- Positive developments on inflation expectations

- There is still excess liquidity to fuel inflation for 12+ months

- Market still has more room to run before facing resistance

Today’s exam question:

Is inflation peaking?

If we knew the answer to that question – markets would be in a very different place.

The problem is – we cannot know for sure.

Yesterday I mentioned the market was waiting on the highly anticipated Core Personal Consumption Expenditure (Core PCE) Inflation print.

This is one of the Fed’s favourite inflation measures – despite excluding volatile food and energy prices (which are both up over 20% YoY in many cases; e.g., meat, poultry, dairy, breads, wheat etc).

As a point of clarity – PCE is quite different to the Consumer Price Index (CPI)

PCE is typically much lower than the CPI used by the Bureau of Labor Statistics. The two numbers differ in that the CPI tracks data from consumers; while PCE is extracted from businesses. The Fed considers PCE a broader-based measure of what is happening with prices on a variety of levels.

Headline CPI for April rose 8.3% from last year.

Below is a summary:

- Core PCE rose 4.9% from a year ago in April, in line with estimates and a deceleration from March at 5.2%

- Headline PCE rose 6.3% (inclusive of food and energy) – slightly lower than 6.6% last month; and

- Personal income rose slightly less than expected — but spending beat estimates as consumers tapped savings

Naturally the market rallied on the (positive) news as these numbers were better (or inline) with expectations. If we received a negative print (i.e. Core PCE accelerated) – we would have likely seen the market lose 2-3%.

Now if we include food and energy – headline PCE increased 6.3% in April from a year ago.

CNBC reported:

“Consumers remained undaunted by inflation last month, strongly increasing spending and changing their mix to more services such as at bars and restaurants, and travel and recreation as the weather warms,” said Robert Frick, corporate economist at Navy Federal Credit Union.

“The spending was fueled in part by higher wages, and also by Americans drawing more money out of savings, which is a giant stockpile of at least $2 trillion.”

That last sentence is critical… a “stockpile” of savings in the realm of $2 Trillion (which I will explore shortly with money supply growth)

The good news is that will most likely keep a recession at bay in the near-term; however excess cash is still fuel for the inflation fire.

