- Market celebrates headline CPI at 3.0%

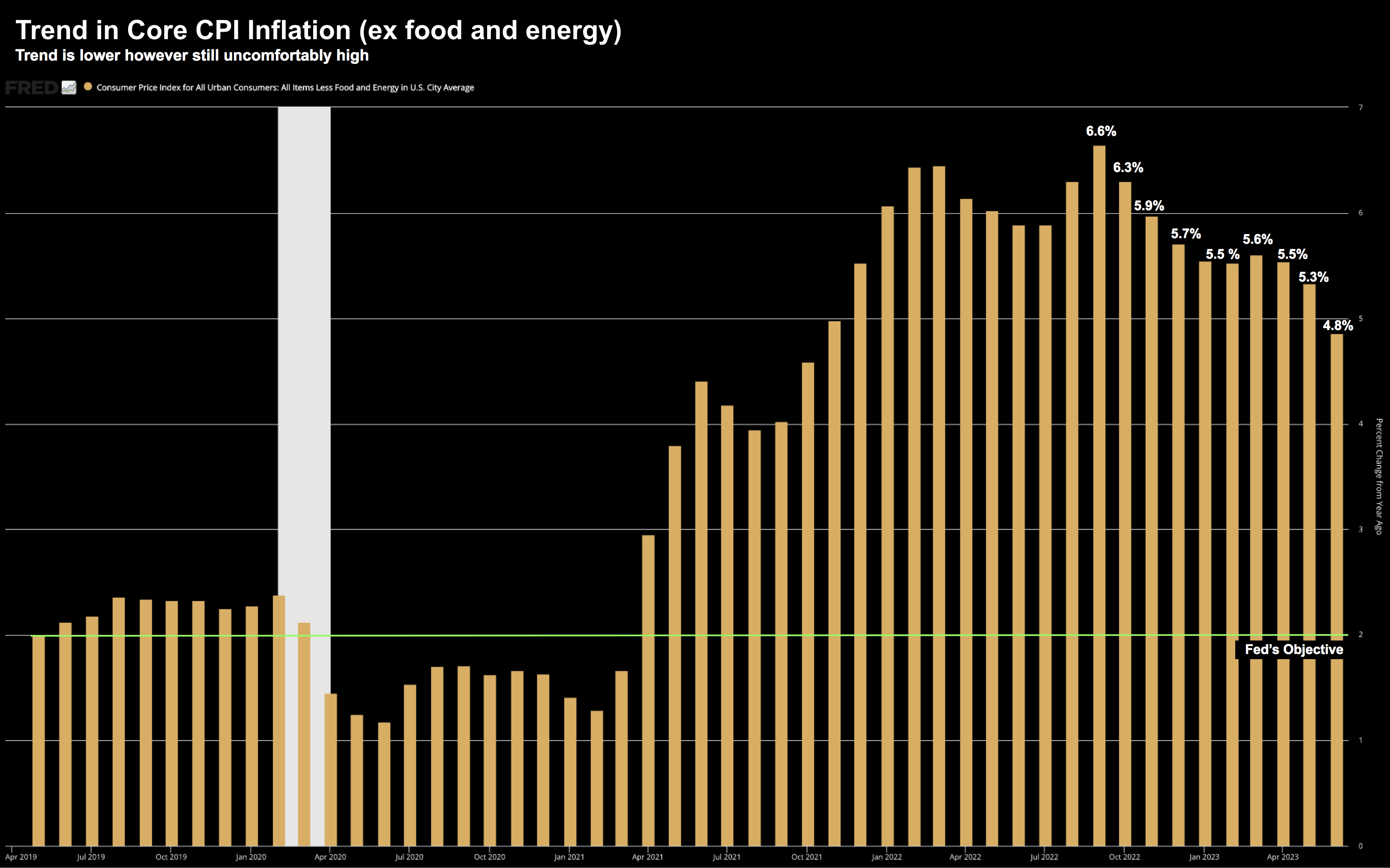

- However, Core CPI remains well above the Fed’s objective

- Bond yields quick to fall on anticipated cuts – but I think they overshot

From the market’s perspective – today was “beer o’clock”

The inflation job is done!

Tools down!!

The market cheered the news of the latest monthly CPI and Core CPI print.

Here’s a quick summary:

- Headline CPI rose 0.2% in June and was up 3% from a year ago, the lowest level since March 2021.

- Excluding food and energy, Core CPI increased 0.2% MoM and 4.8% YoY

- Soft gains in food prices and declines in used vehicle and airline prices helped keep inflation down, while shelter prices continued to rise.

