- Powell nuances his hawkish tone without success

- Why are equities so confident on rates and the economy?

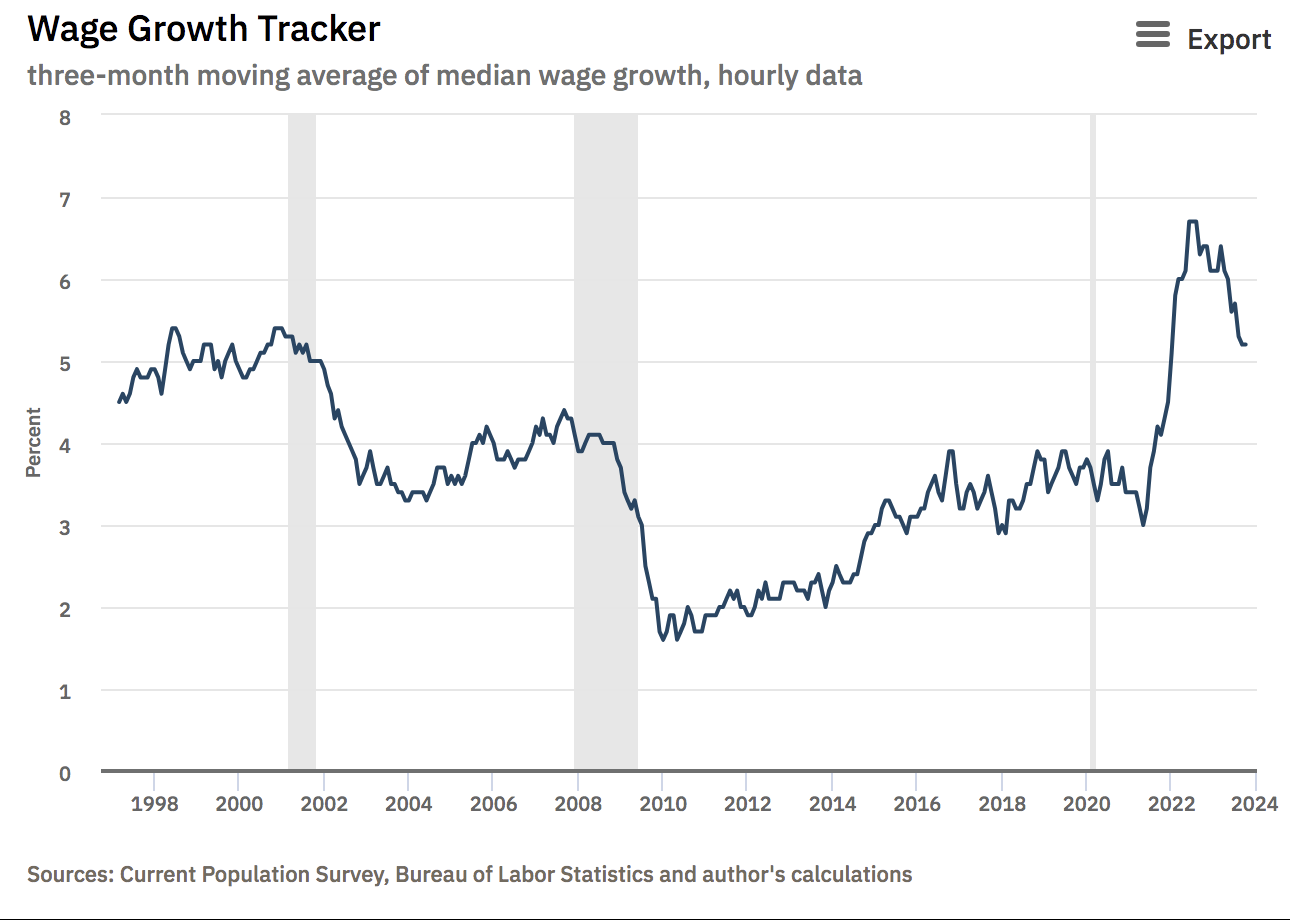

- The Fed needs wage growth to cool

“We still have a long way to go”.

