- S&P 500 books a 19.4% loss for the year;

- A foolish forecast for 2023; and

- Important questions to think about…

And it’s a wrap…

2022 is now officially in the books – with the S&P 500 recording its forth worst performance since 1945 (and its worst since 2008).

- 2008: -38.5%

- 1974: -29.7%

- 2002: -23.5%

- 2022: -19.4%

I’ve personally traded through three of these pullbacks (being only 3 years old in 1974).

By any measure, it was tough going.

For example, those with over-exposure to the following sectors are probably licking their wounds:

- Communication Services: -40%

- Consumer Discretionary: -37%

- Real-estate: -28%

- Technology: -28%

I avoided the first three… however took a hit on big cap-tech (as I shared yesterday)

However, as I wrote yesterday, healthcare and energy were the big sector winners. Specific Dow winners included:

- Chevron: up 52% (its best year since 1980)

- Merck: up 44%

- Travellers: up 19%

- Amgen: up 15%

How Quickly Things Can Change

For example:

- Equities hit their all-time high in the first week of 2022 (S&P 500 at 4817)

- Forward PE earnings multiples traded ~22x

- Fed funds rate was at 0.125%

- US 10-year yield at 1.63%

- CPI was a concern at 7.5% (and trending higher)

- Job additions at 504K; and

- Russia was amassing troops at the border of Ukraine – something to watch.

With respect to the troubling CPI – the Fed had removed the word “transitory” from its vernacular in Q4 – and warned us that rates were going higher. However, what we didn’t know (and could not forecast) was:

- How high?

- How fast? and

- How long?

- S&P 500 had plunged to 3600 – a fall of 25% in 6 months

- Fed reiterated its commitment to contain unwanted inflation at any cost (including a recession)

- Fed funds rate was 1.62% (up 150 basis points after 3x 50 bps hikes)

- US 10-year yield was 2.95%

- CPI hit 9.1% (which turned out to be the peak)

- Job additions were still in the range of 300K+ per month;

- Putin declared an unprovoked war on Ukraine; and

- Oil prices surged

Energy prices, inflation and the Fed’s response consumed the market. In 6 months we had flipped from euphoria to near panic.

This brings us to today:

- S&P 500 closed at 3839 – down 19.4% for the year

- Forward PE multiples trade ~17x (with an open question on the “E” in “PE”)

- $12 Trillion in market cap erased from the market

- Fed funds rate at 4.375%

- US 10-year yield at 3.88% (after trading above 4.1% last month)

- CPI dropped to 7.1% (and trending lower)

- Recession risks notably higher;

- Job additions at 260K per month;

- Putin’s war on Ukraine continues with no end in sight; and

- Will China invade Taiwan?

Dec 30 2022

Technically I felt the market traded ‘per the script’...

Then again, that’s primarily a function of what your own script is!

I’ve shared these lines all year… offering a guess of where the market was likely to find resistance and support.

We entered a weekly bearish trend early in March and proceeded to make a series of lower highs and lower lows.

For example, we found resistance around the 35-week EMA zone — where the market made an interim top whenever the VIX traded at or below 20

What’s more, we found expected support around 3600 which lined up with (a) the high of 2020; and (b) 61.8% outside the retracement labelled A-B

Traders were advised to do two things:

- Sell weaker stocks on any strength (i.e., those with negative free cash flow; high multiples; excessive debt; weak competitive moats); and

- Add to quality on the dips (e.g., strong free cash flow, strong balance sheets etc)

New Lows in 2023?

Looking ahead, I maintain we make new lows in 2023 however it won’t be in a straight line (it never is).

As I’ve written often over the past two months – I think we retest the October lows in the first quarter.

Stocks may catch a bid here as more tactical traders step in.

However, I expect the script of 2022 to repeat, where the market works its way to a multiple closer to fair value (e.g. 15x to 16x forward earnings).

That said, don’t be surprised to see something lower.

Perhaps the more difficult question is what will earnings be next year?

Mike Wilson of Morgan Stanley sees earnings per share (EPS) as low as $180 – which would represent a decline of 18% YoY.

From Fortune:

“The final chapter to this bear market is all about the path of earnings estimates, which are far too high”. Wilson predicts earnings of $180 per share in 2023 for the S&P 500, versus analysts’ expectations of $231

Today consensus earnings are for ~4% growth or $231 per share.

If we apply a 16x multiple to EPS $231 – it would see the S&P 500 at 3696

From mine, I don’t have a specific end of year target.

However, there are three zones (3600, 3400 and 3200) where I will be increasing my long exposure.

Dec 30 2022

I’ve nominated these zones as I don’t pretend to know how low stocks will go next year?

Stock could bottom at “3600” or it could be “2700”.

