- The bull vs bear debate

- Fed minutes suggest more hikes to come

- Three consecutive quarters of earnings decline?

Today the market poured over the latest Fed minutes…

No real surprises – expect rates to be higher for longer.

Almost all Federal Reserve officials at their June meeting indicated further tightening is likely.

And whilst the pace of hikes is expected to be slower – they are not done.

Citing the lagged impact of policy and other concerns, Fed officials saw room to skip the June meeting after enacting 10 straight rate increases.

Officials felt that “leaving the target range unchanged at this meeting would allow them more time to assess the economy’s progress toward the Committee’s goals of maximum employment and price stability”

They add:

“The economy was facing headwinds from tighter credit conditions, including higher interest rates, for households and businesses, which would likely weigh on economic activity, hiring, and inflation, although the extent of these effect remained uncertain”

Here’s the thing:

There is a 12-24 month lag in terms of the full impact of rate hikes (in combination with QE)

We are about 15 months in.

And whilst they are starting to have some impact (e.g., mostly for anyone with a variable loan and/or buying a new asset) – we are early in terms of the impact.

This was mostly offset by the massive amounts of (wasteful) government stimulus (well over $2+ Trillion) still sloshing around in the economy.

We remain awash with liquidity.

But over the next few quarters (and as the Fed reduces its balance sheet) – those lag effects will likely become more pronounced.

Or maybe we will throw away all the history books... and 500 bps in tightening within 12 months; and a sustained, deeply inverted yield curve means nothing?

Either way, I think by this time next year we will know.

The Bull Bear Debate

Perhaps the question of whether you are a bull or a bear is not whether the economy is about to endure a recession early next year…

But rather…. what is the expected state of liquidity and monetary conditions?

After all, excess liquidity was the primary reason stocks had a blockbuster first half of 2023.

Put another way – it was not growth in earnings.

Earnings contracted for the second consecutive quarter… and are now expected to contract again (more on this in my conclusion).

But there remains strong debate on the outlook for monetary conditions.

For example, it’s my view rates will remain higher for longer.

The Fed supported my thesis today with their minutes.

But let’s say the Fed simply holds rates where they are for the balance of the year (as inflation slowly falls) – this means real rates will rise.

But that’s the bearish view…

However, if you’re bullish heading into the second half, you expect rates will ease and monetary conditions will loosen.

And there is every chance you are right.

If that’s true, it’s likely stocks will continue to rally.

However, the level of rates is only one part of the overall equation.

With respect to inflation, many are of the view that higher prices are less a monetary phenomenon – but more supply chain related.

And now that the bottlenecks are clear – inflation will fall rapidly.

I agree with that logic for goods related inflation (which has already come down to pre-pandemic levels in many cases).

However, I believe inflation is largely a monetary phenomenon.

Consider the definition of inflation:

It’s “excess money chasing too few goods”.

Put another way, without excess money in people’s pockets, it’s very difficult for prices to rise (irrespective of whether the goods are available)

