- Liquidity, yield curve and rates

- Bond market suggests ‘policy mistake’ – how will that impact earnings?

- Identifying what we know vs what we don’t (and knowing the difference)

Forecasts are typically a fool’s errand.

Rarely do things pan out as expected.

For example, consider where the ‘smartest folks on Wall St’ saw the S&P 500 at the end of 2022 as at Dec 2021:

- BMO Capital Markets: 5300

- Wells Fargo: 5100 to 5300

- Goldman Sachs: 5100

- JP Morgan: 5050

- RBC Capital: 5050

- UBS: 4850

- Bank of America: 4600

- Morgan Stanley: 4400

For what it’s worth – Bank of America is now at 3600 (22% lower) and Morgan Stanley at 3900 (11% lower) for year’s end.

Forecasts will almost always make you look foolish.

Last week, my ‘best guess’ was to look for the S&P 500 to pause in the zone of 4200 to 4400 before a likely leg lower.

My logic was three-fold:

- Stocks had run up too far too fast (18% in 8 weeks);

- Expect resistance in a weekly bearish trend around the 35-week EMA zone; and

- Valuations were starting to look expensive (once again)

The tech-heavy Nasdaq was off ~2% with names like Alphabet, Apple and Meta down more than 2%.

I own each of these names but I was expecting it.

And whilst never one to read too much into a single day’s price action (long-term trends carry more weight) – it was worth noting the VIX.

I say that because I’m always interested in market sentiment (especially when traders are all leaning to one side of the boat)

You see, sentiment is something we can definitively know.

It’s not a forecast… it just is.

Just on that, it’s helpful to differentiate between:

(a) what we know; and

(b) what we don’t know.

It’s far more important to know what you don’t know. Mark Twain said it best:

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so”.

All of that belongs in the “I don’t know” category (and I’m the first to say).

However, sentiment is something we can gauge.

For example, last week with the VIX below 20 – it told me investors were complacent.

And given the wide array of risks ahead (more on this shortly) – it felt reckless to be buying with gusto. What’s more, it supported my thinking the market felt extended; and to expect a volatility spike.

My alarm bells started to ring.

Just like that – the VIX closed 16% higher today.

Below is the updated weekly chart for the S&P 500 – highlighting where I felt we might see selling pressure:

Aug 22 2022

- Keep an eye on the high labelled “B” (4169). A close below this level on Friday will be what I call a “false break” of the high. In my experience, these are generally higher probability reversal signals.

- This will add to my conviction that it’s probable (not certain) we retreat a meaningful amount over the next few weeks.

- The next level of expected interim support is likely at point “A” or 3800.

Much will now depend on what we hear from the Fed on Friday…

And here I’m less interested in their rate decision – but specifically liquidity.

Which brings me to the heart of tonight’s missive…

Key Fed Talking Points

To use a baseball analogy, are we at “Innings 3” or closer to the “7th dig”?

My thinking is more the former.

To that end, knowing where we are in the Fed’s cycle will be helpful.

For example, equity optimists believe we are nearer to the end on the assumption inflation has peaked.

I remain sceptical… particularly given what we see with structural inflation.

As I’ve said previously – going from 9% to 5% is easy.

However, from 5% to 2% is hard given the relative ‘stickiness’ of wages and rents.

Three things which deserve attention going forward…

#1. Liquidity Risk

In short, liquidity expansion is a boon to risk assets. The opposite also holds true.

