This week the S&P 500 traded as high as 4167 before closing at 4145.

It’s been a rapid move from the June 3636 lows — catching many of the shorts off guard.

Further to recent missives, this is very typical of bear markets.

In fact, I was calling for it.

But the ~14% rally now faces its first real test – technically and fundamentally.

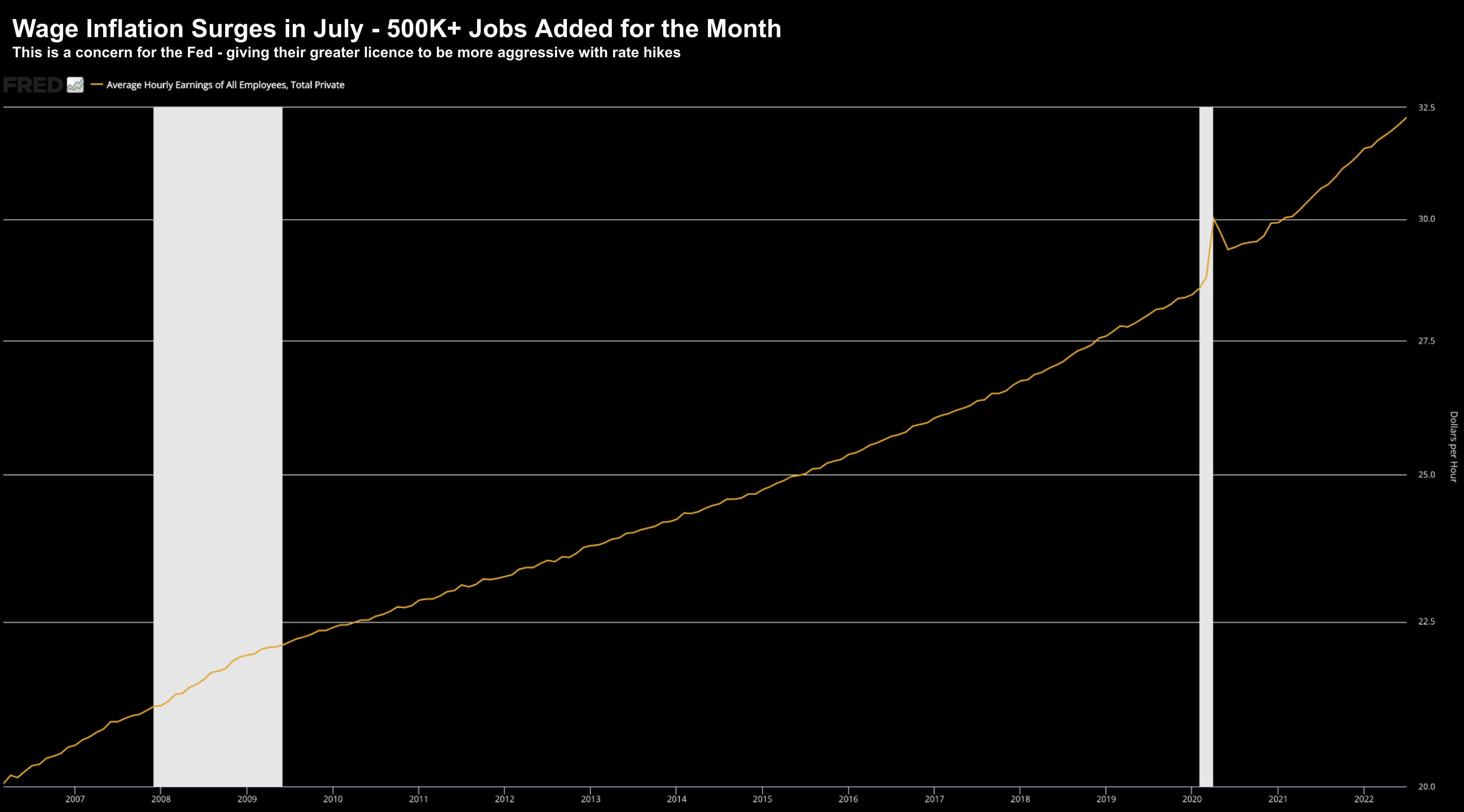

Monetary headwinds are only likely to increase in the months ahead…. and look no further than the strong wage inflation we saw over July.

Wage Inflation Rips Higher

The most important data point to hit the tape this week was wage inflation for July.

With more than half a million jobs created last month (great news for hard working Americans trying to combat higher prices) – it’s worth asking how that will that help Fed’s efforts to crush demand?

Jobs appear plentiful and wages are increasing.

That said, how much of ~520K job additions were driven by unacceptably high inflation – as they work harder / longer just to make ends meet?

I ask this question as Uber’s CEO said 70% of all drivers are now signing up as their second job:

As inflation rates hit 40-year highs, a surge of new drivers are joining Uber’s platform in the hopes of earning extra cash.

In the company’s earnings call Tuesday morning, CEO Dara Khosrowshahi estimated that more than 70% of drivers said inflation had played a part in their decisions to join the ride-hailing service.

