- Market sees a 2% chance of no rate cuts this year

- Several reasons the Fed can afford to “wait and see”

- Still expecting a buyable pullback

At the time of writing, the market is pricing in three rate cuts for 2024.

But is this realistic?

My argument is no. Not even close.

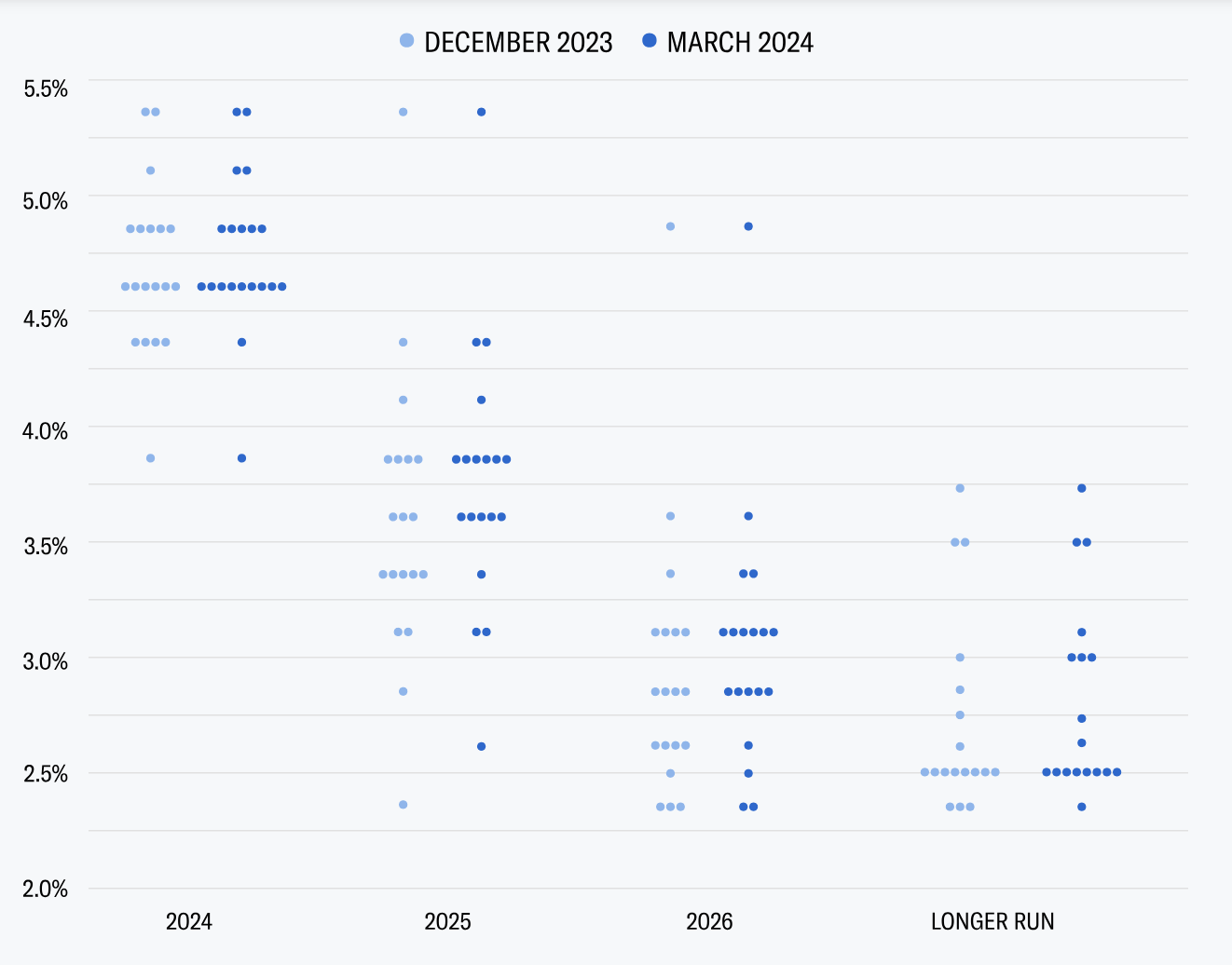

Let’s frame the discussion with the latest ‘dot plot’ following the March FOMC meeting:

Here we can see the division among FOMC members. For example:

- 9 see 2 rate cuts;

- 9 see 3 rate cuts; and

- 1 envisages 4 cuts

As I wrote last Friday – if just one of the members forecasting three cuts becomes two (e.g. due to stronger than expected employment and/or inflation) – then two cuts will be the scenario.

