- Where bond yields go… so go stocks

- Snap craters ~40% – but most of that are ‘Snap’s problems’

- Google, Meta, Apple, Amazon and Microsoft report next week

Many people were talking about the ~40% capitulation in Snap’s shares today.

Mmmwehh.

Unless you own the stock – who cares?

We know there’s a slow down in ad-spend. We also knew about Apple’s new privacy policy.

And yes… the macro headwinds are there for all to navigate.

Nothing new there.

If you ask me… ‘80%’ of Snap’s troubles are self-induced. They had a chance to act sooner… they didn’t.

But there’s a much bigger – more important – narrative to follow. And it’s across:

- The negative trend in 10-year bond yields (and yield curve);

- The language we hear from the Fed next week on monetary policy; and

- Big-cap tech Q2 earnings and more importantly – forward guidance.

Tonight I will touch on all three…

But let’s start with old market saying:

“Where bond yields go – so go stocks”

For those less familiar – higher bond yields are a sign of a market which is comfortable taking more risk.

That is, participants are less willing to seek the relative safety of bonds and choose greater risk/reward with equities (note: lower bond prices equals higher yields).

On the other hand, when bond yields are falling, it means investors are looking to sell stocks and buy bonds (i.e. driving bond yields lower).

This suggests participants are worried about the growth outlook and park money in the safety of bonds.

Now after rallying sharply the past few months (mostly on the inflation outlook) – bond yields are pivoting sharply.

Let’s take a look at the weekly chart (and then some of the implications opposite the Fed)

10-Year Yields Crash

As part of this post on July 7th – I said to look out for a pivot in bond yields.

I felt that 3.50% could be a near-term top… here’s the chart (and forecast) from 2 weeks ago:

July 7th 2022

I was looking for the 10-year to find resistance around 3.50% – perhaps with a move back to around the 2.20% zone (i.e. just above the 35-week EMA)

Let’s update the chart:

July 22 2022

The 10-year is now trading ~2.75% as markets worry about the increased risks of recession.

It may not sound like a lot – but 85 basis points in just two weeks is an incredibly big move in these yields.