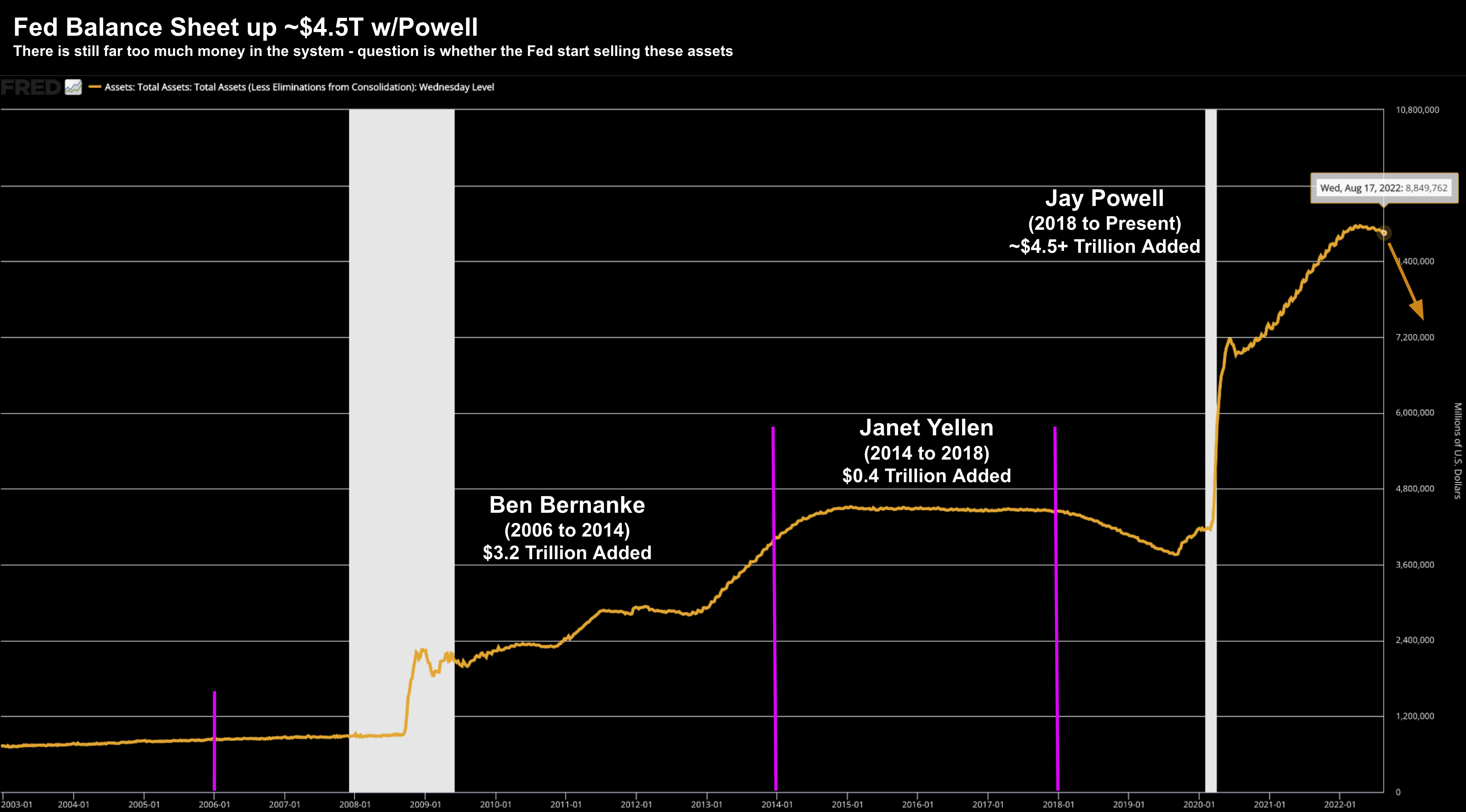

Over the past 24 months, Jay Powell & Co have expanded their balance sheet by $4.5 Trillion — the fastest expansion we have seen in Fed history.

In turn, this enabled a massive amount of government spending which in turn gave rise to inflation.

For example, I think it’s very likely the Fed could start selling mortgage backed securities to reduce liquidity towards the end of the year (if not sooner)

Remember:

The name of the game for the Fed is less money chasing goods (not more).

So why does this matter for stocks?

Three things:

