Words: 1,950 Time: 8 Minutes

- Hawkish Shift in Fed Projections

- Market’s ‘Surprise’ Reaction and the Impact

- Political Uncertainty Refuses to Abate

As part of my last post (Dec 14th) I made the comment that in the event the Fed decides to either:

(a) not cut rates by 25 bps (which would be a surprise); and/or

(b) issue more hawkish language with respect to projections

… this could rattle the bulls.

For example, a rate cut was a near certainty – priced at a 96% probability. Therefore, the only question was whether it was:

- a dovish rate cut (several more rate cuts ahead); or

- one that was more hawkish (i.e., fewer rate cuts next year)?

We got that latter.

And all the toys were thrown out of the cot.

But why were markets ‘that’ surprised with Powell’s language?

They should not have been.

A Hawkish Shift

Post Powell’s remarks – mainstream called it a ‘surprise shift’.

I could only smile – as from mine – there was very little surprising about it.

However, what I was more interested in was how Powell would explain why they were cutting rates.

As I’ve written of late – my view was the data didn’t support aggressive rate cuts.

Therefore, how Powell could justify further cuts was curious to me.

As it turns out… he struggled.

The irony was Powell did a better job of explaining why rates should not be lowered (which is obviously at odds with their decision to cut).

From my lens, Powell effectively boxed himself into a corner by telegraphing more cuts were coming over the past two months. This proved to be a poor decision – as he removed optionality.

Irrespective of the decision – the market reaction was swift – especially in fixed income markets.

On the one hand, I felt equities were already overvalued coming into the print.

Only good news was priced in.

Therefore, to see stocks move ~2.5% lower was a non-event.

For example, I might have taken notice if we saw a 5-10% move lower (and maybe that’s still ahead?)

However, watching the 10-year yield rip past 4.50% is worthy of note for several reasons. That caused shockwaves around the global financial system.

And this largely due to three things (not limited to):

