- With the Fed on pause – it could pay to remain invested

- Four critical assumptions being made by the market

- Analyzing S&P 500 performance over the past 4 Fed pauses

It’s a brave person who is short the market.

Probabilities suggest we are headed higher in the near-term.

But more on why later…

My sentiment can best be described as ‘cautious… but invested’.

To that end, one should always be invested to some extent.

And whilst it’s always unwise to be completely remiss of the risks — it would be an even greater mistake not to have some exposure to higher quality risk assets and fixed income (at current yields)

Well managed companies are still making handsome profits.

Now, some of the risks could include (not limited to) interest rates remaining high through the first half of 2024 (minimum); core inflation staying high; a weaker consumer who is spending less; coupled with slower-than-expected economic growth.

Put together, with rates likely to remain restrictive during the first half, I don’t think we can rule out a recession in 2024. If true, that will likely see earnings contract (vs current 12% growth assumptions)

That implies the market is expensive today (at more than 19x forward).

However, on the other hand, it’s clear the market is not rolling over anytime soon. And should the market break to the upside (which I will talk to shortly) – you want to take advantage.

As part of this missive – I will offer 4 charts which demonstrates what happens when the Fed goes on pause.

Spoiler alert – generally there could be money to be made.

For me personally, my market exposure is around 65% of my investable capital. It’s a ratio I’ve held consistently all year – which has seen my portfolio generate year-to-date gains of over 15%.

If I can finish the year anywhere near this figure – I will take it (especially given my conservative approach)

Now, if I was a perma-bear and chose to sit mostly in cash, bonds or gold (or worse – shorted the market) – it would not have been a good year.

The bears did well last year – however they are licking their wounds in 2023. To that end, there might be some people who have missed this rally entirely.

And whilst hindsight is always easy – they made a mistake.

Today I’m going to outline assumptions built into the market (both good and bad); what we see with bond yields (which are largely responsible for the market gains); and lastly – why there is a case for the market rallying further (despite the recent surge).

First some useful context…

Critical Assumptions Built-In

Earlier this week, I talked about a few critical assumptions built into the market today.

These include (perhaps not limited to):

- Inflation (core and headline) will fall to a 2.x% handle by mid-next year (not necessarily at or below 2.0%)

- The Fed will have greater flexibility to start cutting rates (some believe as early as March);

- Employment is likely to remain robust (where unemployment levels remain below 4.50%); and finally

- There will not be a recession next year.

Given these assumptions are now priced in – the question you should be asking is what probabilities do you give each?

First, the logic around the Fed having greater flexibility to cut hinges entirely on what we find with real rates.

As we know, real rates are a function of inflation (our first assumption).

For example, if we assume headline and core inflation falls to 3.0% (for illustration purposes) – and with the effective Fed Funds Rate held steady at 5.50% – the real interest rate is 2.50%

This is important as anything above 0% is considered restrictive (and where zero is neutral).

