- 4.2% is “full” employment – but is that where we’re going?

- Stocks still aren’t cheap based on low equity risk premium

- Why the Fed may have scope to cut (vs being forced to cut)

- Do we have a ‘good, solid’ economy or one that’s at risk of a recession?

- Is the employment market robust or one that’s slowing sharply? and

- Should the Fed cut 50 basis points or 25? And if 50… why?

Pending who you read (or listen to) – you’ll get a different opinion.

As I will highlight below – they are not easy questions to answer – as you can make the case either way (pending your lens).

Regardless, the popular narrative is one favoring a soft-landing.

Jay Powell echoed this sentiment with a victory lap at Jackson Hole.

Former Fed Chair Janet Yellen supported Powell with this over the weekend:

“We’re seeing less frenzy in terms of hiring and job openings, but we’re not seeing meaningful layoffs. I’m attentive to downside risk now on the employment side, but what I think we’re seeing, and hope we will continue to see, is a good, solid economy. Job growth has slowed compared to the “hiring frenzy” when the U.S. reopened after the Covid-19 pandemic, but the economy is “deep into a recovery” and “basically operating at full employment” (Sept 7 2024)

None of this is factually wrong.

And Yellen is far from alone. Highly respected economists such as Torston Slock (Apollo) and Mark Zandi (Moodys) cite (positive) metrics such as:

- Non-farm payrolls better in August than July

- Average hourly earnings and hours worked in August higher than July

- 4.2% unemployment (i.e., full employment)

- Nominal Q2 GDP revised higher to ~3.0%; and

- Real PCE around 3.5%;

In Slock’s interview with Bloomberg – he literally pounds the table saying “the economy is not slowing down in the way people are anticipating”

