- Market disappointed by the dot-plot

- Bond yields rally on rate cut – why?

- Powell tried to explain the ‘pivot’ – but he may have failed

“We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with this inflation. That’s what we’re trying to do, and I think you could take today’s action as a sign of our strong commitment to achieve that goal”

― Jay Powell (Fed Chair) – Sept 18 2024

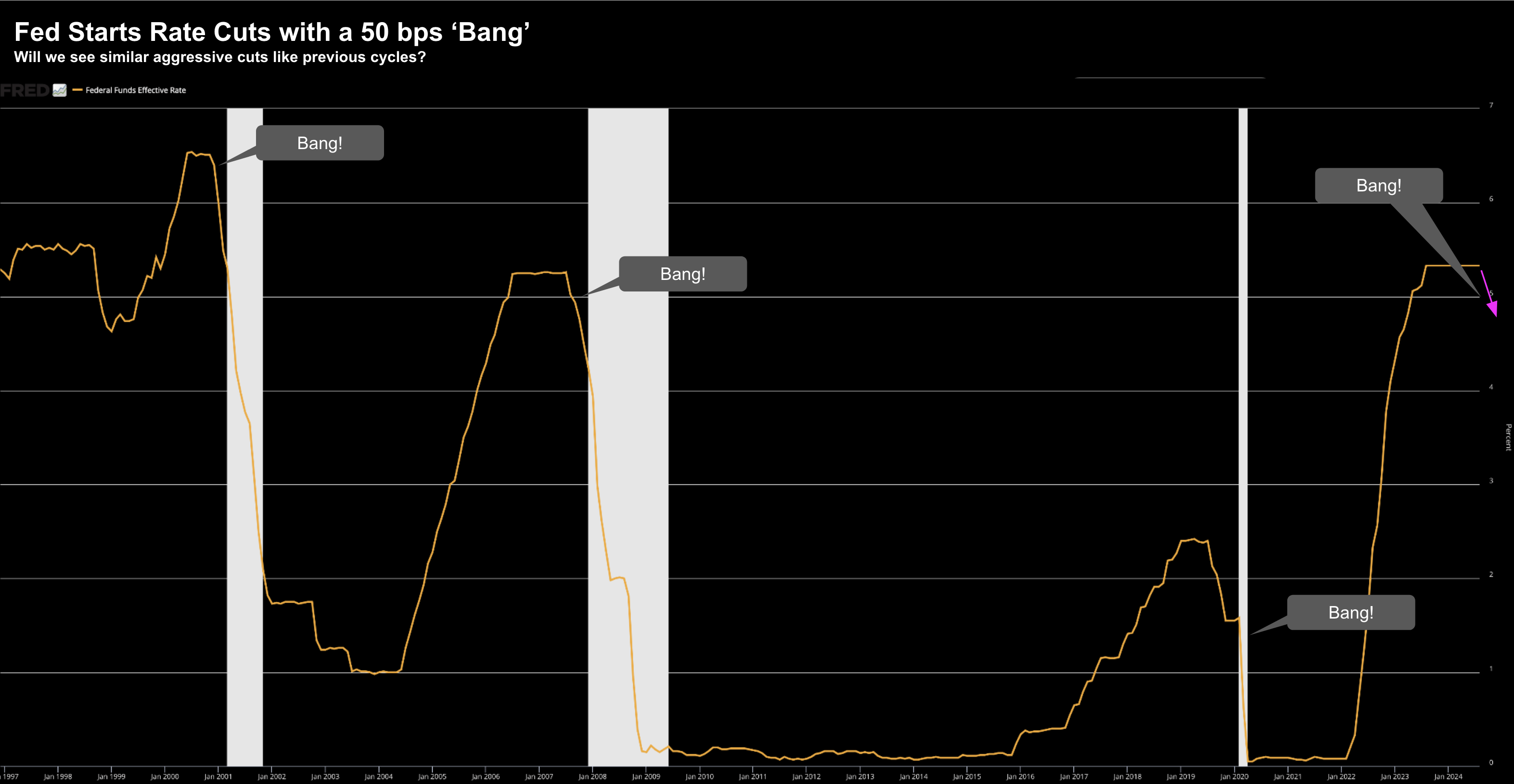

It was the kind of bang we saw in 2001, 2007 and 2020:

Now earlier this week, market’s were pricing in the possibility of a 50 basis point (bps) cut as high as 70%.

They were right.

But despite this, the market closed lower.

Why?