However, what if zero rate cuts become a possibility?

This post attempts to explore reasons why that outcome should be considered.

Probability of No Rate Cuts

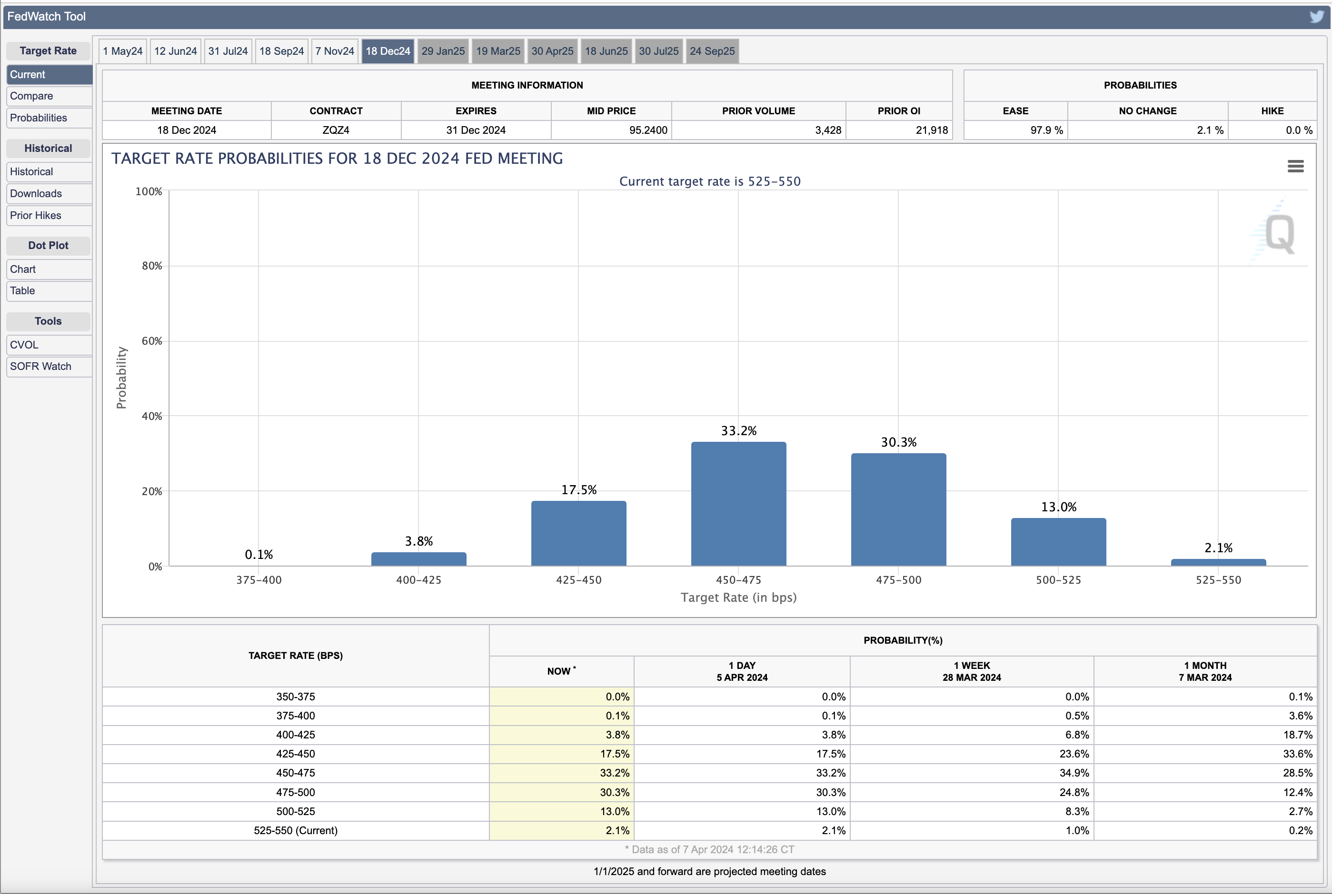

The probability of the Fed maintaining rates where they are is not something which is priced in.

