- January Core PCE inflation comes in hotter than expected

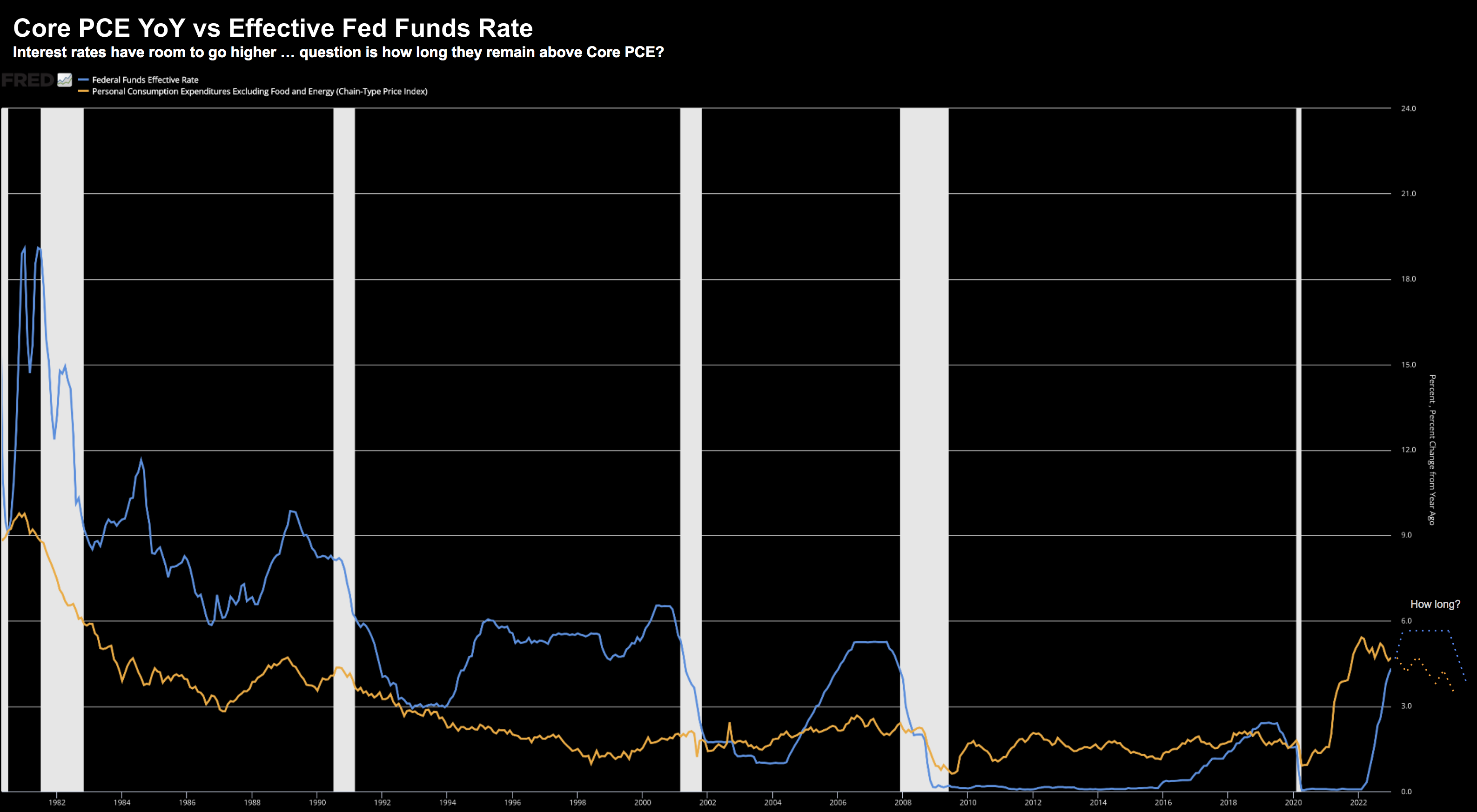

- Why rates to remain “higher for longer” in one simple chart

- S&P 500 trades per the script… keep some powder dry

Equities might have missed the memo.

