- Powell delivers what was expected

- One Fed nuance the market may have missed

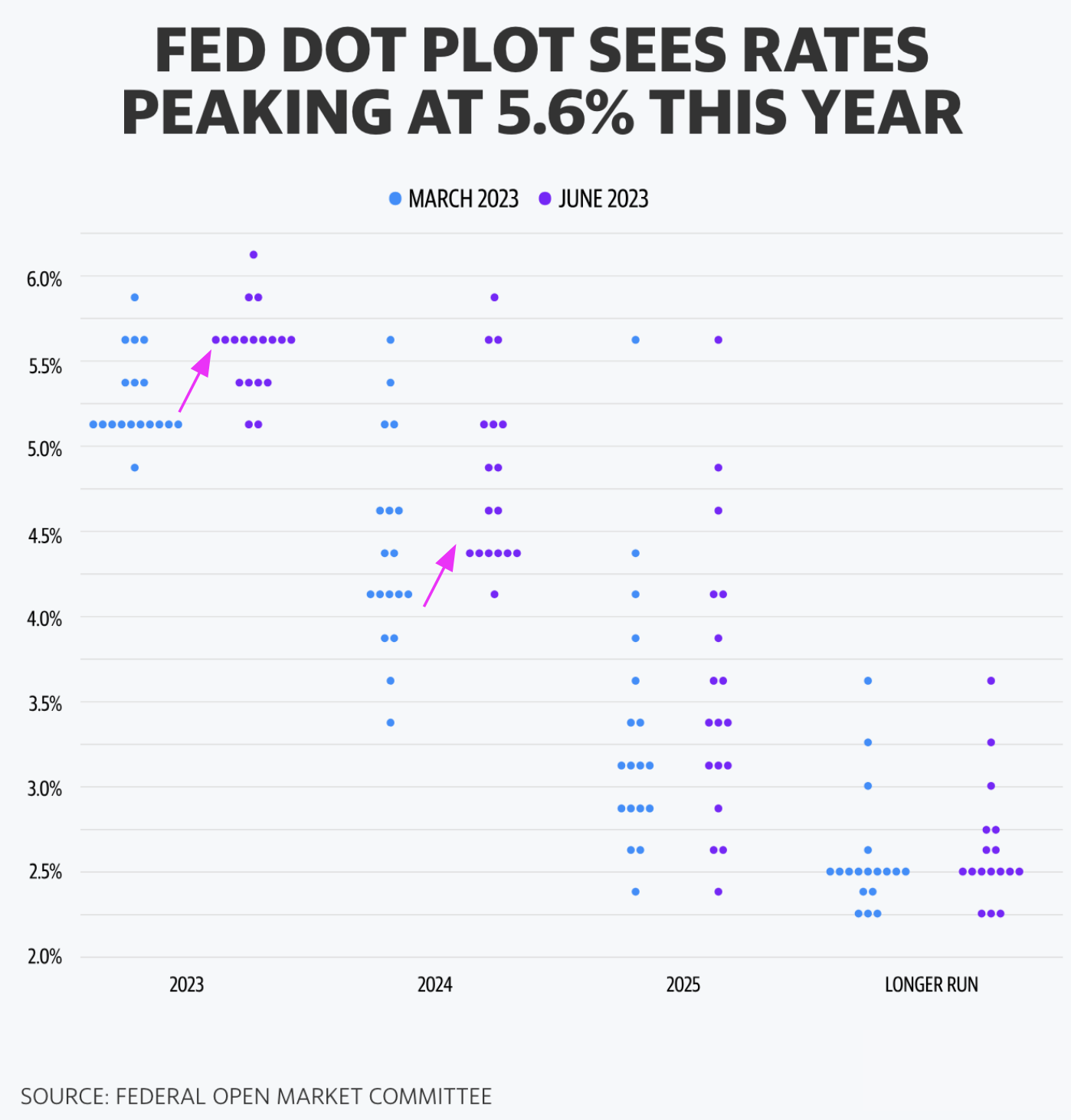

- Fed ‘dot plot’ sees 5.60% terminal rate this year

Younger readers may not get the ‘Dirty Harry’ reference.

It dates back to the 70’s…

However, that’s who Jay Powell was channelling today:

“You’ve got to ask yourself one question: ‘Do I feel lucky?’ Well, do ya, punk?”

In Callahan’s case, there might have been just one… maybe two… left in the chamber.

Were you willing to take that chance?

Sure, Powell delivered what the market expected. However, he reminded us there’s still more ‘lead in his Magnum 44’

The other day I shared how the market has already priced in a 60% probability for one more hike.

That probability remains unchanged after today.

