- Food, Rent and Medical Costs all Higher

- Core PCE up 0.6% in August and 6.3% from the period a year earlier

- Start eyeing 4.00% for the Fed Funds Rate next year

It looked as though we were about to see a ‘technical bounce’ from what I felt were (near-term) oversold levels.

However I added the market was about to face a litmus test.

Today it failed.

Folks, this is a strong bear market.

It’s that simple.

And there’s no point making it any more complicated.

The good news is bear markets don’t last forever.

Trees never grow to the sky and seldom to things go to zero.

But if you listen to the financial talking heads… they flip from bullish to bearish pending the direction of the wind!

Last week I heard calls for “the lows are in for 2022”. Today the “sky was falling”.

“Infotainment” is what it is – designed simply to monetize your eyeballs.

Here’s the thing:

If you’re changing your sentiment from bullish to bearish in the space of a couple of weeks – you will lose money.

Your broker will love you… but you will lose.

This is why I emphasize lengthening your time horizons.

Beyond that – you need to exercise a basic plan. And it could be as simple as:

- there are times to make money (bullish markets); and

- times not to lose too much money (bearish markets)

In this environment, we feel better about making bullish bets with companies that have consistent (growing) revenue; positive free cash flow; strong moats and balance sheets; with large addressable markets.

But when we have a market like today – where stocks are making lower highs and lower lows – it’s probable strength is sold.

Our task in this market is to be extremely patient.

Wait for the market to come to us. Don’t chase it.

The goal is to not only buy quality (that’s always the case)… but more importantly… buy well.

Most people try to do the former – but not the latter.

Let me also add that markets rise more than they fall. For example, markets are said to rise about 65% of the time.

This is why over 50+ years the total average compound growth rate (CAGR) for the S&P 500 is ~10.5%

It’s not a straight line… but the trend is from the “bottom left to the upper right”

But first, let’s dive into last month’s inflation print.

It confirms what I’ve been stressing the past few months (or closer to a year)

The Problem with ‘Sticky’ Inflation

- CPI increased 0.1% in August and Core PCE (the Fed’s measure) rose 0.6% – both higher than expected.

- Costs were driven by increases in food, shelter and medical care services, offsetting a sharp decline in gasoline prices.

- Real average hourly earnings adjusted for inflation rose 0.2% for the month.

And from mine, this shows you the fight the Fed has on its hands.

