- Apple soars on OpenAI enabled phones

- Further signs of divergence in the market

- Consumer sentiment falls again… forth straight month

It was another banner week for stocks.

The S&P 500 added 1.6% this week – notching another record high – up over 14% for the year.

Hat tip to Apple (who just joined the AI party), Adobe and Nvidia.

As an aside, I last reviewed Apple here (March 7th) – suggesting a price b/w $150 and $165 was a good long-term buy (it traded as low as $164.07).

Repeating some of my language:

Given the quality (and strength) of Apple’s business (e.g., its strategic moat, free cash flow, balance sheet etc) – it deserves a multiple of ~25x (some might say more – especially with the growth in AI)

This puts the stock at ~$200 (or higher) pending the assumed multiple.

In summary, if you’re picking up the stock around $165 (or lower) – the upside reward outweighs the downside risks over the long-term.

Apple closed at $212 this week – now trading at a multiple of 31x forward

The surge was due to their announcement of AI enabled iPhones.

Funny…. here’s what I offered readers in March:

Let me explain how they can leverage their unique strategic hardware / software moat…

For those who use an iPhone – they have a voice assistant called “Siri”

If you have used it – it’s rubbish.

And whilst it’s probably the worst single product that Apple has developed (and they would agree) – equally it could be their biggest opportunity.

Siri only does a couple of things well today.

For example, it can set a timer or alarm; and it can tell you the weather. But ask it anything else… and you will end up having an argument!

“No Siri. Stop. Just stop”

However, imagine when (not if) Apple starts to focus more on AI and the (useful) services it could do. For example:

- “Hey Siri, optimize my electricity bill and make sure I’m getting the best price”

- “Hey Siri, I need to travel to New York next Wednesday and I have three meetings before noon with a, b and c clients – please schedule flights and accommodation”

- “Hey Siri, take a look at what’s in my fridge (as you use the phone’s camera), let me know what I can cook with this tonight. And please order what food I need for the week”

These are random use-cases but intended to be indicative of what Siri could do.

How many of Apple’s 1.2B daily users might adopt this service (and be willing to pay for it)?

For example, let’s say you saved a person say 1-hour per week on some menial task – there’s “$100” per week saved. What’s more – it gives you back your most precious commodity – time.

This week the market ‘connected the dots’ on the unique advantage Apple enjoys to bring AI to the masses (with very little friction)

Apple should be a core holding in your long-term portfolio.

However, don’t over pay.

If you missed this rally – I would wait for another pullback.

As I always say… it’s not simply what we own – it’s equally how much we pay.

Main Street vs Wall Street

All things Apple and AI aside…

I find it curious that the market continues to focus singularly on “AI” and not much else.

And whilst Wall Street celebrates that an “iPhone might be able to better answer our questions” – it’s a different story on the other side of the fence.

Here I’m talking about ‘Main Street’.

Question:

Do you think the majority of consumers understand the optimism on Wall Street?

And similarly, do you think Wall Street understands why consumers are complaining?

I wonder…

Regardless, the dichotomy of sentiment is striking.

Think about the following from the lens of the average consumer:

- Food prices up ~30% since the pandemic (worse if you’re eating out);

- Housing up more than 30% (but great if you own a home outright);

- Credit card interest rates ~25% (not good if you rely on credit);

- Heathcare costs are up 30%;

- Transportation costs are higher by ~20%; and finally

- Cost to insure your home or car up ~30%

For now, very little of this is having a major bearing on the S&P 500.

But will that be the case in “a year” from now?