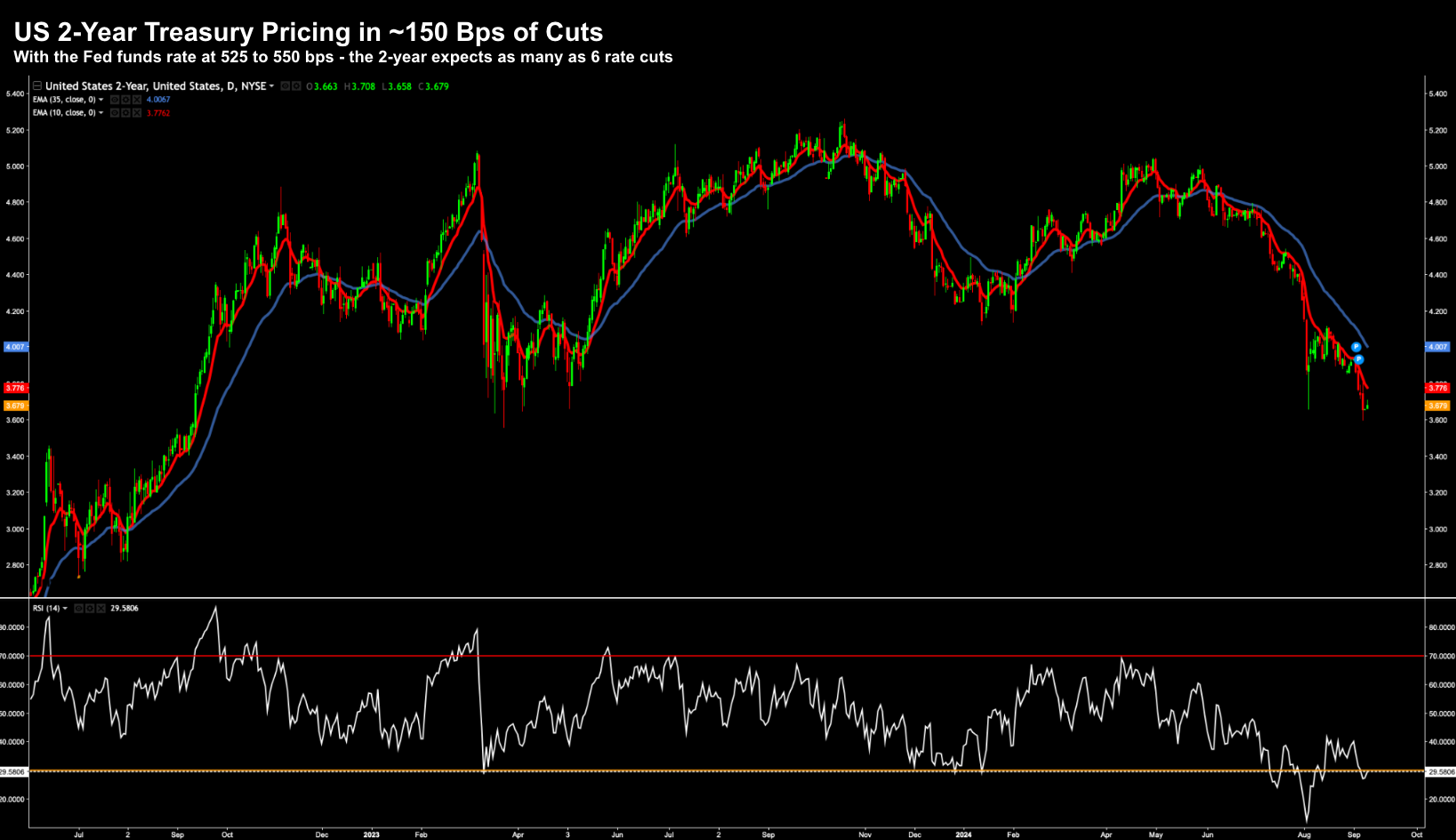

And therefore, those pricing in say “8 cuts” (200 bps) over the next 12 months is not happening.

And whilst Slock also concedes there is some slowdown with job openings – there is no sign of any material slowdown (echoing Yellen).