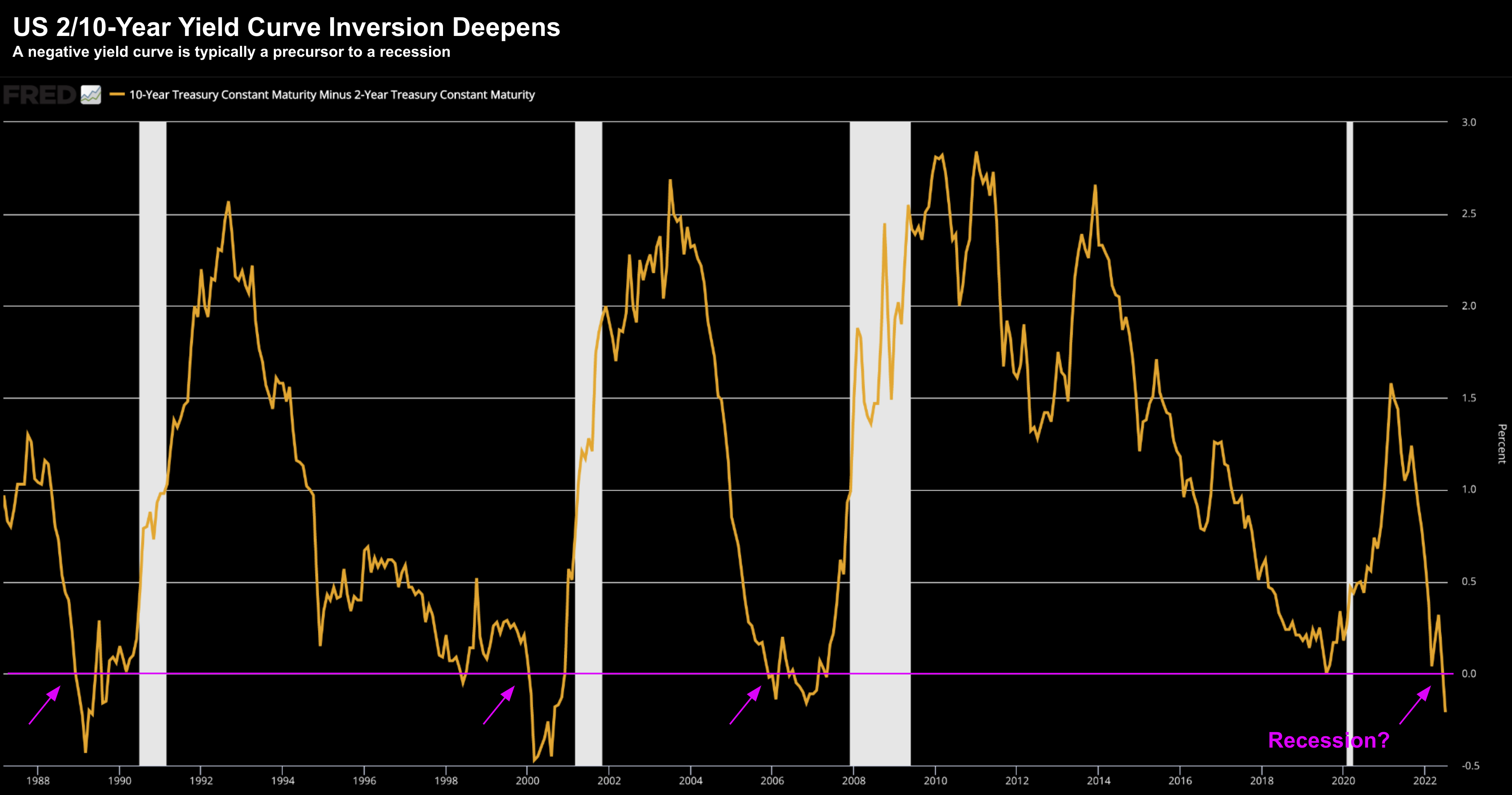

What’s more, the 10-year has continued its descent below the 2-year yield (causing the yield curve to invert further)

July 22 2022

And as we know, a sustained move below 0% with the 2/10’s is generally a strong precursor to a recession.

Things are certainly looking that way – especially with the Fed set to raise short-term rates and the 10-year to sink further.

Now I’ve heard many people suggest we might avoid recession – citing such things as the strength in unemployment and so on.

I am less convinced..

For one reason, many of these reasons are backward looking.

Take unemployment claims. They are now trending higher – which I feel is the ‘next phase’ in the cycle (falling PMIs the first).

For example, one by one we are hearing about layoffs.

We heard from Ford Motor last week – cutting a whopping 8,000 staff.

JP Morgan before them cutting 1,000 folks from their mortgage business (citing poor demand)

Others to cut staff include (certainly not limtied to) Netflix, Tesla, Rivian, ReMax, Peloton, Compass, Redfin and online car dealer Carvana – who slashed 12% of its workforce.

And who knows how many folks lost jobs in the “crypto” world? What a disaster that’s been.

This has seen the number of Americans applying for unemployment benefits last week rose to the highest level in more than eight months

Applications for jobless aid for the week ending July 16 rose by 7,000 to 251,000 — up from the previous week’s 244,000, the Labor Department reported Thursday. That’s the most since Nov. 13, 2021.

What’s more – consider today’s warning from the Purchasing Manager’s Index (i.e., private sector output). Here’s Daily FX

- Flash US Composite output index falls to 47.5 in July from 52.3 in June, hitting a 26-month low

- Services PMI at 47.00 from 52.7 prior, also a 26-month low.

- Meanwhile, Manufacturing PMI slows to 52.3 from 52.7, its worst reading in two years

- The sharp slowdown in business activity suggests that the economy could be heading for a hard landing

But again this is by design…

How do you pull down unacceptably high inflation?

You start by taking money out of people’s pockets.

The goal is less money chasing more goods (not excess money chasing fewer goods)

And this is what the bond market is telling us.

It’s saying the path to growth is contracting (as we saw with todays PMIs)… it means more people are going to be out of work… and it’s more than likely we are going to go into recession.

But what it can’t tell us is whether that recession is mild or something more sinister?

