- Jobs continue at a hot-pace

- BoomGPT and drawing parallels to ~20 years ago

- Invest with optimism; however with your eyes open

As I write, the US Senate just passed the Biden-McCarthy debt ceiling bill.

Everyone exhale.

Markets barely flinched on the prospect of potential default – they knew it would get done.

Make that 78 in a row.

Zero defaults.

However, what the market will be focused on is the upcoming Fed decision on June 10th.

Participants expect the Fed to pause and I think that’s what they will do.

That said, it’s premature to rule out further hikes in subsequent months.

For example, earlier this week Fed Governor Jefferson signaled the central bank is inclined to keep rates steady at its next meeting in June.

“Skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming,” Jefferson said. He also advised that a pause doesn’t necessarily mean the Fed’s done.

Imbalance in the Labor Market

Jefferson’s remarks feel aligned with what Chair Powell suggested in May.

However, there are several ‘Fed hawks’ who believe rate hikes could still be in play.

For example, Cleveland Fed President Loretta Mester has publicly stated she is opposed to taking a rate hike off the table.

Mester is leaning into the in-balances we find in the labor market – where wages continue to grow around ~6.5% YoY

Private payrolls added 278,000 jobs last month – far stronger than what the market anticipated.

According to CNBC – the market was looking for just 180,000 job additions.

The good news from the Fed’s perspective is wage gains have slowed — to an annual gain of 6.5% (down from 6.7% last month).

Those switching jobs reported an annual increase of 12.1%, off a percentage point from the month before.

To be clear, this is still well above the Fed’s (unspoken) ‘3% wage gain‘ objective – however the trend is slightly lower.

As an aside (and perhaps adding to the wage pressure) – the number of unfilled jobs in the US unexpectedly jumped to over 10 million.

Economists surveyed by Dow Jones expect job growth in May of 190,000, a slowdown from the 253,000 jobs added in April.

Now if this comes in hotter than say 250,000 for the month – with unemployment at a 70-year low of 3.4% – it’s possible the Fed could choose to lift rates again in June.

But the devil will be in the detail…

And if not June – perhaps subsequent months if labor conditions remain strong.

BoomGPT

Switching topics…

Unless you have been living under a rock… it’s hard to notice the crack up boom in tech stocks the past few months.

It feels eerily similar to the dot com boom of 2000.

