- How Powell used ‘the stick’ with ‘a carrot’

- Fed Chair says decisions will be meeting to meeting

- 225 bps in hikes needs to ‘settle in’ and take effect

After yesterday’s exhale on Google and Microsoft Q2 earnings – all eyes turned to the Fed.

Was it going to be:

- beating inflation into submission at ‘any cost’ (the stick); or

- a more dovish Fed – open to backing off rates on signs of inflation cooling (the carrot)

Turns out we got both.

But what you heard from the Fed will very much depend on your lens.

Did you hear a dove? Or a hawk?

I think you could equally interpret their comments as either… and I will explain why.

In any case, the market took the comments with a dovish lens and leapt higher.

And this is consistent with how the market reacted to each of the previous two rate hikes the day of the Fed’s release.

However, what followed in the days subsequent was a sell-off.

Will we see a repeat?

So What’s Changed?

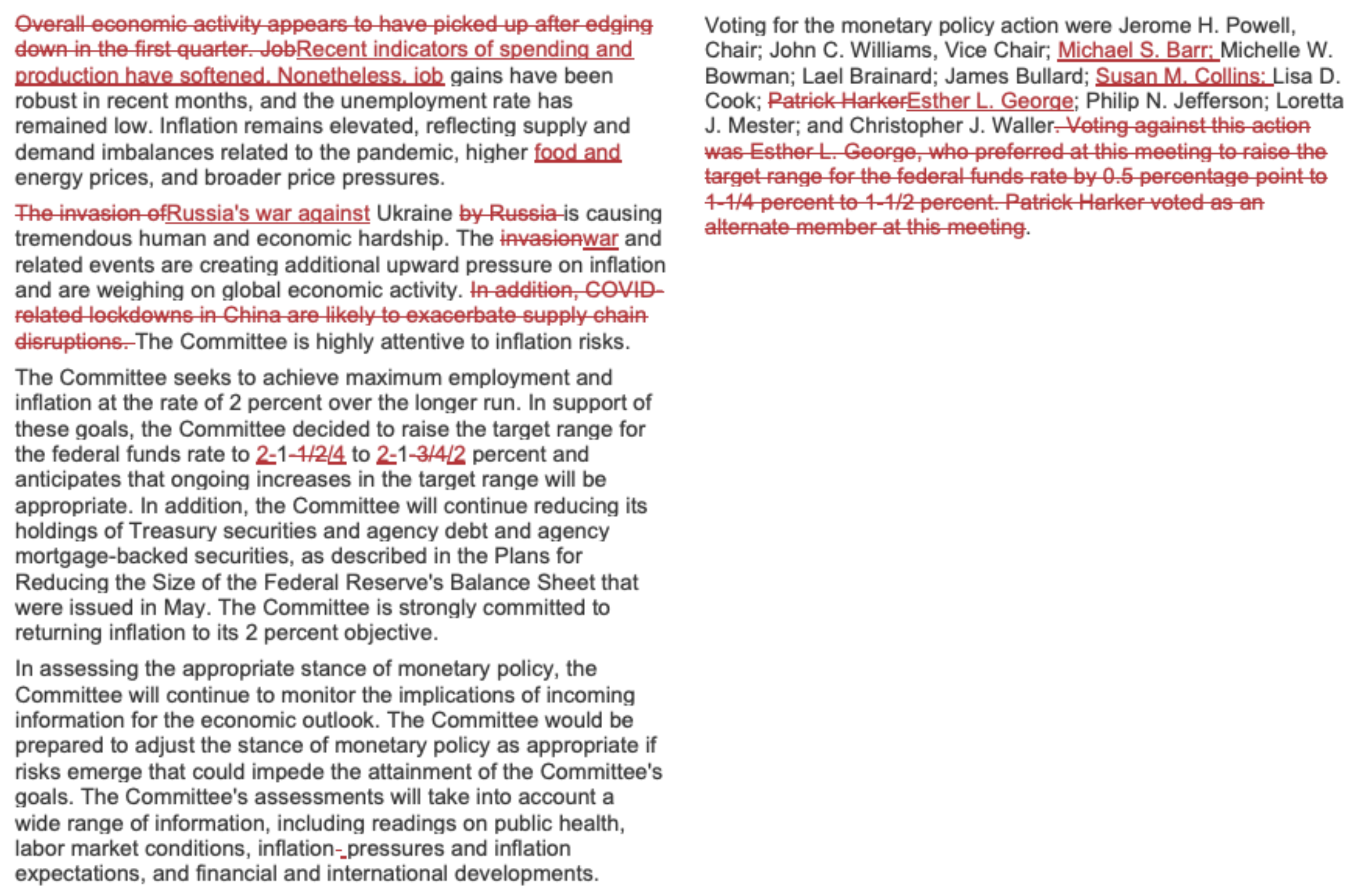

Before I get to how the Fed changed their narrative – here’s what’s changed (in red) from June’s statement:

In summary, we see changes with:

- Recent indicators of spending and production have softened

- Higher food and energy prices

- Russia’s war (vs invasion) of Ukraine; and

- Removal of China’s COVID lockdowns causing supply chain disruption

That’s it!

