)?

Obviously we want to see much more of the former vs the latter.

Now there were three primary sectors which dominated the job additions:

(1) health care (+72K); (2) government (+71K); and (3) leisure and hospitality (+49K)

The public sector was (again) a major source of job additions – averaging b/w 60K and 70K jobs the past 12 months.

Health care jobs continue to surge – essential to meet the needs of millions coming across the border. Similarly, social assistance jobs rose by 9K in March (which followed 12K in Jan; and 21K in Feb) for very similar reasons.

However, look at what we see with higher paying jobs?

The job additions are minimal (to negative).

It’s also noteworthy that no manufacturing or information jobs were added last month.

Hours & Wages

- Average weekly hours of all private employees rose 0.1 hours to 34.4 hours.

- Average weekly hours of all private service-providing employees was flat at 33.3 hours.

- Average weekly hours of manufacturers was flat at 40.0 hours.

And with respect to wages – this was the most important number in the print (from the Fed’s lens at least).

For example, if we saw a month-over-month gain of 0.4% or higher, I felt this could pose a problem for the Fed.

The good news is this came in at 0.3% – inline with expectations. And I think this is a function of where the jobs are being added.

- Average hourly earnings of all Nonfarm Workers rose $0.12 to $34.69. A year ago the average wage was $33.31. That’s a gain of 4.14%.

- Average hourly earnings of Production and Nonsupervisory Workers rose $0.07 to $29.79. A year ago the average wage was $28.58. That’s a gain of 4.23%.