If you ask me – it will be mild – and more akin to what we saw in the early 90s (not 2008)

5-Year, 5-Year Fwd Inflation Expectations Plummet

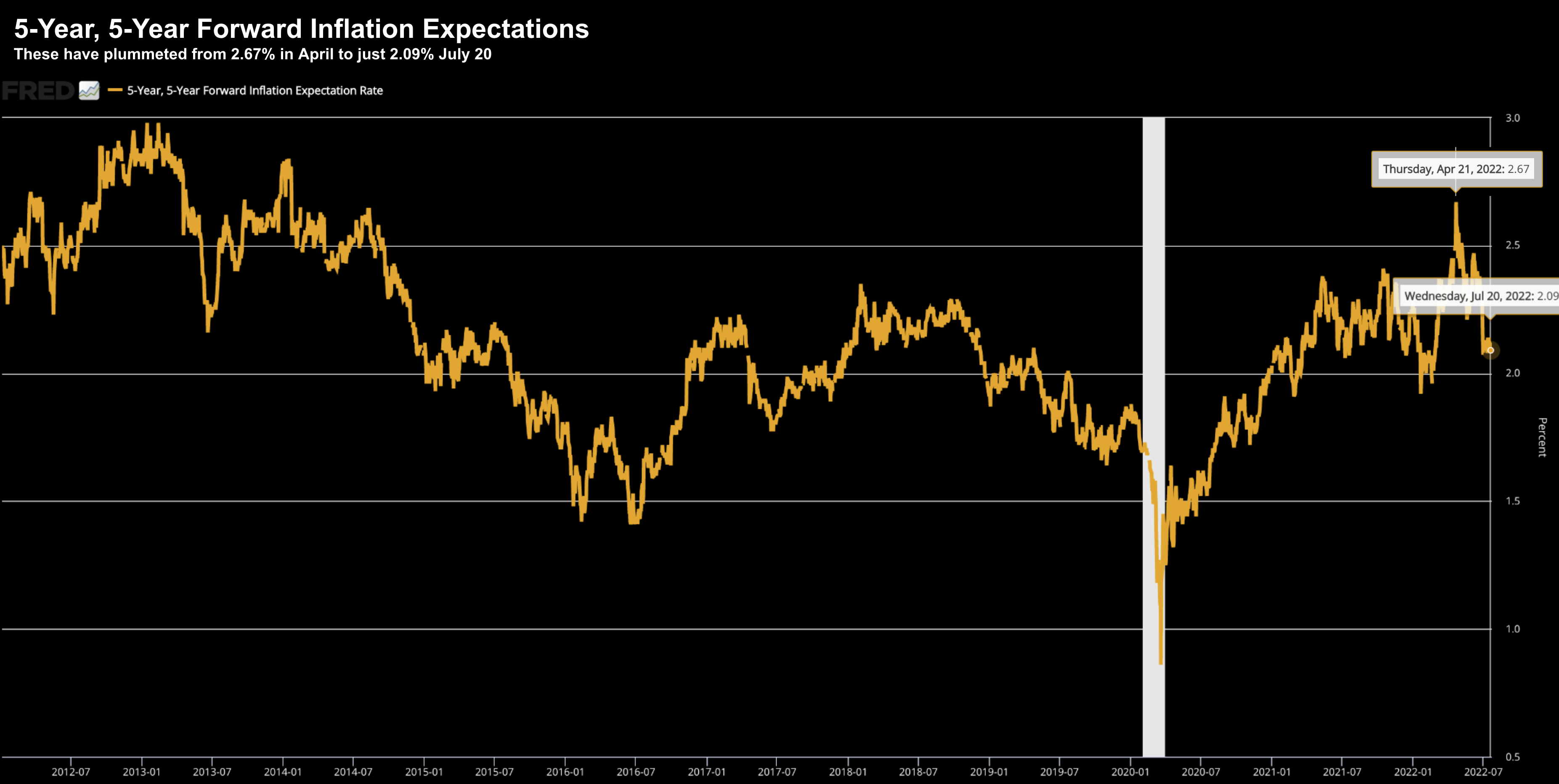

Now somewhat related to the 10-year falling sharply are what we see with 5-year, 5-year forward inflation expectations.

In other words, what the market believes inflation will average between the years 2027 and 2032

July 22 2022

Further to my recent missive on why I think we could be past the worst of inflation (see this post) – the market is now of the same opinion.