“To some extent, we could be seeing evidence where it’s helping us in that it’s a very significant consideration base for drivers coming on to the system,” Khosrowshahi said of inflation

From mine, two data points deserve attention:

- Wage inflation; and

- Stagnant labor force participation

The first point does not augur well for (recent) ‘Fed doves’ – where some are now ambitiously see rate cuts coming as early as Q1 2023.

But what’s clear is that employers are being forced to raise pay for two reasons:

(a) lure new hires (with more job openings today than available workers); and

(b) adjusting wages higher to account for a sharp increase in costs of living.

If you put (a) and (b) together – you get a wage inflation spiral.

And this exactly what the Fed must stamp out.

For example, average hourly earnings for all employees rose 0.5% in July – marking the third straight month of acceleration:

Aug 06 2022

Above all else, this has to slow if the Fed is to achieve its 2% inflation objective.

As I like to say – the goal is less money (not more) chasing more goods.

But what we continue to see is excess money chasing the same (or fewer) goods.

Note: I am not sure how $433B in new government spending helps bring down inflation? That’s math I do not understand.

Fed Must Crush Inflation

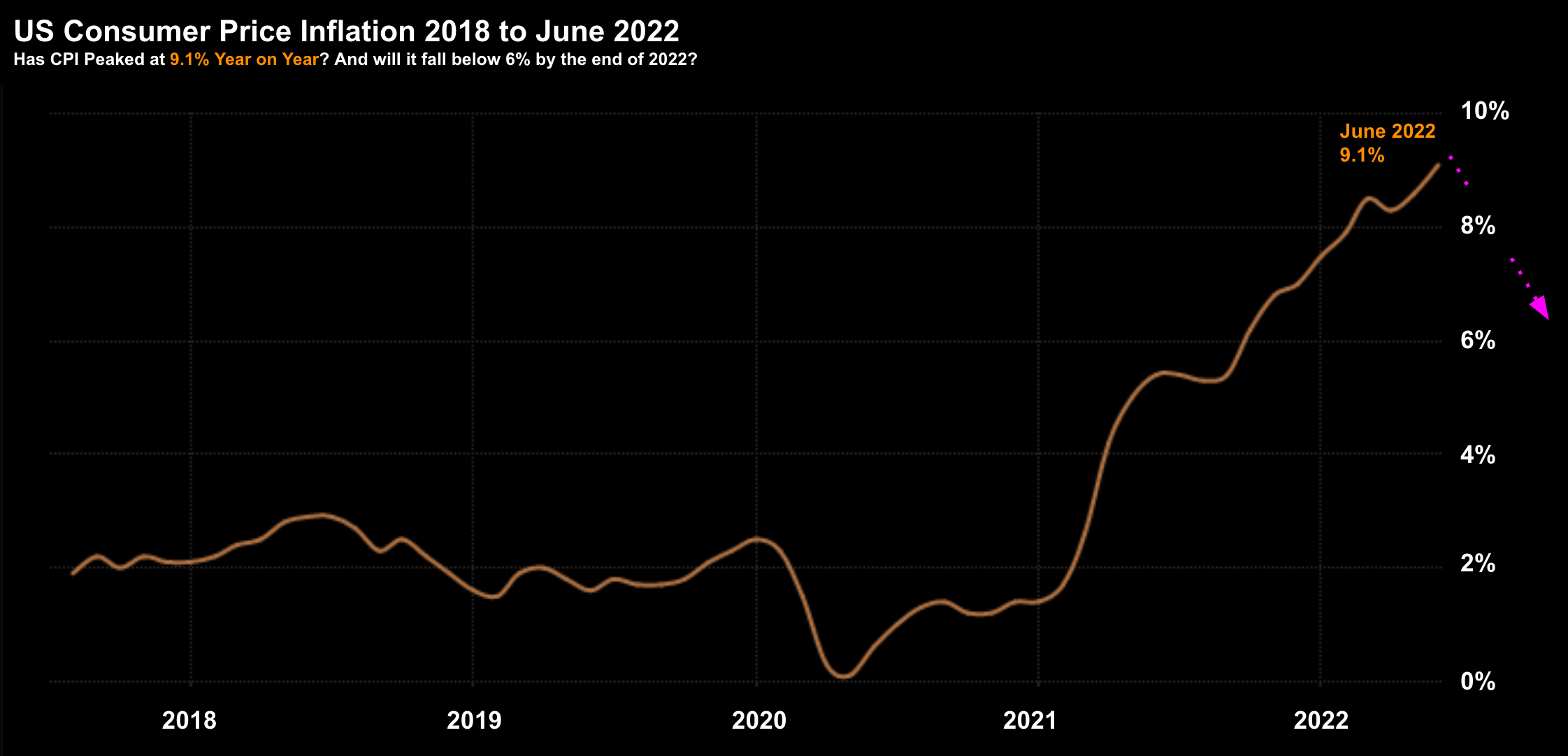

Incremental to unwanted wage inflation – next Wednesday (Aug 10) we get Consumer Price Inflation (CPI) for July.

As a preface, it’s probable we’ve seen CPI peak at 9.1%.