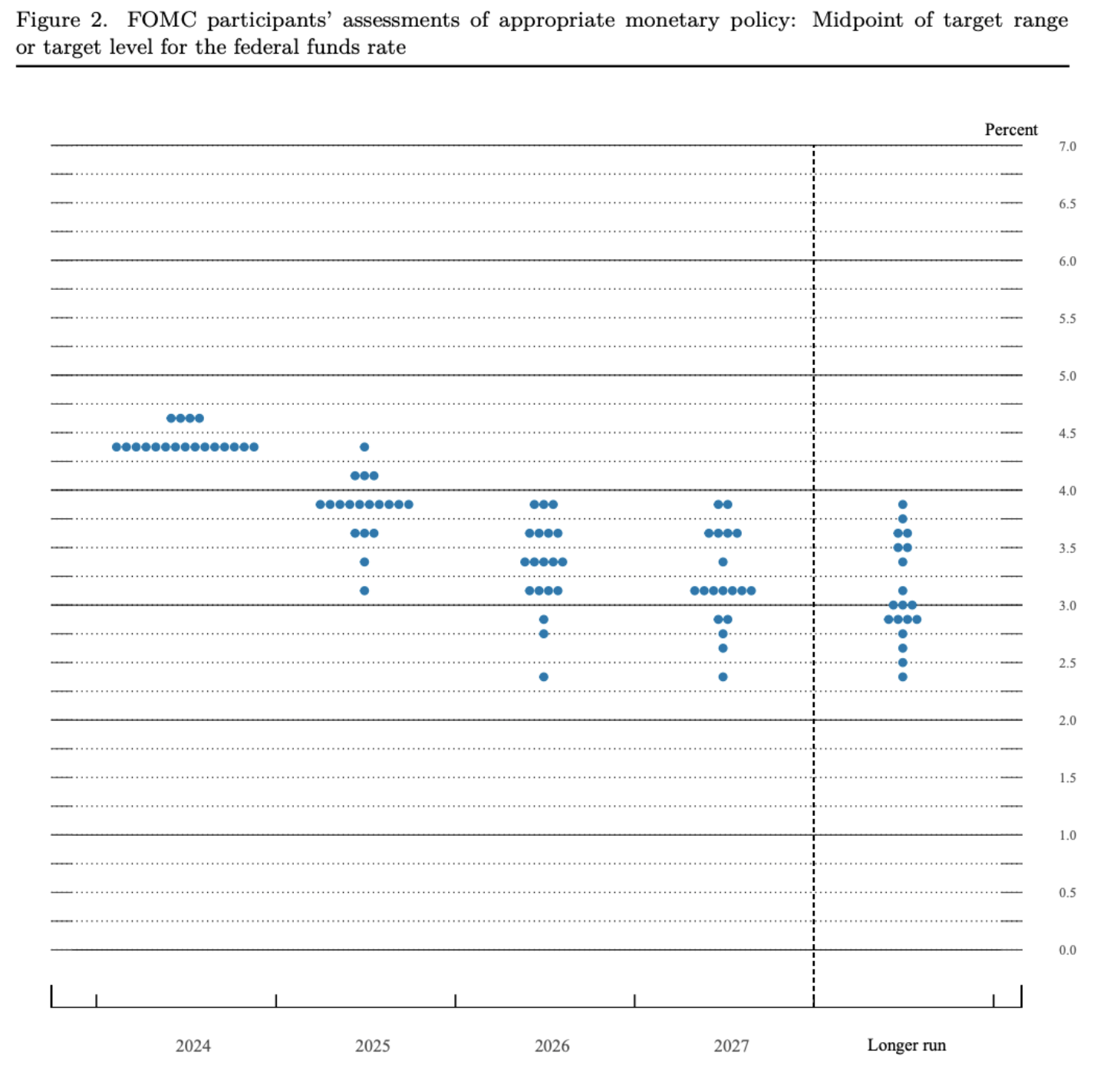

- Fed’s latest projection showing just two 25-basis-point cuts for 2025;

- Higher than expected inflation (and growth) forecasts; and

- Widespread fiscal uncertainty (e.g., unsustainable debt and deficits; impact of tariffs etc)

The jump in the 10-year treasury yield was reminiscent of the Taper Tantrum of 2013 – where these yields ripped from 1.6% to around 3.0% – causing havoc in equities and risk currencies.

Remember: it’s often less about the nominal figure – it’s about how fast we get there.

December 19 2024

For example, this saw the world’s reserve currency continue to strengthen – exacerbating pressure on weaker currencies.

December 19 2024

For example, the Aussie Dollar (as a proxy for risk) dropped to a fresh 2-year low – trading around 62c.

Don’t be surprised to see the 60c level fail in subsequent weeks (if we see further dollar strength / higher US 10-year yields)

But coming back to Powell’s justification (or lack of) – the key issues are inflation and growth.

It’s largely these variables which influence long-term yield vectors.

For example, the updated dot plot (see below) not only showed a higher expected inflation trajectory but also projected stronger growth.

As a result, many committee members revised their expected rate path higher for next year.

But what matters is how that compares to market expectations….

It was only very recently (perhaps 2-3 months ago) that equities saw 200+ bps of cuts next year.

That’s gone.

What’s funny is equities made the same mistake at the start of the year – expecting 6 or 7 cuts this year.

And this (from mine) is what’s sending shudders through the global financial system.

Impact on Markets and Sectors

Whilst this rise in bond yields was perhaps the most striking development from yesterday – it was not unprecedented.

It’s my expectation that the 10-year continues to push higher here – perhaps challenging the 5.0% zone.

However, it won’t be in a straight line.

For example, yields might take a breather after such a strong run.

But longer-term – we are headed higher.

If we do see 5.0% (and above) – this will pressure equities – specifically rates sensitive sectors such real estate and utilities.