And this is why…

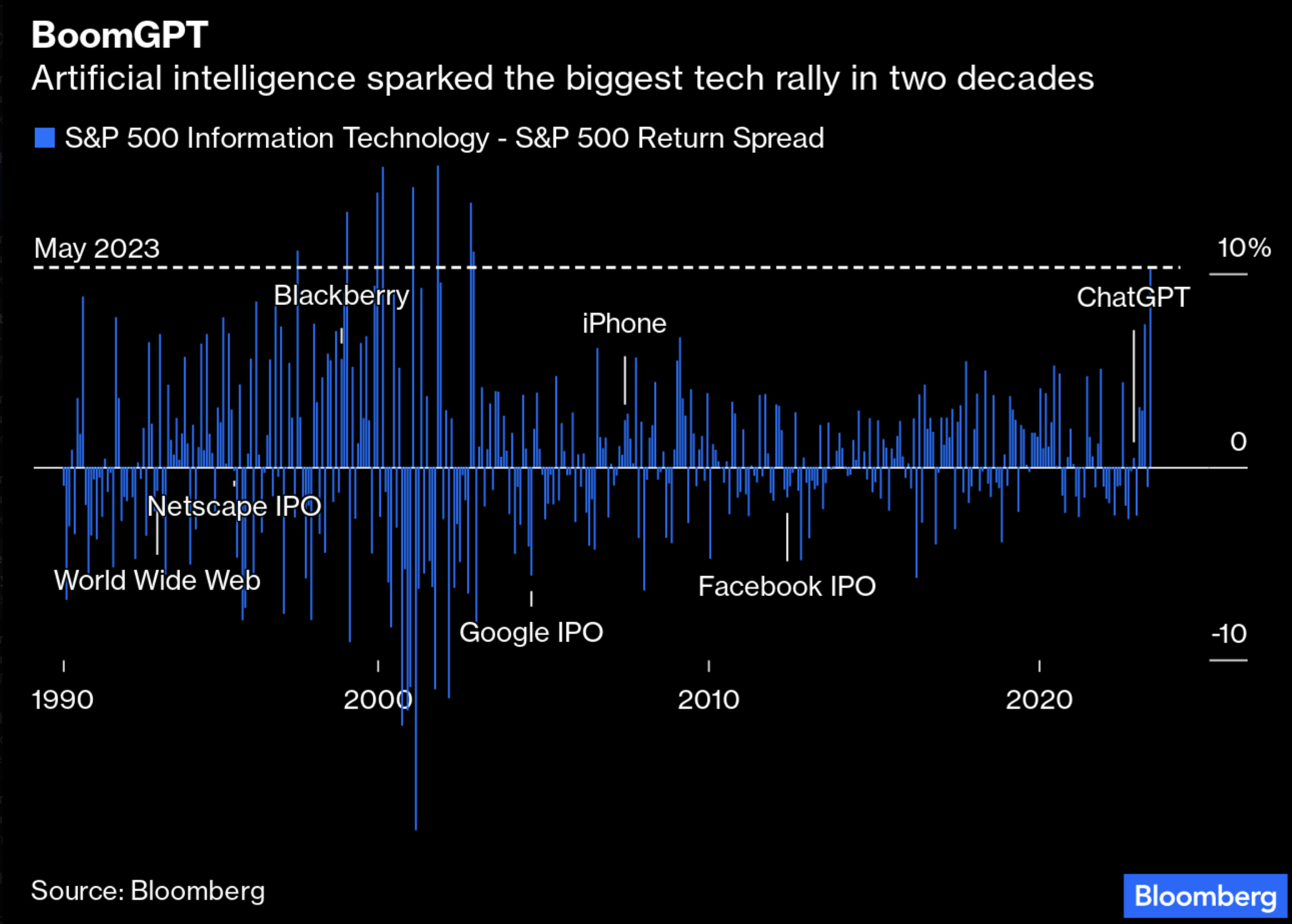

Bloomberg posted this great chart from Bespoke Investment Group.

This chart shows the spread between the return on the S&P 500 Information Technology sectors vs the broader S&P 500 for each month going back to 1990.

The spread is as high as we have seen at any time since the dot.com bubble..

