- Apple beats very low expectations – as revenue declines

- ‘Bank’ is a now a ‘four letter word’

- Do you believe the market or the Fed?

Stocks fell again today as they wrestled with the threat of more regional bank failures and a committed Fed.

Here’s my basic question:

Will we see three rate cuts before the end of the year?

My view is we won’t see a single cut (let alone three).

If I’m right (and I may not be) – there will be a painful adjustment in the market.

However, if I’m wrong, and we do see a series of rate cuts, what would cause that?

Regardless, my money is on the Fed.

I choose not to fight them.

But that’s not the market’s view – with the gap between what the market expects and the Fed over 80 basis points.

So by all means…

Go right ahead and fight the Fed.

But I’ve learned over 25 years doing this is probabilities are on your side if you go with the Fed.

Today we have:

— Higher interest rates for longer (i.e. 5.00%+)

— Quantitative tightening (i.e. Fed balance sheet reduction); and

— Strong credit tightening from the banks

Is that highly conducive for economic growth and stock earnings?

Not from my lens.

Bank – A Four Letter Word

Before I get to Apple – there’s renewed fears in the regional banking sector.

This was a popular topic at yesterday’s Fed address.

Jay Powell went to lengths to remind people the US banking system is sound.

And it is…

However, that comes with a caveat.

For a banking system to be sound – people need to have confidence that the system is indeed sound.

That’s the issue.

As context, banking can be a very fragile business when confidence is lost.

It doesn’t help if you have bankers who prioritize profits over risk – but that’s another discussion.

This fragility is because of the illiquidity of bank assets as compared to their liabilities.

Commercial banks accept deposits and use them to make loans and invest in financial assets (e.g. short and long-term bonds).

But…

In order for banks to make profits they only keep enough cash on hand to cover a relatively small proportion of deposits.

Therein lies the rub… profits over risk.

That’s can be a problem if people panic and want their deposits returned (e.g., for fear of losing their money; and/or moving money to a higher yielding asset)

Faces with a potential rush of depositor withdrawal means they need to move to find ways to convert assets – potentially very illiquid assets – into cash.

Liquidation of illiquid assets can be costly and can result in a bank becoming insolvent.

That was First Republic and Silicon Valley Bank.

Two example of poorly run banks how placed profits ahead of risk.

Heck!

SVB didn’t even have a Chief Risk Officer.

Now regional banks like Western Alliance, First Horizon, Bank of Marin, Metropolitan Bank, Comerica, East West Bancorp, Keycorp or Pacific Western Bank (it’s a long sorry list) face large losses on their securities portfolios should they be forced to sell their (long-term) treasury assets well below par value.

However, the Fed can provide liquidity where needed against those securities (as they are quality assets – unlike the rubbish ‘assets’ held in 2008)

The Fed also has a lending facility available which is arguably under-utilized given the apparent stress in the system.

These are the things which should give people confidence the banks can meet their liabilities.

But this crisis of confidence (which I call it) is similar to what we saw with ‘Savings and Loans‘ decades ago during a period of higher interest rates.

“Inflation rates and interest rates both rose dramatically in the late 1970s and early 1980s. This produced two problems for S&Ls.

First, the interest rates that they could pay on deposits were set by the federal government and were substantially below what could be earned elsewhere, leading savers to withdraw their funds.

Second, S&Ls primarily made long-term fixed-rate mortgages. When interest rates rose, these mortgages lost a considerable amount of value, which essentially wiped out the S&L industry’s net worth”

There are no new ways for banks to go broke.

But that won’t stop us trying to find new ways.

Rinse and repeat.

From mine the Fed’s current monetary policy is appropriate when dealing with unwanted sticky inflation (you may see it differently)

But with Core PCE still in the realm of 4.6% and employment very strong – they can justify raising rates.

However, as I described yesterday, the Fed can use its supervisory and regulatory policy to provide the banks the liquidity they need.

But most importantly – use that to restore people’s confidence the liquidity is there.

From an investing and trading perspective – I think the regional banks are a no touch.

Many more will not make it.

Thats not a bad thing either (the world is far better served with less bankers) — but it will cause problems in the economy and with stocks. Less credit will be made available.

They have mismanaged their risk opposite the event of higher rates.

Profits over risk.

However, quality systemically important banks like Bank of America, JP Morgan and Wells Fargo offer value if held over the long-term

Will there be more volatility along the way?

Of course! A lot more.

And these (sound) systemically important banks could trade a further “20%” lower from here… I really don’t pretend to guess.

But these banks are not going broke and trade at (or very close to) 1x book value.

That’s the time you want to own banks.

