Words: 1036; Reading Time: 5 Mins

- Geopolitical risks rising, but impact remains contained (for now)

- The market’s tug of war between conflicting signals

- Continue to maintain long exposure despite volatility

In my experience – growth ultimately defies fear.

And whilst stocks will always climb the wall of worry – over time – growth prevails.

The challenge for investors is the pathway is rarely in a straight line.

Put another way, markets are constantly in a tug-of-war between opposing forces.

Consider what we see today…

On one side, we have a surprisingly robust US economy, defying expectations of a slowdown (go deeper).

Tailwinds include Fed easing, disinflation and a consumer which continues to spend.

The counterforce to the further growth are escalating geopolitical tensions in the Middle East – which threaten to disrupt the global economic order.

This clash creates uncertainty in the minds of investors – filled with contradictions and potential turning points.

Shortly we will look at a chart for the fear index – the VIX – which is now back above 20.

This tells us participants expect volatility.

So what are the implications for investors?

🏃 Room to Run?

Despite persistent fears of a slowdown (or possible recession) – recent U.S. economic data paints a picture of a growing economy.

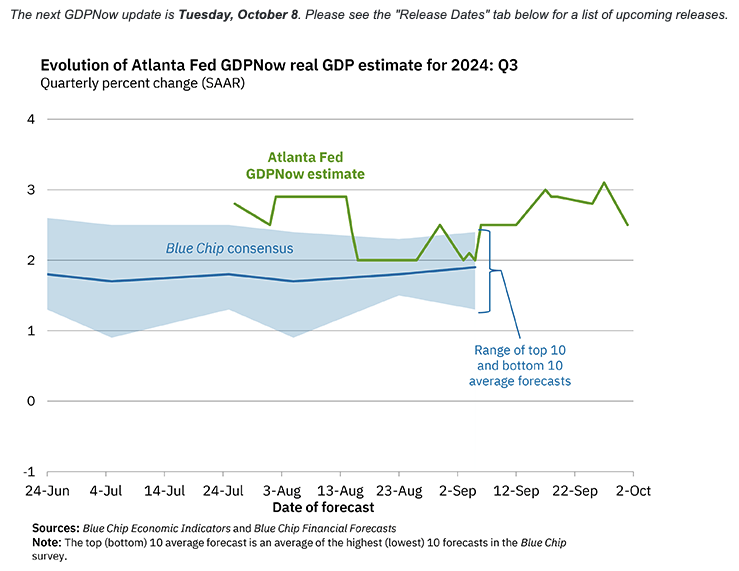

For example, the Atlanta Fed’s Real GDP growth forecast is in the range of ~2.50% (near it’s long-running average)

This is consistent with what we see with consumer spending – which continues to hold up well (see this post)

We also learned the unemployment rate dropped to 4.1% as part of September’s jobs report – where wage growth remains strong ~4.0% (well above inflation).

And finally, the all-important yield curve has returned to a level above zero (after an unusually long period of inversion)

That said, the re-steepening of the curve from inversion (a.k.a. a “bear steepener“) has often been a harbinger of more difficult times ahead (go deeper)

Irrespective, the resilience in the U.S. economy has prompted investors to reassess the Federal Reserve’s monetary policy trajectory.

A few weeks ago the market sensed aggressive easing from the Fed… after their jumbo rate cut.

For example, some were calling for another 50 bps in November – worried about a sharply declining employment market.

That’s now in doubt…

This positive data, coupled with China’s recent stimulus measures and various central banks easing rates – this has many thinking the current economic expansion has a lot more room to run.

And that could be right…

However, complexities remain given the mounting geopolitical tensions in the Middle East.

⚠ Geopolitical Risks (and VIX) Rise…

The escalating conflict between Israel, Hamas and Hezbollah has injected a significant dose of uncertainty and anxiety into the market.

The VIX – as a measure of expected volatility – is back above 20.

Oct 8 2024

Expect this to climb should tensions escalate further.

For now, the direct impact on the US economy remains limited.

However, the surge in oil is notable.

This week WTI Crude crossed the $78 mark – up sharply just $65/b a few weeks ago. However, today it reversed some of those gains…

Oct 8 2024

Two questions come to mind:

- Is this indicative of the potential for further escalation and possible disruption in the oil market? and second

- Is the Middle East war potentially a binary outcome?

With respect to the latter, either the conflict remains contained (i.e., the favored outcome and good news for stocks); or it escalates dramatically disrupting oil supply through attacks on Iran; and/or by blocking the Strait of Hormuz.

As it stands today, the market is pricing in no further escalation.

However, if this war was to escalate as some expect – it could result in another global economic shock.

🔀 Caught b/w Conflicting Signals

- Resilience with U.S. economic data;

- The relative pace of monetary easing;

- Fresh Chinese stimulus;

- Global central bank rate cuts (excluding Japan);

- The outcome of the U.S. Presidential election; and

- Rising Middle East geopolitical tensions

Put together, it creates a mixed picture.

However, it’s easy to understand why some investors are “bulled up” on the prospect for stocks.

History shows that in the absence of a recession (or global economic shock) – during Fed easing cycle – stocks tend to do very well.

But one needs to carefully balance the risks.

💥 What Matters for Investors

1. A more data-dependent Fed. The latest series of economic data reduces the likelihood of significant rate cuts. My sense was markets got well ahead of themselves by pricing in ~200 bps the next 12 months. This is unlikely – where I expect 10-year yields to rise. Therefore, I’ve reduced my exposure to longer duration bonds (10-year). There’s better risk/reward in the middle of the curve (e.g., 5-year)

2. The balance b/w economic strength and geopolitical risks. While the U.S. economy appears robust, the situation in the Middle East could be a binary outcome. I expect heightened volatility over the coming months – however investors should not lose their nerve.

3. Election Impact: The upcoming U.S election adds another layer of uncertainty – particularly from a fiscal and regulatory lens. From mine, one skews towards lower taxes, incentives and fewer regulations – putting more resources in the hands of the private sector. The other side takes a government-centric approach to growth and resource allocation. Pending the outcome, this could have major implications for investing (and tax) strategies.

4. Stay invested: I remain invested with ~65% long exposure to risk assets. And whilst stocks could easily rally – they’re not cheap at 21x forward. Therefore, I maintain a cash level which enables me to remain agile to take advantage of opportunities (if and when they present)

Putting it All Together

Before I close, there is another layer of complexity to consider.

Q3 earnings season commences this week… with several large banks reporting Friday.

With markets pricing in double-digit earnings growth for the S&P 500 in 2025, companies will need to meet high expectations to justify the current 21x forward valuations.

That said, we know that earnings are rear-view mirror. This is a bar they are expected to clear.

However, earnings beats alone won’t cut it…

What investors are more focused on is guidance, raising questions about whether companies can maintain optimistic projections in the face of potential risks outlined above.

From mine, with earnings season and the U.S. election looming, volatility is likely to persist as investors grapple with a growing number of uncertainties.

Be ready should the opportunity arise.