Three Divergent Charts…

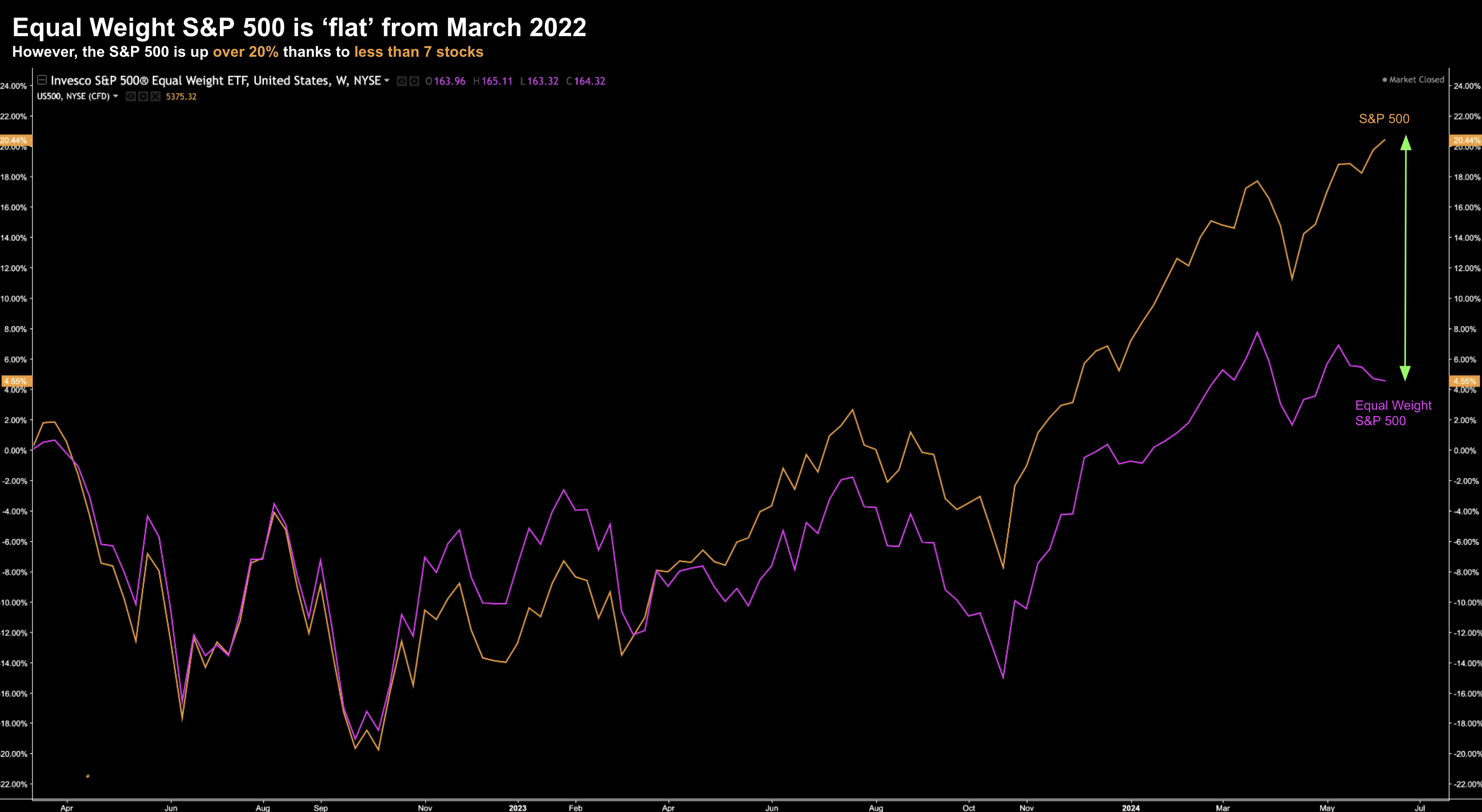

In orange is the S&P 500 vs the Equal Weight Index (purple) from March 2022.

For those less familiar with the equal weight index – it assumes every stock is given the same weight (0.2%)

However, if that were the case (and the Top 7 stocks didn’t comprise ~30% of the total weight) – the S&P 500 would have made very little gains the past two years.

Put another way, the market is as narrow as we’ve seen since the dot.com bust of 2000.

My thesis was when (not if) the Fed starts to reduce rates – and assuming rate cuts are not into a deteriorating employment market – this could help broaden out the market.

In other words, I expect the equal weight index to outperform their large (tech based) peers.