However, beyond July, the market does not expect any.

They believe the Fed is all out of bullets.

Remember – only a few weeks ago – the market felt that rate cuts were still possible this year.

Powell at least put an end to that rubbish.

The Nuance Markets Missed

Typically when Powell provides an update – markets swing wildly in both directions.

We saw that today.

For example, equities were bullish heading into Powells prepared statement.

However, as he made his remarks they sold off.

We have seen this same pattern repeat with every FOMC address this year.

By the close, stocks recovered some lost ground as Powell took questions.

The bond market however was a different story.

There was no “start, stop, wait and go”.

The 2-year yield surged on the Powell’s hawkish sentiment – trading at 4.69%

Naturally, the rise at the “front end” saw the 10/2 yield curve feel deeper into negative territory.

That’s bad news for banks…

You know what I like to say…

A deeply (sustained) inverted yield curve isn’t a predictor of recessions… it’s the cause of recessions.

But if we zoom out to what Powell was saying – I am not sure the market fully absorbed what more than one rate hike could mean.

I say this because it’s not yet priced in.

I talked to this the other day – where the (false) expectation from some people will be they are closer to being done.

I felt that was unlikely.

For example, if we consider things such as (and not limited to):

- Stocks trading where they were over a year ago;

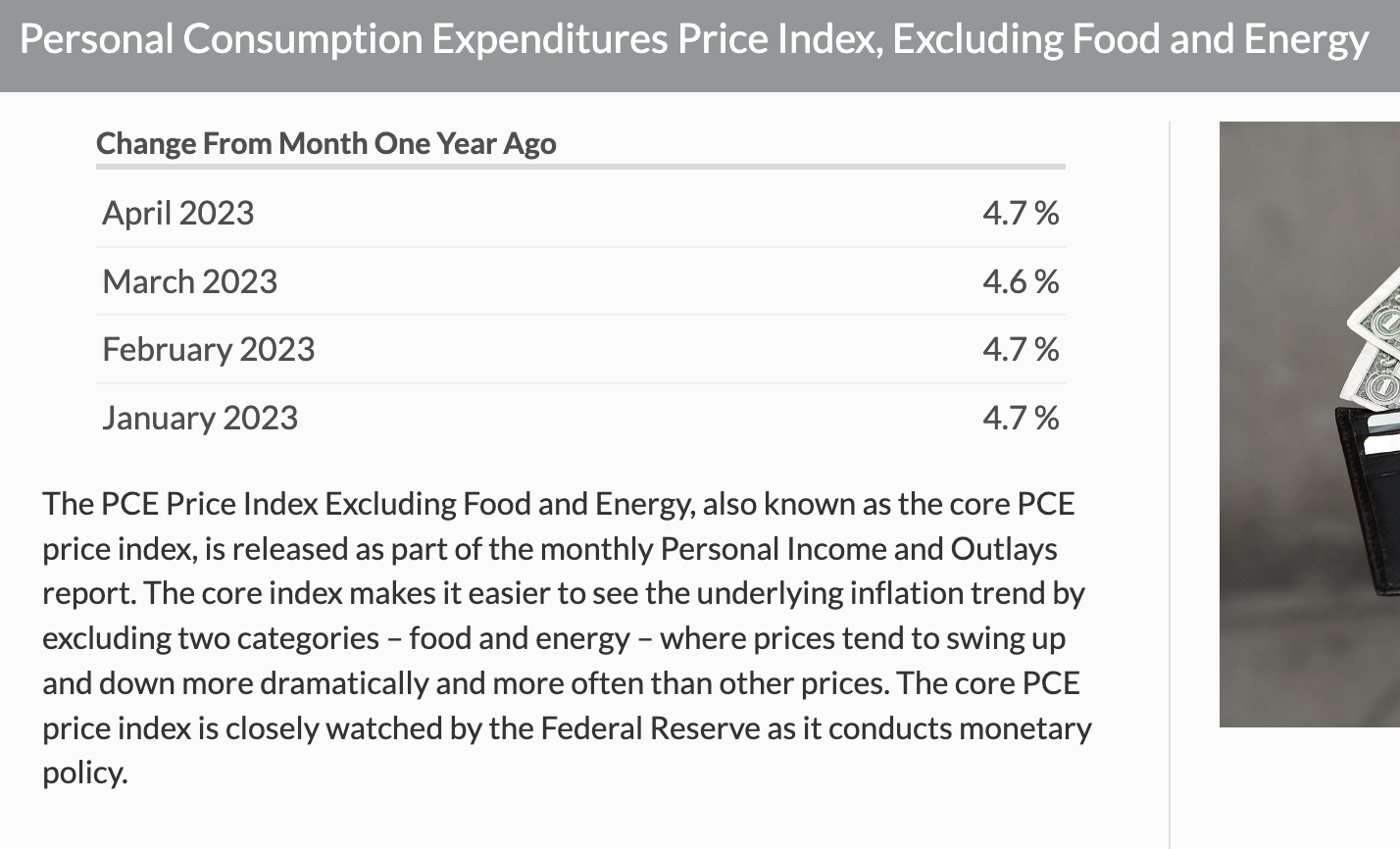

- Core CPI ~5.4% and Core PCE ~4.7% (where it was a year ago)

