- The rush to safety in dollars

- There is no ‘winnable’ outcome for Putin

- Volatility unlikely to subside in the near-term

Russia. Inflation. Monetary Policy

Whilst in no particular order, these concerns look set to influence market sentiment over coming weeks and months.

For example, March 10th we get the next read on Consumer Price Inflation.

Many are now thinking this number will exceed 8%.

Sounds reasonable.

Why wouldn’t it?

The Fed has the pedal to the metal and the prices of just about everything continue to soar.

I’m now expecting CPI of 10% in the coming months… given the Fed’s ‘go easy’ path (not to mention WTI Crude now topping $130 a barrel).

But with respect to Russia – things seem to be going from bad to worse.

Putin will not negotiate.

Putin Lays Siege…

Putin continues to lay siege to the cities and innocent people of Ukraine.

We have not seen anything like this since World War II.

A question: how does Putin ‘win’ this war?

What does he hope to gain? And what does ‘winning’ look like in his deranged mind?

It’s impossible to know what goes on in such an evil, narcissistic, sociopath’s head.

But if winning looks like the following:

- Russian oligarch’s bank accounts, villas and ‘toys’ seized;

- Visa and Mastercard refusing to process credit card transactions outside Russia;

- Russian major banks cut-off from international clearing functions with the SWIFT network;

- About half of Russia’s foreign exchange reserves frozen abroad;

- The Ruble losing nearly half of its value; and perhaps most importantly

- Some countries are eliminating future purchases of Russian oil and gas.

Then yes… you are ‘winning’.

Another question: when will the US stop buying Putin’s oil?

Hopefully sooner rather than later.

Not a single cent should be flowing from the US to Putin – even if oil trades at “$200 a barrel”.

Whether Putin “wins” his war with Ukraine (and I use the term liberally) – I struggle to see how Russia thrives (or even survives) as a pariah state for potentially ‘decades’ to come.

The growing list of international companies are now refusing to conduct business – some of it critical.

For example, Boeing and Airbus are now refusing to provide any parts to support their aircraft?

From mine, the focus needs to be on energy.

Russia is entirely dependent on its export of energy – supplying ~10% of the global supply.

We need to take this away.

What’s more, Russia needs to import every other good.

Sadly it’s also the Russian people that will also suffer as a result of this tyrant.

Because at some point over the next 6-12 months (and assuming total sanction of Russian energy) – they will be completely starved of all liquidity for a long time.

What then?

Subject for another post.

China Should Choose Carefully…

Throughout this war, it’s interesting that China has refused to denounce the criminal actions of Putin.

But they should choose carefully…

Here’s the thing:

The trade wars of 2018 demonstrated how inextricably connected the global economy now is.

No country can exist as a pariah.

Not Russia. And not China.

And whilst the likes of Putin and Xi think they can thrive without the cooperation of the West… can they?

Putin may have assumed he would take control of Ukraine in relatively short order (given the strength of his forces; and with Ukraine not a NATO member).

But that didn’t happen.

The Ukrainians continue to fight harder (and longer) than anyone thought imaginable.

It’s not the ‘size of the dog’… it’s the size of the fight in the dog.

Every day this war continues – the worse it will be for Putin.

But what he perhaps failed to estimate most was the strength of the global alliance against him (notwithstanding China).

Russia has been cut from the world financial system….

And that choke hold looks set to increase.

Visa, Mastercard, Apple, AirBnB, Google, Boeing, Airbus, VW, and many others have ceased offering their services and support. Even energy giant Exxon Mobil is pulling out of an oil-and-gas operation on Sakhalin Island.

So where does Russia go from here?

Is Putin cornered?

And if there is a so-called “off ramp” – what does it look like?

I don’t think he has one… not from his perspective.

But what of China?

Shortly after the Olympics concluded (where China put on its best ‘western face’) – they declared their intention to join Russia on a mission to “remake the global order” (whatever that means)?

Now Xi has a window into what a (potential) alliance with Putin looks like.

The Chinese leader has had the time to carefully assess what any (fateful) alliance could mean – if he were to set a pathway of conflict with the democratic West.

