- Core PCE at 4.6% YoY too hot for the Fed’s liking;

- 6-month trend shows zero improvement; and

- Why I expect at least two more hikes this year

Very few saw the S&P 500 rallying 15% for the first 6 months of this year.

Some did… but they were in the minority.

I did not see it at all.

Now a preface, I don’t pretend to be a great predictor of where stocks will go in the near-term.

That’s a coin flip.

The shorter your time frame, the more of a coin flip it becomes.

For example, earlier this year my best guess was for the market to rally to a zone of 4200 to 4300 where it would find resistance.

And for a period of time – that was largely accurate.

However, the S&P 500 smashed through that zone and is now pushing 4500.

It’s the highest it’s been since April 2022 (when interest rates were just 0.25%)

500 basis points later in Fed hikes and here we are… go figure.

As the chart shows below – the market is now up 27.5% from the October 2022 lows.

Jul 01 2023

So can we go higher from here?

Sure.

Why not?

Stocks can always go higher (and lower) what anyone believes possible.

Yes, we can spend time and energy trying to explain why they shouldn’t – but the market will always do ‘irrational’ things.

However higher we go – the riskier things get.

Remember – it’s less about what we buy – but what price we pay.

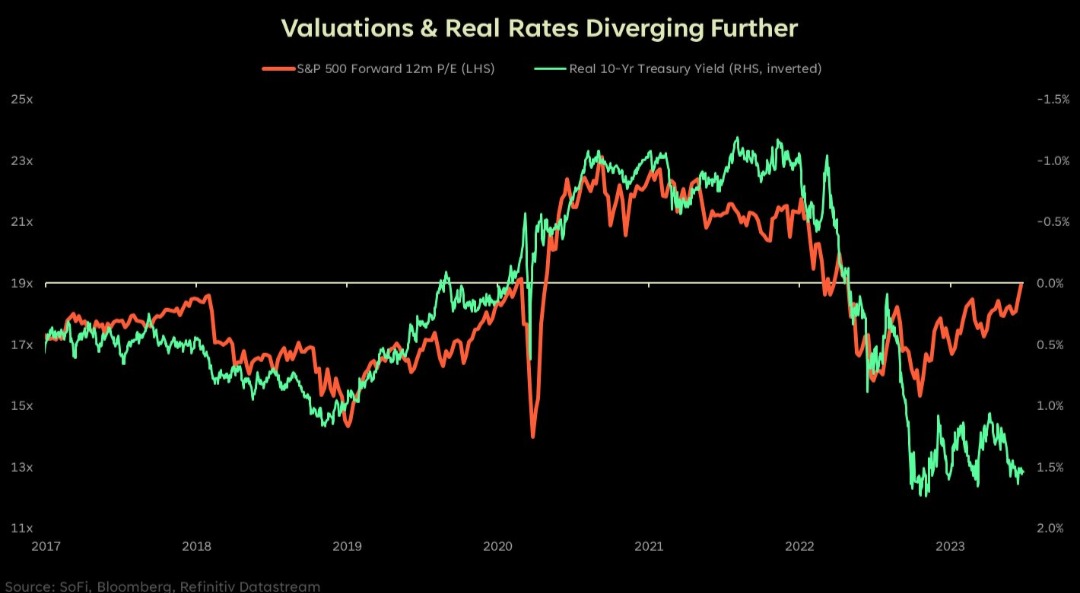

As I explained here – stocks are not cheap.

When compared to the risk-free 6-month Treasury (~5.41%) (which I added to this week) – stocks are not compelling.

For example, as part of my post, I calculated stock’s earnings yield at a forward PE of 20x (which assumes 2023 of $220 earnings per share (EPS))

That’s a yield of 5.0% (i.e. the inverse of the forward PE)

Put another way, investors are being asked to take on a lot of risk for a lower yield than the risk free rate.

Alternatively, you can get a 6-month risk-free rate at 5.41%

But here’s the thing:

- Interest rates are likely to go higher from here (which I will explore below); and

- We still cannot eliminate the risk of recession later this year (or early next)

Higher rates means the risk-free return gets better.

For example, I think 5.47% could easily challenge 6.0% this year.

If we see that, it makes stocks even less compelling.

In addition, if we’re to experience a recession within the next 12 months (which I don’t think we can rule out) – then $220 in EPS is very optimistic.

Earnings typically contract during recessions (they don’t expand).