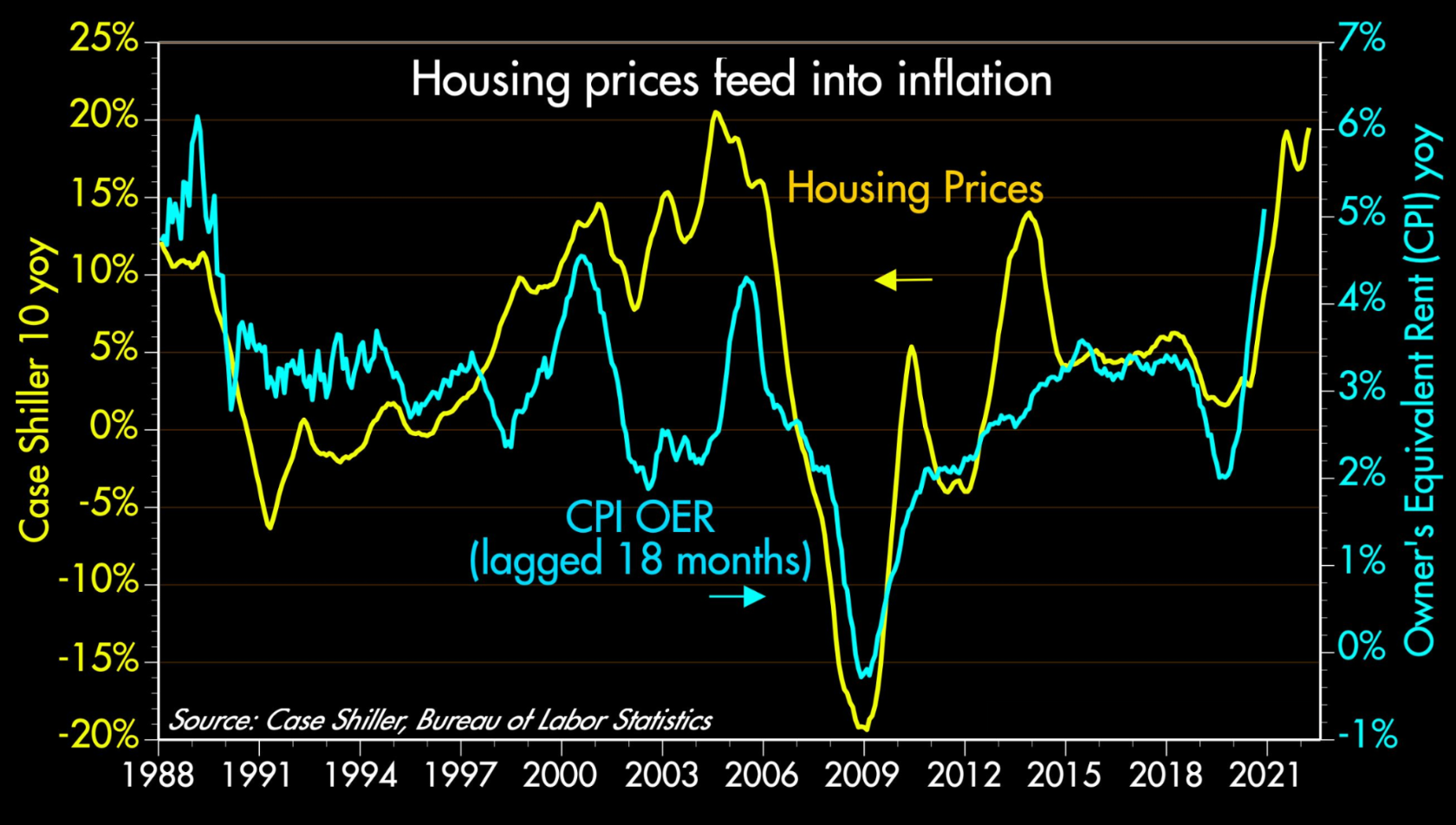

Shelter costs, which make up one-third of the weighting in the CPI, jumped 0.7% and are up 6.2% from a year ago.

And as we know, rent prices trail housing by around 18 months:

Source: Scott Grannis

The other concern is medical care – rising 0.8% on the month and up 5.6% from August 2021.

Now whilst we can all choose to ‘eat out less’ – we cannot easily reduce spending on things like food, rent or medical services.

That’s the problem.

And whilst over time the Fed’s measures will curb demand – this will take time.

It’s wishful thinking the Fed is about to “pivot or pause” on rate increases – like many wanted to believe.

As I’ve written recently – my expectation is we will see the Fed funds rate challenge 4.0% next year (and possibly more)

Bond Yields Surge

No-one does.

Plenty think they do – but they don’t.

For example (and repeating a portion of a previous post) – to answer this you need to know questions like (certainly not limited to):

- inflation (Core PCE and CPI) will be in 3, 6 and 12 months?

- whether there will be recession in 2023; and how deep or long it will be?

- what the unemployment rate will be in 3, 6 or 12 months?

- where the 10-year yield will be;

- how will the war in Ukraine end; and where oil prices will be?

- will China invade Taiwan; and what impact will that have on US / China relations? and

- who will win the election in 2024?

If nothing else from today’s report — it confirms the US remains in the throes of a highly unpredictable inflation.

I say that because much will depend on factors that economists can’t possibly model, including developments such as those listed above.

Now assuming you can answer all of these accurately – think about the dynamics between these variables.

If “A” then “B”… else if

A change to one input will impact the other.

So much for predictions!

However, what I do know is the Fed are likely to keep raising rates with Core PCE more than 3x their target rate of 2.0%

I only state this as Jay Powell told us.

Now from mine, it appears that equities are only just starting to connect the dots between:

- the magnitude of stickier inflation (e.g. how it offsets declines in other inputs); and

- the lengthy difficult fight the Fed has ahead.