However, most people buy banks closer to 2x book when everything appears rosy.

That’s when you lose money.

What if the Apple Falls from the Tree?

Let’s now turn to another bank… of sorts

The Bank of Cupertino.

As an aside, when Apple launched its savings account paying 4.1% this year, it raised something like $1B in 4 days.

Needless to say, I am sure there was money “flying” from a traditional bank paying below 1% on a savings or checking account – to get a solid 4.1% from Apple.

No fixed term deposit. No strings. Just 4.1% on your savings.

Thank you very much say consumers.

“The account’s eye-catching 4.15% annual return, plus the ubiquity of iPhones, is likely the main driver for account openings, especially when the average bank is paying less than half a percent.

By the end of launch week, roughly 240,000 accounts had been opened, one source adds. The account is offered through a partnership with Goldman Sachs Bank USA.

Goldman’s own high yield savings account housed under its consumer brand, Marcus, offers a 3.90% return, notably less than the Apple product. When asked about the deposit and account figures, Apple and Goldman Sachs declined to comment”

As an aside, my own personal savings account is with Marcus (yielding 3.90%)

Now, the US’ largest publicly traded company barely beat very low earnings and revenue expectations.

However, it was far from a stellar report.

Apple’s shares are just up 2% post earnings – trading at a massive 27x forward earnings.

My guess is this mostly due to (a) $90B share buyback; and (b) an increase in the dividend payout.

A $90B buyback is very shareholder friendly.

This means there is far less stock available to buy – making it more valuable.

Here’s the breakdown for 2023 Q2 Revenues

- iPhone – Up 1.5% YoY – $52.3B

- Services – Up 5.5% YoY – $20.9B

- Mac – Down 31% YoY – $7.2B

- Other – Down 0.6% YoY – $8.8B

- iPad – Down 13.0% YoY – $6.7B

There were just two segments for Apple which managed to grow: iPhone up 1.5% and Services up 5.5%

But there are not what I would consider “stellar” growth numbers.

Here’s the thing with the iPhone…

They only posted growth due playing catch up from Q1 where they recaptured losses from their Q1 factory issues.

In other words, those won’t repeat.

In full disclosure – Apple is one of my Top 3 core holdings.

I don’t try and “trade around it”.

And whilst I think it’s expensive at 27x – I won’t be adding to the stock above $150.

As an aside, this is the largest forward PE premium given to Apple since the financial crisis in 2008.

Overall, I would give the quarter a “5/10”.

Why just 5?

Revenue declined for the second consecutive quarter.

That needs to change.

However, they are defending their margins given their strong moat.

And no-one can deny the reliability of the free cash they generate.

Name another company buying back $90B of shares?

There are companies in the S&P 500 not even worth $90B!

Further growth will come from its services business (annualized at $85B) opposite its 1B+ install base.

That install base is not about to be challenged anytime soon.

Ask any kid what phone they want… my guess is “90%” of them will say iPhone.

That’s extremely hard to replicate.

Let’s look at the weekly chart:

May 4 2023

Apple has been caught in a range between $130 and $180 for 2 years.

My bet is $150 will act as a ‘gravitational pull’ and where you could add to it (if you don’t own it).

I don’t see it bursting above $180 anytime soon (not at 27x forward); however nor do I see it back at ~$130 (not on the back of its $90B buy back which will goose up their earnings per share).

If you are lucky enough to see it trade $130 – buy it with both hands.

We may get that if there is widespread panic in the market.

However, I also think Apple trades as a safety vehicle.

To that end, is Apple really a tech stock?

From mine, Apple’s characteristics are more “Procter & Gamble”; e.g. a consumer staple.

For example, we all need things like laundry soap, toothpaste, deodorant, shampoo, hand soaps etc etc.

And we all need an iPhone (or an equivalent).

How often do you use your phone per day? Over an hour?

If you are like me it’s probably closer to 3 or 4 hours per day (sad I know).

I could not do my job without it.

I even use it on weekends!