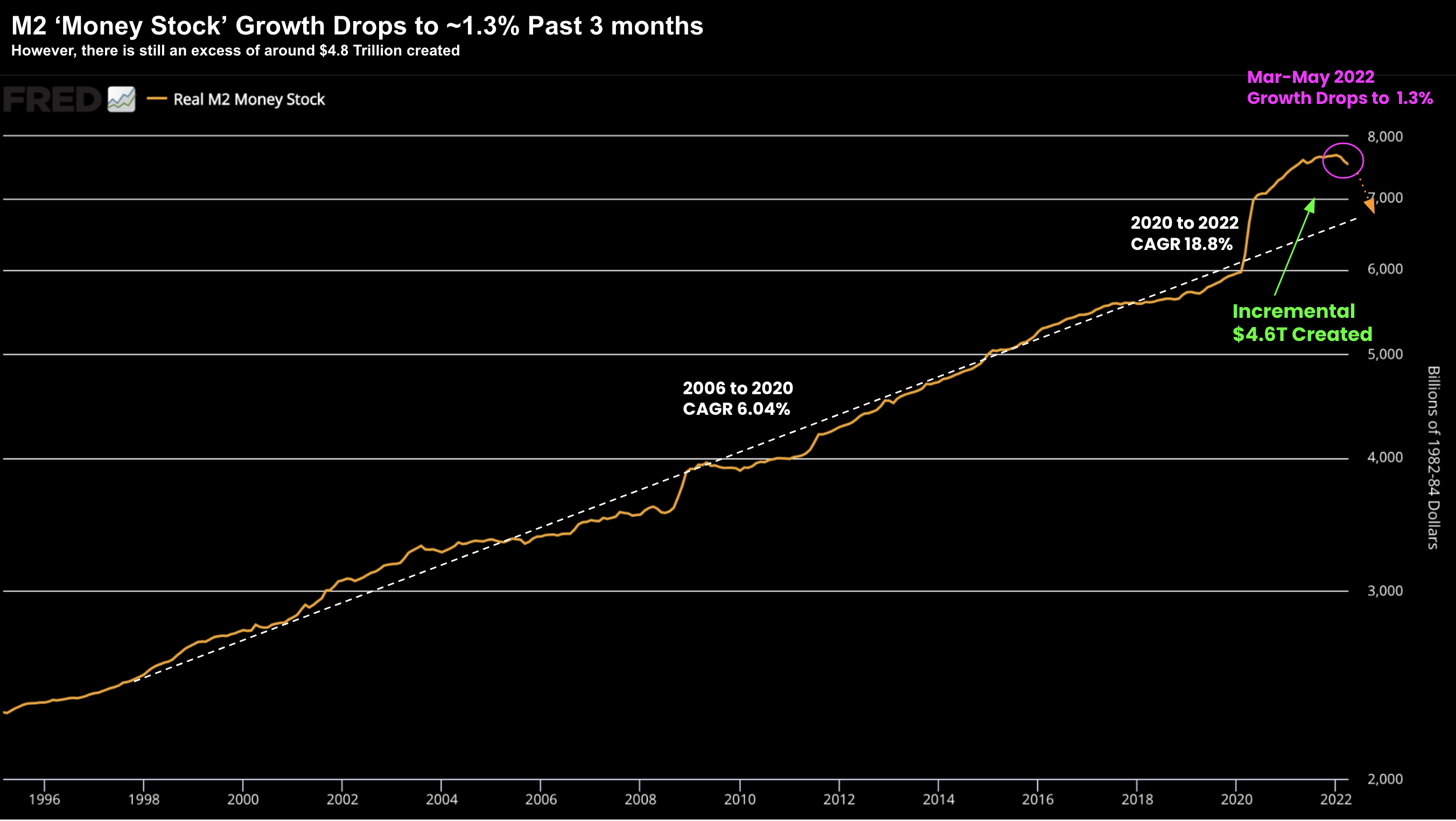

M2 Money Supply Growth Slows

Whilst we could be seeing signs of more “flexible” prices easing – I’m also mindful to balance these data points against what we see with money supply.

Remember: inflation is simply excess money chasing too few goods.

To curb unwanted (sustained) inflation – the Fed’s objective is two-fold:

- Improve demand by making money more attractive (i.e. raising rates); and

- Reduce supply by reducing its balance sheet (i.e. quantitative tightening)

Doing this will help curb inflation over the long run.

However, the challenge is how do we do this at a ‘pace’ which will not crash the economy.

That’s the balancing act.

The other piece of good news is M2 money supply is no longer exploding (as it has done since the onset of the pandemic)

For example, M2 annualized growth rate over the past 3 months has slowed to ~1.3% — down from its all-time of 26.9% YoY in February of last year.

May 28 2022

The explosion in money supply (leading to an incremental $4.6 Trillion above trend) was largely used to enable the (welfare based) COVID spending.

From there, government borrowing was monetized by the Fed and the banking system.

Net result was excess money driving CPI to 40-year highs.

Fast forward ~27 months and the Fed’s dual decision to (a) raise interest rates; and (b) reduce its balance sheet by $95B per month – means less fuel will be poured on a raging inflation fire.

Great news!

But given the lag (and significant excess liquidity) still in the system – inflation isn’t going away this year or next.

We might see signs of its easing – but it’s likely we are faced with CPI north of 5% for at least 18 more months.

That said, the growth slowdown in M2 (and today’s update on Core PCE) is a welcomed development.

Not surprisingly, the bond market is reacting.

For example, I shared the 5-Year TIPS yesterday which now trades around 3.0%

What’s more, the market now expects the Fed to raise its target rate to a maximum of about 3% a year or so from now (and not 3.5%)

Finally, take a look at 5-year, 5-year forward inflation expectations.

Expectations for inflation between 2027 and 2032 have now dropped from over 2.6% to just 2.2%

May 27 2022

All of this is positive as it could mean a less aggressive Fed.

Market Reaction

Last week I said to expect a near-term bounce from technically oversold levels.

Almost right on cue – that’s what happened.

The better than expected inflation news cemented the market gains from earlier in the week. It was the best week for the Dow Jones since November 2020.

May 28 2022

I don’t have much to add from yesterday’s commentary (either technically or fundamentally).

In short, I expect this rally to test the zone of 4200 to 4300 – however that’s where I see selling pressure.

Putting it All Together

2022 has been a challenging market to navigate.

For example, most leading hedge funds I track are down somewhere in the realm of 10% to 20% YTD.

Very few funds are positive.

My own portfolio is down ~5.7% – which is approximately 9% better than the S&P 500 YTD (my own fund in red vs the S&P 500 in blue)

I will take that given my approx +20% return last year.

My performance was dragged lower by meaningful exposure to Google, Apple, Amazon and Microsoft (which are my Top 4 holdings).

However, my market outperformance is largely due:

- maintaining a 65% long / 35% cash position (on the basis the market was expensive);

- selling covered call options against existing longs (enhancing my returns); and

- minimal exposure to low-to-no earnings / negative cash flow / high sales-to-revenue stocks.

What’s more, over the past month or so, I’ve added exposure to quality names in the belief they will rally in the second half of the year (e.g. Apple and Amazon).

To that end, I think quality technology stocks are likely to outperform over the next 12-24 months.

Let’s see how I go…

I hope these missives are helpful for your own investing / trading strategies.