- Jamie Dimon sees a 50/50 risk of recession

- Early chinks in consumer’s resilient (credit) armor

- Confidence drops as labor market worries increase

Yesterday I shared how Berkshire Hathaway sits on a record $167B cash hoard.

Warren Buffett’s message – it’s not a time not to be greedy.

He offered this with his annual letter to shareholders:

“Berkshire will ‘never’ risk permanent loss of capital. Thanks to the American tailwind and the power of compound interest, the arena in which we operate has been – and will be – rewarding if you make a couple of good decisions during a lifetime and avoid serious mistakes”

Investing aside, you can do very well in life by simply avoiding serious mistakes (and learning from the many who do!)

Buffett however remains an advocate of always being invested.

He said he cannot remember a time since 1942 when he has not had the majority of his wealth tied up in US equities.

It’s been a wise move – US equities (over time) – has outperformed every other asset class by a strong margin. I talked about this here (“Many Lessons in One Great Chart”)

That said, price are not cheap today and there are risks.

This is largely why Buffett has amassed such a large cash hoard (a record for Berkshire). He is not one to overpay for an asset.

CEO of JP Morgan Chase – Jamie Dimon – also sent a cautious tone today (not that unusual for the US’ largest banker by assets)

Much like Buffett – Dimon is very much in the “risk management” business.

That’s what good bankers do – carefully manage risk.

In his CNBC interview – Dimon rates the probability of a recession at 50% – significantly higher than most pundits.

As regular readers will know – I’m in Dimon’s camp.

That is, I think it’s unlikely the Fed will successfully “thread the soft-landing needle” following 550 basis points of rate hikes (in addition to ~$1 Trillion in quantitative tightening) without adverse consequences.

However, what’s difficult (near impossible) to estimate is the long and variable lag of fiscal tightening.

Typically it’s in the realm of 18 to 24 months after the Fed’s first rate hike (March 2022)… we’re now at that point.

But maybe we’re seeing a few ‘small chinks’ in consumer’s shining armor…

Chinks in the Consumer Armor?

Over the past 12+ months – consumers have given the appearance of being very resilient given a tighter financial environment and inflation.

Why?

Three compelling reasons that I grossly underestimated:

- The impact of $2 Trillion in excess consumer savings;

- The magnitude of government borrowing and spending post COVID (~$6 Trillion); and

- How much consumers would leverage available credit

And when you also consider ~60% of US homeowners secured 30-year mortgages below 4.0% (with 78% below 5%) – put together – a combination of these factors went a long way towards the US avoiding a recession.

Hindsight is a wonderful thing.

But perhaps the biggest multiplier was the trillions in fiscal spend post the pandemic emergency (more on this with a chart shortly)

More than any other factor alone – this spend closed any potential “GDP gap” left from private sector investment.

Recession avoided.

However, let’s look at each of these three factors.

From mine, it’s possible each ‘stimulus’ measures is closer to its ‘natural end’.