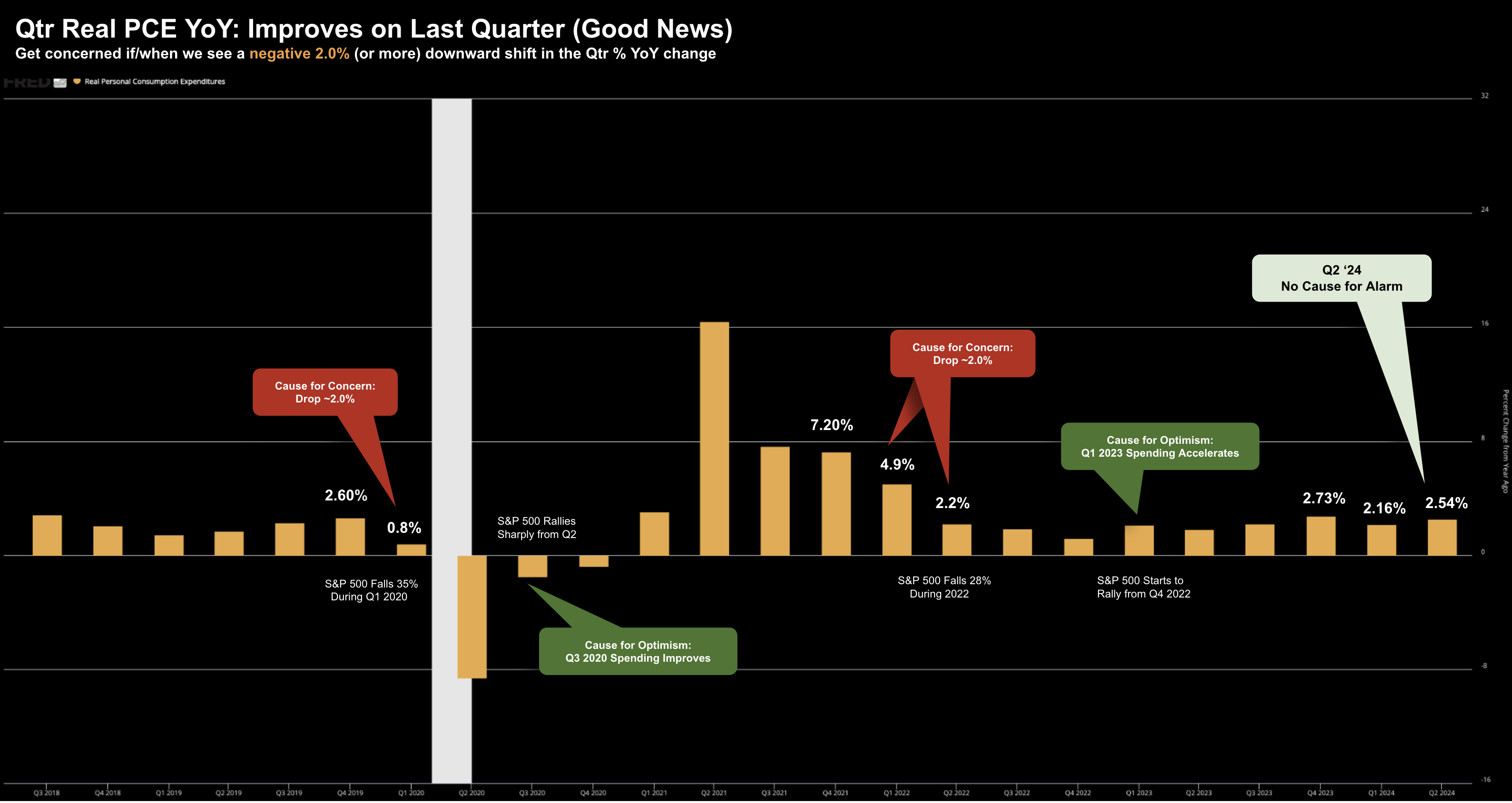

And as I shared recently – consumption trends agree (which is ~70% of GDP).

For example, my preferred leading indicator – Real PCE – where I track the YoY % change on a quarterly basis – is not issuing a warning:

However, there are those who feel the above may not accurately capture where we are headed.

Economists such as Neil Dutta (Renaissance Macro Research) and Wharton’s Jeremy Siegel are arguing the Fed should move sooner rather than later with a 50 basis point cut.

According to Siegel: “...the fed funds rate right now should be somewhere between 3.5% and 4.0%”