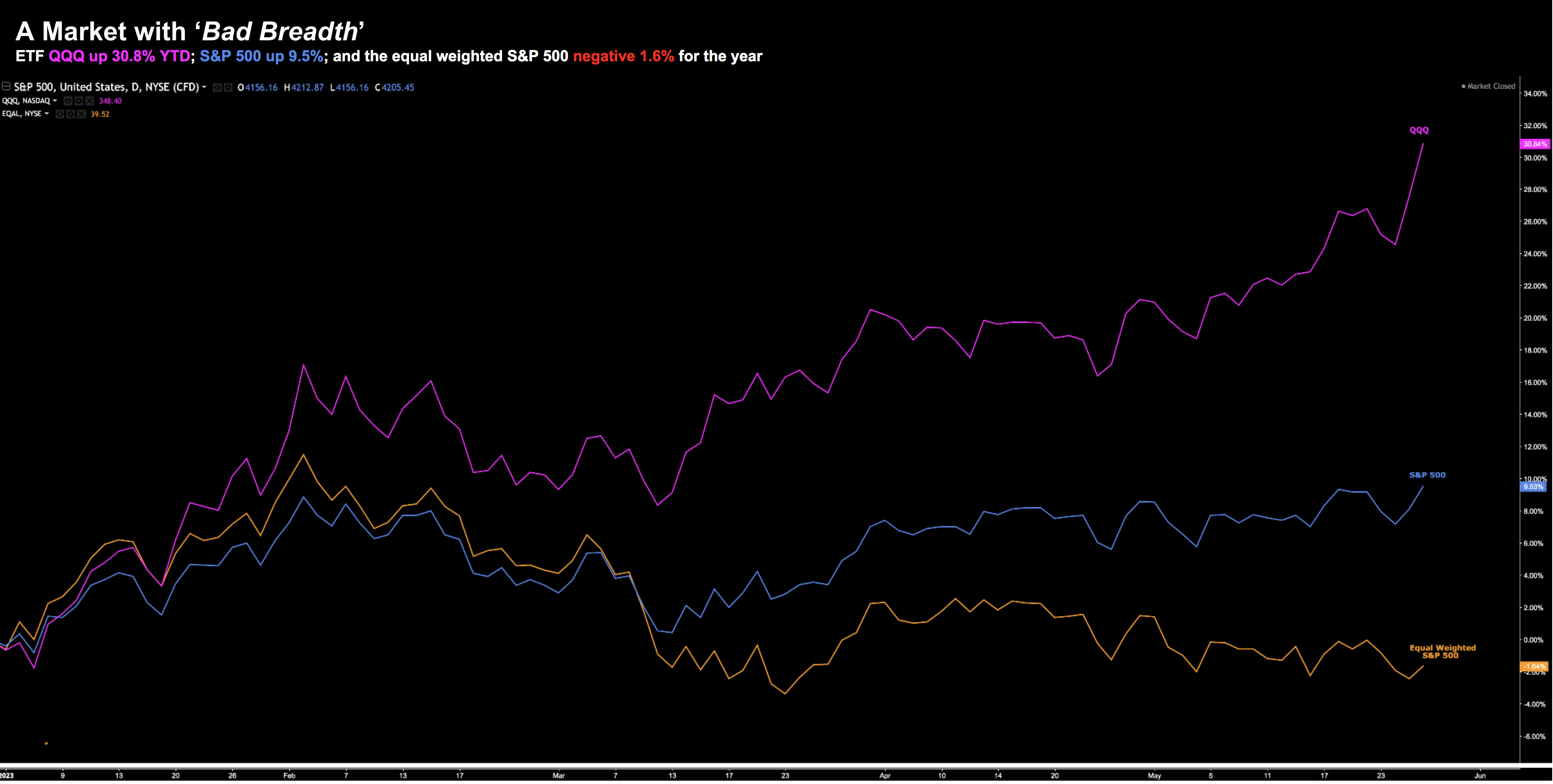

And as I’ve demonstrated recently – here’s how tech has performed vs the equal-weighted S&P 500 YTD:

My argument is the increasing weight of tech in the index adds fragility.

Are there really only less than “10 stocks” which are investable?

If so, that’s problematic.

Bloomberg contributor John Authers framed it this way when talking to the recent boom in AI:

The innovations of the last three decades changed all our lives, and eventually created wealth for shareholders. But it took time for them to work out exactly who would win, and there were some mistakes along the way.

The AI boom has already taken some inveterate bulls by surprise; as Shuli Ren points out for Bloomberg Opinion, even Cathie Wood missed out on it. The potential is obvious, and doubtless much money will be made.

But May’s tech blowout suggests that there will be plenty of opportunities to lose money. Invest with optimism, but keep your eyes open.

I could not have said it better.

Invest with optimism… and by all means maintain exposure to those well positioned to gain (for example, I continue to own each of Apple, Amazon, Google and Microsoft as core holdings)… but keep your eyes open.

Before I close, I want to share two charts from some much needed perspective.

The first is networking infrastructure giant Cisco (CSCO)

In 1994, CSCO traded for not much more than $1.50.

By the year 2000 – it was trading above $80.

