Words: 1,869 Time: 8 Minutes

- Post-pandemic consumer resilience

- Political risks and tariffs

- Government spending cuts – what’s the impact?

The post-pandemic resilience of the American consumer continues to show strength.

Recent retail sales data indicates continued spending, especially as the holiday season approaches.

This is important, as consumption comprises 70% of all U.S. GDP.

According to October’s retail sales figures, consumer spending remains robust, exceeding analysts’ expectations

In October, overall US retail sales rose by 0.4% from the previous month, seasonally adjusted, and increased 2.8% year-over-year unadjusted.

In comparison, September saw a 0.8% monthly rise and 2% year-over-year (YoY) growth.

The NRF’s definition of core retail sales, which excludes sectors such as automobile dealers, gasoline stations, and restaurants, remained flat on a seasonally adjusted monthly basis in October but showed an increase of 5.4% YoY without adjustments.

Jack Kleinhenz said: “October’s pickup in retail sales shows a healthy pace of spending as many consumers got an early start on holiday shopping. October sales were a good early step forward into the holiday shopping season, which is now fully underway”

From mine, falling prices at the pump may have helped prove a few extra dollars for households.

Jason Pride from Glenmede describes the consumer as a “V8 engine firing on all cylinders,” referring to a well-functioning economy with strong consumer demand.

However, I would warn against grouping consumers into one large bucket.

For example, those who own a house and the ability to invest in stocks (i.e., those with extra money) – yes – they might be “firing on all cylinders”.

But are lower income cohorts feeling the same?

The prices of discount retailers such as Dollar General, Dollar Tree and Target might suggest something different.

They trade at multi-year lows.

Irrespective, experts predict spending momentum will carry into the coming weeks, offering an optimistic baseline for the upcoming holiday season.

However, there are several risks to consumption behavior – particularly political developments.

For example, what should we expect with tariffs on imports and potentially cuts to excessive government spending?

Will any changes to these policies impact consumer’s behavior?

It’s worth asking…

🛒 Potential Impact of Policy Changes

One of the central elements of the Trump 2.0 economic agenda is his focus on implementing tariffs on imported goods.

Most believe imposing a fresh round of tariffs could mean higher prices for consumers.

Now one way we can try and dimension this is using precendent (and what we saw during 2018)

At the time, a 50% tariff was levied on imported washing machines, which resulted in a 12% increase in the price – amounting to an additional average $86 per unit.

The intention behind these tariffs is to protect domestic industries and encourage local manufacturing.

That’s the “seen” economic benefit.

But as I like to often say, the true study of economics is the study of the “unseen” (i.e., second and third order consequences)

The unintended consequences of Trump’s 50% tariff was it drove up the price of washing machines.

A study published in the American Economic Review analyzed the impact of this tariff and found that the increased costs were passed down directly to American consumers.

This 2020 study highlights how protective tariffs can harm consumers by inflating prices on everyday goods.

And whilst this study was on washing machines – it could apply to other imported products if similar tariffs are reintroduced.

If true, the impact on consumer spending could be profound… especially on lower-income households who are more sensitive to inflation.

For example, in another 2020 study from the Peterson Institute for International Economics, researchers Kimberly Clausing and Mary Lovely found that the poorest fifth of the population could lose about 4% of their income due to tariffs.

On the other hand, the wealthiest fifth would see a more modest 2% reduction.

Inflation is nothing more than a poor man’s tax.

These findings suggest that tariffs have the potential to exacerbate income inequality – rather than improve it.

Case in point – today we received two different retailer results:

- Target – who reported woeful sales results and guided lower – sending the stock ~22% lower; and

- Williams Sonoma – a high-end retailer – reported surging sales and profits – sending their stock ~20% higher

These two retailers sell to two very different consumers. One sells cheap products imported from China; and the other sells $400+ Le Creuset dutch ovens.

My point:

Inflation over the past 4 years has exacerbated wealth divergence. Wealthier consumers continue to do well.

However, my concern is excessive tariffs could only make the divergence worse.

✂️ Spending Cuts and Social Programs

Post the election – there is a lot of speculation over possible government spending cuts.

For what it’s worth – those cuts could be a good thing (particularly if it removes wasteful spending)

For example, it’s my view (as someone who argues for smaller government) – the US government has become too bloated over the past 50 years.