- Wages adjusted for inflation increased 1.2% from a year ago.

In fairness, there is good news.

Headline CPI down to 3% from a year ago is a welcomed relief.

That said, it was mostly inline with expectations given the baseline effect (i.e. it’s coming off a very high inflation number last year)

But…

Core CPI at 4.8% for the past 12 months (4.6% over the past quarter) should temper some of the enthusiasm.

July 12 2023

From mine, it’s still meaningfully above the Fed’s 2% objective (green line).

Question is – how much of that was considered?

Bond Prices Rally / Yields Fall

Last Sunday I talked about how it was time to consider adding bonds to your portfolio.

I offered readers a couple of helpful ETFs for exposure.

For example, with the US 10-year, you were being paid ~4.0% with the chance of considerable price appreciation on the basis:

(a) inflation continues to cool over the next 12+ months; and

(b) Fed could start reducing rates late next year (pending Core PCE inflation being closer to 2.0%)

In other words, if rates start to fall with a lower inflation risk, it means bond prices could materially appreciate.

But for now, you are being paid 4.0% risk free at the longer-end (and near 5.0% at the front end)

That’s attractive.

Since I wrote that blog – bond yields have dropped (which means bond prices have gone slightly higher)

Following today’s CPI print – yields saw another move lower.

But here’s the thing:

I think both equities and bonds are getting a little too ‘trigger happy’.

To be fair, the market is slowly getting on board with the fact the Fed is closer to its terminal rate (e.g. perhaps another 50 basis points from here).

But the pattern I have observed is investors will often get “bulled up” on the back of one positive print.

Identifying patterns and investor psychology is critically important (more on why in my conclusion).

From there, the market is making the (bold) assumption the Fed is pretty much done.

Presumptuous?

I think so.