- Unemployment at 3.5% (or 70-year lows)

- Wage growth still above 4.0%

… on what basis would the Fed consider permanent pause?

If anything, that kind of narrative would see them lose credibility.

If I was to be honest, I could make the case they should have hiked 25 basis points this meeting.

That said, significant bank tightening has done some of the heavy lifting.

Will There Only be Two More?

During the press conference – the question was asked:

“Why pause rates now if you are so concerned about inflation”

Powell showed some humility in his response.

He admitted the Fed isn’t great on forecasting where inflation will be.

Things didn’t work out so well for the Fed with their inflation forecast 12 months ago – why would they now?

Therefore, Powell said the Fed need to maintain a level of “insurance”

Put another way, he was not so arrogant to assume we have simply defeated inflation.

And that’s the difference with the market…

The market assumes that Core PCE inflation (running at 4.7%) is a war we have essentially won.

Have we?

The Fed Chair said the Fed’s year-end target for Core PCE is 3.9%

If that’s true – then it’s still almost twice their objective.

And if it’s still that high – why not keep pushing head?

But this is the subtle nuance the market may not be quite understanding… the velocity at which core inflation will subside.

This is going to be painfully slow….

Just look at the current trend in Core PCE:

We need to see core (the stickier side of inflation) move down towards the Fed’s objective.

We are not making a lot of “fast ground”.

But the market seems to think we are (or at least will be)?

Now I hope the market has it right and Jay Powell is clueless… and Core PCE is trading around the 3.0% level by year’s end.

If that’s true – maybe the Fed could sit tight for a while and watch it drift lower.

However, based on the trend with core today (forget the headline) – there’s still a lot more work to do.

What’s more, it’s going to take time.

Fed Dot Plot Goes Up

“The (FOMC) committee is completely unified on the need to get inflation down to 2%. And we will do whatever it takes to get it to 2% over time. That is our plan. And the one thing we cannot allow to happen is inflation get entrenched in the US economy”

To that end, we saw a unified bunch of hawks with their latest predictions.

Notice that not one member lowered their forecast for rates.

9 Fed members now see the terminal rate above 5.50%

That is 50 basis points higher than where we are today.

They also increased where they think rates will be in 2024 – moving their terminal rate up to 4.60%

Again, what this suggests (to me) is they think Core inflation is likely to remain well above 3.0% for longer.

This is the disconnect with the market.

For example, as of today, there is not one futures contract which is trading with a second rate rise (beyond July) priced in.

In other words, we see a market “fighting the fed”

Putting it All Together

- Powell was successful in telling the market that rate cuts were not coming in 2023; and

- The Fed increased their outlook for economic growth

But again, if it were me, I would have taken the opportunity to raise rates 25 basis points.

With respect to the upgrade to their growth foreast – the Fed believe a “soft landing” is still possible.

I’m less convinced but happy to be wrong.

For example, a soft landing would be unemployment peaks around 4.5% (no higher) and we get immaculate disinflation.

That’s what the market is pricing in (i.e., nothing can go wrong).

But what the market may not be getting right is the distinction Powell made between the velocity and level of rate hikes.

He said it’s going to be slow… reminding participants of the lagging impact of Fed policy.

He added the Fed will keep going and do whatever it takes to achieve their objective.

The revised dot plot suggests the terminal rate (i.e. the level the Fed will end its rate rises) is now in the realm of 5.60%.

But consider this:

What if Core PCE is still trading with a 4-handle at year’s end?

And let’s say the Fed has already hiked rates to 5.50%?

What then?

Powell is not taking insurance off the table.

Sure Powell is slowing down the speed of its hikes (e.g. 25 bps every second month or so) – but that doesn’t mean they will stop if their objective isn’t met.

I say this because Powell doesn’t pretend to know how this will work out (and nor should he).

He admitted they are not great at forecasting where inflation will be.

The market however thinks it knows better.

So…

“Do ya feel lucky, Punk? Well, do ya?”

We have a market wagering Dirty Harry’s 44 Magnum is empty.