- Goods inflation falls inline with expectations

- Core (services) inflation increased to 5.7% annualized

- Is the S&P 500 about to face resistance?

Today we received the highly anticipated inflation read for December.

And there was something in there for the bulls and the bears.

Let’s start with the key numbers:

- The consumer price index (CPI) fell 0.1% in December, meeting expectations, for the biggest drop since April 2020.

- Excluding food and energy, core CPI rose 0.3%, also in line with estimates.

- On an annual basis, headline CPI rose 6.5% while core increased 5.7%.

- The biggest reason for the easing in inflation came from a sharp drop in gasoline prices, which are now lower on a year-over-year basis.

- Food – up 10.4% YoY

- Energy – up 7.3% YoY

- New Vehicles – up 5.9% YoY

- Shelter – up 7.5%

Food, energy and shelter costs are not discretionary items.

However, more discretionary goods like “apparel” pulled down the overall number to 6.5%

What would you rather?

A “t-shirt” falling say $2 from $25; or your food or rent expense falling $300 per month?

But it leads to a very important question (and one that is often overlooked)…

Simply calling it “inflation” or “CPI” is insufficient.

We need to be specific with our language.

For example, I can tell you the Fed is far less interested in things like “t-shirts” or “used cars” falling 5%…

However, they’re laser focused on wages rising 5%

With respect to core CPI – almost 70% of that number is services.

That’s all that matters in the monthly print.

And as I said last month – the extent to which the Fed decides to pause will depend far less on the headline CPI print than it will wage growth (the key to service-sector inflation).

All Inflation Isn’t Equal

Again, the market was thrilled to see headline CPI come in with a mid-6 handle.

Buy, buy, buy!!!

As I said last month – expect something closer to 4% by mid year.

That’s already priced in.

But it won’t be the catalyst for the Fed to shift gears (as some may think).

Wage growth is still accelerating well above 4.5% annualized.

Powell will feel that is still too high….

In addition, we need to consider housing.

While new rates for rental housing have been falling for months, it takes about a year for that to be fully reflected in renewed leases and CPI.

In other words, what we see with the December inflation report is not consistent with what we are seeing on real-time sites like Zillow etc.

Here’s Investor Business Daily’s read on the latest print:

Some analysts highlighted that services prices excluding shelter rose 7.4% from a year ago. However, that category includes energy services prices, which are up 15.6% from a year ago.

Excluding energy and shelter, services prices are up about 6.2% from a year ago.

To get a better idea of how the CPI core services inflation data compares to Powell’s focus on PCE core services minus housing, IBD made a few alterations.

Food away from home, which is part of the PCE services sector, was the only addition. Owner’s equivalent rent, rent of primary residence and health insurance, which doesn’t feed into PCE inflation data, were subtracted

The latest data looks generally positive. While prices for this batch of core services rose 6.5% from a year ago, the annualized 3-month trend improved to 5% from 6.5% in November and 7.1% in October.

In summary, whilst goods fell, services rose sharply.

That won’t change the Fed’s script.

Here’s another way to frame it:

Even if we were lucky enough to see goods inflation all the way down to 0% – it’s unlikely you will see core inflation below 5.0% in the near-term.

Therefore, expect the Fed to hike a minimum of 25 basis points next month (possibly 50 bps) on this print.

And until we see core starting to meaningful trend towards their 2% objective – they have little reason to stop tightening.

Bond Market at odds with the Fed

Whilst I think the Fed will stick to their hawkish script – it’s clear they are fighting the market.

I will take a look at equities shortly (as I think stocks are about to find resistance)… but here I’m talking to the bond market.

There is a clear dislocation happening… and I don’t pretend to know who will eventually be proven right.

The Fed has a lot of credibility on the line.

For example, when I look at the 10-year trading at 3.46% and the 2-year at 4.15% — it tells me one of two outcomes:

- Either the Fed’s terminal rate is going to be a lot lower they expect; and/or

- The economy is going to be much weaker.