For example, following last month’s “strong” employment data (where almost all of the jobs added were part-time) – the market sees this as a small 2.1% probability.

From the CME’s FedWatch Tool:

The column on the far right hand side suggests a 2.1% probability that rates stay the same (i.e., 525 to 550 bps).

However, that probability was just 0.2% one month ago.

Three rate cuts (a target rate of 450 to 475 bps) is still the favoured outcome.

But my feeling is 2% underestimates the possibility of the Fed taking a wait and see approach through the second half of the year.

And there are a few reasons for that…

The Wealth Effect

Outside of more often cited metrics such as employment and inflation – there are other factors which will weigh on the Fed’s decision to ease.

For example, one is the huge “wealth effect” from risk assets in recent months (which in itself is inflationary)

Let’s start with the stock market…

Since November 1 last year – the market is up around 25% or ~$10 Trillion Dollars

Apr 7 2024

This 25% surge now finds the S&P 500 with a total market capitalization of ~$43 Trillion.

Naturally, investors have seen their wealth accelerate – whether it be their 401Ks or other investments.

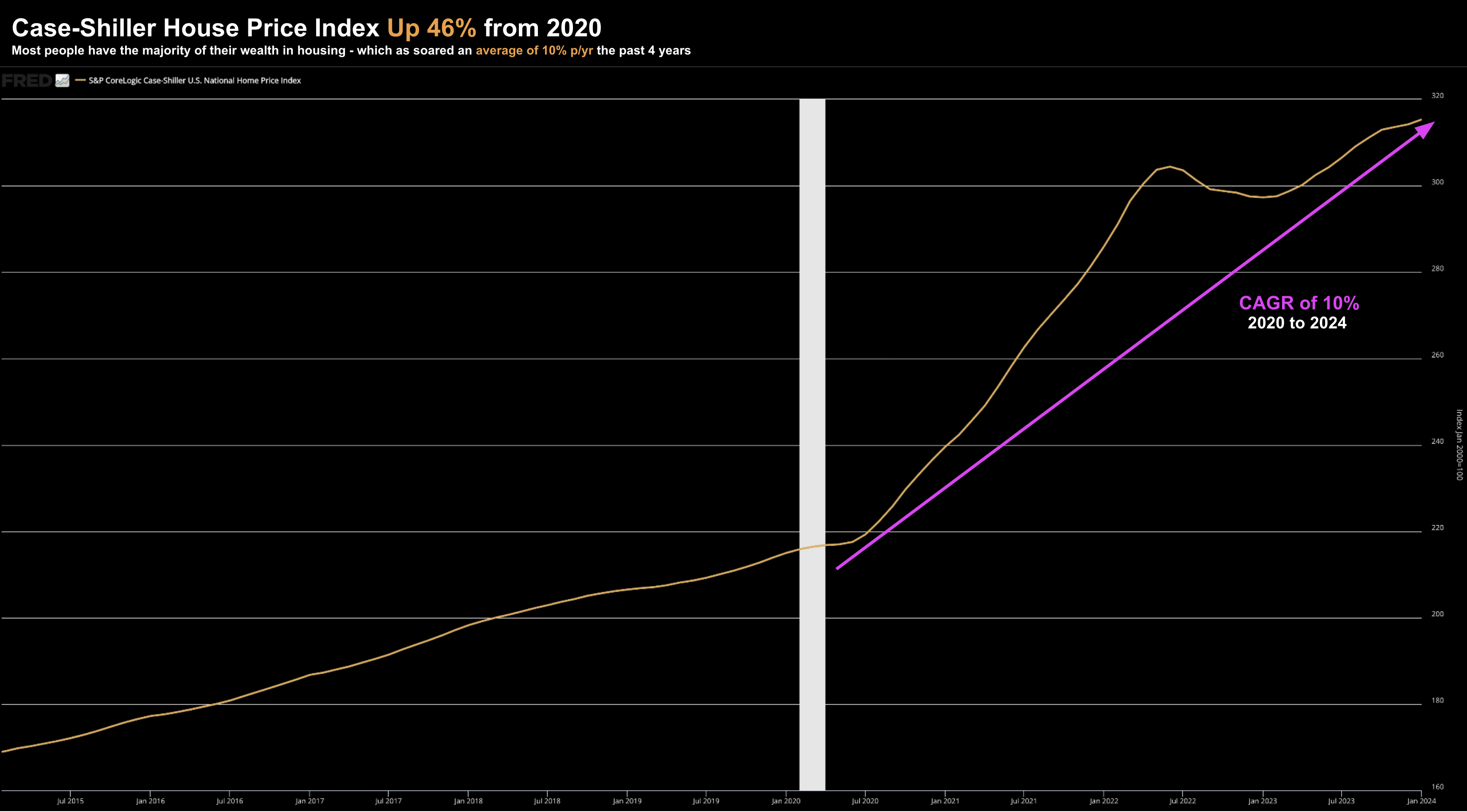

Now let’s consider housing…

Property has also enjoyed stellar gains (thanks to record low levels of inventory) – up an incredible 46% the past four years – a CAGR of around 10% per year.

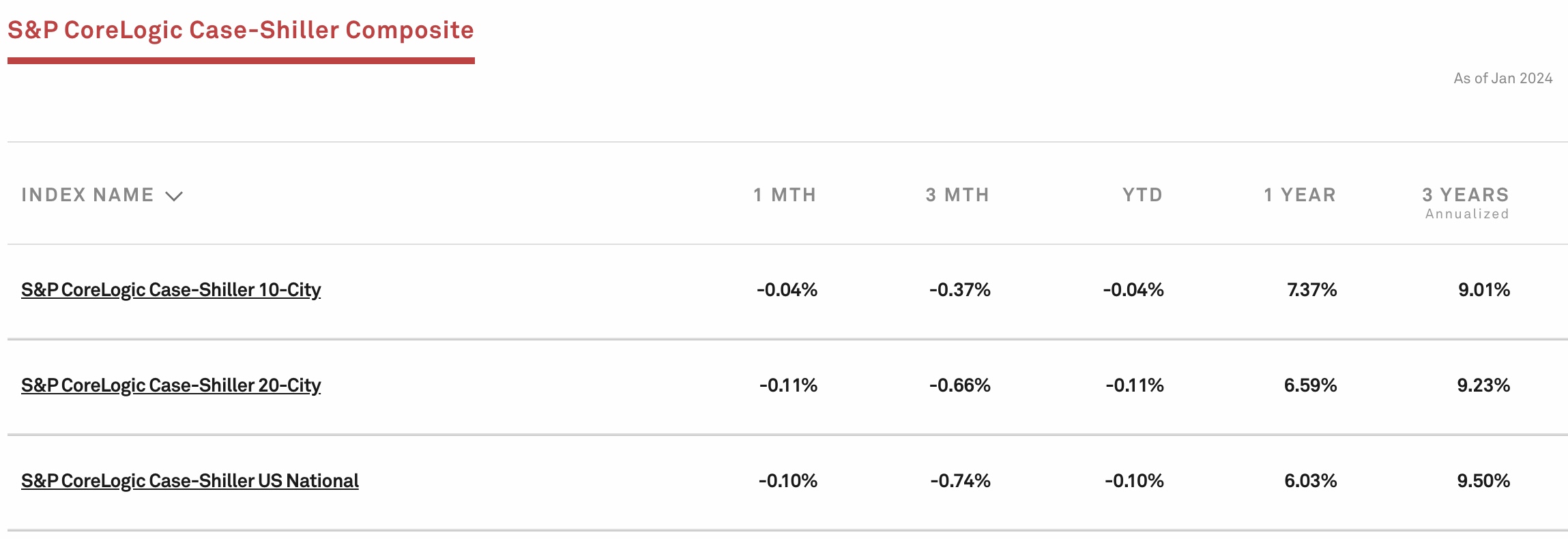

Below is the Case-Shiller House Price Index – a leading measure of U.S. residential real estate prices, tracking changes in the value of residential real estate nationally.