In short, I think Powell’s outsized cut was at odds with the Fed dot plot (i.e., summary of economic projections).

And whilst the market certainly cheered 50 (initially at least) – there remains an open question over how aggressively the Fed will continue to ease.

For example, the market wants around 200bps of cuts over the next 12 months – however the Fed’s projections are closer to 150bps.

Let’s explore…

Dot Plot Suggests No Hurry

Given the 50 bps cut – Powell was (rightly) questioned on what possible concerns or risks he sees with the economy.

Here’s what he said:

“I do not see anything in the economy right now that suggests that the likelihood of a recession is elevated. [Economic] growth at a solid rate; inflation is coming down; and a labor market that’s still at very solid levels”

Phew – nothing to worry about.

Now typically this would not justify an outsized cut of 50 bps

However, these are far from normal times.

For example, in Powell’s favour, with the inflation rate ~2.50% (and falling) and prior to today – the effective Fed funds rate at 5.25% – the Fed arguably has at least 200 bps of room to get to a so-called neutral rate (or 1.00% above inflation)

And whilst Powell will never tell you what the neutral rate should be – he feels they’re overdue to start the process to get closer to that rate.

In other words, they have ample scope to begin the process of normalizing rates (without being forced to cut due to very weak economy)

And this comes back to what disappointed the market…

Will they get ~200 bps of cuts?

The answer is maybe not… not yet.

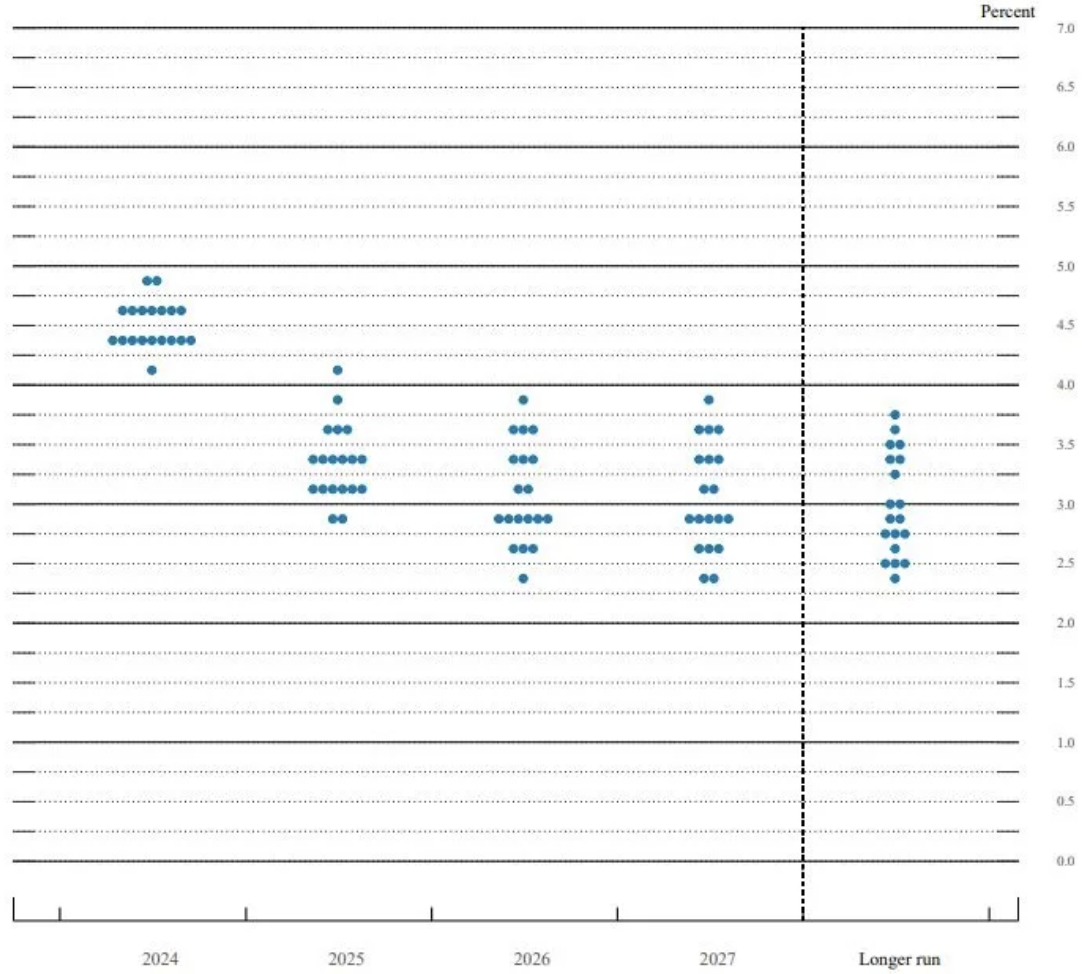

According to the dot-plot – 19 FOMC members see the fed funds rate at 4.4% by the end of this year, equivalent to a target range of 4.25% to 4.5%.