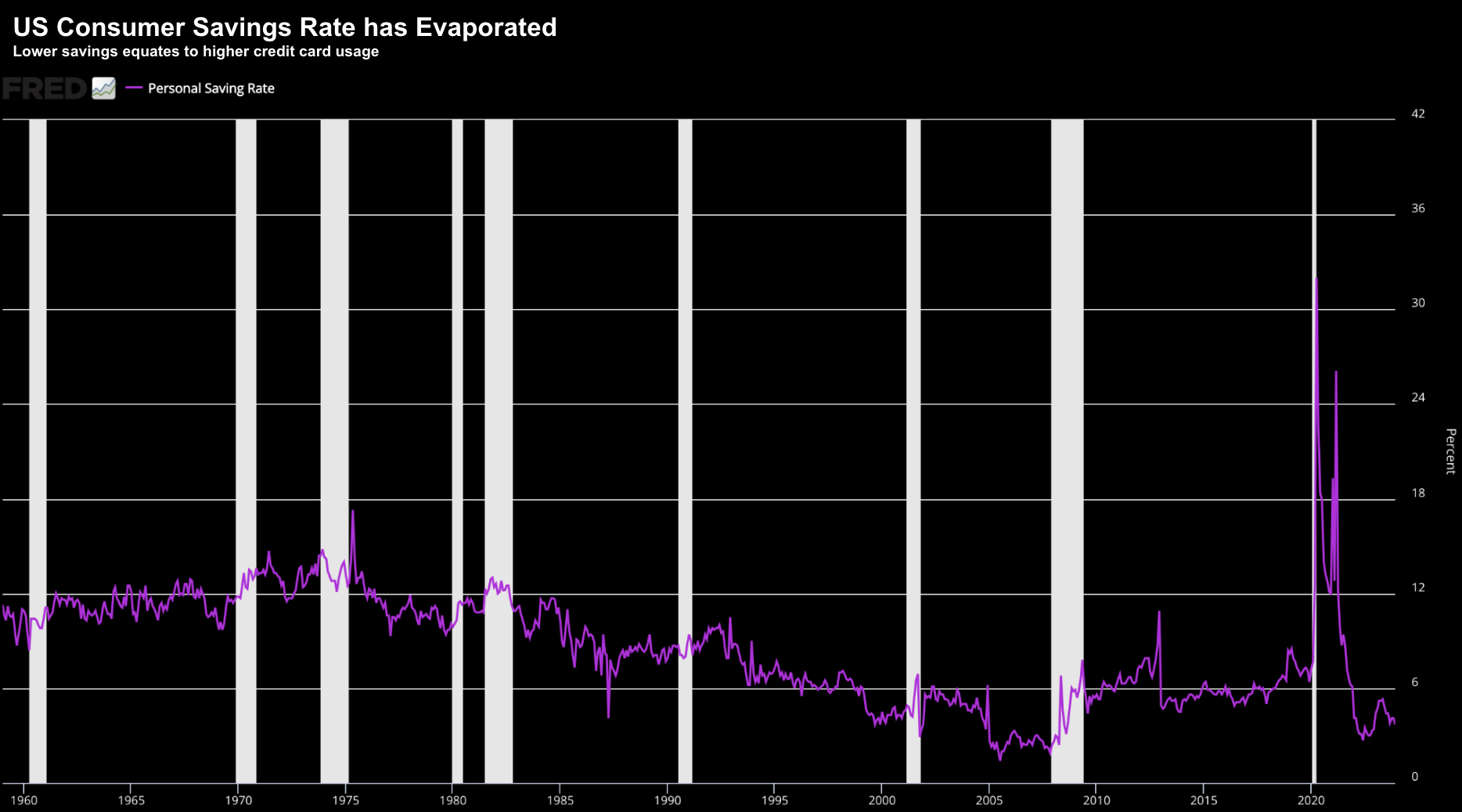

First, the trend with consumer savings:

Feb 27 2024

US consumer savings rate is now at levels not seen since 2008 (after seeing record highs during the pandemic). Again, look no further than trillions in government handouts. Speaking of which…