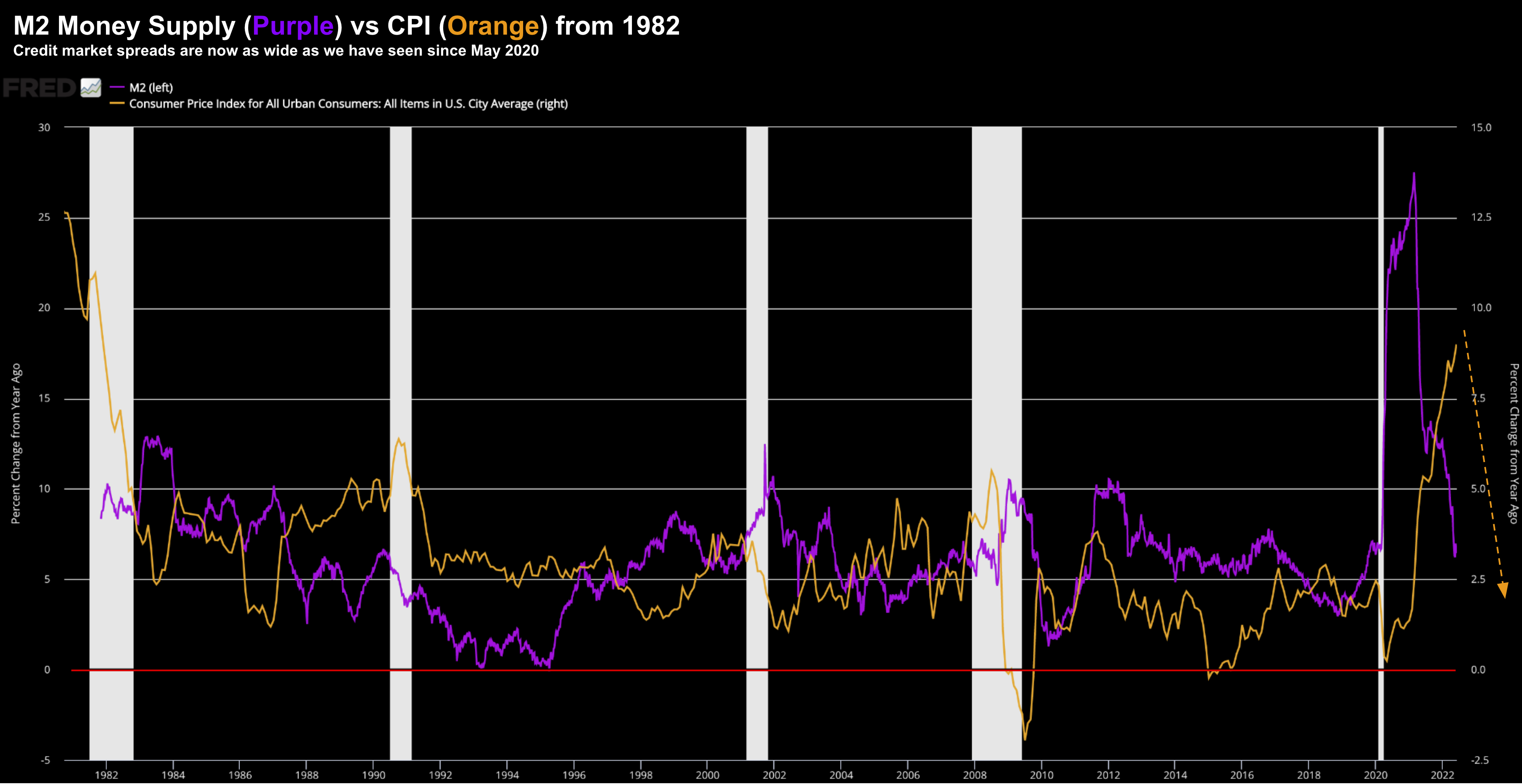

For example, I shared a chart showing the sharp decline in the rate of growth of M2 Money Supply – and the relationship it has with CPI

July 14 2022 – Source FRED

We have already seen the sharp reversal in the price of several leading commodities (less so oil) – but it’s this chart which gives me confidence inflation is likely to materially move lower next year.

Don’t get me wrong – we’re still going to have to contend with inflation of at least a 5-handle for the balance of this year (and possibly into 2023)

I’m sure you will start to see headlines soon around “inflation has peaked” – but anything above 3% is still uncomfortably high.

