- May CPI – Will it Exceed 8.2%?

- Energy prices likely hold the key to lower CPI

- Why the Fed has no choice but to go into recession

If there’s one thing I know about bear markets…

Strength is sold.

And this is exactly what we have seen over the past 8 to 10 weeks.

As soon as the bulls mount some form of charge… it’s snuffed out by the bears.

As I like to say – “things are trading per the script”.

In a moment I will look at the weekly tape… and why it makes sense stocks are struggling around the 4200 zone.

We haven’t seen the lows for 2022 yet.

But first, the market struggled today opposite:

- ECB hawkish rhetoric

- Atlanta Fed for Q2 now at 0.9% (down from 2.1% only 30 days ago); and

- CPI tomorrow expected to be north of 8.2%

But it’s inflation which is front of mind for investors.

A hot number (8%+) will keep the market on tenterhooks. However, anything below 8% (which I think is unlikely) could see markets catch a bid.

But here’s why inflation is not likely to show any signs of moving meaningfully lower in the near-term.

Four key inputs (with their relative CPI weighting)

- Food ~14% of CPI

- Energy ~9% of CPI;

- Shelter ~32% of CPI (i.e., where rents follow house prices); and

- Medical ~8.4% of CPI

These four day-to-day non-discretionary costs make up almost 65% of CPI.

Most of us cannot go without any of these items every day.

How about dining out less? Sure.

Or traveling less to holiday destinations (e.g. fewer hotel room and airfare expense)? Easy enough to put those trips off for another time.

Or how about delaying the purchase of a used car; or your next flat-screen TV; or a new pair of shoes?

Sure. All of it.

All of those things can wait and are likely to ease opposite supply chains.

But not food, energy, rent and medical.

And whilst the Fed likes to cite “Core PCE” (which removes more volatile food and energy) – tell me someone who doesn’t use transport to get to work or eat?

Essential costs are up 20%+ year on year (notably food and energy).

Therefore, one must ask how the Fed can bring any of these down with the blunt instrument of monetary policy?

For example, can the Fed dial up more oil from spigots? Or ask landlords to lower rents? Or get Ukraine to export more wheat?

Nope.

As I say, the Fed has a sledgehammer (in the form of interest rates and QT); whereas it needs the “hands and tools of a surgeon”.

Good luck.

We will know more about where CPI is tomorrow – but we all know it’s most unlikely to materially fall anytime soon.

But that’s what the Fed will need to see before it even considers shifting on its hawkish stance; i.e. several months of CPI moving significantly lower (not simply “peaking”).

Energy to Force the Fed’s Hand

Perhaps the most significant thorn in Fed’s side are energy prices.

As a result of both government policy and the war in Ukraine – oil supply remains under pressure.

As we started 2022 – I nominated what I felt were the 5 most important charts for 2022.

At the top of my list was WTI Crude.

And the reason was simple: very rarely do we avoid recession if we find a sustained oil price above $90.

Today we are well above $120/b and going higher.

Give this – it follows this would have major bearing on Fed policy.

Let’s take a look:

June 10 2022

As the weekly chart shows, WTI Crude traded as low as ~$40 in the final quarter of 2020.

Inflation remained low; economic growth was strong and the globe was awash with oil.

However, from late 2020, the price of WTI has tripled.

Now Russia’s invasion of Ukraine has played some role in prices rising – given Russian constitutes around ~10% of all gobal supply.

That invasion commenced Feb 24th.

However, by early February the price of WTI was already ~$100 a barrel – twice that of the previous quarter.

Now with supply severely constrained… and China coming back online (increasing demand)… it’s hard to see how WTI prices fall back below $100 in the near-term?

Again, we know that energy prices constitute 9% of CPI.

