- Bond yields and dollar index drive equities

- There is a bullish case but I would argue it’s weak

- Stay patient here – we’re likely to make new lows

The stage was set for a market meltdown Thursday.

The consumer price index (CPI) came in white-hot – with CPI running at 8.2% YoY and Core CPI (ex food and energy) at 6.6% YoY

Choose your poison – either way it wasn’t pretty.

Inflation continues to be stubborn… arguably where it hurts consumers most:

- Gas utilities – up 33.1% YoY

- Gasoline – up 18.2% YoY

- Food – up 11.2% YoY

- Shelter – up 6.6% YoY

Some will say there are signs where inflation is peaking…

And that’s true… there are.

But I would suggest stickier forms of inflation (e.g., shelter and wages) isn’t easing anytime soon.

As I have often said, going from “9% CPI to 5%” is the easy part. However, going from “5% to 2%” will take a little more work and time.

What’s more, the Fed is only an observer.

Yes they can reduce the supply of money (and influence its price) – but they have little control over the supply side.

For example, tell me how the Fed can:

- produce more energy;

- produce more food; and

- provide more shelter?

That’s where fiscal policy needs to do some of the heavier lift (but it’s not coming).

Inflation is two sided.

On the one hand is excess money (i.e., what the Fed control); however on the other – it’s excess money chasing too few goods.

The Fed is using its blunt instrument to suck money out… but that’s all they can do.

Now moving to the market’s reaction on Thursday – selfishly – I was hoping to see the market plunge 5% or more.

When I woke at 5:30am (Pacific Time) to get the number… I was confident equities would trade materially lower.

What’s more, I was hoping my buy order for 3400 on the S&P 500 might get filled.

But a funny thing happened about two hours into the trading session…

The markets reversed course in a stunning manner.

The Dow closed over 800 points higher while the S&P 500 and Nasdaq jumped by more than 2% each.

But it turns out the enthusiasm was short-lived (more on this in a moment when I look at the weekly chart)