With that, let’s talk to why I think the Fed has a “full green light” to continue hiking rates.

Core PCE Remains Stubborn

I could only smile when I read the headlines of “lackluster inflation” this week.

Really?

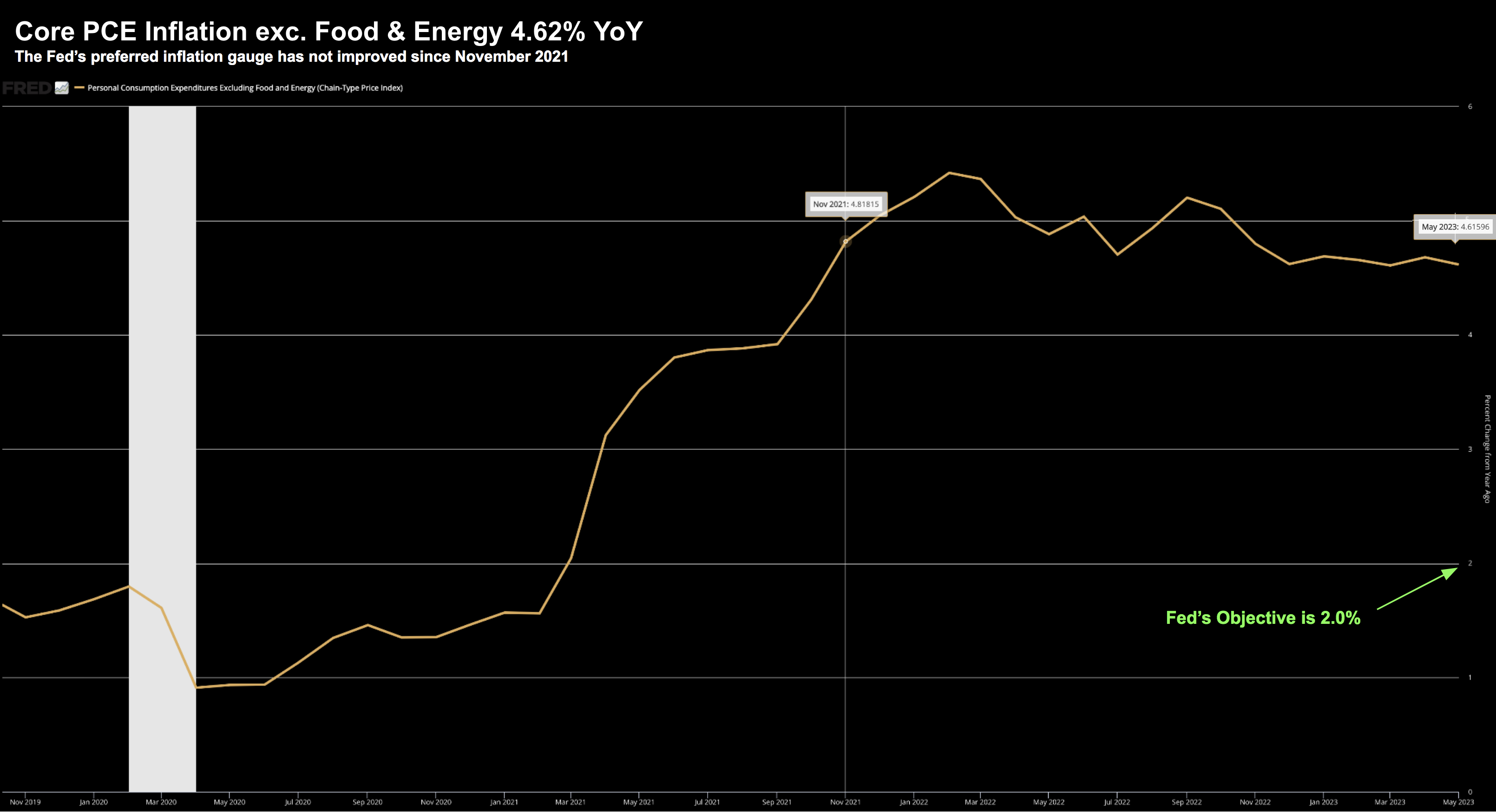

May’s print for Core PCE came in 4.6% YoY – hardly lackluster.

From mine, the massive disconnect between the market and expectations for rates only widens.

For those less familiar, simply using the term “inflation” is no longer useful.

If you see the headline “inflation is falling” – you need to ask what specific type of inflation?