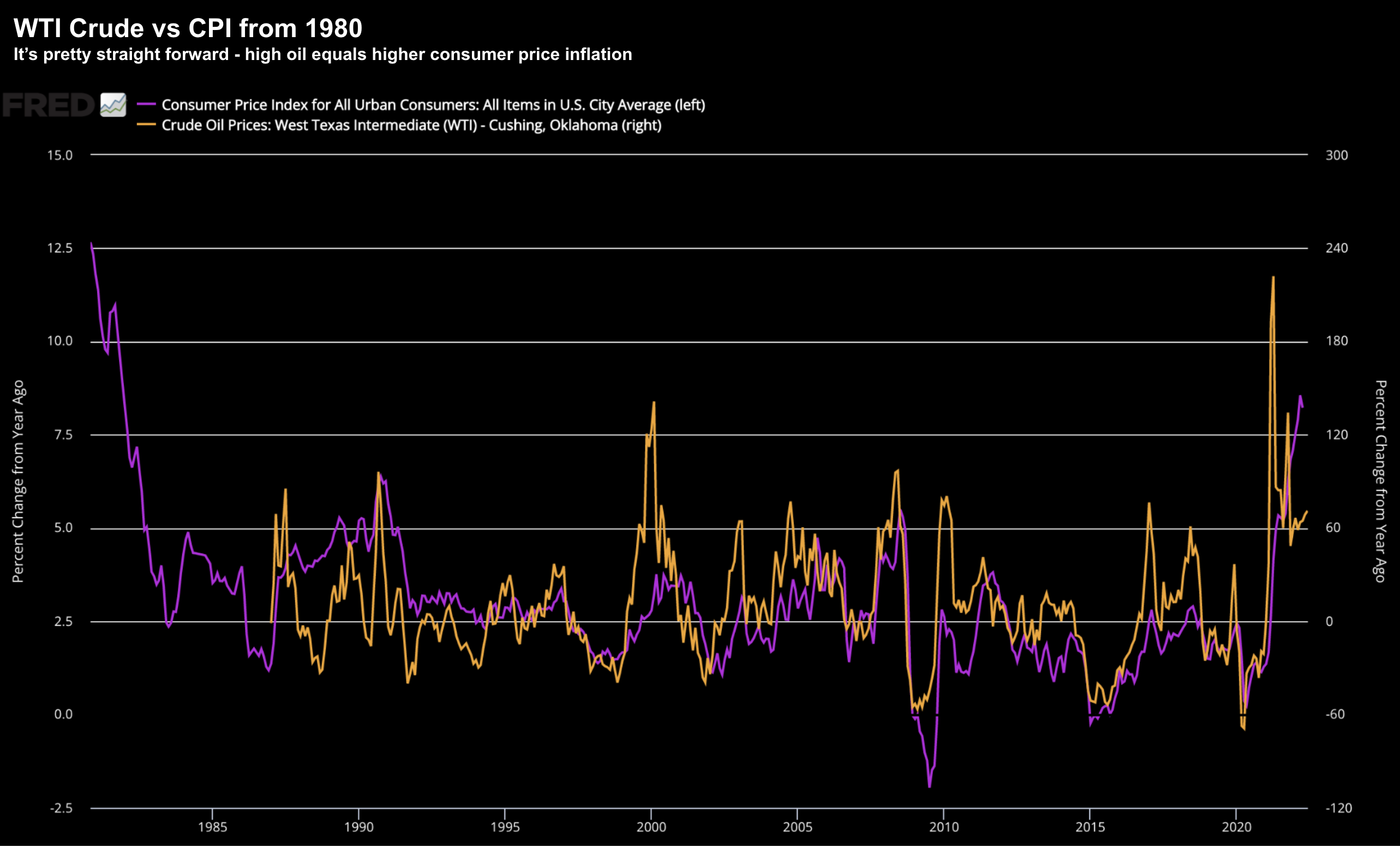

Now look at the (40-year) correlation between WTI Crude and Consumer Price Inflation:

June 10 2022

It’s a striking correlation….

Now as an aside, NPR reported this week that gas prices are averaging $5+ per gallon across 10 US States. Prices are closer to US$6.34 across California (i.e. ~AU$2.40 per litre).

How will this result in a lower CPI print?

To that end, higher oil (in part) will actually help to bring about eventual demand destruction.

And ultimately… prices come thundering down.

Because that is the (recessionary) script we’ve seen time and time again.

Is this time any different?

Some will say that consumer inflation around 8.2% is now “peaking”.

That might be true.

However, it’s still unacceptably high.

For example, unless your salary is rising more than 8% YoY – you’re going backwards in terms of your purchasing power.

That’s another tax.

Hands up if your salary increased at least 8%?

