- Druckenmiller sees high probability of deep recession next year

- Global bond yields fall sharply – allowing stocks to catch a bid

- Assessing the S&P 500 using the monthly chart

The sharpest rallies are those which happen in bear markets.

And days like today should be expected.

And there will be more.

But don’t be fooled…

Days where equities rally 2%+ and/or bond yields sink 30 basis points are far from “positive” signals.

They are more representative of a market in trouble.

Yesterday I reminded readers that it’s all about bond yields.

I felt that we needed to see some level of ‘calm’ with fixed income in order for equities to find their footing.

Almost on cue – the US 10-year yield reversed sharply overnight (after topping 4%)

And as yields fell – equities rallied.

But perhaps much of the catalyst was across the pond in the UK.

The Bank of England hit the panic button – and was forced to intervene in their bond market to avoid a collapse.

Here’s Yahoo!Finance:

The Bank of England stepped into Britain’s bond market to stem a market rout, pledging to buy around 65 billion pounds ($69 billion) of long-dated gilts after the new government’s tax cut plans triggered the biggest sell-off in decades.

Citing potential risks to the stability of the financial system, the BoE also delayed on Wednesday the start of a programme to sell down its 838 billion pounds ($891 billion) of government bond holdings, which had been due to begin next week

“Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability,” the BoE said.

“This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy.”

Here’s the thing:

This intervention was entirely due to an inept UK government.

The fiscal policy decisions being made in England at present are farcical.

The new PM has announced new measures of (unnecessary) massive fiscal stimulus (I assume due to political pressure); as their central bank (BoE) are trying their hardest to fight surging inflation higher than 10%.

Remember:

They way you cure inflation is less money chasing more goods (not more money)

Econ 101 folks.

Unfortunately the BoE had no choice but to invoke a measure of “QE” due to reckless fiscal policy.

Fortunately, the US is not in the same position.

Janet Yellen knows better than to throw a bunch of unnecessary (harmful) fiscal stimulus on a raging inflation fire (despite what Biden would like to spend)

But it was the sharp reversal in both UK and US bond yields which saw the market catch a short-term break.

I will say this…

Don’t get too excited.

As I said only yesterday – it won’t take much to see this market rally ~5% or more.

Technically we were oversold in the very near-term… whilst trading at a key support level.

Druck Warns

If you’re going to listen to anyone in the financial media – it should be Stan Druckenmiller.

“Druck” very rarely gives interviews (at most two or three per year) – but when he does – you listen.

For those not familiar, he is perhaps the only fund manager to rival Buffett’s incredible 57-year 21% average CAGR record.

Druck maintained an average annual return of 30 percent (without any money-losing year) for 30 straight years.

It’s virtually unparalleled.

Today at CNBC’s “Delivering Alpha” conference – he offered his view on the market and what’s ahead:

“Our central case is a hard landing by the end of ’23. I will be stunned if we don’t have a recession in ’23.

I don’t know the timing but certainly by the end of ’23.

I will not be surprised if it’s not larger than the so-called average garden variety.”

And the legendary investor, who has never had a down year in the markets, fears it could be something even worse. “I don’t rule out something really bad,” he said.

Druckenmiller believes the extraordinary quantitative easing and zero interest rates over the past decade created an asset bubble.

“All those factors that cause a bull market, they’re not only stopping, they’re reversing every one of them. We are in deep trouble.”

Here’s how I frame it:

Central banks will exaggerate both the boom and bust cycles.

We had the boom… a bust is simply a question of when.

Not if.

Druck’s sentiment largely mirrors what I was only saying yesterday.

That is, trillions of QE with rates artificially held at zero (negative in real terms) for far too long gave rise to a massive misallocation of capital.

Misallocated capital leads to asset bubbles.

Businesses are able to attract speculative capital they otherwise would not (e.g. Cathie Wood).

And similarly, people take speculative bets where risk has been (grossly) mis-priced.

That is now being unwound at pace… but we are yet to see the fall out.