Commodity prices continue to fall (most importantly oil) along with slower M2 money supply growth – with expectations for July 0.3% MoM — bringing the annual rate down to 8.7%

And for what it’s worth – markets have priced in a number somewhere in the realm of 8.5% to 8.7%

But here’s my take:

Whether its 8.5% or 9.0% – it’s unbearably high.

And to fix this – the Fed needs to crush demand.

Which leads to the following question:

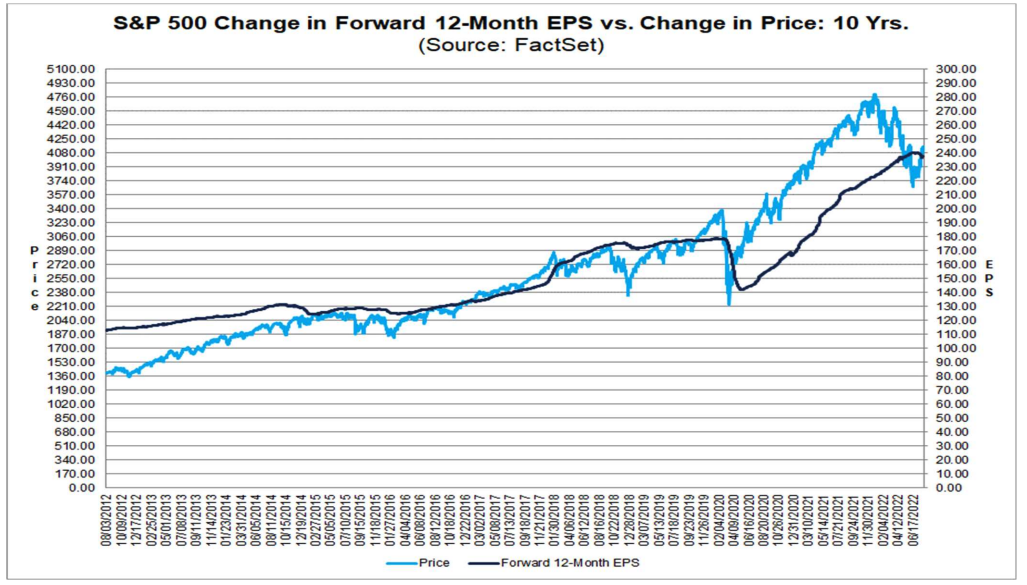

With the S&P 500 trading in the realm of 4200 (~18x forward earnings) – has it priced in the forward demand destruction to come?

Market Assumptions at 4200

With demand destruction the Fed’s primary goal – and the market trading ~4200 – I question whether the upside gains here handily outweigh the downside risks.

I think that’s one of the more importants question to ask if choosing to put more capital to work around this level.

My answer is no.

And I will address this from both an earnings and multiple lens.

For example, if we assume the best case scenario is forward earnings estimates are accurate.

According to Factset – this implies earnings in the realm of $237 per share (with a forward PE of 17.5x).

The average long-term forward for the S&P 500 is ~15x.

Assuming 17.5x – that’s a 17% premium.

Now if we also assume we can stretch the multiple to 18.5x – at $237 per share – that puts us at ~4400.

From mine, that’s your ‘best case’ outcome (which assumes earnings forecasts are accurate) — offering near-term upside in the realm of 4.8%.

But…

Is a forward multiple of 18.5x good risk/reward during a likely contraction (i.e., where demand destruction is still ahead of us)?

I don’t.

And with short-term rates going to at least 3.50% in addition to quantitative tightening (QT) ramping to $95B… how will that bode for equities?

Personally, a forward PE in realm of 16x is not reasonable – which puts us closer to 3800 (which assumes that the current earnings estimate of $237 are accurate and will not fall).

But here’s something else (not often discussed)

Corporate earnings have also been the beneficiary of higher inflation

For example, Walmarts “6% YoY sales growth” was mostly due to inflation.

This isn’t volume growth – it’s simply the higher cost of the products they sold (which is 50% grocery)

Now if we assume that inflation is likely to come down (and by all indications it will) – what will happen year-on-year revenue and earnings comps?

They will also come down.

Chart Indicates More Work To Do

The chart has not changed a great deal since my previous missive.

Things continue to trade ‘per the script’ – rallying to my nominated resistance zone of 4200.

Aug 06 2022

- A lot of the buying was systematic funds buy billions of stock based on their algorithmic models; and

- Q2 earnings have been much better than feared (especially big-tech – which constitutes almost 25% of the entire S&P 500 market cap)

And while we could easily push another 5% (at a guess) – the risks are to the downside.

I’m still not ruling out a re-test of the lows for the reasons above.

Putting it all Together

If you are putting more capital to work here (I’m not) – you should ask yourself whether the downside risks outweigh the upside gains.

And your answer should be couched opposite the Fed’s primary objective to stamp out inflation.

That implies a pathway to demand destruction.

How much has been priced in?

My view not enough… especially not after what we saw with the jobs (and wage) report for July.

Let’s see what CPI offers us next week – expect something in the realm of 8.5% to 8.7%.

And if this is accurate – lock in at least 50bps or 75bps hike in September.