But that’s not unusual…

The memo was rates will remain higher for longer.

How long we don’t know (more on that with a chart shortly)

Today a closely watched inflation metric – core personal consumption expenditures (PCE) – knocked the bulls off balance.

It rose 0.6% in January and 4.7% from the prior year.

Expectations were for a rise of just 4.3%.

That’s a problem – as Core PCE is the Fed’s preferred measure of inflation.

Here’s the thing:

CPI plunging from its peak of ~9% to levels closer to 6% was low hanging fruit. Most of that was goods inflation.

However, equities may have been quick to assume the inflation fight was won.

Here come the rate cuts (or so they thought)

Heck, even acclaimed Wharton Professor Jeremy Siegel said as much only two months ago:

I wonder if Siegal still see rates cuts in the next couple of months?

Maybe… he’s a perpetual bull.

Fed President John Williams explained how the Fed assesses inflation here.

He used the analogy of an onion.

The outer two layers of the inflation onion are goods and commodities.

They are typically the first to fall.

However, at the core are services – which was a more challenging problem.

Services are a function of the labor market… not so much finished goods.

That remains extremely stubborn.

This was the piece I felt equities may be underestimating.

Fed is in for a Fight

A rise of 0.6% in January (MoM) and 4.7% from the prior year with Core PCE rattled the market.

Put another way: the upside surprise was not priced in.

Regular readers will know I’ve been beating this point like a drum.

For example, I stressed the zone of 4100 to 4200 on the S&P 500 felt optimistic.

Optimistic on two specific fronts:

- the inflation fight being rear-view mirror; and

- the Fed on the verge of pausing.

Equities are now re-thinking each of the above.

Now here’s the a chart which I think explains why the Fed still has a fight ahead:

Feb 24 2023

The orange line shows the trend for Core PCE YoY – currently ~4.7%

The blue line shows the effective Fed funds rate at ~4.63%

Two things to note:

- These rates about about to intersect for the first time since the Fed started tightening; and

- In other episodes of tightening – the effective rate has exceeded Core PCE for a period

Now I’ve sketched in a couple of dotted lines showing what we might see going forward in each case.

For example, we can assume that Core PCE will gradually work its way lower.

But it won’t be fast…

Much of that is going to be a function of what we see in the labor market (which remains exceptionally tight).

To that end, this will be slower than watching paint dry or grass grow.

Now whilst this remains sticky – it’s likely the Fed continue to raise rates above that of Core PCE (e.g. maybe as high as 5.50% or higher)

