- Stan Druckenmiller warns of a “hard landing”

- Consumer sentiment crashes

- S&P 500 having a hard time holding above 4200

That’s my best advice.

Not only do I think this market is fully valued at 19x forward earnings — it represents meaningful downside risk.

And I’m not alone…

For those less familiar with market speak – 19x is not cheap.

The 100-year average for the S&P 500 is closer to 15.5x

But perhaps what concerns me most is what the market assumes will happen over the next ~6-9 months.

For example, at the time of writing, it sees rates being slashed three times this year.

Is this realistic with Core CPI YoY is still travelling around 5.5%?

But first, let’s start with one of the greatest investors on the planet.

Like Warren Buffett and Charlie Munger last Saturday, he didn’t waste his words.

Druck Sends a Warning

- Warren Buffett – who has delivered an average of 21% CAGR for 57 years

- Stan Druckenmiller – who delivered an average of 30% CAGR for 30 years; and

- Howard Marks – who has delivered an average of 19% CAGR for over 30 years

I don’t care who it is.

What have you done (vs what you say)?

Few will boast a better record than those mentioned above.

Sure, anyone can post stellar returns over 1, 2 or maybe even 5 years.

That’s not hard.

But in excess of 30 years means you are doing something consistently right.

What’s more, you understand when to:

- carefully manage your risk; and

- capitalize when conditions are more favourable.

Yes, they will sound exceptionally intelligent.

And most people who constantly preach fear often sound as though they see things others don’t. That’s intentional.

But in GMO’s case – with a paltry record of just 6.97% CAGR over 25 years – why would you listen?

For example, if you were to simply buy the S&P 500 Index and do nothing — you would have substantially outperformed Grantham’s GMO fund by 4% per year.

Heck – if you bought a property and did nothing – you could deliver average annual returns of around 6% the past 25 years. You don’t need to be clever to do that.

But why listen to anyone with a track record which has not meaningfully outperform the market?

You get my point.

Buffett, Marks and Druckenmiller play both great defense and even better offense.

Sure, great defense is important – but it’s not enough.

This week “Druck” warned of what he sees with the market today (as part of the 2023 Sohn Investment Conference)

I quote:

- “I am not predicting something worse than 2008 – yet to be a good risk manager – it’s just naive not to be open-minded to something really, really bad happening”; and

- “You’re going to have unbelievable opportunities in the next couple of years”

- US economy is teetering on the edge of a recession and predicts a “hard landing” (e.g., 5%+ unemployment and a 20% slump in earnings)

- The downturn will occur at some point during the current quarter (far sooner than what most believe)

- Declines in retail sales and the nation’s regional banks prompted him to accelerate his forecast for a recession

- On Fed policy – he said they have left themselves less wiggle room compared with previous economic cycles – where they have basically “wasted all their bullets“; and

- On fiscal policy – he spoke to the dangers of unchecked future government spending, added that “it is a lie and it is a fantasy to say we don’t have to cut entitlements. The problem is we’re either going to cut them now or we’re going to cut them later and later will be much more costly”

It won’t be more costly to the current generation – it will be more costly for future generations who have to pay for it (and didn’t get the benefits)

Sadly, I doubt the current Administration has any appetite to cut one penny of spending… that’s not how they think.

No-one ever spent their way to prosperity.

I digress….

If you’ve been reading my blog at any time the past 12 months – Druck echoes much of my sentiment.

He also called the market being expensive around 19x forward.

But let’s look at what the market assumes.

And why that could represent risk.

So What’s Priced In?

To date, revenue growth has been pitiful at just 3% YoY.

And most of that has been opposite inflation. Put another way, adjusted for inflation revenue is in decline.

But as you know, the market rallied on the news as this was “better than feared”

Now the market is always uncertain to a degree.

But I think the amount of ‘certainty’ it has feels presumptuous.

Let’s start with the Fed….

The market is pricing in a pause (80% probability).

And I think that’s a reasonable assumption.

However, if they were to hike at any time between now and the end of the year – what would that do?

For example, the market is also pricing in three cuts before the end of 2023.

Why?

One assumes because inflation risks are off the table and the Fed needs to stimulate growth.

My personal view (and I might be wrong) is services inflation is still too high for the Fed to consider cuts.

What’s more, it’s also not slowing at the velocity the Fed needs to see.

This week’s CPI data was a gentle reminder.