However, there are other divergences (or opportunities?) that deserve mention…

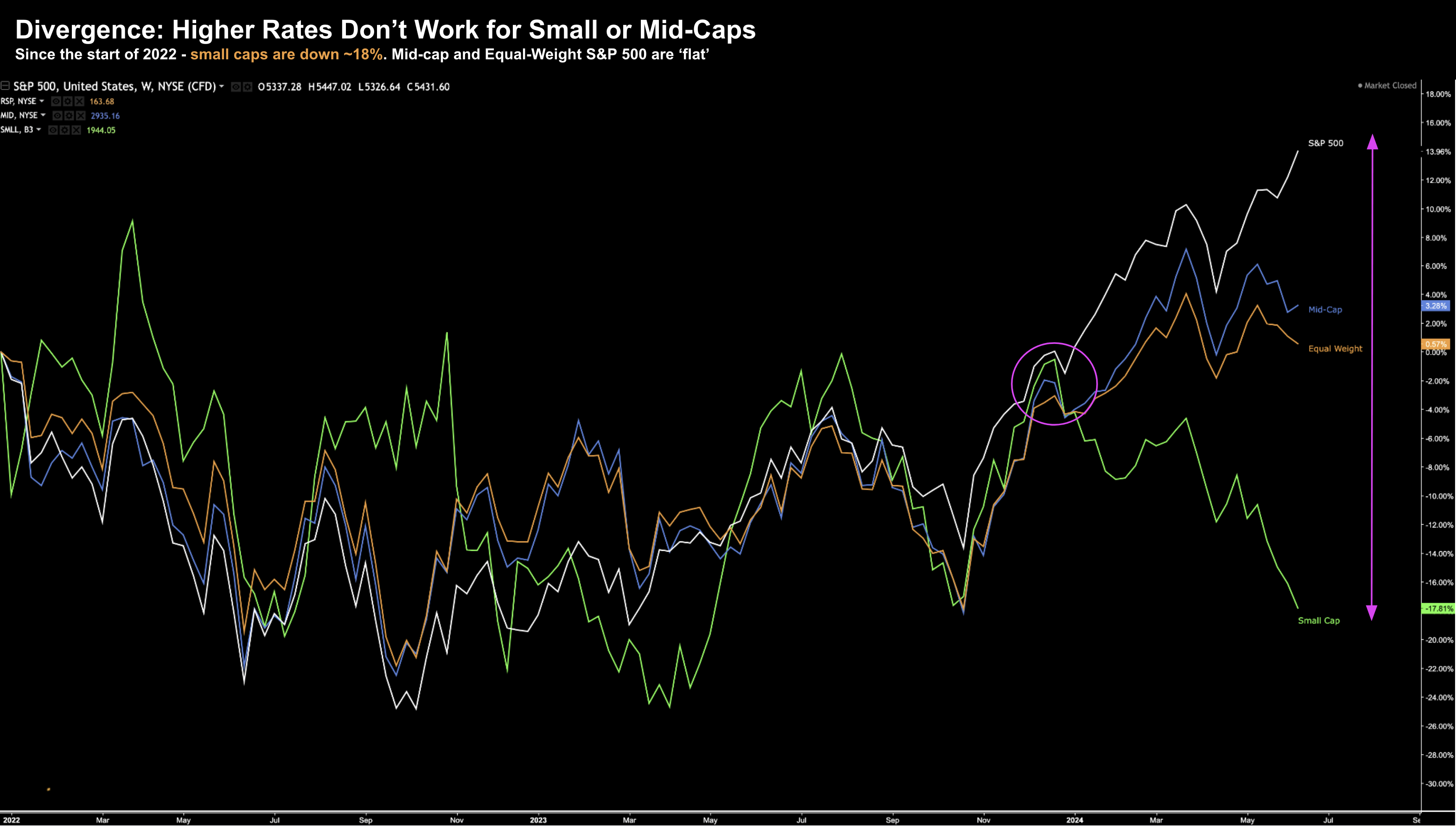

Consider mid-cap and small-cap stocks.

With rates “higher for longer”…. they have felt the full force of the Fed’s heavy hand.

Why?

In short, small- and mid-cap stocks have neither the predictable cash flows or balance sheet strength to cope with higher interest rates.

Many of these business depend heavily on leverage to meet their obligations (e.g., payroll, rent, insurance etc)

Large-cap tech on the other hand are mostly self-funding.

Rate hikes make little difference when you have “tens” (or hundreds) of billions in the bank.

But let’s take a look at the divergence we find in these two segments of the market:

June 14 2024

Since the start of 2022 – the small cap sector (green) is down almost ~20%.

Mid-cap (blue) are performing roughly in-line with the equal weight index (i.e., flat)