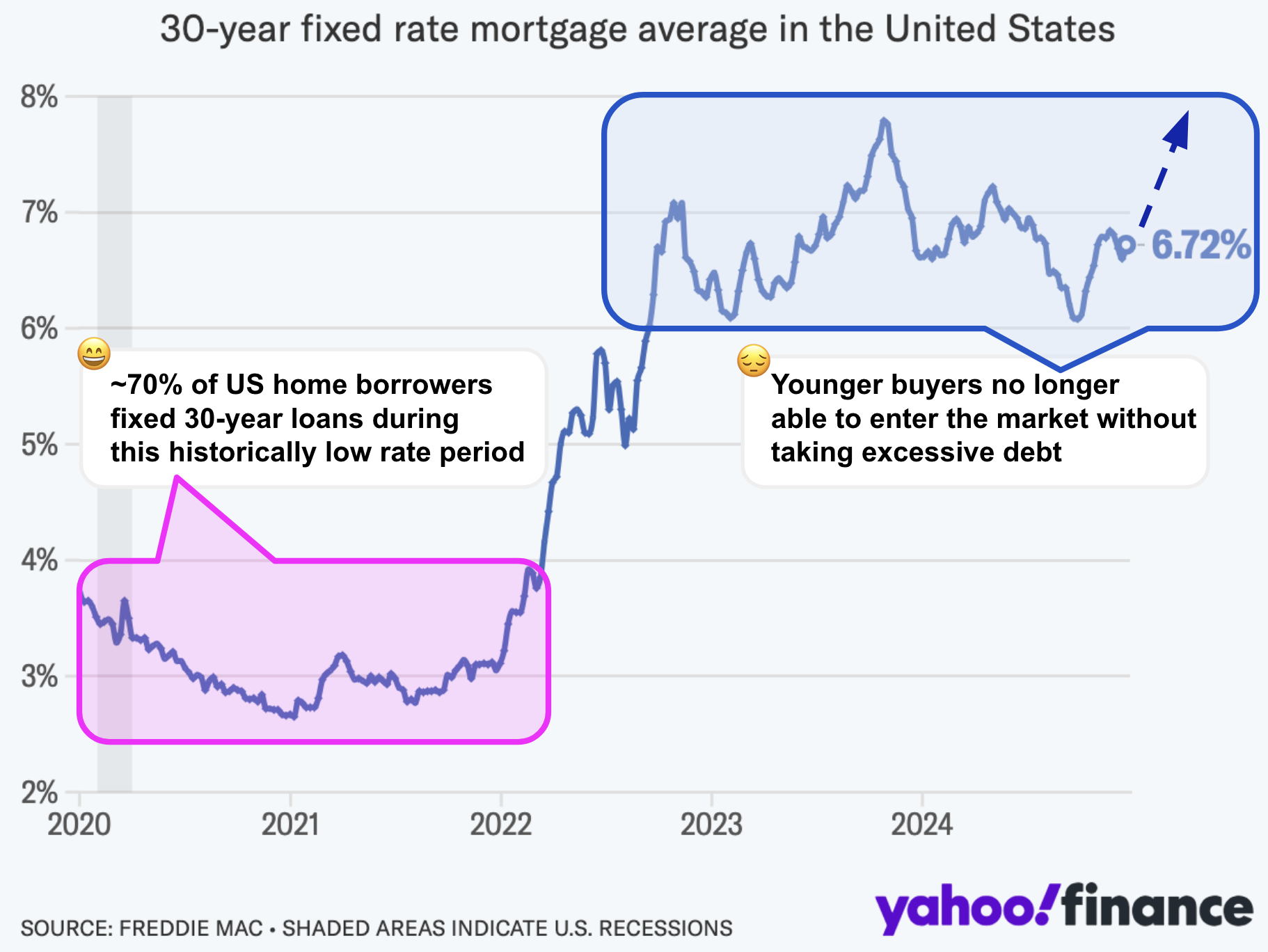

For example, low interest rates typically stimulate housing and construction by making mortgage financing cheaper.

However, after the Fed’s presser yesterday, 30-year mortgage loans shot higher (again). We could see this test 8% in the coming months.

Note: mortgage rates are determined by what we see with US 10-year yields

** As an aside (and not the purpose of this post) – the 100-year average compound annual growth rate (CAGR) for housing in good areas is between 5% to 6%. However, with a weighted cost of capital near 8% (excluding other costs) – housing doesn’t work.

According to Yahoo!Finance “the average 30-year mortgage rate was 6.72% in the week through Wednesday, compared with 6.6% a week earlier, according to Freddie Mac data”

The average 15-year mortgage rate was 5.92%, from 5.84%.

Naturally with borrowed money set to cost a lot more – this dampened investor enthusiasm for these sectors.

By way of example, here’s a quote from the US’ second largest home builder – Lennar – on the impact of higher rates:

“Even while demand remained strong and the chronic supply shortage continued to drive the market, our results were driven by affordability limitations from higher interest rates,” Lennar’s co-CEO Stuart Miller said.