For example, let’s consider Mike Wilson’s $180 EPS target (or an ~18% decline YoY)

Let’s apply a range of forward multiples to those earnings:

- 15x = 2700 (inline with historical market average)

- 16x = 2880

- 17x = 3060

- 18x = 3240 (arguably expensive with rates above 4.0%)

Wilson’s target of $180 cannot be ignored. In fact, his target is very much line with average recession declines.

Below is a research note from D.A.Davidson giving further weight to his forecast:

It is important for investors to know during recessions that economic downturns create challenges for corporate profits, and S&P 500 earnings growth turned negative in each of the past ten recessions.

S&P 500 earnings per share (EPS) declines, from peak to trough, ranged from -4.6% in the 1980 recession, to -91.9% during the Global Financial Crisis (GFC) from 2007 to 2009.

The average earnings decline across all ten recessions was -29.5%.

That included two unusual events, as the GFC caused a collapse in the financial system and bank earnings, and the earnings decline in 2001 followed the bursting of the technology bubble, causing a massive earnings decline in that sector.

Excluding the recessions of 2001 and 2008 — the average earnings decline during the other eight recessions was -18.7%

My guess is we see an EPS contraction in the realm of 10-15%.

And if we see that – I would consider that a very mild (light) recession.

That said, if your view is at least three years, buying the market in the range of 3200 and 3600 will most likely see you produce above average returns (e.g. CAGRs of 10%).

Remember:

It’s not only what we buy that matter… it’s also how much we pay.

Questions to Ask

Just like very few predicted the events of 2022… we should expect the unexpected in 2023.

For example, how can anyone know:

- How high the Fed raises rates (more on this in moment)?

- How long the Fed maintains rates above 4.00%?

- How far the Fed unwinds their balance sheet (more than $1 Trillion)?

- How high (and low) the US 10-year yield will trade?

- How high the oil price will go?

- How persistent wage and rent inflation will be?

- How high will the unemployment go before the Fed pivots? 6.0%?

- How far will earnings fall? Or will they rise (as some predict)?

- How long will Russia’s criminal war w/Ukraine last (and the global ramifications)? and

- Will China invade Taiwan (perhaps low probability but a scary proposition)?

… and on and on it goes (this list isn’t comprehensive).

If you know the answers to these questions – you are better than me!

Don’t worry – turn on the TV – there are plenty of people who pretend to have all the answers.

But let me furnish you with what the market expects with respect to the Fed (where I think monetary policy will have the greatest impact on asset prices):

How High Will Rates Go?