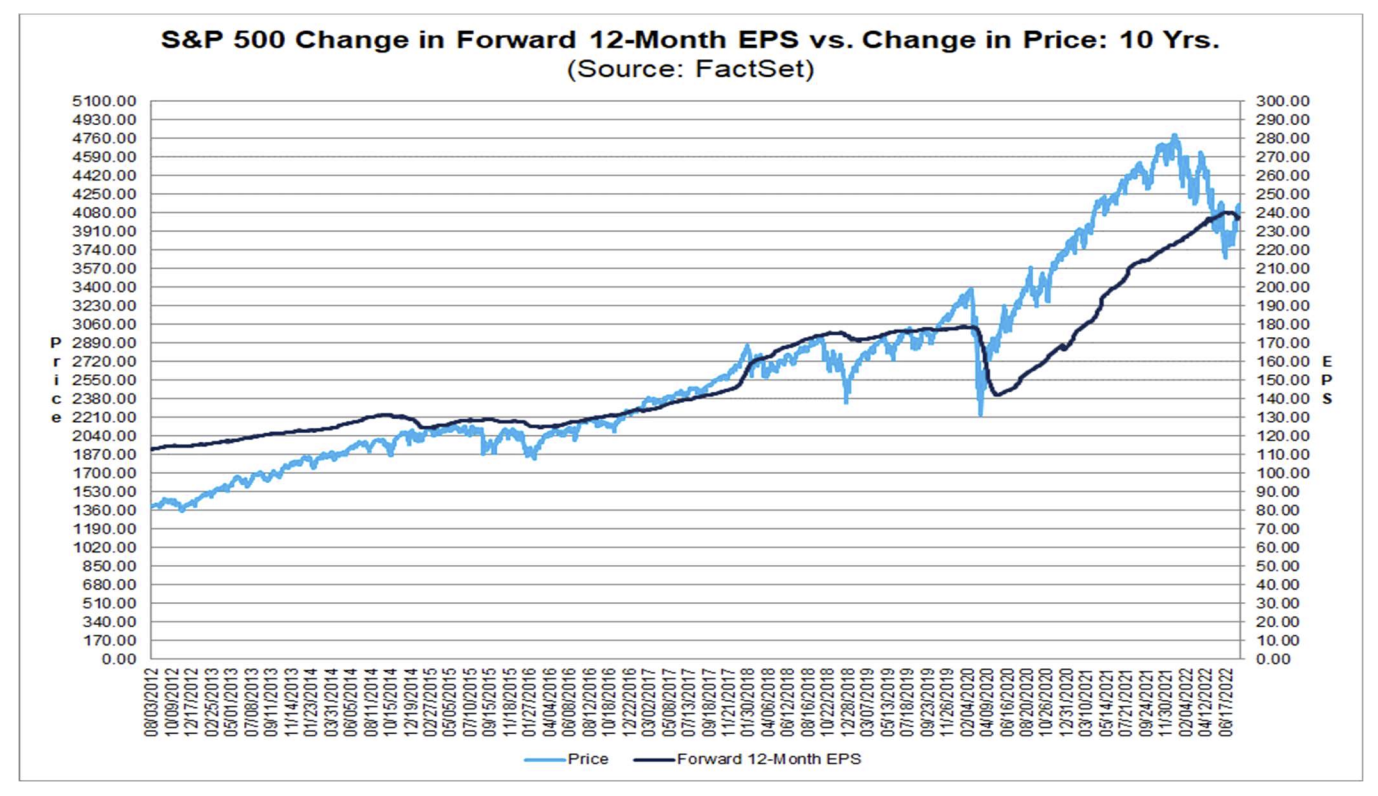

- Over the long-term – stock market direction is a function of earnings;

- Earnings is a function of what we see with economic activity (i.e., borrowing and spending); and finally

- Economic activity is determined by money availability.