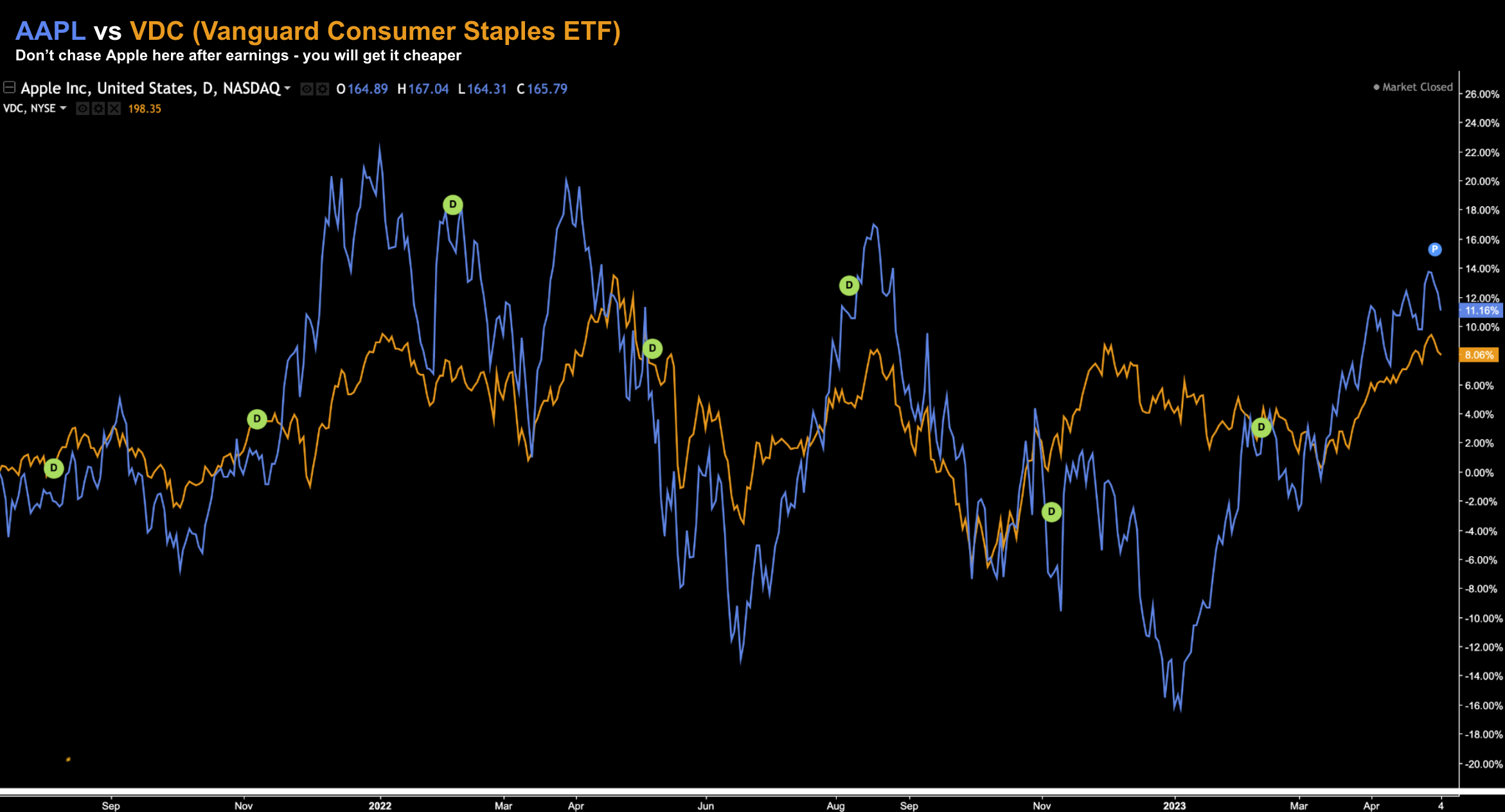

Now, to make my point, consider this chart where I compare the Vanguard Consumer Staples ETF (orange) to Apple (blue)

May 4 2023

The Vanguard Consumer Staples ETF (VDC) top holdings include Procter & Gamble Co., Coca-Cola, PepsiCo and Costco.

Things we use every single day.

Apple shows a lot more volatility (to be expected) – but over time – these two tend to trade in the same direction.

What basket of stocks typically outperform during times of economic slowdown?

Stuff we simply can’t do without.

For me, Apple’s characteristics are less tech and more staples (but with a far better margin and moat)

It’s little wonder Buffett bought this stock when its forward PE was just 8x.

Not dumb.

Putting it All Together

To my final question of the day:

“If the Apple falls from the tree… does the tree fall?”

What worries me about Apple is if the stock happens to stumble – it’s likely to bring the market down with it.

Apple trades at 27x forward.

That’s very rich.

To be clear, Apple deserves a premium to the market.

It’s one of the best companies on the planet (who also make great products).

However, from mine, the premium for Apple should be closer to 22x to 24x (at most)

For example, with EPS in the range of $6.30 – at 24x – we get to $150

That’s where I would be comfortable adding to the stock.

Obviously I don’t mind if it runs higher (as I own it)… but from mine the upside feels limited.

This blog was written on an iMac (which I love)