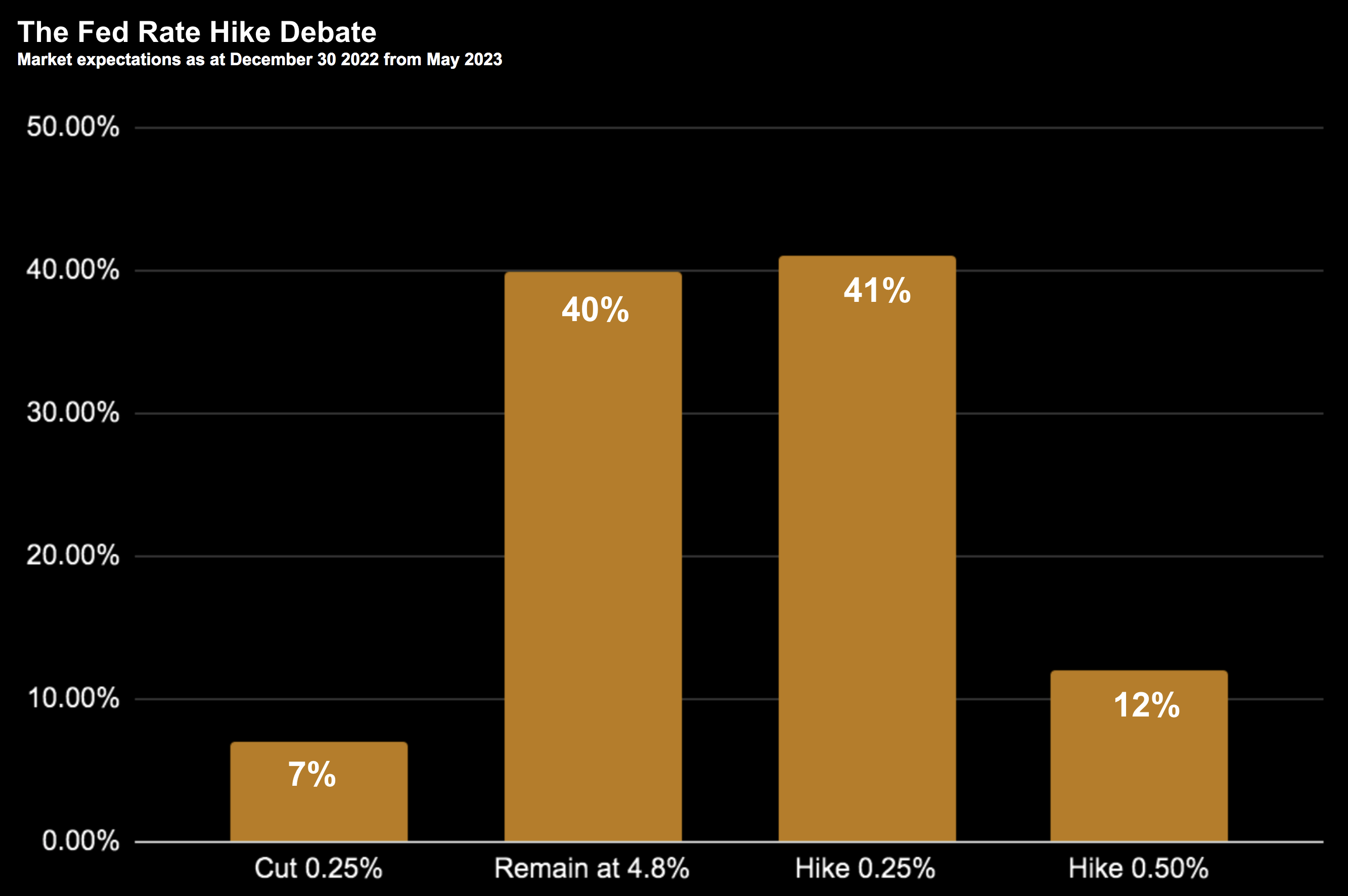

With rate hikes of at least 25 bps ‘baked in’ for February and March – the real debate will kick off in May.

And by then, we will have four more reports on both inflation and employment.

At the time of writing, this is what the market is pricing in (from May):

December 30 2022

At present, over 80% of the market expect rates to either remain at 4.8% (factoring in 50 bps in hikes over Feb/Mar) or raise a further 25 bps.

12% see rates exceeding 5.00%

You can put me in the “5.00% camp” opposite (a) sticky wage inflation and (b) persistent job additions.

This brings me to the rate outlook for 2023/24:

December 30 2022

I think what’s interesting here is not so much the Fed funds rate getting to 5.00% (or even 5.25%) — it’s the expectation that rates will remain above 4.50% into early 2024.

And from there, how much will that impact the real economy as companies, investors (and consumers) renew maturing debt?

This is an important question as it takes at least two quarters (perhaps three) for the impact of rate hikes to feed into the real economy.

Will “QT” Pose the Biggest Risk for Stocks?

For all the focus on rate hikes… I wonder if the story for 2023 will be reduction in the Fed’s balance sheet?

At the time of writing, the Fed is the very early stages of reducing its balance sheet.

At present, they are allowing $95B of mortgage debt to roll-off – which will result in ~$1 Trillion of assets being removed next year (see orange line below).

December 30 2022

The Fed holds a whopping $8.5 Trillion in mortgage and government debt securities.

To put that into perspective, that is around 30% of all government and mortgage bonds.

Personally, I would like to see them completely out of the mortgage debt business… it has no place there (a subject for another blog)

But this level of involvement is what caused the massive distortion in all assets.

And whilst the Fed has removed about $400B (where their balance sheet peaked at $8.94T) … it has a long way to go.

For example, prior to the pandemic, their balance sheet stood at ~$4.1T.

The pandemic saw this double.

So what are some of the questions this raises for 2023?

- Will there be any systemic risks should the Fed continue on its current path of asset reduction

- What will this do to credit spreads (will they widen)?

- What will this do to long term bond yields?

- Is it likely to push them higher?

- How hard will this bite the real economy (irrespective of asset prices)?

To that end, I think the balance sheet will come into its own should we see any signs of systemic risk.

Until such time, the focus will be on rates.

Obviously I don’t have answers to the above questions (and these questions are not exhaustive) – however directionally I think the risks are to the downside.

How much we don’t know.

And guess what – I don’t think the Fed knows either – as they have never been in this situation.

However, what we do know is:

- When the Fed are adding liquidity — it’s a positive for risk assets; however

- When the Fed is reducing liquidity — it tightens credit conditions — a negative for risk assets.

And the latter needs to happen if the Fed are to kill inflation.

One other important thing to add:

The Fed is now getting some “help” from both the ECB and BoJ in terms of bonds – which is also helping to push up yields.

Putting it All Together

This is my last post for 2022.

It’s been a pleasure sharing the 142 missives for the year… I hope they offered some value.

And whilst it was a difficult year to navigate – hopefully we ended the year a little wiser.

As to my final scorecard… the results are now in.

I finished the year down 0.86%

December 30 2022

I managed to sneak into ‘the green’ 5 times through the year… but in the end… no cigar!

That said, I will take that over giving back 19.4% (especially after having a great 2021)

My balance sheet remains intact and I’m genuinely excited about the opportunities we will get in 2023.

Here’s wishing you and yours a very happy and prosperous new year.

Thanks once again to all those shared who their feedback – I try and read every email – it’s very much appreciated.

Happy New Year!