That was the warning from Jay Powell this week.

After what many felt was a slightly less hawkish Fed Chair last week – sparking an equity rally – Powell attempted to adjust his tone at an IMF event.

“We should not be misled by good data on prices. We know that ongoing progress toward our 2 per cent goal is not assured: inflation has given us a few head fakes. If it becomes appropriate to tighten policy further, we will not hesitate to do so.”

This was more hawkish language than two weeks ago – where markets figured the Fed were finished with rate hikes.

Powell clearly wasn’t impressed.

And whilst equities traded lower after Powell tweaked his stance – the selling didn’t last.

Equities surged lifting year-to-date gains for the S&P 500 to 15.0%

It raises a question:

Are stocks attempting to call the Fed’s bluff again?

It would not be the first time over the past 12 months.

Premature

Based on the past two weeks – speculators clearly have a strong conviction on what lies ahead.

Unfortunately I don’t…

For example, perhaps they know where bonds (and rates) are headed?

I say that because much of the rally we’ve seen has been on the back of sharply lower yields (where the 10-year has fallen about 40 bps from 5.0%)

But can we confidently say we’ve seen peak yields?

I would like to say “yes” – but I don’t think that’s the case.

Not yet.

From mine, bond markets are yet to find stability – especially with respect to the long-end.

By way of example, last week there was a terrible 30-year bond auction.

From Yahoo!Finance:

The 30-year auction stopped at a high yield of 4.769% , higher than what the market expected at the bid deadline, suggesting that investors demanded a premium to take the bond.

The rate miss of more than 5 basis points was the largest since August 2011, according to Action Economics in a blog after the auction. Other metrics were poor as well. The bid-to-cover ratio, a gauge of demand fell to 2.24 , from 2.35 at the October sale, and the 2.39 average.

Indirect bidders, which include foreign central banks, took 60.1%, down from 65.1% in October and the 68.6% average. November’s indirect bids were the worst since November 2021, analysts said. Analysts described the auction as “terrible” and “ugly”.

In addition, we still find high levels of volatility with the US 10-year note.

For example, these yields should not be trading up and down “25 to 50 basis points” on a weekly basis… however that’s what we see:

Nov 11 2023

But in order for bonds to stabilize, the market needs greater conviction the Fed is done.

That’s not what we heard from Powell.

However without this – it’s difficult to gauge a timeframe the Fed will likely remain on hold.

Markets assumed they had it post the November FOMC statement (e.g., with the 10-year falling to 4.50%).

That trade started to reverse this week.

However, there are other factors we also need to consider.

It’s More than ‘Just’ the Fed

There are three primary things helping to drive uncertainty with fixed income.

- Monetary policy;

- Core Inflation; and

- the Economy

The first thing markets will attempt to do is discount what the Fed is likely to do.

We saw that last week post Powell’s FOMC address.

As soon as he suggested the Fed “might” be closer to the terminal rate – yields fell and stocks rallied.

The second is inflation.

Whilst things are headed in the right direction – it’s still premature to think the battle is won.

Specifically, I think the Fed’s primary battle will be with labor markets.

For example, during the week the Atlanta Fed published its latest “wagetracker” data. This shows wage growth peaked last year above 6%.

And while it’s declined in 2023, it’s not falling at the velocity the Fed would like.

Last month, the overall wage rise was unchanged – however wage growth for part-time work was higher.

The part-time rise in wage inflation will be discomforting to the Fed – especially as it pertains to services inflation.

One of the preferred inflation metrics cited by the Fed is “super-core” – which is services inflation excluding shelter.

For this to come down – we will need to see much slower wage growth.