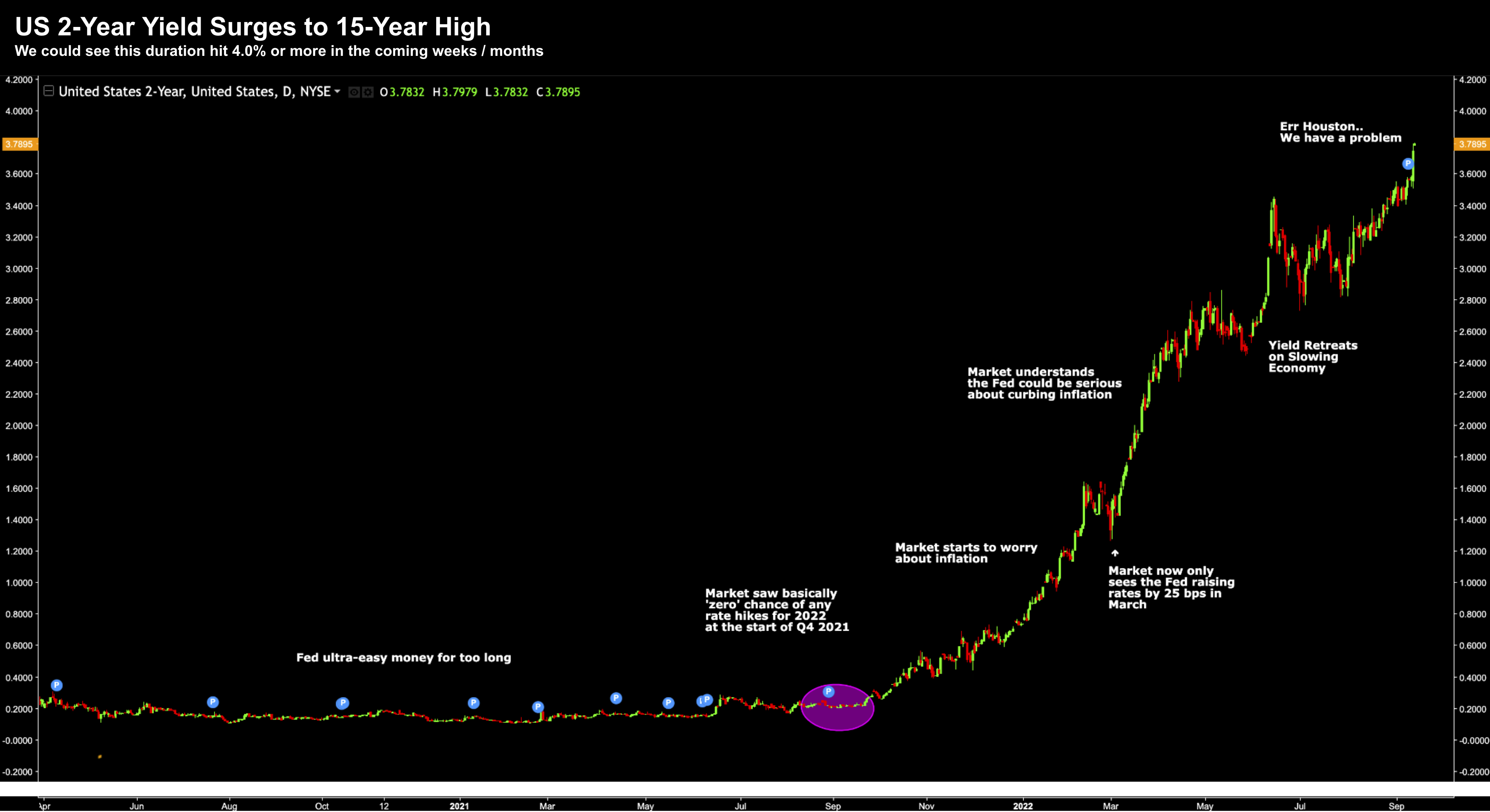

Let’s take a look what we saw with the US 2-year today:

Sept 13 2022

From mine, the 2-year is a good proxy for the short-term Fed funds rate.

It’s basically telling you where the Fed needs to be.

