- Retail sales continue to slow

- Consumers are burning through excess savings

- Big banks double their credit card loss provisions to ~$8B

Never underestimate the US consumer’s willingness to spend.

And from mine, that’s been the story of this year.

Consumers have used whatever means available to spend, spend, spend.

That’s the mindset…

Now with ~70% of US GDP consumption based – that has also meant the economy managed to keep its head above water.

As an aside, it also helps when the government hands out trillions in stimulus… that’s not unnoticed.

But what does it look like going forward?

That’s a harder question but an important one.

Do consumers still have ultra-strong balance sheets to keep it up? And are rates starting to bite?

I ask this because if US consumers are closer to maxing out their credit cards (with more than $1T in debt)… the odds of a recession (dramatically) increase.

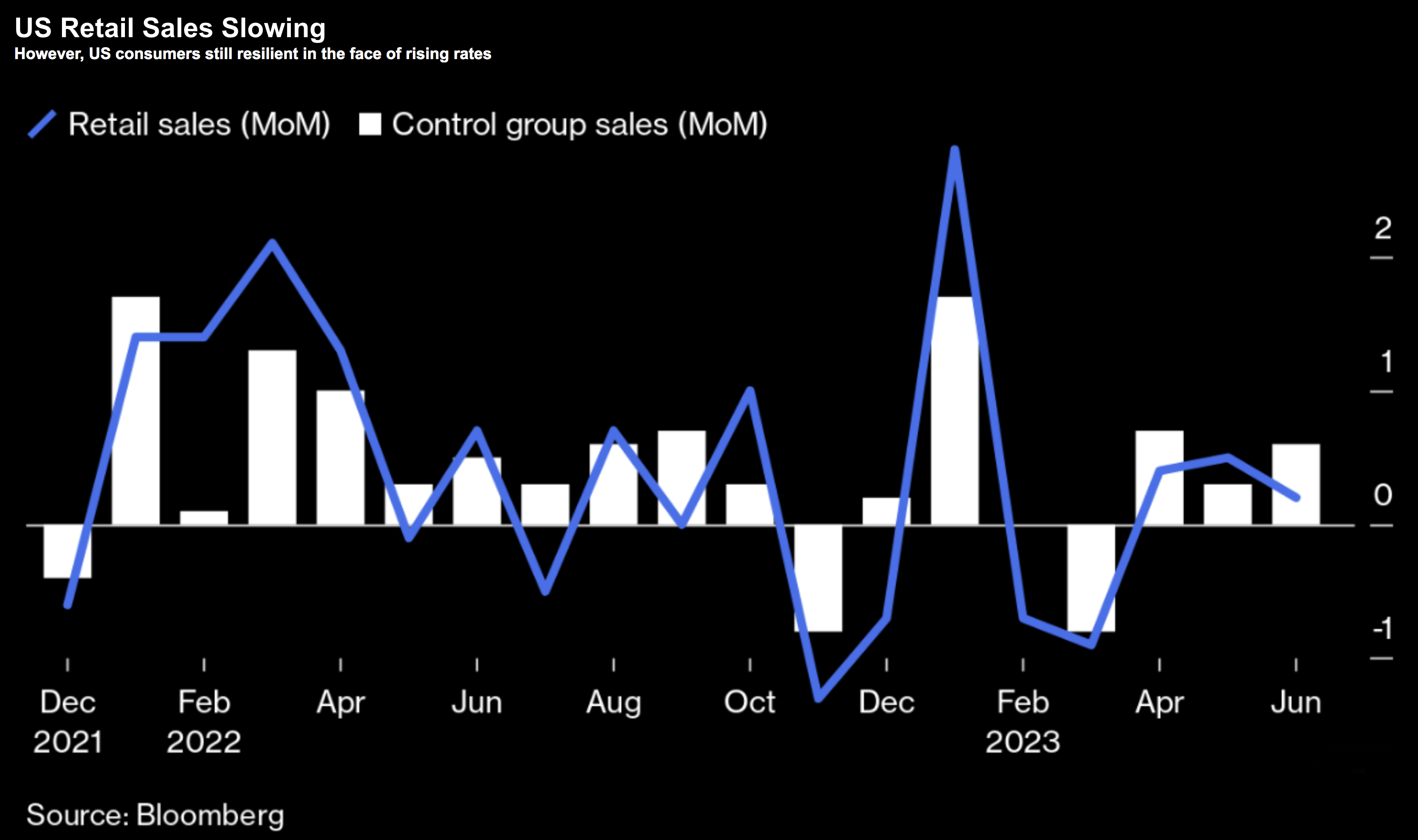

Retail Sales Slowing

The latest read on US retail sales showed the consumer is slowing… missing expectations.

From Reuters (July 18)

U.S. retail sales rose less than expected in June as receipts at service stations and building material stores declined, but consumers boosted or maintained spending elsewhere, which likely kept the economy on a solid growth path in the second quarter.

Overall, the mixed report from the Commerce Department on Tuesday painted a picture of consumer resilience, though slowing momentum in spending growth. It did not change expectations that the Federal Reserve would resume raising interest rates this month after keeping them unchanged in June.