This makes the second consecutive 75 basis point (bps) rise; and an aggregate of 225 bps since March:

That’s one of the most aggressive moves we have seen from the Fed in 40 years.

Question is what next?

Powell Chooses his Words Carefully

First let me say that Powell is getting better at choosing his words…

What’s more, he knows the downside of making forecasts and/or promises.

Anyone remember his statement that “inflation will be transitory”?

He’s not making that mistake again.

Today Powell was more considered with his narrative… and it struck the right tone.

For example, he started with the “stick” by making clear what’s most important – eliminating unwanted high inflation.

And they will use all their means until they see signs its reversing.

Any decision to change course will be a function of the data.

However, as we went along he told the market he is paying close attention to what they see with the economy.

And on this – his tone became more dovish (the ‘carrot’).

For example:

“… down the road it likely will become appropriate to slow the pace of increases”

That said, the statement is suitably nebulous.

And that’s the point – he doesn’t pretend to know when that pivot will be – and remains non-committal.

CNBC reporter – Steve Liesman – tried baiting Powell with a “what if” on rate cuts – but the Chairman wasn’t having any of it.

Jay Powell gave the right answer!

He reiterated that any decisions will be a case of ‘meeting by meeting’

We now have two months to see the impact of the cumulative 225 bps in hikes so far this year (in addition to some quantitative tightening)

And that’s a good thing…

In fact, I would not be adverse to seeing how the economy goes over 3 or 4 months without further intervention.

I say that because there will be a strong lag effect to the measures the Fed has put in place.

It will take time…

But as reflected in the their statement — we are already starting to see signs of softening demand (you only have to listen to earnings reports and guidance)

From mine, Walmart’s pre-announce said it all.

And I expect that softening will continue over the coming months.

And should CPI show continuous monthly meaningful declines – one would expect the Fed to pause.

But let’s be clear… inflation is unlikely to fall below a 5-handle in 2022.

Closer to ‘Neutral’

Another ‘carrot’ from the Fed was indirectly admitting 2.50% is closer to the neutral rate (vs 3.50% previously expected)

And this echoes what we see in the latest ‘dot plot’.

But again, the assumption is inflation trends is consistently lower.