One more chart…

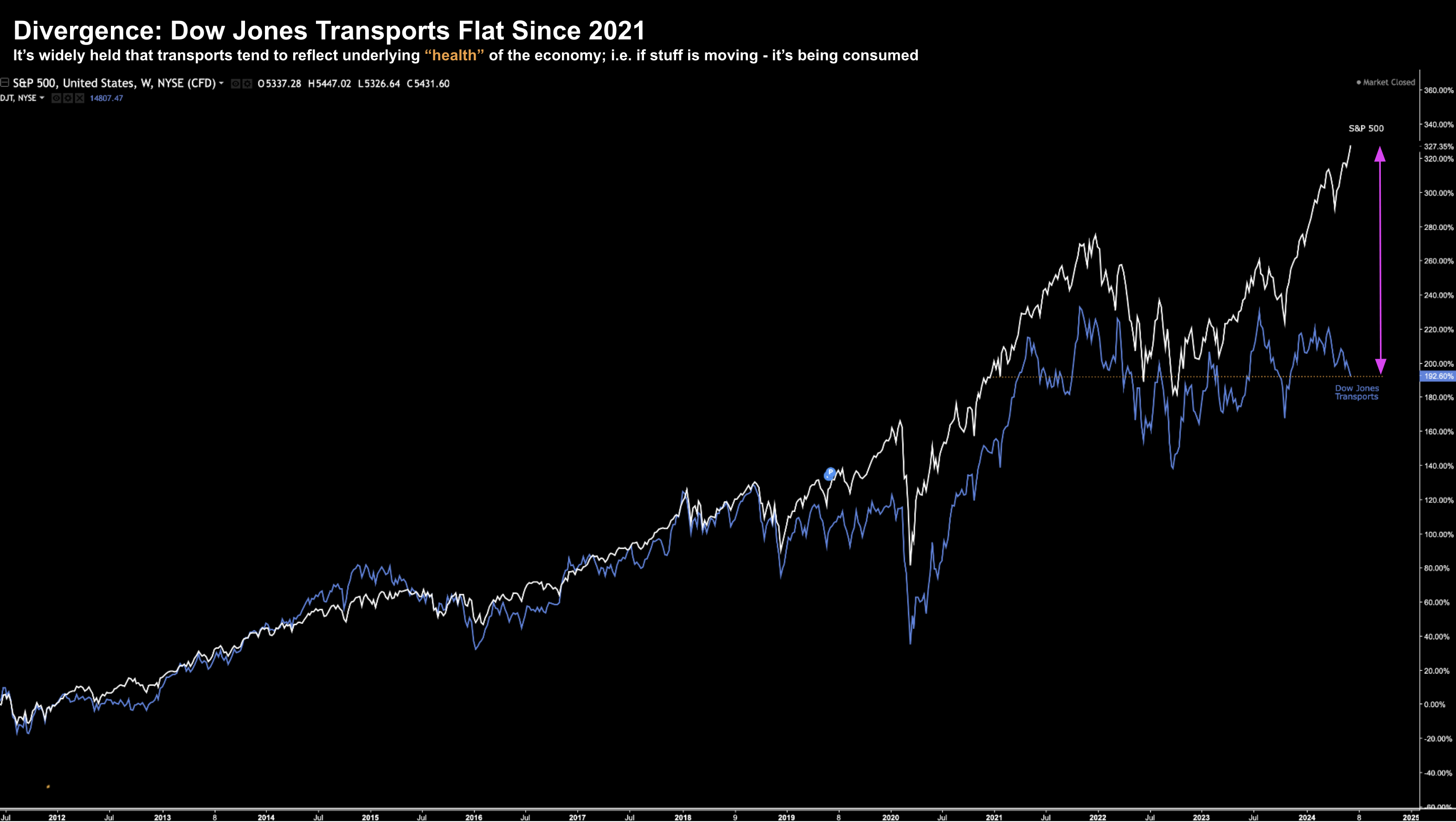

Below is the S&P 500 vs the Dow Jones Transportation Index.

June 14 2024

Typically these two indices trade largely in lock-step… not today.

From late 2023 – the divergence between these two has continued to widen.

The transports index is now trading back at the same levels we saw in early 2021.

Cause for concern?

From mine, there is enough weight in these charts for investors to at least ask questions around the longevity of the current rally (or at least challenge its lack of breadth).

For now, it’s ‘AI’ (and perhaps GLP-1) stocks and very little else.