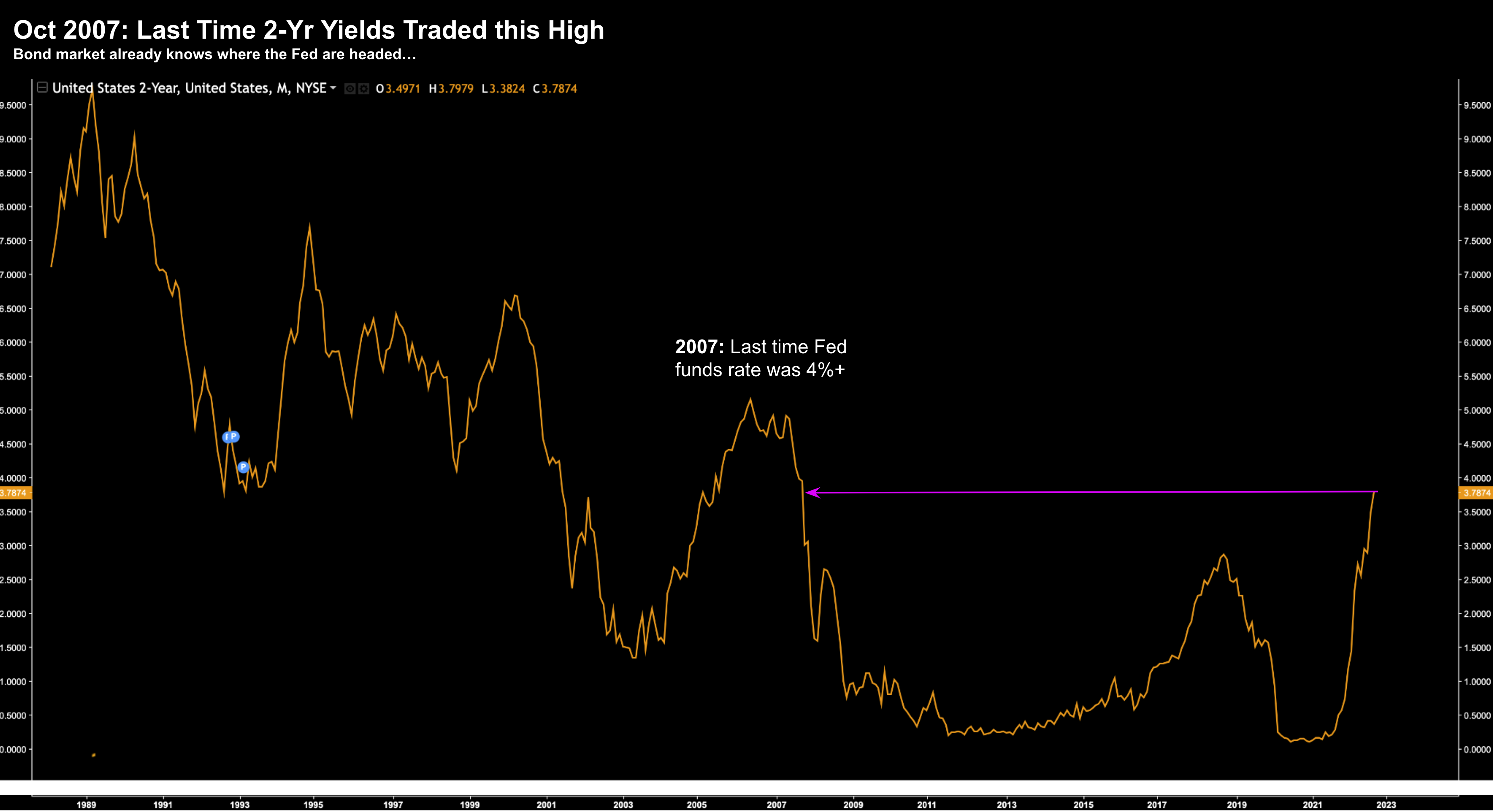

This is ~3.8%… a level not seen since October 2007.

However, fifteen years ago the Fed was slashing rates. Now they are hiking rates into a slowing economy.

Sept 13 2022

S&P 500: Red Flag

If this were a Formula One event – I would instruct drivers with a red flag.

What does that mean?

The red flag is displayed by marshals when conditions are unsafe to continue the session or race.

When shown during a practice or qualifying session, all cars must immediately reduce speed and proceed slowly back to the pit lane.

That’s how you should be trading this market.