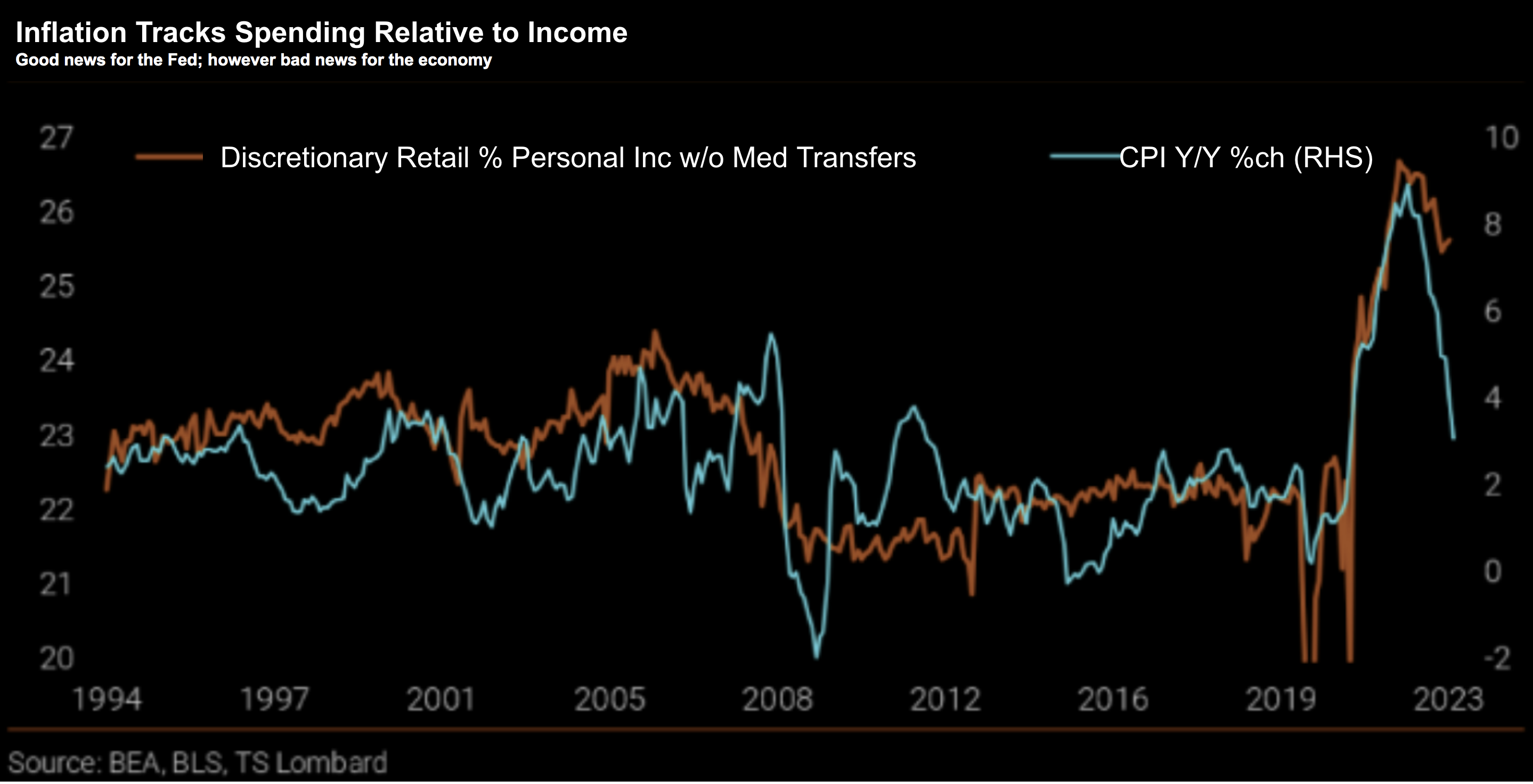

From mine, this is both good and bad news.

The “good” news is the Fed will be happy seeing the economy slow.

Slower retail spending will help cool inflation.

Inflation enjoys a close relationship with spending.

However, the “bad” news is it will likely impact company earnings and economic growth.

Tapped Out?

For now, US consumers are doing well.

As the Reuters report suggests – they remain “resilient”

Put another way – they have income and access to credit.

And whilst these two things remain in place – they will spend.