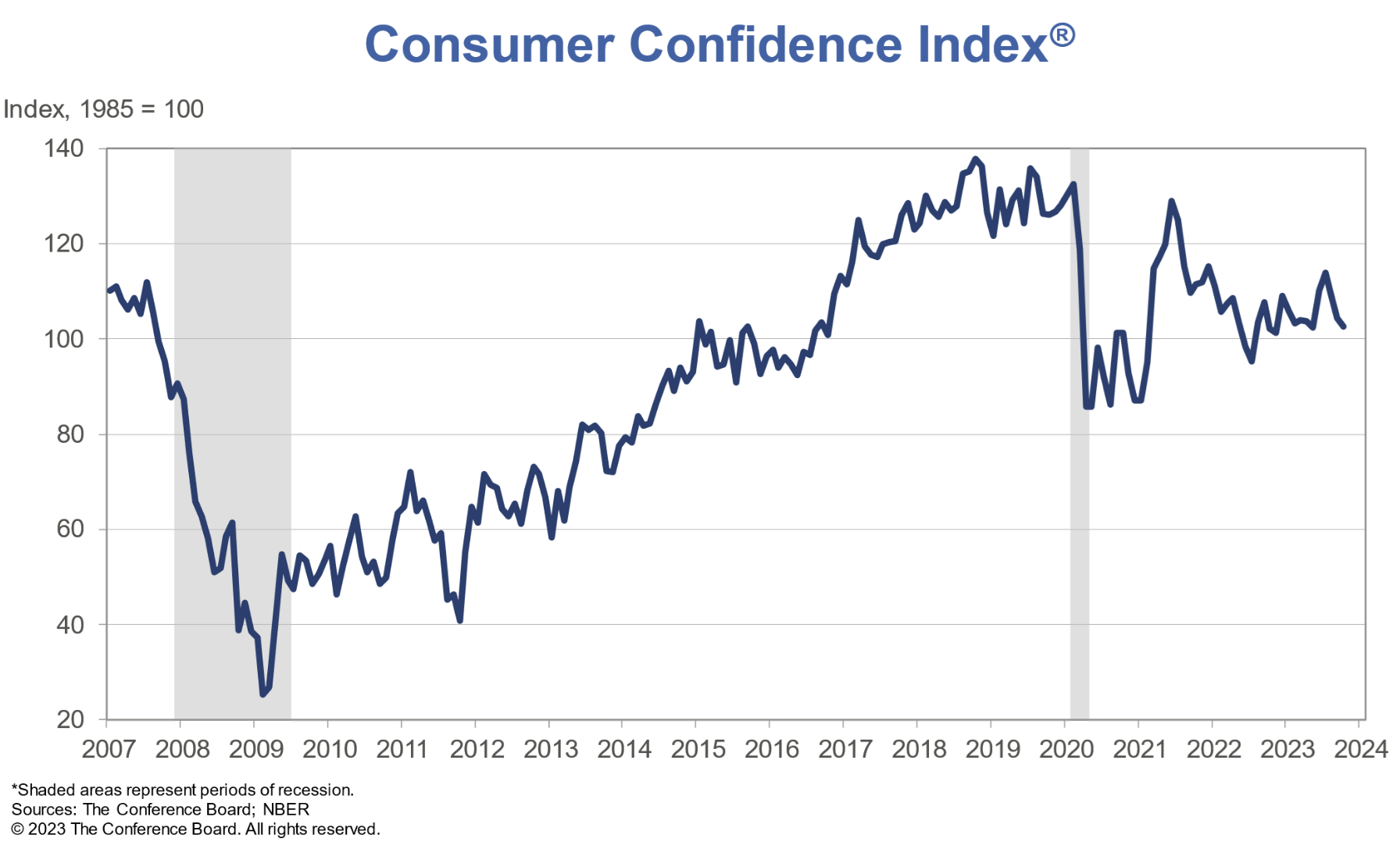

The third is what we see with economic growth. Here we need to consider variables such as (not limited to):

- consumer confidence, borrowing and spending;

- employment trends (outlined above);

- fiscal policy; and

- business investment etc

Put together, this is an incredibly complex set of factors to accurately gauge.

Consider the consumer…

Consumption (consumer spend) constitutes something like 70% of GDP.