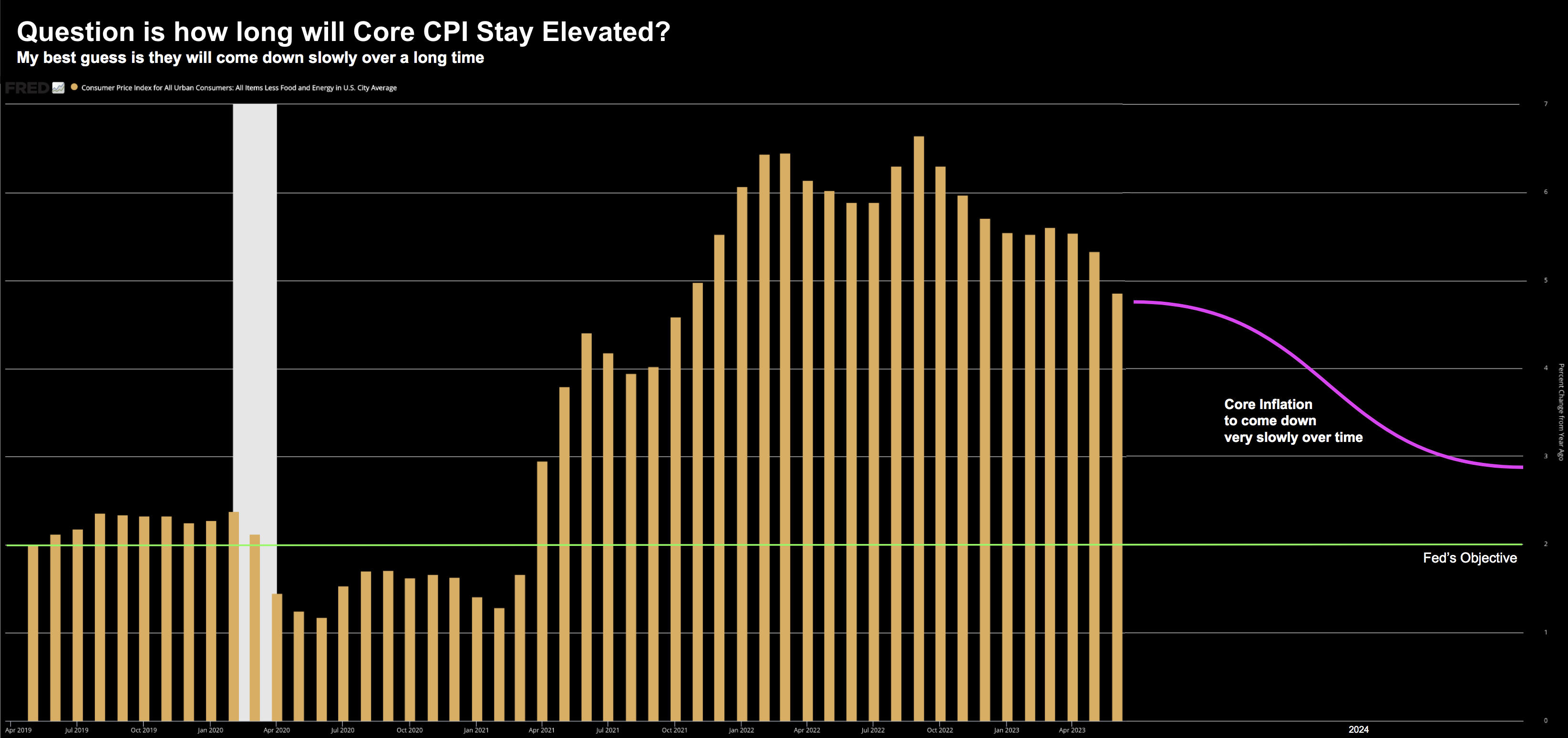

Core inflation is likely to only come down slowly over time. For example, it could something be closer to this:

For example, it would not surprise me to see Core CPI still above 3% 12 months from now.

Then again, I don’t pretend to be great at ‘macro’ forecasts.

And if that’s true (and it may not be) – then the Fed could comfortably hold rates where they are.

Powell has said (and I’m paraphrasing) “we will get to the policy rate where we want it” (likely to be at least 25 bps higher) – and they will keep it there for a long time.

He has said this could easily be one year or two.

And for me, that’s the disconnect in the market.

Here’s what I mean:

After today, the market now believes we will see 125 basis points of rate cuts in 2024.

Last week that was 80 basis points

Question:

Do you think the Fed is thinking of cutting rates by 125 basis points next year (or more like 150 bps assuming they raise 25 bps the next meeting)?

My best guess is not if Core inflation is anything above 3%.

When Powell talks at the next Fed meeting July 26 – he is going to remind investors that Core inflation is still far too high and their work isn’t done.

And when we get Core PCE on July 28 (their preferred inflation metric) – that will probably reinforce the case.

