- Core PCE MoM +0.2% vs +0.2% Expected

- Fed on a ‘glide path’ towards rate cuts / soft landing

- S&P 500 up 13 of 14 weeks – looking overbought

If there’s one inflation indicator the Fed tracks more than any other – it’s Core PCE (personal consumption expenditures)

The PCE price index looks at U.S. inflation by measuring changes in the cost of living for households.

It tracks the prices of a basket of goods and services, each with different weightings, to reflect how much a typical household spends every month.

The weightings are important.

For example, let’s say the price of gasoline rises in a given month but the price of tomatoes falls.

Gasoline represents a larger portion of a family’s monthly budget, so it’s weighted more heavily in calculating PCE. That means rising gas prices have a bigger impact on the overall index than say cheaper tomatoes.

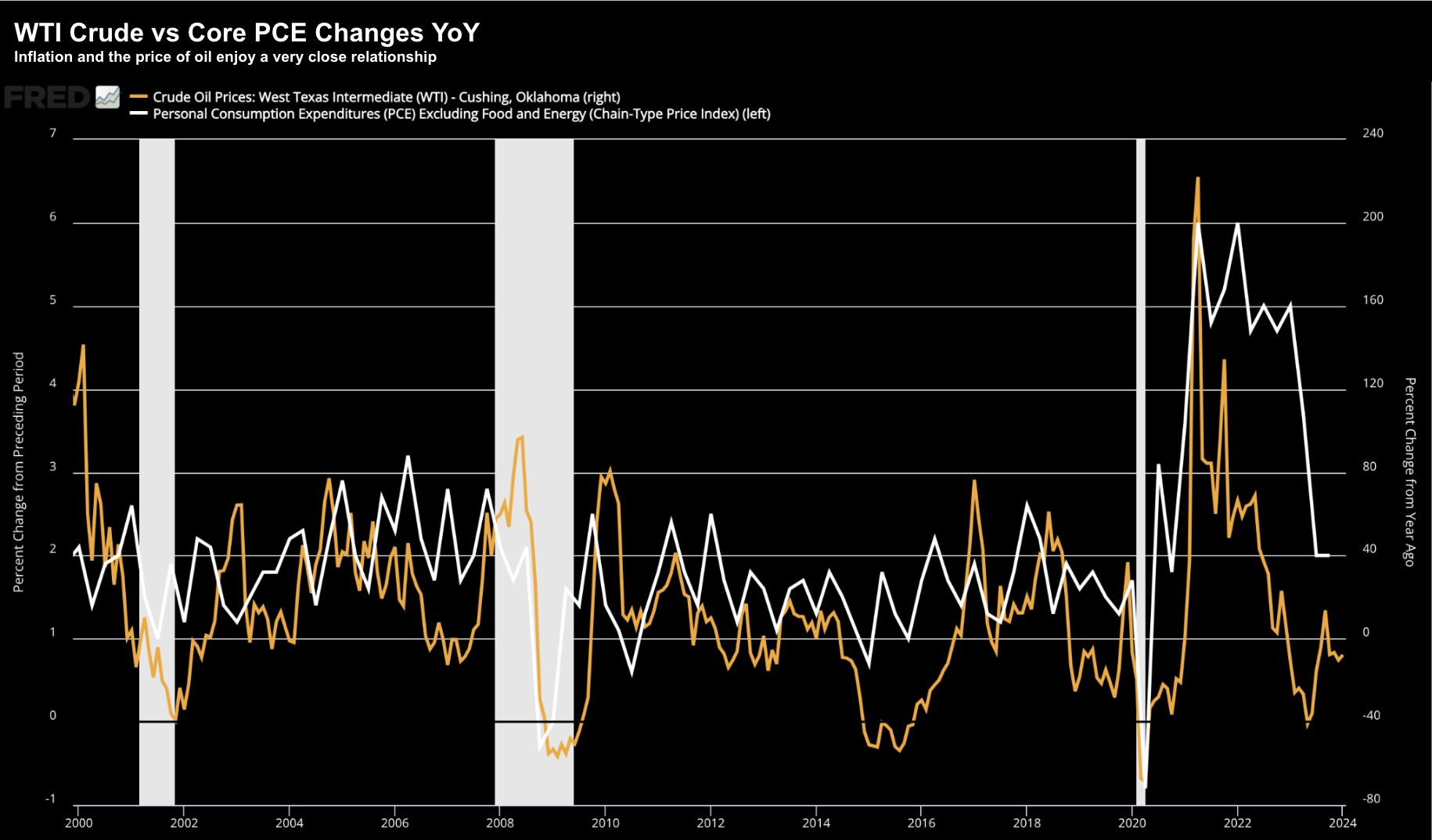

For example, below we see the close correlation between WTI Crude and Core PCE:

In January 2012 the Fed adopted PCE as its primary measure of inflation over CPI based on the following three reasons:

- PCE adjusts its basket weights as people substitute more expensive goods and services for less expensive ones;

- PCE includes more comprehensive coverage of goods and services; and

- Historical PCE data can be revised.