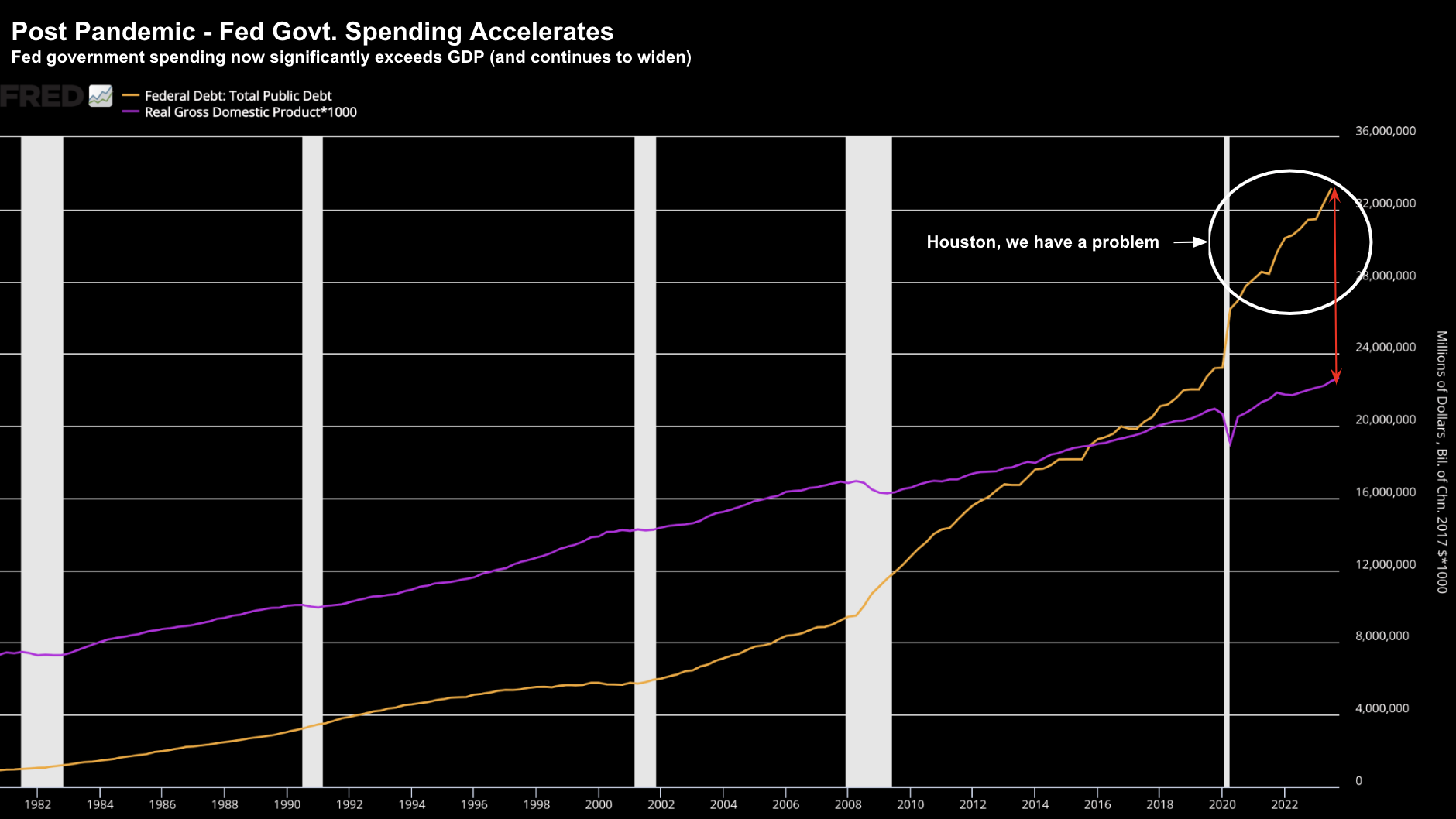

Our second chart is what we see with US federal government spend vs real GDP:

Feb 27 2024

As Jay Powell told 60 Minutes two weeks ago “the trend (in fiscal spend) is not sustainable”

What will see this reverse?

Answer: when the cost to service the debt becomes crippling. As an aside, interest payments are only 1% lower (as a function of the total budget) than ‘health’ and ‘defense’!