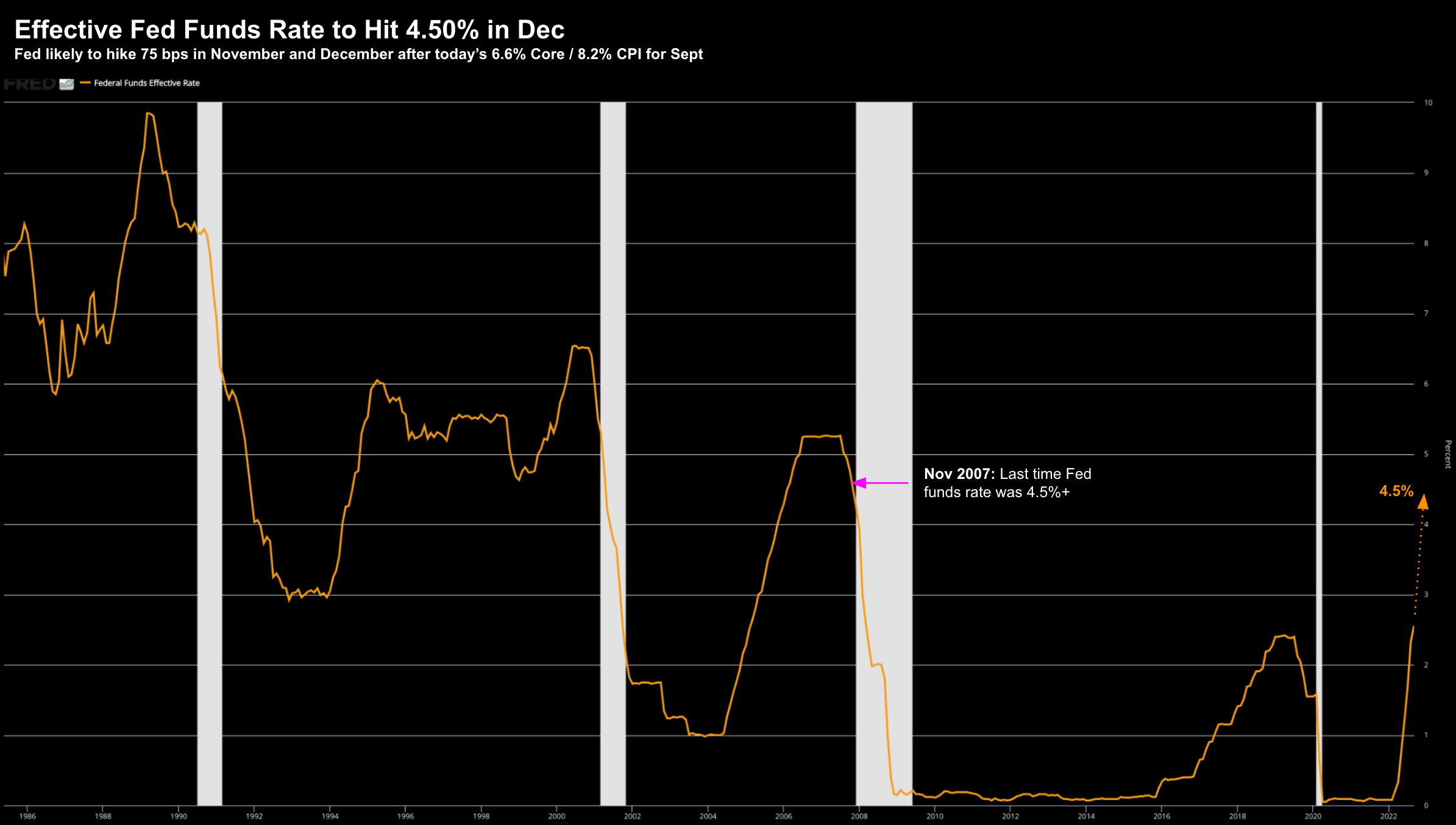

75 is the New 25

- 75 basis point (bps) rise for November; and a

- 60% probability of another 75 bps for December

The 75 bps for November was almost a certainty given the strong labor report; however, the odds increased for a repeat dose in December.

If that proves to be true… 2022’s rate hikes will look like:

25 + 50 + 75 + 75 + 75 + 75 (Nov) + 75 (Dec) = 450 bps

October 14 2022

Notice what happens every time the Fed sharply hikes rates?

Yields resumed their path higher along with the dollar.

And as regular readers know… that does not bode well for equities.

My thesis is if we are to get bullish on this market (which will come) – both of these variables have to show clear signs of peaking / trending lower.

That’s not the case… not yet.