With respect to Fed policy and inflation – he said:

The Fed made a policy error when it came up with a “ridiculous theory of transitory,” thinking inflation was driven by supply chain and demand factors largely associated with the pandemic”

“When you make a mistake, you got to admit you’re wrong and move on that nine or 10 months, that they just sat there and bought $120 billion in bonds”

“I think the repercussions of that are going to be with us for a long, long time.”

“You don’t even need to talk about Black Swans to be worried here.

To me, the risk reward of owning assets doesn’t make a lot of sense”

When the smartest guy in the room is warning of the (large) risks ahead… take note.

But the question I would have for Druck – is at what point does he think the risk/reward for owning ‘risk assets’ starts to make sense?

30% lower? 50% lower? More?

Maybe the monthly lens can help us shed light on this…

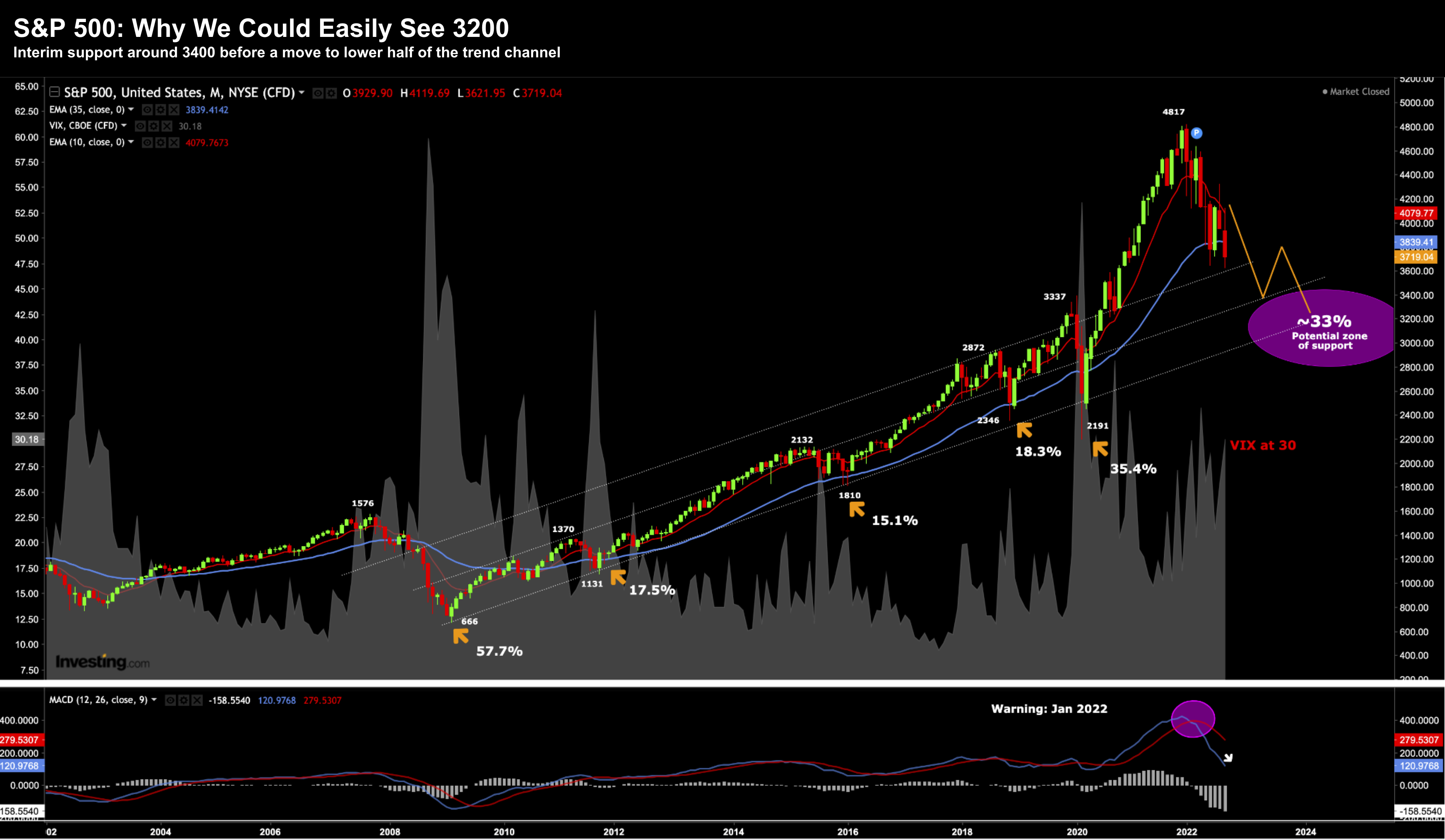

S&P 500: The Monthly Lens

Further to my preface, don’t get to excited about today’s 2% rally.

I think we could see a further “5%+ upside” and I would not be excited (just like I wasn’t excited by the recent rally to 4200 – declaring it a bear trap)

Often it pays to extend your horizon… and in this case I draw your attention to the monthly chart.

And as readers will know, this was one of the reasons (not the only reason) I warned of meaningful downside risks ~4800 at the start of the year.

We are simply far too extended. Fundamentally and technically.

I’ve shared this chart previously but it deserves repeating…

Sept 28 2022

The primary objective of this chart is to highlight the 15-year trend channel from 2008.

The channel has been defined by the series of higher lows (highlighted by the orange arrows)

During 2020 we broke to the upside – fueled entirely by the Fed’s $4.5 Trillion in fresh liquidity (coupled with short-term rates held at zero)

We pulled back to the 35-month EMA (blue-line) and the top of the trend channel.

And that was expected (maybe not for some!)

Technically I think we’re likely to see a battle between the bulls and bears around this zone (3600).

However, momentum indicators (such as the MACD) suggest the bears are winning.

For example, notice how the MACD warned us in January (which I called out at the time)