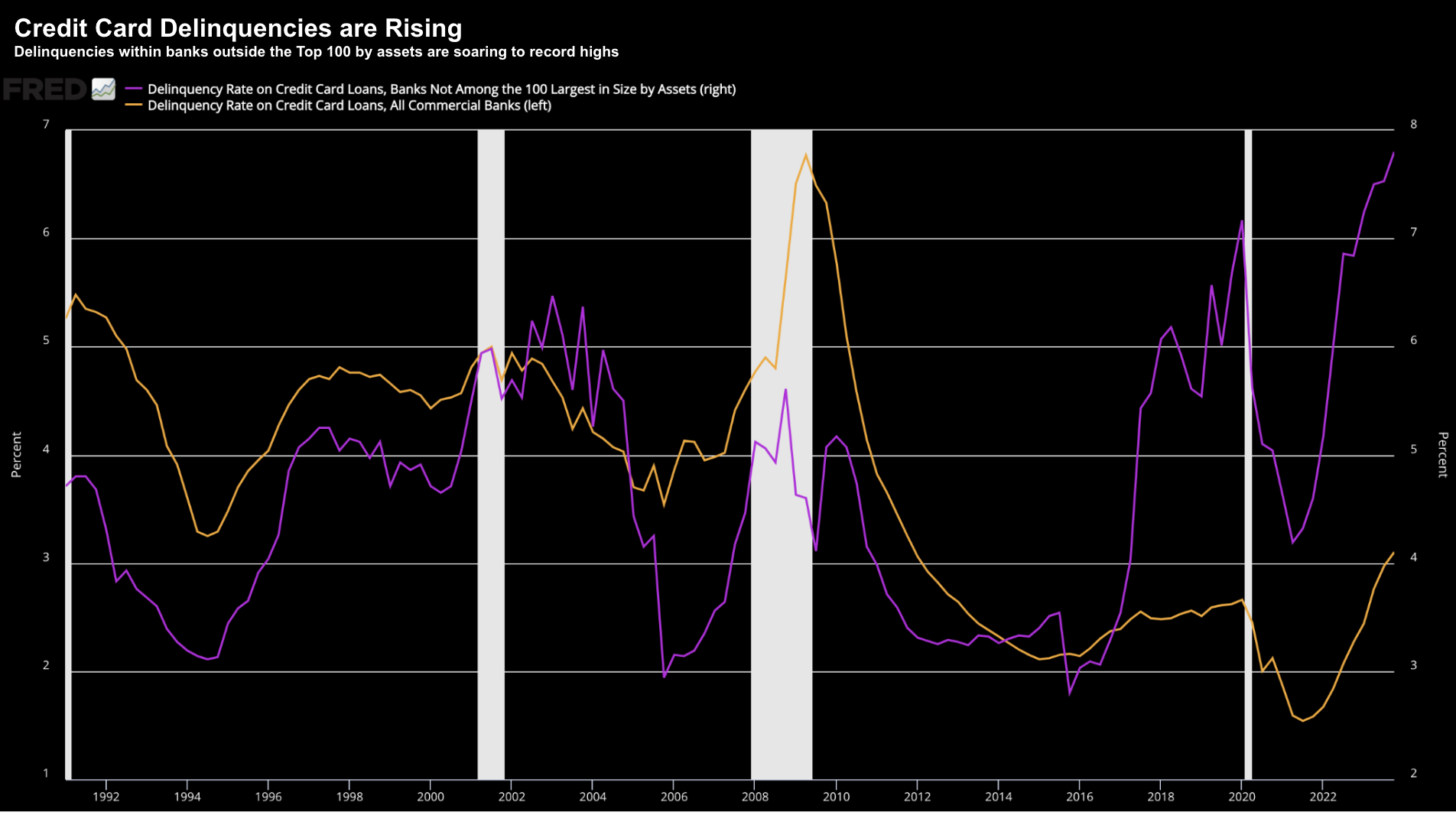

Third is what we see with credit card delinquencies.

This data point is what I’m most interested in this year – given consumption is ~70% of GDP.

For example, if consumers are not accelerating their spend from 2023 – it’s hard to see how we will see 11-12% EPS growth.

Which brings me to this chart:

Feb 27 2024

- Purple – credit card delinquencies w/banks not included in the Top 100 (by assets); and

- Orange – delinquencies across all commercial banks

For smaller banks – delinquencies now exceed 2008 levels. However, with respect to all commercial banks, we are now at the highest default rates since 2012.

Here’s my question:

What does the trend in delinquencies tell us about consumer resilience? And second, is the 2024 consumer the same as what we saw last year?