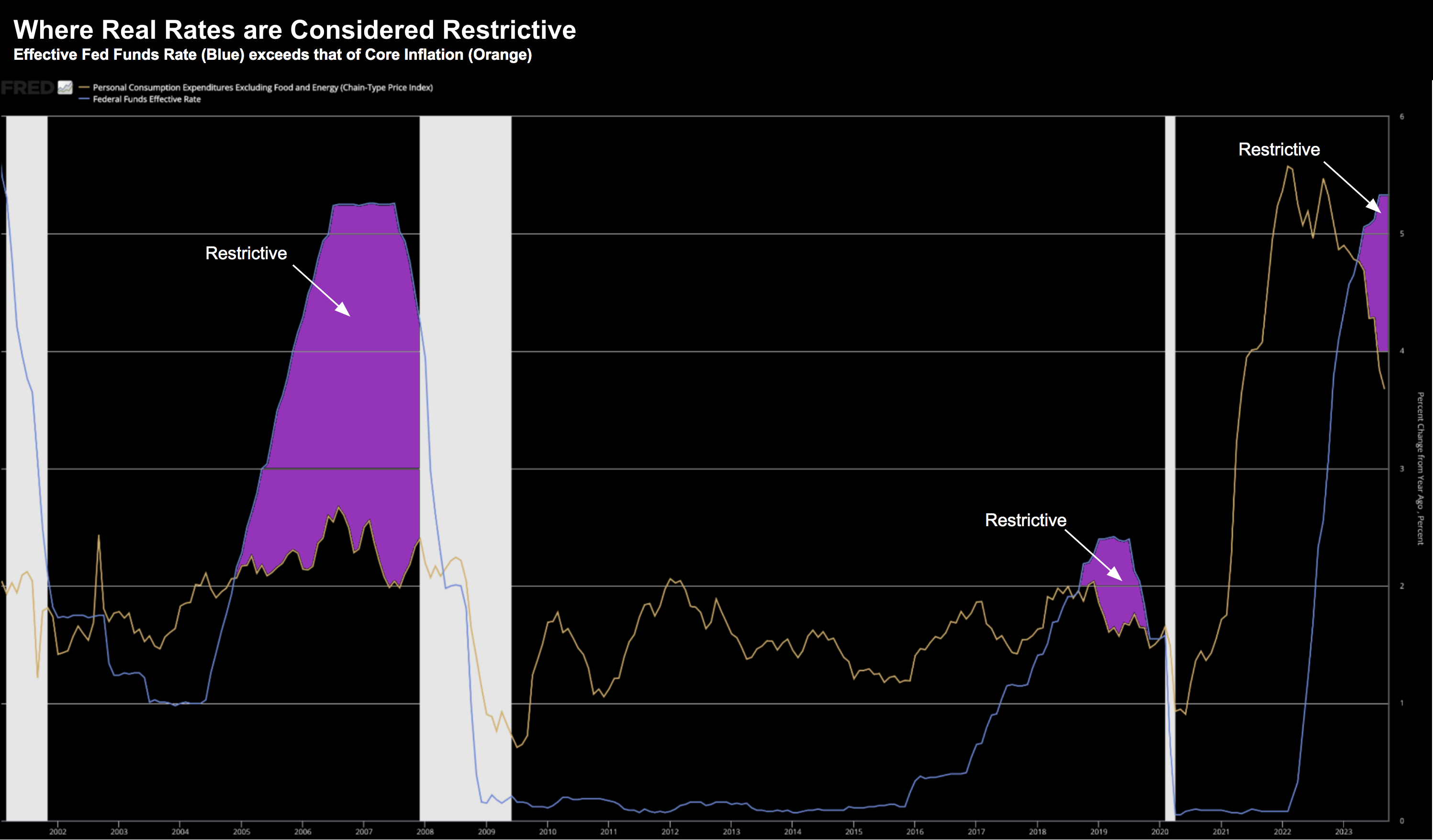

For example, as of May this year, the real rate of interest turned positive. This is where the Feds effective funds rate exceeds the level of core inflation.

Below is a chart which helps highlight where rates are restrictive (purple areas). As you can see – generally this acts as a precursor to a recession.

Nov 24 2023

A recession happens when money becomes too restrictive for too long – as access to affordable credit stalls.

For example, I would argue this is already happening in small businesses… where they can’t access credit for less than 9%.

Note – this is partially why the Russell 2000 has woefully underperformed larger (better capitalized) names that are not dependent on access to credit.

In addition, we’re seeing the early stages of credit tightening in the commercial real-estate sector (I expect we will see more pain in 2025 – when a greater portion of loans are reset)

Now if we first assume inflation (headline and core) is likely to continue to head lower (and I think it does) – whilst also assuming the Fed remains on pause for a period (which is reasonable) – it follows that real rates will increase.

In other words, we will see something similar to what we saw happen over 2006/07.

And I think that is a fair assumption…

However, what follows is less clear.

For example, whilst the market is pricing in rate cuts – it also assumes they can do this without the economy tipping into recession.

Personally I don’t think we can make that call.

Let’s now look at bonds as they shed more light on this picture.

Bonds Price in Cuts & Lower Inflation

From mine, fixed income markets are pricing in both Fed rate cuts and much lower inflation.

Again, I think this is reasonable.

Consider what we’ve seen with the US 10-year (using the weekly timeframe)

Nov 24 2023

Whilst the sharp ~60 bps move lower in 10-year yields was eye opening – we could see these push even lower (e.g., testing around 4.20%)

However, I would be even more surprised if they dipped further.

A couple of thoughts:

First, if the bond market felt there was going to be a recession, yields would be much lower.

Bonds are not pricing in this outcome (not yet).

What’s more, if the stock market felt that way, prices would be at least 15% to 20% lower (given the likely earnings contraction).

Therefore, if we take recession out of the equation and only look at inflation dynamics – then I don’t see the 10-year dropping too much further.

Yes inflation is coming down. However, core inflation is not coming down fast.