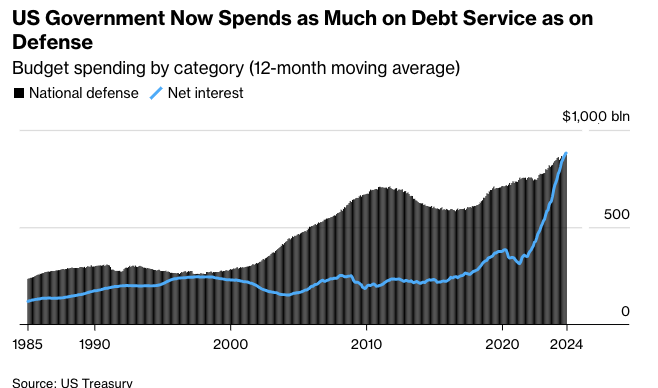

Look at the following graphic – where spending to service its debt now exceeds that of defense. Note the vertical ascent of the blue line post 2021…

Personally, I don’t believe this trend is sustainable (regardless of what political party you support)

And hence why I suggest cuts could be a good thing.

However, Trump’s plan to slash wasteful government spending has many worried (none more so than government employees)

Strategas’ Dan Clifton has pointed out that social programs like Medicaid, food stamps, and student loans could all face reductions.

And whilst we don’t know where the cuts will be made (that will come early in 2025) — if cuts are made to those programs which are closely tied to consumer spending – this could impact growth.

For instance, food stamps, which provide assistance to low-income families, directly impact spending on groceries and related retail sectors.

Similarly, cuts to Medicaid, which provides healthcare assistance to low-income individuals and families, could reduce disposable income for those relying on the program.

But for now — we’re simply guessing on where the cuts might be made.

Clifton believes the GOP will push for cuts to entitlement programs as a way to offset the costs of extending tax cuts.

That’s possible.

However, these cuts would likely face substantial political resistance (for obvious reasons)

Moreover, the challenge of passing these spending cuts through a polarized Congress adds another layer of uncertainty to the outcome.

That said, pending where the cuts are made, it is possible they could strain the financial situation of lower income households who depend on government handouts.

That said, less wasteful government sector will help enable the private sector (and not crowd it out).

For what it’s worth – I don’t believe Trump’s intent is to directly harm lower-to-middle income earners (those who elected him to office).

However, I do believe he will be targeting wasteful programs.

Investor’s should be aware that consumer discretionary stocks, which include companies that sell non-essential goods and services, tend to perform well during periods of strong consumer spending — but falter if spending slows.

It remains to be seen whether any (wasteful) government spending cuts will have a direct impact on consumer spending.

👀 The Consumer Outlook

Looking ahead, it’s still too early to accurately assess the positives and negatives of the Trump 2.0 agenda

There will be clear winners and losers.

For now, the market appears to be assuming it is all upside.

I doubt that will be the case (as I wrote here)

For example, the introduction of likely tariffs on foreign made goods (and possible cuts to wasteful government spending) could pressure specific consumer cohorts.

Similarly, it may to the advantage of others (as we’ve seen)

As I write this (Nov 20) – it’s fair to suggest that consumer sentiment and retail sales are robust – buoyed by ongoing economic recovery.