The ‘good news’ is the Fed’s actions are starting to take effect (not so much for the poor people who have lost employment)

But it will be interesting to hear how the Fed sees this next week…

Fed the Focus Next Week

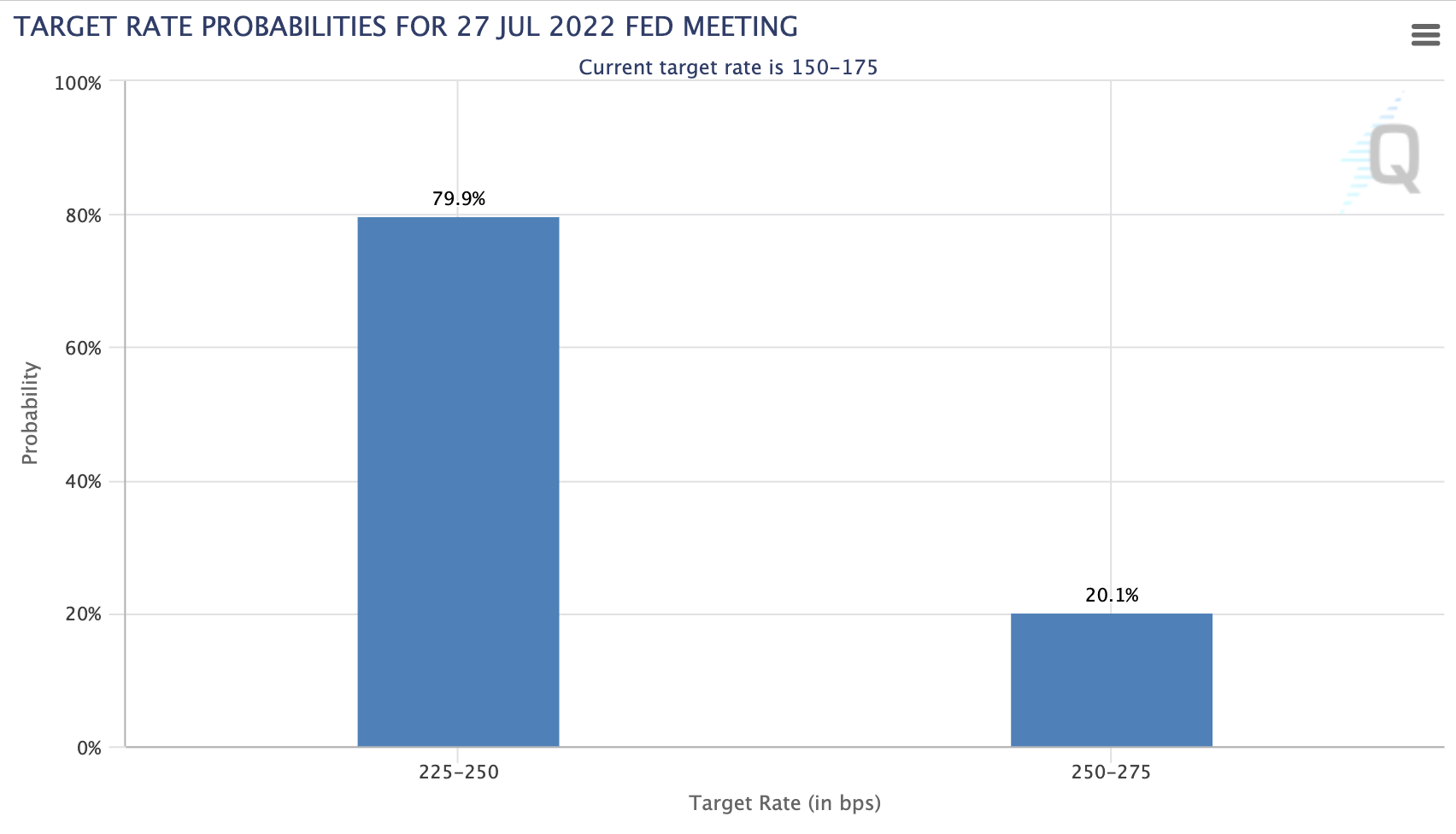

The biggest debate in markets at present is how much the Fed will raise short-term rates next week.

For example, CME’s Fed Watch Tool sees an 80% chance of a 75 basis point rise; and 20% probability of 100 basis points

My take is they will go 75 bps this month; and a further 75 bps in September (with no meeting in August)

However, I would like to see them go 100 bps (as we saw from Canada).

Surely if Canada can do it… so can the US?

From a market’s perspective, we have fully priced in 75 bps.

