- US dollar index and 2-year yields fall (slightly)

- WSJ ‘Fed Whisperer’ gives the market hope on rates

- Short-term rip could rally another ~10%

My previous post led with “Short-Term Rip… Then a Bigger Dip”

Markets felt poised to pop… like a coiled spring.

All they needed was a spark.

And today that fuse was lit by a Fed whisperer.

As I will show shortly – the S&P 500 surged 4.7% this week – right on cue.

Don’t be surprised to see a similar move next week (pending earnings, treasury yields and the dollar).

But here’s the thing:

With a VIX still trading around 30 – expect daily price moves of up to 2%

That’s what we saw this week… and the volatility isn’t finished.

S&P 500 – Short-Term Rip

As a preface, I don’t read too much into these kinds of rallies.

One good week – from oversold (near-term) levels – hardly defines a trend.

But there were three reasons stocks were a little more optimistic:

- Relief from the UK and Japanese bond markets (i.e., more emergency bond buying)

- The US dollar index and 2-year treasury yields both pulled back (as forecast); and

- A hint from the Fed (more on this in a moment)

And given we were trading in a well defined zone of technical support – it was not hard to foresee the bounce (as I penciled in last week).

Oct 21 2022

This short-term rally could easily challenge the 35-week EMA zone.

For example, we saw that in June (19% from low to high)

And should we see something similar – it will be time to reduce exposure.

Not only technically is it primed for another leg lower (given the strength of the bearish trend) — fundamentally it’s also the case.

Which brings me to earnings…

Earnings: Make or Break

Next week, we will hear from 25%+ of the S&P 500.

Google, Meta, Apple, Amazon and Microsoft are all on tap (~$7 Trillion in market cap across these 5 stocks) – as are widely held names such as McDonalds, Coke, UPS, Visa, Halliburton, Boeing, ServiceNow, T-Mobile, Honeywell and Caterpillar.

Now we will get some hits and misses. That’s always the case.

But overall, it’s most likely earnings will beat expectations… as the bar is very low.

Personally, neither my focus or concern is with Q3 earnings.

Looking forward is what I am interested in – as the headwinds have become far stronger since the July quarter.

What is the guidance?

And this brings me back to fundamentals for the S&P 500.

For example, let’s say the S&P 500 rallies to ~4100 (i.e, the 35-week EMA zone).

Two scenarios in terms of what PE this represents:

- Consensus 2023 earnings of $240 p/share – implying 8% YoY growth

- Recessionary 2023 earnings of $210 p/share – implying a 5% YoY decline

If you favour #2 (which I do) – 4100 represents a forward PE multiple of 19.5x

If you think earnings will be close to consensus at $240 – that represents a forward PE of 17x.

Here’s the thing:

Both are what I would consider expensive in the likely event of a recession – where nominal Fed rates are likely to be north of 4.50%

3200 to 3400 is far more compelling.

Snap’s Trainwreck

Before I get to what I think was the primary catalyst for today’s rally – I want to touch base on social media stock Snapchat (SNAP) briefly.

Many in the media are saying these earnings do not bode well for the likes of Meta and perhaps Google.

From mine, that’s a mistake.

That’s like comparing Apple to Samsung.

Yes they both make phones. But that’s where the similarities end.

In this case, the only parallel is SNAP operates in the online ad market.

But that’s about it.

For example, if you compare things like (not limited to) balance sheets, free cash flow, moat(s), and sheer scale (and demographic) of users – there’s no comparison

Now there’s a good reason the teenage messaging app (as that’s all it really is) lost ~30% in today’s session.

It comes back to a ‘growth’ stock with a sharply declining revenue trend.

For example, they reported top-line growth of:

- 38% YoY in March

- 13% YoY in June

- 7% YoY in Sept

- 0% forecast for the current quarter; and

- Potential decline for Q1 2023

That’s not a stock worth 4x its sales revenue. I would be reluctant to pay 2x sales.

A year ago the stock traded at $83.34 – today it fell below $7.50.

And look no further than the trend in revenue.