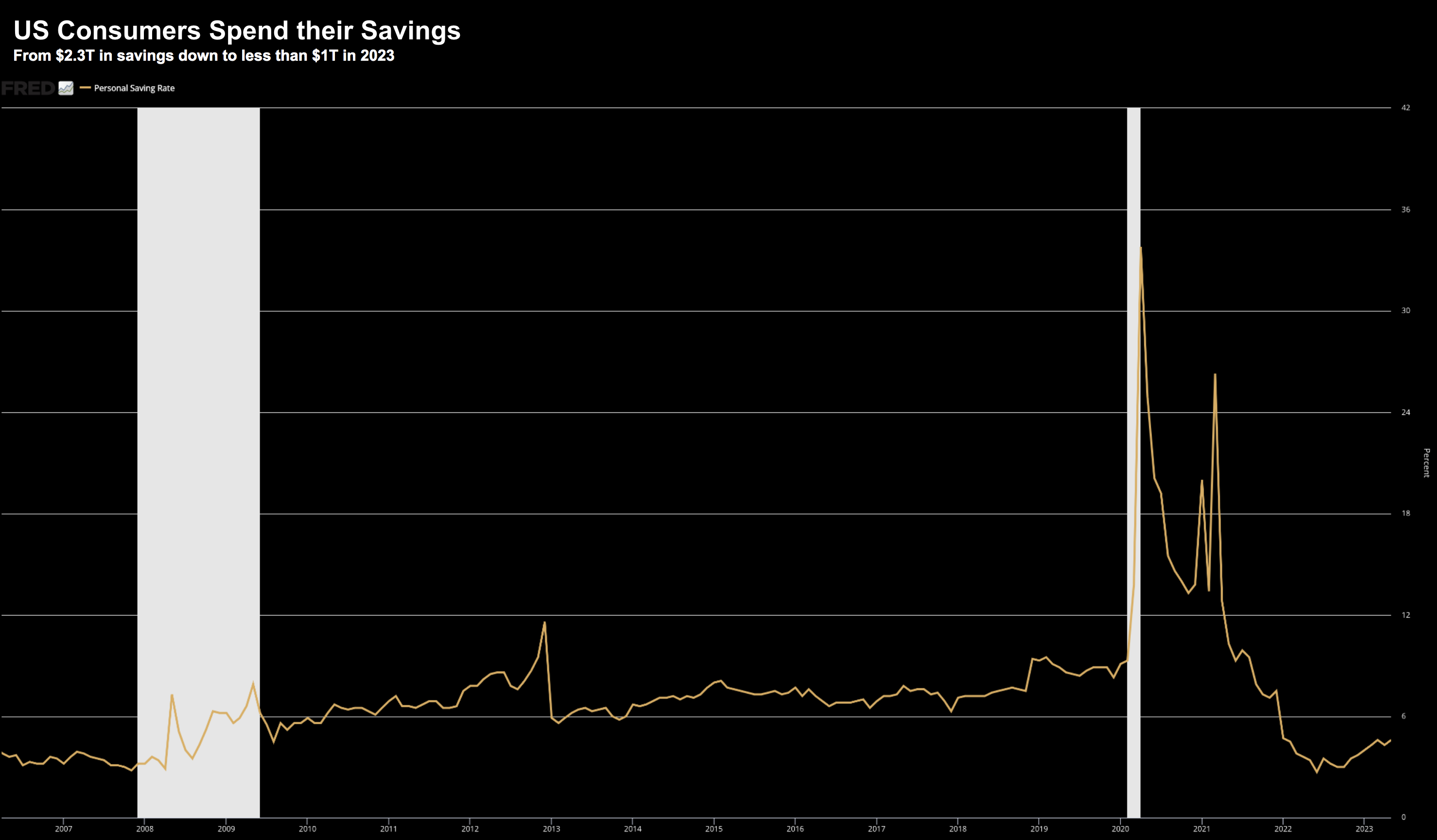

However the other (major) driving force behind the strong spending over the past two years has been money left over from the pandemic.

For example, consumers savings at one point in 2020 topped $2.3 Trillion…

From the Fed:

Over the pandemic, historic levels of government transfers boosted household income while household spending was severely curtailed by social distancing.

This led the personal saving rate to soar, and we estimate that U.S. households accumulated about $2.3 trillion in savings in 2020 and through the summer of 2021, above and beyond what they would have saved if income and spending components had grown at recent, pre-pandemic trends.

Since late last year, households have decumulated about one-quarter of these excess savings, as the saving rate has dropped below its pre-pandemic trend.

According to the Fed’s paper – excess savings are now below $1 Trillion.

What’s more, consumers are depleting these savings in the realm of $150-$200B per quarter.

That translates to approximately 0.6 to 0.7% of GDP.

And if you project this forward say 2 or 3 quarters… there’s a high probability we could be in recession.

For example, trimming GDP 0.7% for three quarters would see in contraction by Q2 2024.

Banks Increase Loss Provisions

In light of the above – it’s not surprising to hear provisions for loan losses increase from most banks.

For example:

- JP Morgan set aside the provision for credit losses at $2.9 billion (far higher than expected);

- Wells Fargo allowed for $1.71 billion as a provision for credit losses – significantly higher than the $580 million set aside during the same period last year

- Discover Financial Services missed Wall Street estimates for quarterly profit this week as the digital bank increased its provisions to cover potential loans losses. They hiked its provisions for credit losses to $1.3 billion in the quarter, compared with $549 million a year earlier; and

- U.S. Bancorp warned of more for potential credit losses – provisioning for $821 million for credit losses, up from $311 million a year earlier and $427 million in the first quarter

The largest six lenders will set aside ~$8B to cover loans that are likely to go bad due to higher rates.

That is nearly double what they were in the same quarter a year ago — where credit cards are the biggest source of pain.

And with credit card interest rates averaging more than 24% – it’s little wonder.

Putting it All Together

Before I close, the consumer is not tapped out yet.

And they have enough “juice in the tank” to keep the economy out of recession for the balance of this year.

But…

My question is whether they will keep their job?

No job equals no income.

With less income (and depleted less savings) – that will see consumption collapse.

Again, for now that is not a problem. There are plenty of jobs out there.

But the trends in employment, wage growth, savings levels and spending patterns deserve close scrutiny through the balance of the year.