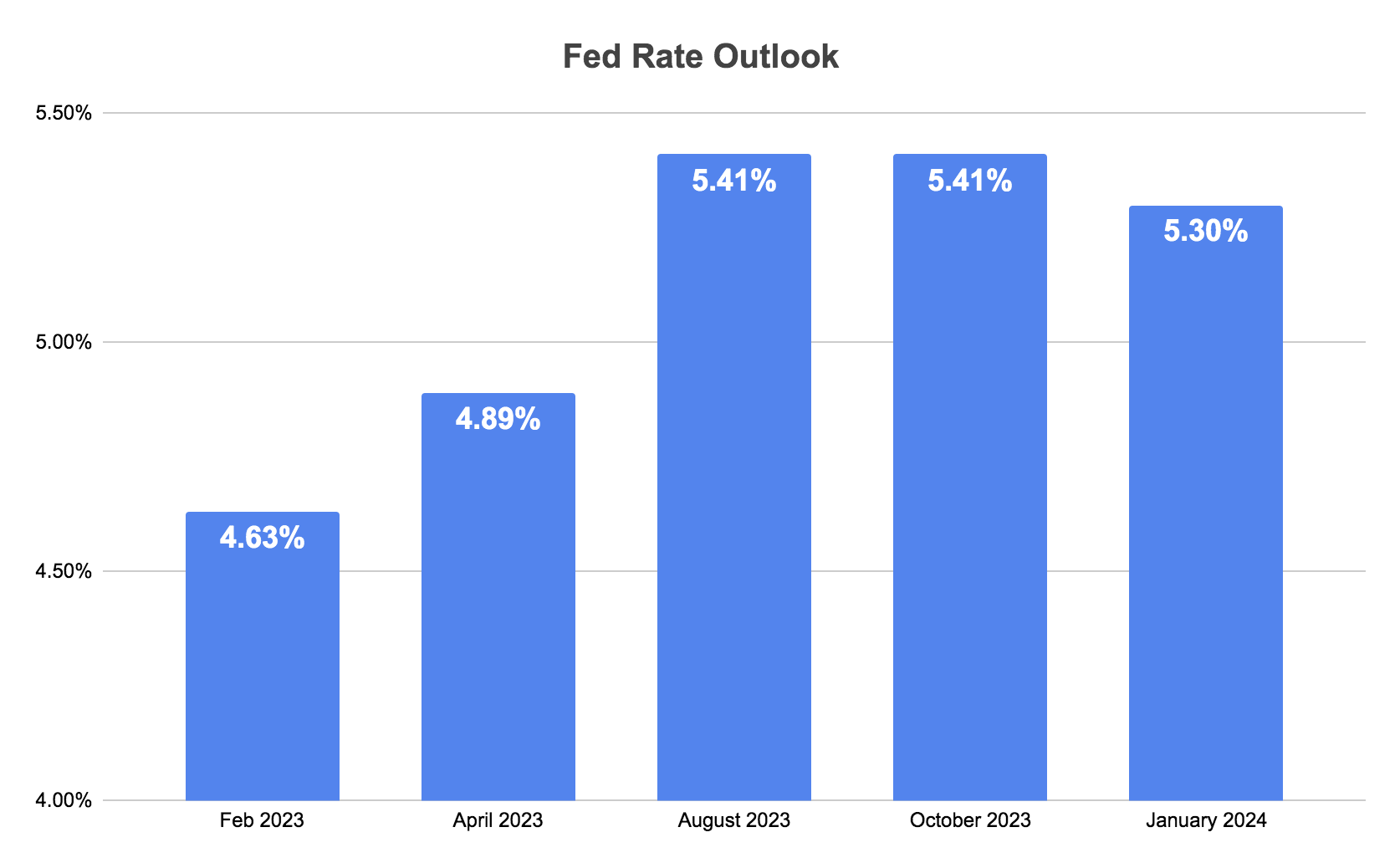

For example, consider what we see with the current Fed rate outlook:

Phillip Jefferson – Fed Governor – perhaps said it best:

“High inflation may come down only slowly. Bringing services inflation under control depends on a better balance in the labor supply and demand“