The table below shows the changes over the past few months, year-to-date and past 3 years (where gains are ~9.50% annualized on a national basis).

Rising property values are also another major source of the ‘wealth effect’

But there’s one more asset class we might be forgetting…

Here I’m talking about the $2.64 Trillion market that is “crypto”

Consider the most prominent coin – Bitcoin.

It has rallied from ~$15K at the start of 2023 to ~$70K at the time of writing.

Who knows…. Bitcoin could be “$80K” or more by the time you read this (or maybe less than $50K!)

So here’s the thing:

The leading cryptocurrency by market value has gained over 50% in 2024 – extending last year’s 155% surge.

Apr 7 2024

There is little doubt this too has played a significant role in (some) investors feeling ‘wealthier’.

In fact, there is research to support this.

Consider this article from CoinDesk – who cite research from Harvard Business School on crypto’s wealth effect (especially with younger investors who have a higher propensity to spend):

A 2023 paper by Harvard Business School’s Marco Di Maggio and his team of economists estimated that the marginal propensity to consume – the amount spent on consumption for each additional dollar earned – out of unrealized crypto market gains is double that of stocks.

That means a sharp rally in crypto prices, like the current one, can lead to a wealth effect that injects inflation into the economy by creating extra demand.

“The rise in bitcoin and ETH and alts is inflationary as it creates more money-like assets and a strong wealth effect for young people with a high marginal propensity to spend,” Brent Donelly, president of Spectra Markets, said on X.

The wealth effect is a behavioral economics concept that says that individuals, households and businesses spend more when the value of their financial assets rises.

That increased spending is financed, essentially, by wealth created out of thin air – asset price gains. However, it adds to demand-side forces in the economy, putting upward pressure on prices.

Therefore, when you consider the sharp rises we’ve seen in risk assets across the board (e.g., stocks, housing and crypto) — it’s not reasonable to think this is “injecting” further inflation into the economy.