We need to be more precise with our language.

For example, the Core PCE price index, which excludes food and energy products and is the inflation measure favored by the Fed.

That’s what we should be most interested in (as it will determine interest rates).

This week we learned that this dipped in May to 4.62%, from April (4.68%), but was above March (4.61%), and was exactly where it had been in December (4.62%).

So for me – there’s your headline:

“Core PCE inflation has not improved since December”

Here’s the Core PCE trend over 4 years:

July 1 2023

This chart from the Federal Reserve has been sideways for about 6 months.

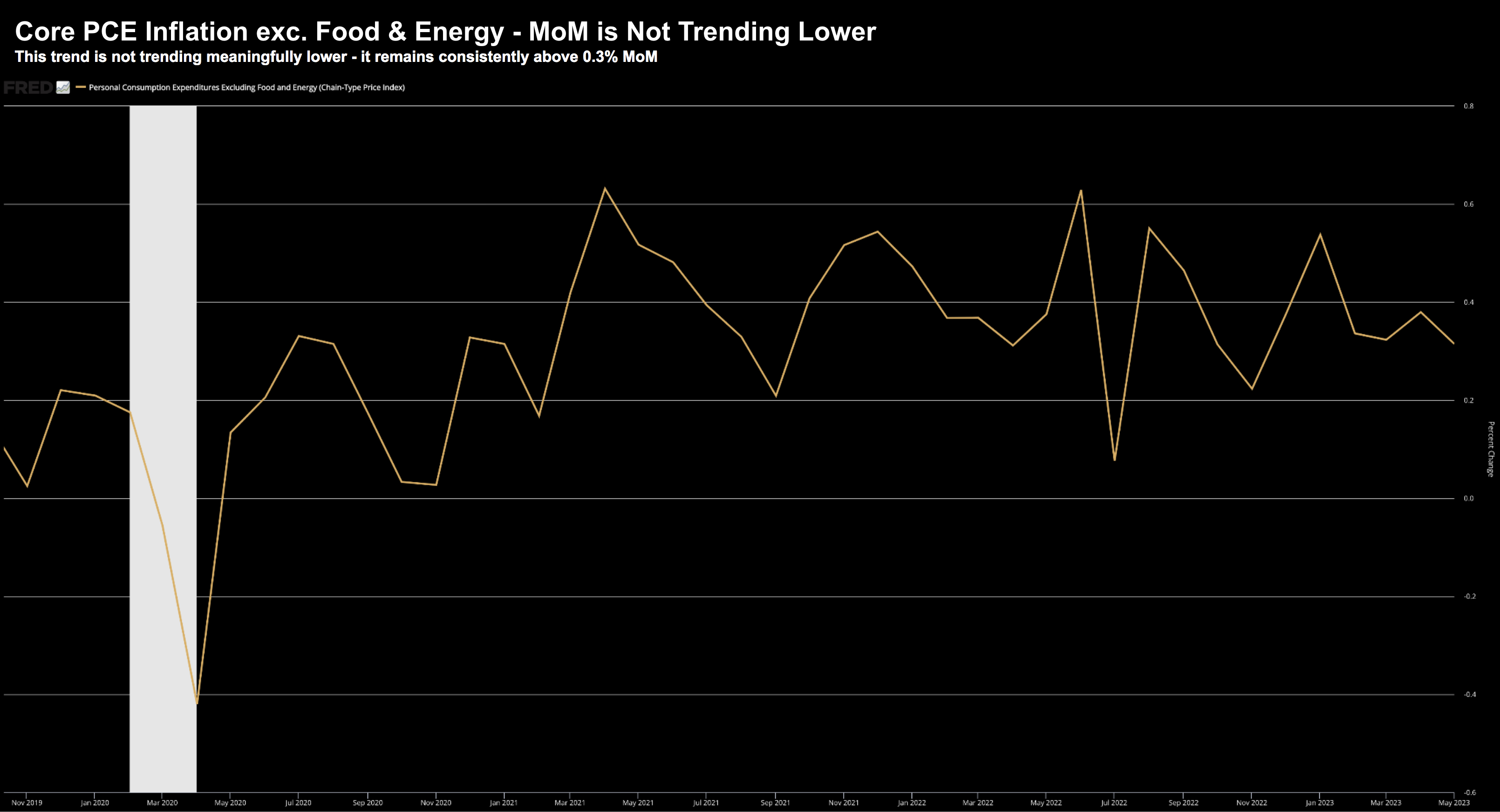

Now mainstream will say the month-to-month matters far more than the year-over-year trend…

And that might be true…

On that basis, what do we see with the month-on-month trend?