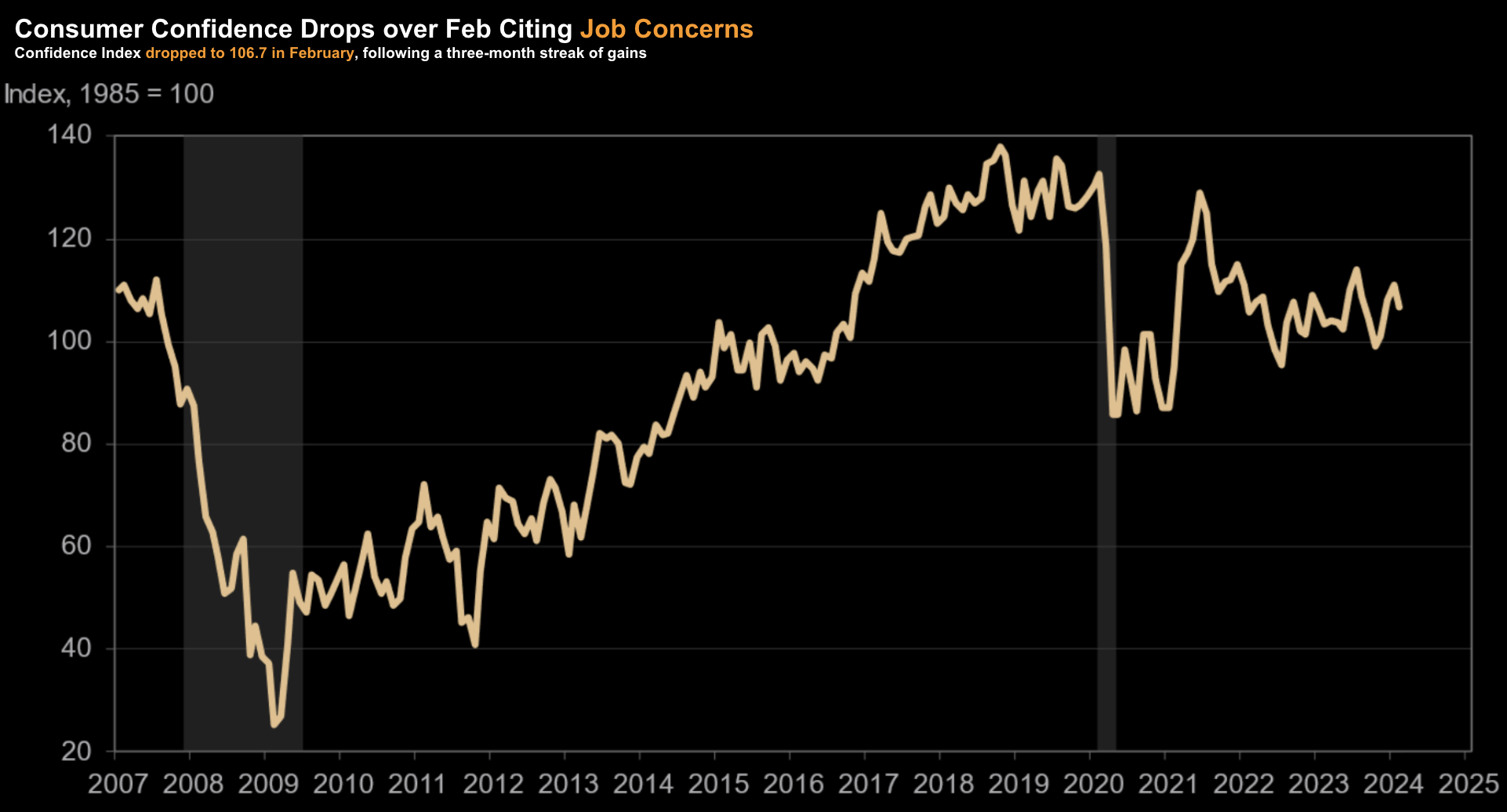

Confidence Falls

Perhaps related to the above discussion was the declining consumer confidence report from the Conference Board today:

The decline in consumer confidence in February interrupted a three-month rise, reflecting persistent uncertainty about the US economy,” said Dana Peterson, Chief Economist at The Conference Board.

“The drop in confidence was broad-based, affecting all income groups except households earning less than $15,000 and those earning more than $125,000.

Confidence deteriorated for consumers under the age of 35 and those 55 and over, whereas it improved slightly for those aged 35 to 54

Feb 27 2024

The Board added that February’s write-in responses revealed that while overall inflation remained the main preoccupation of consumers, they are now a bit less concerned about food and gas prices – but more concerned about the labor market situation and the political environment.

Again, will lower consumer confidence impact spending decisions?

One might assume that’s likely.

Putting it All Together

With stocks pushing all-time highs – trading around 21x forward earnings – the market is very confident on the outlook. For example, it sees:

- Very limited geopolitical risk;

- A low chance of recession – with limited adverse impact to employment;

- Headline and core inflation trending towards the Fed’s 2.0% objective;

- Consumers to accelerate spending in 2024; and

- Earnings to grow in the realm of 11% to 12% per year

What’s not to like?

But for me, each of these assumptions is highly presumptuous.

Dimon sees the risks of recession at “50/50” – well above what the market is pricing in.

And Buffett is willing to ‘sit tight’ with $167B in cash (a record) – reminding investors that Berkshire will never risk a permanent loss of capital.

As for me – whilst I love to put cash to work when probabilities are in my favor – for now I maintain the highest cash position I’ve had in ~15 years (50%).

This decision may prove to be an investment mistake this year… or it could lead to picking up higher quality assets at more reasonable prices.

I honestly don’t know… but I’m willing to take that risk.