- Bond volatility needs to ease for stocks to recover

- Why 3600 could easily break down

- Panic selling in corporate debt ETFs

The headlines will read “stocks make a new low for 2022“

And they are correct… they have.

But for me, stocks are a sideshow.

They are not the main event.

And pending your lens, stocks continue to ‘trade per the script’.

What’s more, I think they’re headed lower.

I will talk more about this shortly – but it’s nothing I haven’t said over the past few months (i.e., start dialing in a 3200 handle)

If true, it would represent a peak-to-trough decline of around 33%

And that’s very typical if we are to experience a recession next year.

For example, if S&P 500 2023 forward earnings come in ~$210 (vs $240 expected) – at a PE of 15x – that’s 3150

But let’s get to the main game… bonds.

Bond yields are ripping higher with the 10-year pushing 4% – sending the US 30-year fixed mortgage rate above 7%.

We have not seen that since prior to 2008… and we are not done yet.

All About Bond Yields

There’s an old market saying:

“Where bonds go – so go stocks”

And this has certainly been true in 2022.

Bonds have been obliterated this year – sending yields sharply higher (n.b., bond yields trade inversely to their price).

It doesn’t help that the largest buyer in the bond market (the Fed) has “left the building”!

Funny that.

Rapidly rising bond yields reflect the unwinding of expectations for an early “pause or pivot” from central banks (not just the Fed).

My thesis was markets misinterpreted the Fed after their July statement – seeing it as potentially dovish (as I wrote here)

But people will choose to hear what they want to hear.

In September – Powell reiterated the commitment to squash inflation irrespective of the cost.

In this case, that cost could mean a recession.

This has seen that trade unwind.

Let’s start with the most important financial instrument on the planet…

US 10-Year Pushes 4.00%

At the time of writing, the US 10-year yield trades just below 4.0%

By the time you read this – it will likely be above this level.

But as I wrote last week – it’s not uncommon for these yields to trade in excess of 5.0% to 6.0%

There’s just one difference:

Today’s market became dangerously addicted to historically low rates (i.e., free money) – in turn inflating the value of all risk assets.

Businesses which were not viable all of a sudden were given capital.

End result is you get a massive misallocation of capital (as debt (and risk) are grossly mis-priced).

The tab is now closed.

Sept 27 2022

What is spooking the market is not so much the nominal 4.0% yield — it’s how fast we got here.

Volatility in bond markets is causing havoc in just about every asset class.

And it’s starting to show in debt markets…

Take a look at these two telling charts.

1. High Yield Debt

The first is the ETF HYG – a good proxy for higher yield (i.e. lower quality) debt:

Sept 27 2022

[Two-year yields] are tracking for the biggest annual back-up since the infamous bond market massacre of 1994 (an event that was witnessed by very few of today’s risk takers . . .

By construction, everything that’s now playing out in real time — drastically higher policy rates, the undertow of Fed balance sheet contraction and tighter constraints on US bank capital — points squarely in the wrong direction for liquidity.

Furthermore, one can argue this inflection has just begun. While liquidity is only one input in the fundamental equation, it’s clearly a gathering headwind for risky assets — and again has created a sensation of “abandon ship” within the equity market.

But it’s not just low quality debt…

2. Investment Grade Debt

The ‘higher quality‘ investment grade debt ETF is LQD.

Not unlike HYG – LQD is now trading at its lowest level since 2009.

In fact, it has plunged below the levels we saw during the peak of the pandemic crisis (before the Fed stepped in as a buyer)

Sept 27 2022

Unlike what we see in equities – this is panic type selling.

For example, last week this ETF saw outflows of nearly $800M in a single day.

My read:

The market sees bankruptcies coming next year.

And maybe this is exactly what Powell meant when he warned of “pain” ahead.

“LQD is trading 10% below its 200-day, that’s only reserved for panic type moves — financial crisis and Covid,” said Todd Sohn, ETF strategist at Strategas Securities.