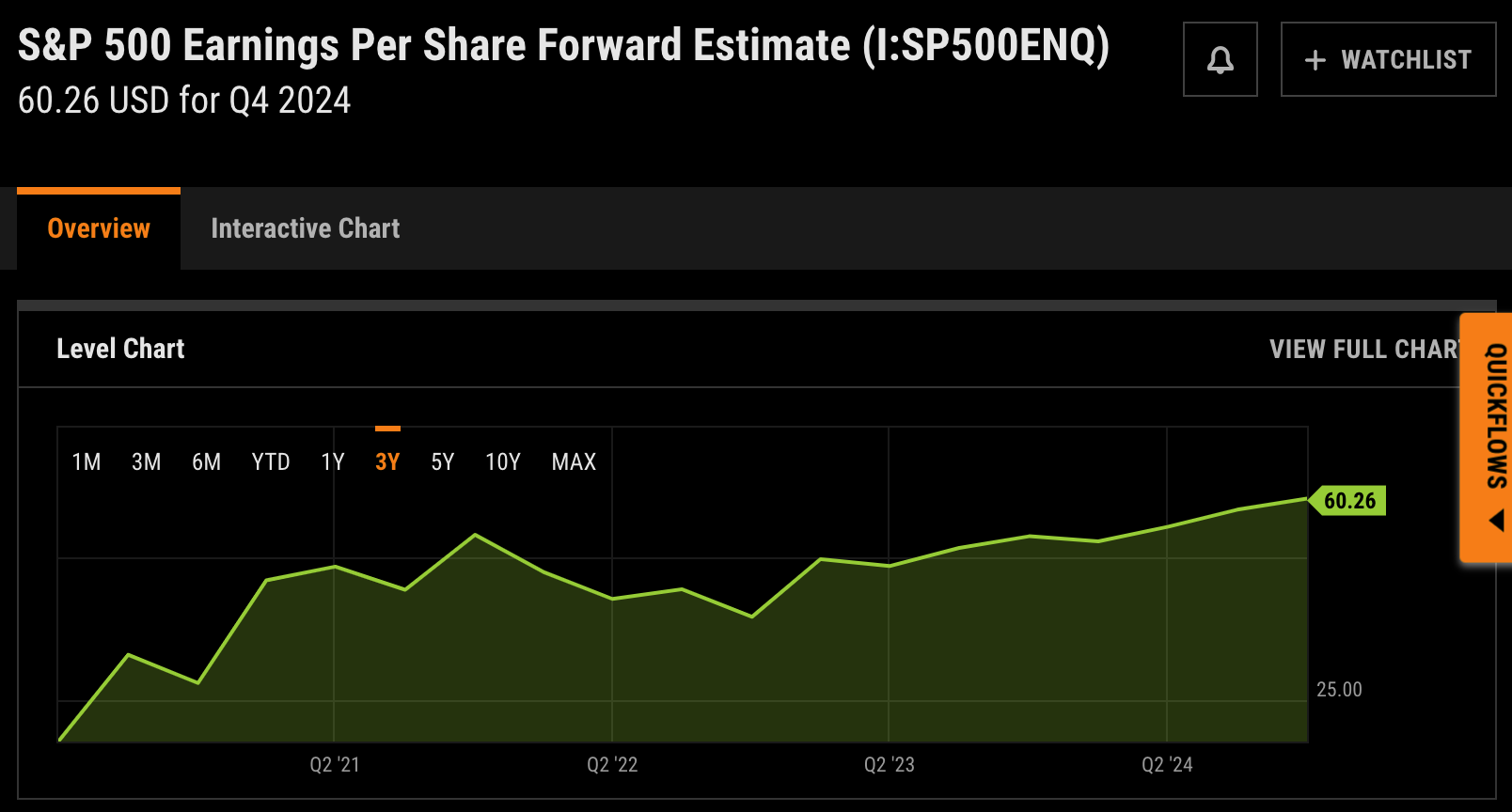

What about earnings?

The market is pricing in strong earnings growth throughout this year

Look at the slope of the line from Q2 2023 to Q2 2024

With the S&P 500 ending the week at 4124 – that’s roughly 18.7x forward.

Now if we do see this upward trajectory – it also assumes there will be no recession.

Is that reasonable?

I ask that question because we have never seen earnings expand during a recession.

But here’s an observation I made with earnings…

Whilst they may have been ‘better than feared’ – we have not seen analysts raising their guidance.

I’ve seen some cuts… but no raises.

This suggests to me (indirectly) expectations may need to come down.

Finally, the market believes the consumer is excellent shape

And to a degree they are.