- MoM was +0.2% vs +0.2% expected (prior MoM +0.1%)

- Headline PCE +2.6% vs +2.6% expected (prior +2.6%)

And with respect to consumer spending and income for December:

- Personal income +0.3% vs +0.3% expected. Prior month +0.4%

- Personal spending +0.7% vs +0.4% expected. Prior month +0.2% (revised to +0.4%)

- Real personal spending +0.5% vs +0.3% prior (revised to +0.5%)

The market applauded the Core PCE data – as it strengthens the ‘soft landing‘ narrative this year.

Let’s explore…

Core PCE on Track for 2.0%

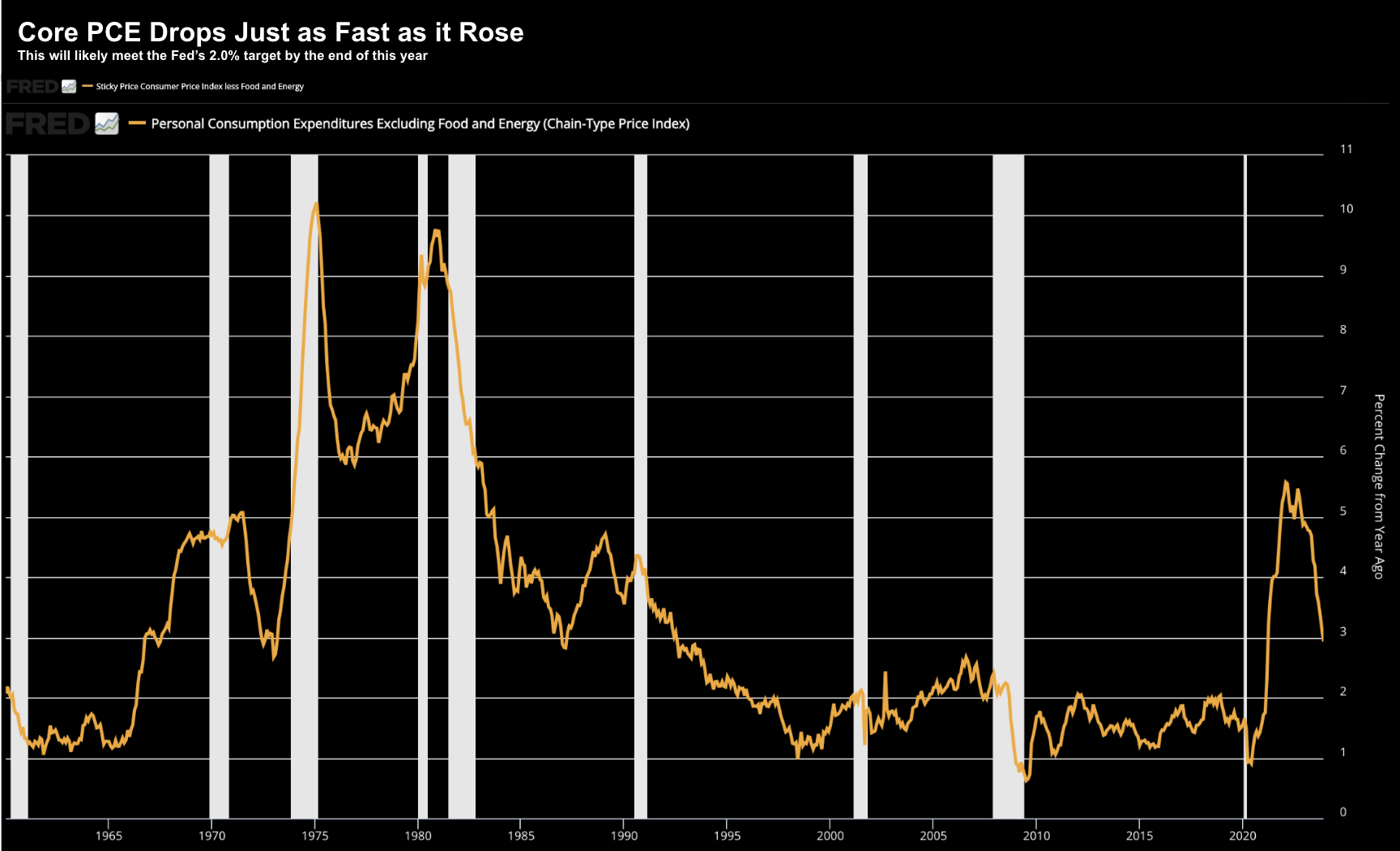

Below is the long-term YoY trend for Core PCE:

Jan 26 2024

The Fed’s target for Core PCE is 2.0%.