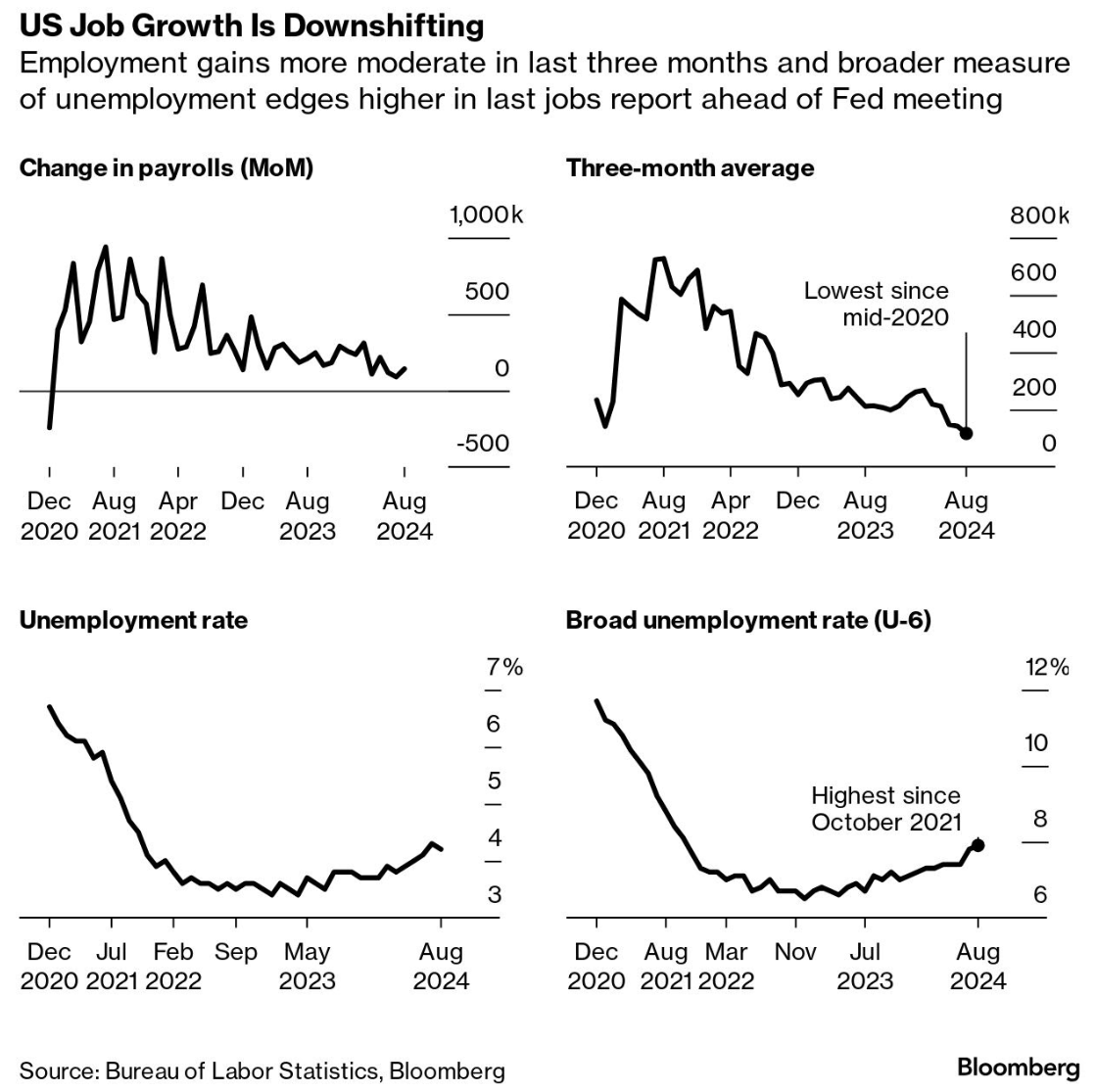

Their concerns center mostly on trending weaker employment (less so the 4.2% print). For example:

- 3-month average job additions are 116K – the lowest reading since the pandemic – which outweighs headline 4.2% unemployment

- Revisions for June and July cut 86,000 in gains – in addition to the 800K+ revisions lower to estimates for the full year

- More than one-in-six of the jobs created last month came from the government; and

- JOLTS (job openings) continue to slow

Others echoing their sentiment for 50 bps include Michael Feroli, chief US economist at JPMorgan Chase; and former Fed Reserve economist Claudia Sahm

In other words, the train has left the station.