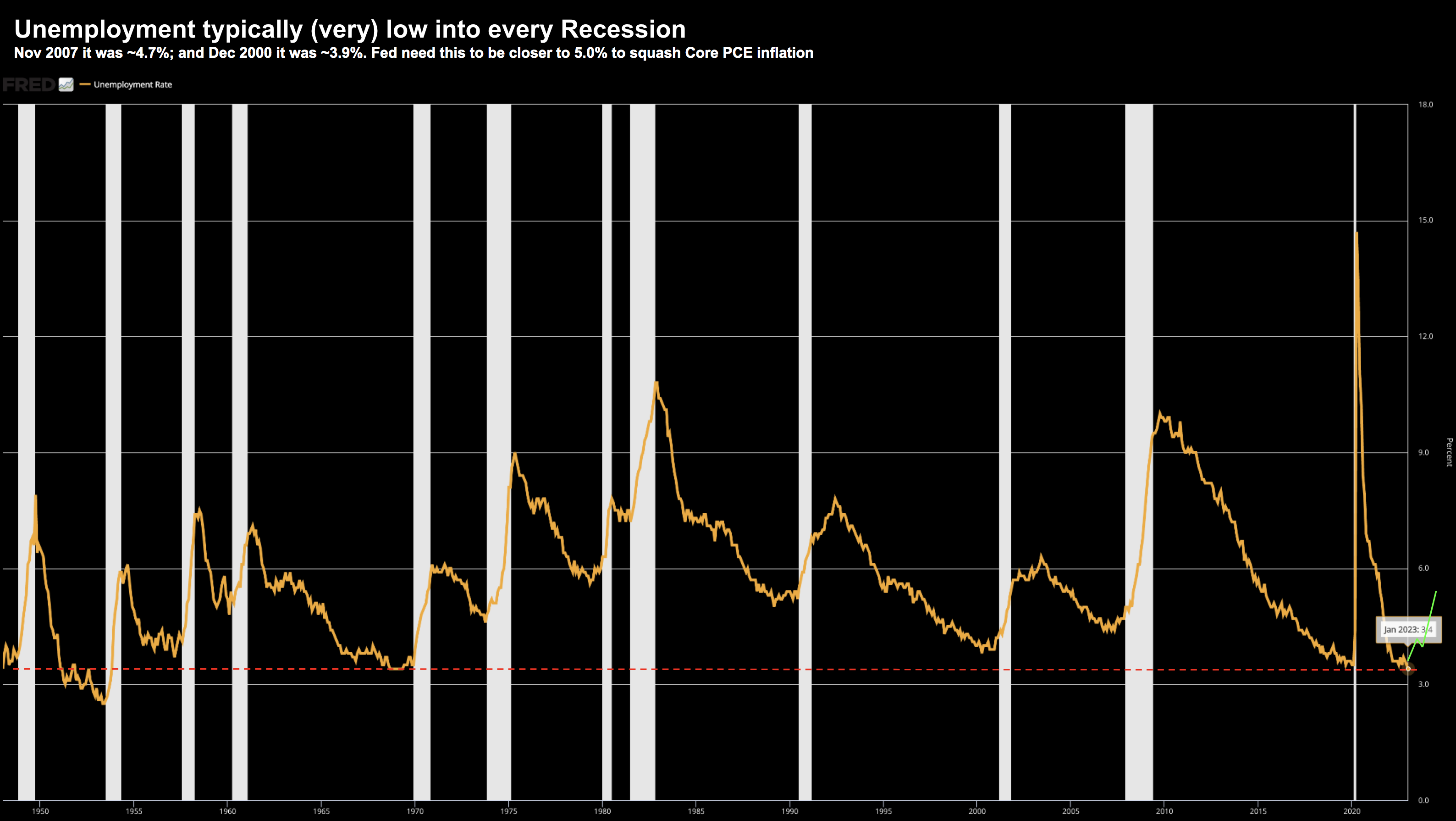

This is why I felt at the start of the year – this was the most important chart to watch in 2023:

Feb 24 2023

That’s how the Fed kills unwanted inflation.

Now… does 5.0%+ unemployment equate to a “soft, hard or no” landing?

I don’t know… it’s mostly semantics from my lens.

I see the Fed continuing to over-tighten at the cost of a recession (which is what the yield curve indicates – more on this below)

And if that’s correct (and it may not be) – we will see much lower equity prices.

It’s Not Different This Time

Research shows there has never been an instance of central banks aggressively fighting inflation without a recession.

Not one.

But if you tune into CNBC or Bloomberg — you will hear at least one talking head say “this time it’s different”

No. It’s not.

There will be an impact with all this tightening (as this article from CoreData Research suggests):

“A significant portion of U.S.-based asset managers think further Federal Reserve rate hikes would lead to a recession or some disruption in global financial markets, according to research last month by London-based CoreData Research.