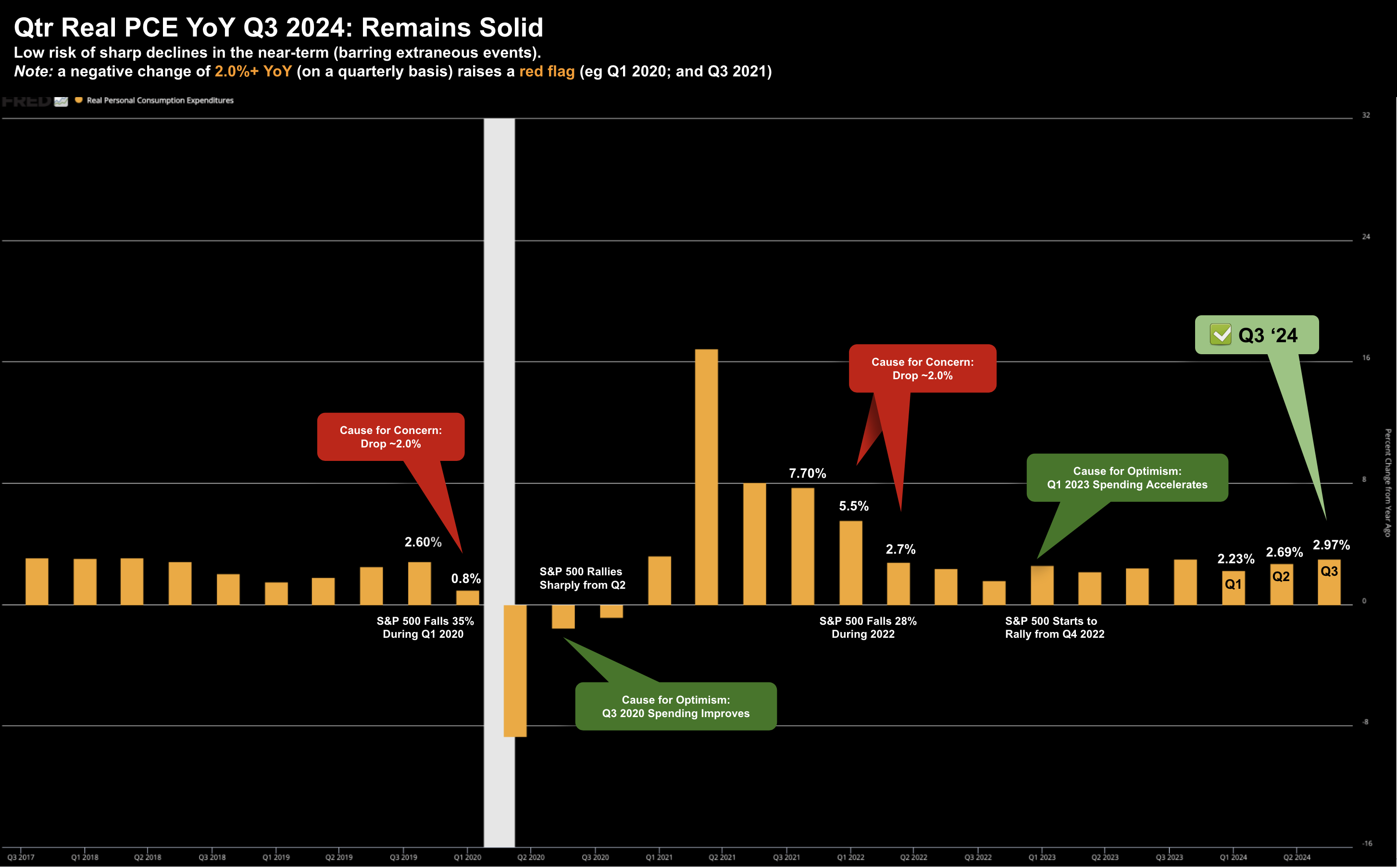

My preferred leading economic indicator – Real PCE – measured on a quarterly change basis year-over-year – remains positive.

The better than expected October retail sales implies Q4 has started strongly ahead of the holiday season.

However, political developments, particularly excessive tariffs, could weigh on consumption over the coming quarters.

And if we see price inflation (e.g., similar to what we saw during 2018) – it’s likely discretionary spending could slow – as families prioritize essential goods over non-essential purchases.

With respect to possible cuts in various social spending — this would likely see a negative impact sectors that rely heavily on discretionary spending, such as retail, travel, and entertainment (given lower income cohorts will have less discretionary dollars available)

🎯 Target Misses the Bullseye

As I mentioned earlier, the reaction to Target’s results were brutal.

Here’s CBS on what went wrong:

Target is heading into the holiday season with a gloomy outlook, with the retailer reporting its sales and profit fell short of analysts’ expectations and lowering its earnings forecast for the current quarter.

The retail chain said its third-quarter sales rose 1.1% to $25.7 billion, while net income dropped 12% to $854 million, or $1.85 per share. Analysts had forecast sales of $25.9 billion and per-share earnings of $2.30, according to analysts surveyed by FactSet.

Target is struggling to gain traction with inflation-weary consumers, with many seeking bargains or refocusing on essential items, said Neil Saunders, an analyst with GlobalData.

The retailer’s struggles in the most recent quarter and its lowering of its forecast for the current quarter may not bode well for its holiday season, he added.

“Sales have virtually flatlined and have done so against the backdrop of a very poor prior year,” Saunders said in a Wednesday research note. “And this has occurred during a quarter when multiple banner events — among them, back to school, Halloween, and deal weeks and days — should have helped to drive spending.”

- Is this simply a Target execution issue (e.g. not getting their inventory mix right)?

- Could it be a function of Walmart taking market share (as their shares hit record highs)? or

- Is this case of lower-to-middle income cohorts looking for better deals / shopping more conservatively

Let’s take a look at the chart:

Nov 20 2024

Technically I think Target heads lower – continuing its bearish trend – testing the zone of $100 to $105.

This is where it traded mid-last year.

Now fundamentally the stock looks like value at a forward PE of ~12.2x

However, their lack of earnings growth and profit margins are being challenged.

Keep an eye on this…

At some point the valuation might start to look attractive over the long-term.

From mine, that area is around $105.