“This move higher in yields is a global phenomenon, perhaps best shown by the evaporation in negative-yielding debt.

You have to wonder how much more pain can go on here though.”

S&P 500: Brace for 3200

A common question I get from readers is when will stocks carve out a bottom.

Short answer is I don’t pretend to know.

And anyone who does is kidding themselves.

However, I can tell you that whilst bond yields continue to rip higher (along with the dollar) – stocks will remain under pressure.

Put another way, we will need to see the bond market calm down for stocks to stabilize.

We have not seen this kind of volatility in bonds since the financial crisis.

It’s highly unusual.

Then again, the Fed adding $4.5 Trillion to its balance sheet whilst keeping rates at zero for more than two years is also highly unusual.

Swings and roundabouts.

Again, I don’t pretend to know when bonds will calm down (especially when you look at what’s going on in the UK – as their bond market collapses)

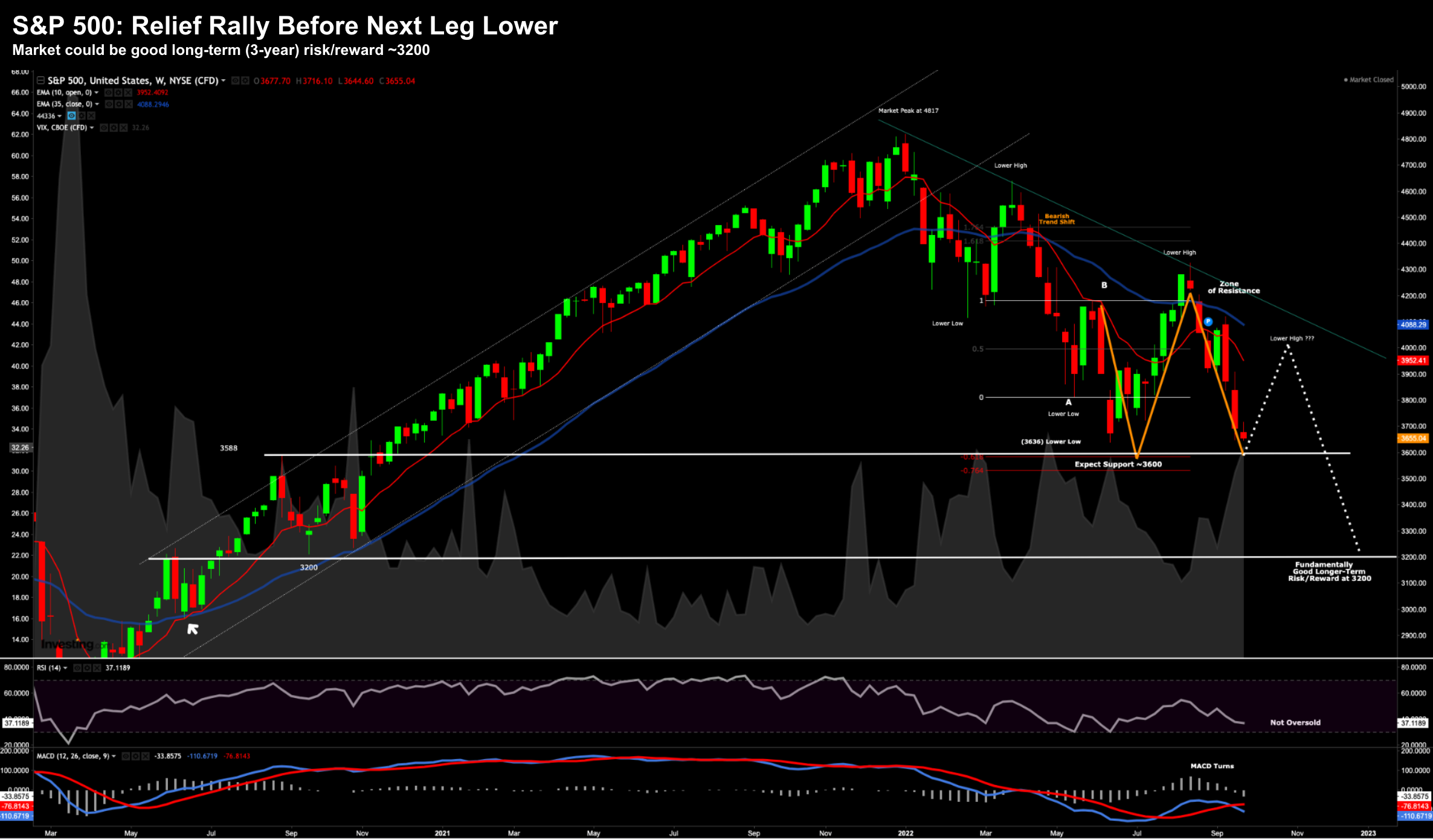

Let’s check in with the weekly chart for the S&P 500 – as 3600 could be about break.

Sept 27 2022

The market feels like it’s at a binary moment.

For example, on the one hand there’s a chance we find support around 3600 (like we did in June) and rally sharply (e.g. 5% or more)

However, I would say there’s an equal chance this level breaks and we finally see “panic selling”

My bet is on the latter.

I say panic selling because we are yet to see it in equities.

The selling to date (although painful for some of you I’m sure) has been orderly.

And those stocks that have lost 70% to 90% of their value fully deserved it.

No sympathy from me if paying more than 10x sales revenue for any stock.

I digress…

But consider the VIX – it’s only trading ~32.

I think that’s too low given the environment and the risks.

From mine, I would prefer to see the VIX trading somewhere between 35 and 40

I think when you see the VIX hitting those types of levels – many traders (and investors) have simply thrown in the towel.

At this stage, everything is sold.

I don’t think we have seen that yet… especially when I see Apple trading above $150.