Yields and Dollar Dictate Terms

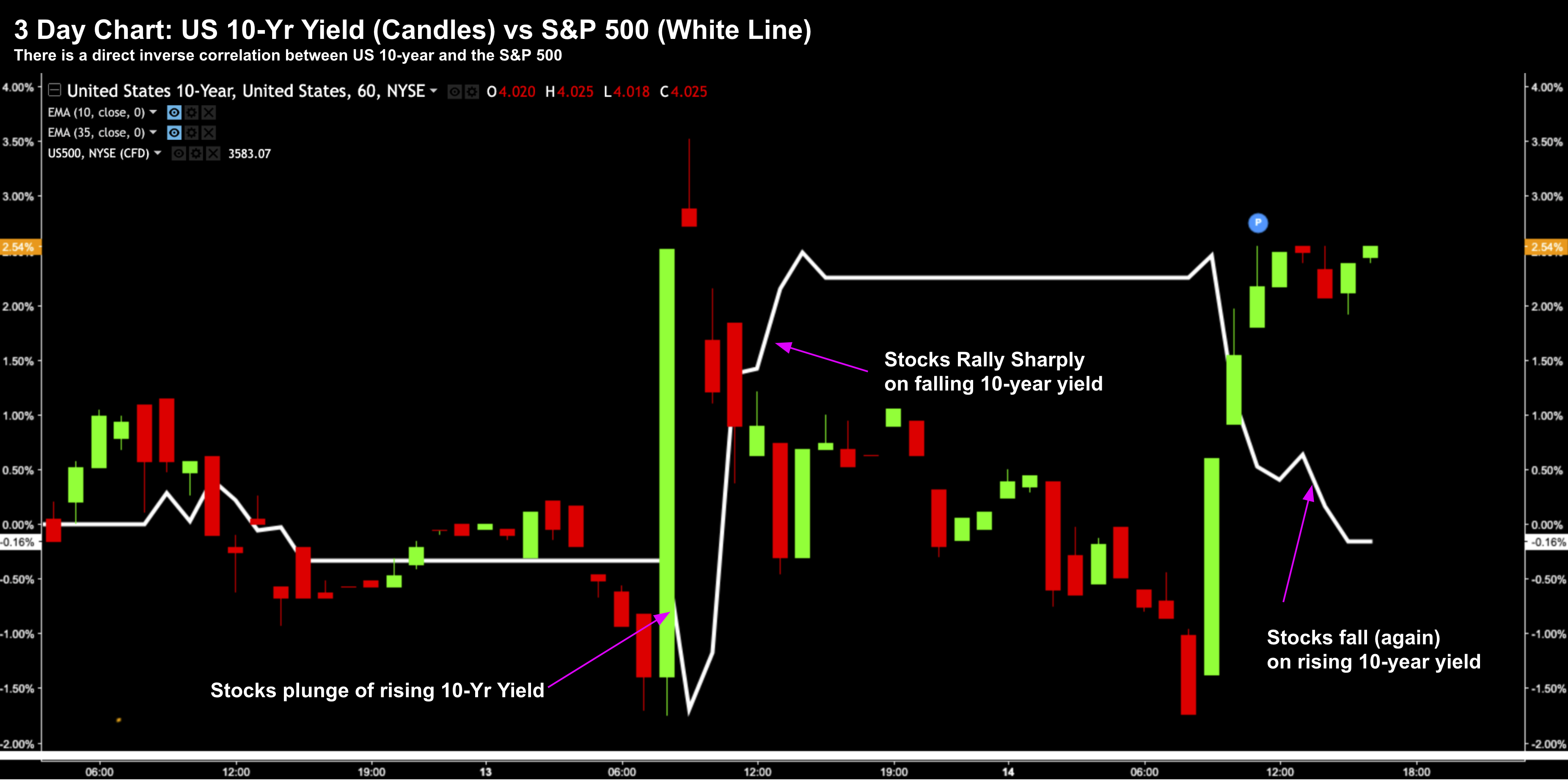

There was one thing I noticed opposite yesterday’s bizarre trading activity.

Equities rallied sharply when yields and the dollar reversed course.

Similarly, when yields rallied today, the market was quick to give back most of its gains.

For example, below is the 3-day chart showing the correlation between US 10-Year yields and the S&P 500:

October 14 2022

This shows the close inverse correlation between these two datasets.

From mine, it’s been clear for a few months that both 10-year yields along with the dollar index tell us which way things will trade.

But let’s talk to the other global ‘wrecking ball’ – the almighty dollar index.

Among the numerous headwinds challenges facing the economy — an energy crisis, surging inflation, a slowing China, fragility in credit — the dollar could be the most significant.

‘King Dollar’ is up about 15% for the year – and on course for the biggest surge since the early 1980s.

October 14 2022

Not only will the theme of “FX headwinds” dominate earnings reports over the next few weeks (e.g. Microsoft, Google, Salesforce, etc etc) — it’s also causing concern among the IMF and World Bank.

Consider for example:

- The yen this week weakened past levels that recently spurred Japan to intervene in the market. With the weakest exchange rate since the 1990s, prospects are for even bigger trade deficits as energy-import bills climb;

- Euro area officials are also contending with diminished purchasing power. France’s central bank governor, Francois Villeroy De Galhau, recalled the days when the Group of Seven mounted coordinated interventions (perhaps as a direct “jab” at the Fed Reserve); and perhaps of most concern

- Developing nations with big dollar-debt burdens face rising repayment risk. Central Bank of Kenya Governor Patrick Njoroge warned about some becoming effectively “shut out of the capital markets.”

Repeating Jamie Dimon’s sentiment – “this is very serious”

In short, the Fed’s inflation fighting tactics with QT and higher rates is driving the dollar’s strength.

What’s more, the Fed is seemingly going at it alone.

Put another way, there is not a lot of coordination between central banks, which is arguably not helping the stress in markets.

As I outlined in my preface – markets now see the Fed hiking a further 150 bps before 2023. If that eventuates – it means dollar strength is likely not finished.

Here’s Bloomberg:

“Think of the scenario in which inflation in the United States doesn’t get under control for a long period of time,” IMF Managing Director Kristalina Georgieva said Thursday.

That would be “bad for the US, but it also has spillover impacts for the rest of the world.”

Yes… the “spill over” effects will be far worse for the rest of the world than it will be for the US.