From mine, there are four themes causing this decline:

- Overall ad market is soft (impacting all businesses in the market);

- iOS privacy changes (also impacting Meta);

- Competitive threat from social rival TikTok; and

- How they monetize

Points 1, 2 and 3 are well documented.

And it’s why the likes of Google and Meta are well off their highs (not to mention Meta’s Metaverse pain).

However, #4 is less discussed and it’s specific to SNAP.

Today the app monetizes primarily through a discovery page. However, users are far more engaged with the scroll feature used by the likes of Instagram (owned by Meta) and TikTok.

For example, look over the shoulder of someone using these apps (I don’t use any of them) – and watch them mindlessly scroll through endless rubbish!

It’s like dopamine for some people.

That’s what SNAP must solve to arrest the severe revenue decline (in addition to 1, 2 and 3)

I would be reluctant to read too much of SNAPs ad problems into the likes of Meta and perhaps Google next week.

Yes, the online ad market is soft and e-commerce revenue is down 2% YoY.

Look for this to also show up in Amazon’s numbers next week.

But SNAP have meaningful problems of their own to work through… with some heavy competition from the likes of TikTok and Instagram.

Moving to the story of the day…

The Fed Whisperer

From mine, this was the story which moved markets.

And it came courtesy of Nick Timiraos.

For those less familiar, Nick writes for the Wall Street Journal… and is a well-known Fed Whisperer.

It’s a poorly kept secret that the Fed uses the press (specifically the WSJ) as a leak channel ahead of decisions.

And their favoured reporter is Timiraos.

Case in point:

July 17, 2022, Timiraos had a column titled “Fed Officials Preparing to Lift Interest Rates by Another 0.75 Percentage Point.”

Sure enough… we got 75 bps.

They used him to sound out the market’s reaction.

Today, via the WSJ, he gave equities signs of hope with this article:

What happened to unanimous?

Two things here:

- Fed will definitely raise 75 bps in November (the market knows that); however

- The Fed may not be committed to 75 basis points for December.

Fed Funds Futures are currently pricing a 75 bps December as 60% probability.

However, Timiraos may have poured cold water on that… suggesting it could be as “low” as 50 bps.

This leak could cause a sharp rally in markets – which you might argue is not within the Fed’s best interests.

Personally, I think investors are missing the bigger picture by agonizing over whether it’s “50 or 75” bps in December.

