- Bill Ackman and Bill Gross call for lower bond yields

- Have we seen the high-water mark for the 10-year?

- So how does one start to safely ‘venture’ into bonds? Start with the 2-year

Over the weekend – I made the case for investing in fixed income.

In short, I think there is a compelling longer-term opportunity for investors.

Turns out, it may not be just me thinking this way.

For example, last week I referenced Howard Marks’ latest memo which talks to fixed income yields.

He explained how some are offering equity-like returns for investors (e.g., above 8% for non-investment grade debt).

What’s more, Warren Buffett said he was increasing his exposure to bonds (at the short and long-end) a couple of months ago.

Today another billionaire investor may have ‘rang the bell’ on the 10-year yield at just over ~5.0%

That someone was Bill Ackman.

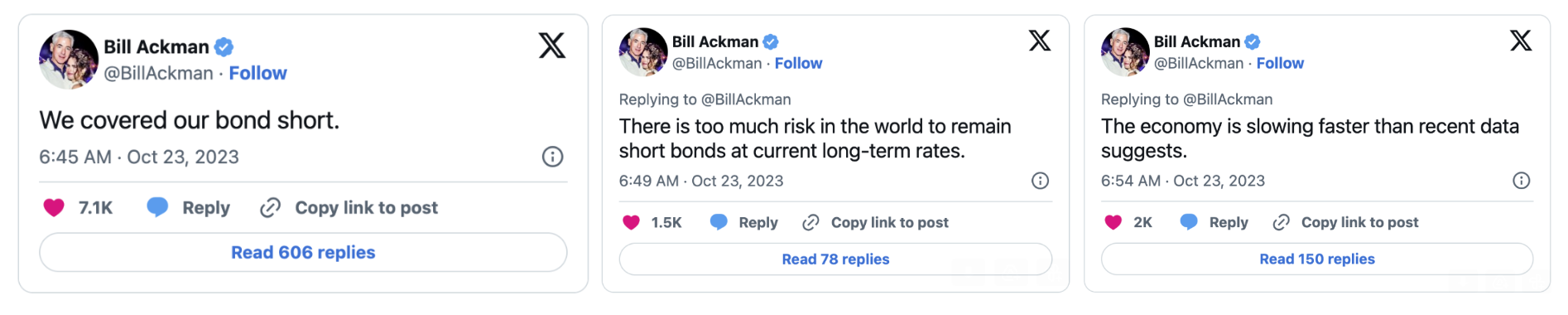

He sent this series of tweets today:

“There is too much risk in the world to remain short bonds at current long-term rates” and “the economy is slowing faster than recent data suggests”

Sounds like a few quotes from TradetheTape?

To be clear, Ackman is not out there saying he is long bonds.

No – he is covering his (very well-timed) short position – which means the risk/reward is no longer as compelling.

And whilst yields probably still have room to move higher – perhaps the upside (from here) isn’t worth the risk.

Call it a trade.

Let’s take a look…

Ackman Covers His Short on Bonds

Early August, Bill Ackman could have been described as a “bond vigilante“.

The CEO and founder of the ~$18 billion hedge fund Pershing Square declared that the $24 trillion U.S. Treasury market was out of control.

At the time, the US 10-year yield traded around 4.0% … Ackman said it’s likely going to 5.0%

His logic was simple enough:

The US government was borrowing far more than it could afford (i.e. issuing lots of debt) – however there were insufficient buyers.

The market – Ackman felt – needed to see a far higher term premium to accept the “IOUs” from Treasury.

He was right.

His timing was excellent.

10-year and 30-year yields soared as the bond market capitulated.

Ackman may have made hundreds of millions – perhaps billions.

But today – Ackman decided it was right to cover his short and lock in those 3-month profits.

This news ricocheted around the world – leading to a massive drop in bond yields (or a rise in bond prices)

Not only did Ackman caution on “slower growth ahead” he also said that “inflation was starting to ebb”

Both of these things auger for lower bond yields.

I could not help but think of the post I issued over the weekend – saying something very similar to Ackman.