The greatest anticipated risk of continued Federal Reserve rate hikes is a possible recession. Overall, 59% of survey respondents took a neutral look at a recession scenario, that there would be “a moderate recession in 2023, followed by a gradual recovery as central bank policies bring down inflation over time,” while 14% opted for a bull case, defined as “a mild recession in the first half of 2023, followed by a strong recovery, falling inflation and rising equity markets [in the second half of 2023],” and 27% said they agree with a bear case, defined as a scenario in which “stagflation and a deep recession [occur] in 2023, accompanied by a 10-20% fall in the equity markets, as central banks struggle to defeat inflation which remains high.”

I am in the 27% camp; i.e. stagflation with low growth and a high probability of a 10-20% fall in equities.

Of course what’s impossible to predict is the precise timing (which doesn’t bother me)

For example, similar to what CoreData’s survey results suggest – my best guess is late 2023 or first half of 2024.

But does it matter?

Not a great deal.

Leading indicators suggest we can’t avoid what’s ahead.

However, the bigger mistake is leaning into trailing indicators as the basis for bullish optimism.

Unemployment for example is a trailing indicator. GDP another.

But it’s lazy thinking…

You only have to look at the lead up to the recessions of 2001 and 2008 in terms of what we saw with employment.

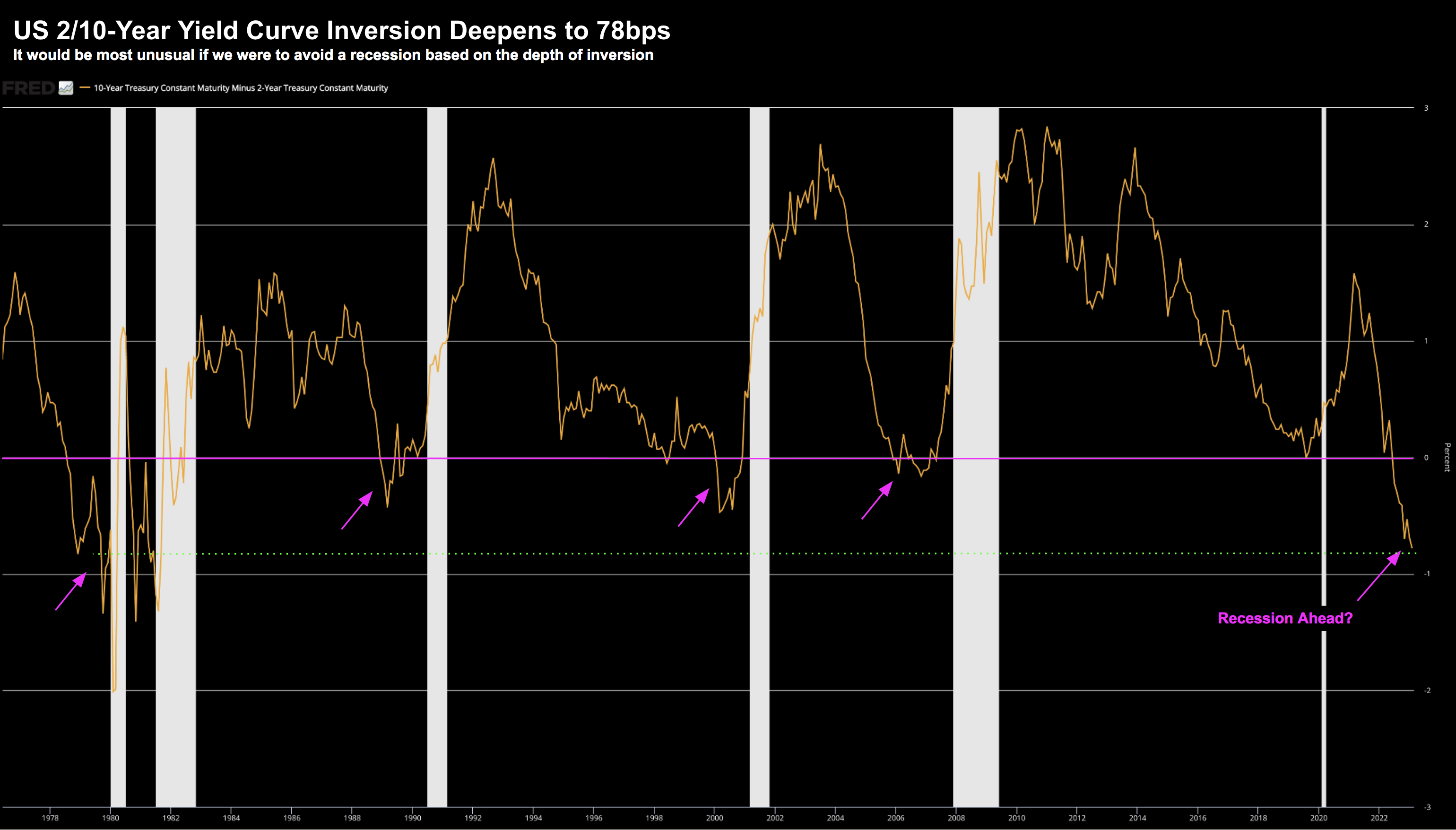

One the best leading (real-time) financial indicators to observe is what we see with the 2/10 yield curve:

Feb 24 2023

As I touched on above – this tells me the Fed are tightening into a recession.

The other great leading (real time) indicator are credit spreads.

For example, when they start widening (and they haven’t yet) – cracks are appearing in the financial system.

That’s in front of us.

So here’s a question:

How much are investors (and traders) paying attention to history? And why do they think this time different?

For example, could some basing their bullish thesis by effectively chasing lagging indicators (e.g. GDP and employment)?

I wonder?

S&P 500: Trading Per the Script

For anyone who chased this rally higher… this week might have been painful.

It was the market’s worst week for the year – reducing year-to-date gains to just 3.3%

It wasn’t too long ago and this was above 7.0%

Let’s take a look at where we could be headed next:

Feb 24 2023