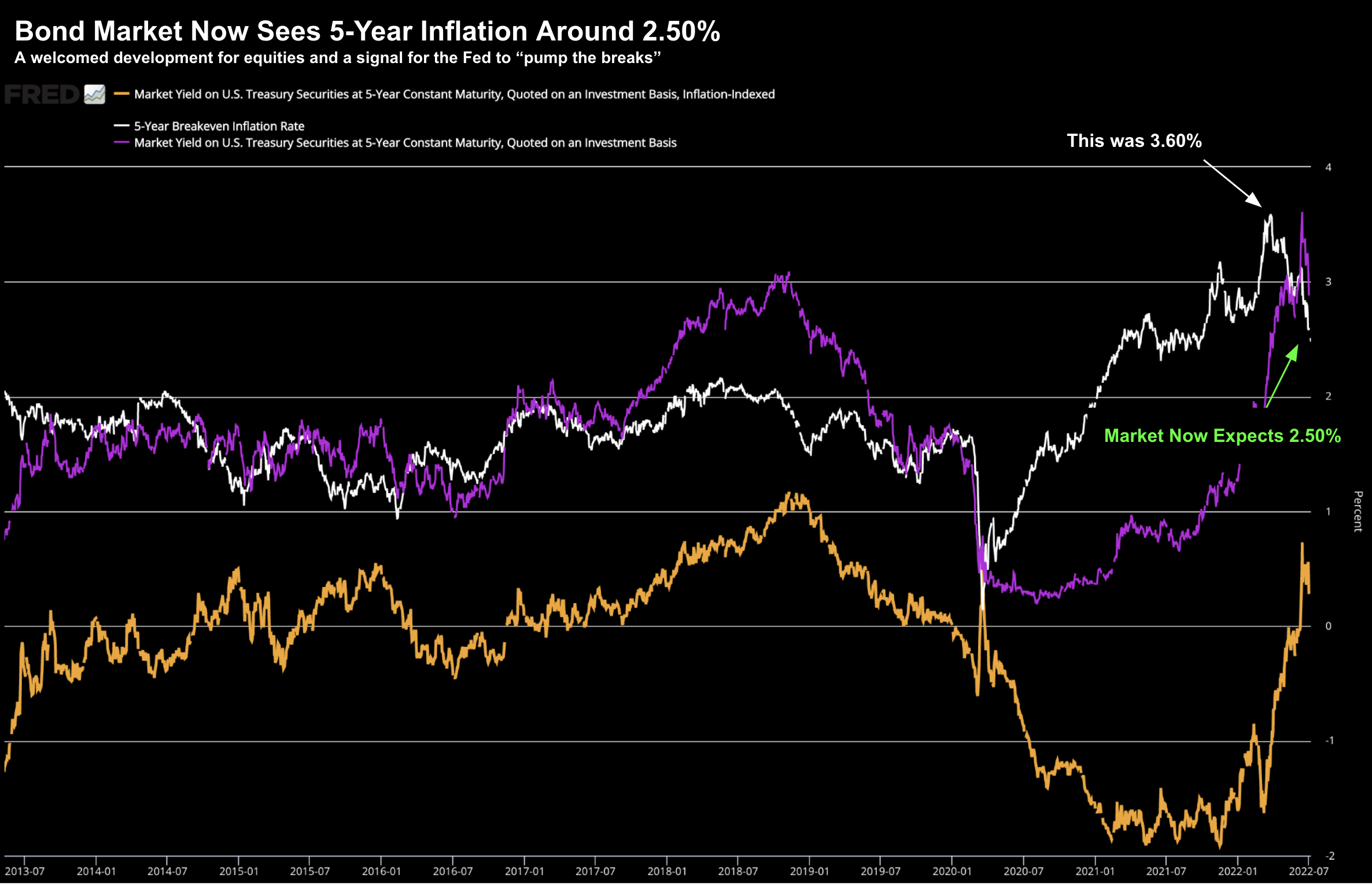

Now if we look at the 5-Year TIPs market – it sees inflation coming down. Below is the chart I shared here from 2 weeks ago:

Turns out the Fed was paying attention.

But what Powell may not admit is he is taking his cues from the yield on the 2-year treasury:

July 27 2022

These yields have pulled back ~50 bps from June…

As I’ve said in the past – if you want to know where the Fed is headed – pay attention to this duration.

And should these yields fall – look for a dovish Fed come September.

Stocks React Positively…

It was a positive reaction to Powell’s perceived dovish tone.

Yes, at “some point down the road” the Fed will pivot on rates.

But again, that’s not really telling us much.

My read is to expect the central bank to remain aggressive until they see continuous monthly falls in CPI.

The challenge however will be two-fold:

- stickier inflation with rents and wages; and

- what we see with oil prices.

This is what is likely to keep inflation high for the foreseeable future. For example, if oil continues to trade above US$90/b – CPI will remain high.

But let’s check in with the S&P 500 – as things continue to trade per the script:

July 27 2022

Today’s big move to upside was fuelled by two things:

(a) Google and Microsoft earnings which were not ‘falling off a cliff’; and

(b) the perception of a more dovish Fed

However, from mine it’s still premature to say the bottom is in.

I expected the rally to 4100 to 4200 (i.e. 35-week EMA zone) – however that’s also where I see resistance.

The litmus test will be what we do at this point?

My guess is we turn lower.

Putting it All Together…

One thing I didn’t get to tonight was Meta’s earnings.

TL;DR is they announced their first ever revenue decline since listing in 2012 – missing on both the top and bottom lines.

From CNBC:

- Earnings: $2.46 per share vs. $2.59 per share expected

- Revenue: $28.82 billion vs. $28.94 billion expected

- Daily Active Users (DAUs): 1.97 billion vs 1.96 billion expected

- Monthly Active Users (MAUs): 2.93 vs 2.94 billion expected

- Average Revenue per User (ARPU): $9.82 vs. $9.83 expected (a decline of 14%)

The stock is down ~5% after hours.

And whilst MAUs and DAUs (Daily Active Users) held up — this wasn’t a good result from Meta.

In addition, it also shows how resilient the businesses of Google and Microsoft are – posting double-digit growth in a very challenging market.

Meta (aka Facebook) is another story… expect more downside in the stock.