- 10-Year Bond Year Plunges to find support at ~4.50%

- Job additions slow sharply in Oct – but govt jobs surge (again)

- Markets still betting on no recession for 2024

What a week!

A weaker than expected October payrolls print sent stocks flying and bond yields sharply lower.

The S&P 500 finished at 4358 – a whopping 5.9% for the week.

It was the market’s best week for the year!

I will take a closer look at the tape later in the post… offering some parallels to other times we’ve seen stocks add ~5% in a week.

My best guess for the renewed bullish enthusiasm was investors betting the Fed is done.

And that makes sense…

Repeating my language from earlier in the week – if employment, growth and inflation continue to soften – there’s every possibility the Fed has hit its terminal rate.

However there is a caveat…

Not only will the Fed need softer economic data – they are hoping the bond market continues to keep financial conditions tight (i.e. bond yields stay high)

This could promise to be an interesting dynamic in the months ahead – particularly if the 10-year yield falls too far.

My expectation is we will see a 10-year yield closer to 3.5% by mid 2024 (and why I was accumulating bonds the past few weeks)

With that, let’s start with a deeper dive on October’s jobs report.

I think it was actually weaker than reported (similar to last month)

Jobs are Slowing

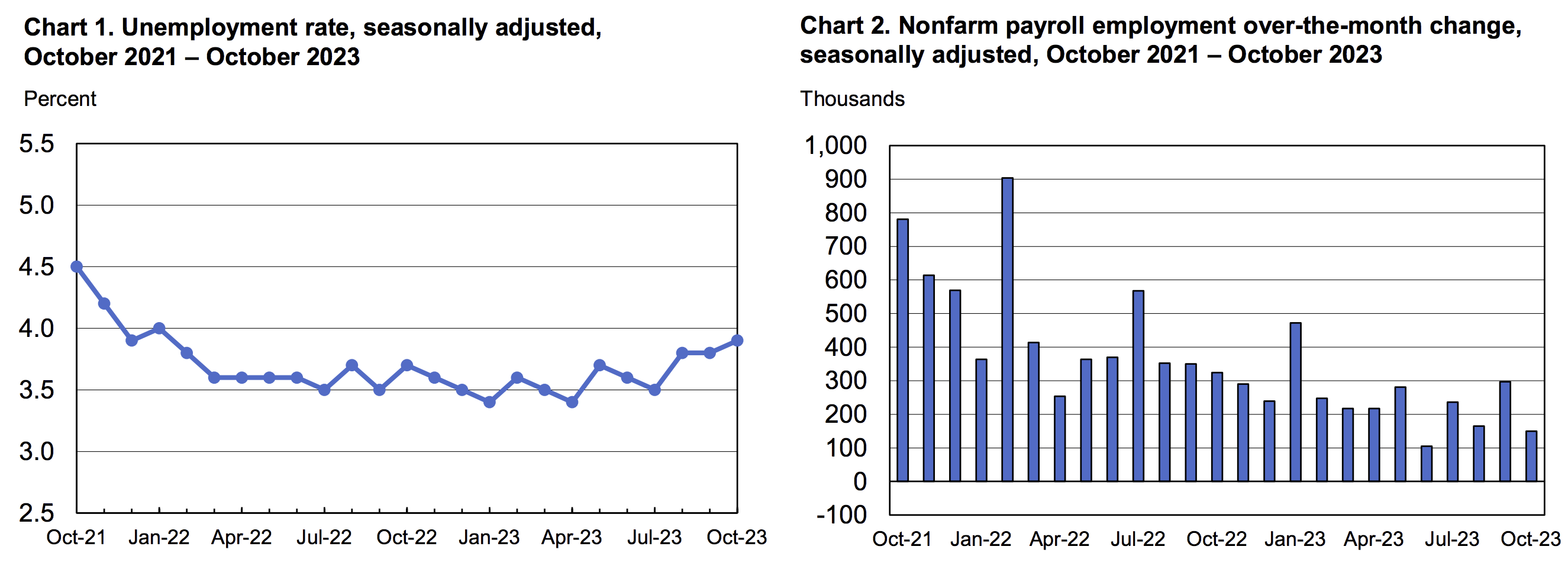

The BLS told us that total nonfarm payroll employment increased by 150K in October – a lot lower than the 180K expected.