Based on the last few month-on-month Core PCE prints – it’s now likely (80%+) we see this target achieved towards the end of the year (or perhaps early 2025).

And whilst precise (macro) timings are difficult to predict – what clear is the trend is lower.

That’s important.

Despite the Fed being late with rate hikes – what’s impressive is they’ve been able to bring down Core PCE without any major pain to the economy (to date)

Of course – that could come later however for now things are going well.

Now almost two years ago (before the Fed started hiking rates in March of 2022) – Jay Powell warned markets there will be “pain” for households.

It’s rare any Fed Chair would use such language – however he was setting expectations.

The market was braced.

Powell knew the central bank needed to be aggressive with monetary tightening to effectively tame inflation and ‘suck out’ some of the $6 Trillion injected into the economy during the pandemic (i.e. due to excessive government borrowing and spending).

Note: The definition of inflation is excess money chasing too few goods.

History suggests that 550 basis points of rate hikes and almost $1 Trillion in quantitative tightening would result in economic dislocation up to ~24 months after the first hike.

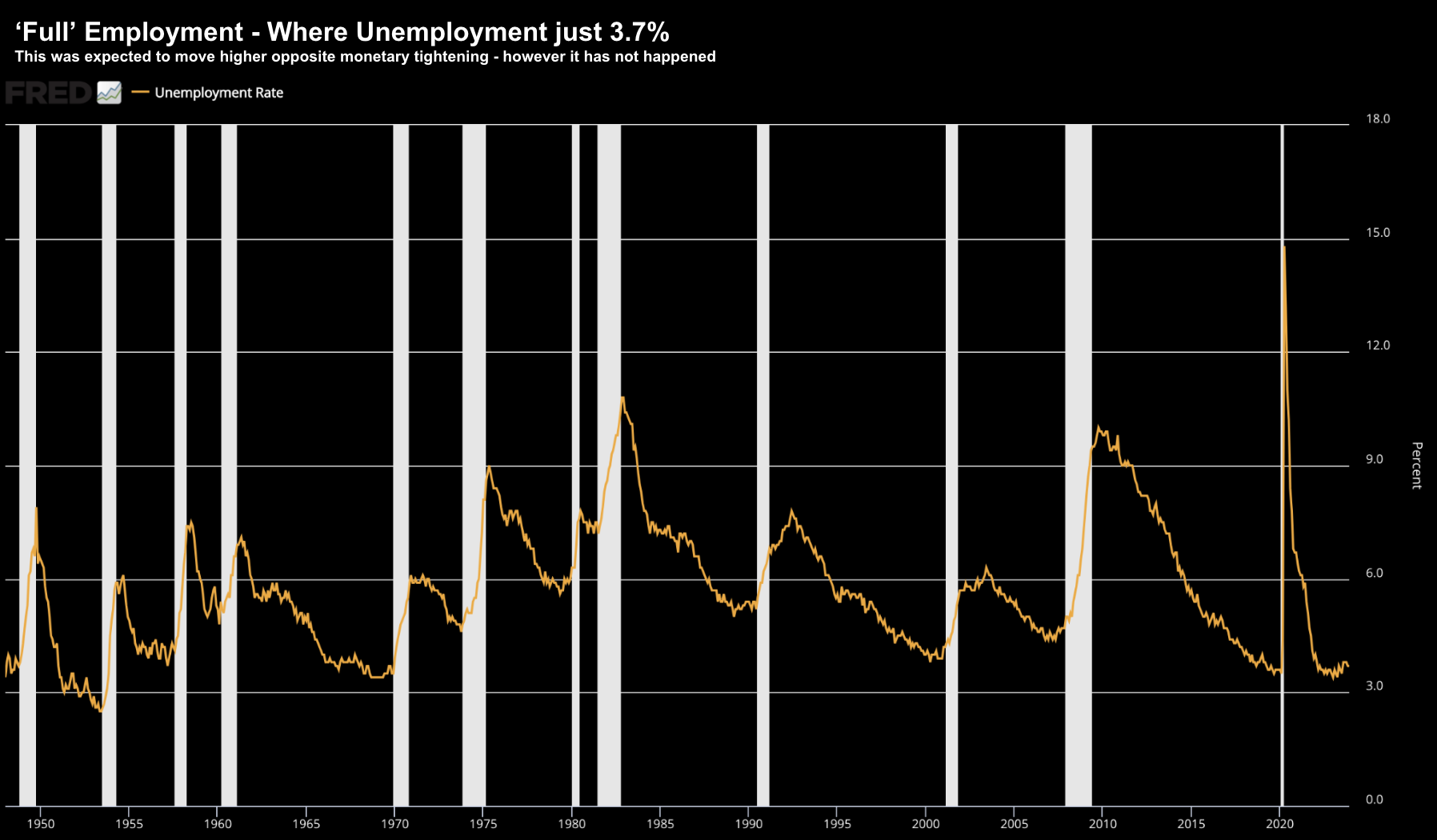

And yet despite hitting that milestone in ~2 months – we have not suffered a recession – where unemployment remains well below 4.0% (despite signs of softening in recent months – more on this shortly when I talk to job openings).

Is this likely to increase later this year?

Fed Want to “Stick” the Landing

Late last year, I made the comment that the Fed will shift from being singularly focused on inflation (at any cost) to risks opposite the business cycle.

Put another way, with a so-called soft landing in sight, they will want to try and ‘stick the landing’.

Now next week the Fed meets next to give their latest assessment on monetary policy