Consumers Feel the Pinch…

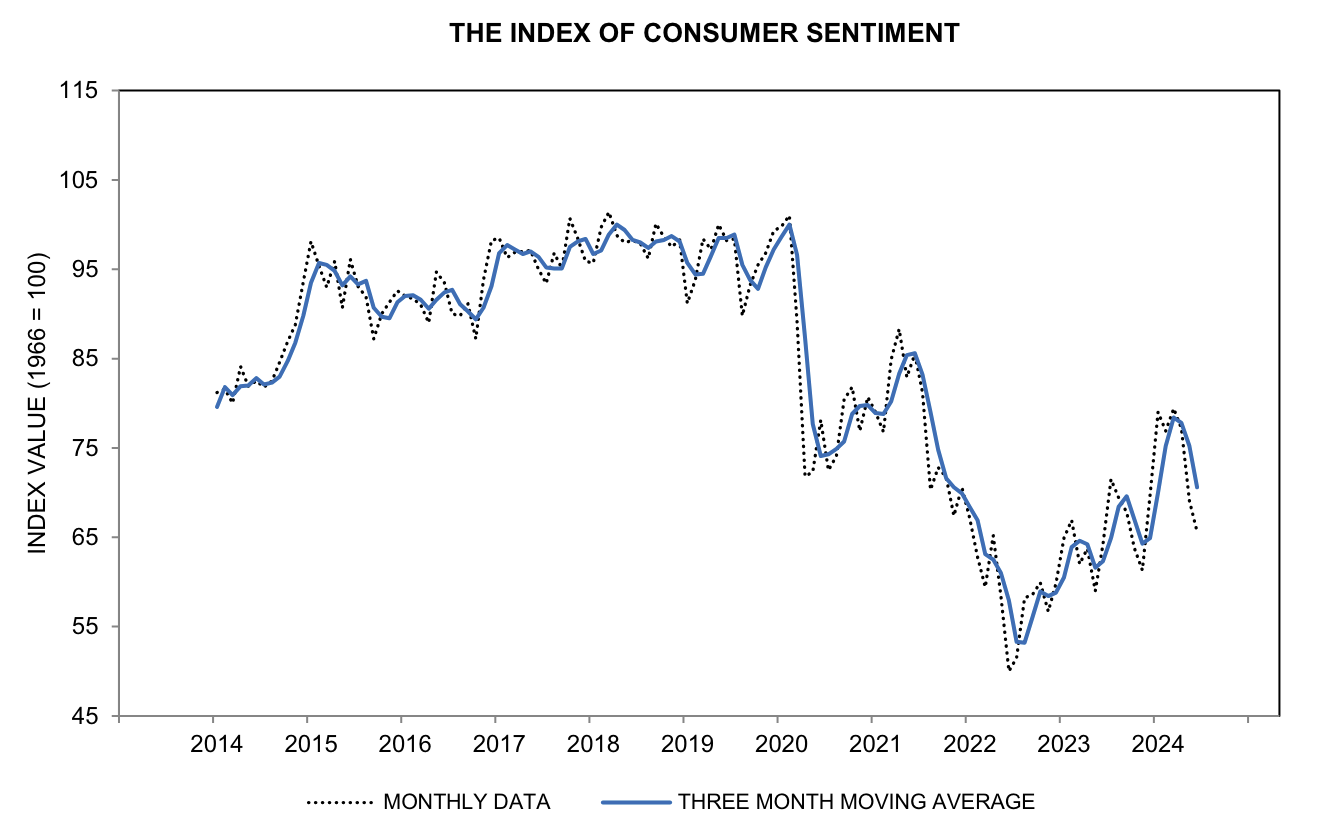

Further to my preface on the rising costs of food, insurance, healthcare etc (it’s a long list) – this week we received the June Consumer Sentiment Survey.

The news wasn’t good…

Sentiment declined for the fourth consecutive month to 65.6, below the median estimate of 72 and last month’s 69.1.

We are long way below the consistent highs we saw between 2016 and 2020.

And despite the trillions in stimulus and various government handouts – consumer sentiment has not recovered.

People continue to feel lousy about this economy and their prospects.

Driving the drop was the Current Economic Conditions sub-index, which fell from 69.6 to 62.5 month over month.

The report offered few surprises…

Elevated prices and weakening income opportunities caused respondents to report depressed feelings regarding their personal finances.

In addition, I also read this week that the National Retail Federation (NRF) forecasted that spending on Father’s Day gifts (this week in the US) and entertainment is likely to decline from last year’s record high, following a trend of weaker spending on Mother’s Day.

But this is all ‘good news’ from Wall Street’s lens…

Here’s the (stock) equation:

Weaker consumer => lower spending => falling inflation => increased chance of rate cuts => higher stock prices.

Got it.

Putting it All Together

Divergent signals are not something to ignore.

Whilst the S&P 500 continues to make all-time highs – we also find:

- Mid and Small Caps stocks not participating;

- Consumer confidence falling for the forth straight month; and

- The Dow Jones Transport Index trading at the early 2021 levels.

Looking ahead – we will get more confirmation on the health of the consumer next week.

For example, on Tuesday we will get May retail sales. The market expects to see spending accelerate.

That might be the case – but where is it coming from?

More credit?

At the end of the week we get unemployment claims, housing starts and flash PMIs

These are all insights into consumer strength, corporate appetite for labor, price pressures, construction activity and manufacturing momentum.

For now, bad news remains good news.

But at some point, Wall Street will need to see Main Street participating.

Today they are worlds apart.