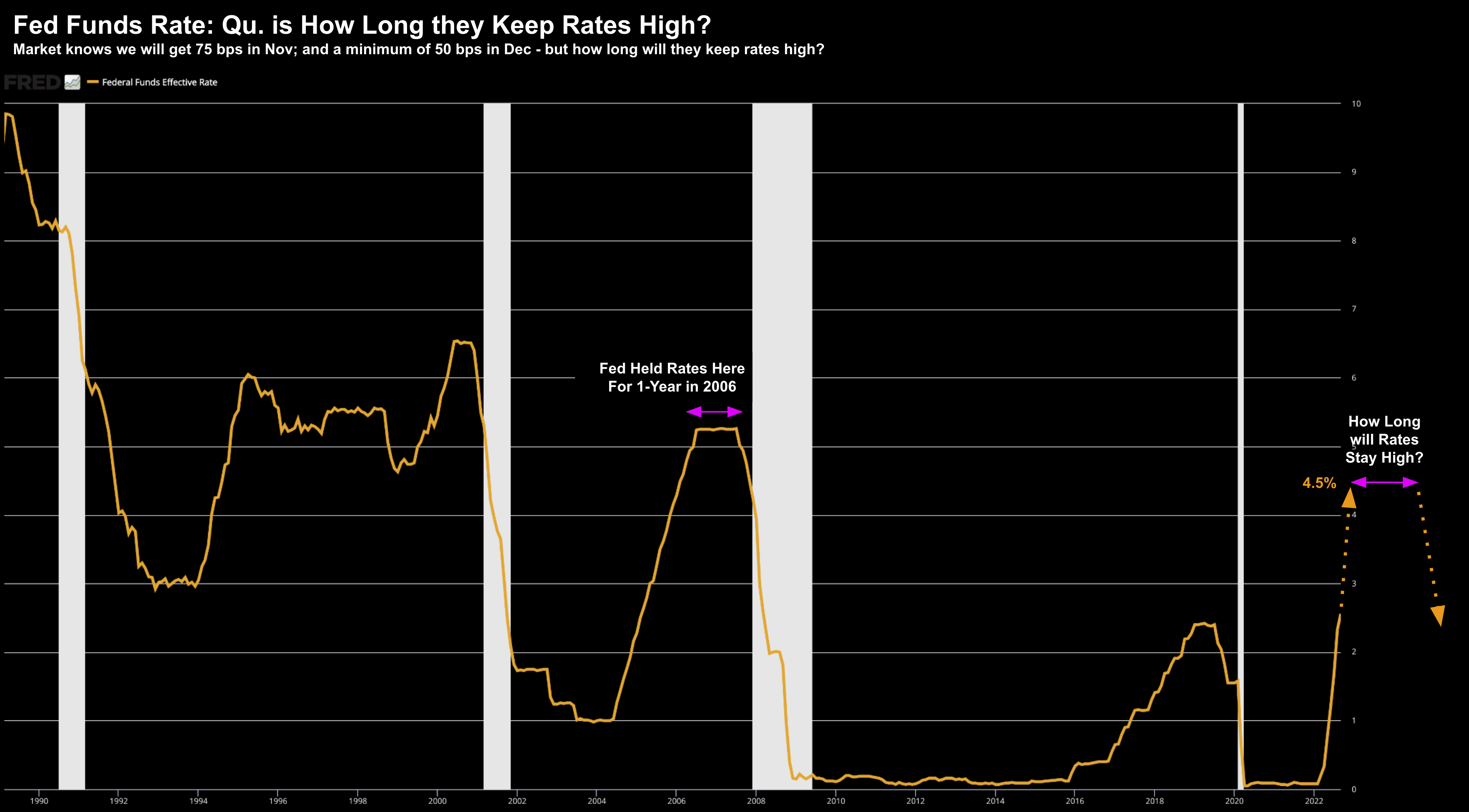

For me, the more important question is how long does the Fed stay at nominal levels of ~4.50% (or above)?

That is going to have a much bigger impact….

For example, take a look at what happened in 2006.

The Fed held rates above 5.0% for a year.

And pending what we see with core inflation – we could see something similar throughout 2023.

In other words, don’t expect the Fed to simply cut.

They will most likely simply hold rates in restrictive territory for an extensive period.

For example, I maintain the Fed is unlikely to start cutting rates until we see:

- Unemployment work its way to ~5% (vs today’s full employment of 3.5%)

- A major contraction in GDP; and most importantly

- Definitive signs core inflation has come down (and is trending lower for consecutive months)

- The economy is adding jobs (more than 260K jobs added in September);

- GDP is essentially flat (perhaps contracting slightly); and

- Inflation moved higher last month (particularly wages, food and rent)

And whilst the Fed may only hike 50 bps in December – it’s a moot point.

The target rate is likely to exceed 4.50% in 2023; and stay there until we see one (or more) of the three conditions above.

Putting it All Together

Next week could be ‘make or break’ in terms of the current bear market rally.

For what it’s worth, I think ‘big tech’ will handily meet and/or exceed very low expectations for Q3.

That’s priced in…

But how bullish will these companies be with guidance (assuming they offer it)?

For example, Jeff Bezos tweeted earlier this week to “batten down the hatches”

Question:

What does Bezos see that others may not?

For example, he has a great vantage point across both enterprise spend (with AWS) and the consumer.

Arguably better than anyone?

Bezos joins a long list of prominent CEOs’ warning of more difficult conditions ahead (e.g. JP Morgan’s Jamie Dimon).

And if companies are to guide lower (like Snap this week) – do forward earnings justify the current multiples?

I don’t think so… certainly not at 4100

Happy to be wrong.