In May, it rose by 0.31%, a slightly smaller increase than in April (0.38%).

Lackluster?

But look beyond April and you can see it’s roughly equal to March and the same as where it was in October 2022 (0.31%),

Based on the Fed’s own chart – Core PCE MoM has been in a range of 0.3% to 0.4% for 4 consecutive months.

In fact, if you take a 6 month rolling average of the Core PCE MoM – it’s 0.38%

If we annualize 0.38% – that translates to ~4.7%

So that’s the “good” news…

Now let’s look at the more stubborn element of Core PCE Inflation – services.

That’s higher again.

Core Services inflation (without energy services) rose by 5.4% in May YoY.

It was fractionally lower than April (5.5%) – but equal to what we see in both March and December (5.4%).

Similar to Core PCE – it too is stuck in a tight range for 5 consecutive months.

Services inflation is largely a function of higher labor costs.

And therefore, until we see material weakness in the labor market (specifically wages) – this too will remain well above the Fed’s objective.

Higher for Longer

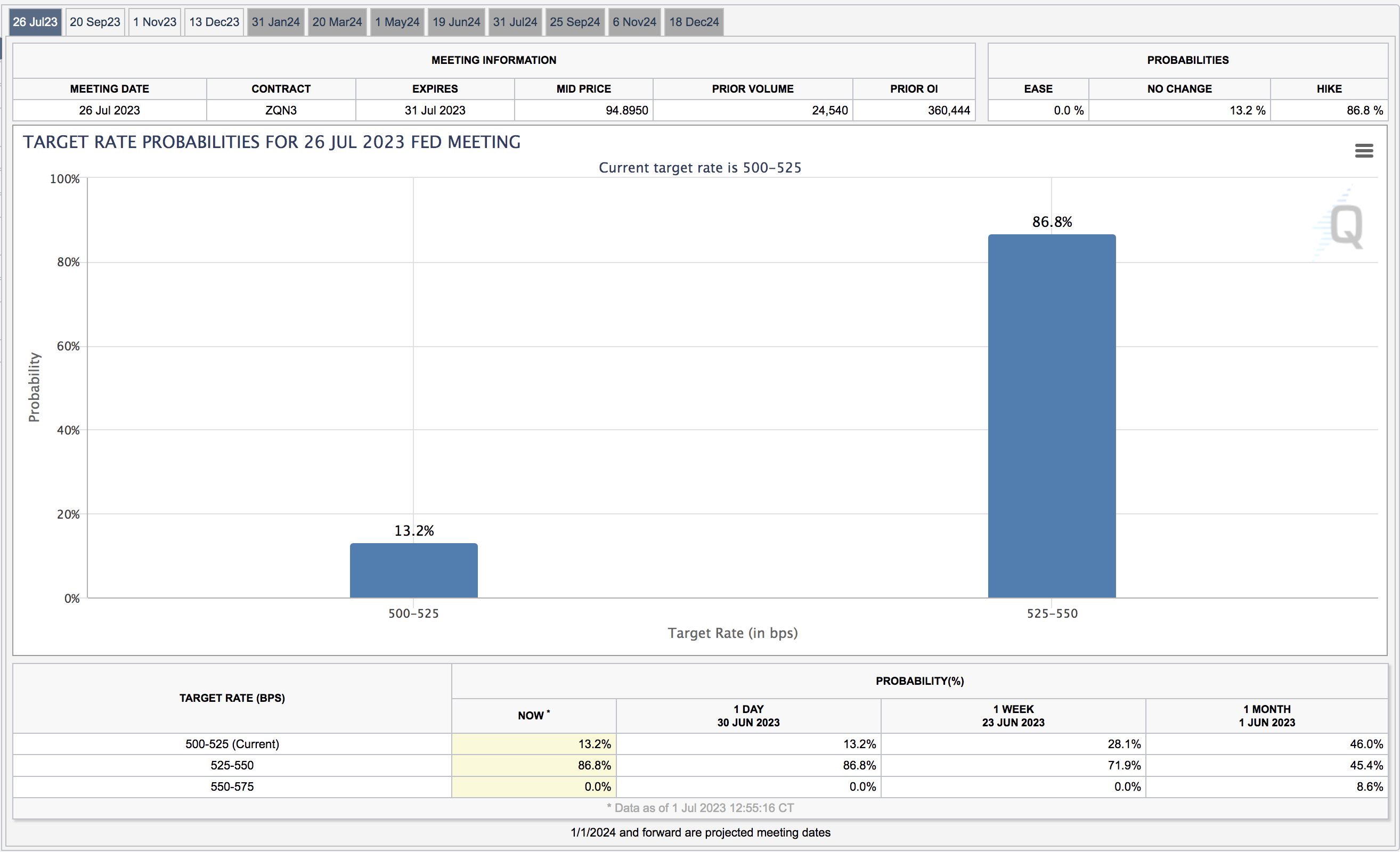

Looking at inflation metrics which matter to the Fed (Core PCE and Core Services) – why wouldn’t the Fed continue to raise rates?

But that is not what the market is pricing in.

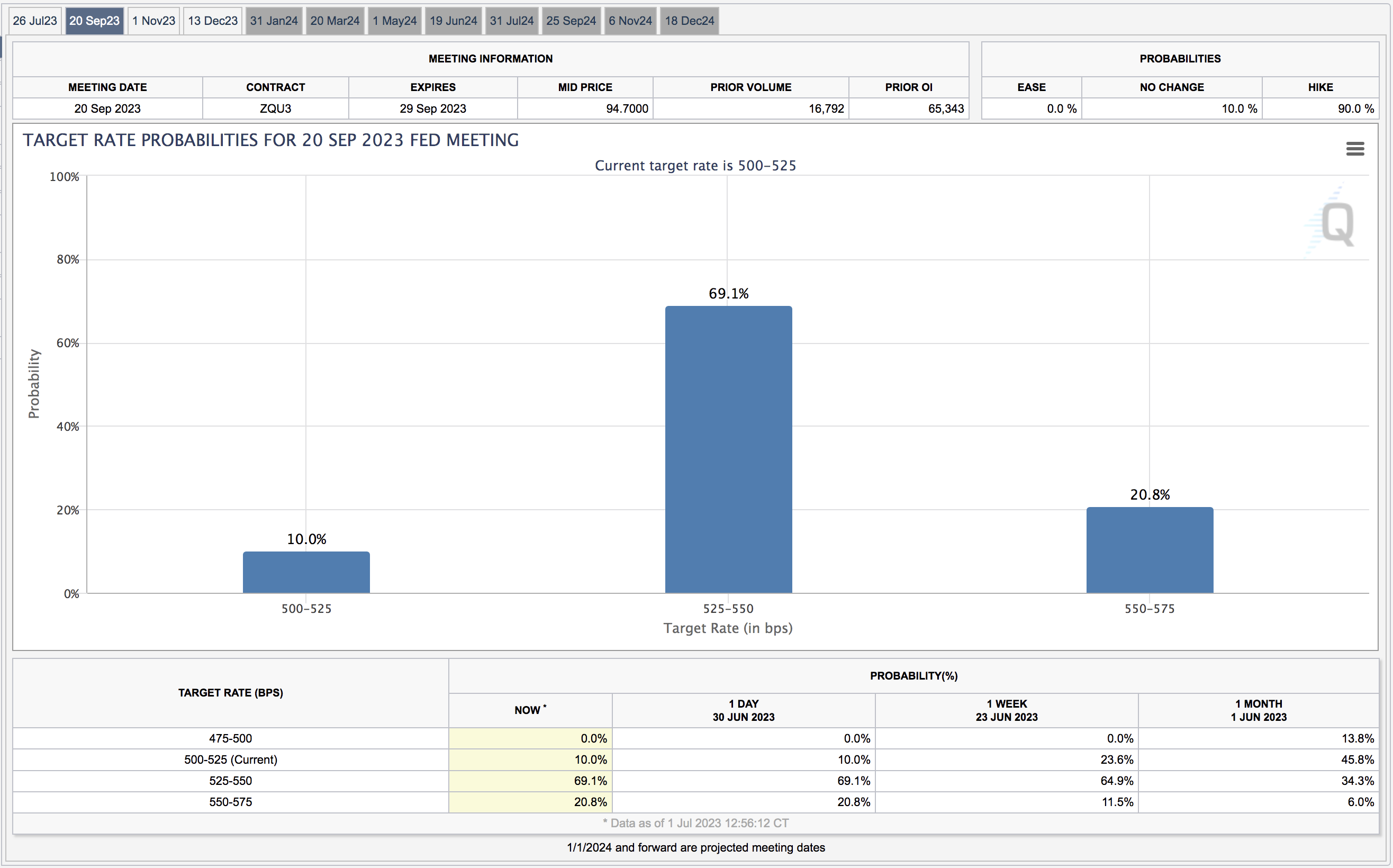

For example, at the time of writing (and post the Core PCE news) – the market has priced in a 86% chance of a 25 basis point hike in July.