Repeating a portion of my post (citing three reasons for taking a long position in bonds)

1. Longer duration bonds are getting to a point where the value is just too compelling. We are already seeing this with the 2-year – where the rise in yields has slowed – meaning buyers are willing to wade in. Over time, we will see this extend along the curve. In addition, when we consider 5-year, 5-year forward inflation expectations are 2.5% – this tells me the 10-year at 5.00% is exceptional value. Typically the difference between the 10-year and inflation expectations is closer to 1.0% to 1.5% (as I explained Friday)

2. If Real GDP growth is to trend back to levels of 2.0% (or less) next year (which I expect) – and you’re getting the 10-year at 5.00% – that’s also a great deal. Over time, the 10-year yield will track real GDP.

3. If you’re of the view inflation is trending lower (meaning the Fed will move back to easing within 12 months) – this is also good news for bond investors.

It sounds like Ackman is singing from a similar hymn sheet.

Hey… I will take it!

Almost immediately after Ackman posted – the 10-year yield dropped 0.11 percent

But it turns out – it was not just Ackman tweeting…

Another “Bill” joined the fray calling for lower yields / higher bond prices. This time it was former Bond King – Bill Gross:

“Various combinations 2/10 and 2/5 should go positive by years end“

Well well well…

A High Water Mark for 10-Year Bonds?

I think it’s too early to say either Ackman or Gross’ calls signal a top in bond yields.

It might… but it’s still too early.

As I was saying over the weekend – I think we could still see it move as high as 5.25% – however we are getting closer (for the three reasons I outlined above)

I also don’t think Ackman or Gross are trying to predict the top – but they know it’s getting closer.

And that’s my sentiment… it’s time to start dipping your toe in.

My sense is there’s capitulation in the bond market (or very close to). People who have been long bonds for the better part of this year (and last year) have been crushed.

Either due to prudent risk management or simply not being able to wear the pain – they have sold – sending the 10-year north of 5.0%

There’s also evidence to support that reasoning…

It’s been something like forty years since we have seen the 10-year term premium move this much so fast.

Something was broken (more on this shortly when I talk to liquidity issues).

The good news is we’re now seeing safety in the front end (e.g., what we see with the 2-year yield).

What do I mean by “safety”…

The 2-year has been fairly steady of late despite the action in the “10s” – in turn causing the un-inversion of the 10-2 yield curve (which Gross said will likely turn positive)

For example, up until the last couple of months, there has been an argument that even the 2’s were not safe. I say that because there was uncertainty around where the terminal rate was for the Fed.

In other words, how many hikes were there to come?

That’s now changed.

The 2’s are now seen as a much safer place to be and it’s attracting buyers… which is keeping yields steady.

Now to be clear, we don’t see this in the 10’s just yet – but it will come.

And if the Fed is more or less done (and I think they’re close) – then it’s safer to start buying 2’s.

This is how the bond market finds its footing. It will start at the shorter-end and over time – work its way along the curve.

And actions from the likes of Bill Ackman and Bill Gross today are an example of what I was talking about.

Now I doubt they read my missives over the weekend – but the timing of their respective tweets was uncanny. I will take it.

So Who Else is Buying?

As a preface, that’s always very hard to ascertain.

But if I were to guess – it’s retail investors.

For example, 70% of the Treasuries are held here in the US.

Now we can see the supply coming from Treasury – as it’s published.

But you can’t see who is buying (apart from tweets like we got from Ackman and Gross) – until well after the event.

That said, we also know who is not buying.

For example, we know it’s not the Chinese, Japanese or the Fed.

They are all sellers.

And I also think we can rule out the banks – as they are already overweight longer-term bonds.

Therefore, I think it goes into retail.

Put another way, I think it’s folks like you and me moving from equities into bonds; and/or moving out of cash into bonds.

Remember:

Whilst you may be earning close to 5.0% on your cash today in a money market account – it’s highly unlikely you will be earning that same yield in 6-9+ months from now.

I think it will be a lot lower.

Therefore, you can secure this yield by moving from cash to bonds (as I’ve been doing).

Buyers Strike Will End

Now at some point, the current “buyers strike” on the 10-year and 30-year will run its course.

As Ackman succinctly said back in August – we had a problem of far too much supply (government issuing (ridiculous) amounts of debt) – with very few buyers.