That’s what bonds are telling us.

Today the Fed may see the bond market’s message…. but is ignoring it (for now).

As I say, I think the Fed is of the mindset that overshooting is a price they are willing to pay if it means recession.

And I think that’s where the market is at odds.

Equities and bonds believe the Fed will either pause (or potentially pivot) in the not-too-distant future. Some even see two rates cuts in 2023.

Now you might argue that recent (30-year) history suggests the Fed will cave to market pressures and pivot.

After all, isn’t that what they always do?

Yes.

However, equally we have not had core inflation ripping above 5% at any time in the past 30 years… with the threat of it becoming entrenched.

That’s new.

The last time the Fed faced this situation was the 1970’s.

And as I said a few weeks back – I don’t think Jay Powell wants to remembered as the next ‘Arthur Burns’.

A recession is a relatively small price to pay vs entrenched wage inflation over 4%.

S&P 500 Rallying into Resistance

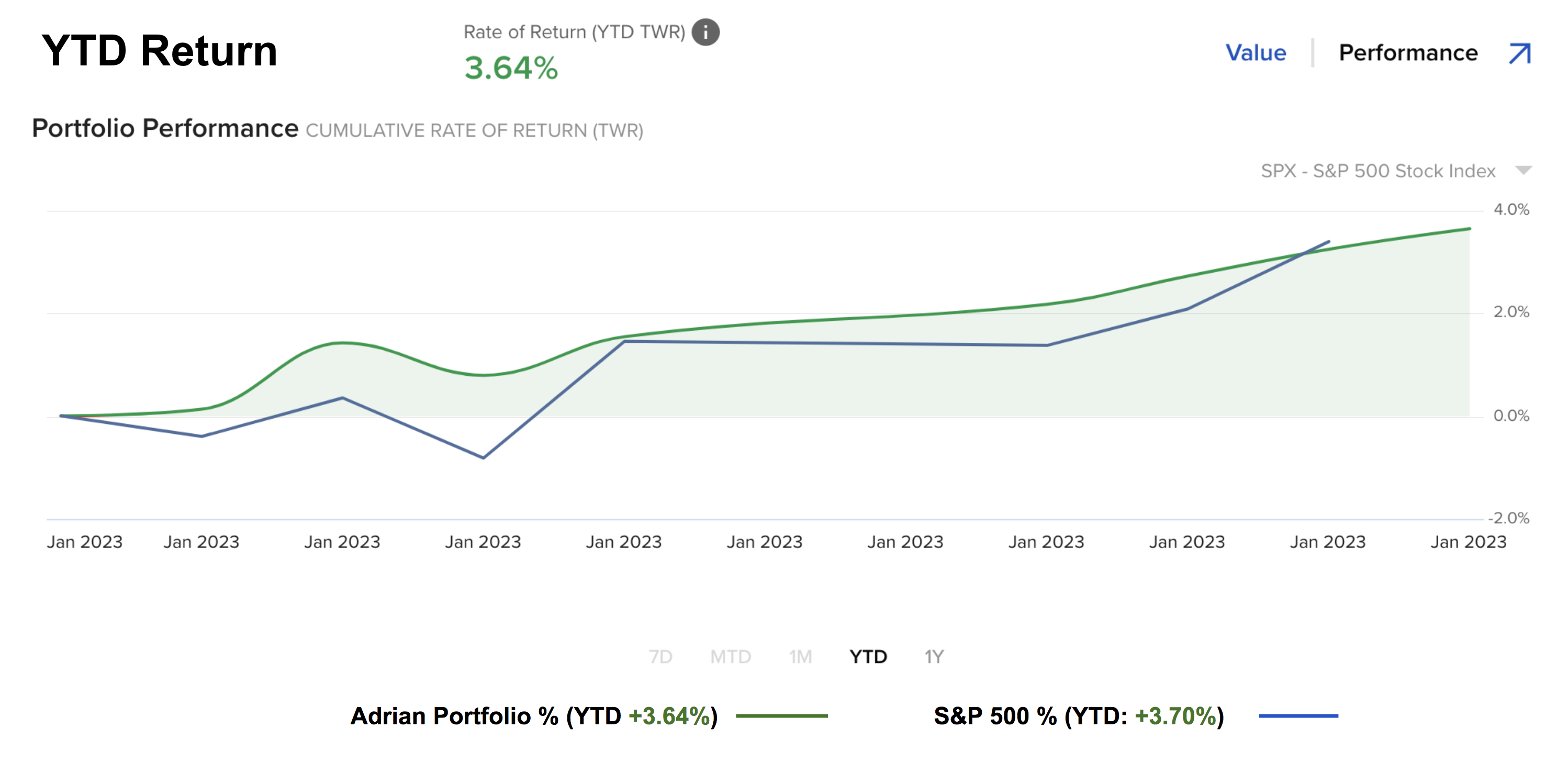

The S&P 500 is up a tidy 3.7% in just 2 weeks… and it’s nice going along for the ride.

And hey… I’ll take it!

Jan 12 2023

I share this because even though I think we will make new lows in 2023… I maintain long exposure.

For example, I have had some readers ask why I haven’t sold all my positions given I think we could see the market trade lower than 3600 this year.

Good question.

My first response is I will always be long the market… what varies is my exposure.

What’s more, I don’t pretend to know where the bottom could be.

It might already be in for all I know?

However, I’ve also been long stocks like Apple, Microsoft, Google and Amazon for well over a decade… and that trade seems to have worked out (even with the pullback last year)

And I’m reasonably confident I will still own them in ~10 years time.

Why wouldn’t you?

The way I choose to hedge my portfolio is to sell call options against long positions when the market looks ‘stretched’ (which is the case today)

The alternative is to buy puts… however I choose a “covered call” strategy.