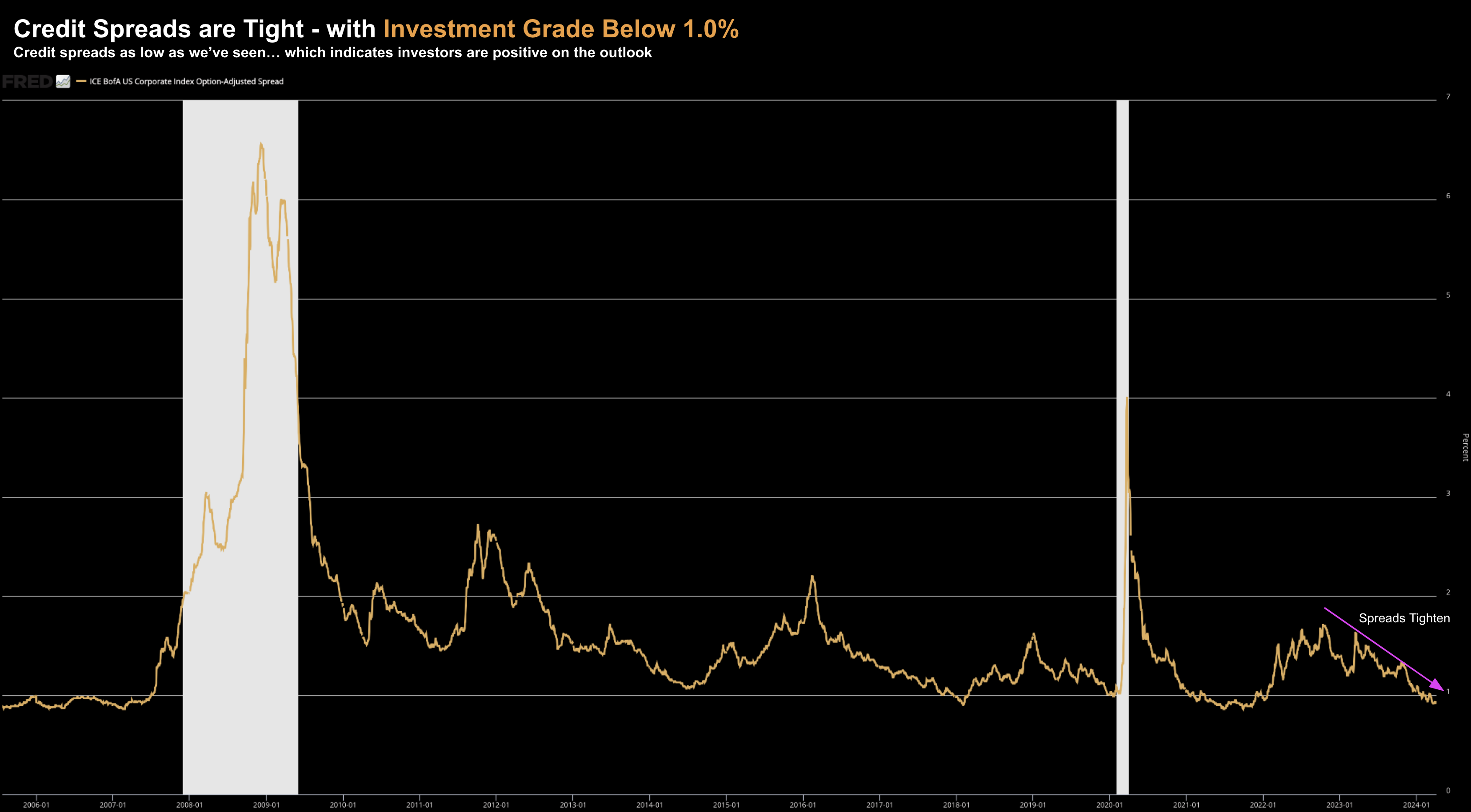

Credit Spreads also Tightening

Something else which tells me the Fed are likely to hold are what we see with credit spreads.

They are starting to tighten.

For those less familiar – credit spread compression happens when the yield differences between Treasuries and other bonds (e.g. corporate debt) that share the same maturity shrink.

In recent months, the compression of credit spreads has proved beneficial for high-yield, bank loans, emerging markets, and corporate bonds.

As Treasury prices fall and their yields rise, investors generally move into other debt instruments.

This typically happens when the economic environment is positive or improving, causing narrower spreads.

On the other hand, when the economic environment turns negative (e.g., odds of recession increase) – then investors sell out of riskier investments like corporate bonds in favor of the safety of Treasuries.

This, in turn, causes the spread to widen.

Therefore, if we’re to experience a so-called “soft landing” (which the market anticipates) – expect spreads to narrow further.

Apr 7 2024

Now when (not if) we are to see unease in credit markets – with spreads widening – it could support the case for rate cuts.

But this is not what we find.

