- Markets surge on revived rate cut hopes

- Is the labor market weakening?

- Consumer sentiment plunges to fresh lows (and it’s easy to explain)

Never confuse the stock market for the economy.

They are two very different things.

And whilst there are times when the two will trade in unison – there are also plenty of occasions when they diverge.

Now is possibly the latter.

For example, this week we had a plethora of ‘less than positive’ economic news (which I will get to).

But it didn’t stop the market surging back to near record highs.

Why?

Every bit of bad (or soft) economic news is a step closer for the Fed to lower rates.

Lower rates (and bond yields) are generally good for stocks (in the absence of a recession).

That’s what the market is pricing in – at least one cut (maybe two) before year’s end.

All that stands in the way is uncomfortably high inflation prints (i.e., anything with a 3-handle or above)

But should at least one rate cut fail to materialize (which I flagged as a risk early April) – then stocks will likely recalibrate.

Let’s recap some of what we learned during the week…

Job Layoffs Edge Higher

If you’re a regular reader – you will know I’ve been calling for a rise in the unemployment rate.

For example, my expectation is this will rise to between 4.0% and 4.5% before year’s end.

And if we see something close to 4.5% – pencil in a recession.

But for now, employment appears strong (at least in terms of part-time work).

I say that because over the past 12-months – the economy has lost 398,000 full time jobs.

This has been a part-time job recovery.