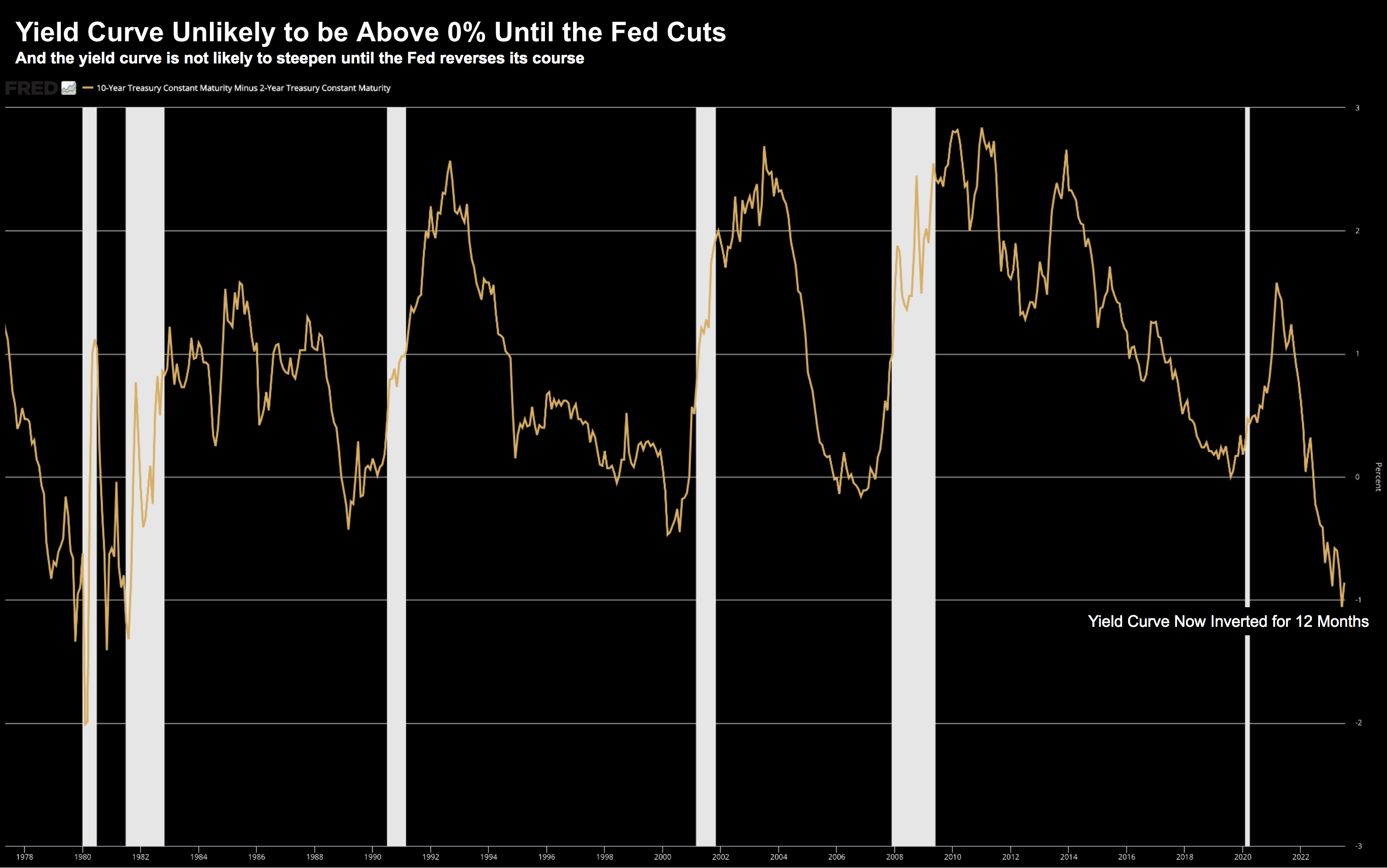

Yield Curve to Remain Deeply Inverted

The other reason to hold on “breaking out the bubbly” is what we see with the yield curve.

The longer this stays inverted (i.e., below 0%) – the more pain this is inflicting on business.

And at some point later this year – it’s likely to have a meaningful impact on the real economy (if not already).

For example, take the popular 2-year / 10-year curve:

July 12 2023

Another way of reading this chart is it’s the (bond) market saying the Fed is far too tight.

In other words, they need to lower rates at the short-end (so they are below that of the longer end)

However, as I discussed last week, the US 2-year yield was close to ~5% and the 10-year ~4% – resulting in a 100 bps inversion.

But if the Fed continues to hold rates higher (with core inflation well above its objective) – the yield curve will remain inverted.

And from mine, only when the Fed starts to cut rates will we see this curve back above 0%.

To be clear, the curve may steepen a little if the market thinks the Fed is closer to being done (e.g., it steepened this week).

That’s simply the short-end getting “in front” of the Fed.

But in terms of the shorter-end trading at a lower yield than the long-end (implying it moves above 0%) – that could be at least 12+ months away.

And that hurts.

Keep Watching Bonds

As I was saying last week – keep your eye on treasuries as a great risk / reward play into next year.

With yields dropping this week – bond prices have rallied (along with stocks)

However, they may have overshot on just one data point.

That’s the typical pattern.

I think once we see the Fed raise rates again July 26th – reminding investors their work is far from done – yields will resume their upward move.

That’s the point where you can add bond ETFs like:

- AGG – iShares Core U.S. Aggregate Bond ETF (note: similar ETF is LQD)

- EDV – Vanguard Extended Duration Treasury ETF (note: similar ETF is TLT)

… as you position your portfolio to be more “recession ready” for 2024.

Putting it All Together

On an unrelated note – I encourage readers to subscribe to Howard Marks’ free newsletter.

His latest memo is titled “Taking the Temperature”

He provides a great review of the various times (in his 50+ year career) when the market was showing either irrational exuberance or extreme pessimism.

However, the ability to identify these patterns is difficult.

For Marks… it took him three decades to really understand. I quote:

You may have noticed that the first of the five calls described above was made in 2000, when I had already been working in the investment industry for more than 30 years. Does this mean there were no highs and lows to remark on in those earlier years? No, I think it means it took me that long to gain the insight and experience needed to detect the market’s excesses.

That gives you some perspective on how much time it takes to really understand markets. It’s both time and continued study.

To that end, he adds:

Hopefully we learn from our experiences as we go through life. But to really learn from them, we have to step back on occasion, look at an entire string of events, and figure out the following: (a) what happened, (b) is there a pattern that has repeated, and (c) what are the lessons to be learned from the pattern?

Could not agree more.

I think what we’re seeing with bond yields and the shape of the yield curve is a pattern that has consistently repeated.

And given the pessimism in bonds (with yields high) – and the risk of recession next year – that could represent opportunity.

But please read Marks’ latest memo – it’s packed with timeless insights and perspective.

You will be smarter for it.