- Debt ceiling noise should be ignored

- Core PCE comes in hot – too early to rule out hikes?

- US Dollar and Yields take off on ‘higher for longer’

Mainstream media remain fixated on ‘debt ceiling’ negotiations.

“This will be a financial catastrophe if this doesn’t get done”

Or at least that’s the sentiment.

Ignore it.

This is the 78th time we have hit the so-called debt ceiling.

And how many defaults has there been?

Zero. None.

I don’t see why this won’t be any different.

Does that mean there won’t be volatility and nerves?

No – there will be.

There will be your typical political fear mongering from the usual suspects who love to warn about what will happen if a deal isn’t reached.

The “mother of all crisis” warn CNN.

Par for the course.

And sure, some government employees may be delayed in getting paid for a few weeks (don’t worry – they won’t miss out)… or your national park might close… or there could be hiccups with things like social security.

That’s not a default.

The US will always pay what is owed to bond holders.

But right up to the deadline (whenever that is) – the blame game from each side will become more frequent and louder.

That said, a deal will get done.

My best advice is to ignore the (mainstream) noise and if an opportunity presents – take advantage.

This script is repeated every couple of years… and we will be here again in 2025.

We will see more political posturing and the same blame game.

That’s how it goes.

But we will also get the same outcome (as we have seen the previous 77 occasions)

Let’s turn our attention to something more worthwhile…

The prospect of more Fed rate hikes.

Don’t Rule Out More Hikes

A data point we should not ignore hit the tape Friday – Core PCE inflation

Not surprisingly (pending your lens) – it came in hotter than expected.

- Consumer spending was double expectations – up 0.8%

- Core PCE was up 0.4% MoM; and up 4.7% YoY (well above forecasts)

In short, it appears the US consumer is hanging in there.

And as I was saying earlier this week – while they have a job – they will keep spending (even if they don’t have the money)

