Words: 1,202 Time: 5 Minutes

- Counterintuitive reaction in oil market post Israel’s strike

- Economic concerns will overshadow geopolitics

- Occidental (OXY) long-term opportunity in a strong cash generation company

Middle East tensions are rising.

However, oil prices are dropping.

Why?

The Israeli missile attacks on Iran, while not entirely unforeseen, triggered a negative response in the oil market.

Now this may seem curious…

Contrary to expectations of a price surge due to heightened geopolitical tensions, crude oil prices plunged ~5%.

That said, if we look at a longer-term chart (which offers more perspective) – WTI crude has been mostly range bound for the better part of ~3 years:

Oct 28 2024

Two things come to mind:

- The calculated nature of the Israeli strikes – which suggests the conflict may be contained; and more importantly

- Market sentiment tends to prioritize economic supply and demand concerns over (short-term) geopolitical risks.

🛢️Deconstructing the Oil Market

Commodity prices follow a law of supply and demand.

If demand is high and supply is limited – prices tend to rise.

The opposite holds true.

Following the Israeli strikes on Iran – the move lower in oil prices can be explained with three vectors:

1. Targeted Strikes: Israel strategically avoided targeting Iran’s oil infrastructure, ensuring that production remained unaffected. This deliberate approach mitigated immediate supply disruptions, allaying fears of a global oil shortage.

2. Muted Escalation: Both Israel and Iran have signaled a reluctance to engage in further escalation, suggesting a desire to contain the conflict. This measured response has reassured market participants that a full-blown war, with its potential to disrupt oil supply chains, is now less likely; and

3. Economic Pessimism: Despite the resilience of the US economy, China’s stimulus efforts (more on this below), and the prospect of further US fiscal expansion – the oil market is concerned about demand (mostly from China). This pessimistic outlook overshadows geopolitical concerns, driving down oil prices.

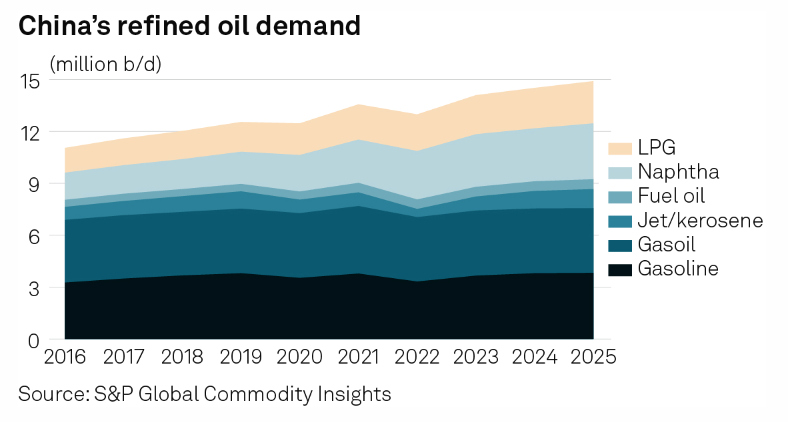

China is the variable which arguably concerns the market.

The Middle Kingdom comprise 16% of world demand. However, weakness in their economy casts a shadow over commodity markets.

For example, reports last week revealed a sixth consecutive monthly decline in refinery throughput, with imports down 0.6%, marking a persistent demand contraction.

China’s refinery slowdown has left a surplus of nearly 1 million barrels per day in recent months.

With Chinese imports underperforming year-on-year, the market questions whether OPEC’s 2024 demand forecast of a 580,000 bpd increase is too optimistic.

This helps explain why traders are cautious to bid up oil prices – worried about the likelihood of prolonged weak demand from the world’s top importer.

And yet – despite the government’s recent stimulus announcements (aimed at bolstering demand) – traders do not believe it will be enough to ‘move the growth needle’.

I tend to agree…

As I explained recently – China adding more debt to a debt problem – is unlikely to be effective.

Structural problems require structural solutions (i.e., debt reduction)

⚡ Disconnect b/w Geopolitics and Economics

From mine, the oil markets muted response to the Middle East conflict underscores a disconnect between geopolitical risks and economic fundamentals.

While geopolitical tensions typically drive oil prices higher in the short-term (e.g., due to supply the threat of supply disruptions) – the current market dynamics suggest a prevailing belief that economic factors will ultimately outweigh geopolitical risks in determining oil demand.

First and foremost are the demand concerns referenced earlier.

The oil market appears to be pricing in a weaker global economic outlook.