Therefore, what level of confidence do we have that consumer spending is likely to reaccelerate in the months ahead?

We might get a read on that next week when we hear from the US’ largest retailers (Walmart, Target etc).

Now if the latest Conference Board Confidence Index – Q4 guidance might come in soft – as confidence continues to fall.

“Assessments of the present situation were driven by less optimistic views on the state of business conditions, but consumers’ rating of current job availability held steady. Fewer consumers said that business conditions were good, and more said they were bad.

Regarding the employment situation, slightly fewer consumers said that jobs were ‘plentiful’ compared to September, but the number saying jobs were ‘hard to get’ also declined.

However, when asked to assess their current family financial conditions (a measure not included in calculating the Present Situation Index), those responding ‘good’ rose, and those citing ‘bad’ were little changed. This suggests consumer finances remain buoyant in the face of elevated inflation.”

And whilst there remain open questions on the health of the consumer – I also worry about the fiscal situation.

For example, Friday afternoon the US credit received another downgrade, this time from Moodys.

Moody’s on Friday lowered its outlook on the U.S. credit rating to “negative” from “stable” citing large fiscal deficits and a decline in debt affordability, a move that drew immediate criticism from President Joe Biden’s administration.

The move follows a rating downgrade of the sovereign by another ratings agency, Fitch, this year, which came after months of political brinkmanship around the U.S. debt ceiling.

Downgrades like this only support the case for higher bond yields (not lower)

But despite all of the above – stocks essentially shrugged – maintaining a high degree of conviction.

What is it based on?

Not Done With Volatility

It’s been a volatile start to November across most markets.

And I don’t think that’s likely to change.

For example, until we get things such as:

- more confidence about where the Fed is;

- economic data that’s so dire it will force the Fed’s hand; and

- stabilizing bond markets…

… it remains difficult to maintain any conviction in equities at these levels.