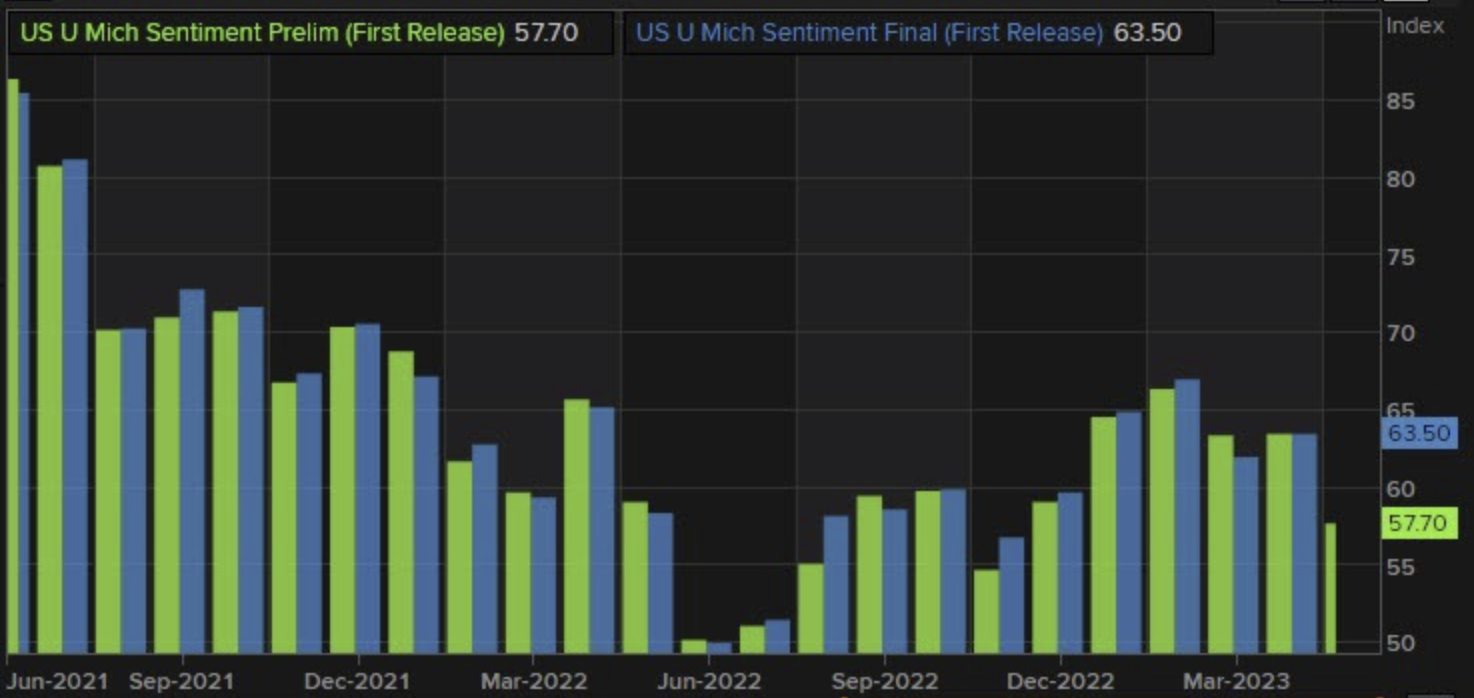

However, today we received the Michigan Consumer Sentiment survey.

Why not?

Sentiment was much lower than expectations and is at the lowest level going back to November 2022.

The inflation expectations data was mixed with the one year coming down but the five-year moving higher (and highest level since 2011).

- Consumer sentiment 57.7 versus 63.5 estimate. Weakest since November of last year.

- Current conditions 64.5 versus 67.0 estimate. Lowest since December of last year

- Expectations 53.4 versus 59.8 estimate. Weakest since July of last year.

- 1-year inflation 4.5% vs 4.6% last month

- 5-year expectations 3.2% vs 3.0% last month. Highest since 2011

That’s precisely what the Fed is trying to eliminate.

In summary, is what’s priced in reasonable? Or is it remiss of the risks?

I lean towards the latter.

With that, let’s see how the market finished the week.

S&P 500 ‘Stuck’ at ~4200

Watching grass grow is more entertaining…

May 12th 2023

Sure, anything is possible.

But is it probable?

My defensive position echoes Druckenmiller’s sentiment; i.e., there are meaningful risks to the downside.

For example, if you asked me if we’re more likely to see 4,400 or 4,000 over the next two to three months?