What’s more, the unemployment rate nudged slightly higher to 3.9%

From mine, the troubling part of the report was where the jobs were added (as I highlighted last month).

Health care, government, and social assistance saw the strongest gains.

For example, the government accounted for a whopping 50K of the 150K jobs

This is consistent with the avg 50-60K government jobs being added every month the past 12 months.

Excessive government jobs are not productive.

They are an increased tax burden on the economy – where deficits and debts are already at unsustainable levels.

What we need to see are stronger gains in the productive (income producing) part of the economy – but we are not.

It’s the income producing part of the economy which generates the tax revenue.

It’s not more government workers!

Now with respect to productive employment – we saw this decline again.

In fact, we’ve lost more than 700K productive jobs since June. The strongest sector in decline over October was manufacturing.

Employment fell by 348,000 increasing the already wide divergence between jobs and employment.

In August, employment rose by 222,000 but unemployment rose by 514,000.

From mine, I think we will see the chart on the left (the unemployment rate) continue to tick higher.

It’s now at the highest level since January 2022. However, most economists expect this not to exceed levels of ~4.5% next year.

What’s also noteworthy are the previous monthly revisions.

Job additions were revised 101,000 lower over the past two months – which is material. For example:

- August was revised down by 62,000 (from +227,000 to +165,000); and

- September was revised down by 39,000 (from +336,000 to +297,000)

Let’s now turn to hours worked and wages.

- Average weekly hours of all private employees was flat at 34.3 hours (from 34.6 hours a year ago)

- Average weekly hours of all private service-providing employees fell 0.1 hour to 33.2 hours.

- Average weekly hours of manufacturers fell 0.1 hours from a negative revision to 40.0 hours.

And whilst ~18 mins per week YoY lower may not sound like much (i.e. 34.6 to 34.3 hours) – it removes more than $50B of income from the economy.

- Avg hourly earnings of All Nonfarm Workers rose $0.07 to $34.00. A year ago the average wage was $32.62 – a gain of 4.2%.

- Avg hourly earnings of Production and Nonsupervisory Workers rose $0.10 to $29.19 – a gain of 4.2%.

And whilst these gains are now keeping pace with inflation – they are still ~1.2% too high for the Fed’s comfort zone.

The Fed typically target wage growth of ~3.0% vs 2.0% inflation.

Yields Plunge on Jobs News

If you ask me, the stock market rally was fueled entirely by what we saw in the bond market.

I will start with the 2-year yield – which is a great proxy for where the market believes the Fed is headed with monetary policy:

Nov 4 2023

One week ago you had the opportunity to secure a 2-year yield of 5.15%.

Not now.

Today that yield is just 4.84% and from mine – is likely to head lower.

As an aside, this is why I was suggesting last week that folks look to secure this attractive yield. It may not last.

And whilst the 2-year has dropped around 41 basis points over 3 weeks – the move in the 10-year was equally extreme.

Nov 4 2023

The week before last the 10-year traded a fraction over 5.0%

This week they traded just below 4.5% – a drop of 50 bps.

That is a stunning move by any standards…

However, I could argue that the drop in the 2-year is more important (for the simple reason the market sees cuts as early as June 2024)

Fed Funds futures now show only a 10% chance for a hike by January, down from 32% prior to the October payrolls report

And down from a 41% probability before Jay Powell spoke saying “they might be done”

Now back to the 10-year….

With yields trading above 5.0% – Bill Ackman and Bill Gross both ‘rang the bell’ on this instrument.