What’s more, we find wage inflation remains above 4.2%

On that basis, you might argue that around 4.40% to 4.50% is close to fair value (a number Bill Gross suggested last month).

However, inflation prints will continue to have a very large bearing on what we see with 10-year yields (note: we get Core PCE next Wednesday).

For example, if core remains sticky (especially services) – expect the 10-year to rise. In other words, the bond buying of late might be overdone.

But whatever the case with inflation (and what we see with growth forecasts) – I think bonds remain extremely volatile in the near-term. And that’s not helpful for equities.

Let me offer three reasons why we are unlikely to get bond stability:

- Lack of certainty around 2024 economic growth projections (e.g. recession or no recession)?

- Lack of clarity with monetary policy (e.g., when are the Fed likely to start cutting rates)? and finally

- A technical set-up which suggests the 10-year could trade anywhere from 4.0% to 5.0% in a matter of weeks or months.

Put another way, we still have an unanchored bond market.

We are starting to see some stability with the 2-year (which is welcomed) – but we are not there yet at the long-end.

My argument has been until we get more clarity / certainty on each of the above (growth projections, Fed policy and a better technical setup) – then expect continued volatility in bonds.

Stocks continue to misprice this risk.

The Case for Further Upside

When I look at the assumptions above – what resonates loudest is the case for the Fed pausing.

However, what I give far lower weight to is:

- The Fed cutting rates as early as May (or even June);

- Core inflation coming down quickly (e.g. to 2.x%); and

- The US economy avoiding recession in the second half of the year

However, a Fed maintaining rates at the current level of 5.50% with core inflation around 4.0% (and falling) – I think that is reasonable.

Therefore, my question is what does the market do when we see a Fed go on pause?

Here I turn to the history books (as I have little else).