However, I think we have also priced in the Fed backing off its ultra-hawkish language given what we find with things like

- rising unemployment trends;

- sharply falling PMIs;

- falling commodities (excluding oil due to severe supply constraints)

- inverted yield curve; and

- long-term falling inflation expectations

Put another way, if the Fed continues its hawkish rhetoric without acknowledging the slowdown clearly taking place – this will be bearish for stocks.

There is a risk they over-tighten.

That’s what’s most important here… not the decision itself (assuming its 75 bps)… but how hawkish their rhetoric is.

Big-Cap Tech on Deck!

It’s a toss up as to whether earnings (and guidance) from big-cap tech next week trumps the Fed?

Both play a major bearing on where the market goes from here…

For example:

- A less hawkish Fed could see the market rally; and

- Soft forward guidance from big-cap tech and/or Q2 miss could see the market fall

Now the likes of Google, Amazon, Apple, Microsoft and Meta make up as much as 25% of the entire S&P 500.

There is something like $8 Trillion in market cap right there (and why Snap is a sideshow)

In full disclosure, I have long positions in all of these stocks… with the first four comprising my Top 4.

Fortunately these stocks have rallied sharply the past few weeks – however I have hedged some risk going into next week.

The reason:

I am not confident the “Qs” rally substantially from here.

For example, I think Q2 earnings will be ‘okay’ – however look for a stronger dollar impact that what’s priced in.

I also think we’re going to see pressures on margins and subsequent guidance.

And whilst I’m not a seller of these names (I’ve been adding to them prior to the recent run up) — I have been selling out-of-the-money (60-day) call options.

In short, I expect the stocks to do one of three things post earnings:

- Fall

- Stay flat; or

- Rise slightly (e.g. less than 10%)

In each of these cases, I will collect the option premium at a healthy yield. And should the stock rally meaningfully – then I face a decision on whether I want to be called away on the positions (also keeping the premium and pocketing a nice capital gain).

But if I zoom out – I don’t like the look of the weekly QQQ chart:

July 22 2022

Four observations from a technical lens:

- The weekly bearish trend (which commenced first week of Feb) remains in-tact

- The QQQ broke its previous major low the last week of Jan (also a warning)

- Prices continue to make a pattern of “lower highs and lower lows”; and finally

- This ETF has rallied 15% in 5 weeks (too much too fast)

Put together, there’s little which instils confidence this ETF can rally much further in the near-term

Sure, we might see another 5 or 10% assuming these companies post:

(a) better than expected Q2 earnings (usually the case for Apple); and equally

(b) provide robust forward guidance.

I expect the former but not the latter.

But what I have more confidence in technically is resistance at the 35-week EMA zone (blue line) – whilst we are in a bearish trend.

From there, I think we go lower.

From that perspective, it would not surprise me to see the QQQ fall back to its 6- year trend channel between $220 (the extreme lower end) and $260 (upper end).

And if that were to eventuate – and with big-tech comprising ~25% of the S&P 500 total capitalization – that could see us somewhere near 3500 on the S&P 500

That’s a good long-term risk reward entry point.

Putting it All Together

Whilst the market was higher for the week — Friday dragged on the session.

Maybe some traders were trying to read the online ad “tea-leaves” from Snap (and Twitter) as it applies to say Meta and Google.

Part of me gets that – it’s the same market. However, it’s not like-for-like.

Not even close.

Consider the most important financial metric of all – free cash flows.

Meta does something like $24B and Google $70B annually.

Snap on the other hand doesn’t make a profit and burns through $150M… whilst posting flat revenue growth (more detail in yesterday’s post)

Moving on…

Big-cap tech earnings next week will be crucial as to the market’s direction.

I would argue it carries just as much (if not more) than the Fed.

For example, we know what the Fed are going to do 75 bps – we are just waiting to hear how hawkish they choose to be.

Will they dial it back given the recent (weakening) data points?

But we don’t know what big-cap tech is going to tell us looking ahead. For example, some questions could include:

- How do they see both enterprise (cloud) and consumer spend (most relevant for Apple)?

- How is inflation impacting margins?

- What has been the strong dollar impact on offshore earnings (as much as 50% of the total)?

- What capex and opex decisions are they making to counter the headwinds? and

- What trends / challenges does Apple see in China (a big part of their growth story)?

For me, this will determine the next leg of the market and perhaps whether we have seen “the bottom” for 2022.