The risk of the Index performing a ‘false break’ of the previous 4100 high has taken shape.

Further to my post from Feb 10th – this tells me lower prices are likely.

In addition, it looks like the weekly trend could be about to resume its bearish path (after threatening to turn higher)

In terms of a target – I like the zone of 3800 – which was good support through December.

However, if that zone fails, it’s a quick trip to 3600.

From mine, I think it’s a high probability we test 3800. Put it this way, I favor the market testing 3800 before it retests 4200.

I’m still not willing to rule out a retest of the 3600 lows (which was a contrarian comment only two weeks ago)

Less so now?

Around that zone – the longer-term (3-year) risk / reward looks like a good bet.

For example, if we assume 2023 S&P 500 earnings hold up ~$210 per share — that’s a forward multiple of ~17x

Assume earnings can expand 5% in 2024 (to ~$220 per share) – that multiple becomes 16x.

That’s reasonable.

But remember:

If we are to experience a recession – forward multiples are could easily test 14x to 15x

The question of course is what will be the “E”?

Putting it All Together

2023 is far less about supply-chain issues – it’s all about the services sector

You might say the underlying pressure shifted from having limited “goods”… to strains in the labor market.

Households have exhausted their pent-up demand for more stuff (stuff they probably didn’t need in the first place).

Now they want experiences they were denied for two years.

They are flying to venues. Eating out. Going to concerts etc

And using every bit of their credit cards to do it!

That’s what the world’s central banks are contending with… this pent up demand for services.

Citigroup economists led by Nathan Sheets offered this:

“The upshot is that this substitution to services consumption is fueling labor demand, wage growth, and ongoing services inflation”

That’s what today’s Core PCE told us…

In this Bloomberg article – a restaurant in downtown Nashville is raising prices after having to cough up $17 an hour for dishwashers, up from about $12 before Covid. A line-cook now makes more than $20, compared with $14 back in 2019.

That’s service sector inflation.

And that’s not going away until Jay Powell & Co can reduce tension in the labor market.

The market is slowly connecting these dots.

Before I close, I’ve updated my website where you can now track my week-to-week performance vs the S&P 500 (things are off to a good start!)