That’s why his conviction on higher yields was very strong.

And look, we could see evidence of this in the government auctions (something I track). For example, if we look at the cover ratios of Treasury auctions (specifically the long-end) – it has been very poor.

However, things are starting to improve as the value (or compensation with yields) improves.

But at some stage, you start to get to the point where the value is just too good.

Again, this is why Ackman chose to cover today.

Let me repeat what I said over the weekend:

- When the real yield (which today is around 2.5%) is comfortably above the long-term GDP trend rate (which I think is just below 2.0%) – you are sufficiently covered.

- Put another way, the inflation risk is locked when the real yield exceeds the long-term trend real GDP.

Now – that doesn’t mean it’s a “risk free” bet. Not at all – these yields could still rise.

However, I believe that you will look back in 6-9 months time and say “getting the 10-year at 5.0% was a pretty good deal”

Liquidity and Solvency Issues?

Some readers wrote to me over the weekend and challenged my thesis…

For example, they put forward the argument of both liquidity and potentially solvency issues… given the unsustainable debt path the government is pursuing.

And that’s a very fair question (particular liquidity).

Let me address both of these…

To start, you can rule out any solvency concerns. The US will pay its debts. Period.

It has never defaulted and won’t default.

If that happens – we have far bigger problems.

And whilst I get why credit agencies have put the US on “credit watch” – I think there is zero chance the US do not pay their debts.

That settles solvency (from my lens)

What about liquidity?

This is the price of getting things done.

For example, if you have an illiquid market (irrespective of the security) – it’s harder to push a very large trade through the system.

In short, you have a wider bid/offer spread.

This is precisely why the US government is having to pay more for their debt – there aren’t buyers “lining up” to buy the debt.

There is a somewhat of a liquidity issue today in the Treasury market.

In short, the banks are not willing to hold a large inventory of treasuries. Therefore, the intermediaries are not there.

Naturally, liquidity and risk premium will move in tangent. For example, if you have an illiquid market, then the bid/offer spread widens, exaggerating the price of what gets filled.

This is partially why yields were spiking. There was insufficient liquidity.

We are seeing record moves in the term premium for the long-end (which I think creates very good opportunity)

What’s the ‘Safest’ Way to Trade This?

Assuming you don’t have any exposure to bonds – now is a good time to start.

For example, let’s say you are still very wary of the 10-year yield moving higher (and it absolutely could).

Again, we could see it move as high as 5.25% given the torrent of debt coming down the pike.

I doubt whether Ackman’s or Gross’ comments today change anything fundamentally – as the supply / demand dynamic is still under stress.

And if the 10-year is not for you – then you should have confidence moving into the 2-year.

With 2-year yields at 5.05% and the Fed almost done – you are unlikely not lose a lot of money (and that’s if you lose any money any at all)

I think this is a very low risk way to play the bond market.

From there, you can then slowly look further out the curve. Remember – as you move out – your duration risk increases.

With respect to myself – I’m looking at the next 6-9 months – not the next 2-3 months.

Therefore, I’m more comfortable adding exposure to 10’s and even 30’s

And you can gain exposure via any number of low cost ETFs (e.g., EDV from Vanguard; or TLT among others for longer end exposure ).

These are also equivalent shorter-duration bond ETFs.

Putting it All Together

The sell-off in bonds the past three years has been truly historic.

It’s comparable to the equity crashes of 2001 and 2008.

However, it may not yet be over.

It’s impossible to pick a bottom (or top)

A lot will depend on what we see from Washington DC – and their insatiable desire to keep borrowing and spending beyond their means.

Will common sense prevail?

More and more that feels like too much to ask (from either side)

More debt seems to be a panacea for government.

If they can’t – then the bond vigilantes are likely to drive yields higher.

But as I said earlier – at some point – the value becomes too compelling.

Question is – what’s the level?

None of us know.

For example, if Ackman knew the answer – he may not have covered his short – meaning there was still “more juice to squeeze” on his short bond position.

I think we’re closer – especially in the near-term.

Over the next decade or so is another story… yields could continue to go a lot higher… especially if the US are unable to get their fiscal house in order.