Through 2025, the central bank forecasts interest rates landing at 3.4%, indicating another 100 bps point in cuts.

That’s clearly less than hoped – and perhaps why bond prices fell (i.e, yields shot sharply higher).

Consider the intra-day 5-minute chart for the US 10-year yield

It was the reaction in bonds (not equities) which I was most focused on post Powell’s Q&A.

And from mine, the reaction in both the US dollar and bonds is not what Powell expected.

For example, the Fed’s intent with a 50 bps cut was for market based rates to fall (not rise)

Now should the long-end continue to rise – he will have achieved the opposite.

Note: it’s the 10-year which determines your mortgage, car loan and so on.

Back to the dot-plot and Fed member expectations…

Through 2026 – rates are expected to fall to 2.9% with another 50 bps reduction.

Based on these projections – Powell said the committee sees no rush to get this done – and these things “evolve” over time.

For example, Powell reminded investors they should not assume it will continue at a 50 bps pace going forward.

We’ve waited. And I think that patience has really paid dividends in the form of our confidence that inflation is moving sustainably under 2%, so I think that is what enables us to take this strong move today.

I do not think that anyone should look at this and say, ‘Oh, this is the new pace. I think we’re going to go carefully meeting by meeting, and make our decisions as we go.

And for me, this helps partly explain why yields rallied.

I say ‘partly’ as perhaps the bond market also sees (overly) aggressive cuts could potentially reignite inflation risks.

“Recalibrate” or “Pivot“

If there was a word of the day in Powell’s address – it was “recalibration”

Powell used the word approx 9 times (that I counted) to explain their decision to start with 50 bps.

What’s ‘recalibrate’ mean in plain english?

My take: pivot.

Now I found it curious given in July – Powell told the market the committee is not even thinking about a 50 bps cut.

Since then we’ve had two employment and inflation prints.

Inflation was trending lower however one of the two employment prints was much lower than expected (only 114K monthly jobs added – and subsequently revised lower).

It’s my assumption that something reared its head in those two reports (and it wasn’t inflation). Here’s the language Powell chose:

“This recalibration of our policy stance will help maintain the strength of the economy and the labor market, and will continue to enable further progress on inflation as we begin the process of moving toward a more neutral stance. We are not on any preset course. We will continue to make our decisions meeting by meeting”

“Maintain strength in the economy and labor market“… that’s the part of the dual mandate Powell has effectively ‘pivoted’ to.

They are far less concerned about the trends with inflation (for now) – however see potential risks with labor.

From mine (and echoing previous posts) – keep your eye on two things:

- The YoY quarterly % change in Real PCE (i.e., are consumers continuing to spend?); and

- The (lagging) unemployment rate

Spending is a leading indicator.

It drives profitability (earnings), increased production, greater capex and ultimately more jobs.

If this continues to slow (which is my expectation) – we will find unemployment accelerate.

And whilst the Fed project unemployment will peak at 4.4% (which was a revision higher from a previous forecast) – this could be optimistic.

But here’s the question to ask:

What is the unemployment rate where the Fed (and market) hits the panic button? Is it 4.8%? 5.0% Higher?

I doubt Powell would tell us what that is – however I think there’s a number where the narrative will quickyl shift from “we have a strong labor market” to “which needs urgent assistance”.

Putting it All Together

Generally Powell does a good job of these things…

But today I felt he missed the mark.

I felt his messaging was confusing and potentially contradictory.

Whilst I didn’t care whether it was “50 or 25” bps (I think that makes little difference) – the more important part was the messaging.

For example, if they were electing to go big with 50, then they needed to message it carefully.

That’s the part I think he missed.

Now should consumer spending continue to accelerate; and employment doesn’t deteriorate – stocks will respond well to rate cuts.

That could happen.

As I’ve shared in previous posts – if the Fed is cutting whilst employment is stable or improving – stocks do very well.

However, if the Fed are cutting rates where unemployment is rising, stocks don’t perform.

Put another way – if we’re headed into a recession – all bets are off.

And for that, I will be guided by what we see with Real PCE