Easing Financial Conditions

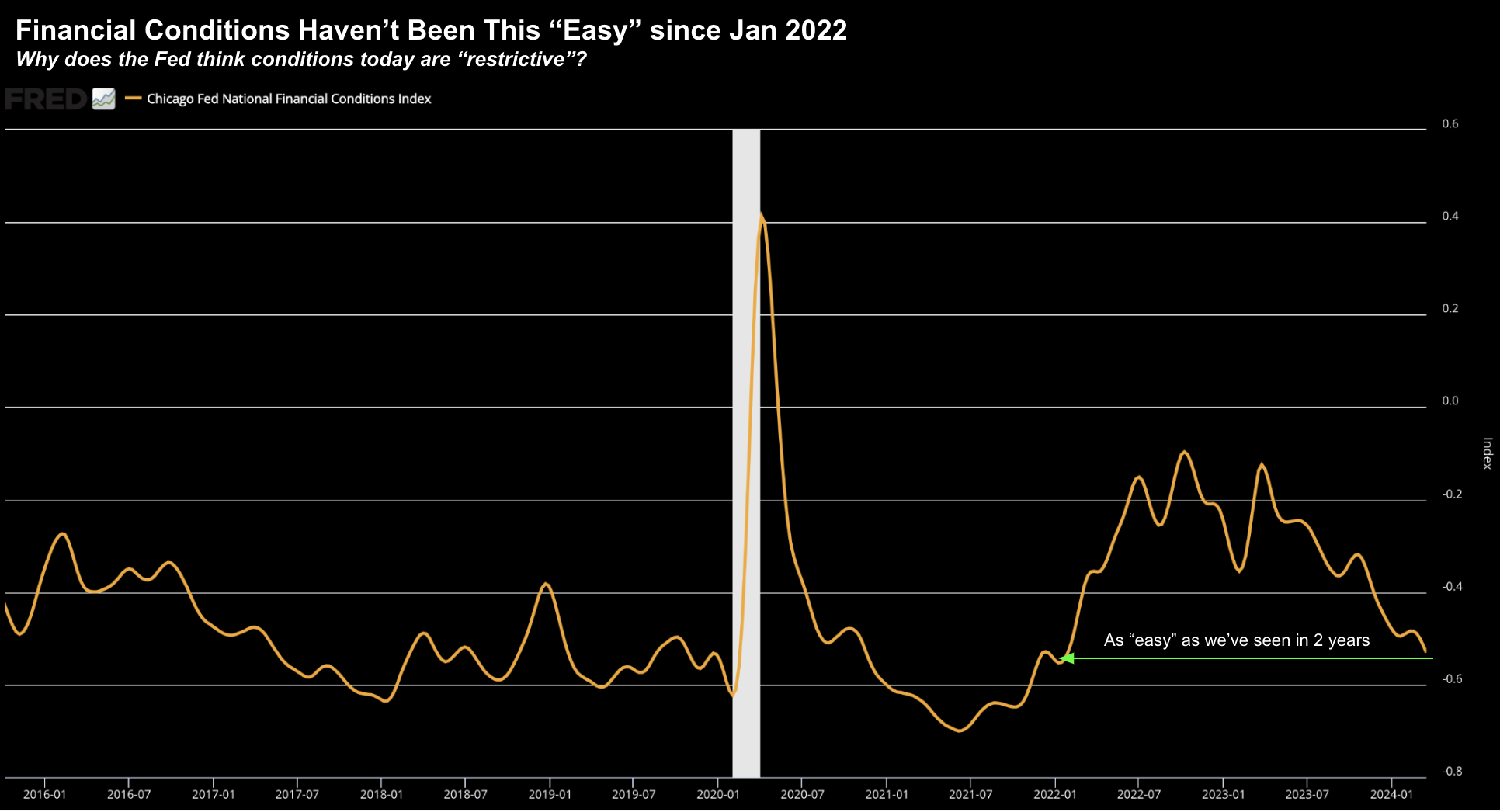

Last but not least – consider what we see with financial conditions.

I offered this Fed chart recently – asking why central banks believe financial conditions are “restrictive”?

Again, if conditions were considered tight, then it might support the case for the Fed to ease.

However, conditions are as “easy” as we’ve seen in 2+ years.

As an aside, the way the Fed measures “restrictive” is by something they call the “r-star” rate (or neutral rate).

From that lens, there could be an argument rates are restrictive pending on what you deem the neutral rate to be for a growing economy where inflation is stable.

For example, is that 1% or 2%?

To that end, Powell has not definitely said. He generally skirts the question.

However, if your lens is financial conditions more broadly – there’s no headwind.

Tailwinds

Each of the above are all tailwinds for the economy.

What’s more, each of them are inflationary as they increase demand and consumption.

But what about the so-called lag effect of monetary tightening you might ask?

Well so far we have not seen it…

Typically the long and variable lag effect of rate rises will come into play up to 18 to 24 months after the Fed first hikes rates (March 2022)

But here we are two years later and it’s been negligible.

There was been a small impact with the unemployment rate moving from a very low 3.4% to 3.8% – but certainly not the “economic pain” Jay Powell told us to brace for.

From mind, there have been 4 major tailwinds which have effectively offset tighter monetary policy:

- Cumulative $2T in excess consumer savings (which is now gone);

~$6 Trillion in fiscal spending; - 70% of US home borrowers securing 30-year mortgages below 4% (minimizing the impact of rate rises); and

- The wealth effect from appreciable gains in stocks, houses and crypto currency.