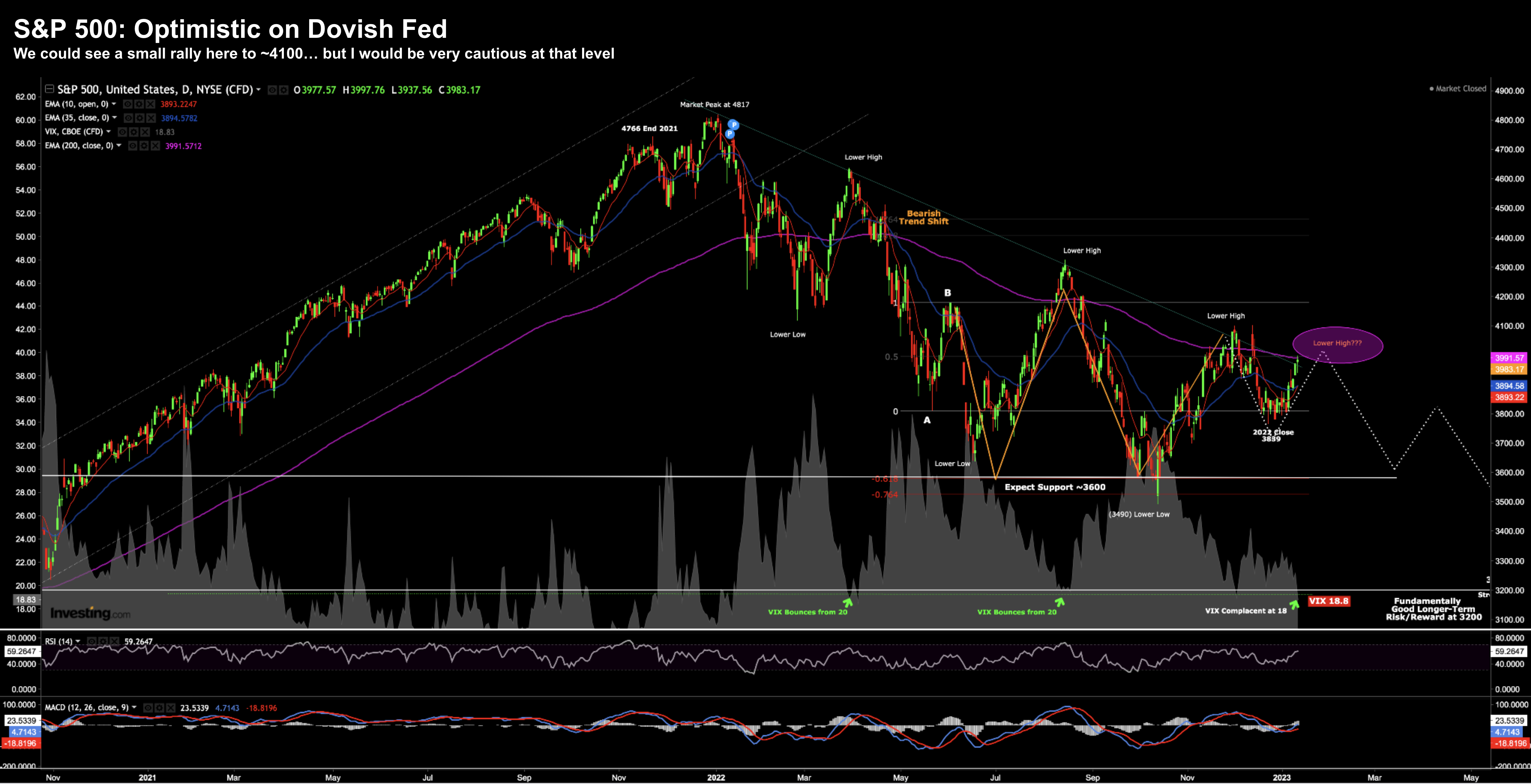

Now if take a look at the S&P 500 using the weekly timeframe – my best guess is we’re about to face resistance around the 4100 zone:

Jan 12 2023

You may notice I have not changed the title or subtext to this chart from what I shared a week ago!

At the time I said the market was rallying on hopes of a more dovish Fed (opposite lower inflation) – where we could see prices push to the zone of 4100

Today (Thursday) we closed at 3983.

Therefore, I think it’s highly likely the market can add another 3% to 4% here.

But I think that’s where things get challenging…

Remember: this is still a bear market.

But in terms of the 4100 zone – not only technically does this feel like resistance (a series of lower lows and lower highs) – we must also consider upcoming earnings and guidance.

Expect a decline in Q4 earnings (e.g. as much as 4%) and soft guidance.

But is that what the market is pricing in?

I don’t think so.

For example, Factset says consensus is for 4% earnings growth in 2023… or around $230 per share.

My guess is that number will end up closer to $200 (i.e. a decline of ~10%).

If that’s true… then plug in a recessionary market multiple of say 15x to 16x forward earnings – and you’re potentially trading in the realm of 3200.

Putting it All Together

Financial leading indicators suggest there will be a recession this year.

I don’t think that is fully priced in at levels of 4100.

3600 maybe…. not at or above 4100.

However, there’s divided opinion on whether a recession will be mild (what most expect) or something far worse?

That will largely depend on what we see with unemployment and services (core) inflation.

For example, if core inflation stays around the 4-5% level (driven by wages and rents) – then expect rates to be higher for longer.

You won’t see rate cuts this year if this scenario plays out.

Now the Fed may pause at “5.00%” (it could be higher or lower)… but a pause doesn’t imply rate cuts if core inflation is double their target.

That’s what we will need to watch month on month.

Repeating what I said above… we could see goods inflation fall to “zero percent”… it makes little difference if core (services) inflation remains well above 2%

And I am not entirely convinced the market has that right.

From mine, expect the Fed to stay the course when they speak Feb 1st.

And we will see how the market reacts then.