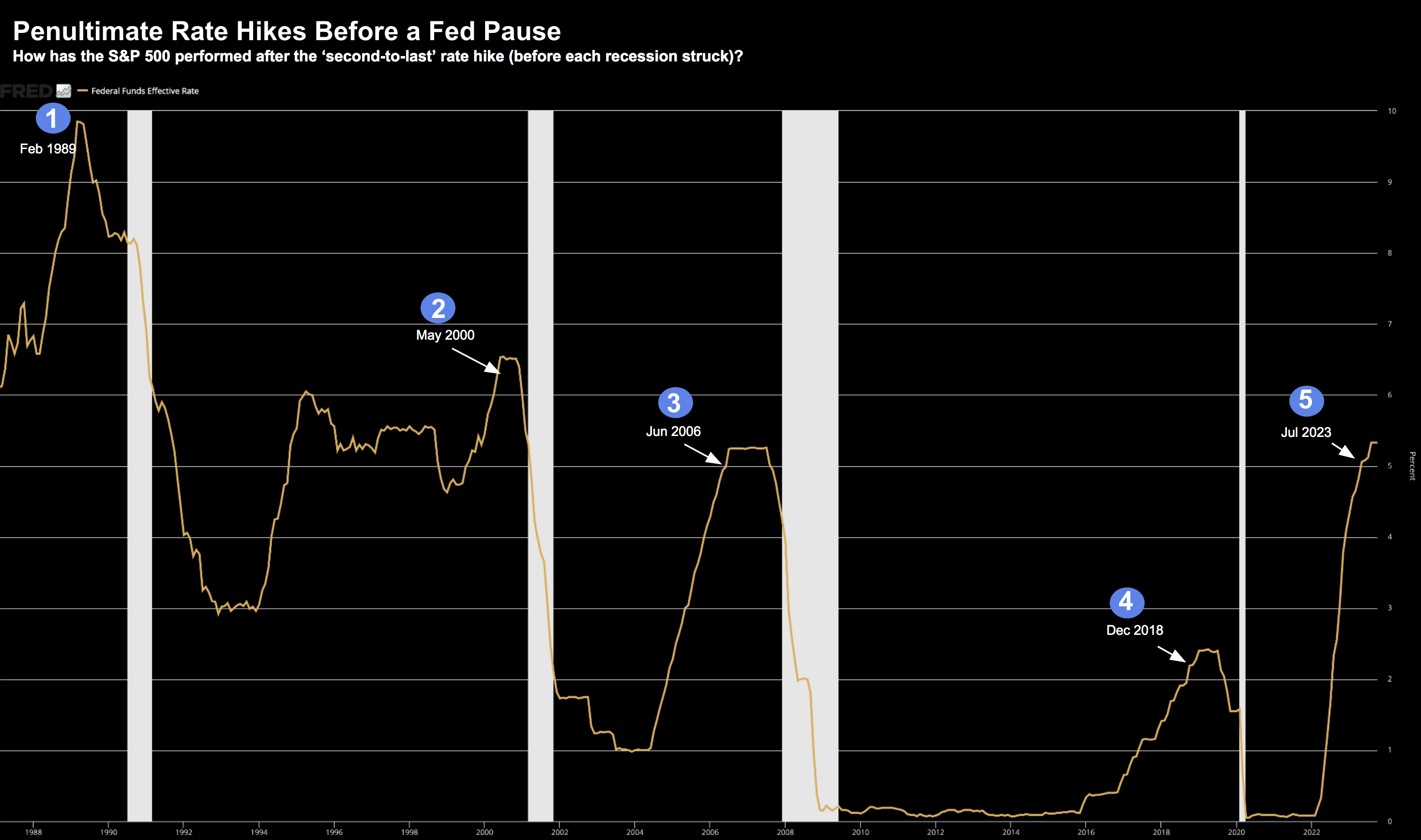

I went back to 1989 and noted each of the 4 penultimate rate hikes from the Fed and calculated how the S&P 500 performed from there (before each recession struck).

34 years ago – investors were wise to have maintained exposure whilst the Fed paused.

From the date of the penultimate hike (Feb 1989) to the first rate cut (July 1989) – the market rallied ~12%.

And as the Fed continued to cut rates into the slowing economy – the market piled on some 27% from the date of the second-to-last hike.

Once the recession was in play – the market gave back 20% of those gains – trading back at levels from two years prior.

Let’s chalk this one up as a point for the bulls.