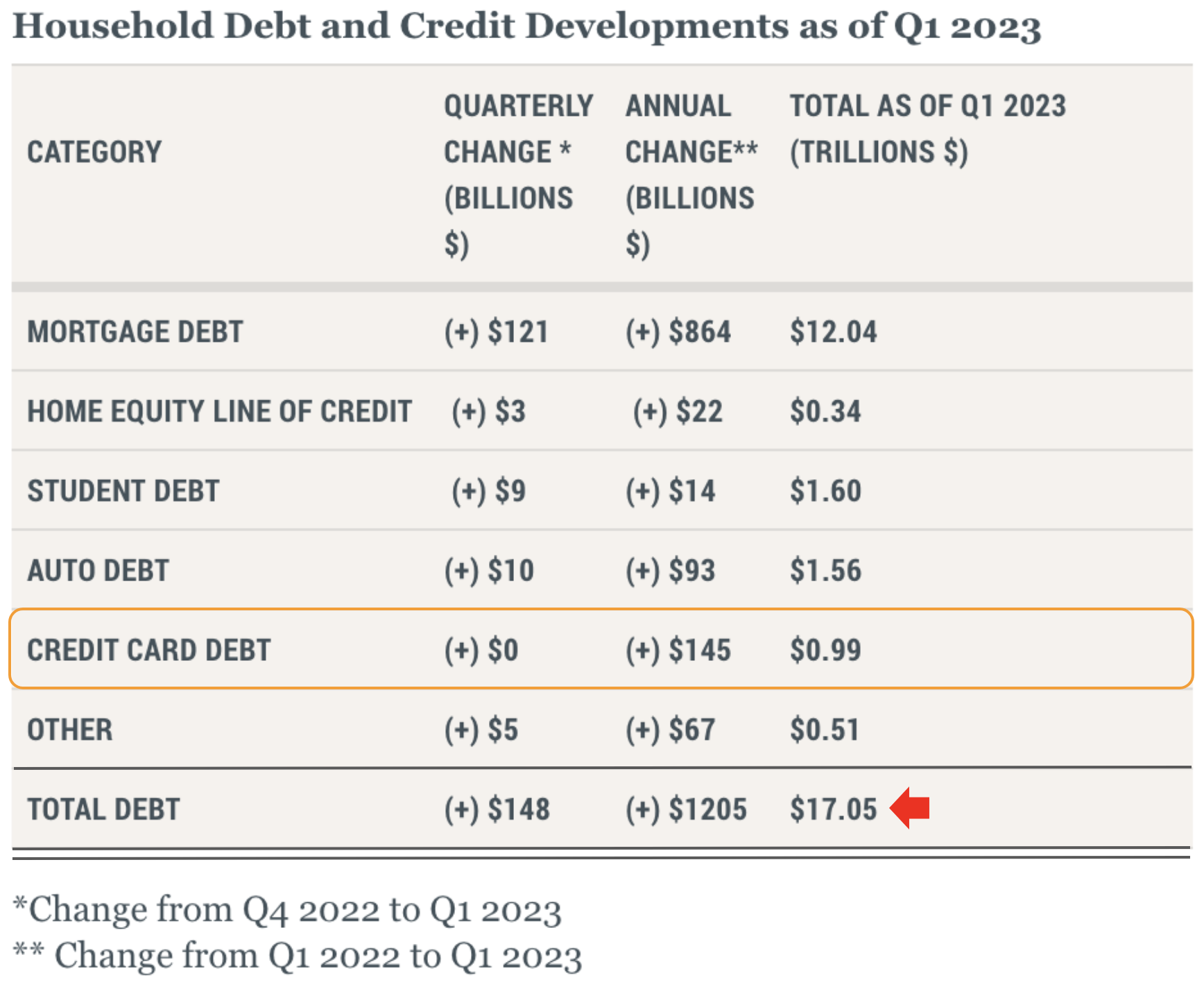

US consumers now owe a total of $17 Trillion… up $1.2 Trillion on last year.

But whilst the average consumer has access to credit — the economy will keep its head above water.

Beyond that, inflation indexes are not falling at the velocity the Fed needs to see. They remain stubbornly high.

And with the Fed’s preferred measure still clocking 4.7% YoY – it’s still too early for the central bank to declare victory.

As I wrote here – it was premature to think last month’s 25 bps hike was going to be “one and done”.

My best guess was whilst a pause in June was likely – further hikes between now and the end of the year cannot be ruled out.

What I was willing to rule out was three rate cuts.

And it would appear the market is coming around to that view.

For example, take a look at the reaction from both the dollar and treasury yields post the Core PCE report for April.

From mine, they suggest higher for longer.

US Dollar Rallies

Despite the ‘threat’ of the US defaulting on its debt – King Dollar continues to push higher.

May 27 2023

As an aside, if the market really felt the US was not able to pay its creditors, this trend would be headed sharply in the other direction.

Immediately after Core PCE crossed the wire, the dollar caught another bid.

But if we look at the long-term chart – we see how the dollar found expected support and rallied.

For those learning how to read technical charts – often you will find the previous levels of resistance become new support.

From here, I think King Dollar can go higher as the market realizes the Fed do not have the scope to start cutting rates.

The Core PCE for April simply reiterated that fact.

And if anything – they may need to lift rates again.

And if my thesis is correct – a stronger dollar will act as a headwind for equities (and gold)

Yields also Move Higher

The other immediate beneficiary of hotter than expected inflation were treasury yields.

Below is the weekly chart for the all-important US 10-Year:

May 27 2023

In just 3 weeks – these yields have rallied from 3.29% to as high as 3.86% Friday

Based on the prevailing trend – the path of least resistance looks higher.

Now this should have investors asking a few questions…

For example, we know tech stocks will typically struggle as yields push higher.

However, so far tech has mostly ignored the resurgence in bond yields – offset by some AI pixie dust.