It’s time to go…

Focus More on the Direction of Travel

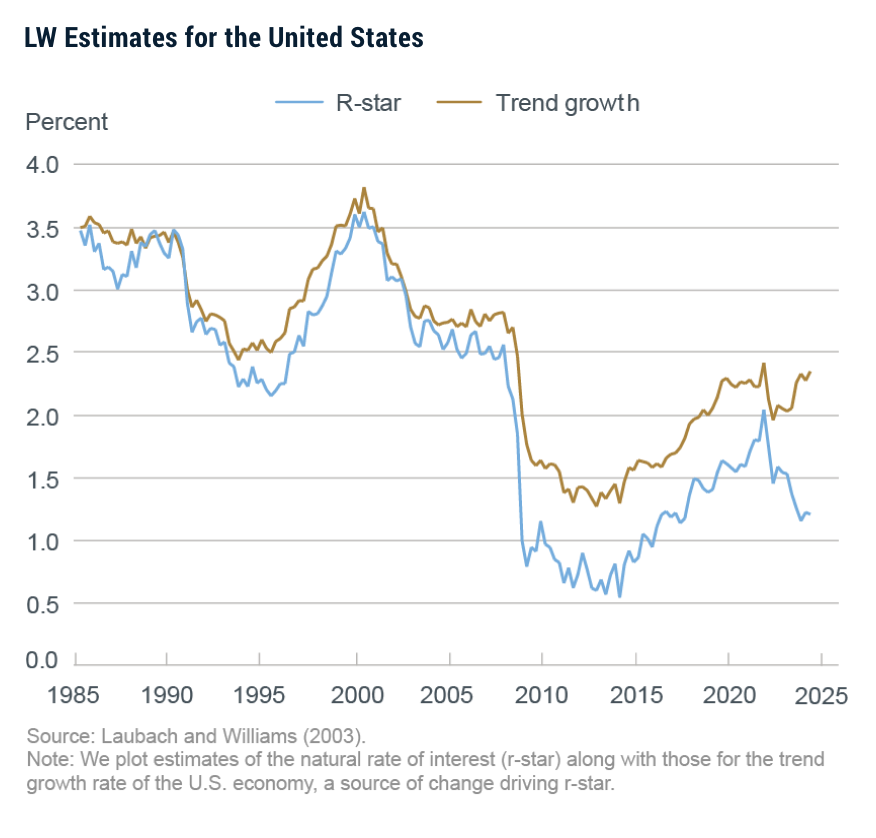

One of the (stronger) arguments made in favour of cutting rates 50 bps is not because they “have to”… it’s more because “they can”

There’s an important difference…

Being forced to cut rates 50 bps could imply panic; e.g., where they feel the economy is slowing at a rate they’re not comfortable with.

However, having the luxury to cut 50 basis points where the natural rate of interest is much lower is something they should take advantage of.

For example, the New York Fed estimates the r-star to be ~1.75% to 2.00% today:

For those less familiar “r-star” is the interest rate at which the economy would be at full employment and stable inflation (the Fed’s dual mandate) without any monetary policy intervention.

If accurate – today’s Fed funds rate (525 to 550 bps) is as much as 300 bps too high.

This arguably gives the Fed scope to start lowering rates to potentially arrest the worrying trends below:

Which of these is trending in the right direction?

The answer: none.

The U-6 broad unemployment rate is less mentioned by mainstream but deserves note. This figure includes those:

- actively seeking work but unable to find it;

- marginally attached to the labor force;

- who want to work and have looked for a job in the past 12 months but are not currently looking;

- discouraged workers who have given up looking for work because they believe there are no jobs available for them; and most importantly; and

- who are working part-time but would prefer full-time work and are doing so because of an inability to find a full-time job

Arguably this is more accurate representation of those out of work.

The argument in favor of a larger rate cut is perhaps less about where we are (e.g., 4.2% unemployment) – it’s where we are going.

Feroli (JPMorgan) argues these (job) trends are “weak even by the anaemic standards of the 2010’s expansion”.

For example, assuming we’re in recovery (using Yellen’s words) – by way of comparison – during the recovery period between 2010 and 2015 – the private-sector job gains expanded at twice the rate of today.

Don’t Bet on 50 Bps Next Week

Given the above, which way do you lean?

Are you in the camp of Slock, Zandi and Yellen etc (i.e., nothing to see here things are ‘solid’) – where the Fed only needs to cut 25 bps.

Or do you side with the likes of Dutta and Siegel – who suggest with the inflation battle firmly behind us – it’s time to arrest the deteriorating trend in employment with 50 basis points (given the have the luxury to do so with r-star some ~300 basis points lower)

Personally, I don’t think it will make much difference to what happens with Main Street.

Especially not in the near-term (e.g., next 6-9 months).

That said, given the long and variable lags of monetary policy, maybe sooner rather than later is prudent?

But for those betting on 50 bps – Fed Governor Chris Waller may have cooled expectations last Friday.

Waller called out the “moderation in the labor market” adding “the balance of risks has shifted toward the employment side of our dual mandate”

However, what caught the market’s attention was the following:

As of today, I believe it is important to start the rate cutting process at our next meeting. If subsequent data show a significant deterioration in the labor market, the FOMC can act quickly and forcefully to adjust monetary policy.

I am open-minded about the size and pace of cuts, which will be based on what the data tell us about the evolution of the economy… If the data supports cuts at consecutive meetings, then I believe it will be appropriate to cut at consecutive meetings.

If the data suggests the need for larger cuts, then I will support that as well.

The market interpreted this as 25 basis points is sufficient for now.

However, should the labor market continue to soften, then Waller is open to supporting further (larger) cuts.

And this is what the 2-year treasury is pricing in… .