July 1 2023

But if we look out to September – they are only pricing in a 20% chance of an additional 25 bps hike.

July 1 2023

I think the market is underestimating this risk.

Either that, or it will need Core PCE and Core Services to plunge in the next 2 months.

My view is the Fed will not only hike twice before the end of 2023 – we could see three hikes.

This would take the fed funds rate to 5.75%

If we were to see this – what would that mean for the market at a forward 20x multiple?

If nothing else – it’s not cheap.

Will the Second Half be as Strong?

A question I get often is what I think the second half of the year will do?

Short answer is I have no clue.

You’re probably better equipped to hazard a guess.

For example, look at how wrong I was with the first half!

I saw the market rallying to a zone of 4200 to 4300 and meeting resistance.

Boy was I wrong (and it won’t be the last time)

Therefore, I don’t see why my guess for the second half will be any good.

For what it’s worth, I see stocks trading in a range from 3800 to 4500 (not sure if that’s helpful!)

If nothing elese, you can read that as meaning I don’t see a lot of upside but the risk of more downside.

My logic is simply a repeat of what I shared earlier this week.

Stocks are not cheap at this level.

And that equation becomes even less compelling if we see two more rate hikes.

The higher we press in the absence of a meaningful growth in earnings (and/or much lower rates) – it’s hard to justify the lofty risk premium.