That said, should these yields continue to move higher, can that trend continue?

Personally I don’t think so… but it deserves attention.

S&P 500 Wrestles with 4200

For the eighth consecutive week – the index finds itself pushing the zone of 4200.

May 27 2023

Perhaps what’s different this time is it’s trading higher in the face of a higher dollar and treasury yields.

As I say, generally these are headwinds.

However, given the market remains ‘flush’ with liquidity – and the consumer willing to spend – this is putting a floor under the market.

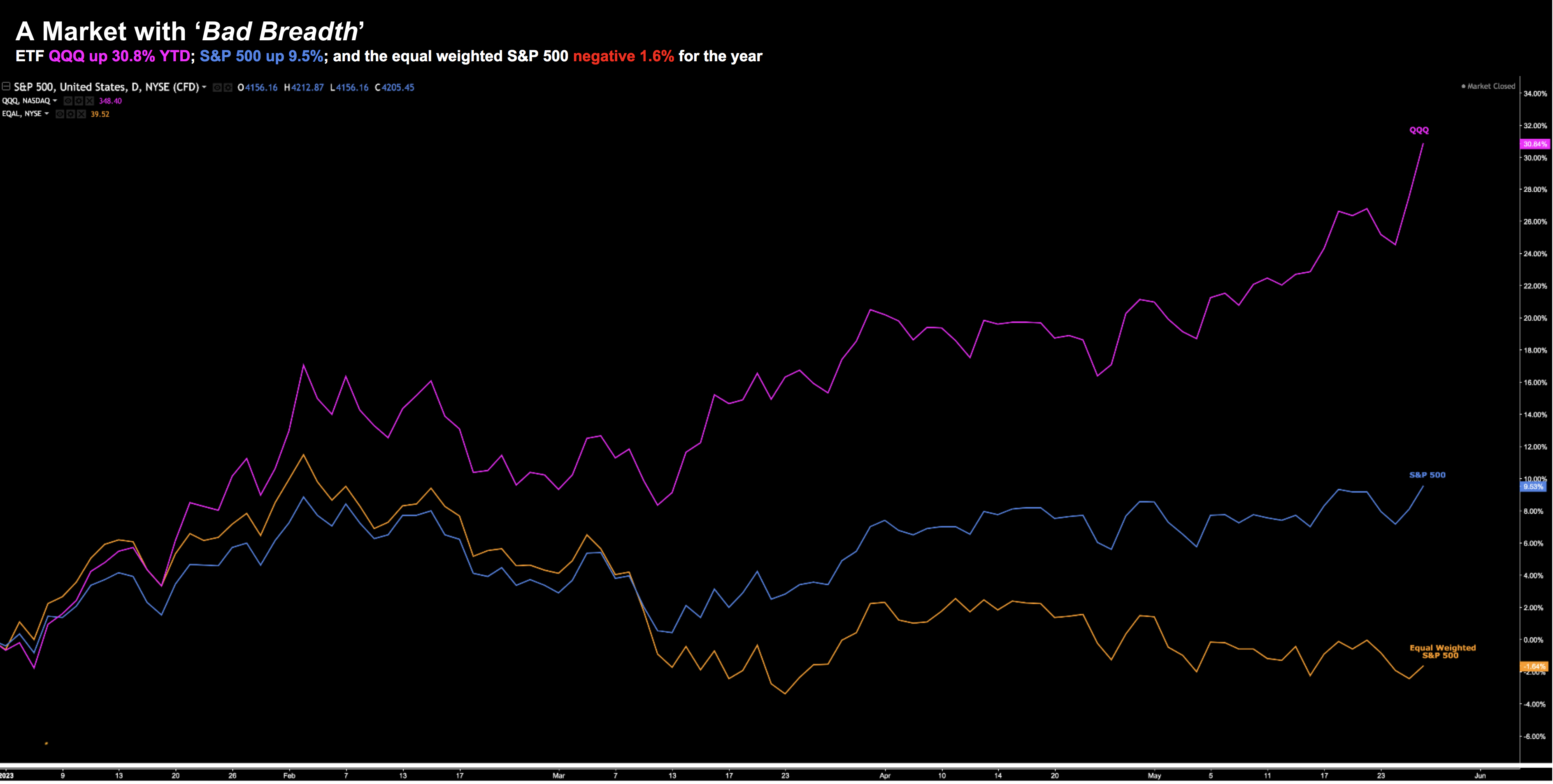

That said – and repeating recent posts – the lack of market breadth is troubling.

Below is my preferred chart which shows the fragility:

May 27 2023

The ETF QQQ is up 30%+ for the year vs the S&P 500 9.5%

And if we look at the equal weighted S&P 500 – it’s negative for the year.

You might frame it this way:

Are there really only “less than 10” stocks in the market worth investing in?

That’s what this chart suggests.

The rally so far in 2023 is confined to just a handful of (large cap tech) stocks.

For example, this week it was chip maker NVIDIA.

The Santa Clara, California-based group gained as much as 30% after saying it expects $11 billion in the next quarter.

That’s 52% higher than the $7.2 billion that analysts had estimated.

It’s quite remarkable that a company only doing ~$27B in annual revenue commands a market cap of close to $1 Trillion.

Some will argue it will grow into this valuation.

Maybe it will.

But don’t think the market for datacenter GPUs is not without fierce competition.

The switch from CPUs to GPUs is happening at scale.

And that represents opportunity

For now NVIDIA has a lead – but they are not the only company capable of producing high-end GPUs needed for things like “AI”.

NVIDIA is now 6x the size of Intel — even though Intel has twice their revenue (~$63B).

I’ve seen this script before… and generally it doesn’t end well.

Putting it All Together

Before I close, a few words on AI (as I work in the space)

This tech isn’t new.

In fact, it’s been around for several years.