Demand will always be strong for housing (we will always need shelter). That’s rarely the issue.

However, with rates set to go higher, we should expect supply to remain tight.

For example, why would existing home owners locked into a 30-year fixed below 4% (which ~70% of owners did three years ago) choose to surrender that mortgage for a new loan closer to 8%?

You wouldn’t unless you were forced (e.g., a change of job; change in family circumstance etc). Therefore, expect supply of existing homes to remain tight.

Beyond real-estate – emerging markets were also hit hard.

Countries with weak currencies, like Brazil, faced considerable pressure.

Brazil’s stock market had already been struggling, and the increase in U.S. yields only exacerbated the situation. The Brazilian real suffered as capital flowed into the U.S. dollar.

Similarly, South Korea saw its currency, the won, fall to levels not seen since the Global Financial Crisis of 2009.

Both Brazil and South Korea were caught in a vicious cycle of higher U.S. rates, political uncertainty, and economic vulnerability, further highlighting the far-reaching consequences of the Fed’s stance.

And if we then add in complexities such as tariffs and any impact on inflation – it’s very hard to see yields (rates) falling.

What’s the bottom line?

The economic landscape is not as stable or certain as equities assume (e.g. with a VIX below 15)… however they’re finally starting to realize.

Powell’s Dilemma

Coming into this week – I continue to ask how the Fed could be dovish in the face of very sticky inflation; strong growth (where GDP was revised higher); rising wages (over 4.0%); and the likelihood of tariffs (which will drive up prices)?

When pressured on these factors, Powell acknowledged these concerns.

However, he refrained from providing a comprehensive explanation for the hawkish change.

Why?

Because he doesn’t have the data to support the decision.

To that end, I felt there was a very strong case for Powell to have skipped this meeting and held steady.

Four other FOMC members also saw it that way.

The economy is in very good shape; unemployment appears solid and corporate profits are strong.

In other words, the economy is coping fine with rates where they are.

Why fan the flames of inflation with cheaper money?

And whilst Powell attempted to downplay the potential impact of fiscal policy, his tone suggested a fear that inflation was not coming down quickly enough.

Hedging Your Risk

Nov 29 (see this post) – I explained a possible hedging strategy for an (expected) move lower in the S&P 500.

For those who missed it – below is what I shared:

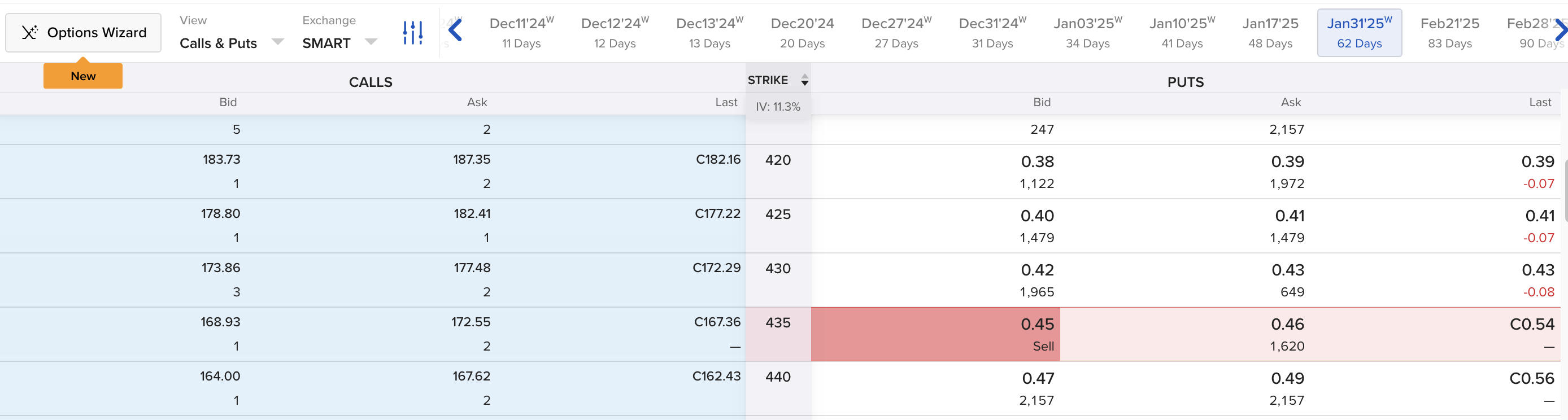

- Let’s say the SPY trades 620 and you buy 2-month Jan 31 SPY 435 strikes (~30% out-of-the-money) for ~45c

Pricing Current Nov 29 2024

- If S&P 500 were to fall ~20% in ~30 days – the Jan 31 SPY put option would increase by ~1,200% (pending any changes in IV).