When Apple breaks down – then I think the entire market gives way.

And selfishly, that’s exactly what I want to see.

Putting it All Together

Technically the chart looks poised to go lower…

But fundamentally I also think there is logic.

For example, there are two catalysts which the market may not yet have fully priced in:

(a) Magnitude of the Nov and Dec rate hikes; and

(b) 2023 earnings revisions

With respect to the former, if you think nominal short-term rates are headed to ~4.50% (and I do) — that implies we could see 50 bps for both November and December.

How much of that is priced into equities?

I would suspect some… but not all.

With respect to the latter, whilst we’ve seen some earnings revisions lower, it has been modest.

For example, according to Factset we have seen them come down around 5.5% (which is twice the historical average).

But looking ahead to 2023 – there has been little change.

My best guess is current estimates for $240 per share are a solid 15% too high.

Put another way, I would not be surprised to see these come back in the realm of $200 to $210 per share.

Remember:

During recessions, earnings typically contract. At $240 per share – it assumes growth.

Now if $200 to $210 per share is accurate (and it may not be) – the next question is what multiple is fair opposite 4.50% interest rates?

My best guess is something in the realm of 14x to 15x would not be unreasonable (it’s certainly not going to be 17x or more)

That lands us around 3200 (or just below)

I’m a strong buyer around this zone if it presents.

And whilst I’m happy adding a little more exposure ~3600 — I will increase my long exposure to around 80% if we see 3200.

Will that be the bottom?

I have no idea.

Probably not.

But I think over 3-years – the upside reward from 3200 handily outweighs the downside risks.

For example, if we can rally back to 4800 in 3 years – that’s 50% upside.

However, if we plunge down to say 2700 (and we could) – that’s only 15% downside.

That’s the sort of trade I’m willing to make.

I can’t say the same thing at a level of 4100 or above.

Certainly not with earnings set to decline in an environment of higher rates and far less liquidity.