Coming back to the weekly chart – this pessimism is reflected in the struggle for WTI to sustain prices above $84 per barrel for ~3 years.

Unlike the stock market – commodities continue to express uncertainty surrounding the global economic outlook.

For example, gold is a great example.

If the outlook for economic growth was strong (with inflation risks low) – one would expect gold to be relatively muted.

But that’s not the case…

The returns for gold this year have exceeded that of the S&P 500 (up over 32%)

Why?

Again, despite what would generally be seen as positive global growth developments – traders fear a global slowdown.

From mine, the ~5% drop in oil prices in recent days suggests there was “political risk premium” priced into the market.

Some of that is now coming out…. but what remains are economic anxieties.

If nothing else, this underscores the vulnerability of oil prices to shifts in economic sentiment.

👀 Opportunity for Investors: OXY

Trading the moves in oil are especially challenging.

It’s one of the more complex puzzles for investors… as we gauge the interplay of geopolitical risks, economic fundamentals and market sentiment.

This makes a short term forecast very difficult (and not something I attempt)

From mine, you are better to focus on the longer-term outlook of specific high quality oil companies – that trade at possible discounts when the crude prices are low (e.g., below $70/b)

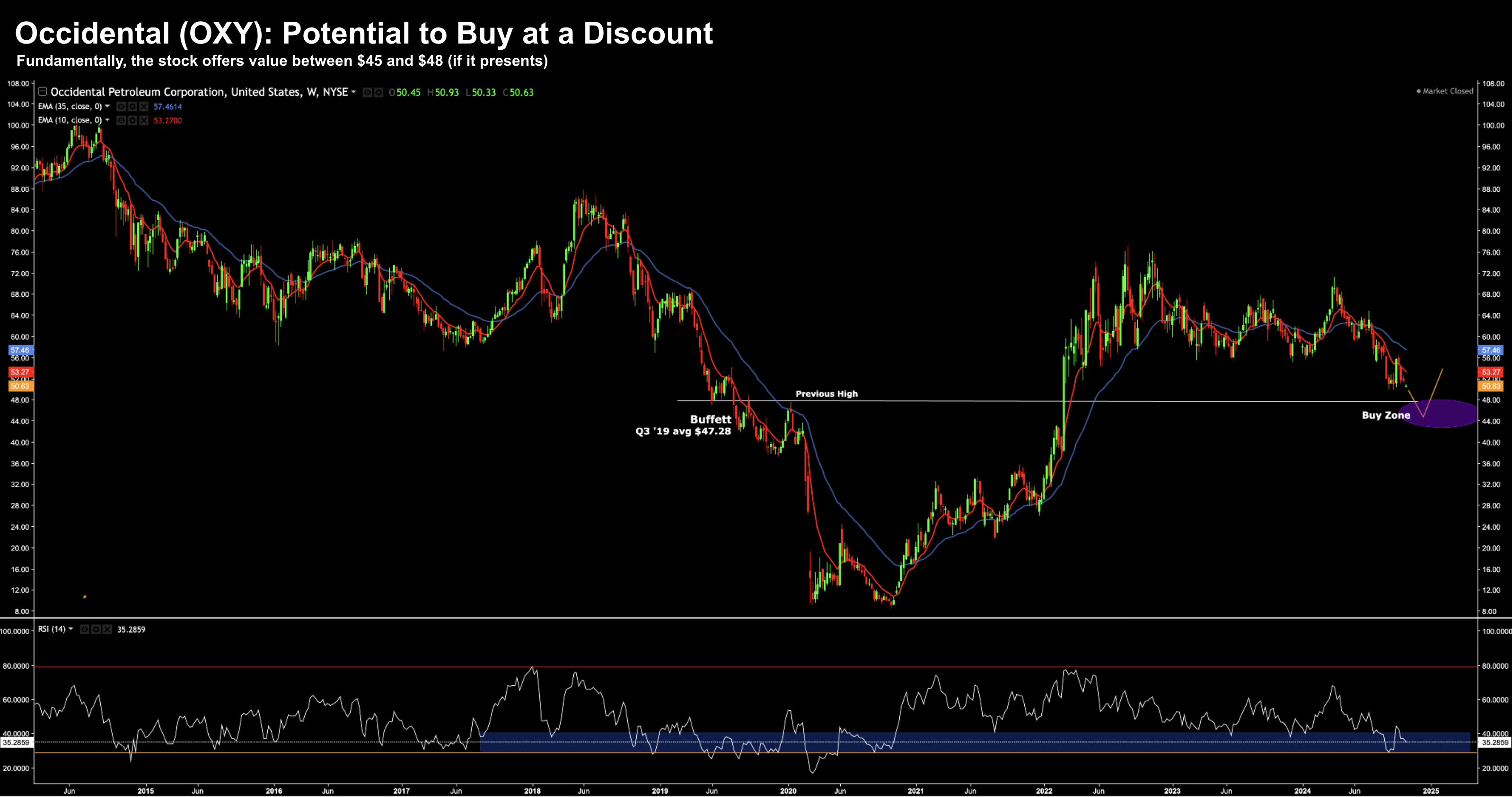