To our second chart…

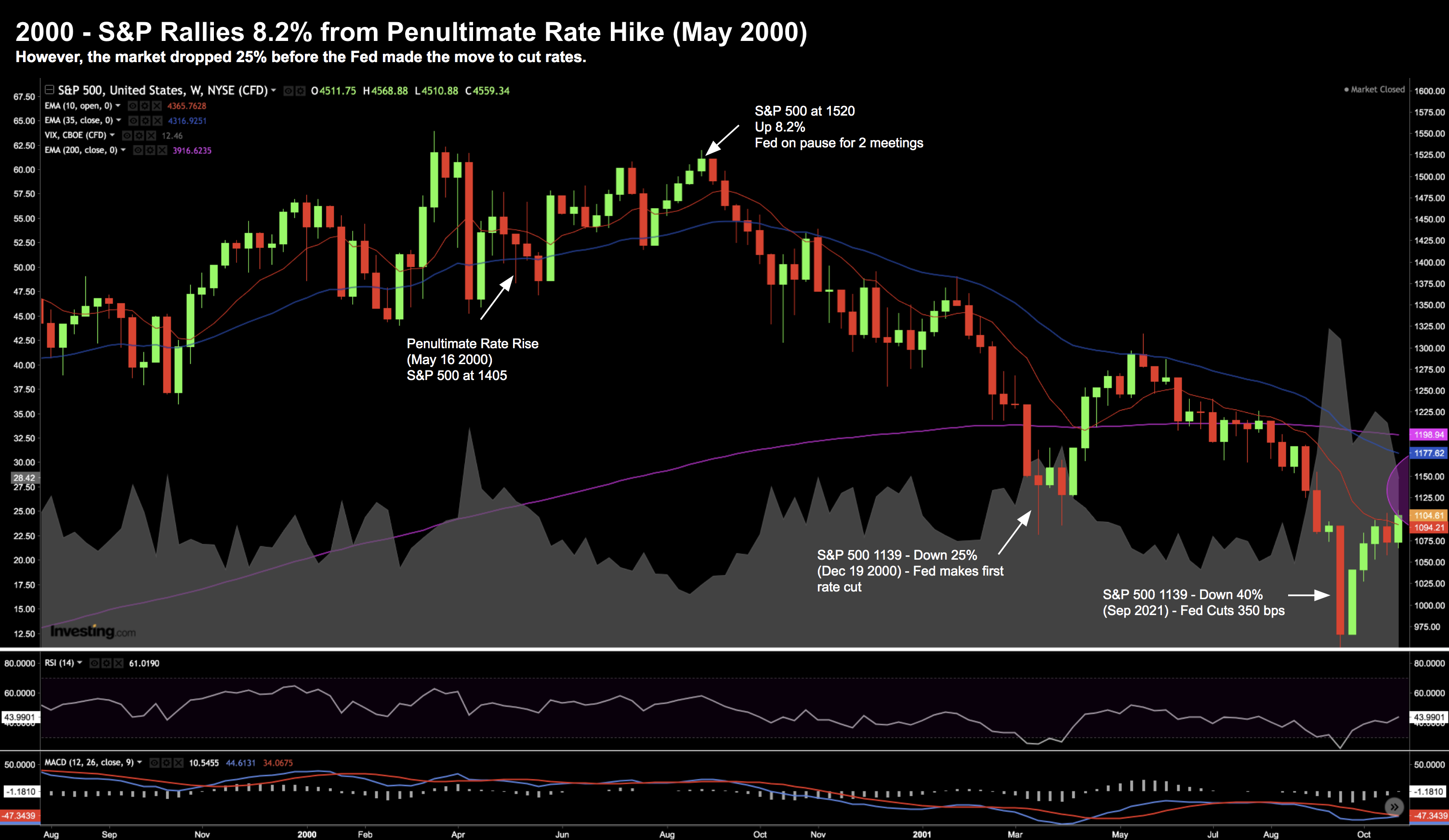

Here we jump forward 11 years to May 2000… before the almighty dot.com crash (and my personal baptism of fire to stock market investing – after thinking it was a ‘pretty easy game’ through the mid-to-late 90s)

This was a different outcome for the bulls…

Whilst the market enjoyed 8.2% gains after the penultimate hike – for the most part stocks lost ground whilst the Fed remained on pause.

For example, the S&P 500 gave up 25% (peak to trough) before the Fed moved to cut rates. And whilst stocks bounced after the first cut – it was short lived.

The market then proceeded to lose more ground despite the Fed cutting rates a whopping 350 basis points.

I’m going to call this one for the bears.

And whilst bulls did enjoy some small (8%) gains in the early part of the pause cycle – it’s unlikely they would have been able to time their gains to offset the precipitous drop whilst the Fed remained on pause.

Moving to #3 – June 2006

I’m going to score this one for the bulls.

In this case of 2006 to 2008 – the Fed went on pause for 12 months – which saw the market rally ~22%.

However, when the Fed moved to eventually cut rates, that was the end of the rally.

Stocks initially sold-off hard before staging a brief 8 week bounce (forming a clear double-top)

The Fed cut again (now a cumulative 50 bps) – which was the nail in the bull’s coffin for 2008.

The index would ultimately lose 50% as rates were slashed to zero.