My best guess (and I could be wrong) is we will see 3600 break – with a move down to around the 3400 zone.

It may not be in the next 2-3 weeks – but I think it gives way.

For example, we could easily see an over-sold rally in the near-term.

Now 3400 is roughly the mid-point of this channel.

What’s more, 3400 lines up with:

(a) resistance in late 2019; and

(b) support in early 2020.

I suspect we will see some support here before another leg lower.

The bottom of that channel is somewhere between 3,000 and 3,200 (my target)

That’s an area where I think you can start adding exposure with more confidence given a longer-term view.

It’s where I think the risk/reward looks attractive over the long term (and hence my question to Druck)

This would represent a pullback in the realm of 33% – which is consistent with most recessions.

However, if “all hell” breaks loose (as Druck suggests) – all bets are off.

From there, targets will quickly move down to the lows of both 2018 and 2020 – resulting in a correction closer to 50% (i.e. what we saw in 2000 and 2008).

At this stage, I favour a “33%” correction vs a ~50% correction of 2008 or 2001.

But we can’t be remiss of the risks.

Putting it All Together

As we have navigated 2022 – my advice has been not to lose too much money.

The goal during bear markets is to preserve capital.

We make money during bull markets.

However, during bear markets we make fewer bets.

Now if you look at your 401K or managed Super Fund – chances are it’s probably down for the year (perhaps more than 15%)

Many leading Hedge Funds have lost more than 50% of their value.

Even Warren Buffett’s portfolio – Berkshire Hathaway – is down ~9% year-to-date.

My portfolio is down 4.86% – which is approx 17% better than the S&P 500

This is my worst performance in 15 years.

It’s been a difficult year to navigate… arguably the most difficult since 2008.

I’m still hopeful of producing a positive year… but I would not be surprised to see my returns end up in the red.

As I like to say, there will be a time to start buying with confidence.

Now is not that time.

And don’t let bear market rallies fool you.

Aggressive traders may try and catch the bounce… but you will need the “hands of a surgeon”.

That’s not me.

If anything, use any near-term rally to offload riskier assets in preparation for lower leg to come.