For example, when gmail suggests the (possible) next word in your email or document, that’s using AI.

It’s leveraging a large language model.

Or when Google Lens processes an image; translates text into a different language; or solves a math problem – that’s also AI.

Google Lens has over 1B downloads…. where people use AI everyday.

Here’s a snippet from a recent article in Vogue (and a use-case I’m very close to with my own role at Google):

I was standing in the Eurostar departures queue at Paris Gare du Nord when I spotted a particularly well-dressed man holding a particularly lust-worthy bag. It’s a tale as old as time: girl sees bag, girl wants bag, girl feels too embarrassed to ask where said bag is from.

So like any self-respecting, social interaction-averse millennial, I take a surreptitious snapshot of the tote, and within seconds I have identified the brand (JW Anderson), product name (striped crochet tote bag), price (£280), and the online retailers that I can purchase the bag from.

And who can I thank for unlocking this new level of technological witchcraft? Google Lens: the search engine’s latest foray into the world of search-based AI.

I worked on the launch of Google Lens in 2017.

However, ‘searching what you see’ is just one example of a long list of (AI) based applications.

But what has changed in the past 3-6 months is the hype surrounding this tech.

Since the launch of OpenAI’s ChatGPT last year – the hype has soared.

For example, listen to the latest round of earnings – all you hear is “AI, AI, AI”.

Kind of funny.

As an aside, I saw a TV ad from Calloway for their new golf clubs.

“AI designed” they claim.

What does this even mean? But why not throw the term “AI” into your marketing.

The rally in NVIDIA’s stock this week added ~$200 billion to the its market cap.

$200B is the equivalent market cap of AMD!

Madness.

In closing, we have seen this movie many times in the past. The parallels to the dot-com bubble are easy to see.

If nothing else, history tends to rhyme.

ps: If you own NVIDIA after this week (well done) – but consider either (a) taking some (not all) chips off the table; and/or (b) selling call options against it.