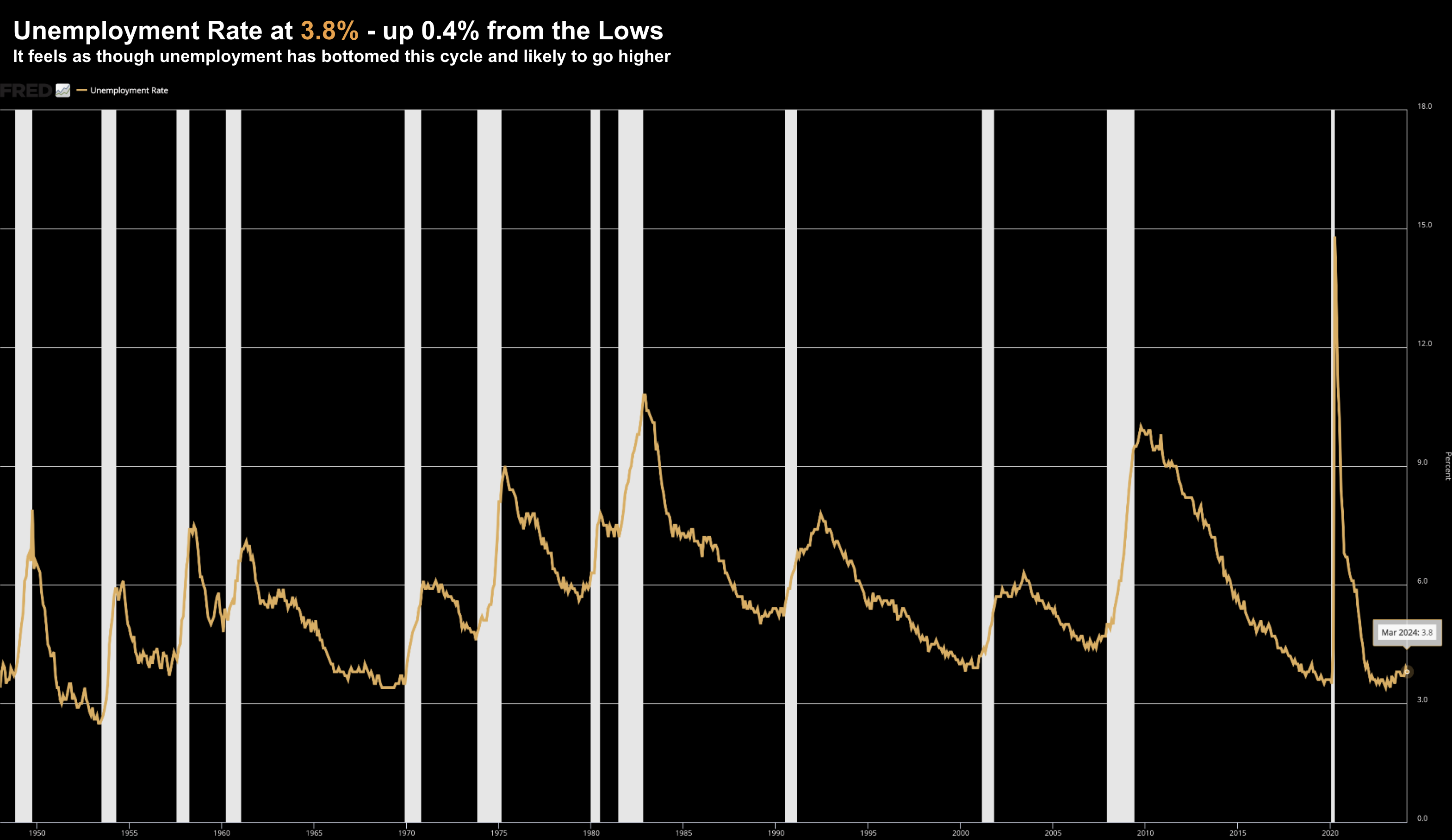

Unemployment Rate

In terms of the unemployment rate – coming into the report I was wondering if this would push 4.0%.

The good news is this remains very low at 3.8% – up 0.4% from the lows.

April 5 2024

As I’ve written previously, when (not if) this starts to rise back above 4.0%, start to get worried.

10-Year Yield Says “Higher for Longer”

Despite equities rallying sharply on the news – the reaction in bond yields was expected.

In short, the ‘smart money’ expects rates to remain higher for longer.

And for good reason…

Now below is what we see with the US 10-year yield (applying a weekly chart):

April 5 2024

Yields have been gradually working their way higher this year.

And from mine, this is the bond market telling us to get used to higher inflation.

Put another way, bonds understand that the Fed will keep its policy rates fairly high (despite Powell’s dovish tones)

However, equities are yet to connect the dots.

Now when I say “high” – that’s a relative term.

To be more precise, they are likely to keep them where they are to ensure inflation doesn’t get out of control.

However, they will be reluctant to raise rates as it could crash the economy.

That said, I read that Fed Governor Bowman said “one more rate rise could be appropriate if inflation stays too high”

“While it is not my baseline outlook, I continue to see the risk that at a future meeting we may need to increase the policy rate further should progress on inflation stall or even reverse,” she said in prepared remarks for a speech to a group of Fed watchers in New York.

“Reducing our policy rate too soon or too quickly could result in a rebound in inflation, requiring further future policy rate increases to return inflation to 2 percent over the longer run.”

As I wrote recently, the “dot plot” from the March FOMC meeting showed that the 19 participants were evenly split.

- 9 members saw two rate cuts in 2024

- 9 saw three; and

- 1 envisaged four cuts

Given what we see with employment and next week’s CPI print – if just one of the members forecasting three cuts becomes just two – then two cuts will be the scenario.

And I personally think that’s likely (where inflation could surprise to the upside – especially given prices rises in energy and housing)

In the space of a few months – we have gone from 7 cuts in 2024 to 6 cuts, to 3 cuts… to potentially just 2.

Is it possible we see none at all?

I think so.

All the while – equities push record highs.

And if you think this is a “head scratcher” – you are not alone.

Putting it All Together

As I like to say, people will take the 300K monthly jobs number to fit any narrative.

My take is the headline number is deceptive.

And whilst it’s not often discussed – it’s remiss to assume the record surge in illegal immigration is not having a material impact on jobs.

As this government paper reports – some 2.6 million inadmissible aliens have crossed the U.S. border since January 2021.

That’s material.

From mine, this helps partially explain where we are seeing the majority of jobs being added.

I say ‘partial’ because my other assumption is many more people now need to work more than one job to make end’s meet; and “boomers” are taking more part-time work after they retire.

With respect to the market – bonds are pricing in a scenario of rates being higher for a lot longer.

And I think that’s the right bet.

However equities still see the Fed cutting three times.

Things which make you go hmmm.

Next Wednesday we get Consumer Price Inflation – expect this to come in hotter than expected.

And who knows – the way this market behaves – equities will probably rally!