For example, Occidental Petroleum (OXY) is a stock that Warren Buffett started to buy in Q3 2019 at a price of ~$47

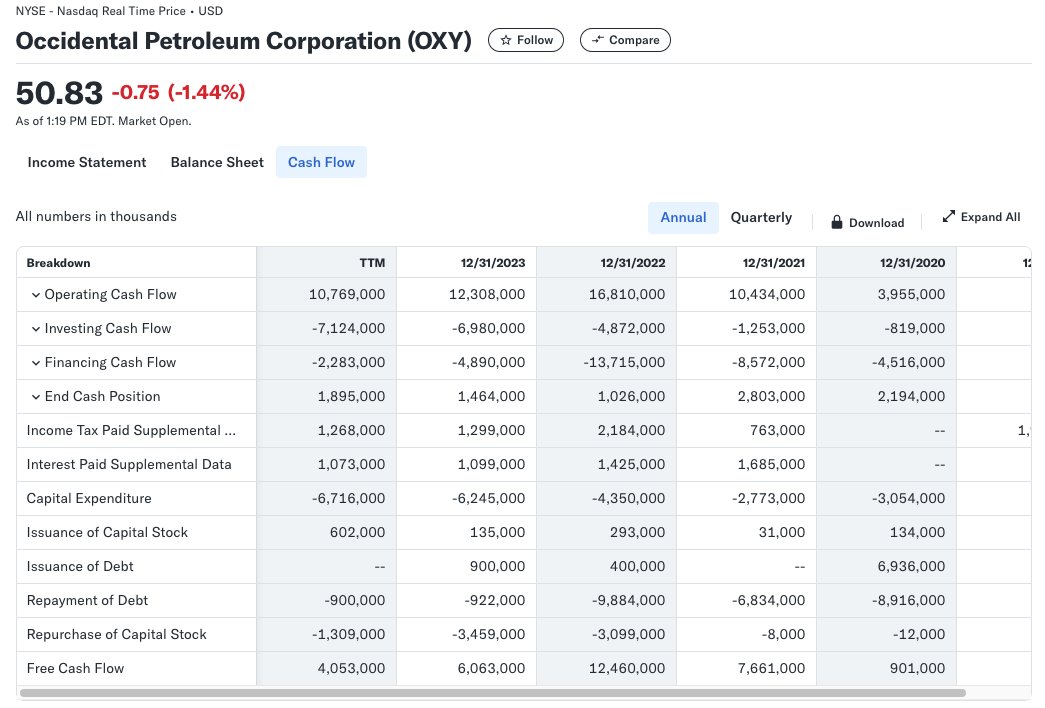

Per the Yahoo!Finance table – OXY is a free cash flow machine (bottom row)

At the time of writing – OXY trades for $50.63 (chart below) – a forward PE of 12.6x

Given the modest valuation; strength of its balance sheet; and strong free cash flow – I understand why Buffett is buying.

Over the past few years, Buffett has continually added to the stock between $50 to $60 (as recently as June – just below $60) – owning a 29% stake (worth ~$13 Billion)

The weekly chart below suggests we OXY could find support around ~$48 (the previous high in 2020)

Oct 28 2024

From mine, picking up the stock around $48 represents good risk/reward over the next 3+ years.

Now could the stock drop another 20% next year?

Absolutely!

If the market is worried that global demand is likely to weaken – expect oil prices to decline.

This will impact all energy companies.

But I would use the opportunity to establish a longer-term holding.

For example, based on OXY’s financials, they are able to produce a barrel of oil at ~US$40.

Put another way, they’re likely to keep generating a lot of cash even if the price of oil dropped another $20/b.

My intended full position size for OXY is 4.0%.

For those who are cautious – consider establishing a half position at ~$48 – adding to it on further weakness.

FWIW: Buffett’s OXY position size is 4.1% of his total holdings.