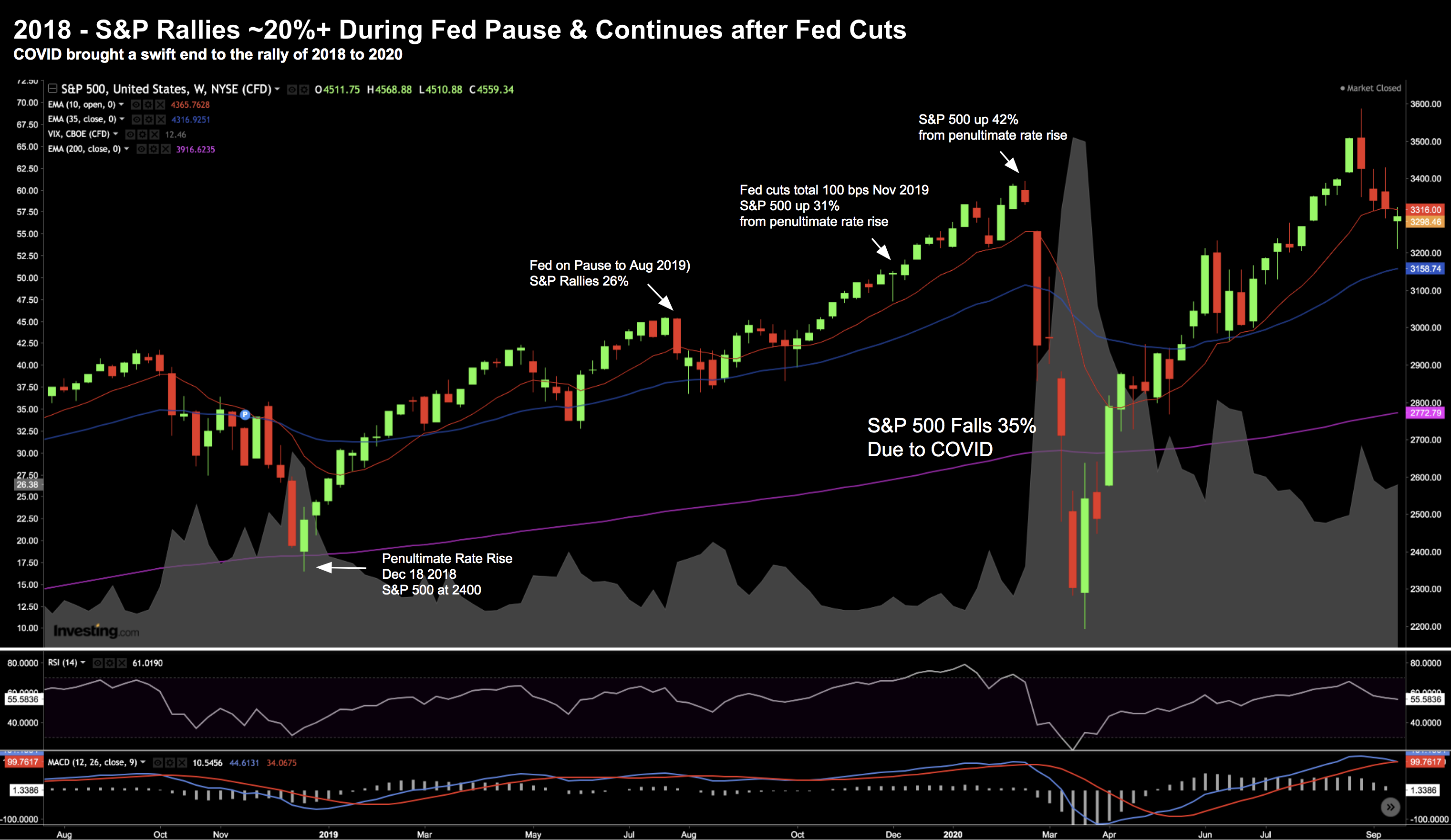

Let’s finally revisit the most recent Fed pause – Dec 2018

Our last chart is another point for the bulls.

This brings our grand tally to 3 for the bulls and just 1 for the bears.

As the central bank paused during 2018 – the market ripped higher – adding more than 20%.

And as the Fed added to its cuts – the market was up some 42% – after the penultimate rate hike.

COVID brought a brutal end to the rally of 2018 to 2020.

In summary, apart from what we saw in 2018 – where the bulls enjoyed a brief stint of upside when the Fed went on pause – most of the time markets continue to rally.

But not only do they rally – these gains are typically over 20%.

That’s not insignificant.

My view (and it could be wrong) is the Fed are now most likely on pause.

Rates are clearly restrictive.

Again, this is also what the market is pricing in.

If true, history suggests a Fed on pause indicates a higher probability of more upside despite what the (stretched) fundamentals suggest (e.g. a forward PE of 19x at 12% YoY EPS growth)

For example, I can argue all day why the market is overpriced. That matters for very little if I watch it add a further 20% without me.

But here’s the important catch…

In every instance, when the Fed starts their inevitable easing cycle, the market is closer to the end of its run. And that turn can be swift.

As I said the other day, you need to ask why the Fed would be cutting rates?

Typically it’s because they are either worried about growth and/or some credit type event.

Neither of those things bode well for equities – regardless of how much they cut.

We’ve seen the Fed cut rates to zero in the past only for equities to keep plunging lower.

The only assets to outperform in this environment are typically bonds (as rates fall) and gold.

Putting it All Together

‘Cautious but invested’ is how I would describe my current position.

For example, I maintain two key tenets:

- Exposure to high quality stocks that boast very strong free cash flows, strong balance sheets and operating margins. And specifically, they have no need to seek debt financing; and second

- I’ve increased my exposure to fixed income (short and long-term treasuries, investment grade debt; and high-yield debt) on the basis I think rates will likely fall in the second half of next year.

If the market continues to rally from here (which feels likely) – then I’m hopeful my exposure to higher quality stocks will continue to work in my favour.

So far, that has worked for me this year.

However, should the economic climate start to deteriorate in the first half of next year – and we find the Fed are closer to easing – I expect my bond positions to appreciate (as yields fall).

Now, I don’t know if this strategy will work. I don’t pretend to be able to forecast the future.

My strategy is based on probabilities.

This is how I choose to be positioned as we enter what I think will be a 6+ month pause from the Fed (pending core inflation and employment).

Time will tell if it was prudent.