Does the Fed care?

I don’t think so.

Despite the so-called “merits” of more coordinated currency intervention, I doubt that’s what we will see.

For example, in 1985 the world’s top industrial powers agreed to rein in the dollar in what became known as the Plaza Accord.

By 1985, the Fed had already brought inflation under control. Again, from Bloomberg:

“Bottom line: we are nowhere near any type of Plaza-style Accord to arrest the dollar’s ascent,” Brown Brothers Harriman currency strategists led by Win Thin wrote in a note.

I agree.

To that end, look for the dollar strength to continue which is a massive headwind for both company earnings and economies alike.

S&P 500 – What’s the Bullish Case?

The bulls were on the front foot yesterday… or so it seemed.

But as stocks rallied – I asked myself what the bullish case was?

I struggled to find an answer.

Today yields rallied (along with the dollar) which sent stocks reeling.

But coming back to my question… below are some of the arguments in favour of the bearish case:

- Unknown fallout from the (escalating) war in Ukraine

- Surging inflation at 8.2% CPI / 6.6% Core (more than 3x the Fed’s 2.0% target)

- 15-year highs for the US dollar index

- Likely earnings contraction going into 2023 (as much as 10%)

- Energy price shocks (e.g., OPEC+ decision and coming Russian embargo)

- Possibility of falling house prices with 7%+ 30-Yr mortgage rates

- Increased possibility of major credit event (e.g. events in the UK and Switzerland)

- Ongoing Covid restrictions in China

- More aggressive tightening from central banks globally (i.e., liquidity is contracting); and

- Generally weakening consumer confidence

And from a technical perspective – we have an exceptionally bearish tape (in almost any timeframe).

With that, let me try and make the bullish case:

- Employment remains reasonably strong;

- Consumer balance sheets are holding up;

- Credit spreads are yet to blow out (although starting to widen);

- The broad atmosphere of overweight negative conditions;

- How far stocks have sold off in a short period of time (hence the “bounce” yesterday); and

- Potentially we’re trading in a clearly defined (expected) zone of support (around 3600)

Often bulls will like to say that “it’s so bad… it’s now looking good”

Sure… I get that.

But I’ve also seen where sentiment is exceptionally poor (e.g., October 2008)… only for the market to make its final low in March of 2009.

Put another way, just because we have extremely negative sentiment doesn’t mean things can’t go lower.

To me, that argument doesn’t hold much water.

But when all is said and done… I will say two things I know to be true:

- Don’t fight the Fed; and

- Don’t fight the tape

And typically it takes a lot longer when working through a likely recession.

Let’s recap the weekly chart (my preferred timeframe) as not much has changed despite the wild daily ‘2%’ swings.

October 14 2022

As I say, yesterday was not something to pay much attention to.

For me, it was a knee-jerk reaction to US 10-year yields and some short-term weakness in the dollar.

Throw in a bit of short covering and there’s your rally.

Technically not much has changed.

I still think there is a possibility for a short-term bounce… maybe as high as the 10-week EMA (or ~3900)

But I would be a strong seller of any strength (not a buyer)

And to that end, perhaps we will get a next cue from earnings… which kicked off today.

Earnings Season Kicks Off

Banks started things today and it was a mixed bag.

For example, JP Morgan and Wells Fargo handily beat (thanks to strong net interest margins opposite rising rates); however Morgan Stanley missed (due to weaker investment banking deals)

But let me say this on earnings…

Let’s say we get a recession next year (which is my base base).

Any form of recession (mild or otherwise) – it will be a bad outcome for earnings.

Period.

And whilst forward multiples have come down a good way (as they do when rates rise) — now we are focused on the “E” in PE.

Is it closer to say $240 for the S&P 500 or $210?

My guess is closer to the latter (as earnings will always decline in a recession).

$240 for example assumes 8% growth in 2023 earnings.

From mine, that’s a bold assumption given the headwinds (not one I’m willing to make)

However, one positive I’ve seen over the past 3 months – we’ve seen a lot of the cost measures taken by companies.

This is a start…

For example, companies such as Amazon, Google, Facebook, Netflix, Uber, Lyft and Intel (and many more) have announced meaningful measures to curb costs.

What’s more, we’ve also seen the softness on the demand side – with revenue warnings from the likes of Samsung, Micron, FedEx, AMD and NIKE.