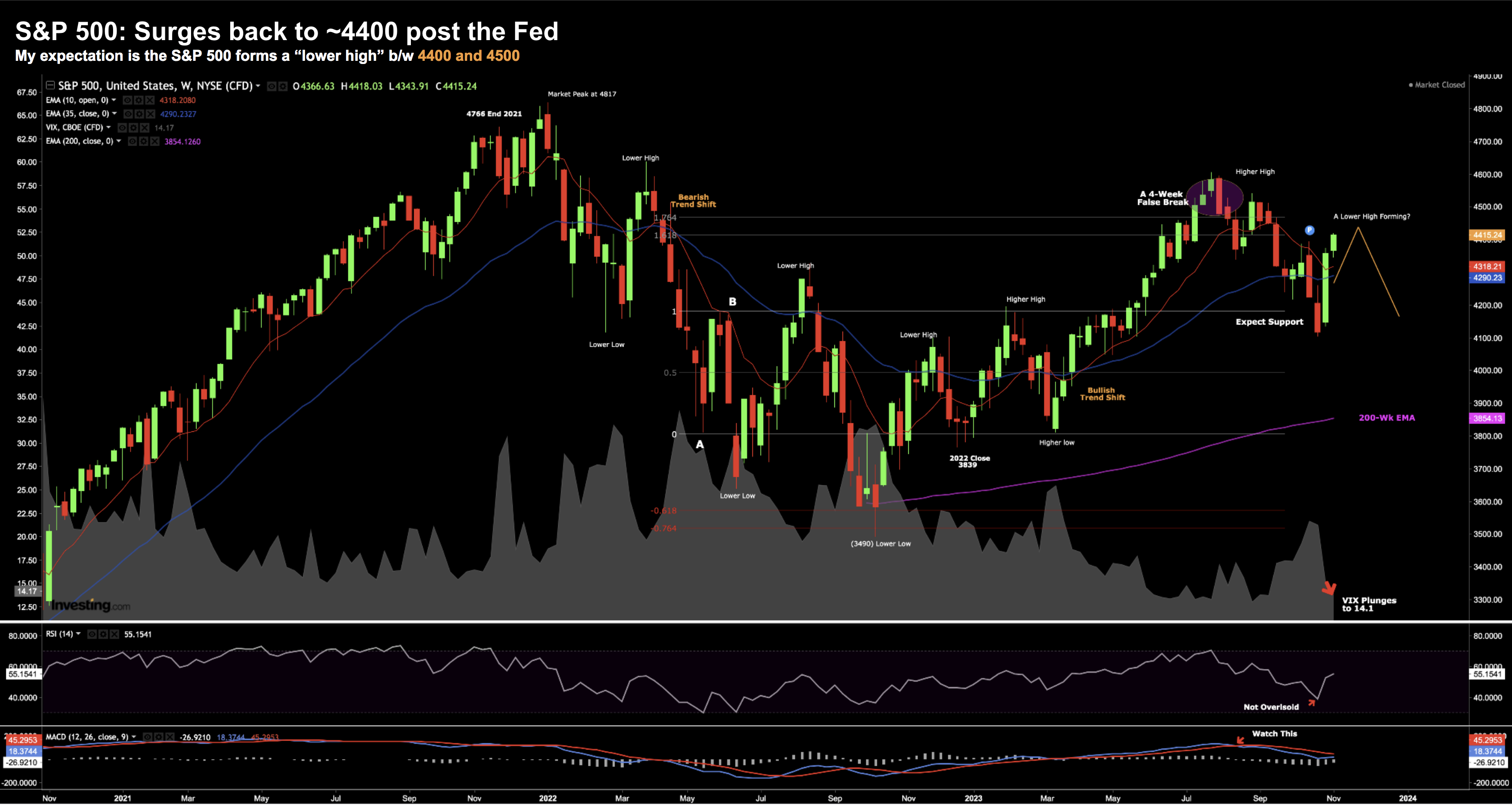

Let’s take a look using the S&P 500 weekly chart:

Nov 11 2023

Stocks have now rallied into what I think could be a zone of resistance (4400 to 4500)

One thing I want to highlight is what we see with the VIX.

This has plunged down to a level of just 14.1 – which tells me the market is very complacent about what it sees.

I think that could turn out to be poor judgement… and it’s likely we see this pick up again.

In short, there are too many large unknowns.

That said, we are in a seasonally strong time of year where markets will typically rally.

My expectation was for the market to catch a bid around the 4200 zone – effectively what we saw.

However, I would not be adding to positions at this level.

The market is not cheap at almost 19x forward earnings (which assumes 12% EPS growth next year)

Don’t chase this 6%+ rally if you missed it.