- However, let’s say the SPY only dropped ~8% in 30 days (to ~550) – a long way above our strike of 435.

- At this time, we would roll the option for another 2-months (again, ensuring it’s ~30% out-of-the-money) – where the existing option would be near breakeven or trade at a small loss.

Dec 19th Update:

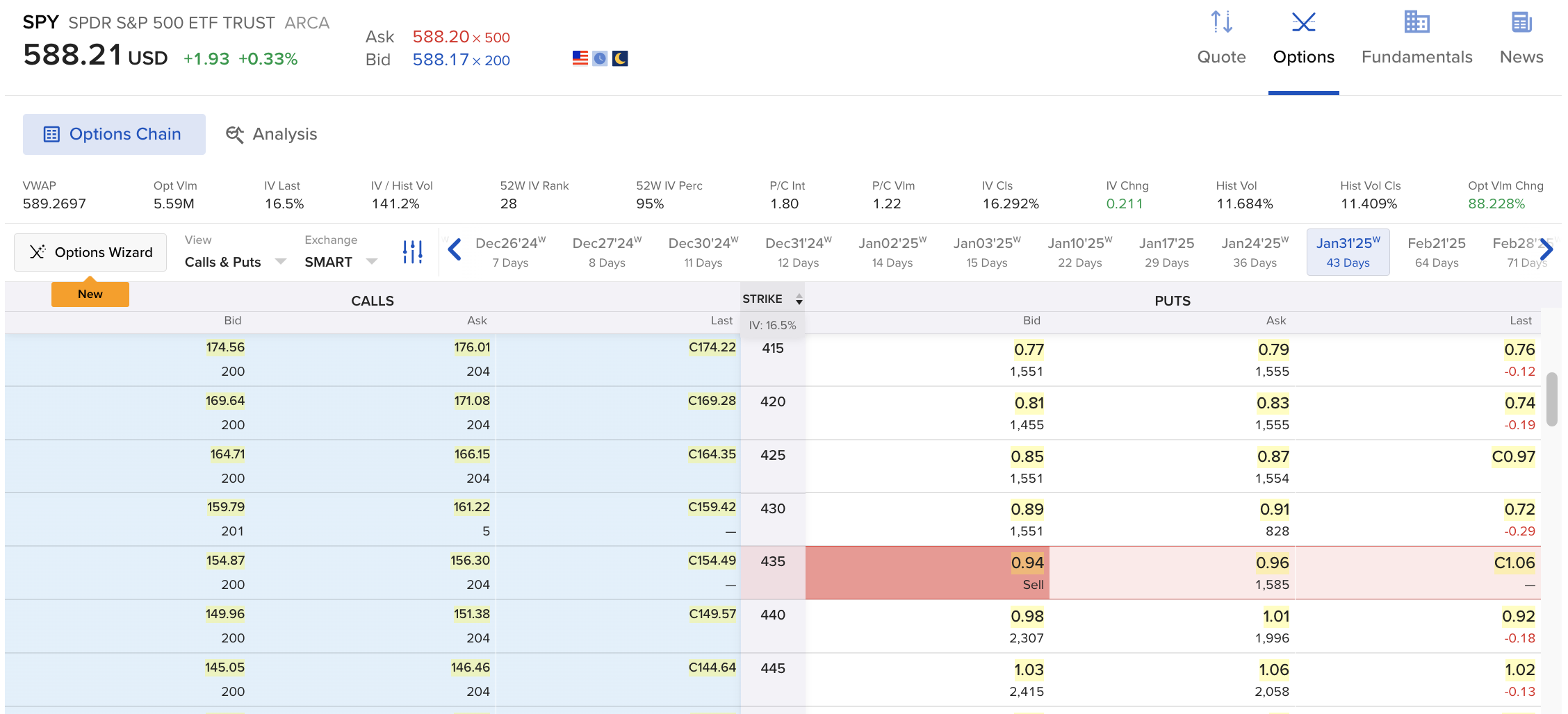

It’s been 20 days since I offered that strategy and the SPY is lower by ~4%

Let’s see how this has impacted this particular option (Jan 31 SPY 435 Strike)

Dec 19th 2024 – Up Over 100% in 20 Days

This instrument (highlighted in red) is up over 100% – trading for a bid/ask spread of 94c to 96c

If you took this position – I would maintain this long put through Dec 26th (when trading resumes post Christmas holiday).