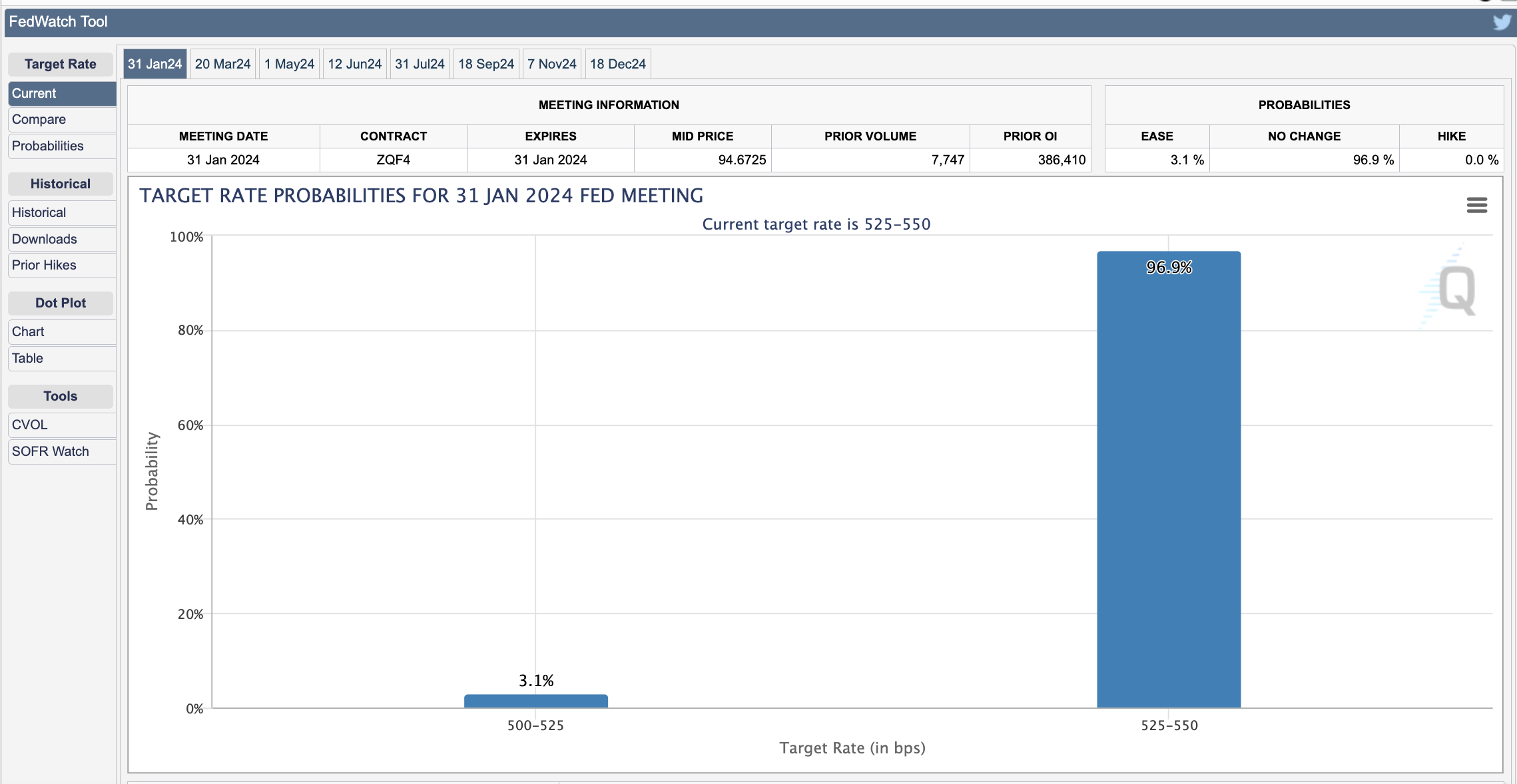

The market does not expect a rate cut this meeting… as shown by the CME’s FedWatch Tool:

However, looking ahead to March, the market sees a 46% chance of a cut (note – this was above 70% two weeks ago).

Based on today’s (favourable) Core PCE print – it feels like the Fed things are on a glide path to (potentially) landing the plane.

The aggressive move to rapidly raise rates with quantitative tightening has restored credibility for the central bank.

Most people – including myself – were critical of the Fed moving too late. However, for now they have been proven correct.

Incremental to bringing inflation down – they’ve also managed to reduce some of the tightness in the labor market.

This is important – as it helps to reduce (systemic) wage inflation pressure.

For example, whilst the unemployment rate has been consistent (~3.7%) – job openings has been consistently trending lower. From the Fed’s lens – this is good news.

This is back to 2021 levels – a success for the Fed.

Whilst all of these are “wins” for the Fed – some caution is still warranted.

For example, the Fed lost credibility by allowing inflation to get to levels not seen in 40-years.

Their assessment that inflation would be transitory was a mistake.

They have now (mostly) corrected their error – supported by the declining trend in Core PCE (coupled with full employment and GDP growth)

However, what they don’t want to see happen is two-fold:

- inflation resurface (a lower probability); and/or

- a recession (which is still possible).

Therefore, there will be a lot of discussion next month about when to start lowering rates to avoid the risk of recession / high unemployment.

Overbought Market

The market took the Core CPE number in its stride.

Probability of rate cuts for March dropped ~2% – however chances for two rate cuts by June increased from 48% to 50%

As I say, it appears the Fed is on a ‘glide path’ to lowering rates without the heightened risk of unwanted inflation.

Let’s take a look at the reaction in equities:

Jan 26 2024

The benchmark index has now rallied 13 of the past 14 weeks – up 19.2% from the October 2023 low.

If we look at the middle window – the weekly RSI is now technically overbought (above 70).

In my book – that’s a red flag for the bulls. That is, it’s too much too fast.