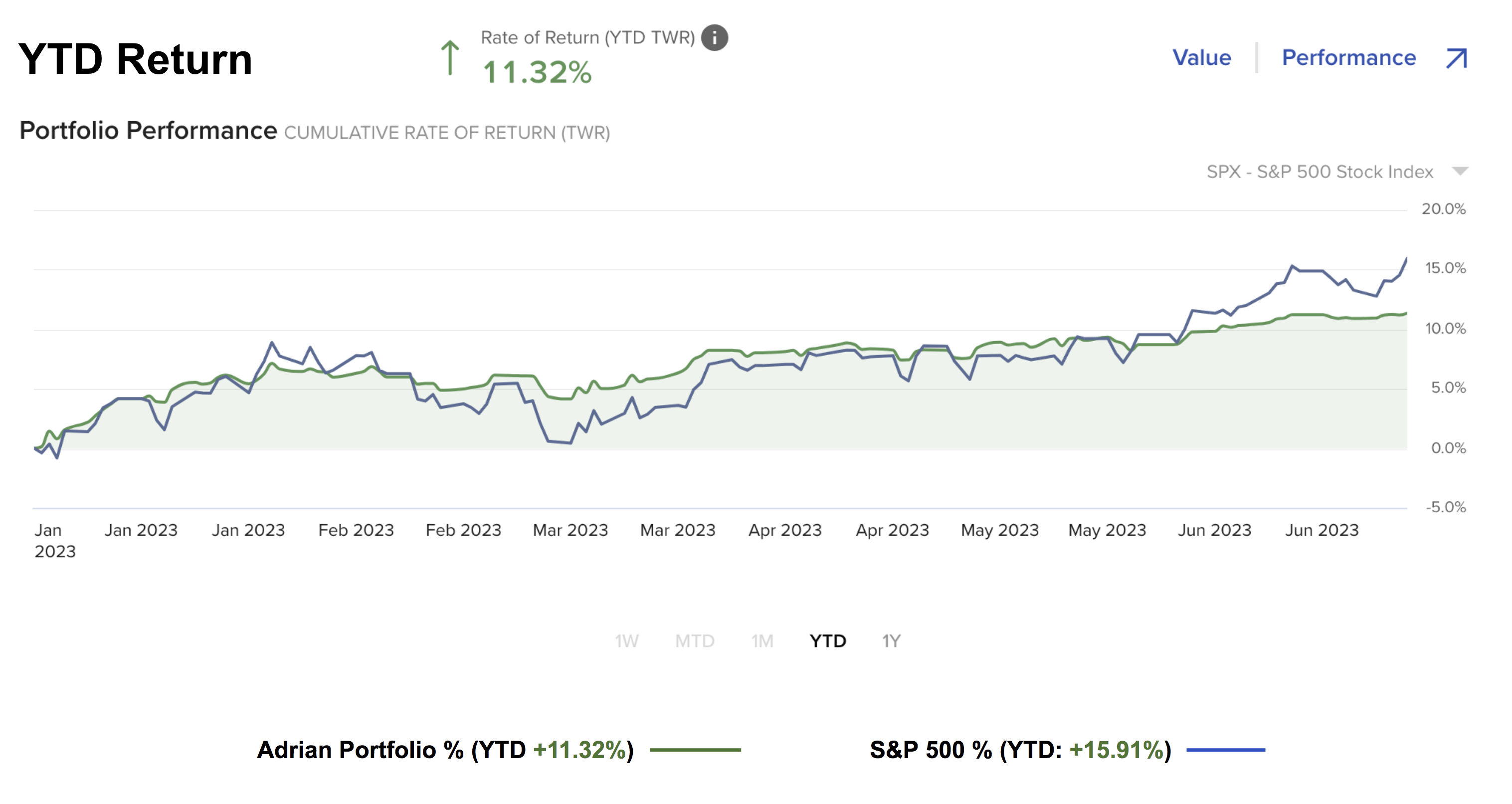

Before I close, below is my own YTD (6-month) performance vs the S&P 500:

July 1 2023

I’m up 11.32% for the first 6 months… a solid result.

I said to a close friend this week that if I finish the year with 15%+ returns (especially given the 19% outperformance last year) – I will be very happy.

So why did I underperform the first 6 months?

Three reasons:

- My long exposure to the market is only 65% (greater exposure would have led to better performance);

- I trimmed my exposure to tech stocks (to below market weight) which (so far) has meant underperformance; and finally

- I increased exposure to energy and bank stocks (which has also seen underperformance)

These three (defensive) decisions led to 4.59% underperformance for the fist 6 months.

But… it’s a very short timeframe as measure of ‘success’.