At this point, I would then close the position (taking any profit or loss) – and establish a new 2-month put 30% out-of-the-money put.

For example, with the SPY trading ~588 at the time of writing – I would look at Feb 410 strikes.

This level may change over the next week or so pending what we see on the SPY.

Again, this strategy is one which will most likely result in a lot of very small losses over several months – as you should risk no more than 0.5% of your total portfolio.

However, if we are to see a move lower of say 10% to 20% in any one month (where the timing is unknown however remains highly probable) – this position could see as much as 1200% upside (in turn – helping to offset any losses on your long holdings).

Putting it All Together

The Fed’s “hawkish cut” and the subsequent market reaction highlight the complexity of the current economic landscape.

It’s been something I’ve stressed continuously for weeks.

From mine, markets were overly complacent coming into the Fed decision, with the VIX trading below 14.

Yesterday it shot back above 25.

That’s a sign all traders were leaning to one side of the boat.

While the reduction in rates was expected, the shift in the Fed’s projections caught some by surprise.

However, it should not have. You only needed to look at the data.

From here, the increased expectations for inflation and stronger growth will see the US 10-year move higher. That said, I expect resistance around 5.0%

Now, 3 months ago when the US 10-year traded around 3.80%, I suggested traders who were long these instruments take profits or reduce exposure (see this post from Sept 26). Repeating my language:

- Lighten your exposure to the long-end of the curve. 10-year yields could easily trade well above 5% or 6% over the next 3 or 4 years – which would wreak havoc.

- As one reader emailed me “the world is not ready for a 10-year at 6.0%”. Correct – they are not.

- Keep an eye on the 10-year and a “bear re-steepening”… it deserves attention. This is a risk to equities

The market is slowly tuning into those risks.

And whilst a bit slow on the uptake – here’s Bloomberg yesterday (citing T. Rowe Price)

Treasury 10-year yields may climb to 6% for the first time in more than two decades as US fiscal woes worsen and Donald Trump’s policies help keep inflation elevated, according to T. Rowe Price

The benchmark yield may first reach 5% in the first quarter of 2025 before potentially climbing further, Arif Husain, chief investment officer of fixed-income, wrote in a report. Husain is doubling down on calls for higher yields, citing persistent US budget deficits as Trump cuts taxes during his second presidency, as well as potential tariffs and immigration policies that would sustain price pressures.

“Is a 6% 10‑year Treasury yield possible? Why not? But we can consider that when we move through 5%,” wrote Husain, who helps the money manager oversee $187 billion. “The transition period in US politics is an opportunity to position for increasing longer‑term Treasury yields and a steeper yield curve.”

Husain has taken a page from my post in September.

Again, if we are to experience a 10-year above 5.0% – then avoid sectors like real estate, utilities, REITS, and emerging markets.

This will be very bullish for the US dollar.

In addition, a stronger US dollar will pressure earnings of companies who depend heavily on revenue from abroad.

For example, expect ‘currency headwinds’ to emerge as a dominant theme when large-cap tech report Q4 earnings in approx two months.

In closing, this is going to be a delicate balancing act the Fed must perform as it navigates the complexities of inflation, fiscal policy, and global economic conditions.

If nothing else, I believe the 20+ year era of ultra-low rates is done (thankfully!)

Two decades of artificially suppressing rates has goosed up the prices of all risk assets (mostly stocks and housing) – which will likely result in a painful adjustment at some point. And whilst that adjustment may not be 2025 or 2026 – it will happen.

When you artificially misprice money for extended periods – you get large misallocations of capital.

What you do is effectively misprice risk – resulting in (lower quality) assets attracting capital (which typically would not have). And that’s how bubbles burst.

But let’s see what happens…