Alternatively, Xi could use this situation to align with his largest trading partners (something Putin would not have calculated)

Xi knows the West does not want to see a China-Russia bloc. And much like Russia – China is heavily dependent on trade with both Europe and the US.

What pathway will Xi take?

If nothing else, Xi will have seen that freedom-loving people from all corners of the world will fight with everything they have against tyrannical governments.

Charts to Watch

This week promises to be another volatile one for markets.

At the time of writing (9pm Sunday night) – Dow Futures are down almost 500 points.

Asian markets opened ~3% lower.

And WTI Crude is trading above $130 a barrel (which was my #1 chart for 2022… who knew?)

Today I want to share what we see with the US dollar index and gold…

#1. US Dollar Index

Among my Top 5 charts for 2022 was the almighty greenback.

I felt it was headed higher... which is not a positive for markets.

Whilst it will help with inflation – equities are better served with a lower dollar.

Below is the chart (and outlook) I shared Jan 3rd… highlighting the expected upside.

January 3 2022

Let’s now update the chart for the past two months…

March 6 2022

The DXY has traded largely ‘to the script’…

Whilst I could not have forecast what we see with the Ukraine – the chart told me to expect upside in the dollar index.

What’s happening here is two-fold:

- A flight to safety; and

- A crisis in the EUR (i.e., liquidity and credit-related stress as a result of Russia)

The latter is significant.

For example, if we consider interest rate swap-spreads in Europe – they are starting to explode to levels not seen since 2017 (or around 80 basis points)

Swap spreads are excellent indicators of both liquidity conditions and the outlook for corporate profits / economic health.

And whilst they are a little higher in the US – they are not yet troubling.

But it’s something I will keep a close eye on…

For example, in any healthy economic environment – interest rate swap spreads will trade for about 15-35 basis points.

Today, US swaps trade around 20 basis points.

But conditions in Europe are now at concerning levels – which is seeing a flood of money seeking safety in dollars.

My expectation is Euro swap spreads will continue to surge as long Putin’s war continues; and Russia’s is locked out of the SWIFT payment system.

#1. Gold Surges

Whilst the world’s reserve currency is catching a bid – so too is sound money.

Let’s first look at the weekly chart:

March 6 2022

The week of Feb 14 gold closed above $1880.

This was a very bullish sign technically – as it broke out of a descending pattern (i.e., lower highs)

For example, note the series of lower highs from August 2020 – when gold peaked at $2,120.

Since then it’s been a largely sideways – as the bulls fought hard to defend the $1,680 low

Now the weekly trend is firmly bullish and looks set to challenge the previous all-time high.

And whilst the pathway will not be in a straight line – I would be a buyer of gold – with a stop of $1780