Sept 09 2024

Regardless, Stocks Aren’t Cheap

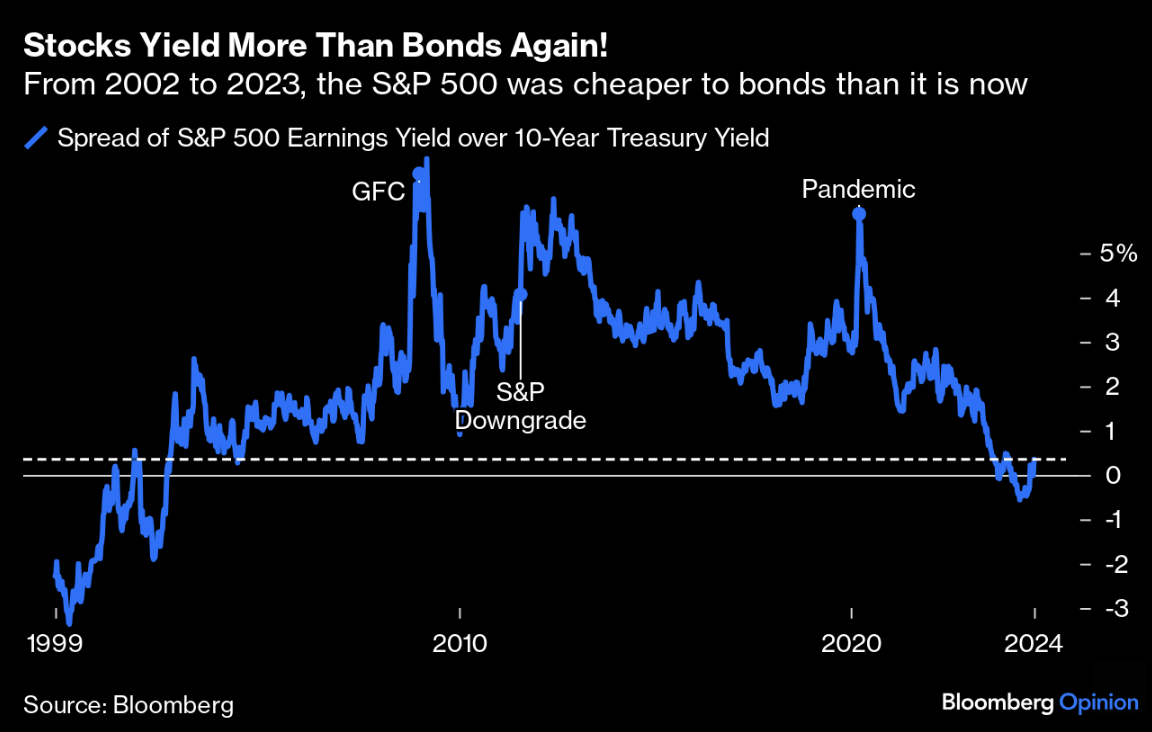

Irrespective of whether the Fed cuts 50 basis points this month (or up to 200 bps over the next 12 months) – stocks remain expensive vs the risk-free alternative.

Consider equity risk premiums (explained in a lot more detail here)

Today these are historically low – which is generally a poor risk/reward to increase risk.

Let’s consider the US 10-year at 3.70% (which I think is likely to rise over the next 12-24 months – given the fiscal situation)