I digress…

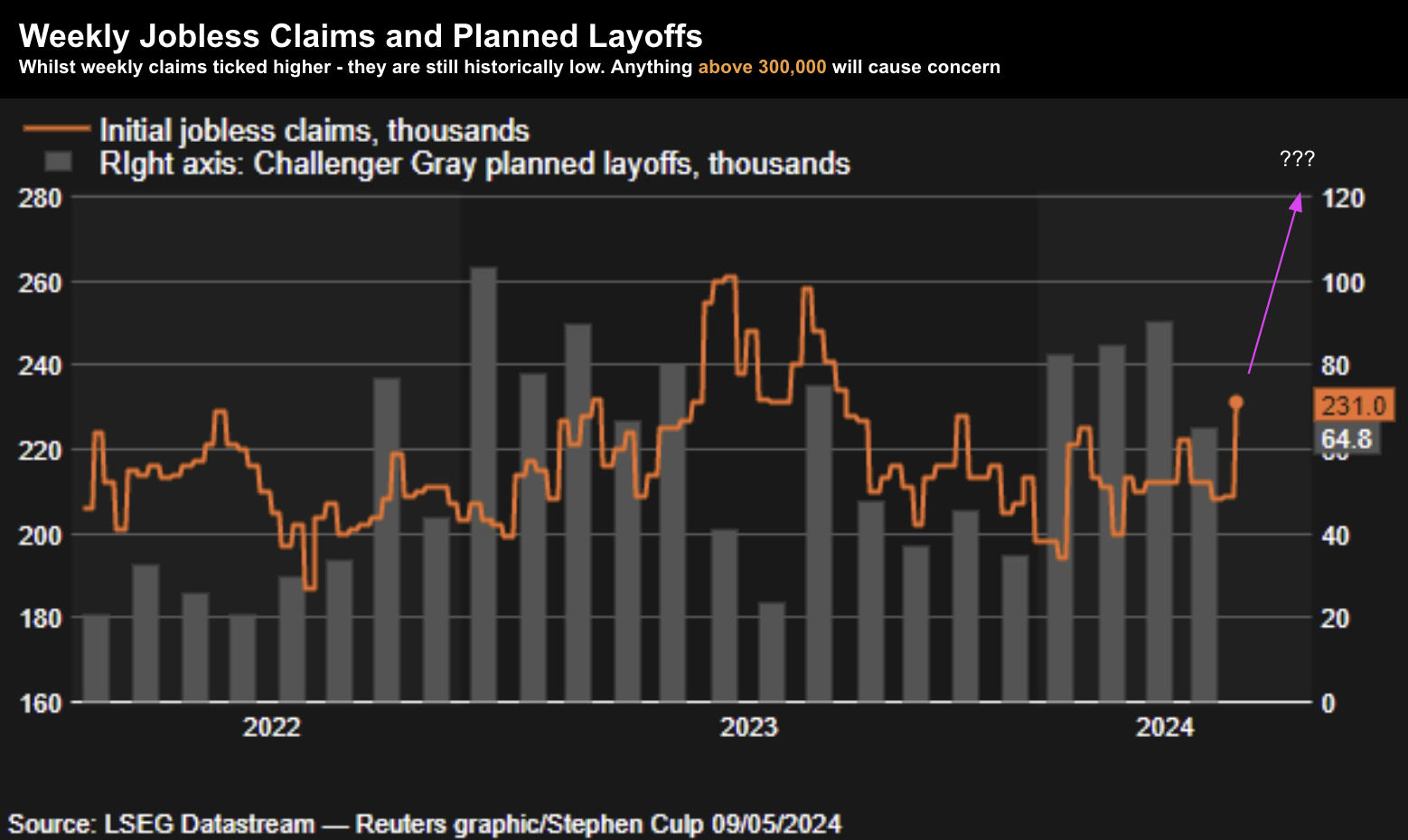

This week’s news of weekly layoffs rising to their highest levels since August sent stocks meaningfully higher.

As I say, “bad news for Main St. is good news for Wall St.”

From APN:

The number of Americans applying for unemployment benefits jumped to its highest level in more than eight months last week, another indication that the red hot U.S. labor market may be softening.

Unemployment claims for the week ending May 4 rose by 22,000 to 231,000, up from 209,000 the week before, the Labor Department reported Thursday. Though last week’s claims were the most since the final week of August 2023, it’s still a relatively low number of layoffs and not cause for concern.

The four-week average of claims, which softens some of the weekly volatility, rose by 4,750 to 215,000. Weekly unemployment claims are considered a proxy for the number of U.S. layoffs in a given week and a sign of where the job market is headed. They have remained at historically low levels since the pandemic purge of millions of jobs in the spring of 2020

I talked about this a while ago… suggesting a weekly claims number less than 300,000 is not cause for concern.

As the APN article correctly noted – it’s still historically low at just 231,000 claims.

However, it was up from 209,000 last week – and why it got the market’s attention.

From mine, if this kind of velocity continues for a few more weeks – then we will likely see a rise in the unemployment rate.

Let’s now turn to another soft data point….

Consumer Confidence Plummets

One of the most important indicators we have is how consumer’s feel about the economy (and their prospects).

And whilst certain political leaders will talk up the economy (e.g., jobs, lower inflation, growth) – it may not align with what average consumers are feeling.

How they feel determines whether they are more likely to borrow and spend.

And the news isn’t good…

The University of Michigan Survey of Consumers sentiment index for May posted an initial reading of 67.4 for the month, down from 77.2 in April and well off the Dow Jones consensus call for 76.

The move represented a one-month decline of 12.7%

Why?

Simple: these are “kitchen table issues”; i.e., putting food on the table; paying for shelter, insurance, health care, energy and utilities.

It comes back to what I was saying about inflation the other week…

Whilst some politicians and economists will ‘brag’ about inflation being “lower” at say 3.5% – prices are still more than 20% higher than 3-4 years ago.

A quick personal story…

Last night I went out for dinner to one of our favourite Japanese restaurants.

We had a modest meal enjoying two beers each.

This is not a ‘expensive’ restaurant by any means (here’s a link to the menu).

For e.g., the ‘Sashimi Sampler’ (9 pieces) is US$29 (exc. tax). And whilst our meal was delicious – there’s no change from US$150 (or AU$230) after the tip.

But that’s what it costs to have a modest meal out…

It’s no longer ~US$100 for two people (which we used to be able to do).

I digress but it gives you sense of what it costs to eat out…. it’s not what I would consider ‘cheap’.

This is why I think many people are feeling the pinch…. they’re not feeling better off vs prior to the pandemic.

Things cost a lot more for essential services (let alone a small ‘luxury’ like eating out)

For example, with respect to where people feel inflation is headed, the one-year outlook jumped to 3.5%, up 0.3 percentage point from a month ago – its highest level since November.

Also, the five-year outlook rose to 3.1% also to the highest since November.

Here is Paul Ashworth from Capital Economics:

“All things considered, however, the magnitude of the slump in confidence is pretty big and it isn’t satisfactorily explained by geopolitical factors or the mid-April stock market sell-off. That leaves us wondering if we’re missing something more worrying going on with the consumer.”

Maybe the 3-4 year ‘20-25%’ increase in the cost of such things as shelter, food, energy, health care and insurance Paul?

Wild guess.

The next important data point for inflation comes Wednesday (Thursday in Australia) with consumer price index (CPI) report for April.

Wall Street economists expect the report to show a slight moderation in price pressures, though the widely followed CPI index has been running well ahead of the Fed’s target, at 3.5% annually in March

From mine, anything with a “3-handle” has the Fed firmly on hold.