Each has culminated to keep the economy out of recession.

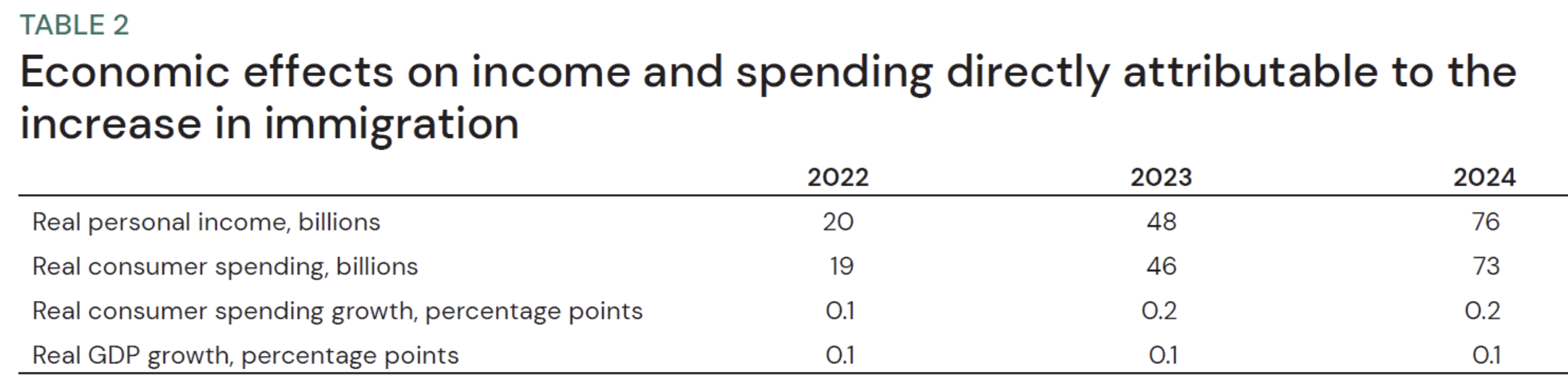

And when you also consider the record amount of immigration in the US (legal and illegal) – this has meaningfully added to the labor force (as I wrote last week).

For example, according to the CBO, the tightness in the labor market is likely to persist due to immigration.

“Using the new CBO estimates of net immigration released in January 2024, we estimate that the labor market in 2023 could have sustainably accommodated employment growth of 160,000 to 230,000. That is still below the actual monthly increases in employment in 2023, but far less so than previously estimated.

Similarly, for 2024 we estimate sustainable employment growth will be between 160,000 and 200,000, approximately double the sustainable level that would have occurred in absence of the pickup in immigration according to the pre-pandemic projections from CBO, BLS, and SSA”

They also add “…the unexpectedly high level of immigration also explains some of the surprising strength in consumer spending and overall economic growth since 2022. Moreover, we expect immigration flows to further boost economic growth in 2024″

All Reasons Not to Cut

Given all of the above – why would the Fed choose to cut rates three times before the end of the year?

This has been my question all year… even when the market was pricing in six rate cuts.

From mine, there is ample demand and inflationary forces at play for the Fed to “wait and see”

Last week’s employment result may force a few Fed members to moderate their dovish views.

And pending what we see this week with CPI – those who were thinking three cuts – may shift to just two.

As it stands right now – I think there is at least a 50% probability the Fed doesn’t cut at all this year.

That’s a long way from the 2% which is priced in….

What am I missing?

Putting it All Together

With respect to the S&P 500 – don’t be surprised to see further profit taking from current levels.

And if we are fortunate enough to see a correction in the realm of 7-10% – but that will be an opportunity to buy.

As an aside, in a non-recessionary environment, the average pullback in any one year is around 13%

There are some years where this doesn’t happen – but it’s unusual.

However, given how far stocks have come, I personally think the probabilities for a buyable pullback are high.

For clarity, I don’t think stocks are going to crash into some abyss this year.

For that to happen, we would need to see a material change to the unemployment picture (e.g. moving towards 4.50%)

However, if that were to happen, then we will see the Fed move aggressively.

But as things stands, I’m finding it hard to make the case for rate cuts.