For example, Ackman covered his large 10-year bond short position (expecting yields would fall); and Gross said now is the time to buy long-term bonds.

Whilst it’s still too early to say – these billionaire hedge fund managers might have “top ticked” the tape.

Personally, I’ve been accumulating a position in long-term debt with yields this high (both across government and corporate debt).

However, I didn’t pretend to know where the 10-year would peak?

For example, I had every expectation we could see 5.25% over the next month or two on the 10-year (depending on how many bonds the government planned to sell).

As I wrote recently – Yellen surprised the market early this week – coming in much lower than expected – sending yields lower.

However, my “bet on bonds” is we will see the 10-year trading with a “3-handle” at some point next year (perhaps in the second half at a guess)

And it could be sooner if the economy deteriorates faster than expected – I don’t pretend to know.

I’m making a directional bet that yields drift lower in the near-term (e.g. where near-term is the next 12 months)

This week, those positions all rallied sharply (good news for my portfolio).

I expect these yields to continually drift lower (i.e., bond prices to rise) on the assumption that economic data like jobs and growth continue to weaken.

Markets Front Run the Fed

Further to my preface, the S&P 500 had its best week all year.

We have not seen a week like it since November 2022 – where the losses of the past two weeks were erased.

Let’s take a look using the weekly timeframe:

Nov 4 2023

On the chart I’ve labelled 4 similar weeks over the past 2 years.

Whilst weeks like this one certainly feel great (and we see the positive impact on our portfolios) – take them with a grain of salt.

Let’s start with the week of Dec 2020 2021 (#1)

That week, the S&P 500 rallied 3.6%. Only three short weeks later those gains were gone.

#2 on the chart was the week of March 14 2022 – where the Index rallied 5.9%. Six weeks later those gains were lost.

#3 was May 23 2022 – which saw the market add 5.7%. Those gains lasted two weeks.

Finally, #4 was the week of November 7th 2022 – gaining 5.4%. Six weeks later those gains were given back.

This week we gained 5.9% (#5).

Will this see something similar?

What’s my point?

Extreme volatility is typically not a good thing.

That’s not a sign of a healthy market. If anything – it’s more indicative of short covering.

And whilst we could easily see a little more follow-through (e.g. to a zone between 4400 and 4500) – I think that’s where we will find selling pressure.

For example if this week was more short-covering than genuine buyers – this rally may not last more than a few weeks.

Now I could be totally wrong…

It would not be first time.

This could be the start of the next major rally and we finish the year near the highs.

And if we were to see further gains – I would not be unhappy given my ~65% long position.