Market Cheers the Bad News

Whilst the market celebrated a weaker job claims report and plunging consumer confidence – it may not love a CPI print in the realm of say 3.3% to 3.5% next week.

My quick take is uncertainty of the inflation path will likely put a lid of equities rallying too far.

However, should inflation continue to weaken (which I expect during H2), the market will have more confidence.

To that end, the Fed will need to try and “thread the needle” of balancing sustained unwanted inflation (i.e., achieving price stability) with growth.

I say that because growth will come under pressure should the consumer weaken.

This comes back to jobs and confidence.

And with the government likely to moderate fiscal spend (we can only hope!) – can the consumer continue to ‘plug’ the so-called GDP gap?

70% of GDP is consumption based.

With that, let’s demonstrate via the tape why “bad” economic news was “great news” for stocks:

May 11 2024

Bulls wrestled back control three weeks ago with a close back above the 10-week EMA.

At the time, I highlighted this a near-term indicator of (bullish) sentiment.

The S&P 500 appears it could challenge the recent high of 5264

And whilst our trend remains bullish – my question is what will the next catalyst be to propel it forward?

For example, a much lower-than-expected CPI figure next week could add to rate cut expectations.

However, the opposite holds true.

Or we may want to pencil in the date of May 22nd…. the day of Nvidia’s (NVDA) earnings.

For what it’s worth, NVDA will beat expectations, raise guidance, then beat again next quarter.

That’s a near ‘lock’ – and the market knows it.

But…

Despite beating… raising… beating again… we’ve seen the stock sell off post impressive earnings.

Put another way – much of this (and more) is already built in.

Therefore, I’m curious as to whether NVDA could signal a market (AI) top.

For example, if there’s a hint “AI investor FOMO” is starting to wane – this could lead to a broader slow-down.

I saw that because we should consider Zuckerberg’s comments recently — reminding investors it will take “several years” to see a return on Meta’s (large) AI investments.

Historically, investing to build these new scaled experiences in our apps has been a very good long-term investment for us and for investors who have stuck with us,” Zuckerberg said on the first quarter earnings call, drawing an analogy to the rollouts of Stories and Reels.

And the initial signs are quite positive here, too. But building the leading AI will also be a larger undertaking than the other experiences we’ve added to our apps, and this is likely going to take several years.

Post Zuck’s comments – it was enough to spook the market.

And whilst I’m certain that (many) AI investments will help companies be more productive / improve their margins over time — how much of this is priced in?

That’s the question (and it’s impossible to know)

With that, pencil in May 22 as a potential market turning event.

As we have seen so far, the slightest breath of disappointment on either earnings and/or guidance has seen stocks get punished.

Putting it All Together

My view is the market remains hopeful there was enough bad news on the economic front to see at least one rate cut this year.

However, the runway for rate cuts is fading as we approach the November U.S. Presidential elections.

The Fed will not want to be seen as influencing the result.

For example, a rate cut (especially with inflation trading with a 3-handle) could be interpreted as helping the current Administration.

As I draw this post to close, I will end with some recent comments from three Fed officials.

Two of them (Williams and Barkin) are doves (much like Powell) – however there is a hawk:

- New York Fed President John Williams on Monday told attendees at the Milken Institute Conference that he anticipates the Fed cutting rates and that monetary policy is currently appropriate for now. The Fed, he maintained, will need to see more encouraging data before beginning to ease.

- Richmond Fed President Thomas Barkin, speaking at the Columbia Rotary Club in South Carolina on the same day, expressed optimism that the existing fed funds rate is sufficient for bringing inflation to the central bank’s 2% target; and finally

- Minneapolis Fed President Neel Kashkari, released a paper this week that maintains continued housing inflation and strong demand points to the potential need for a rate hike. Inflation, he wrote, could potentially settle in at a 3% rate. While speaking at the Milken Institute Conference yesterday, he said he needs to see multiple data points illustrating that disinflation is continuing before he would support a rate cut.

This tells me Fed members remain divided (and with good reason).

For example, whilst it’s true that inflation remains too high… it’s also true the economy is showing clear signs of slowing.

Therefore, does the Fed need to wait until inflation drops to a “high 2-handle” before cutting?

Your answer will be a function of your own lens.

The doves will say they don’t need to wait; the hawks will suggest otherwise.

For what it’s worth, the market still sees one (possibly two) rate cuts before the end of the year.

However, I would suggest that if that’s to transpire – inflation will need to see further signs of slowing.

Until next week…