My money would be on 4,000

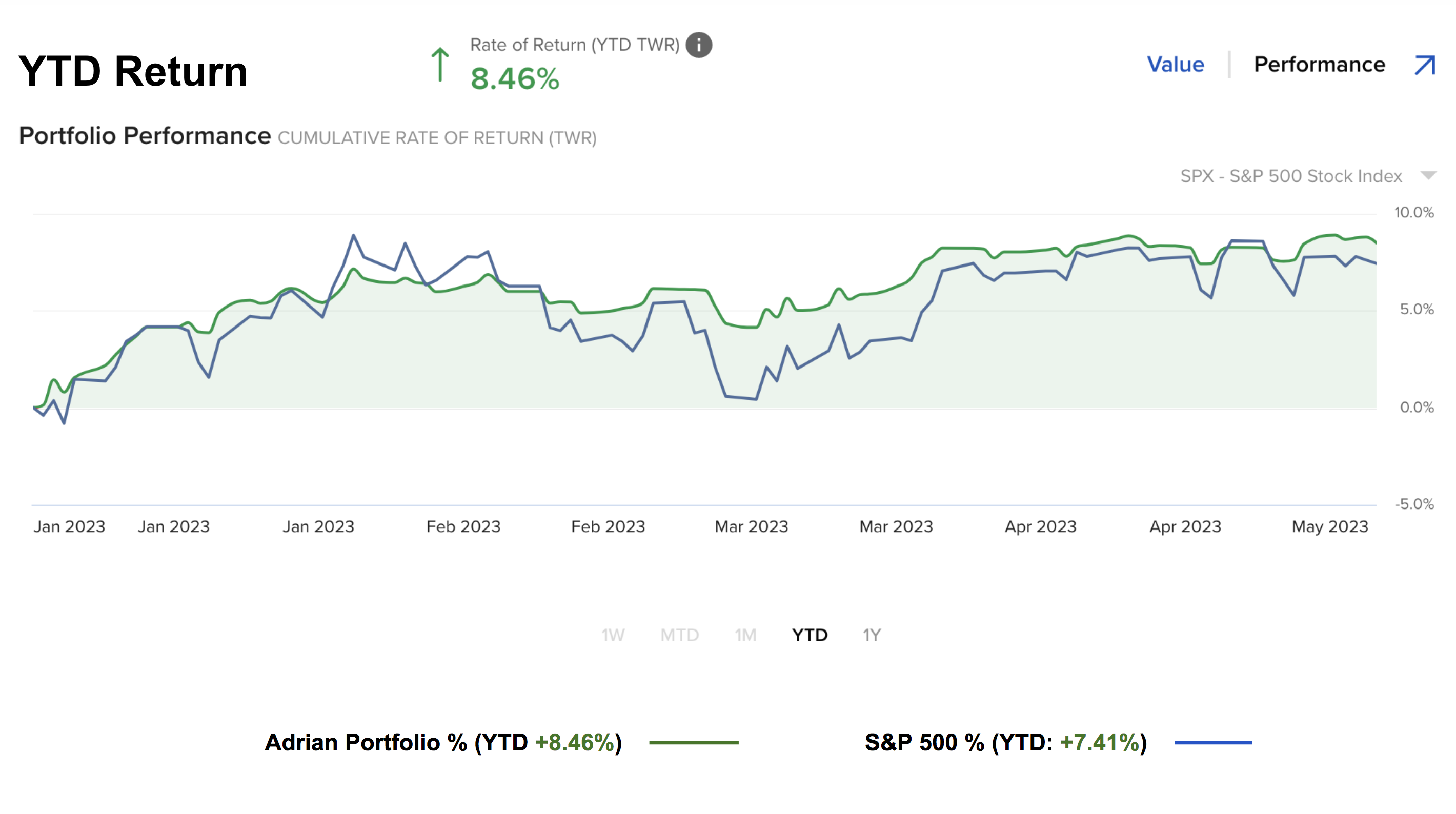

That said, I’m happy maintaining my 65% long position.

There are some quality names I’m happy to own – despite the possibility they will move lower.

This approach sees my YTD gains at 8.46% (vs the S&P at 7.41%)

May 12th 2023

But again, I’m not swinging from the fences here.

My primary concern (today) is avoiding major downside.

Now if viewed over the past 17 months, my outperformance is ~21%.

That’s okay – I will take that.

As an aside, this week I trimmed positions in large cap tech given the forward multiples.

They feel excessive (especially Apple and Microsoft).

Sure, things like AI is promising and will most likely deliver modest growth in the years ahead.

But right now it feels more like mania.

Anyone remember the buzzword before AI? It was “Metaverse”

I called it “Metacurse”… now you see why.

To be clear, I still maintain a large position in the tech, however it’s well below market weight (which is ~25%)

Putting it All Together

What has the market priced in and what is it potentially ignoring?

That’s what I ask myself every day.

What could go wrong? What am I missing? What are my blindspots? What are my assumptions?

For example:

- Are there three rate hikes ahead?

- If there are, what would cause that?

- Will headline CPI trade with a 3-handle by years end?

- If not, what is likely to keep it higher?

- Are earnings estimates too high given what we just learned?

- Are analyst’s revisions higher or lower?

- Will we see a recession later this year or early next (mild or otherwise)?

- What impact will credit tightening have on consumers?

- How are consumer’s feeling?

- Could there be near-term adverse ramifications from the debt ceiling negotiation?

But these are the types of questions you should be asking with the market trading at lofty 19x forward.

19x forward makes sense with rates closer to zero and no risk of recession.

Sure, swing from the fences when given those conditions.

It makes sense to.

But given the above questions (and clear lack of certainty) – the market offers better risk / reward closer to 15-16x.

Then I would be happier with the trade.

19x feels complacent.