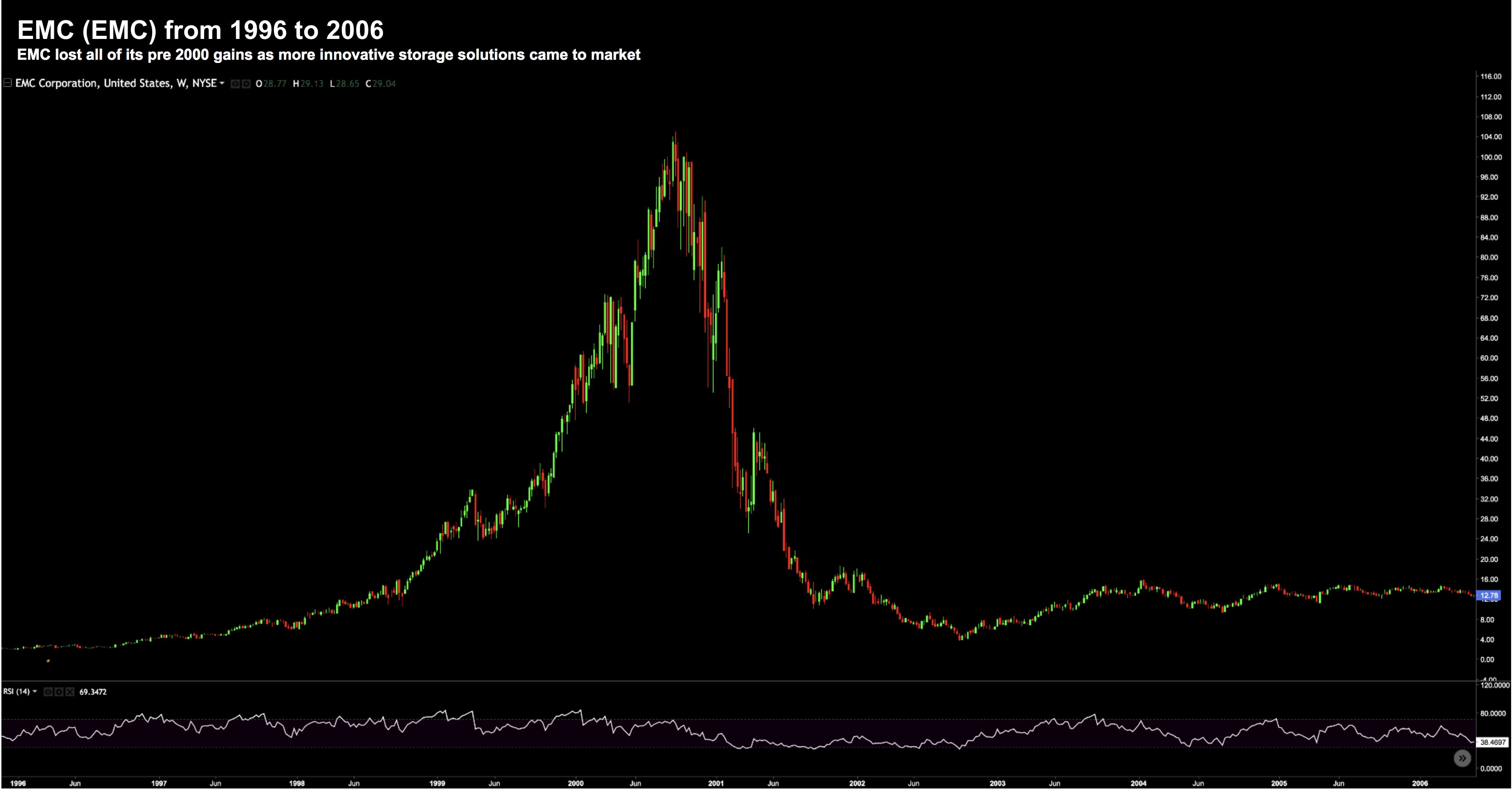

The second chart is (former) data storage company EMC

The chart is very similar… with the stock trading for about $2.00 in 1996… surging to over $104 in 2001.

EMC grew revenue by 33% from 1999 to 2000 according to their Form 10-K

In short, if you wanted to digitally enable your business for the internet – you needed (a) network infrastructure and (b) data storage.

These two companies dominated their respective markets.

But let’s fast forward a few years for each company….

CSCO crashed shortly after 2001 and never returned to its all-time highs.

In subsequent years, various competitive networking infrastructure options emerged – and it was never able to reclaim its leading market position.

EMC is a similar (if not worse) story…

Data storage was one of the first areas of computing to be disrupted – as prices commoditized.

That was the end of EMC.

So what’s my point?

There is no question that companies like NVIDIA have strong market leading positions with their AI chipsets.

And certain companies cannot buy their GPUs fast enough.

NVIDIA are taking full advantage (as they should).

For example, a CPU server box which would cost about $10,000 – NVIDIA are charging areound $200,000 for the same box with GPUs

Now the same could be said for companies like CSCO and EMC in the late 90s’ / early 2000s.

However, all that changed on a dime.

To be clear, there is nothing to suggest that a company like NVIDIA will follow the same path as CSCO and EMC.

They may not.

However, it shows what can happen when we see these hyperbolic moves.

Putting it All Together

The S&P is closed at 4221 today.

It is yet to meaningful break about 4200 and hold that level.

My quick take is we could see stocks continue to grind higher into the Fed meeting (in the absence of any data).

As I’ve reported recently – there is ample liquidity to prop this market up.

However, as I was explaining to one reader yesterday, the upside reward from the zone of 4200 does not handily outweigh the potential downside risk(s).

I continued to maintain a long-only exposure of around 65%.

Year-to-date my returns are inline with the S&P 500 – slightly above 9% (which I will update at the end of the week).

I think it’s a mistake not to have any exposure to stocks (i.e. being overly defensive)

I realize many investors have missed out on their entire rally on that basis.

However, I also think it’s a mistake to be too aggressive.

That’s where you lose money.

What you want is controlled aggression.

For me, that middle-ground is 65% long exposure to quality names (i.e. strong reliable free cash flow, strong balance sheet and moats).

What’s more, I’ve also reduced my tech exposure to below market weight — adding to more defensive ‘value names’.

And specifically, I am looking at business which will hold up well during a recession.

I don’t know if that strategy will pay dividends at the end of the year – it may not.

Time will tell.

But for now, that is my strategy and I’m happy to share my results week to week.

As I say, if your going to write a blog on investing, it’s only fair you share your performance (very few do!)

Invest with optimism however keep your eyes open.