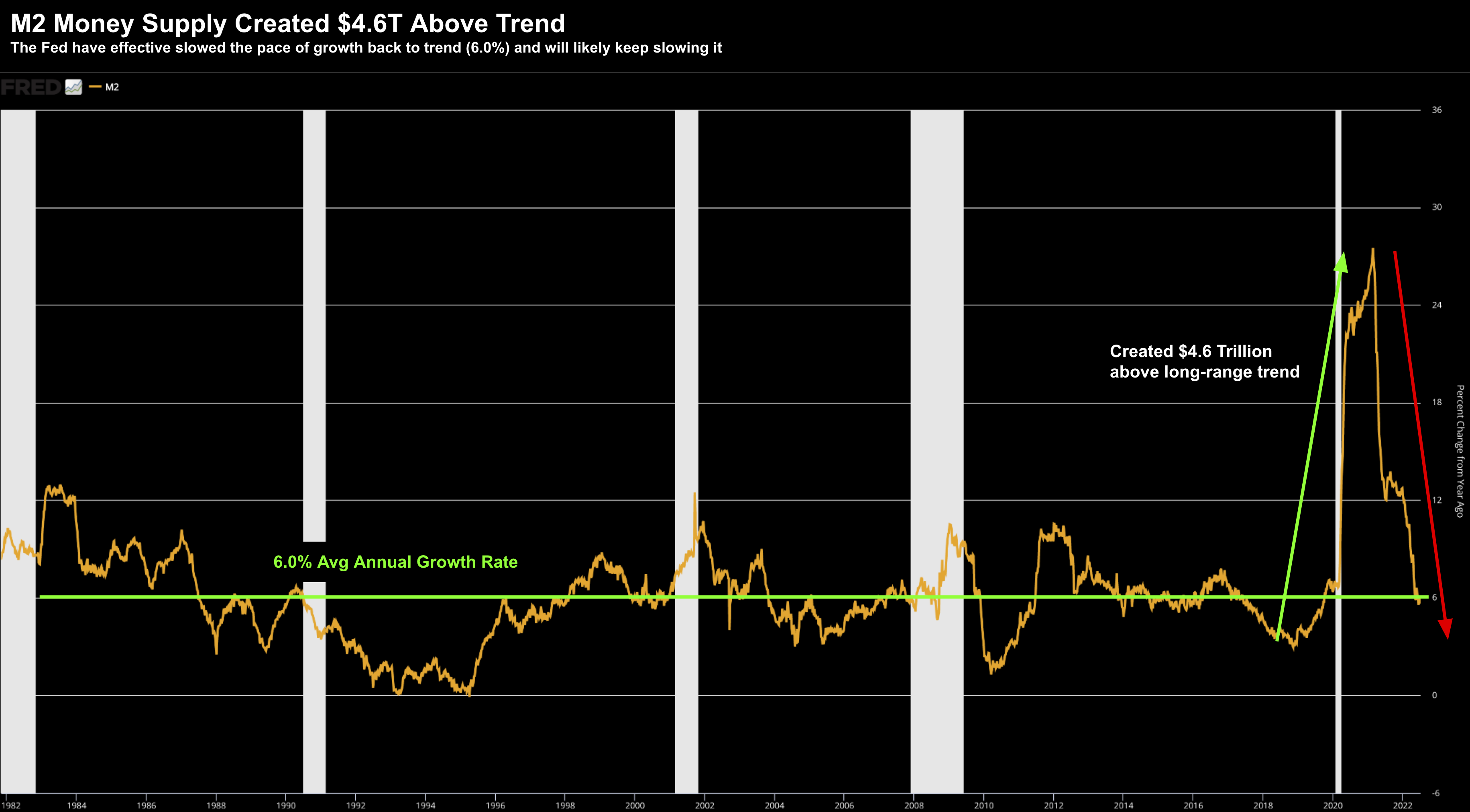

- The rapid slowdown in the money supply growth (chart below); and

- Consumer price inflation already running north of 8% year on year?

Now, that doesn’t mean we won’t experience sharp (bear market) rallies (as we did the past 8 weeks).

But typically, those rallies are not sustained (as stocks marry up to lower earnings)