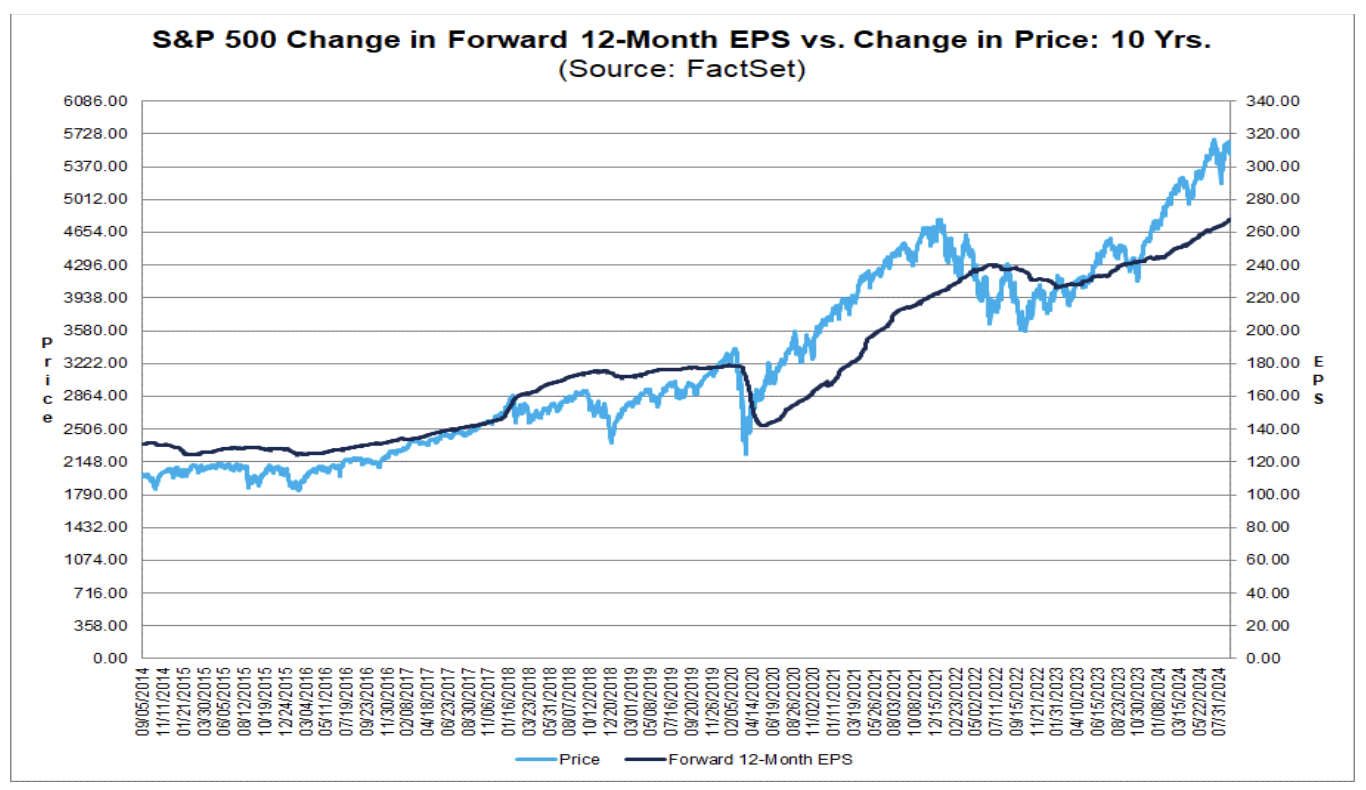

If we assume stocks will generate earnings of $265 p/share next year (11% YoY growth) – that’s a forward PE of ~21x

If we take the inverse of the forward PE (21x) – that’s an earnings yield of 4.8%

That gives stocks a slight 1.0% advantage.

However, it’s not a figure which screams “add risk”.

That’s because they still remain more expensive than they had been for two decades.

For example, the Global Financial Crisis, the downgrade of sovereign debt by Standard & Poor’s in 2011, and the COVID-19 pandemic all created buying opportunities when stocks were extremely cheap on this metric.

From John Authers at Bloomberg:

Bank of America issued a similar warning a few months ago when the 10-year was closer to 4.25% and stocks were at higher levels (closer to 5600)

At that point, the equity risk premium was below zero (as Authers chart shows)

However, it has ticked up slightly in recent weeks due to the significant lower 10-year yield at 3.70% (and stocks trading down – reducing the PE)

From mine, getting paid a premium in the realm of 3% is a better deal (a good risk/reward bet)

5%+ equity risk premium is an exceptional deal.

Putting it All Together

Before I close, the Q2 reporting season has come to a close.

Pro-forma earnings per share (EPS) were $60.55, representing growth of 11.1% year-over-year and 7.3% quarter-over-quarter.

Across sectors, information technology (mostly chip and software stocks) and communication services (e.g., Google and Meta) delivered double digit earnings growth.

Health care bounced back after a challenging first quarter.

Elsewhere, some of the more cyclical sectors, like industrials and materials, saw earnings fall relative to last year. This is to be expected during a period of slowing economic growth. / less demand.

Looking forward, it’s unlikely growth is going to come from the top-line. Those comparisons are much harder year-over-year.

As companies continue to focus on cost management (and as wage growth falls) – improved margins are expected to be the largest contributor to earnings growth.