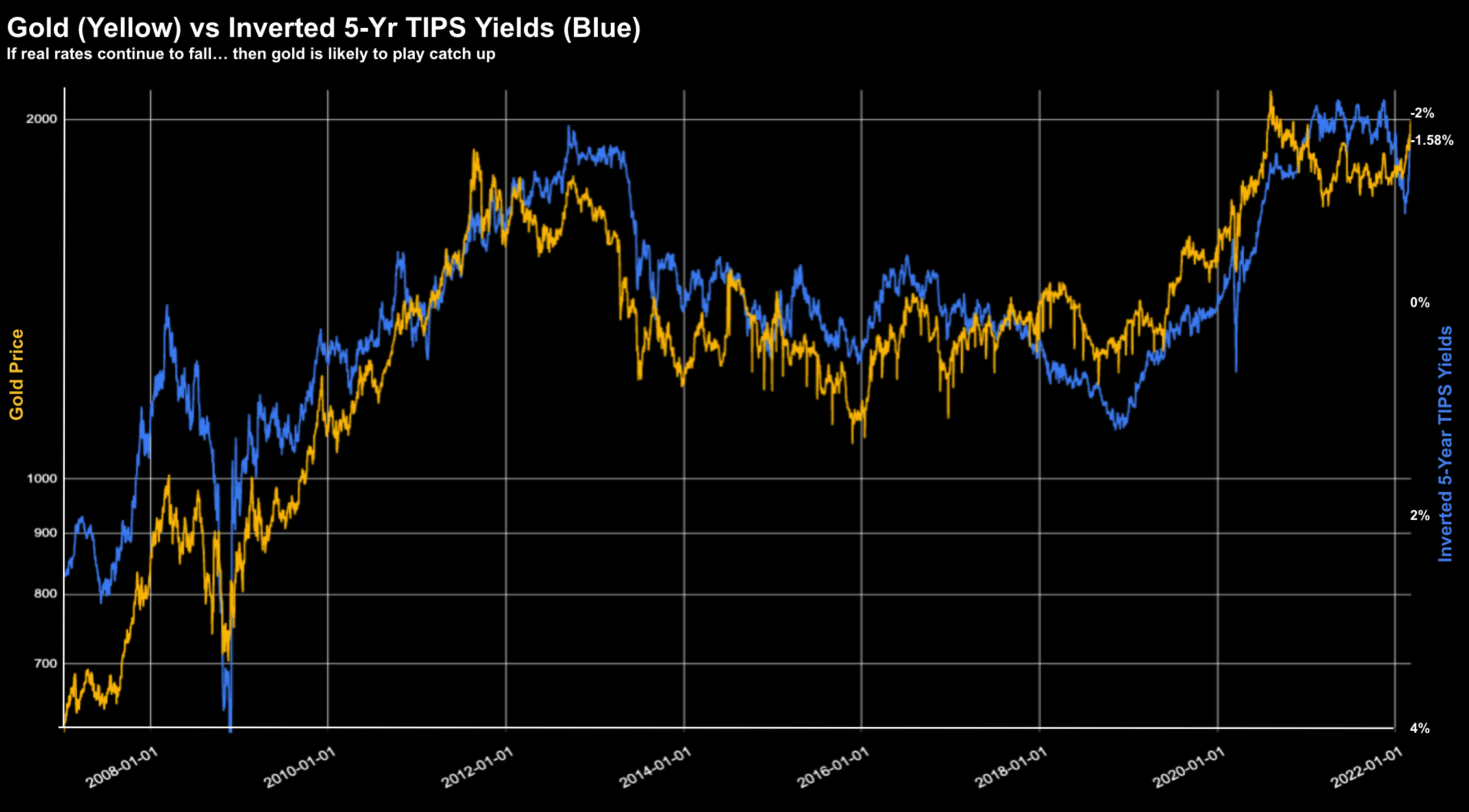

The other ‘gold’ chart I often refer to is how the metal trades in correlation with inverted 5-year TIPS

Below is 15 year chart showing the incredibly tight correlation between the two:

March 6 2022

What to make of this chart?

In short, it echoes the dollar index move and the rush to safety.

When we see TIPS yields plunge (e.g., real yields at -1.58%) and gold soar to almost US$2,000 (at the time of writing) – the market is concerned.

When was the last time we saw similar levels of outright panic?

It was late 2011 through 2013.

The market was worried that the European Union was going to collapse… with countries like Spain, Ireland, Portugal, Greece and Italy at risk of default.

At the time, it proved to be a great buying opportunity.

However, at the time investors were diving for cover (much like today).

And whilst hindsight is always a wonderful thing – investors buying the 17.5% sell-off (at the time) would have realized ~13% CAGR (exclusive of 3% dividends) if buying the Index.

March 6 2022

If we are ‘lucky’ we will see a similar sell-off this time around – enabling cashed up investors to capitalize.

As I have said in recent months – I am a buyer anywhere around this blue line.

Putting it all Together

What we are witnessing in Ukraine is extremely sad.

The news is difficult to watch.

I am thinking that the only way this ends is if Putin is removed.

I say that because he is not going to negotiate… as there is no foreseeable “winnable” outcome in his mind.

He takes over Ukraine or nothing.

We are also seeing a new (modern day) kind of warfare… one where Russia has been severed from the global financial system.

This will result in their currency being worthless – with their citizens deprived of basic goods, services and the freedom of information.

It’s very sad.