And this is exactly what the Fed want – to crush demand.

Therefore, if we connect the dots – this is likely to have more negative estimates than positive.

That’s my thesis… but I could be wrong.

Putting it All Together

The next few weeks will be pivotal to how we close the year…

For example, my best guess is to expect a wave of weak guidance with earnings downgrades.

And if we are to see a recession next year (mild or otherwise) – earnings will contract.

On the technical side, apart from sentiment being exceptionally negative, it’s hard to make a bullish case.

Yes we may see another short-term bounce.

Technically it’s feasible.

However, the support zone of 3600 is starting to feel “heavy” – meaning we could easily make our way lower.

My best tip here is to remain patient.

For example, when my buy order for 3400 on the S&P 500 wasn’t filled Thursday – I didn’t chase it.

It’s remains in the system… unchanged.

And that’s what I’ve done all year – waited to prices to come to me.

I don’t swing at every pitch. The secret is always to buy well (not just buying good things!)

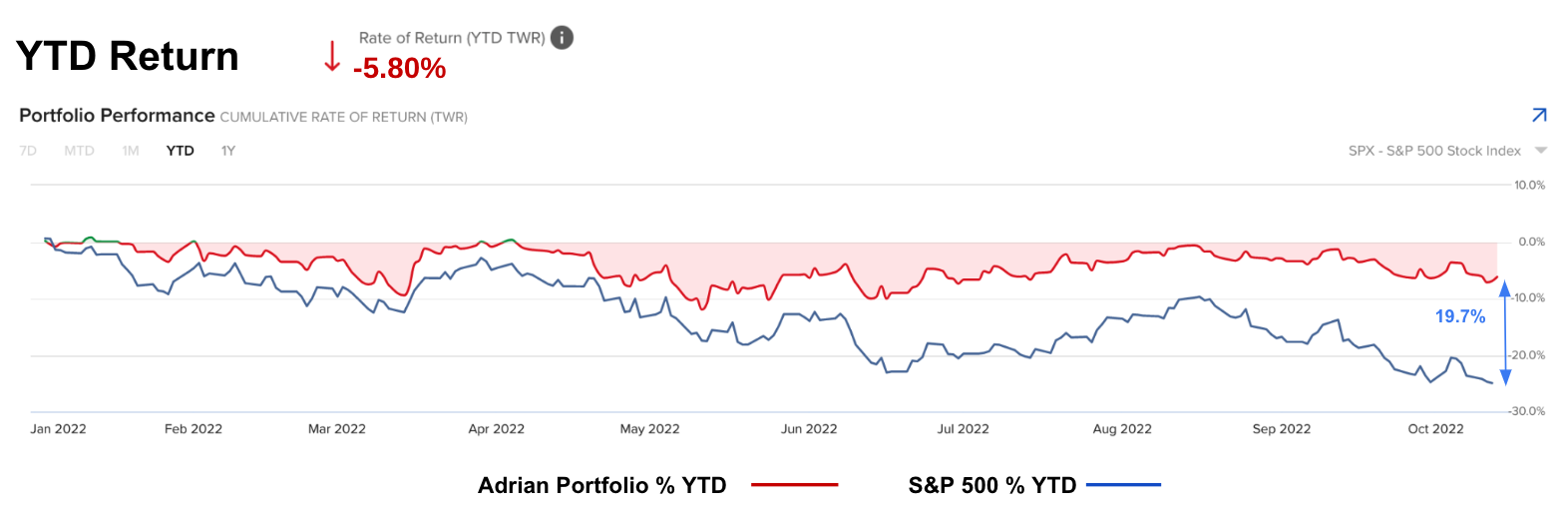

Through a combination of:

- remaining patient;

- reducing my overall exposure; and

- selling covered calls against existing long positions

… this has seen me outperform the S&P 500 by ~20% YTD (my performance in red)

My preference is to add more exposure around 3400… and get more aggressive towards 3200.

For example, quick math tells me S&P 500 (2023) earnings of $210 per share at a multiple of 15x = 3,150

We might go 10-20% lower… and that’s fine (I can’t pick bottoms)

However by taking a 3+ year horizon in quality companies (i.e., consistent positive free cash flow, double digit revenue growth, large defensible moats, low levels of debt) – I believe the upside reward starts to outweigh the downside risks.

That’s my playbook…. let’s see how we go.