💥 What Matters for Investors

Whilst wealthier cohorts thrived post the pandemic (as the value of their assets rose) – others did not.

And whilst the Williams Sonoma vs Target comparison is broad brush (i.e., I think there are Target execution issues) – broadly speaking higher income consumers are doing well.

However, the potential political and policy shifts ahead could impact middle to lower income cohorts.

If the Trump tariffs are excessive – we could see the price of more discretionary items rise. Inflation favors the wealthy – not the poor.

And with respect to potential government spending cuts – hopefully they’re targeted at excessive waste.

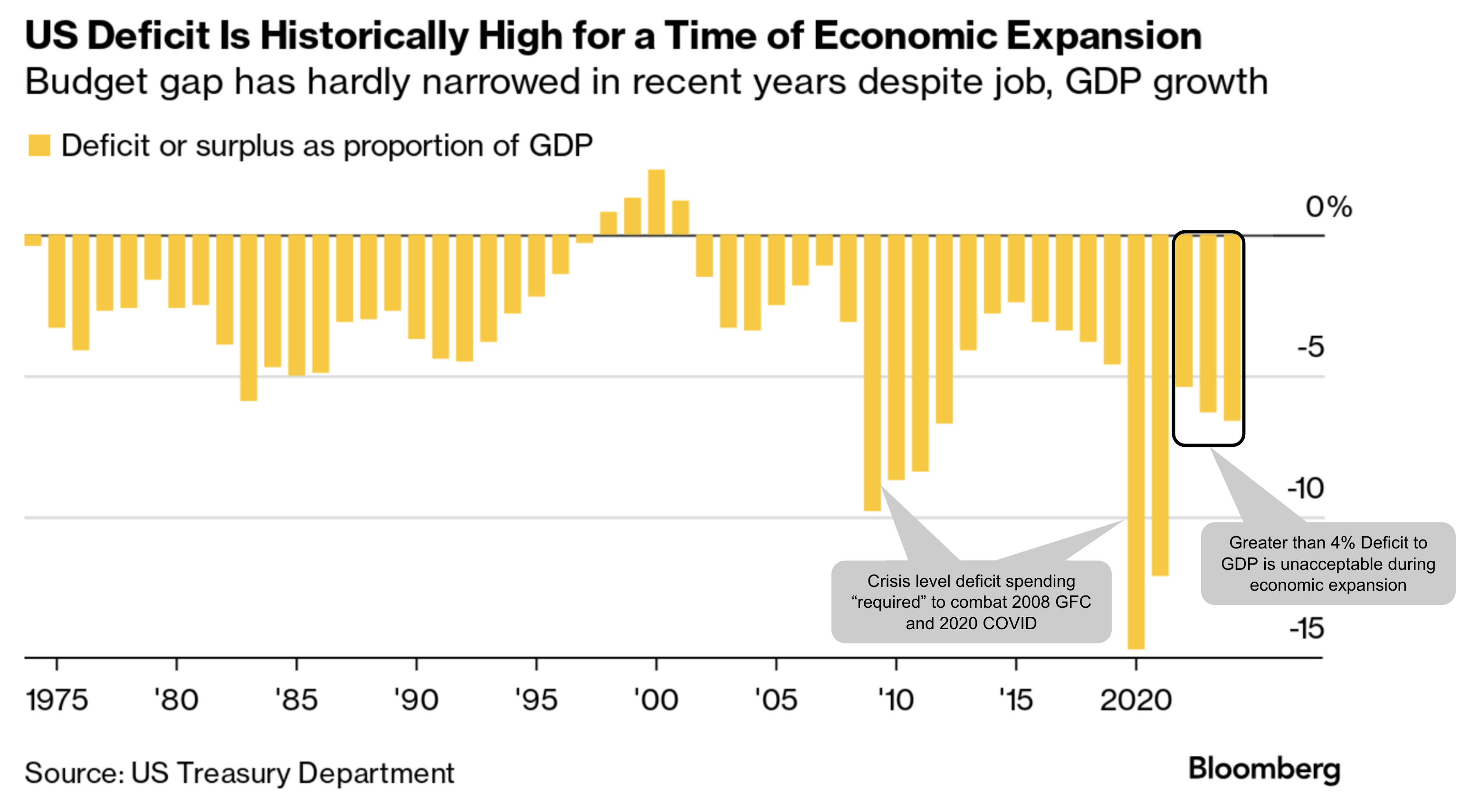

Personally, I think the government should set an objective for the fiscal deficit to be no more than 4% of GDP (a ~3% improvement on today)

That could be as much as $1 Trillion in cuts… we will see.

Watch this space…