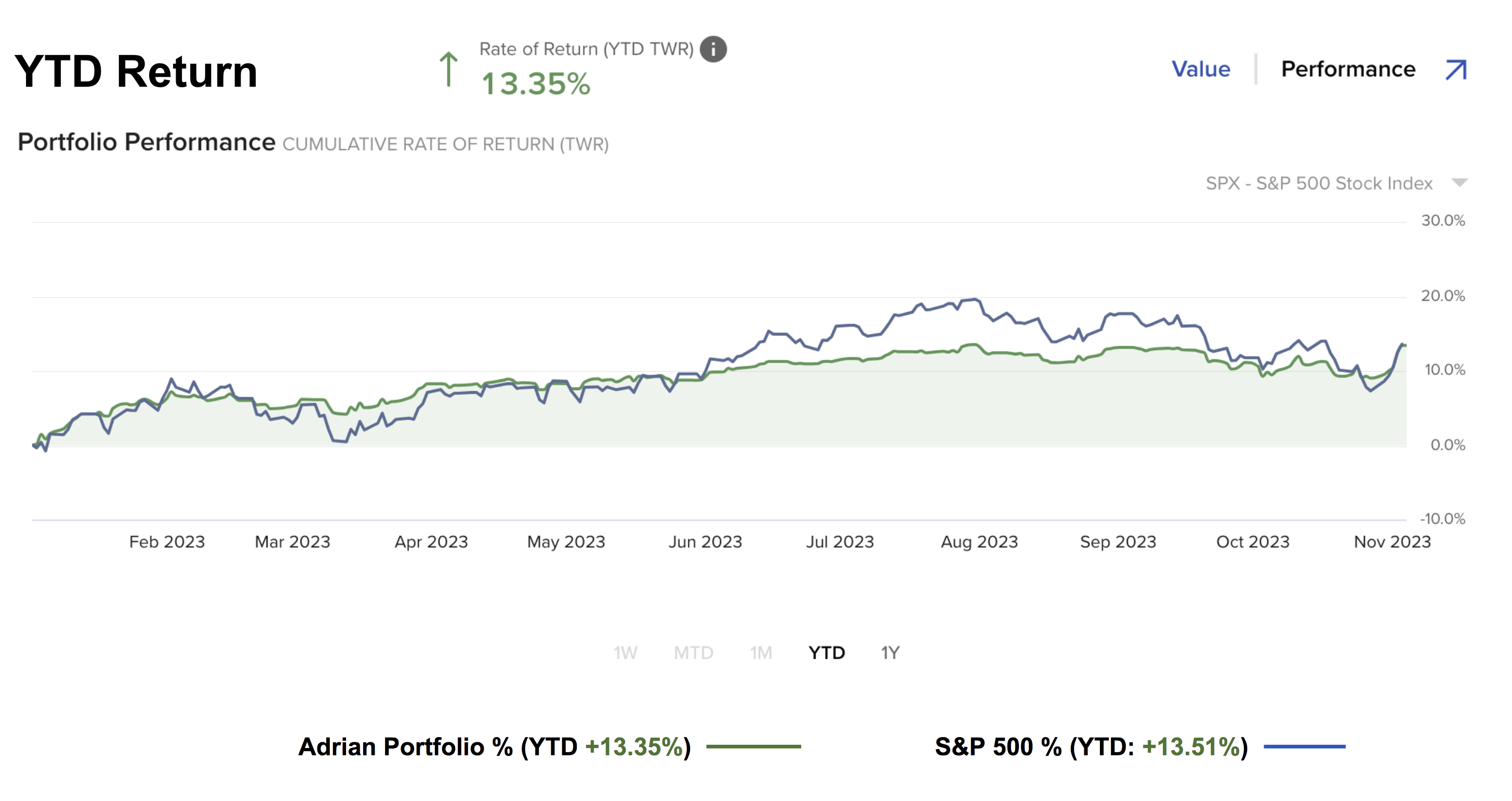

For example, below is how my portfolio performed this week – up ~4.4%

Nov 4 2023

The only positional change I’ve made the past few weeks was my exposure to fixed income.

For example, I increased my position sizes in vehicles such as EDV, AGG and HYG.

Each of these had gains due to lower yields.

I’m essentially at parity with the S&P 500 YTD – just 0.15% behind.

And given my exposure to fixed income – if yields continue to drift lower – I expect my portfolio will do well.

The opposite also holds true.

Putting it All Together

Speculators were very encouraged by the softer economic data.

With wage growth moderating and higher unemployment – it gives the market hope the Fed is closer to ending its rate hikes.

And we’re seeing this with the 2-year yield (as a proxy).

This tells us the market sees cuts ahead in the not-too-distant future (e.g. June 2024)

It’s true the Fed will welcome the slower economic data. However, the central bank also requires the market to keep financial conditions tight.

In other words, it will not want to see bond yields fall too far.

For example, loosening financial conditions could reignite a surge in inflationary pressures.

We need to watch both of these variables.

For now, financial and economic outcomes depend on soft, stable data, not too hot, not too cold.

That’s the soft-landing scenario.

For mine, any so-called “landing” next year might be bumpier than what most expect.