Now the only way the Fed gets back to an acceptable inflation rate with 2-handle (from above 8 today) is through demand destruction.

Put another way – they will need to push the economy into recession.

It sounds terrible but that’s what coming…

But that’s how a $120 oil works its way back to acceptable $40 to $50 a barrel (i.e. where we were in Q4 2020).

The other question worth asking is whether what we see today – any different to other episodes in history?

Not from my lens

Inflationary pressure like this is not new.

Roaring commodity prices isn’t new. And neither is aggressive Fed tightening into a slowing economy.

The script is the same.

However, it’s hard to nominate a time in history where the Fed has navigated this setup successfully.

Almost universally, the Fed has used its ‘sledgehammer’ of raising rates aggressively to combat inflation only to send the economy into recession.

We can argue whether it’s going to be a “light recession” or something worse – but that’s where we are going.

What’s more, the Fed has no choice but to do this — if they are to get on top of 8%+ consumer price inflation.

And in that sense – it always ends the same way.

That part isn’t any different.

The writing was on the wall in the final quarter of last year…. the Fed has already made its policy mistake by running with ultra-easy money for far too long.

S&P 500 – No Catalyst to Go Higher

As I said in my preface, things continue to trade per the script.

Every time stocks try and catch a bid – there are sellers lined up ’10-deep’

Let’s update the chart ahead of tomorrow’s CPI print:

June 10 2022

If you have been following the blog – not much has changed here.

That is, we challenged the 10-week EMA – where it was met with expected resistance (~4200)

Now excluding a CPI print with a 7-handle tomorrow – stocks are likely to remain under pressure.

For example, let’s say we get an expected 8.2% to 8.4% for May (what Bloomberg economists expect), that’s still a number which see the Fed continue with a 50bps + 50bps pathway (with a possible 50 bps in September).

However, I posited that a CPU number greater than 8.5% could unsettle equities. That is, it will strengthen the probability of a third consecutive hike of 50 bps in Sept.

But technically – irrespective of the print – things remain unchanged; i.e.

- The weekly trend remains bearish – therefore expect lower prices (i.e. strength is more likely to be sold)

- We will remain in a bear market until the previous high of 4600 is exceeded;

- 3800 represents a zone of 61.8% outside March retracement (labelled A-B) – which is where I would expect stocks to find some level of interim support;

- Fundamentally, 3800 represents a forward PE of around 16x (i.e., fair value opposite a 10-year yield trading above 3.0%); and

- It’s probable the S&P tests a 15x forward PE in this climate (where the “E” is likely to only show between 5-10% growth YoY)

Further to the final point – the next hurdle for the market are Q2 earnings.

It’s my expectation that earnings expectations will come down.

For example, they could be as low as showing only 5-10% growth year on year.

Case in point:

We’ve heard Target give two profit warnings in just three weeks. I don’t think this is simply a “Target problem” where they ordered too much inventory.

If it’s a Target problem – it’s likely a Walmart problem.

And if these two major retailers (who employ over 2.5M people combined) are feeling it – then it’s a problem across the entire economy.

And listening to further earnings reports this week – we are hearing similar warnings and news of job cuts. That’s what will follow.

Putting it All Together…

For the past decade or so – stocks have gone straight up.

There were a couple of small hiccups (like March 2020) – but the Fed was there like a “knight in shining armor” to make everything whole.

The Fed Put was very much in place.

That’s changed.

The Fed no longer has the luxury it did over the past decade. They must raise rates aggressively and reduce its balance sheet. That’s a new narrative.

Therefore, you need to be very mindful of what stocks you own; and your levels of exposure.

For example, my own portfolio is down ~4.1% so far this year – which is approx 10% better than the S&P 500 (but down nonetheless).

My portfolio return is shown in red vs the S&P 500 in blue.

Anytime you outperform the Index – you are doing okay.

However, I am still exercising patience as I think I will be rewarded (similar to what I was doing in Q1 of this year).

For example, I still think there is a market flush ahead of us.

I say that as we haven’t seen panic yet. The VIX is only trading around 26. It’s too low.

For example, there’s a good chance we get that flush once we see Q2 earnings revisions (which we’re still yet to see).

From there, stock multiples will come down.

And that will be time to put more cash to work for the long-term.