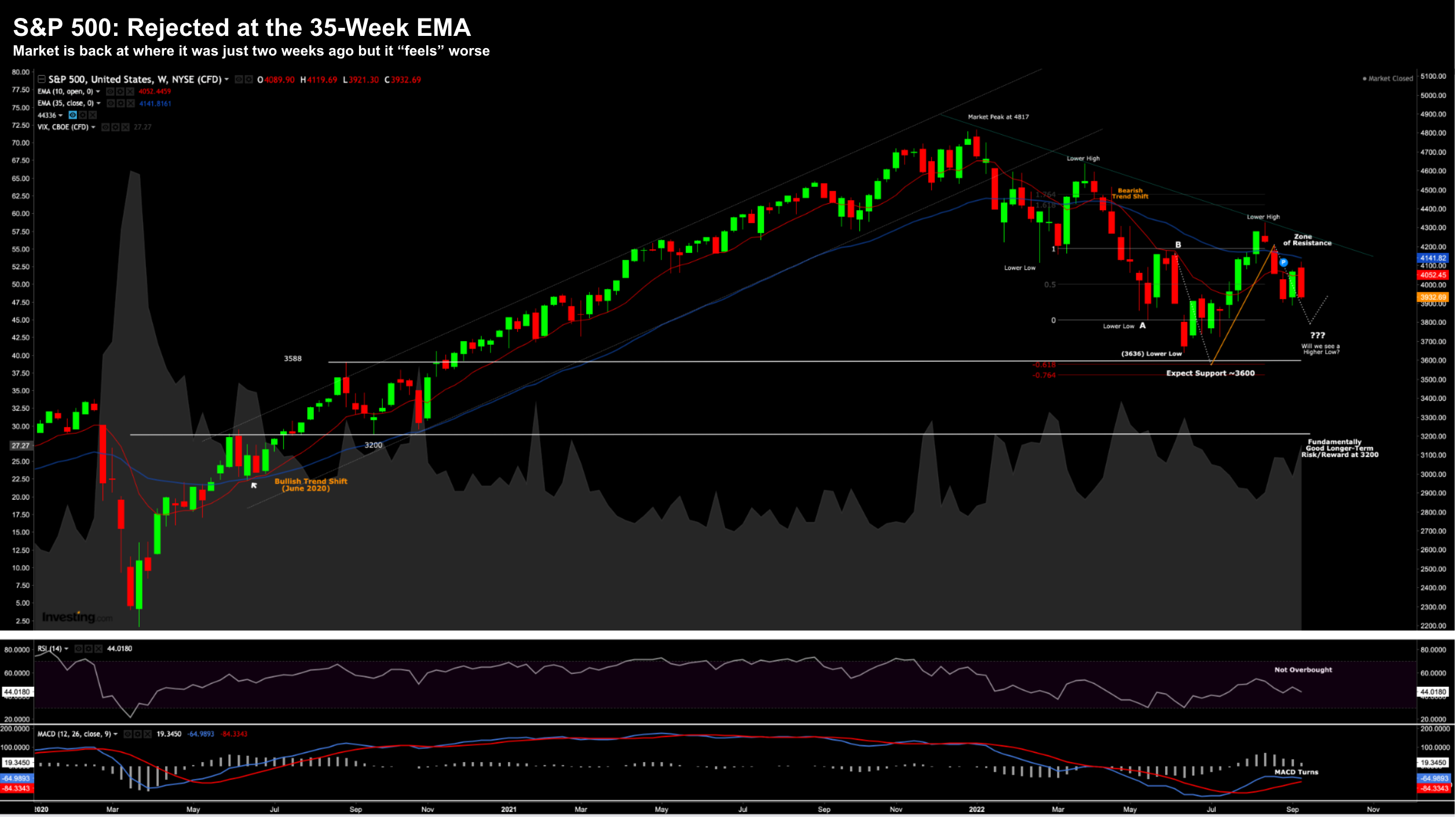

Let’s revisit the weekly chart – as not much has changed with my thesis (despite mainstream’s noise)

Sept 13 2022

“Biggest single day losses for markets in two years” – some of the headlines read.

But take a look at the chart…

We are simply trading back where we were only two weeks ago.

We went up a little bit last week… and we have it back this week.

If you went on holiday for two weeks – you might think nothing has changed.

And you would be absolutely right. For example:

- We’re still in a weekly bearish trend;

- the VIX is still well below 30 (i.e. there’s no panic selling);

- inflation (CPI and Core PCE) remains unacceptably high; and

- the Fed are still likely to hike 75 basis points in Sept… etc etc

It’s a nice time to be cashed up (I’m ~65% long) and be ready to strike when the risk/reward looks more compelling.

It’s coming… but we are not there yet.

Putting it All Together

Based on their recent language – I felt that even if the CPI print came in with a 7-handle – they were still likely to hike 75 basis points.

I think we can almost lock that in now.

For example, Fed Chair Powell has said that he wants to see a “series” of improving inflation reports before he even considers changing his tough-on-inflation strategy.

Therefore, we can now reset the clock at zero.

We don’t even have two consecutive months of lower trending inflation.

That’s not to say inflation might drop next month… it could.

However, there’s a strong chance that food, medical, wages and rents will remain stubbornly high.

And it’s hard to ‘sacrifice’ those things.