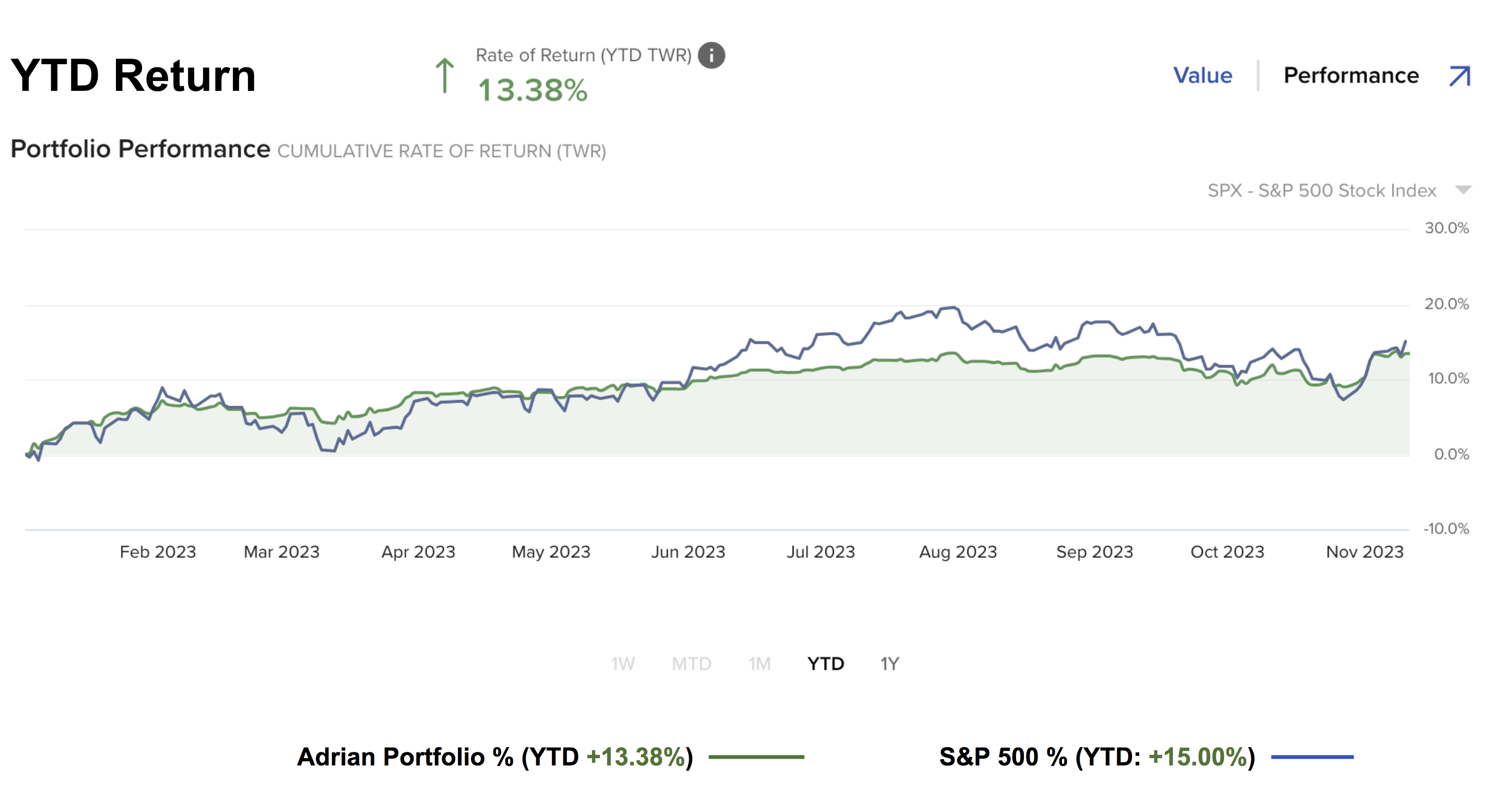

For me personally, I kept my positions largely unchanged which saw my YTD return increase with the market:

I will be very pleased if I finish the year above 12% – given my relatively low level of (risk) exposure throughout the year.

For example, my returns would be much higher if I had increased exposure – however I choose to remain only ~65% long.

For me, it’s a conservative position.

And as I look forward to 2024 – my best idea remains in fixed income.

For example, if you can pick up the US 10-year at ~5.00% or above, I think you might do well.

With the economy likely to slow and the Fed a chance to cut perhaps as early as Q3 (pending what we see with inflation and employment) – we could see the 10-year closer to 4.0% to 4.25%

If my thesis is correct (and it may not be) – that will see substantial capital appreciation for bond investors (in addition to the guaranteed yield of ~5.0%).

Outside of fixed income – I also see value in some lower PE names (e.g., in sectors such as financials and energy)

Putting it All Together

Powell used the stage this week to amend his tone.

I’m not sure his nuance was successful.

Equities initially paused after his IMF address – only to recover in strong fashion Friday.

From mine, labor markets hold the key to monetary policy (and any recovery).

Here I’m looking at both the unemployment rate and wage growth.

For example, if wage inflation remains meaningfully above the Fed’s target of 3.0% – how can we have conviction the Fed is completely done?

I don’t think we can… not yet.

Note: we get Core CPI on Tuesday (Nov 14th) – markets will be hoping for a print of only 0.1% MoM.