The last time the RSI touched this value was late July 2022 (marked “A”).

Again, this should be considered a higher risk zone if increasing exposure – both fundamentally (at more than 20x forward); and technically.

And whilst it can be hard watching the market rally “week after week” (especially if you don’t have long exposure) – being in cash is better than adding risk at an unreasonable risk/reward.

One important note:

Next week we get large cap tech earnings.

Over $10 Trillion (or over one third of the total market) will report.

Tuesday we get Alphabet (Google) and Microsoft. Thursday it will be Meta, Apple and Amazon.

The earnings bar has been set high given how much these names had rallied.

Meta up over 160% the past 12 months; Amazon up over 60%.

From mine, Meta and Google are arguably the most reasonably priced (around 25x forward) – however the balance feels expensive (in excess of 35x forward earnings).

More broadly, the market’s advance above 5,000 will depend on what I’m calling the “Sensational Six” (I think it’s time to get rid of the term “Magnificent Seven” – Tesla is out).

If the Sensational Six fails to meet the (lofty) earnings bar – expect to see stocks reverse gear.

Putting it All Together

For all the criticism the Fed has received (and they deserved some of it) – the economy is better placed than I predicted a year ago.

My expectation was we would be entering a recession in the first half of this year. That is now looking like a lower probability outcome.

To that end, I think the Fed deserves credit.

I don’t imagine setting monetary policy is an easy task.

You’re constantly trying to ‘navigate by the stars under a cloudy sky‘ (borrowing language from Jay Powell).

For example, how can you accurately forecast the spending and saving behavior for hundreds of millions of people?

You can’t. Nothing in economics happens in a vacuum.

This is why we should evaluate events on a ‘spectrum of probabilities’.

You will rarely hear me talk in terms of absolutes and/or definitive outcomes.

Death and taxes being the only two exceptions.

And as we get more data (e.g. as we did today with Core PCE) – we adjust our forecasts.

For now, I still lean towards a recession later this year. However, there is a real possibility things do land softly for the Fed.

And that’s what markets are betting on.