#2. Yield Curve Inversions

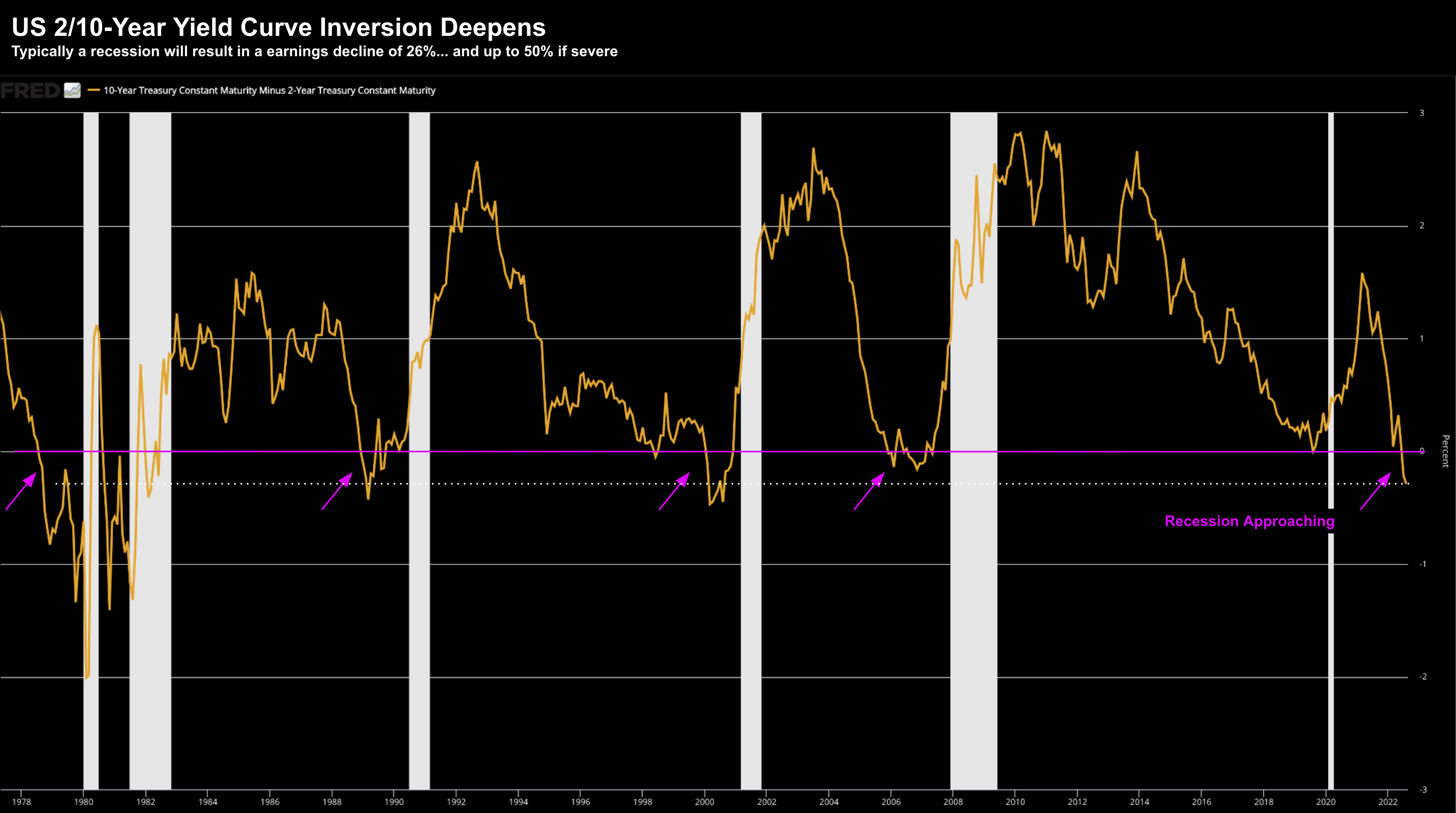

For example, fixed income markets suggest the Fed is in the midst of making (another) policy mistake – best evidenced by the deeply negative inversion(s) – across various durations (e.g., the 2/10’s below).

However equities appear remiss of the risks.

Aug 22 2022

The pink line is the point of inversion (i.e., below zero). The dotted white-line shows the depth of inversion relative to past recessions.

At present, we echo a pathway similar to the recession of 2001/02.

Now whilst history is no guarantee of future events (if only!) – it allows us to apply certain probabilities.

But something else I do know… recessions have always resulted in earnings declines.

That’s known.

However, what’s unknown is whether we have a recession and/or how severe it could be?

As I say, the bond market is usually right but generally early.

What’s interesting is the average earnings decline for the recessions of 1990, 2000, 2020 was a 26 percent from peak to trough. However, the recession of 2008 saw S&P earnings decline by 57 percent from peak to trough.

Therefore, the question to ask is how much earnings estimates for the S&P 500 could fall?

For example, a 20% fall during recession would put us in the realm of $190 to $200 per share.

And from there, what’s the right multiple?

That’s highly subjective. But here’s where markets bottomed on a forward PE basis over the past three recessions:

- October 1990: 15.3x

- October 2002: 20.0x

- March 2009: 17.1x

#3. Short-Term Rates

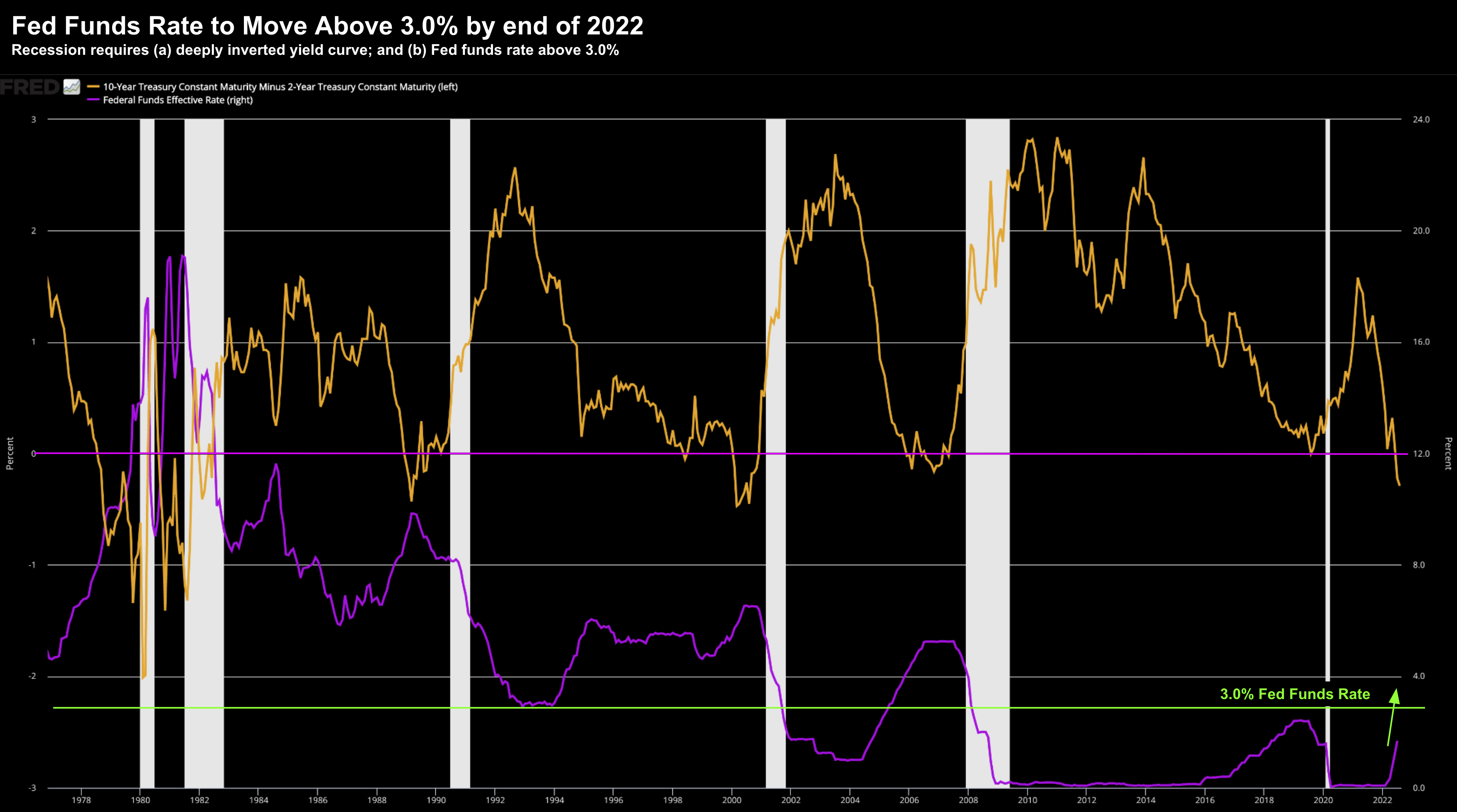

According to Fed funds futures markets – they expect the Fed to hike to ~3.50% by year’s end (another 100 bps).

If that’s correct – we will cross an important threshold of 3.00%

The reason I call this out is every recession over the past 50 years has seen:

- A deeply inverted yield curve (tick); and

- Short-term nominal rates above 3.0%

- Probability of less (not more) money supply;

- A deeply inverted yield curve; and a

- High probability of short-term rates above 3.0%

Again, it’s earnings which will dictate the longer-term trend in equities (as we see below)

All of this very much depends on what we see from the Fed in terms of liquidity and the price of money.

- Is that expanding or contracting?

- Where are we in the cycle?

- And what’s the Fed’s primary objective?

- Has it changed?

Putting it All Together

Today we have an environment where:

(a) liquidity is more likely to contract; and

(b) rates are tightening.

History tells us this is neither conducive for economic activity expansion and/or higher earnings.

And from there, the upside reward doesn’t handily outweigh the risks.

For example, I felt 4600 represented upside of ~5%. However, 3600 represents downside of ~18%.

Is that a ‘pitch’ we should swing on?

I don’t think so.

On the contrary – if the Fed was on a pathway to enhance economic activity (and investment) with

(a) fresh liquidity; and

(b) cutting rates

…we could start making the case for earnings expansion (with higher multiples)

But that’s not today…

My plan will be to wait until prices come to me… where the risk/reward skews more in my favour.