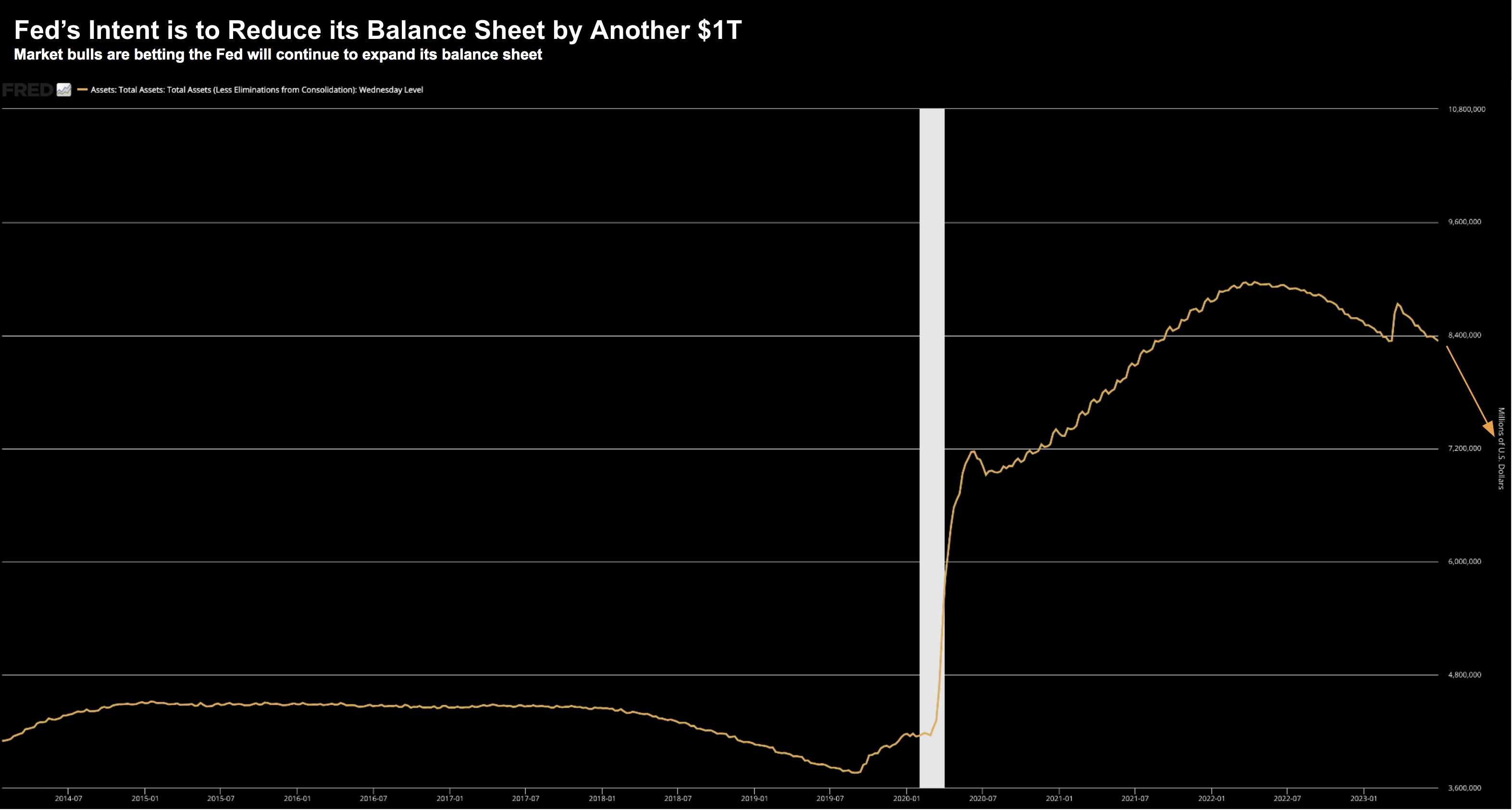

On that point, I think the Fed will continue to reduce its balance sheet.

And if I were to guess… their intent is by as much as $1 Trillion over the next 24 months.

However, that is not what the bulls are betting on.

In summary, we all know the economy can’t get out of first gear.

Some of us think it will likely go into reverse towards the end of this year (or perhaps early next).

Timing is always tricky.

That is mostly due to the expected lag effects of restrictive monetary policy.

However, the bulls believe central banks will reignite the liquidity spigots before long.

I’m not buying it… certainly not with:

(a) Core PCE still well above 4.0%; and

(b) employment remaining very strong.

Putting it All Together

Beyond all things monetary policy – earnings season is almost here again.

What’s interesting (to me) is expectations are slowly but surely being ratcheted down.

It’s curious because stocks have been going higher.

That’s multiple expansion.

Investors are being asked to pay a high multiple for certain stocks today – mostly in tech.

At some point, investors will realize they paid a high price for ‘growth’.

However, there are sectors which offer reasonable (long-term) value (e.g. banks, energy and industrials)

But in terms of the outlook for earnings – they continue to fall opposite a softening economy.

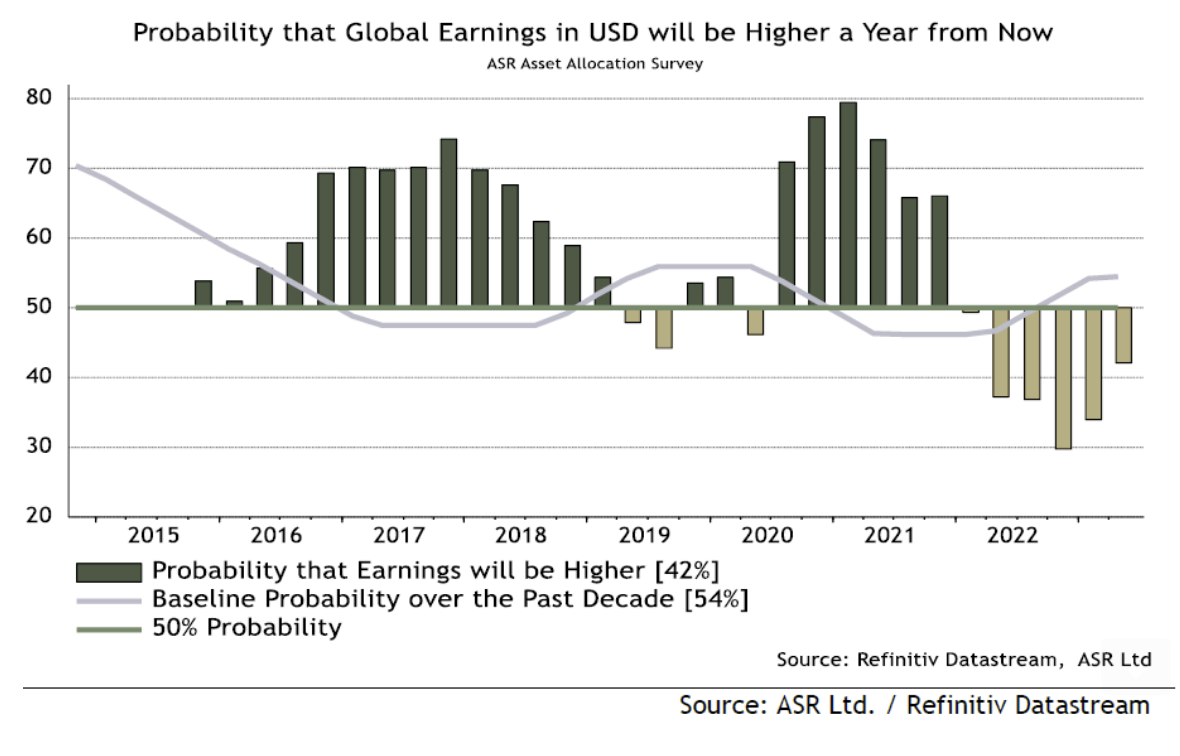

Here’s a chart I came across via Bloomberg this week:

Mmm… earnings expectations are falling.

As I said earlier, don’t be too surprised to see earnings contract for three straight quarters.

A positive for stocks?

We will see.