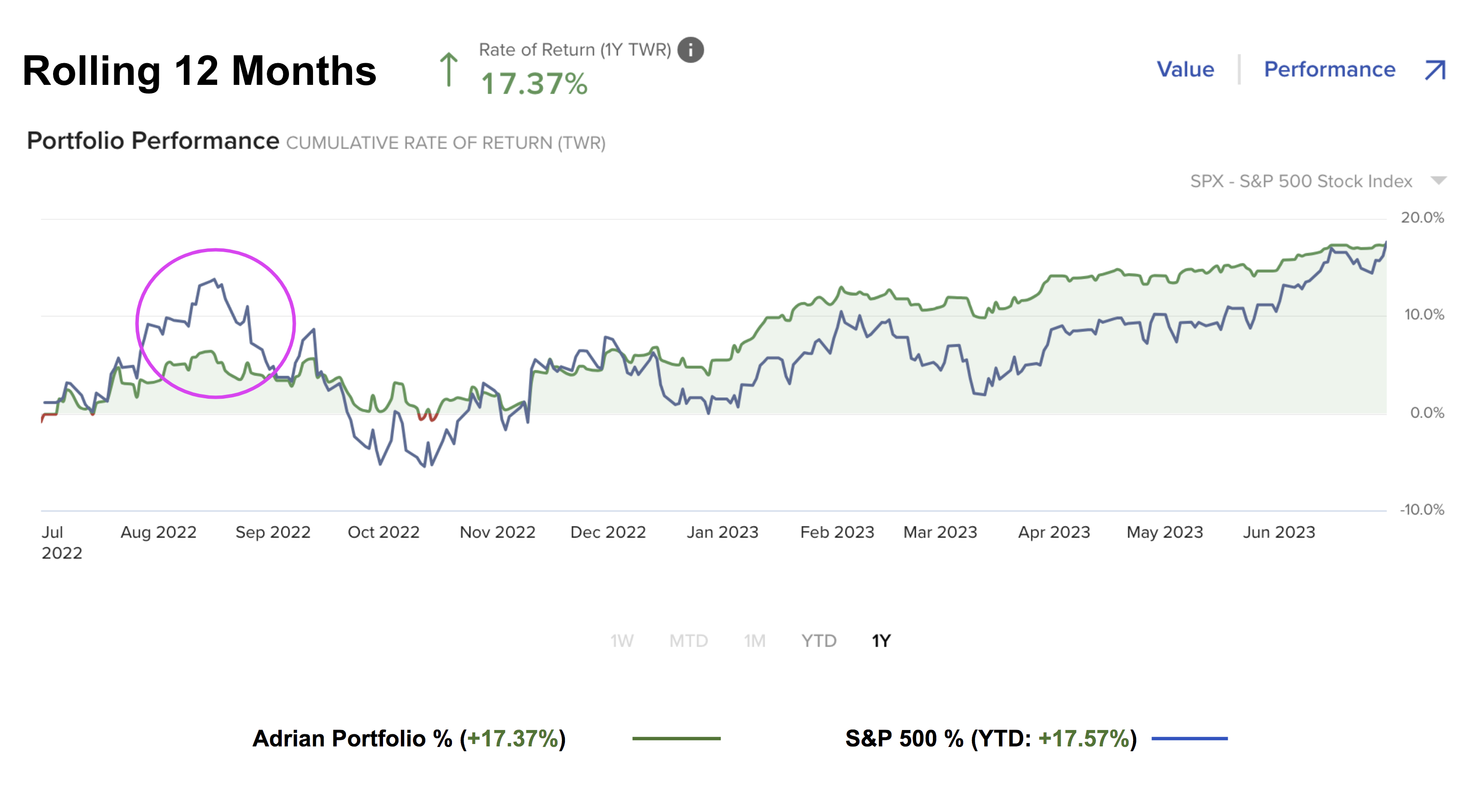

For example, below is my performance against the Index on a rolling 12 month basis:

On this basis – my 12-month (rolling) returns are +17.37% vs the S&P +17.57%

Not too bad…

One quick note:

Circled is what happened in August / September last year.

The S&P 500 was racing ahead (trading above 4300 and up from the 3600 June low) and I was warning of the risks.

Similar to today – things felt stretched – and I took the opportunity to trim / reposition.

Don’t be too surprised to see something similar over the next few months.

Putting it All Together

Trading the market the past 6 months has not been easy.

In fact, it’s more difficult now than what it was when stocks were trading around 3600 to 3800.

Why?

When stocks were selling off there was a lot of irrational fear.

Many felt it could be a repeat of 2008 – with the market down over 20%.

At the time, I felt good about the buying opportunity.

Rates were still low and there was ample liquidity.

I added to positions in quality names.

Today however I don’t feel as good.

There are far fewer opportunities and I need to be more mindful of the risks.

What’s more, there isn’t “blood in the streets”… it’s more like “euphoria”

I am rarely a buyer in euphoric conditions… especially when I think there are risks the market is overlooking (such as monetary policy and inflation).

With that, to my US readers – wishing you a very ‘happy 4th’ – and enjoy the 4-day long weekend.

For me, I plan to catch up on some reading. Two books I’m enjoying at present:

- Antifragile – Nassim Taleb; and

- The Man Who Solved the Market – Greg Zuckerman

The former is a great book on making better decisions. Here’s an excerpt (to give you a flavor):

Indeed, our bodies discover probabilities in a very sophisticated manner and assess risks much better than our intellects do. To take one example, risk management professionals look in the past for information on the so-called worst-case scenario and use it to estimate future risks – this method is called “stress testing.”

They take the worst historical recession, the worst war, the worst historical move in interest rates, or the worst point in unemployment as an exact estimate for the worst future outcome. But they never notice the following inconsistency: this so-called worst-case event, when it happened, exceeded the worst [known] case at the time.

I have called this mental defect the Lucretius problem, after the Latin poetic philosopher who wrote that the fool believes that the tallest mountain in the world will be equal to the tallest one he has observed. We consider the biggest object of any kind that we have seen in our lives or hear about as the largest item that can possibly exist. And we have been doing this for millennia

As I’ve written over the past 12 years – the game of speculation is all about the process of making better decisions.

And here I want to stress the word process.

For example, you could tell me you are “up 40%” YTD with your portfolio. My immediate question is what concentrated risks you took to get that return.

In other words, what was your process?

Because over the long-run – a robust decision making process for managing risk will prove to be more successful than a near-term ‘win’.

With respect to “The Man Who Solved the Market” – this is a terrific insight into one of the great quant traders of our time – the enigmatic mathematician Jim Simons.